The gleaming paint, the fresh scent of a new interior, and the promise of years of reliable transportation — buying a new car is undoubtedly an exciting milestone. Amidst the thrill, however, comes an almost inevitable encounter: the extended warranty pitch. Often presented as an essential shield against future expensive repairs, these vehicle service contracts are heavily marketed by dealerships and third-party companies, promising peace of mind.

Yet, for the vast majority of car owners, the question of whether these warranties are truly the financial safety net they claim to be yields a resounding negative. Auto experts consistently advise caution, highlighting that these agreements are, for most consumers, a complete waste of money. They often fail to deliver the comprehensive protection anticipated, instead proving to be an unnecessary expenditure.

This in-depth article will delve into the critical reasons why car extended warranties are typically a bad deal. Drawing on the insights of industry experts and practical financial advice, we will explore the numerous drawbacks, hidden costs, and systemic disadvantages that make these offerings less about consumer protection and more about corporate profit. Moreover, we will illuminate smarter, more effective alternatives that empower you to safeguard your finances from unexpected car repair costs without falling prey to a costly illusion.

### 1. The Pervasive Illusion of ‘Protection’: Hidden Costs Lurking in Extended Warranties

The concept of protecting oneself from costly future repairs certainly seems like a prudent financial decision on the surface. However, extended warranties, also known as vehicle service contracts, are frequently riddled with a multitude of hidden costs and significant limitations that, more often than not, significantly outweigh any perceived benefits. Understanding these inherent drawbacks is absolutely crucial for any car owner before they consider signing on the dotted line and committing to such an agreement.

These contracts are complex financial products, and their true value is often obscured by the initial appeal of comprehensive coverage. Consumers are encouraged to focus on the potential for large repair savings, while the less obvious financial drains remain in the background. It’s essential to look beyond the immediate promise of security and critically assess the long-term financial implications.

The ‘protection’ offered by these warranties is not as straightforward or all-encompassing as it might initially appear. A closer inspection reveals that the financial landscape of extended warranties is often designed to favor the provider, placing an undue burden on the unsuspecting consumer. This fundamental imbalance is where the true ‘hidden cost’ begins to manifest, impacting your budget without delivering proportionate value.

This initial layer of hidden costs sets the stage for many of the subsequent issues we will uncover. It underscores the importance of a discerning approach to any offer that seems too good to be true, especially when it involves significant financial outlay for a service that may provide minimal actual return. Being aware of these foundational hidden costs is the first step toward making a truly informed decision about your vehicle’s future.

### 2. The Unseen Print: Restrictive Coverage Limitations and Expansive Exclusions

One of the foremost and arguably most significant issues plaguing extended warranties is their often-restrictive nature regarding coverage. These agreements seldom provide comprehensive protection for every potential issue that could arise with your vehicle. Instead, they meticulously enumerate a specific, limited list of parts and systems that fall within the scope of the policy, consequently leaving a vast array of potential mechanical and electrical problems entirely outside of the covered protections.

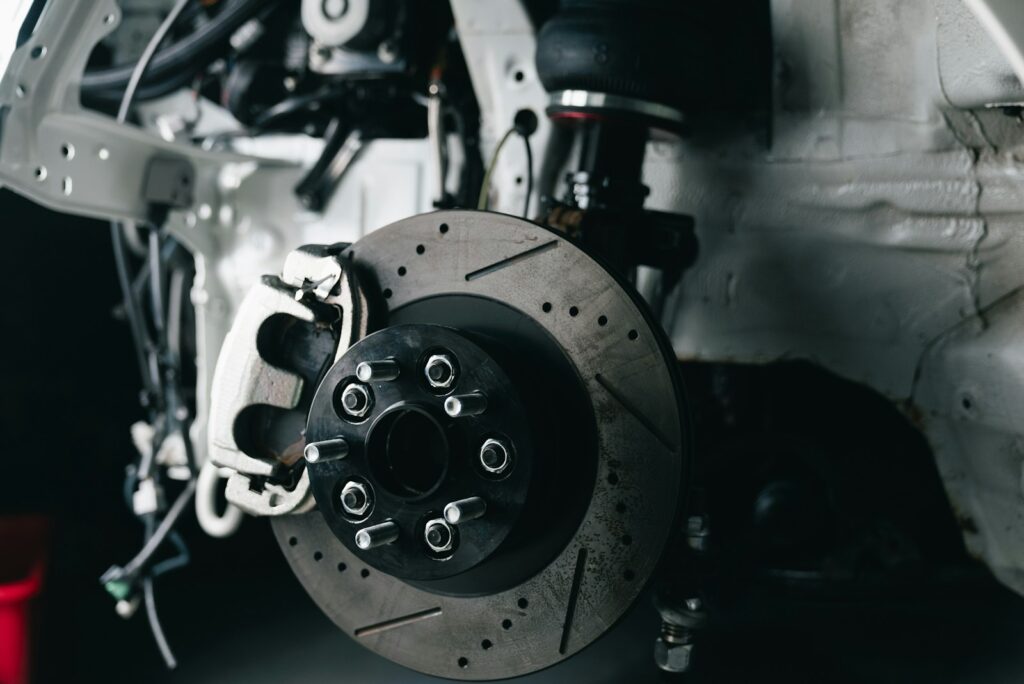

It is paramount for consumers to meticulously read and comprehend the fine print of any extended warranty contract. The exclusions within these documents are frequently extensive and can encompass a wide range of common vehicle issues. For instance, normal wear and tear components, such as brake pads, tires, and routine fluid replacements, are almost universally excluded from coverage. Furthermore, cosmetic damage, which can be quite costly to repair, and even certain advanced electronic components, may also be explicitly left out.

A particularly insidious clause found in many extended warranty agreements relates to manufacturer’s recommended maintenance schedules. Some warranties may explicitly exclude repairs if the car owner has not adhered strictly to the manufacturer’s suggested service intervals and procedures. This means that a lapse in timely oil changes or tire rotations, even if seemingly minor, could potentially void coverage for a major engine or transmission repair, leaving the owner fully liable for expenses despite having purchased the warranty.

Moreover, any modifications made to the vehicle, even seemingly innocuous changes like the addition of aftermarket wheels or an infotainment system, could be grounds for voiding the warranty. This critical stipulation means that a car owner could invest a substantial amount in an extended warranty, only to find themselves without any coverage for a needed repair simply because of a personal modification. This situation ultimately leaves the consumer paying for protection they cannot utilize, making the warranty a clear waste of money.

### 3. Navigating the Minefield: Burdensome Deductibles and Onerous Claim Processes

Even in instances where a repair is undeniably covered by an extended warranty, the policyholder is almost invariably required to pay a deductible. This out-of-pocket expense for each repair claim further diminishes the perceived financial benefit and erodes the overall value of the warranty. Deductibles can vary significantly, often ranging from a modest $50 to a more substantial $200 or even higher per repair incident, effectively rendering the warranty less advantageous for addressing smaller, albeit common, automotive issues.

Beyond the financial outlay of a deductible, the process of filing a claim and receiving approval for repairs can often devolve into a bureaucratic nightmare. Warranty companies frequently impose specific requirements that can be highly inconvenient for the vehicle owner. For example, you may be mandated to take your car exclusively to a specific repair shop or network of facilities, which is often designated by the warranty provider. This restriction can be particularly frustrating if you have a preferred, trusted mechanic with whom you have an established relationship.

The journey from a needed repair to an authorized fix is typically laden with administrative hurdles. The warranty company will often demand extensive documentation, including detailed repair estimates and comprehensive diagnostic reports, before it grants authorization for any work to commence. This rigorous approval process can lead to considerable delays, leaving you without your essential transportation for an extended and often unpredictable period. The waiting game can add significant stress and logistical challenges to an already inconvenient situation.

Furthermore, denials of claims are not uncommon within the extended warranty landscape. These rejections can occur for a variety of reasons, particularly if the warranty company determines that the repair falls under one of the numerous exclusions outlined in the contract or if they suspect a pre-existing condition contributed to the failure. This potential for denial, even after careful adherence to all procedural requirements, significantly underscores the inherent risk and often frustrating lack of reliability associated with relying on these warranties for genuine financial protection.

### 4. Paying for What You Already Have: Pointless Duplication of Existing Manufacturer’s Coverage

A crucial aspect that many consumers overlook when considering an extended warranty is the existing protection their vehicle already possesses. Many new cars are sold with a robust manufacturer’s warranty that inherently covers a substantial portion of potential repairs for a specified period or mileage, typically the first few years of ownership or tens of thousands of miles. Purchasing an extended warranty during this initial coverage phase essentially duplicates protection that is already in place, meaning you are paying additional money for a safety net you already possess.

It is imperative to carefully scrutinize the terms and duration of your car’s original factory warranty before even considering an extended offering. Evaluating the overlap between the existing manufacturer’s coverage and the proposed extended warranty is a critical step. In many cases, the extended warranty’s scope or duration might not offer a significantly better or broader range of protection than what is already provided by the automaker, rendering the additional expense largely unnecessary and inefficient.

Consumers should ask themselves if the extended warranty truly enhances their coverage, or if it merely rehashes what they are already entitled to. If the extended warranty begins immediately upon purchase, overlapping with the manufacturer’s warranty, it provides no real additional value during that period unless its terms explicitly extend the duration beyond the factory coverage or genuinely enhance its scope significantly. Often, such an overlap represents a direct waste of financial resources.

Moreover, it is worth noting that beyond manufacturer warranties, many credit cards offer inherent purchase protection benefits that could cover certain repairs within the initial months of vehicle ownership. These additional layers of protection, often available at no extra charge, provide a further reason to question the necessity of an expensive extended warranty. A diligent assessment of all existing coverages can reveal that you are already adequately protected, making the extended warranty an expendable luxury rather than a vital necessity.

### 5. The Ultimate Driver: Profit Motives for Dealerships and Third-Party Providers

The aggressive promotion of extended warranties by both car dealerships and independent third-party companies is not coincidental; it is a direct reflection of their inherent profitability. These vehicle service contracts are, for the selling entities, incredibly lucrative financial products. They are frequently marked up significantly from their actual cost, meaning that a substantial portion of the price you, as the consumer, pay for the warranty goes directly into the seller’s pockets as pure profit.

Sales personnel, whether at a dealership or for a third-party warranty provider, are often heavily incentivized to sell extended warranties. These incentives can include commissions, bonuses, and other forms of financial rewards tied directly to their sales performance. Such compensation structures can unfortunately lead to high-pressure sales tactics, where salespeople might present the policy’s benefits in an overly optimistic light or even inadvertently misrepresent the true scope of the coverage, pushing for a quick decision.

It is crucial for consumers to remember that the primary objective of these businesses is, first and foremost, to generate revenue and maximize their profits. While they may articulate the benefits of extended protection, the underlying financial model is built on capturing as much of your money as possible. The value they place on your personal financial well-being, therefore, might not align as closely with your own interests as you would hope when making such a significant purchase.

This profit-driven agenda fundamentally shapes the design and marketing of extended warranties. The terms and conditions, the pricing, and the sales pitches are all crafted to optimize the seller’s financial gain. Understanding this underlying motive empowers consumers to approach these offers with a critical and skeptical eye, recognizing that the advice being given is often influenced by a desire for commission rather than an objective assessment of genuine need.

### 6. A Losing Bet: The Odds Are Consistently Stacked Against the Consumer

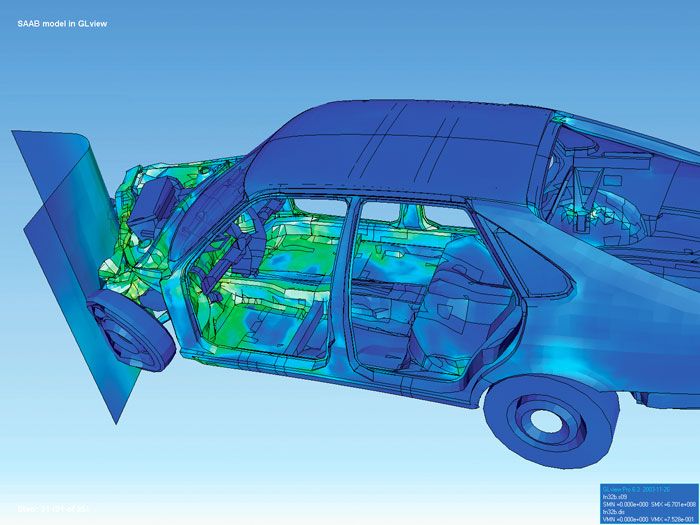

The fundamental truth underpinning the extended warranty industry is that these companies operate on a calculated gamble. They are, quite simply, betting that your car will not experience a significant number of expensive repairs during the specific period covered by the warranty. This business model is meticulously constructed using vast amounts of actuarial data, which allows them to accurately calculate the statistical odds of various types of repairs occurring on different vehicle makes and models. They then price their warranties accordingly, ensuring that, on average, they will emerge profitable.

Extended warranty providers would not offer these policies if the financial scales were balanced in favor of the consumer. Their entire operational framework is predicated on the expectation of making a net profit. This means that, statistically speaking, the immense majority of car owners who choose to purchase an extended warranty will ultimately pay more for the coverage than they will ever receive back in actual repair benefits or reimbursements. The money invested in the warranty could often be put to far more effective use.

Consider this perspective: when you buy an extended warranty, you are essentially placing a bet against the inherent reliability of your own vehicle. The warranty company, armed with comprehensive data and sophisticated risk assessments, has already determined that the odds are overwhelmingly in their favor. This imbalance in information and financial leverage means that the consumer is typically at a significant disadvantage from the outset, making the purchase more of a lottery ticket than a secure investment.

Instead of funneling money into an extended warranty where the statistical probability of a financial return is low, that capital could be strategically allocated to other financial goals. This might include building a robust emergency fund specifically designated for potential car repairs, or investing in other areas where the returns are more predictable or advantageous. Recognizing that the odds are fundamentally stacked against you is a critical piece of information for any savvy car owner deliberating the purchase of an extended warranty.” , “_words_section1”: “1940

### 7. Self-Inflicted Wounds: Risk of Voiding Coverage Through Modifications or Maintenance Lapses

Extended warranties, despite their initial appeal, often carry stringent conditions that can easily invalidate your coverage. A primary concern is the requirement to rigorously adhere to the manufacturer’s suggested maintenance schedule. Even minor omissions, like a skipped oil change or delayed tire rotation, can be cited by warranty providers as grounds to deny coverage for major repairs, such as an engine or transmission failure. This leaves the consumer paying for the repair themselves, despite having invested in the warranty.

Furthermore, any alterations made to your vehicle can jeopardize its warranty. Seemingly innocuous changes, like adding aftermarket wheels or an upgraded infotainment system, may be explicitly stated as reasons to void your extended warranty. Such stipulations mean that a significant investment in a service contract could be lost, leaving you without protection for crucial repairs simply because of personal customization. It’s a frustrating reality where paid-for protection vanishes due to actions often considered routine by car owners.

These clauses, frequently hidden in the extensive fine print, underscore the conditional nature of extended warranty protection. Consumers often overlook these details, focused instead on the broad promise of security. The onus to meticulously understand and follow these intricate terms falls entirely on the car owner, creating a high barrier for maintaining active coverage and highlighting how easily a warranty can become a costly, useless expense.

### 8. The Bureaucratic Gauntlet: Complex Claim Processes and Unjust Reimbursement Hurdles

Even when a repair is clearly covered, navigating the extended warranty claim process can quickly become an administrative nightmare. Warranty companies often dictate that repairs must be performed exclusively at their approved facilities, potentially forcing you away from your trusted mechanic. This restriction alone can significantly inconvenience car owners, limiting their choice and potentially affecting their confidence in the service quality.

The journey to an authorized repair is further complicated by extensive documentation requirements. Warranty providers routinely demand detailed repair estimates and comprehensive diagnostic reports before granting approval for any work. This rigorous process can lead to considerable delays, leaving you without your essential vehicle for an extended and often unpredictable period, adding stress and logistical challenges.

Compounding these issues, claim denials are not uncommon. These rejections can arise if the repair is deemed to fall under an exclusion or if a pre-existing condition is suspected. Even after careful adherence to all procedures, the possibility of denial highlights the inherent unreliability of relying on these warranties for genuine financial protection. As industry experts note, companies can “play hot potato with the costs,” leaving consumers with unexpected bills.

### 9. Diminished Returns: How High Deductibles and Partial Coverage Erode Real Value

A significant drawback of extended warranties is the inevitable deductible. Even for covered repairs, you are almost always required to pay an out-of-pocket expense, which substantially reduces the financial benefit and diminishes the overall value of the policy. These deductibles are not trivial, typically ranging from $50 to $200 or more per incident. For common, smaller repairs, the deductible can often absorb a large portion of the repair cost, rendering the warranty less advantageous.

Moreover, the promise of “comprehensive” coverage is often misleading due to partial coverage clauses. Even if a major component is theoretically covered, the warranty might place limits on associated labor or ancillary parts, leaving you responsible for the remainder. This fragmented coverage, combined with deductibles, ensures that the actual financial relief received is often far less than anticipated, prompting many consumers to question the real worth of their investment.

Ultimately, the combination of high deductibles and incomplete coverage severely erosions the perceived value of an extended warranty. As Consumer Reports consistently highlights, the total financial outlay—the initial warranty cost plus multiple deductibles and uncovered portions—can quickly surpass what it would have cost to pay for repairs outright, particularly for reliable vehicles. This reality should give consumers pause, making them critically assess whether the promised peace of mind translates into tangible savings.

### 10. Hidden Guardians: Overlooking Existing Safety Nets Like Credit Card Perks and Consumer Laws

Many consumers, eager for vehicle protection, often overlook inherent safety nets that offer similar benefits without the added expense of an extended warranty. Beyond the original factory warranty, numerous credit cards provide valuable purchase protection, including extending the manufacturer’s warranty for an additional period. These benefits, which often cover repairs within initial months of ownership at no extra charge, represent an underutilized resource against unexpected repair costs.

Furthermore, statutory consumer protections, such as “lemon laws,” exist in many jurisdictions to protect buyers from defective products. These laws offer recourse for new vehicles with persistent, significant defects that impact their functionality or safety. By understanding these legal safeguards, which often cover major mechanical failures that extended warranties also claim to address, consumers can avoid redundant and costly additional protection.

A thorough review of all existing coverages is therefore essential. This includes scrutinizing credit card benefits, comprehending state consumer protection laws, and re-evaluating the scope of the original factory warranty. Recognizing these “hidden guardians” empowers consumers to realize that they may already possess adequate protection, rendering an expensive extended warranty an unnecessary expenditure. Such informed decision-making optimizes financial resources more effectively.

### 11. The Smart Money Move: Building a Robust Emergency Fund for Vehicle Repairs

Instead of committing significant funds to an extended warranty with questionable returns, a much more financially astute strategy is to establish a dedicated emergency fund for vehicle repairs. This involves consistently setting aside a modest sum each month into a separate, easily accessible savings account. Over time, this fund grows, creating a reliable financial buffer specifically earmarked for any unforeseen automotive expenses.

This emergency fund offers distinct advantages over an extended warranty. It provides unparalleled freedom to choose your preferred, trusted mechanic, circumventing warranty restrictions that often mandate specific repair networks. Crucially, it empowers you to negotiate repair costs directly and sidestep the administrative burdens and potential claim denials associated with warranty providers. You maintain full control over your finances and vehicle’s repair decisions.

The financial logic is compelling. With rising car repair costs, self-insurance through a dedicated savings account proves highly efficient. For instance, if you save $500 over five years and incur only a $200 minor repair, you retain the remaining $300. In contrast, that same $500 spent on a warranty might only cover the $200 repair, leaving no residual value. This approach not only ensures liquidity but allows your savings to potentially earn interest, enhancing your financial position beyond the static cost of a warranty.

### 12. Proactive Protection: Investing in Preventative Maintenance and Thorough Reliability Research

A cornerstone of responsible and economically savvy car ownership is a proactive commitment to preventative maintenance. Strict adherence to the manufacturer’s recommended service schedule—including regular oil changes, fluid checks, and tire rotations—is critical for extending your vehicle’s lifespan and averting costly breakdowns. Diligent maintenance not only keeps your car running smoothly but also acts as an early warning system, identifying minor issues before they escalate into major, expensive problems.

Alongside meticulous maintenance, conducting comprehensive research into a vehicle’s reliability history before purchase is an invaluable layer of proactive protection. Esteemed resources like Consumer Reports and J.D. Power offer crucial data on the long-term dependability of various makes and models, pinpointing those prone to specific issues as they age. This vital information enables informed decision-making, guiding buyers toward vehicles renowned for their robustness and lower incidence of significant mechanical failures, thereby inherently reducing future repair expenses.

Opting for a car with a proven track record of reliability significantly diminishes the perceived need for an extended warranty. When a vehicle is known for its durability, the probability of encountering major, unexpected repair costs is substantially reduced. This principle applies equally to used car acquisitions; researching a model’s reliability can help steer consumers away from vehicles plagued by chronic problems. By prioritizing preventative care and informed selection, car owners can proactively mitigate the risk of expensive repairs, rendering an extended warranty largely superfluous and ensuring more effective allocation of their hard-earned money.

### The Bottom Line: Be a Savvy Car Owner

The persuasive promise of an extended car warranty—a shield against the daunting prospect of unexpected repair costs—is a potent marketing tool. However, as this comprehensive analysis has demonstrated, for the vast majority of motorists, these contracts represent a financial miscalculation. The intricate tapestry of hidden fees, constrained coverage, cumbersome claim processes, and the often-redundant nature of their protection consistently overshadow any advertised benefits. Industry experts caution against them, reiterating that these agreements are, more often than not, a significant waste of money, primarily designed to bolster seller profits rather than genuinely safeguard consumer finances.

Instead of surrendering your financial peace of mind to a wager where the odds are decidedly unfavorable, true security emerges from empowered knowledge and diligent financial foresight. Cultivating a dedicated emergency fund for vehicle repairs grants you fluid capital and the freedom to choose your trusted mechanic, bypassing the bureaucratic hurdles of warranty claims. Equally crucial are an unwavering commitment to preventative maintenance, keeping your vehicle in peak condition, and meticulous research into a car’s reliability before making a purchase. These actionable strategies form the bedrock of astute car ownership, offering superior protection and greater control over your automotive expenditures.

Ultimately, the power to insulate yourself from unforeseen repair costs lies squarely in your hands, not within the convoluted fine print of an expensive, and often disappointing, extended warranty. Equip yourself with accurate information, critically evaluate every offer, and prioritize these financially sound alternatives. By embracing these principles, you can confidently navigate the complexities of car ownership, driving forward free from the unnecessary financial burden of a wasteful extended warranty.