A comfortable retirement is a goal many of us share, and for the vast majority of Americans, a 401(k) stands as a cornerstone of that financial future. This employer-sponsored retirement plan offers invaluable tax advantages and the incredible potential for long-term growth, making it an indispensable tool for building financial stability. However, simply having a 401(k) isn’t enough; its effectiveness hinges on how well it truly performs.

While it can be alarming to find your retirement account not meeting expectations, panicking is the last thing you should do. Many people navigate a gray area regarding what their 401(k) is genuinely invested in and how effectively these accounts are working for them. The good news is that understanding the common reasons behind underperformance is the first crucial step toward taking control and making informed decisions to revitalize your savings.

Experts consistently point out that a significant number of employer-sponsored retirement accounts are underserving their investors, often being either underperforming or overpriced. Almost 84% of 401(k) plans may even harbor at least one red-flag infraction, potentially leading to reduced returns for you. By identifying these subtle signs of underperformance, you can proactively address them and set your 401(k) on a path toward optimal growth. Let’s explore the key indicators that your 401(k) might be quietly falling short.

1. **Wrong Benchmarking or No Benchmarking**One of the most foundational errors many 401(k) holders make is comparing their portfolio’s performance against an unsuitable benchmark. This is akin to comparing apples to oranges and can lead to false conclusions about your investment health. A common mistake is measuring a diversified portfolio—including U.S. stocks, international equities, and bonds—solely against the S&P 500.

The S&P 500 exclusively tracks large U.S. companies. It cannot accurately reflect the broader scope and different risk profiles of your diversified holdings. If your returns don’t match the S&P 500, it doesn’t automatically signal underperformance. Instead, it highlights a mismatch in your comparative analysis. This misdirection can prevent you from identifying actual issues or lead to rash decisions.

To accurately assess your 401(k)’s health, diligently review your plan’s holdings first. Understand precisely which asset classes you are invested in. Once clear, compare your portfolio’s performance to a blended benchmark that genuinely reflects a similar mix of investments.

Many 401(k) providers offer sophisticated performance comparison tools on their websites. These are incredibly helpful for accurate assessment. The Department of Labor even recommends benchmarking 401(k) plans at least every three years. More frequent reviews are always better for keeping tabs on your fund’s progress against appropriate standards.

Read more about: Trump Fires Labor Statistics Chief Amid Claims of ‘Rigged’ Job Numbers, Sparking Concerns Over Data Integrity

2. **Excessive Fees Eating into Returns**Beneath the surface of your 401(k)’s growth, excessive fees can quietly erode your hard-earned savings. Some 401(k) plans are burdened with high expense ratios on mutual funds, steep administrative fees, or even hidden costs. Ted Benna, “father of the 401(k),” warned that many employer-sponsored plans levy excessive fees. He noted the mutual fund industry has “profited enormously” from these plans.

The impact of these fees, even seemingly small increases, can be “gigantic” over the life of an investment. As Benna explained, “over the life of an investment, it is a real hit — it is gigantic.” The U.S. Department of Labor has highlighted that a mere 1% increase in 401(k) fees could reduce savings by 28% for participants over 35 years or more.

This substantial reduction could mean the difference between a comfortable retirement and one with financial struggles. To combat this, review your 401(k) plan’s expense ratios diligently. Aim to choose funds with an expense ratio ideally below 0.50%. Actively seeking out low-cost index funds, like S&P 500 index funds, provides a cost-effective solution.

Since 2012, the government has mandated 401(k) plans disclose their fees. Ask your HR department for your 401(k)’s fee disclosure document. Understanding fee categories — administrative, investment management, and individual service — and checking for hidden costs empowers you. Ensure your money isn’t unnecessarily siphoned away.

Read more about: $200 Million Mistake: The 15 Financial Decisions That Sank Iconic Celebrities’ Fortunes

3. **Suboptimal Investment Allocation (Too Conservative or Aggressive)**A common, often overlooked reason for underperformance is an investment allocation mismatch. It might not align with your financial goals or risk tolerance. Many individuals approach their 401(k) without a clear plan, investing randomly or defaulting to options without understanding implications. This lack of strategic foresight can lead to issues.

Your portfolio could be excessively conservative, holding too much in bonds or cash. This results in disappointingly low returns. Or it could be overly aggressive, exposing you to uncomfortably high volatility, especially as retirement nears. Jake Falcon, CEO at Falcon Wealth Advisors, notes this leads to disappointment when markets soar but your balance bumps along. He emphasizes the need for a plan.

To rectify this, check your current asset allocation. Determine if it aligns with your age, risk tolerance, and retirement timeline. Your plan’s risk assessment tool can help find a suitable mix. For a hands-off approach, target-date funds automatically adjust allocation from aggressive to conservative as you near retirement.

A general rule suggests subtracting your age from 100. This indicates the approximate percentage of your portfolio in aggressive investments. For example, at age 40, around 60% could be aggressive. If retirement is within five years, consult a financial planner. They can factor in your complete financial picture to craft a truly comprehensive strategy.

4. **Missing Out on Employer Match**One of the most straightforward, yet frequently missed opportunities is failing to contribute enough to receive the full employer match. This isn’t just a minor oversight; it’s literally leaving “free money” on the table. It’s a direct gift from your employer that can significantly accelerate your retirement nest egg’s growth. Ignoring this benefit is akin to declining a raise.

Employer matching programs incentivize employees to save for retirement. They provide an immediate, guaranteed return on your investment that is hard to beat. If your employer offers to match a percentage of your contributions, failing to meet that threshold sacrifices a substantial, effortless boost to your long-term wealth. This “free money” compounds over decades, transforming into a considerable sum.

The solution is simple and powerful: increase your contributions to the level needed to receive the full employer match. If increasing contributions all at once seems daunting, consider a gradual approach. Boost your contribution by 1% every six months or annually. You can also use annual raises or bonuses to seamlessly increase contributions without feeling a significant impact on your take-home pay. Maximizing this match is a fundamental step.

Read more about: Don’t Let These Critical Retirement Mistakes Cost Americans Thousands: A Consumer Reports Guide

5. **Emotional and Poor Timing Decisions (Market Volatility)**The unpredictable dance of market volatility often tempts investors into making emotional, ill-timed decisions. These can severely undermine long-term 401(k) returns. Many individuals fall prey to panic-selling during downturns, driven by fear, or buying high and selling low, chasing trends. Such impulsive reactions, fueled by short-term market fluctuations, can devastate a retirement portfolio.

This tendency to overtrade, as studies suggest, demonstrably leads to underperformance. Steven Neeley, CFP, states that “Studies show that retail investors who trade more often underperform on average.” Frequent trading not only incurs additional costs but also disrupts the powerful effect of compounding interest. When you react to market noise instead of a disciplined strategy, you work against your financial interests.

The most effective antidote to emotional decision-making is to commit to a steadfast, long-term investing strategy. This means avoiding knee-jerk changes based on market headlines. A powerful strategy is dollar-cost averaging: invest a fixed amount regularly through automatic contributions. This smooths out market ups and downs.

Instead of selling during nervous periods, consider rebalancing your portfolio to maintain your preferred stock/bond mix. Neeley recommends trying to “only re-evaluate your 401(k) once a year.” He emphasizes that “These accounts are not meant for day trading.” Stick to your plan, and let time and disciplined investing work for you.

6. **Neglecting Regular Portfolio Rebalancing**Even a perfectly allocated portfolio can “drift” from its original target percentages over time. This happens due to varying investment performance. For example, if stock investments have strong growth, they might comprise a larger portfolio portion than intended. This makes your overall allocation riskier for your comfort level.

This unintentional shift can expose you to greater market fluctuations than you are prepared for, especially during volatile periods. Failing to rebalance regularly prevents you from capitalizing on the natural ebb and flow of the markets. It disrupts the “buy low, sell high” principle.

Rebalancing involves selling off well-performing assets that have grown beyond their target. The proceeds then buy more of the underperforming assets, which are now “on sale.” This disciplined approach removes emotional biases. It keeps your portfolio aligned with strategic objectives.

To keep your 401(k) optimized, review your portfolio at least once a year. Rebalance if necessary to restore your asset allocation. Many 401(k) plans offer automatic rebalancing; activate this feature if available. Regular rebalancing manages risk, maintains diversification, and ensures your strategy is effective.

Building on the foundational insights of the first six signs, it’s time to delve deeper into additional, often overlooked indicators that your 401(k) might be quietly falling short. These more nuanced issues can significantly impact your long-term financial health, and understanding them is crucial for taking proactive steps to optimize your retirement savings. By addressing these deeper structural and behavioral challenges, you can ensure your 401(k) is truly working for you.

7. **Lack of Investment Choices**One common impediment to a well-performing 401(k) is a severely limited menu of investment options. Some plans simply don’t offer enough variety, making it incredibly challenging to build a truly diversified portfolio or find funds with competitive, low expense ratios. This lack of choice can force you into higher-cost or less suitable investments, ultimately hindering your growth potential. Consistent underperformance, especially when market conditions generally favor growth, might point to a systemic issue within your plan’s offerings.

When faced with constrained options, you don’t have to feel entirely stuck. If your plan offers a self-directed brokerage option, take advantage of it. This feature allows you to access a much wider range of investments beyond the default choices, giving you greater control over your portfolio’s diversification and cost structure.

However, if your 401(k) plan is particularly restrictive or plagued with consistently underperforming, high-fee funds, a strategic approach might be necessary. In such cases, consider contributing just enough to your 401(k) to secure the full employer match – that ‘free money’ is always a priority. Then, invest any additional retirement savings in a low-cost Individual Retirement Account (IRA) or a taxable brokerage account, where you’ll likely find a broader selection of investment vehicles and lower fees.

Read more about: Listen Up: 14 Critical Signs Your Body Is Quietly Signaling Nutrient Deficiencies

8. **Old 401(k) Accounts Are Scattered**As you move through your career, it’s common to accumulate multiple 401(k) accounts from previous employers. While each account might hold your hard-earned savings, having these old plans scattered across different providers creates a logistical nightmare. It makes it incredibly difficult to track your overall investment performance, monitor asset allocation, and keep tabs on all the various fees you might be paying. This fragmentation can lead to missed opportunities for consolidation and optimization.

Managing multiple accounts also means dealing with different sets of rules, online portals, and potentially varying fee structures. This complexity often deters people from regularly reviewing their holdings, which can be detrimental if some of these older accounts are burdened with higher administrative or investment management fees that silently erode your returns over time. A consolidated view is essential for making informed decisions about your entire retirement picture.

To simplify your financial life and potentially reduce costs, consider consolidating these old 401(k)s. You can roll them into your current employer’s 401(k) plan, if permitted, or, often a more flexible option, roll them into a low-cost IRA. Consolidating your accounts makes management much easier, allowing for a clearer overview of your investments, a more consistent investment strategy, and a better chance to minimize those cumulative fees that can add up significantly.

Read more about: Simplify Your Finances in 2025: 7 Practical Strategies to Reclaim Control and Reduce Stress

9. **Borrowing from Your 401(k)**While the option to borrow from your 401(k) might seem like a convenient way to access funds without external loan applications, it comes with significant financial repercussions that can severely undermine your retirement savings. When you take a 401(k) loan, that money stops growing. The power of compounding interest, which is your greatest ally in long-term wealth building, is put on hold for the borrowed amount, meaning you miss out on valuable investment gains that could have accrued over time.

Furthermore, 401(k) plans typically charge interest on these loans, often about 1% to 2% over the prime rate. While you technically pay this interest back to yourself, if that interest rate is consistently below your fund’s potential rate of return, you’re effectively fighting against the tide and losing out on growth. Even more concerning are the risks associated with repayment: if you leave your job, you might have to repay the entire outstanding balance very quickly. Failure to do so can result in the remaining balance being considered a taxable distribution in the year of default, potentially incurring income taxes and a 10% early distribution penalty if you are under age 59 1/2.

Before considering a 401(k) loan, it is crucial to explore other financing options that don’t jeopardize your retirement security. If you find yourself in a situation where a 401(k) loan is the only viable option, make it a top priority to pay it back as quickly as possible. Crucially, even while repaying a loan, strive to continue making regular contributions to your 401(k) to maintain momentum in your retirement savings and minimize the long-term impact on your nest egg.

Read more about: Don’t Let These Critical Retirement Mistakes Cost Americans Thousands: A Consumer Reports Guide

10. **Overdiversification**Diversification is a cornerstone of smart investing, designed to spread risk across various assets and reduce the impact of any single investment’s poor performance. However, there is such a thing as “overdiversification,” a subtle trap that can actually lead to underperformance rather than protecting your returns. As Steven Neeley, CFP with Fortress Capital Advisors, rightly points out, being spread too thin often leads to poor results. The goal isn’t to own every stock and bond in the world; it’s to build a robust, yet focused, portfolio.

When your portfolio becomes excessively diversified, with too many different funds or asset classes, you dilute the impact of your best-performing investments. The returns from your winners get averaged down by the returns of a multitude of less effective holdings, making it hard to achieve significant growth. Neeley suggests keeping things simple, stating that unless you have very good insights into why a certain sector or asset class should outperform, there’s no reason to invest in it. For most people, there’s no need to own high-yield bonds, emerging market stocks, commodities, or real estate within their 401(k) plans, as these can add complexity and often don’t contribute meaningfully to long-term growth for the average investor.

The key is to strike a balance. Focus on a well-diversified core of low-cost index funds that cover broad market segments, such as U.S. large-cap, international, and bonds, appropriate for your risk tolerance and timeline. Regularly review your holdings to ensure there isn’t unnecessary overlap or too many niche investments that aren’t contributing to your overall financial goals. A streamlined, thoughtfully diversified portfolio is often more effective than one that is overstuffed.

11. **Unseen Plan Violations**Perhaps one of the most alarming and subtle signs of an underperforming 401(k) lies in the presence of undetected plan violations. Experts indicate that the vast majority of employer-sponsored retirement accounts are underserving their investors, with many being either underperforming or overpriced. Even more critically, almost 84% of 401(k) plans may harbor at least one red-flag infraction, which could directly lead to reduced returns for participants or even severe penalties for the company.

These violations can range from severe issues to less serious but still impactful infractions. Abernathy-Daley, a consulting firm, estimated that a significant 43% of 401(k) plans in the U.S. have at least one severe violation, covering areas like fraud, dishonesty, insufficient fidelity bonds, or a failure to offer qualified default investment alternatives. These can directly impact your retirement savings, leading to a major hit. Beyond severe issues, a whopping 76% of American 401(k) plans are also plagued with at least one less serious violation, such as failing to offer automatic enrollment, failing to issue corrective distributions of excess contributions, or failing to disburse payments in a timely manner. These issues, while seemingly minor, can subtly erode your fund’s performance and accessibility.

If you have any concerns about your 401(k) plan or notice any red flags, performing your due diligence is essential. Schedule a one-on-one meeting with your company’s plan manager to discuss your concerns and request to see the fund’s benchmarking analysis, which compares your fund’s performance against others. The Department of Labor recommends benchmarking 401(k) plans at least every three years, and more frequently is always better. If your company’s fund manager hasn’t done so recently, it’s a significant cause for concern. Additionally, take your concerns to your HR department, making sure they understand that 401(k) infractions can result in substantial penalties and fines for the company. The threat of these consequences can be a powerful motivator for them to address any problems swiftly.

Read more about: Donald Trump: A Detailed Chronicle of His Life, Business, and Political Impact

12. **Comparing Your Savings to Others**It’s a natural human tendency to look at what others are doing, especially when it comes to financial success. However, comparing your 401(k) savings or investment performance to that of friends, family, or even social media stories can be a dangerous trap, as Jake Falcon, CEO at Falcon Wealth Advisors, wisely warns. Hearing about a neighbor’s “dog tripling their money overnight” can lead to irrational decisions, chasing hype, and a feeling that your own plan is underperforming when it might be perfectly on track for *your* specific goals. This comparison game often lacks crucial context and can derail a disciplined long-term strategy.

Every individual’s financial situation, risk tolerance, timeline, and goals are unique. What works for one person’s 401(k) might be completely inappropriate for another. Getting caught up in the allure of “better” investments or sensational gains often leads to impulsive actions like buying high and selling low, which are detrimental to long-term growth. Instead of focusing on external benchmarks that don’t reflect your situation, the most effective strategy is to concentrate on your personal financial plan and stick to it steadfastly.

To counter the impulse to compare, prioritize a clear understanding of your own investment strategy and risk tolerance. Ensure your fund selections align with your specific goals for long-term growth, income, or stability. Get educated on the benchmarks your chosen funds use and their expense ratios. As Falcon advises, the best course of action is to have a well-defined plan, stay disciplined, and regularly check in with a financial advisor who can provide personalized guidance tailored to your complete financial picture, not just your 401(k) assets. This focused approach will keep you on the path to a secure retirement.

**The Bottom Line**

Read more about: Home Refinancing 101: Your Essential Guide to Knowing When to Refinance — And When to Hold Off for Bigger Savings

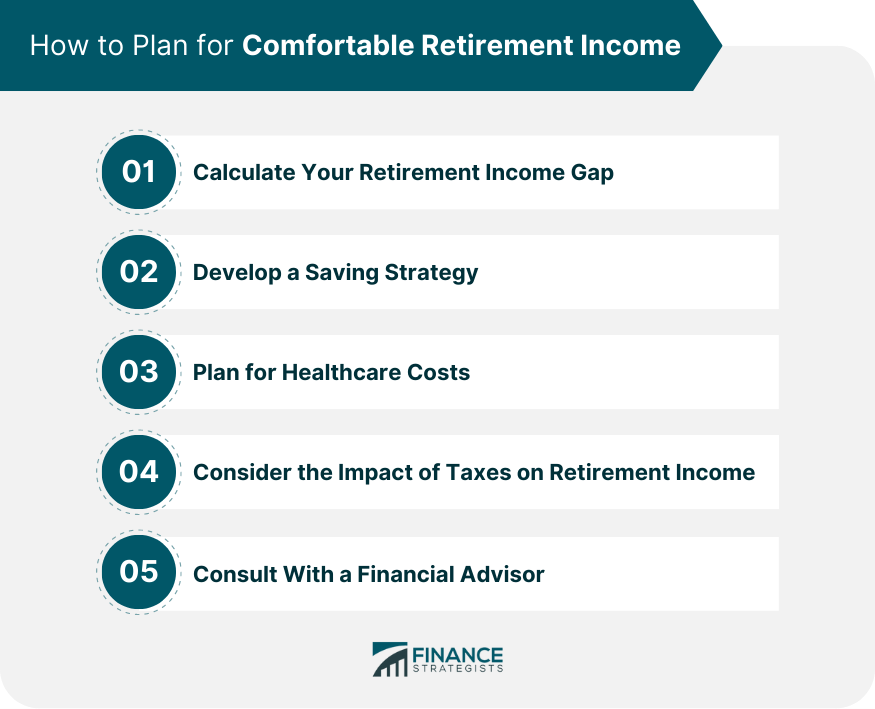

While market cycles and volatility are unavoidable, an underperforming 401(k) is not a permanent sentence. By diligently applying these strategies—minimizing fees, optimizing asset allocation, maximizing contributions, wisely managing existing accounts, avoiding detrimental borrowing, being aware of plan specifics, and staying disciplined against external comparisons—you can significantly boost your retirement savings. Regularly evaluating your 401(k)’s performance, making necessary adjustments, and understanding the nuances of how your money is working for you are key to securing a comfortable, stress-free retirement. Take control, stay informed, and ensure your 401(k) is truly optimized for your financial future.