Nobody wants to find out they’ve become a victim of credit card fraud, and finding suspicious purchases on your card can be worrisome. This pervasive financial crime affects hundreds of thousands of Americans each year, underscoring the constant need for vigilance and informed action. Credit card fraud is fundamentally defined as the “unauthorized use of a credit card account for purposes of stealing goods or money,” a crucial distinction tracked by the Federal Trade Commission (FTC). This crime extends beyond the simple theft of a physical card, encompassing a wide array of illicit activities from establishing bogus accounts in your name to exploiting stolen data for online purchases.

The scale of this issue is significant; the FTC, which tracks financial crimes nationwide, logged 426,038 complaints of credit card fraud in 2023. This figure, though representing a 5% decline from 448,466 complaints in 2022, still highlights the ongoing threat. New account scams, where criminals establish a bogus credit card account in a victim’s name, remain particularly prevalent, accounting for 89% (381,164) of complaints in 2023. However, existing account fraud, involving theft or abuse of physical cards or account numbers, saw its share of complaints increase from 9% in 2022 to 11% in 2023.

The good news is that you are not powerless against this financial threat. While fraudsters continuously evolve their tactics, knowing precisely what to do if you suspect fraud can significantly protect your finances and minimize potential damage. Credit card companies themselves have robust safeguards, with “perhaps the most prominent of these safeguards is the EMV chip — that small silver- or gold-colored chip embedded on the face of most new credit cards.” This small but mighty chip helps make transactions more secure and may reduce credit card fraud.

However, even with advanced security features, your personal vigilance remains your strongest defense. If you find yourself “looking at charges on your card that you definitely didn’t make,” the most crucial initial response is not to panic. Instead, take a deep breath and prepare to act decisively and systematically. We’ve rounded up a comprehensive list of critical steps you can take to address credit card fraud, safeguard your financial well-being, and protect yourself from future incidents.

1. Contact Your Credit Card Issuer Immediately

When you uncover suspicious charges, the very first and most crucial step is to get ahead of the fraudsters before they can inflict more damage. As soon as you suspect your card may have been stolen, or you discover unrecognized transactions on your account, notify your card issuer without delay. You can typically do this by phone, through the card’s dedicated phone app, or via its web dashboard.

The sooner an issue is reported, the more quickly the card issuer can investigate the suspicious activity. Prompt reporting also expedites their ability to resolve any unauthorized charges, potentially saving you from greater financial distress. Providing details like the transaction date, amount, and merchant will assist them in their investigation.

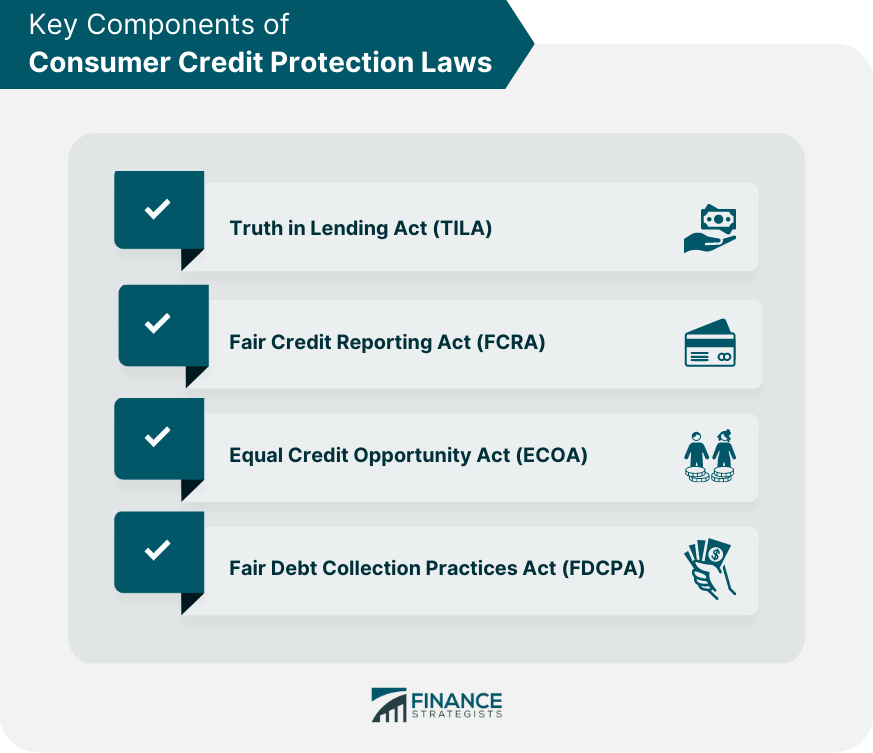

Furthermore, major card networks like Visa and Mastercard have “zero-liability policies designed to ensure that you won’t be held responsible for unauthorized charges made with your credit or debit card or account information.” Even if your credit card company does not have an explicit zero liability policy, your liability for credit card fraud is legally limited to $50 under the Fair Credit Billing Act, provided you report the unauthorized activity within 60 days of receiving the credit card statement. Many card issuers, including Citi, go further by promising “$0 liability for unauthorized charges on all its cards.”

After you report the fraud, your card issuer will likely “issue you a new card with a new card number and investigate the charges immediately.” They will guide you through the next steps, ensuring that the compromised account is closed and a new, secure card is on its way. This swift action is your best defense against further financial loss and a pivotal move toward resolving the fraud.

2. Secure Your Accounts by Locking Them Down

Beyond notifying your issuer, an immediate and practical step you can take to prevent further unauthorized transactions is to utilize your credit card’s lock feature. Many credit cards now offer a “card lock feature” that allows you to “block new transactions without interfering with recurring payments you may have assigned to the card.” This can be a vital tool for immediate damage control.

This immediate action can be incredibly useful in several scenarios. It’s an excellent tactic for “seldom-used cards,” which fraudsters might target assuming they are less frequently monitored. It’s also highly effective “anytime you think a card is misplaced, but you still expect to get it back,” offering a temporary but robust shield against potential misuse while you search for it.

By locking your account, you are effectively putting a pause on any new charges, giving you valuable breathing room. This allows you to gather your thoughts, contact your card issuer, and take other necessary protective measures without the constant worry of additional fraudulent activity occurring. It’s a quick, accessible solution to an urgent problem, providing an instant layer of security.

Read more about: A Financial Advisor’s Blueprint: 15 Essential Investment Strategies for a Secure Retirement in 2025

3. Implement a Fraud Alert, Security Freeze, or Credit Lock on Your Credit Reports

If you’ve been “victimized by credit card fraudsters or notified that your personal information has been exposed in a data breach,” it’s imperative to take steps that safeguard your broader financial identity. Activating a fraud alert, security freeze, or credit lock on your credit reports can “help stop criminals from doing further damage, like opening up a new credit card” in your name.

A fraud alert serves as a warning flag to potential lenders. It “requires lenders to verify your identity before processing any credit application made in your name.” This additional verification step makes it significantly harder for identity thieves to establish new bogus accounts using your stolen personal information. You can set up a fraud alert by contacting any of the three major credit bureaus—Experian, TransUnion, or Equifax—and they will automatically notify the others on your behalf.

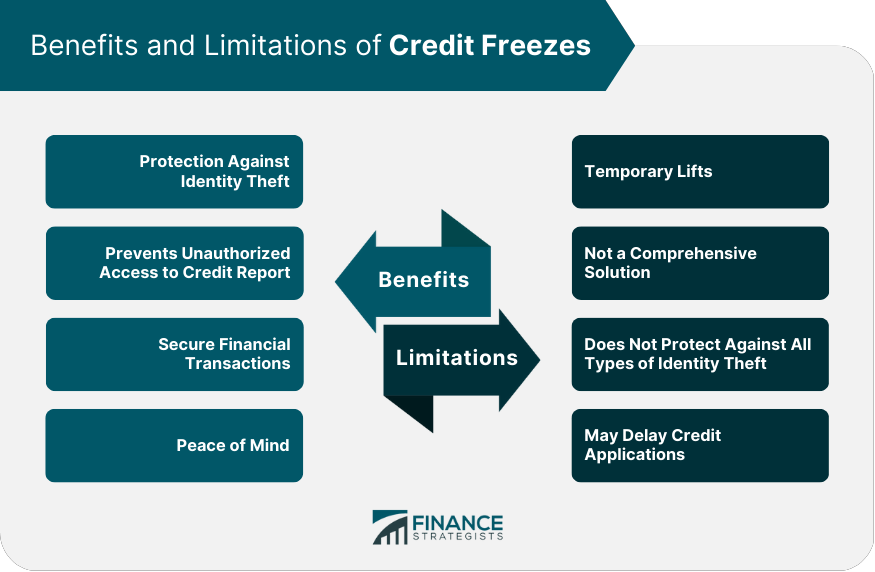

For an even stronger layer of protection, consider a security freeze or a credit lock. “Security freezes and credit locks are functionally equivalent: Both block most credit checks altogether (and must be removed before you can apply for new credit cards or loans).” These measures offer the highest level of defense against new account fraud, effectively preventing anyone from accessing your credit file for new credit applications until you explicitly lift the freeze or lock.

It is crucial to act swiftly when considering these protective measures. While they offer robust security going forward, “illicit actions taken before you activate a fraud alert, security freeze or credit lock can still turn up afterward” on your reports. Therefore, prompt activation is key to preventing future damage to your credit history and establishing control over your financial identity.

4. Establish Credit Monitoring Services for Ongoing Vigilance

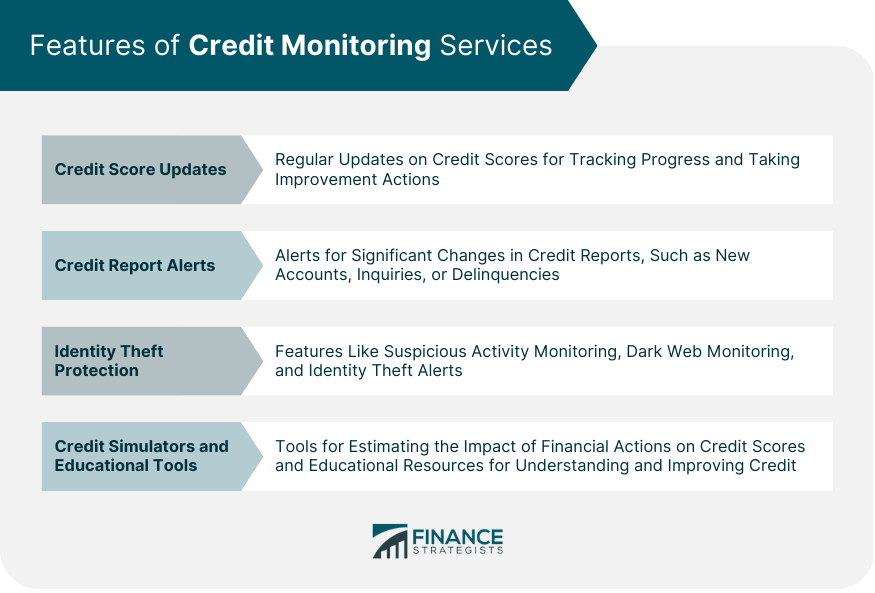

Even after addressing immediate fraudulent charges, the threat of lingering or new identity theft can persist. This is where credit monitoring services become invaluable. “Credit monitoring services alert you, via email or text message, when certain new information is posted to your credit reports,” providing an essential layer of ongoing vigilance. These alerts cover a range of activities, including new credit applications, newly established accounts, and even bills sent to collections.

These alerts empower you to “detect credit card fraud and other forms of identity theft quickly, so you can take action quickly and minimize their impact.” Rather than passively waiting to discover new fraudulent activity, credit monitoring proactively notifies you of changes, allowing you to respond swiftly and decisively. It’s a key proactive measure that keeps you informed of any activity occurring in your name across your financial spectrum.

Many resources are available for establishing credit monitoring. For example, consider “enrolling in free credit monitoring from Experian, which alerts you instantly when a new credit application or account is recorded on your Experian credit report.” Similarly, “Credit Karma can also help when it comes to staying on top of your credit reports,” offering “free credit monitoring in addition to free VantageScore 3.0 credit scores and reports from two of the three major credit bureaus.”

Consistent monitoring is vital because “fraudulent charges can keep appearing on your card statements months after your card information is stolen if there was any additional information, such as login credentials, that may have been compromised.” These services provide that necessary long-term security, ensuring that you remain aware of and can address any potential threats to your financial health. They serve as your personal sentinel, guarding against unforeseen attacks.

Read more about: Buyer Beware: Major Credit Cards Ban Transactions on Fake Sites Spoofing These 11 Retailers

5. Report the Fraud to Appropriate Law Enforcement and the Federal Trade Commission (FTC)

While notifying your card issuer is the first crucial step, credit card fraud is not merely a financial inconvenience; it is a serious criminal offense, a form of “identity theft.” Therefore, reporting it to appropriate law enforcement and government agencies is vital. A good starting point is to report it at “the FTC’s IdentityTheft.gov website,” which serves as a central hub for victims of identity theft.

The Federal Trade Commission plays a critical role in combating these crimes. By collecting fraud reports, the FTC helps to “identify trends and take action against scammers” on a broader scale, potentially preventing others from falling victim. Your report contributes to a larger effort to track and dismantle fraudulent networks, making it a civic duty as well as a personal protection measure.

Beyond the FTC, “credit card fraud is a criminal offense, regardless of whether your card was stolen or not, so reporting fraud to the police should be considered in all cases.” Your card issuer may even recommend involving additional authorities, particularly if the fraud appears extensive or involves significant losses. A police report creates an official record of the crime, which can be essential for disputes and other recovery efforts.

“Filing a police report is especially crucial if you see a pattern of fraudulent charges in the days following the first signs of suspicious activity” or if “multiple credit cards or financial accounts” have been compromised. In such scenarios, “the police can use your records to open an investigation.” If you’re dealing with “serious identity theft,” the FTC “can assist you in developing a ‘recovery plan’ to prevent further loss and get things squared away with the police and credit bureaus as necessary,” offering comprehensive support beyond just the credit card fraud itself.

6. Diligently Review Your Credit Card Statements for Any Irregularities

One of the most effective and ongoing strategies for detecting credit card fraud is the diligent and regular review of your credit card statements. “Whether you receive your statements online or as hard copies, it’s important to examine the transaction histories on all of your credit cards to check for suspicious activity.” This habit forms the bedrock of early detection, allowing you to catch unauthorized charges before they escalate.

When reviewing your statements, it’s not just about looking for large, obvious purchases you didn’t make. “Discrepancies don’t have to be glaring to raise a red flag.” Identity thieves sometimes employ a tactic of running “test transactions involving very small sums to confirm access to an account, as prelude to taking it over or making a more substantial charge later.” These small charges can easily be overlooked but are critical warning signs.

It is equally important to “do so for cards you seldom use as well as the ones you reach for regularly.” Fraudsters frequently target less-active accounts, operating under the assumption that these cards are monitored less frequently by their owners. By extending your meticulous review to all your cards, you close potential loopholes that criminals might exploit.

Regularly checking your statements allows you to spot unfamiliar charges, merchant names, or payment locations promptly. This vigilance ensures that you can report suspicious activity within the critical timeframe required by federal law and most card issuer policies, significantly boosting your chances of having fraudulent charges removed and minimizing your liability.

7. Proactively Keep Tabs on Your Credit Reports from All Three Bureaus

While diligently reviewing your credit card statements is vital, your credit reports offer an even broader and deeper view into your financial identity and potential fraudulent activity. “Regularly checking your credit reports from all three national credit bureaus (Experian, TransUnion and Equifax) can help you detect attempts to obtain credit in your name,” which is a common form of new account fraud and identity theft.

Accessing your credit reports is straightforward and free. You “can get your credit reports free once each week at AnnualCreditReport.com.” This valuable resource allows you to maintain continuous oversight of your credit file. When you review these reports, it’s essential to “study them carefully, noting the appearance of any new accounts you don’t recognize or any hard inquiries that are unfamiliar.”

Hard inquiries are particularly important to note, as “lenders typically perform hard inquiries when they are processing new credit applications.” An unfamiliar hard inquiry could be a strong indicator that someone has attempted to open a new line of credit using your personal information. Identifying these early can prevent significant damage to your credit score and financial standing.

If you discover any suspicious entries, it’s crucial to “exercise your right to dispute inaccurate credit report information and have fraudulent information removed.” Even if you’ve already implemented fraud alerts or freezes, remember that “it can take days or weeks for lenders to report events to the credit bureaus,” meaning illicit actions taken before your protective measures were active can still surface later. Continuous, proactive monitoring of your credit reports is a cornerstone of long-term financial security.

Navigating the immediate aftermath of credit card fraud is critical, as discussed in the initial steps of this guide. However, truly fortifying your financial well-being requires more than just reactive measures; it demands a shift toward proactive, long-term strategies. By adopting ongoing habits and understanding the protective mechanisms in place, you can build a robust defense against future incidents and maintain control over your financial identity. This section will guide you through additional essential steps, moving beyond immediate crisis management to establishing a continuous shield of security. You’re not just recovering from fraud; you’re preparing to prevent it.

8. Do Not Ignore Communications from Debt Collectors for Unfamiliar Debts

Receiving a letter or phone call from a debt collector for a bill that simply doesn’t belong to you can be alarming, but it’s a critical signal you shouldn’t overlook. This often indicates a more insidious form of fraud: a criminal may have opened a new account in your name, run up charges or cash advances, and then abandoned it, leaving you with the repercussions. These communications are not merely an annoyance; they are direct evidence of potential new account fraud.

When confronted with such a situation, it’s important to act deliberately. The first step is to contact the debt collector directly to investigate the unfamiliar debt. Explain that you believe you are a victim of identity theft and that this debt is not yours. This initial communication can help clarify the situation and initiate the process of disputing the debt.

Beyond engaging with the debt collector, it is prudent to follow up with the relevant card issuer mentioned in the collection notice. You should also consider informing appropriate law enforcement agencies, especially if you have already filed reports for other related fraud. Being proactive in challenging these debts can prevent them from negatively impacting your credit score and financial standing.

9. Understand and Leverage Zero Liability Protection

One of the most powerful protections consumers have against credit card fraud is “zero liability protection,” a feature offered by many (though not all) credit cards. This crucial safeguard “shields you from financial responsibility for fraudulent charges made on a stolen card,” providing immense peace of mind. It ensures that you won’t be held accountable for unauthorized transactions, as long as certain conditions are met.

This protection is not only a policy from card networks but is also supplemented by federal law. Under the Fair Credit Billing Act, your maximum liability for unauthorized charges is legally limited to $50, provided you report the theft within 60 days of receiving the credit card statement. Many card issuers, such as Citi, go even further by promising “$0 liability for unauthorized charges on all its cards,” offering complete protection.

To fully benefit from zero liability protection, your vigilance is key. You “must pay attention to your account and report suspicious charges or the theft or loss of a card as soon as you’re aware of it.” Prompt reporting is the cornerstone of this protection; delaying notification could jeopardize your ability to be fully protected from fraudulent charges.

Given that “credit card fraud is common and often outside your control (in the case of a data breach, for instance),” zero liability protection is an exceptionally valuable feature. When comparing credit cards, actively look for issuers that prominently advertise this policy. It’s a testament to a card’s security features and a vital layer of defense against unforeseen financial attacks, making it a prudent consideration for every cardholder.

Read more about: A Financial Advisor’s Blueprint: 15 Essential Investment Strategies for a Secure Retirement in 2025

10. Adopt Habits to Safeguard Your Physical Credit Cards

In an era of digital transactions, it’s easy to overlook the importance of safeguarding your physical credit cards, yet card theft remains a significant method of fraud. Make it a habit to “keep the cards you use regularly in a secure wallet.” Simple vigilance in daily life can prevent opportunistic thieves from gaining access to your financial tools.

Equally important is avoiding situations where your card details could be easily compromised. “Avoid lending them out or leaving them out in plain sight (on a restaurant table or bar, for example),” where a “practiced criminal could memorize their details with just a glance.” Such scenarios, often termed “shoulder surfing,” allow criminals to gather enough information to make “card not present” transactions or even create “cloned cards.”

For cards you don’t use frequently, ensuring they are stored securely is paramount. “Keep cards you don’t use regularly in a spot that’s secure, but where you’ll notice if they go missing.” This practice helps you detect if a card has been stolen or misplaced before it can be used fraudulently, giving you crucial time to report it to your issuer.

Read more about: Financial Scrutiny: High Stakes and Hard Lessons from 14 Music Icons’ Ventures into the Volatile World of NFTs and Crypto

11. Opt for Contactless Payment Methods Whenever Possible

Embracing modern payment technologies can significantly enhance your security against certain types of credit card fraud. “Systems that let you pay with your smartphone or by tapping with your card are more secure and far less susceptible to skimming than those that require swiping or ‘dipping’ your card.” These contactless methods encrypt your payment information, making it extremely difficult for fraudsters to intercept.

The primary advantage of contactless payments lies in their resistance to skimming. Skimming involves the “abuse of account holder information captured with a ‘skimmer’—an innocuous-looking card scanner placed over the slot on the card reader at an ATM, gas pump or other self-serve kiosk, which steals card information as you make a legitimate transaction.” By eliminating the need to swipe or dip your physical card, contactless payments bypass this vulnerability entirely.

As “the FBI estimates that skimming amounts to over $1 billion in losses each year,” adopting contactless payment methods is a tangible step you can take to protect yourself from this prevalent form of fraud. Whether using your smartphone, smartwatch, or a tap-enabled credit card, choosing these options adds an extra layer of encryption and reduces the exposure of your sensitive card data during transactions, making them a wise choice for everyday purchases.

Read more about: Walmart’s Red Sticker Mystery: Shoppers Decode the New Anti-Skimmer Tactic and How to Stay Safe

12. Rigorously Guard Your Personal Identification Number (PIN)

While not all credit card transactions require a PIN, it plays a critical role in preventing certain types of fraud, particularly cash advances. “Credit card cash advances often require use of a four-digit PIN,” and the absence of this code can effectively “thwart a thief who’s stolen or cloned your card” from accessing quick cash, which is a common goal for criminals. Safeguarding your PIN is thus as important for your credit card as it is for your debit card.

When you do need to enter your PIN, whether at an ATM or a point-of-sale terminal, extreme caution is warranted. “Just as you should with a debit card PIN, take care to conceal the keypad when you enter a credit card PIN.” This simple but effective action helps “prevent detection via hidden camera or ‘shoulder surfing,'” where criminals attempt to observe your PIN entry over your shoulder or through hidden devices.

Your PIN is a crucial access key to your funds, and keeping it private is non-negotiable. Never write your PIN down or share it with anyone, regardless of how trustworthy they seem. Memorizing it and discreetly entering it are fundamental practices that add a significant layer of security, making it much harder for fraudsters to exploit your compromised card for cash advances.

13. Avoid Storing Your Credit Card Numbers on Online Shopping Platforms

The convenience of online shopping often comes with the temptation to save your credit card information for future purchases, streamlining the checkout process. However, this convenience carries inherent risks that can significantly increase your vulnerability to fraud. “At online checkouts, decline the offers to save card info for future use.” While it might feel like “a hassle to type in your card number each time you shop, but it’s less painful than dealing with credit card fraud if your information is stolen.”

The primary concern with stored card information is the risk of data breaches. “Retailers may store your credit card information, so if their data networks are breached, your info could be compromised.” Data breaches, where hackers steal personal information, including credit card numbers, are “on the rise” and can expose your saved details to illicit exchanges on the dark web. Manually entering your card details for each transaction mitigates this risk by ensuring your card information isn’t permanently resident on potentially vulnerable servers.

Even if you trust a particular merchant, the sheer volume of your saved card data across various platforms collectively increases your exposure. By choosing to manually input your details every time, you reduce the digital footprint of your sensitive financial information, making it less accessible to hackers who might target online databases. This practice is a proactive measure that prioritizes security over momentary convenience.

14. Promptly Report and Replace Any Missing or Lost Credit Cards

Losing a credit card or realizing it’s missing can be a stressful experience, but immediate action is paramount. “Unless you know the whereabouts of a missing card and are certain you can retrieve it quickly (in which case you should lock the card), err on the side of caution: Report the card missing and request a replacement.” The urgency of this step cannot be overstated, as every moment a card is unaccounted for increases the risk of fraudulent use.

Card issuers are well-equipped to assist in these situations. “Many card issuers offer free next-day delivery on replacement cards, and others can expedite shipping for a fee.” This ensures that you can quickly regain access to your purchasing power while the compromised card is swiftly deactivated, preventing any unauthorized transactions. Don’t hesitate to utilize these services.

The goal is to prevent any potential thief from using your card for purchases or cash advances. A lost or stolen card, especially if it falls into the wrong hands, can lead to immediate financial distress. By reporting it promptly, you activate the card issuer’s protective measures, including zero-liability policies, and ensure that a new, secure card is issued to you, effectively shutting down avenues for fraud.

Read more about: Unlock Your Car’s Security: The 15 Most Common Items Thieves Target (And Why You Should Never Leave #5 Behind)

The possibility of fraud is an unfortunate side effect of the convenience that credit cards offer in our modern financial landscape. Yet, as this comprehensive guide illustrates, being a victim of credit card fraud doesn’t have to derail your financial life. From the moment you discover suspicious activity to the ongoing vigilance of monitoring your accounts, a series of clear, actionable steps can empower you to protect yourself. By consistently “keeping watch on your cards, account statements and credit reports,” you can rapidly “detect fraud quickly and nip fraud in the bud.” Remember, you are equipped with valuable tools and knowledge, from understanding zero liability protection to embracing secure payment methods. Staying informed and proactive is your strongest defense, ensuring that you can navigate the world of credit cards with confidence and security. While fraudsters may evolve their tactics, your commitment to financial fortification remains your most reliable safeguard.