Working hard today means maybe you won’t need to later. Early retirement attracts lots of people right now. Can anyone honestly say they don’t feel this appeal? The world is big with friends and books waiting for your time. Finishing work early seems like a great money achievement after years.

Desiring early retirement is not enough without a solid plan. Just leaving work soon does not always mean your finances are secure. A report in 2024 said few Americans felt ready to retire. Just 35 percent felt they were on the right track, down from 40. Even older folks near retirement did not feel fully ready. This shows many people want it but are not financially prepared.

To avoid later regrets get advice from a financial expert. This helps make sure your early leaving is not scary later. Advisors have lots of experience helping people get their finances straight. They know good ways to reach a strong financial place for you. These experts want to teach you proven methods they know work. Build a strong money setup supporting exactly what you want.

1. **Define Your Goal and Savings Rate** Experts say starting early retirement needs basic important steps. It is not just about what age you stop working. Think about the life you want when not working anymore. People retiring early know exactly the lifestyle they want. This helps figure out the money stuff you must do. Doing the math here is needed for your plan.

You must guess all the costs for your chosen goals and lifestyle. Include key factors that affect your money’s future. Think about prices going up and important healthcare expenses. Ensure your money setup will last securely over many years.

Certified planner Nicole Carlon says a plan must show needed income. It should list spending cuts for retiring early lifestyle she says. ” Save lots of money and spend less to get wealthy faster,” she says. A good plan also smartly invests your money Carlon adds. The investment approach should fit your risk and growth needs. Make sure your investments are spread out among different assets.

More money you save earlier makes the final pot bigger she thinks. Your money has more time just growing there she notes. Analysis shows starting young means less saving needed later she finds. Starting at age 22 needs saving £1,900 yearly for retiring at 68. To retire at 60 need £3,100 yearly starting age 22 this shows.

Someone age 30 needs £5,300 every year for an age 60 exit. This shows saving early and lots truly matters here. FIRE groups suggest investing major income and spending little. Live below means and buy things carefully they advise people. Don’t spend each last penny you have say FIRE group.

2. **Calculate Your Lifestyle Costs** Know your money picture well before starting early retirement plans. Look at income, current spending, what you own, and what you owe. This means checking where your money comes and goes now.

Remember big costs impact savings before the early retirement date. This includes things like college for kids or buying a new house. Maybe caring for older parents affects your money-saving plans. These costs before retirement still change how you save for it.

Once info is gathered track your income and spending habits now. Budget apps or software help show exactly where the money goes. See areas where you can realistically spend less or stop buying. Put those savings towards your big goal of retiring early and fast. Knowing real costs precisely is not something to skip.

3. **Practice Living on Your Retirement Budget** Advisor Joel Cundick gives clients practical advice for trying it. Do a test run of life on your planned retirement budget. Do not just suddenly quit work and go golf right now. Live on the retirement money amount while still working the job.

If the test amount feels too small or not enough is it ready? This shows maybe you are not financially ready to stop working yet. Money is important but how you live matters a lot too. Part of this test run means taking a long time off work you see. Try a practice schedule on how you hope to spend your days.

Early retirement dream feels really good Cundick notes from afar. Reality may be less fun if you are not ready he finds. Some clients who retire early went back to work he told. They had not figured out how to handle lifestyle change well. This shows trying the lifestyle matters like the money test.

Remember income and spending usually shift when you retire he adds. Include Social Security estimates like the 4 percent rule suggestion. Adjust expenses like less travel costs but maybe more healthcare ones. Make different fake budgets for looking at various situations possible. Practice living using less money budgets if you must try it. See if living on less money is sustainable for you now.

4. **Maximize Tax-Advantaged Accounts** Saving in special tax accounts is super important for retiring early. Use things like company 401(k) plans to save your money. Put as much money in these accounts as you possibly can now. Always get the company match if they offer it experts say. That match is like free money helping your savings grow fast.

If self-employed think about SEP or solo 401(k) plans. Age 50 plus means the IRS lets you save even more money easily. These catch-up savings boost your retirement nest egg quicker.

Experts say to save 10 to 20 percent of income for retirement normally. For early retirement, you need much more savings than that is normal. Need cash to cover living costs many years before Social Security starts. Earliest Social Security age is 62 experts explain this detail. Waiting longer usually gets you a larger monthly check later he notes.

Early retirees must get enough money lasting years before regular paychecks. So consider saving outside typical tax accounts people advise. A taxable brokerage account lets you access cash before age 59 1/2. This helps avoid early withdrawal penalties normally happening she notes. Lower taxes on investment gains may be waiting until income drops a lot. The FIRE approach encourages saving more yearly in these accounts too. This gives tax benefits and uses compound interest well they say.

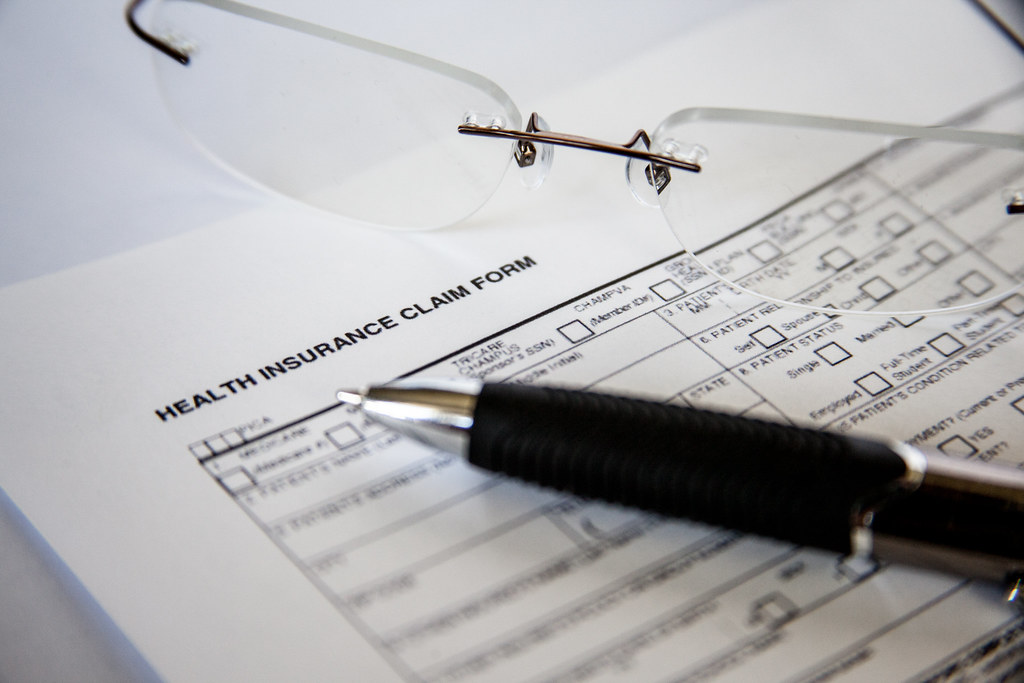

5. **Look Into Your Health Insurance Options** Many people forget to think about health insurance for early retirement. How to pay for healthcare after company coverage stops is the big question. Leaving work means losing the health plan from your workplace. This is hard if your family members rely on that coverage to say an expert. Medicare is only for people age 65 or more experts say. A big gap exists until age 65 for the healthcare plan you need. This gap needs careful plans and thinking ahead for costs.

It is essential to find ways to cover years before Medicare starts she finds. Several choices bridge this coverage gap for you here. Use the federal Health Care Marketplace maybe for plan options they say. Join your spouse’s workplace plan if they still work there. Maybe use money from a Health Savings Account like HSA for costs.

HSA gives great tax benefits in three different ways they point out. Contributions are tax-free earnings grow tax-free money comes out tax-free too. Planning for healthcare costs is not only about money matters here. It makes sure you get needed medical help if you need it. Protects your financial plan from very big health bills later Cundick says. Do not forget this very important piece when making plans.

6. **Adjust Plans As Needed** Nothing in life is set in stone says experts thinking about it. This goes extra for your early retirement money plans she says. Goals and life change a lot over time notes Nicole Carlon here. Life happens and your needs just might change suddenly she adds. Outside things like markets keep changing and moving around all the time.

So it is crucial to check and change your plans regularly you see. This is not a time thing but something always going on. Carlon wants clients to re-check plans every single year needed she says. This flexibility helps you change investing or saving ways easily. Adjust spending to ensure you stay on track for your goal.

Carlon says being flexible helps readiness for early retirement money. It also keeps things secure and flexible in the long run she finds. Carlon says “Clients improve their readiness while keeping security flexibility.” Constant changes link to idea being ready to pivot fast notes. Few people retire early and need laser focus giving up things now.

Sometimes life forces you to cut savings or speed plans ahead. Good thing planning an early exit means you are ready for surprise leave. Like if illness or family needs mean you stop working suddenly. If you don’t leave work early you still got lots of extra money. You accumulate significant extra cash by the time you leave the workforce later.

7. **Get Your Plan Checked by a Pro** You can do some early retirement steps by yourself it is true. For big goals like leaving work early better get expert help. Paying for seasoned financial advisor expertise is really worth it now. These pros know complex money strategies very good experts say. They helped many clients reach their early retirement goals already. Advisors know which ways work best by seeing others’ journeys.

Financial advice costs various prices now making it more open. If you mainly need investing to help a robo-advisor cost less. Robo-advisors are one best low-cost options available today. Some services even include access to human advisors here now. They offer useful tax optimization services also she says. It mixes computer help and expert guidance together she thinks.

For more personal help beyond just investments see planners she suggests. Traditional financial planners offer advice fit for your life she says. They charge hourly or fixed fees for special services offered to him. Look for an advisor holding the CFP credential when you choose. CFP means they must put clients’ needs first always legally speaking. This crucial trust someone with your money future she says here.

Free government help like Pension Wise helps understand pensions age 55+. But for early retirement plan advisor is specifically equipped you know. Talking with neutral experts helps see things objectively they say. Expert not emotional about the choices you make she finds. Friends know you well but expert outside view is priceless value. Getting expert help really makes achieving your early retirement dream possible.

Becoming financially free and quitting work early takes hard work, and involves careful strategy. After setting your targets, learning costs, and starting saving, other vital points need addressing. This makes certain leaving your job early works out and feels safe. These next steps look closer to making your money better and getting ready for a very long retirement starting sooner than typical.

The path to early retirement needs refining your plan. You need to address debt smartly plus ensure investments work well. Getting future money sources secured matters. Each action builds upon the start you have made. It changes wishing into a solid, protected truth. This plan holds up even when things get tough unexpectedly.

8. **Pay Off Your Mortgage** One big money worry impacting comfortable early retirement is having a mortgage loan. This loan must extend into years you are not working. Experts point out mortgage payments that require withdrawing more funds quickly from retirement savings early on. This could mean using your money up faster than planned.

One big money worry impacting comfortable early retirement is having a mortgage loan. This loan must extend into years you are not working. Experts point out mortgage payments that requires withdrawing more funds quickly from retirement savings early on. This could mean using your money up faster than planned.

Removing this large regular bill before stopping work simplifies things financially. Your retirement income and savings help cover daily expenses better. It also helps with living how you want. Money isn’t tied down for housing bills. This step matters for reducing financial strain when you only use saved wealth. Lower-income streams might happen at first.

Ways exist to tackle your mortgage balance before the date you retire early. You might think about using the 25% tax-free lump sum money from your pension. You can get this after age 55, which goes to 57 after 2028. Clearing the debt this way is one option. Making extra payments now also speeds up the process. Many mortgage contracts let overpay a percentage of the loan yearly fine. This chips away at the main amount, cutting the total loan time a lot. It helps reach that goal of being free from the mortgage sooner you might think.

Read more about: From Everyday to Elite: Proven Habits and Strategies That Can Help You Build Millionaire Status

9. **Review and Optimize Your Investments**Making sure your investment approach completely fits your aim stopping work earlier than average is crucial. Many people do not understand fully how their pension savings are invested. A study showed most savers know their pension is invested. Only a small number though knows what it is invested in. This not knowing could mean missing chances for your money to grow.

Making sure your investment approach completely fits your aim stopping work earlier than average is crucial. Many people do not understand fully how their pension savings are invested. A study showed most savers know their pension is invested. Only a small number though knows what it is invested in. This not knowing could mean missing chances for your money to grow.

Experts suggest workers younger than 40 might lose out on returns. They are put into low-risk pensions with not much chance for higher growth. With five years or more until retirement happens, stocks should usually be a bigger part of what you invest in. Stocks are riskier, yes. But they have historically worked to grow wealth over longer times. Younger investors have time to recover from markets going down.

The effect of choosing a higher-growth investment way over time is big. One calculation reveals an average earner could expect much more money at retirement. This is by investing all in stocks compared to a balanced fund. That fund holds fewer stocks. Financial experts advise checking investments often. Ensure you feel okay with the risk amount you take. Confirm your pension’s default investment fits your timeline and early retirement aims. Spreading money across different asset types is key too. It protects your investments if one area drops. You benefit from growth wherever it occurs in the market world.

10. **Check Your State Pension Entitlement** Planning to retire way before the official state pension age, still knowing your right to this money matters. It helps build your total money picture. The state pension provides a good layer of income later in life. In many places, its value stays protected. Rules adjust it for earnings growth and inflation. You can claim it now at 66. This rises to 67 by 2028. It might go to 68 by 2046. Knowing the potential amount you will receive later helps plan. It bridges the income gap in years you retire earlier.

Receiving a state pension requires a minimum count of qualifying years making National Insurance contributions. For the full money, you need more years contributing. Checking your state pension record reveals how many years you have saved up. It also estimates the potential income you could get.

Importantly, checking the record can also show gaps in your contributions history. Money experts like Alice Haine stress filling these gaps might be the best retirement choice you make. Ask if times you received benefits like Child Benefit or Universal Credit count for NI credits. Often you can also buy voluntary NI contributions to fill past gaps from tax years gone by. This boosts your future state pension amount. But think if buying credits is right financial move for your specific situation today.

11. **Track Down Old Pensions** This sounds surprising, truly. A lot of money meant for retirement sits unclaimed in pensions that are lost. Research shows billions of pounds wait claimed. This money is spread across millions of pension pots inactive or lost. The average amount in these lost pots is not small. It is money boosting your retirement income a lot.

Pension money gets lost usually when people switch jobs often. Or they move house but do not tell old employer pension provider new contact details. Over a long work life, losing track is easy. Contributions made years or even decades ago get forgotten. Companies you do not work for anymore hold them. This unclaimed money is a big part of your future retirement fund. It is not working for you currently. It’s not even in your planning math.

Good news, resources exist to help locate these forgotten funds. Government websites often have free pension tracing help. They are designed to find contact info for schemes you lost. You can also try remembering your job history. Check old work papers. Look for missing spots in your own pension records. Contact past employers or known pension companies directly. Update your details and ask about any money held in your name. Finding and combining old pensions adds a big lift to your total retirement money.

Read more about: The Path to Millionaire Status: Careers, Habits, and Strategic Planning

12. **Understand Defined Benefit vs. Defined Contribution Plans** Planning for retirement, especially early on, means handling different savings kinds. Federal employees, for instance, might see both types. This happens within their retirement plan, like FERS. Knowing the difference between these kinds is vital. It manages your money streams throughout retirement potentially long.

A defined benefit plan, like the FERS Basic Retirement Benefit or Social Security, gives guaranteed income for life. The amount received is based on salary history usually. It also uses the years you worked. This predictability offers a stable base covering needs and living costs in retirement. It gives security value, especially when quitting work early. You need money lasting for many years ahead.

A defined contribution plan is different. The Thrift Savings Plan (TSP) is one, 401(k) in the private sector. Income from these plans depends on contributions made. It also depends on how contributions were invested. How fast money is taken out matters too. There is a risk of using up savings if withdrawals are too high. This is true especially early in retirement. Balancing guaranteed income with carefully managed withdrawals from defined contribution plans is a critical part. It ensures your money lasts the entire early retirement period you want.

13. **Manage Debt** Paying off the mortgage before retiring early is important, yes. But managing other debt kinds is also a crucial part of being ready financially. When reviewing your money situation for early retirement plans, look at income, spending, what you own, and what you owe. High consumer debt like credit cards or personal loans means owing money. This drains income through interest payments. It takes principal repayments too.

Reducing or ending high-interest debt before early retirement frees cash flow. This money goes towards savings and investments instead. Living below your means and buying smart are habits. This is what movements like FIRE teach. It means making careful choices when purchasing items. Not spending every last penny is part of it. This disciplined way helps avoid getting into debt not needed. It lets you focus on saving aggressively for your early retirement goal.

Having fewer debt amounts means your budget for retirement needs to cover fewer required payments each month. This lowers the stress on your money sources in retirement. It gives you greater flexibility financially. Whether it is student loans, car payments, or credit card debt you carry. Actively working to pay down these debts is a real step. It supports your goal of becoming financially independent. You enjoy secure early retirement without big payment burdens.

14. **Plan for Inflation** One big difficulty for anyone planning a long retirement is inflation’s effect. This is very true for retirement starting early. The rising cost of living decreases the buying power of your savings and fixed income sources later. If retire in your 50s or younger, you need a strong plan to manage these rising costs. This is especially true since cost-of-living increases on FERS benefits might not start until older age, maybe 62. This leaves a gap where your benefit does not match price increases.

Estimating total costs for retirement life chosen, and factoring in things like inflation is completely necessary. Your money plan must ensure funds last safely over many years ahead. This means considering how much more expensive things could become decades from now. Nicole Carlon, a certified financial planner, points out good plan must include considering these points. It ensures money lasts.

Managing investments smartly is key to fighting inflation in early retirement times. Your investment mix needs ready for growth. It must also handle risk inflation surges. This means maybe putting some money in assets. Those assets have the potential to grow faster than inflation over the long run. Without a plan addressing the rising prices effect. Your saved nest egg might not support your desired way of life. This could last throughout all of your early retirement.

15. **Commit to Continuous Financial Education** A key part of Financial Independence, the Retire Early movement, valuable practice too. For anyone wanting early retirement, learning continuously matters. Getting support from the community helps. Many start working careers without much knowledge about money stuff. Budgeting, investing, and early saving importance missed often. Taking responsibility for my own money and learning feels strong.

Many ways exist in learning about handling money and early retirement ways. The FIRE community offers multiple ways of getting involved. Online chats and forums are available. Educational YouTube channels too. Even events in person happen. These places let people share knowledge. Learning from others’ experiences is possible. Gaining tips and insights valuable is easy. One expert said people are actively learning from each other. They learn to be more conscious consumers. This is a good habit any saver needs.

Talking to a financial advisor is highly recommended for help personal. Especially for something complex such as an early retirement plan. Continuous learning yourself adds to professional advice. Learning all you can about investments, saving on taxes, and retirement plans. This lets you make choices knowing more. Better understand strategies experts suggest. This process of ongoing learning is not just for people saving extreme amounts. It’s useful practice for everyone wanting to handle money well. Achieve money security long term. This is true retiring early or on time more typical.

Going on the path to early retirement takes hard work. It demands careful planning and consistent saving habits. Focus on these key actions you read about. Pay off debt well. Make your investments work best. Secure future money like state pensions. Stay learning about money. You build a stronger future for yourself. Stay focused on your goals. Make choices knowing facts. Do not fear asking for professional help when facing hard decisions. Following a full plan, and staying committed. You greatly improve the chance get the financial independence needed. Enjoy retirement fulfilled on your own rules. Possibly much sooner than you ever thought it was possible.