Meme stocks have undeniably reshaped the investment landscape in recent years, proving that traditional market forces aren’t the only drivers of astronomical gains. Driven largely by the collective power of online communities and the swift currents of viral trends, these unique assets have captured the imaginations—and often, the wallets—of countless retail investors hungry for significant, rapid profits. The allure of finding that elusive “next big winner” before it rockets skyward is compelling, but it’s crucial to approach this arena with a clear understanding of its distinct dynamics and actionable strategies.

While the meme stock phenomenon might seem like a chaotic lottery, there’s indeed an art and a science to identifying potential candidates before they go parabolic. It’s not just about luck; it’s about being plugged into the right channels, understanding the underlying catalysts, and interpreting the subtle (and sometimes not-so-subtle) signals that precede a viral surge. The original GameStop saga of 2021 perfectly illustrated the immense influence these communities hold, turning a struggling video game retailer into a symbol of retail investor power.

In this first part of our in-depth guide, we’ll peel back the layers of what truly defines a meme stock, explore the indispensable role social media plays, and equip you with foundational detection strategies. We’ll dive into how monitoring online communities can be a goldmine for early chatter, and why analyzing stock volume and trends is key to confirming traction. Furthermore, we’ll unveil some of ChatGPT’s insightful criteria, specifically focusing on the critical indicators of high short interest and a surge in social mentions, empowering you to better position yourself in this exciting, albeit volatile, investment space.

1. **What Defines a Meme Stock?** A meme stock isn’t your typical, fundamentally driven investment, and understanding this distinction is the first step toward spotting the next one. These are company shares that experience a meteoric rise in popularity, propelled primarily by social media buzz and the collective enthusiasm of online communities, rather than traditional financial metrics like earnings, revenue growth, or inherent valuations. Their value is, in essence, a testament to viral sentiment, leading to dramatic price swings that can offer both exhilarating gains and daunting losses. It’s a market segment where the ‘why’ behind a surge is often less about a company’s balance sheet and more about a captivating narrative.

Unlike traditional stocks, where diligent research into a company’s financial health, management, and competitive landscape dictates investment decisions, meme stocks operate on a different plane. Their value often springs from the shared conviction and coordinated action of retail traders who congregate on platforms like Reddit. This collective belief system creates a unique environment where the usual rules of investment are temporarily suspended, allowing a stock to “go parabolic” for reasons that can appear, on the surface, irrational to the seasoned institutional investor. As the context suggests, identifying these stocks is “more of an art than a science.”

Ultimately, meme stocks are often low-priced equities that experience rapid price appreciation for no particular fundamental reason, but rather due to short-squeezes ignited by fervent retail investor enthusiasm and widespread social media hype. They frequently resemble penny stocks more than blue-chip companies, lacking stable dividends and exhibiting poor fundamentals that attract short sellers. The very nature of their ridiculous, sentiment-driven price moves exposes them to ridicule, often giving rise to the “clever memes” that define their viral popularity.

2. **The Pivotal Role of Social Media Platforms** If meme stocks are the phenomenon, then social media platforms are the engine that drives them. These digital arenas are not just places for casual conversation; they are central to the inception and propagation of meme stock rallies, serving as the primary breeding grounds for stock gossip and trending narratives. Without the rapid dissemination of information and the ability for vast numbers of retail investors to coordinate, the explosive surges seen in stocks like GameStop simply wouldn’t be possible.

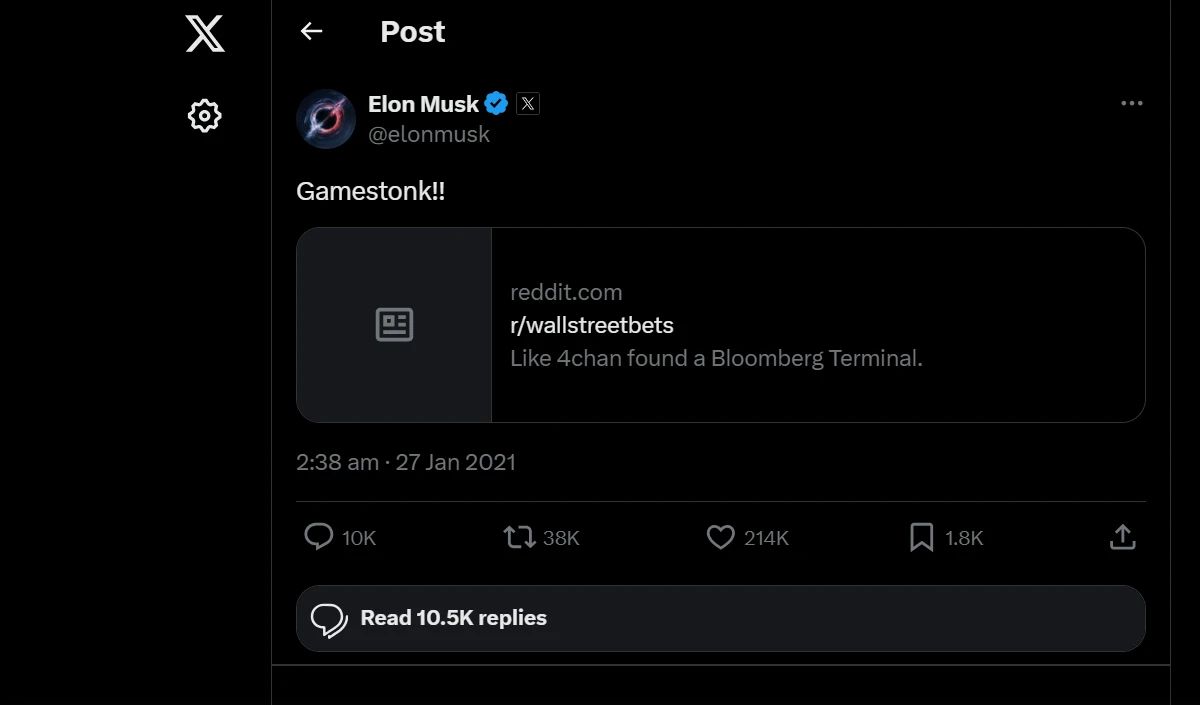

Online forums, particularly communities like Reddit’s r/WallStreetBets, alongside platforms such as Twitter and TikTok, act as crucial epicenters where retail investors converge. Here, users passionately share investment theories, enthusiastically ‘pump’ stocks they believe have significant untapped potential, and meticulously construct compelling narratives around why a particular stock is poised to become “the next big thing.” The context vividly illustrates this with GameStop, whose stock was driven to “incredible highs” directly by the conversations and shared conviction on Reddit, showcasing the profound and immense influence these digital communities wield.

Indeed, the very mechanics of a meme stock rely heavily on a substantial and engaged retail investor following. These stocks aren’t necessarily valuable assets based on their inherent company worth; instead, their value is community-driven. Online communities coordinate efforts, often spurred by a shared desire to challenge institutional short sellers, leading to a surge in buying pressure that can dramatically inflate prices. This makes social media not just a channel for discussion, but a fundamental component of a meme stock’s existence and potential for growth.

Read more about: Joy Taylor Vs. Jason Whitlock: Inside The Scorching Feud Over ‘Big Rack’ Comments & Cam Newton’s Controversial Defense!

3. **Monitoring Online Communities: The Goldmine for Early Signals** For any individual investor aiming to spot the next meme stock before it becomes a household name, actively monitoring online communities is absolutely non-negotiable. Platforms like Reddit, Discord, and even specialized stock-focused subreddits are veritable “goldmines for early chatter” regarding potential meme stock candidates. The key is to look beyond surface-level posts and delve into threads that are showing a noticeable increase in activity, paying close attention to stocks that begin to rack up repeated mentions, as these are the ones to watch most closely.

This proactive surveillance allows you to tap into the pulse of retail investor sentiment long before it hits mainstream financial news. By consistently following trending topics and carefully monitoring the emotional tone and sheer volume of discussions, you can effectively “get ahead of the curve.” The insights shared by platforms like Trading212 underscore the critical importance of understanding these online discussions; they serve as a unique, early warning system for developing trends. In fact, many of the most impactful “viral trends can be found early on Reddit,” providing a crucial head start for alert traders.

Furthermore, the combination of heightened social media engagement with rising stock volume often serves as a powerful confirmation of a burgeoning meme stock trend. Traders who are successful in this space are constantly on the lookout for these twin signals. It’s about more than just seeing a stock mentioned; it’s about identifying a rapidly escalating conversation. While the term “Dumb Money” is sometimes used to describe retail investors, those who master the art of community monitoring prove that collective intelligence, when channeled effectively, can indeed spark significant market movements.

4. **Analyzing Stock Volume and Trends for Traction** While social chatter provides the initial spark, a truly promising meme stock candidate will also exhibit concrete signs of increasing investor interest in its trading data. This means keeping a vigilant eye on stock trading volumes, as a “sudden spike in volume,” especially when it’s “paired with increasing social media chatter,” can act as an undeniable “early indicator that a stock is gaining traction.” It’s the tangible evidence that online buzz is translating into actual market activity, a crucial step in a stock’s journey to viral status.

Beyond just raw volume, charting tools become invaluable allies in this quest. These tools allow you to identify “unusual activity in terms of price swings or abnormally high interest relative to the stock’s historical averages.” Such deviations from the norm are red flags (or green flags, in this case!) signaling that something out of the ordinary is brewing. Whether it’s a sudden surge in daily trades or an unexpected jump in average daily volume, these data points provide objective, quantifiable evidence of burgeoning excitement around a particular company.

The real power, however, lies in integrating these two distinct but complementary data streams. “Combining social signals with trend analysis gives you a broader picture of which stocks are heating up.” This holistic approach means you’re not just relying on anecdotal evidence from forums or isolated spikes on charts; you’re seeing a confluence of factors pointing to a legitimate contender. This method, a key aspect of “data analysis and trends,” provides a more robust framework for identifying meme stock candidates that are truly beginning to capture the market’s attention.

Read more about: The Ultimate Status Symbol? Unpacking the Millions Collectors Pay for Reborn Classic Cars

5. **ChatGPT’s First Key Criterion: High Short Interest** As the pursuit for the next viral stock intensifies, even artificial intelligence is being tapped for insights. ChatGPT, when prompted on how to spot the next meme stock, highlighted four critical criteria, with “High short interest (>20% float), Days-to-cover ≥5” leading the charge. This isn’t just a technical detail; it’s a foundational element that dramatically increases a stock’s susceptibility to the kind of explosive, short-squeeze-driven rallies that define meme stocks. A significant short interest acts like kindling, ready to ignite when the right spark appears.

The mechanism here is elegantly brutal: when a large percentage of a company’s shares are sold short, it indicates a strong bearish sentiment among institutional investors who expect the stock price to fall. However, this also creates a pool of potential forced buyers. If the stock price unexpectedly rises, these short sellers face escalating losses and are compelled to “cover” their positions by buying back shares, which further fuels the price ascent. As the context explains, “Meme stocks must have a high short interest to spark a short squeeze,” making it a non-negotiable factor in the original GameStop saga, which famously had a “140% short interest.”

This high short interest creates the classic “David vs. Goliath mentality” that often drives meme stock fervor. Retail investors, seeing the heavy shorting by hedge funds, sometimes unite to actively buy the stock, viewing it as an opportunity to “stick it” to Wall Street. The higher the price climbs, the more desperate short sellers become, creating a feedback loop where forced margin calls automatically trigger surges of buying pressure. The short interest is not just a factor; it’s “the fuse triggering the short squeeze,” transforming a stock into a potential battleground.

6. **ChatGPT’s Second Key Criterion: Surge in Social Mentions** Building on the importance of online communities, ChatGPT’s second key criterion for identifying a potential meme stock is a “Surge in social mentions (Reddit/Twitter).” This criterion directly taps into the power of collective attention and the rapid dissemination of information across digital platforms. It’s a clear signal that a stock is no longer just a quiet investment, but is actively captivating the imagination and discussion of a growing number of retail traders. A sudden increase in chatter often precedes, or accompanies, a significant price movement.

The AI chatbot specifically highlighted “noting sudden increases in a sock’s mentions or upvotes on social media platforms such as X, Reddit and Discord.” This isn’t about casual mentions; it’s about a distinct uptick in frequency and engagement, indicating that the stock is gaining significant traction within these influential communities. Tools like ApeWisdom and AltIndex are mentioned as valuable resources for assessing this social momentum, allowing investors to quantify and track the volume and sentiment of these discussions, giving them a data-informed edge.

This criterion ties directly into the broader concept of “social media momentum” and the community-driven nature of meme stocks. When a stock starts trending, or its story gains a viral storyline, it creates a powerful pull that draws in more retail investors. As the context sagely notes, “The more irrational it is, the more likely short-sellers get involved and the more potential it has to short squeeze.” A widespread surge in social mentions often builds a narrative, no matter how speculative, that can attract both retail buyers and, ironically, more short-sellers, setting the stage for increased volatility and the potential for a squeeze.

Having laid the groundwork for understanding meme stocks and initial detection, we now delve into more advanced strategies. This next phase isn’t just about identifying potential candidates, but about understanding the deeper mechanics that fuel their explosive growth and, crucially, managing the inherent risks. We’ll explore further AI-driven insights, the profound impact of influential figures, and essential risk management techniques, empowering you to navigate this exhilarating, yet volatile, investment landscape with greater confidence. The journey to spotting the next big winner before it goes viral continues, armed with even sharper tools and a more nuanced perspective.

7. **ChatGPT’s Third Key Criterion: Unusual Options Activity (OI Spikes)**Beyond short interest and social chatter, AI tools like ChatGPT highlight unusual options activity as a critical signal for impending meme stock surges. Specifically, it points to instances where “retail traders often pile into out-of-the-money (OTM) call options.” This isn’t just casual trading; it signifies a concentrated bet on a significant upward price movement, indicating strong speculative appetite among retail investors. Such activity often precedes a parabolic climb, signaling that a stock is primed for a major breakout.

This phenomenon frequently leads to what’s known as a gamma squeeze. When retail investors aggressively buy OTM call options, market makers, who sell these options, must hedge their exposure by purchasing the underlying shares. As the stock price rises and options move closer to being in-the-money, market makers are compelled to buy even more shares. This creates a powerful feedback loop, where their forced buying further fuels the stock’s price ascent, turning a speculative options play into a significant market driver.

Observing these spikes in open interest (OI) for call options offers an early, tangible indication of where retail investor capital is actively positioning for massive gains. It reveals a level of coordinated belief and action beyond simple buying, suggesting a potentially explosive short-term move. This type of activity serves as a powerful confirmation signal when combined with other meme stock indicators, indicating a stock is not just being discussed, but actively being positioned for an upward surge.

8. **ChatGPT’s Fourth Key Criterion: The Power of a Meme Narrative**The final, yet equally crucial, criterion illuminated by ChatGPT is the presence of a compelling “Meme narrative (pop‑culture, underdog story).” Meme stocks thrive on stories that resonate deeply with online communities, galvanizing collective action and igniting fervent enthusiasm. This isn’t about dry financial reports; it’s about a captivating storyline, often one that pits average retail investors against institutional giants, fostering that potent “David vs. Goliath mentality” famously driving the GameStop short squeeze.

These narratives can emerge from various sources. A company might have strong pop-culture relevance, like Krispy Kreme or AMC Entertainment, tapping into nostalgic or emotional connections. Alternatively, it could be an underdog battling financial challenges or short sellers, inspiring a collective purpose to ‘save’ or ‘punish’ with buying power. The context mentions American Eagle Outfitters, whose ad campaign starring Sydney Sweeney ignited buzz across Reddit and X, creating a viral storyline that fuels meme stock fervor.

An engaging narrative transforms a mere stock into a symbol or a trending topic. The more irrational or emotionally charged a narrative seems to traditional investors, the more it can attract the very forces—both retail buyers and, ironically, short-sellers—that escalate its volatility and potential for a massive short squeeze. A strong narrative provides the emotional glue that holds a meme stock community together, sustaining momentum even when fundamental logic might suggest otherwise.

9. **The Influence of Market Sentiment and Influential Figures**Beyond quantitative signals, understanding market sentiment is an indispensable component of advanced meme stock identification. Meme stocks are, by their very nature, sentiment-driven. They often wouldn’t appear on screeners for revenue growth or high profit margins, but for their “declining sales, poor margins, and minimal future growth prospects.” It’s the collective ‘mood’ of retail investors that propels them. Tools like MarketBeat’s media sentiment tracker can help gauge positive or negative headlines regarding trending stocks, offering insights into this elusive yet powerful driver.

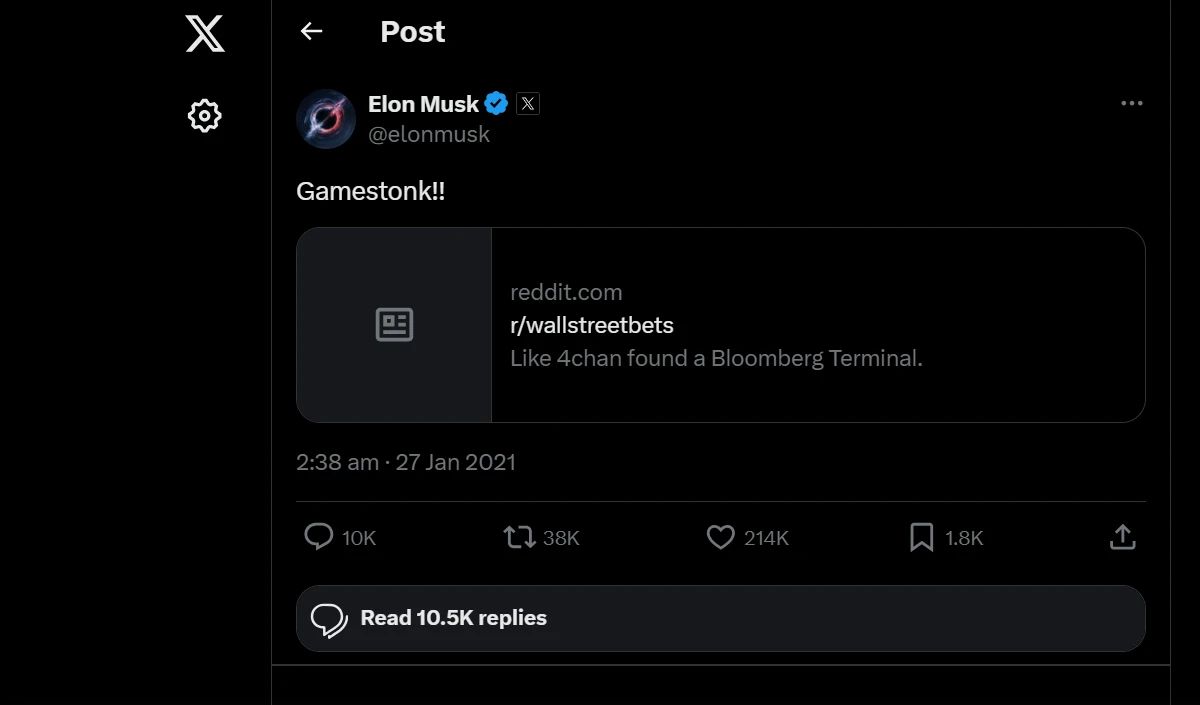

Moreover, the landscape of meme stocks is heavily influenced by prominent figures. “Following Influential Figures”—be it well-known traders, analysts, or social media personalities—can provide crucial insights into which stocks might become the next sensation. The context highlights how Elon Musk profoundly impacted assets like DOGE coin, turning it into a “meme coin” synonymous with his brand. Similarly, public figures such as Shaq or Dave Portnoy, by discussing markets or picking stocks, can ignite widespread interest.

However, a crucial caveat accompanies the influence of these figures: always take celebrity endorsements “with a grain of salt.” As the context notes, “celebs get paid for the ad, not for investing in the asset.” While their mentions can create undeniable buzz and initial momentum, an investor’s decision should be rooted in more than just a famous name. Understanding their impact, while critically aware of their motives, is key to leveraging this aspect of meme stock dynamics responsibly.

Read more about: Dame Stephanie Shirley, Pioneering Tech Entrepreneur Who Championed Women in Computing, Dies at 91

10. **Understanding the Company’s Fundamentals (Even for Meme Stocks)**While meme stocks famously defy traditional fundamental analysis, a foundational understanding of the underlying company’s health remains a vital, albeit often paradoxical, tool. It’s true that their value is “community-driven” and often disconnected from “inherent company worth.” However, looking at factors like a company’s financial health, business model, and growth prospects can still help you make more informed decisions, even if those decisions are about trading the hype rather than investing in intrinsic value.

The paradox is that poor fundamentals are often a prerequisite for a stock to become a meme stock. Companies with “negative fundamentals,” which draw in bears and short sellers who expect prices to fall, create the perfect conditions for a short squeeze. This negative sentiment causes the high short interest that is a “key factor for meme stocks.” Therefore, recognizing these weak fundamentals isn’t about finding a good investment, but identifying a company ripe for the ‘meme treatment’ due to its vulnerability to a squeeze.

Indeed, successful meme stock traders know that these aren’t long-term stock picks; they’re “a wave meant to be ridden and abandoned when volume dries up.” Understanding the fundamentals helps gauge the depth of the company’s distress, providing context for the level of short interest and the potential for a short squeeze. It allows you to distinguish between a company with genuinely improving prospects (rare) and one whose surge is purely speculative, aiding in strategic entry and exit points.

11. **Navigating the Volatility and Avoiding Fraud (Risk Management)**Before diving headfirst into the exhilarating world of meme stocks, it’s absolutely crucial to grasp the profound risks involved. “Meme stocks are inherently volatile.” The very forces that drive “meteoric rises” can just as quickly lead to “devastating falls once the excitement fades.” Sites like Nerdwallet emphasize the critical importance of understanding this volatility; a sudden drop in online activity or shifting sentiment can trigger steep losses for unprepared investors.

Beyond volatility, the meme stock arena is not immune to darker elements, with “pump-and-dump schemes” being a prevalent threat. These manipulative tactics involve individuals artificially inflating a stock’s price through false or misleading information, only to sell their own holdings for a profit, leaving other investors with significant losses. Public.com strongly advises that these risks make “caution and research essential,” underscoring that succumbing to the temptation of jumping in because “everyone else is doing it” is a perilous path.

Ultimately, while “outsized profits” are possible, it is an “extremely risky endeavor” that demands precise market timing—a skill even seasoned professional investors find challenging. Predicting which stocks will surge and which will not is “nearly impossible” with any consistent accuracy. Given their community-driven, often “valueless assets” nature, robust risk management, grounded in skepticism and thorough research beyond the hype, is paramount to protect your capital.

12. **Controlling Emotions and Avoiding FOMO**The most significant, yet often overlooked, challenge in the meme stock landscape is managing your own psychology. “Meme stocks rely on the fear of missing out (FOMO) and short-squeezes to accelerate and maintain their altitude.” The intense pain of a missed opportunity, seeing others brag about their gains, can make you “anxious to jump on the next big meme stock.” This emotional pull is incredibly powerful and can lead to impulsive, poorly considered decisions that undermine any rational strategy.

It is absolutely vital to “control your emotions should you take a position in a social media meme stock.” Remember, due to their typically weak underlying fundamentals, “they are best for trading” rather than long-term investing. The allure of their “irrational” price moves is precisely what attracts short-sellers, setting the stage for the short squeeze. However, this inherent irrationality also means prices can deflate as quickly as they inflate, leaving those caught at the top with heavy losses.

As a stark reminder, “every meme stock mentioned in this article has sometimes fallen over 90% from its highs.” This underscores their dangerous nature, emphasizing that they are “only worth holding if you get in at a good price and things are fundamentally improving.” Success in this unique market niche demands not only research and timing but also a “healthy amount of skepticism” and rigorous emotional discipline. Approach meme stocks with a well-informed strategy, and you just might navigate the frenzy to come out ahead, skillfully avoiding the pitfalls that ensnare many others.

And there you have it – a comprehensive toolkit to help you navigate the dynamic and often dizzying world of meme stocks. From dissecting the core mechanics of short squeezes and viral narratives to harnessing the power of AI insights and tempering your approach with essential risk management, you’re now better equipped. The hunt for the next big winner is indeed more art than science, but with these advanced strategies, you’re no longer just guessing. You’re learning to read the subtle whispers of the market and the collective roar of online communities, positioning yourself not just to react, but to anticipate. Happy hunting, and may your due diligence lead you to the moon, or at least a profitable ride!