For many car owners, the idea of an extended auto warranty offers a comforting shield against the unpredictable nature of vehicle repairs. It’s a promise of peace of mind, a safeguard against those dreaded, budget-breaking breakdowns that seem to strike at the most inconvenient times. Dealerships and third-party providers alike often present these contracts as essential investments, implying that without them, you’re leaving yourself vulnerable to potentially ruinous costs. With nearly 48% of people planning to buy a car soon, understanding these offerings is more crucial than ever.

However, a closer, more objective look reveals a surprising truth: extended auto warranties are often a bad deal for consumers. While they certainly can effectively prolong your factory warranty coverage and protect you from surprise car repair bills when something breaks due to a factory defect, their cost, limitations, and the fundamental economics of the industry frequently tip the scales against the car owner. This in-depth analysis will peel back the layers of marketing and sales pitches to expose the core reasons why these seemingly beneficial protections often fall short of their promise, urging consumers to make truly informed decisions.

This slideshow will delve into a comprehensive examination of the various factors that contribute to extended auto warranties being a questionable financial choice for many. We will explore the critical insights that reveal why, despite their allure, these policies are frequently not the wise investment they appear to be. From the actual costs versus potential savings to the fine print full of exclusions and the often-frustrating experience of dealing with providers, we aim to equip you with the knowledge needed to navigate this complex aspect of car ownership.

1. **The Warranty May Cost More Than It Saves You**At the heart of why extended auto warranties are often a poor investment lies a fundamental financial imbalance: the cost of the warranty itself frequently outweighs the potential savings on repairs. The average extended auto warranty, particularly for bumper-to-bumper coverage, can cost around $1,000 per year. This is a significant upfront or recurring expense that consumers commit to in anticipation of future breakdowns.

However, when we look at the actual average repair costs, the picture changes. RepairPal, a site that compiles automotive repair data, estimated that the average vehicle only costs around $652 per year to maintain and repair in 2019. Adjusted for rather steep inflation, that is over $920 in 2025 dollars. This crucial comparison suggests that, for the average vehicle, the likelihood of needing enough repairs to justify the average cost of comprehensive warranty coverage is low.

This isn’t a “gotcha” moment; it’s a simple economic reality. Warranty companies are in business to make a profit. If they consistently lost money on most plans, they couldn’t stay afloat. Therefore, their pricing models are designed such that, on average, they take in more in premiums than they pay out in claims. For a consumer, this means that while you might be protected from a random $4,000-plus repair bill, you are statistically more likely to pay more into the warranty than you ever get back in benefits. It often requires being in a specific situation or getting an exceptionally good deal for an extended warranty to prove a clear financial win. The peace of mind might be a factor, but a guaranteed financial return is not.

Read more about: 9 Overrated Car Brands: Unmasking the Truth About Reliability Problems and Sky-High Maintenance That Kill Value

2. **Even Robust Plans Have Significant Exclusions**Another critical factor contributing to the questionable value of extended auto warranties is the prevalence of exclusions, even within the most robust “bumper-to-bumper” plans. The industry adage, “auto warranties cover most of the parts, some of the time,” rings true here. Consumers often assume that a top-tier plan covers virtually everything, but the reality is far more nuanced.

Even a Platinum-level plan, which covers over 90% of a car’s parts (that’s why they’re also called “exclusionary” plans), still leaves out several common items and scenarios. These typically include cosmetic parts, glass and body panels (unless they rust), and crucially, wear-and-tear parts like brake rotors and tires. These are components that naturally degrade with use and are a significant part of regular vehicle maintenance, yet they are rarely covered by extended warranties.

Furthermore, the fine print often includes exclusions for parts that failed due to neglect, such as missing an oil change, or repairs needed due to damage from a collision, misuse, or abuse (like off-roading or towing too much). This means that even if a covered part breaks, the claim could be denied if the provider links the failure to an excluded cause or a lack of routine maintenance. Consumers are not always made aware of these specific exclusions upfront, making it essential to read the chosen plan carefully before committing. The discrepancy between perceived comprehensive coverage and actual limitations can lead to unexpected out-of-pocket expenses, eroding the very financial protection the warranty was supposed to provide.

3. **Poor Value of Non-Exclusionary Plans**Extended auto warranties generally come in different tiers, from basic Powertrain plans to mid-range Silver/Gold plans, and the most comprehensive Platinum or “bumper-to-bumper” options. While the top-tier Platinum plans are often marketed as the best relative value due to their extensive coverage, the non-exclusionary plans (Powertrain, Silver, Gold) are generally a poor financial value for consumers.

Powertrain plans, for instance, typically only cover your engine, transmission and drive axle(s), encompassing less than 5% of the 5,000-plus parts on a vehicle. Silver/Gold plans add coverage for your electronics, cooling system and maybe a few other components, covering around 10% of the parts. While these plans are significantly cheaper than Platinum options (Powertrain plans can be around 50% cheaper, and Gold/Silver plans are around 30% cheaper than Platinum plans), the cost-to-coverage ratio is remarkably unfavorable.

Consumers might be drawn to the lower price point of these basic and mid-tier plans, believing they are getting a bargain for essential coverage. However, considering the vast number of components in a modern vehicle, covering only 5% or 10% of parts means that the vast majority of potential mechanical failures will remain uncovered. This makes it highly likely that any significant repair needed will fall outside the scope of these limited plans, rendering them effectively useless for the unforeseen expenses they are meant to mitigate. The perception of saving money on the policy itself often masks the reality of insufficient protection.

4. **Limited Access to Your Preferred Repair Centers**A significant drawback of many extended auto warranty plans is the restriction they place on where you can get your vehicle serviced. Once you have purchased an extended warranty and an event warranted against it happens, you can only take the vehicle to the designated repair centers listed on the contract. You cannot take the vehicle to any repair or service centers of your choice.

Reputable warranty companies might have formal partnerships with various automotive service providers, which is understandable to a certain extent. However, a “bad warranty” will only provide you coverage for service provided at very specific garages or chains, sometimes leaving consumers with limited or no convenient options. This is particularly problematic for individuals living in a more rural area where the selection of approved garages might be sparse, unlike in an urban area.

If you try to solicit service at a garage outside of the warranty’s specified partners, the provider may refuse to cover the cost, leaving you responsible for the entire bill. This limitation can override the very purpose of having a warranty, forcing you to choose between paying out of pocket for a trusted mechanic or driving potentially long distances to an unfamiliar, approved facility. It is crucial for consumers to obtain a comprehensive list of all garages they can get service from when considering a warranty and ensure that at least a couple are easily accessible. This hidden restriction can severely diminish the practical value and convenience that an extended warranty promises.

Read more about: Beyond the Badge: A Deep Dive into 14 Overrated Car Brands You Might Regret Buying in 2025

5. **The Overlap with Factory Warranties and Other Protections**Many consumers purchase extended auto warranties without fully realizing that they may already have sufficient, or even overlapping, coverage from other sources. This redundancy can render an extended warranty an unnecessary expense. All new cars come with manufacturer warranties, also known as factory warranties, which provide assistance in the case of manufacturing defects. These typically last for around 3 years/36,000 miles to 5 years/60,000 miles, with some brands offering even longer periods like Kia and Hyundai.

Extended warranties are designed to kick in only after the factory warranty expires. However, during the period when the factory warranty is active, the extended warranty offers no additional protection against mechanical failures already covered. This means you are essentially paying for coverage that you already have for a period, making the initial years of an extended warranty redundant. Furthermore, the option to extend a factory warranty directly, or the existence of Mechanical Breakdown Insurance (MBI), can further diminish the unique value proposition of a separate extended warranty.

Mechanical Breakdown Insurance (MBI), for instance, serves a similar purpose in softening the blow of expensive repairs but operates under a very different regulatory path. MBI is an insurance policy filed with and overseen by state regulators, meaning its premiums must pass a reasonableness test, and the insurer must maintain reserves to pay claims. This regulation helps keep pricing in check and protects consumer. Since an extended warranty is technically a vehicle service contract, it lacks this direct oversight. Understanding that you might already be covered, or have more regulated and potentially better-value alternatives like MBI, highlights why an extended auto warranty might be an overlap that adds cost without adding substantial, unique protection.

6. **The “Cash Cow” Reality for Vendors**Perhaps the most revealing truth about extended auto warranties is their fundamental design as “cash cows” for their vendors, whether they are automakers, dealerships, or third-party providers. This inherent profitability model inherently places the consumer at a disadvantage. As Eric Evarts, associate autos editor at Consumer Reports, succinctly puts it: “Dealers and automakers sell extended warranties to make money. The consumer is only at a disadvantage with these things. They have to pay out less than they’re earning or they don’t make profits.”

The entire business model of extended warranties is predicated on the principle that the total amount collected from premiums will exceed the total amount paid out in claims. This means that, on average, a consumer is more likely to contribute to the vendor’s profit margins than to receive a net financial benefit from the warranty. Evarts himself speaks from experience, recounting paying $1,800 for a legitimate extended warranty on a used all-wheel-drive Chrysler minivan, only to have a single claim for a broken air conditioner paid for $900. Ultimately, he was out $900.

This commercial reality puts car owners in the perverse position of actually wanting their car to fail significantly so that the policy will prove to be a “good buy.” The focus shifts from proactive vehicle maintenance and enjoying a reliable car to hoping for breakdowns to justify an expensive purchase. While the peace of mind argument is often made, it’s crucial for consumers to recognize that this peace of mind comes at a substantial, and often disproportionate, cost designed to benefit the seller first and foremost. This foundational aspect of the industry underscores why, from a purely financial standpoint, these warranties are frequently a bad deal.

7. **Difficulty Canceling Plans and Obtaining Refunds**One of the less-discussed but equally frustrating aspects of extended auto warranties is the notorious difficulty many consumers face when attempting to cancel their plans or secure a rightful refund. While most reputable providers should offer a full refund within 30 days of purchase, followed by a partial, prorated refund afterward, the reality for many customers is far from straightforward. This lack of transparency and often outright obstruction can transform a seemingly simple process into a protracted battle.

ConsumerAffairs readers have frequently reported significant challenges in this area. For instance, one reviewer named Sharry in Utah recounted a “nightmare” experience, involving multiple calls and customer service interactions described as “outright disrespectful.” This individual was even forced to cancel a credit card to stop recurring charges, only to discover the company continued to accrue costs. Such anecdotal evidence underscores a systemic issue where companies make it unduly difficult for customers to exit contracts, often prioritizing their revenue streams over consumer rights.

A truly good warranty provider would facilitate cancellations, offering a refund for the unused portion of the service. However, for less scrupulous companies, retaining every customer means preserving a cash flow. This often translates into giving customers the “runaround,” ignoring calls and emails, or employing pressure tactics to dissuade cancellation, even when the customer no longer needs the service. This highlights the crucial importance of thoroughly understanding a provider’s exact cancellation and refund policy in writing before committing to any extended warranty.

8. **Modern Car Reliability Reduces the Need for Extensive Coverage**The landscape of automotive engineering has evolved significantly, with modern vehicles boasting impressive levels of quality and reliability. This inherent improvement in vehicle durability plays a direct role in diminishing the practical necessity of an extended auto warranty for many owners. When a car is designed and built to perform reliably over many years and miles, the likelihood of frequent or extensive mechanical breakdowns that would justify a costly extended warranty is naturally reduced.

For consumers who own newer models, the prospect of substantial and unexpected repairs often becomes less of an immediate concern. A vehicle that does not frequently break down, leading to expensive fixes, fundamentally negates a primary reason for purchasing supplemental coverage. This enhanced reliability means that the financial gamble on an extended warranty—hoping for repairs significant enough to offset the premium—is less likely to pay off.

While it is true that modern cars are increasingly complex, which can make repairs more expensive when they do occur, the frequency of such repairs has generally decreased. This shift suggests that for many drivers, the peace of mind offered by an extended warranty might be an overestimation of risk. Instead, a more strategic approach could involve leveraging the inherent reliability of contemporary vehicles, thereby avoiding an unnecessary annual expense.

Read more about: Consumer Reports Guide: Top 14 Cars of 2024-2025 Redefining Safety with Cutting-Edge Technology and Unbiased Crash Test Results

9. **The Preference for a Dedicated Savings Account for Repairs**For many financially savvy car owners, a compelling alternative to purchasing an extended auto warranty is establishing a dedicated savings account specifically for vehicle repairs. This approach puts the consumer in direct control of their funds, eliminating the profit margins inherent in warranty contracts and allowing money to accumulate for actual repair needs, should they arise. Given that the likelihood of extensive mechanical damage is often low, this strategy aligns with a more proactive and self-sufficient financial plan.

Consider the economics: the average extended auto warranty can cost around $1,000 per year for comprehensive bumper-to-bumper coverage. In contrast, RepairPal data from 2019 estimated average annual maintenance and repair costs at about $652, which, even when adjusted for inflation to over $920 in 2025 dollars, often remains less than the warranty premium. By simply setting aside the equivalent of a warranty premium each year, consumers can build a substantial reserve for potential repairs.

This “self-insurance” method ensures that if no major repairs are needed, the money remains the owner’s, available for other financial goals or simply retained as savings. While a ConsumerAffairs survey indicated that only 41% of drivers have enough saved to cover a $1,000 repair bill, systematically contributing to a dedicated repair fund provides a robust financial buffer. This method offers genuine peace of mind, backed by readily accessible funds, rather than a contract with potential exclusions and cancellation difficulties.

Read more about: Mastering Your Retirement Budget: Real-World Insights from a 65-Year-Old Retiree’s Monthly Spending Plan

10. **Extended Warranties as a Burden for Short-Term Car Ownership**The value proposition of an extended auto warranty diminishes significantly for individuals who do not intend to keep their vehicles for an extended period. For short-term car owners, purchasing such a warranty often becomes an unnecessary financial burden, as the policy’s benefits are unlikely to be fully realized before the vehicle is sold or traded in. The core design of these warranties is to provide coverage once the factory warranty expires, making them most relevant for long-term ownership.

As Dr. Heather Bono, a professor of finance at the University of West Georgia, rightly notes, “If an individual does not keep cars for long, the standard warranty would likely be all they need.” This underscores that for those planning to own a car for only a few years, the factory warranty typically offers sufficient protection against manufacturing defects during the most critical initial period. Investing in an additional, long-term contract when the car will soon be out of their possession simply does not make financial sense.

The true utility of an extended warranty is unlocked when a vehicle is retained for many years beyond its initial factory coverage, particularly if it’s a model known for higher repair costs or if the owner seeks long-term protection against eventual wear. For others, the upfront cost and ongoing premiums of an extended warranty represent an outlay that will not yield proportional returns. This makes careful consideration of one’s ownership timeline paramount before committing to such an agreement.

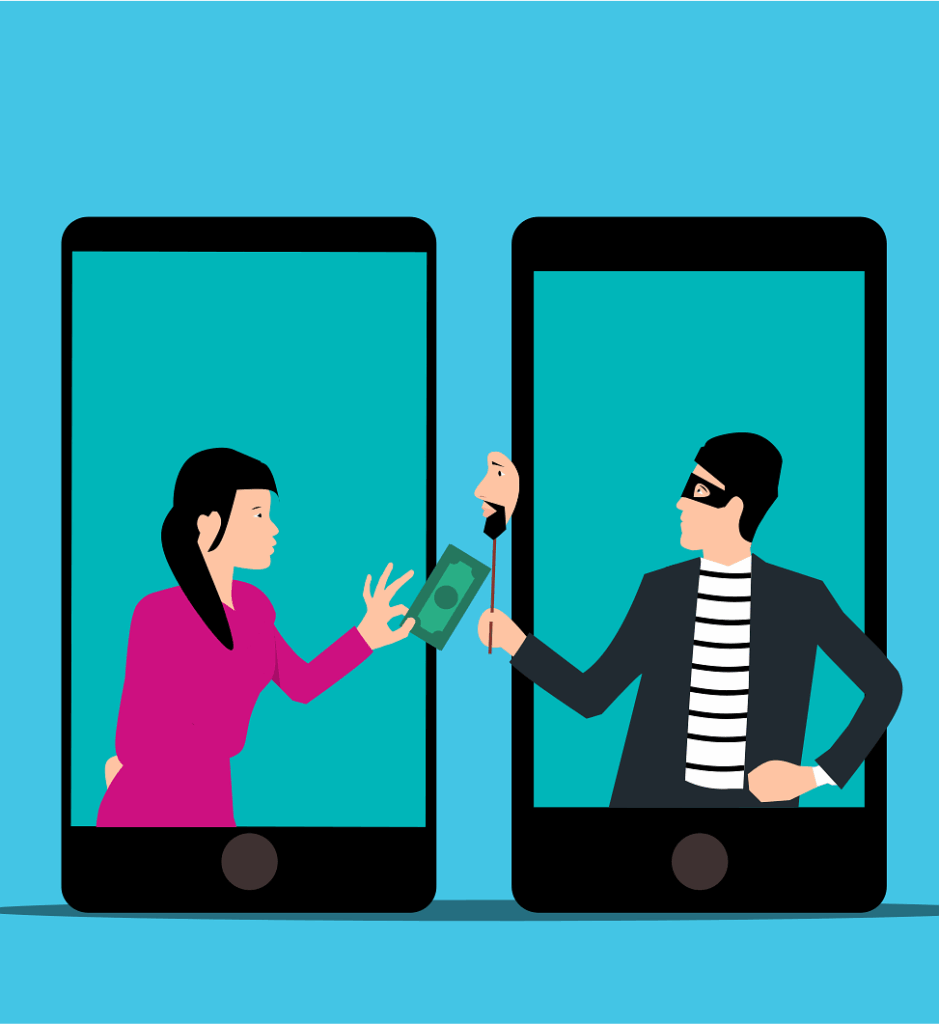

11. **Navigating the Minefield of Aggressive Sales Tactics and Scam Perceptions**The extended auto warranty market is unfortunately plagued by aggressive and often misleading sales tactics, which contributes to a pervasive “scam perception” among consumers. This environment makes it challenging to discern legitimate offers from outright fraudulent ones, putting car owners in a vulnerable position. High-pressure sales techniques, whether from telemarketers or even some dealership personnel, aim to rush consumers into decisions without adequate review.

The Federal Trade Commission (FTC) explicitly warns against “fast talkers” and telemarketers who employ high-pressure tactics to obscure their true motives. These tactics often involve cold calls or texts claiming detailed knowledge of a vehicle, designed to create a sense of urgency about an “expiring warranty.” Such pitches frequently demand personal information or payment before the consumer can even review the fine print, a clear indicator of a “misleading offer.” This manipulative approach can lead consumers to purchase overpriced or entirely worthless service contracts.

Protecting oneself requires vigilance and a methodical approach. It is crucial to insist on receiving the full contract in writing and to thoroughly research the provider’s reputation and ability to pay claims. Never finalize a purchase based solely on a sales call, and always look for clear, transparent cancellation terms. By being aware of these red flags and prioritizing diligent research, consumers can better navigate this complex marketplace and avoid falling victim to deceptive practices that ultimately erode trust and financial well-being.

12. **The Critical Lack of Direct Regulatory Oversight Compared to MBI**A fundamental difference that often places extended auto warranties at a disadvantage compared to Mechanical Breakdown Insurance (MBI) is the critical disparity in direct regulatory oversight. While both products aim to mitigate the financial impact of expensive repairs, their operational frameworks and consumer protections diverge significantly due to their legal classifications. This distinction has profound implications for pricing, claim fulfillment, and overall consumer safeguards.

Mechanical Breakdown Insurance is categorized and regulated as an insurance policy. This means it is filed with and supervised by state regulators, necessitating that its premiums undergo a “reasonableness test” and that the insurer maintains sufficient reserves to pay claims. Such oversight is vital for keeping pricing fair and ensuring that the insurer has the financial capacity to honor its commitments, thereby offering a higher degree of consumer protection.

In stark contrast, extended auto warranties are typically classified as “vehicle service contracts,” a designation that largely exempts them from the direct regulatory scrutiny applied to MBI. This regulatory gap allows dealers greater leeway to mark up prices, sometimes by thousands of dollars, and has historically resulted in instances where providers have gone bankrupt, leaving policyholders with unpaid claims and no recourse. Understanding this critical lack of oversight is essential for consumers to appreciate the inherent risks and make a more informed decision about which form of protection, if any, best serves their interests.

The decision to purchase an extended auto warranty is a personal one, influenced by individual risk tolerance, vehicle reliability, and financial circumstances. However, as this comprehensive examination reveals, the perceived universal benefit of these contracts often does not align with their practical value. From the unfavorable cost-to-benefit ratio and numerous exclusions to the challenges of cancellation and the inherent “cash cow” model for vendors, consumers face multiple potential pitfalls.

Read more about: Are Electric Trucks Worth It? A Driver’s Honest Review of the Electrifying Road Ahead

While the “peace of mind” argument holds an emotional appeal, a truly informed decision requires a thorough understanding of the fine print, an awareness of market dynamics, and a realistic assessment of one’s own vehicle and financial readiness. Empowering oneself with this knowledge allows car owners to look beyond aggressive sales pitches and objectively weigh whether an extended warranty is a prudent investment or if alternative strategies, such as a dedicated savings fund, offer a more reliable and financially sound path to managing future repair costs.