The nation’s fiscal landscape is once again drawing significant attention, as the federal government’s budget deficit for the current fiscal year 2025 has expanded more than anticipated, reaching a staggering $2 trillion. This substantial shortfall represents a nearly $100 billion increase from the previous fiscal year, underscoring persistent challenges in balancing federal revenues against a growing array of expenditures. The latest data from the nonpartisan Congressional Budget Office (CBO) provides a detailed, if sobering, look at the trajectory of federal finances, revealing complex dynamics at play across both spending and revenue streams.

This comprehensive overview delves into the critical components driving the deficit’s expansion, focusing specifically on the first eleven months of fiscal year 2025. We will meticulously examine the overarching increase in federal spending, pinpointing the specific mandatory programs and other obligations that are exerting the most significant pressure on the national coffers. Concurrently, we will analyze the various facets of federal tax receipts, including the notable impact of customs duties and other income streams, to understand how revenue generation is evolving in the current economic climate and its capacity to mitigate the growing deficit.

The CBO’s recent monthly budget update for August painted a clear picture. It confirmed that the deficit reached $1.989 trillion in the first 11 months of fiscal year 2025. This figure alone represents a $92 billion increase in the deficit when compared with the first 11 months of fiscal year 2024, signaling an accelerating trend. Understanding these interconnected elements is not merely an academic exercise; it is crucial for grasping the full scope of the nation’s fiscal health and its long-term implications for economic stability and future policy decisions.

1. Overview of FY25 Deficit Expansion

The federal government’s budget deficit has reached a concerning $2 trillion for the current fiscal year 2025. This figure signals a substantial widening of the nation’s financial imbalance. This marked expansion represents an increase of nearly $100 billion when compared to the deficit recorded in the previous fiscal year. Such a significant increase underscores the ongoing fiscal pressures faced by policymakers and the broader economy, demanding careful analysis of its drivers and consequences.

According to the nonpartisan Congressional Budget Office (CBO)’s monthly budget update for August, the deficit for the first 11 months of fiscal year 2025 stood at an estimated $1.989 trillion. This precise figure confirms the trajectory towards the $2 trillion mark. It highlights the rapid accumulation of federal debt within a single fiscal period. The CBO’s rigorous analysis provides a critical benchmark for evaluating the nation’s financial health and assessing the effectiveness of current fiscal policies.

Comparing these figures to the preceding year, the CBO’s report indicates a $92 billion increase in the deficit. This is when juxtaposed against the first 11 months of fiscal year 2024. This year-over-year growth in the shortfall points to an acceleration of the deficit trend. It makes it imperative to analyze the underlying causes. This substantial widening of the gap between federal spending and revenues raises serious questions about the long-term sustainability of current fiscal trajectories.

The consistent growth of the deficit at this pace, particularly reaching $1.989 trillion within the first 11 months, places significant strains on the nation’s financial resources. It exerts upward pressure on interest rates, potentially fueling inflation and creating an uncertain economic environment. Understanding this expansion is fundamental to comprehending the challenges ahead for fiscal management and the stability of public finances in the coming years.

2. Drivers of Increased Federal Spending

Overall federal spending has experienced a considerable surge, increasing by $391 billion, or 5%, during the first 11 months of fiscal year 2025 compared to the same period a year ago. This substantial rise in outlays is a primary contributor to the widening budget deficit. It demonstrates an expanding scope of government activities and commitments across various sectors that collectively elevate the federal financial burden.

Much of this $395 billion increase from last year was predominantly driven by mandatory spending programs. These programs include vital initiatives like Social Security and Medicare. They represent non-discretionary commitments largely determined by existing law and demographic factors, making them difficult to reduce in the short term. Their growth is closely tied to the aging U.S. population and statutory benefit structures. This establishes them as significant and persistent drivers of federal outlays that demand continuous funding.

Beyond these direct program expenditures, the rising cost of debt service has also emerged as a major factor in the escalating increase in federal spending. The federal government spent $6.7 trillion in the first 11 months of fiscal year 2025. A notable portion of this increase can be attributed to the cost of borrowing. As the national debt continues to grow, so too does the interest accrued on that debt. This represents a substantial and unavoidable claim on federal resources. It diverts funds that could otherwise be allocated to other critical priorities such as infrastructure or research.

The combined impact of these mandatory spending increases and climbing interest payments creates a powerful upward force on the federal budget. Policymakers face an enduring challenge in managing these expenditures. This is particularly true given their inherent nature and the broad public constituencies they serve. The sustained growth in these areas necessitates a careful examination of their long-term fiscal implications. They are not merely cyclical but structural in nature, requiring comprehensive and forward-looking strategies.

Read more about: Debunking 9 Electric Car Charging Myths That Could Cost You Thousands: Experts Set the Record Straight for Savvy EV Drivers

3. Rising Costs of Social Security

A significant component of the increased federal spending stems directly from the rising costs associated with Social Security benefits. Payments for Social Security benefits were up by $111 billion, representing an 8% increase from the same period last year. This substantial rise is a clear reflection of both demographic shifts and policy adjustments. It highlights the program’s considerable and growing impact on the federal budget.

The primary reasons for this escalation include higher benefit payments resulting from the annual cost-of-living adjustment (COLA). The COLA mechanism is designed to ensure that Social Security benefits maintain their purchasing power in the face of inflation. This protects the financial well-being of retirees and other beneficiaries. While a crucial provision for recipients, these automatic adjustments invariably lead to higher aggregate outlays for the program. They contribute significantly to the overall spending increase.

Furthermore, a growing number of beneficiaries amid the aging of the U.S. population is also a critical factor contributing to the increased spending. As the large baby boomer generation continues its transition into retirement, the sheer volume of individuals becoming eligible for and receiving Social Security benefits expands considerably. This demographic trend is not a temporary fluctuation but a long-term structural factor in the program’s cost. It exerts sustained pressure on the federal budget.

The trajectory of Social Security spending underscores the pressing need for ongoing fiscal planning to ensure the program’s solvency and long-term sustainability. The dual pressures of COLA adjustments and an expanding beneficiary base mean that Social Security will continue to be a dominant and growing force in federal expenditures. Its substantial and predictable growth requires strategic long-term budgetary considerations, including potential reforms to address the underlying fiscal challenges.

Read more about: Beyond the Red Carpet: 12 Celebrities Unfiltered on the Brutal Realities of Fame and Fortune

4. Medicare’s Expanding Outlays

Medicare spending has also seen a significant increase, contributing further to the widening federal deficit. Medicare outlays increased by 8%, amounting to $64 billion higher than the same period last year. This growth is indicative of the increasing healthcare needs of an aging population, coupled with the escalating associated costs of providing these critical services. This makes Medicare a pivotal area of federal expenditure.

The rise in Medicare spending is largely attributable to two key factors: higher payment rates and an increase in the number of enrolled beneficiaries. Higher payment rates reflect the escalating costs of medical services, pharmaceuticals, and advanced healthcare technologies. These are influenced by a multitude of factors, including inflation within the healthcare sector and continuous advancements in medical care. While beneficial, these advancements often come with a higher price tag.

Concurrently, the growing number of enrolled beneficiaries places a greater and more sustained demand on the Medicare system. As more Americans become eligible for and enroll in Medicare, the total pool of recipients expands. This directly translates into higher aggregate spending. This demographic shift, similar to that affecting Social Security, represents a fundamental structural pressure on the federal budget. One that is expected to continue for the foreseeable future as the population ages.

The consistent growth in Medicare spending poses considerable fiscal challenges. It necessitates careful management and consideration of healthcare policy to ensure the program’s financial stability. The dual pressures of rising per-beneficiary costs and an expanding beneficiary base make Medicare a critical area for budget analysis and reform discussions. Ensuring the program’s long-term viability requires proactive, comprehensive, and potentially innovative policy approaches to manage costs while maintaining quality of care.

5. Soaring National Debt Interest Payments

The cost of servicing the national debt has become an increasingly significant driver of federal spending and a major contributor to the wider budget deficit. Interest expenses on the national debt have seen a notable rise. Net interest payments increased by $72 billion, or 8%, during the first 11 months of fiscal year 2025. This escalation directly reflects the growing principal of the national debt. It demands ever-larger allocations from the federal budget simply to cover borrowing costs.

The fundamental reason for this increase is straightforward: the national debt itself is substantially larger than it was in the previous year. As the federal government continues to run annual deficits, it must consistently borrow more money to cover the gap between its spending and revenues. This continuous accumulation of borrowing adds to the outstanding debt. This then inexorably incurs interest payments, creating a compounding burden on future budgets.

Moreover, rising interest rates, influenced by various economic factors including persistent inflation and the monetary policy decisions of the Federal Reserve, amplify the cost of servicing this larger debt. Even modest increases in benchmark interest rates can translate into billions of dollars in additional interest expenses. This is particularly true when applied to a national debt now totaling in the trillions. This creates a powerful and often unavoidable compounding effect on the federal budget, limiting fiscal flexibility.

The trajectory of interest payments highlights a critical feedback loop that policymakers must confront. Persistent deficits lead to a larger national debt. This in turn leads to higher interest payments, further exacerbating future deficits. This cycle underscores the urgent need for fiscal discipline to mitigate the growing burden of debt service on the federal budget. It represents an increasingly inflexible and substantial component of federal outlays. It consumes a larger share of taxpayer dollars that could otherwise be invested.

Read more about: Buyer’s Remorse Behind the Wheel: 15 Vehicles Owners Deeply Regret Buying and Why

6. Overall Revenue Growth in FY25

While federal spending has surged considerably, it is also important to acknowledge that federal tax receipts have seen an overall increase. However, this growth has not been sufficient to fully offset the rapid expansion in outlays. In the first 11 months of fiscal year 2025, total tax receipts rose by a notable $299 billion, representing a 7% increase compared to the same period in the previous year. This revenue growth provides a partial, yet insufficient, counterweight to escalating expenditures.

Individual income tax receipts, which form the largest component of federal revenue, were up by $181 billion, or 8%. They reached a total of $2.357 trillion in fiscal year 2025 so far. This substantial increase in individual income tax collection suggests robust economic activity, including strong employment figures and higher individual incomes. These collectively lead to greater tax liabilities for millions of Americans. It reflects the ongoing strength of the labor market and personal earnings, contributing significantly to the federal coffers.

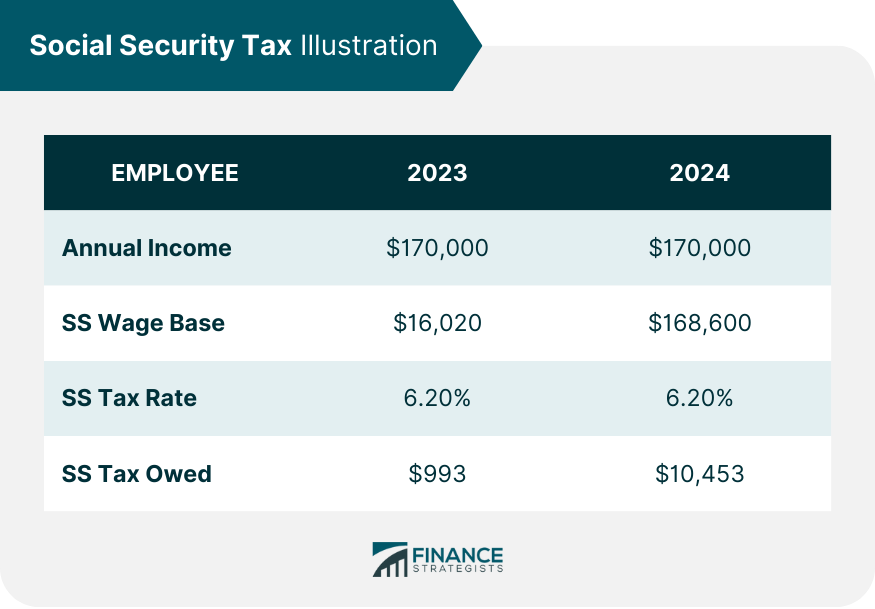

Payroll taxes, specifically earmarked to fund Social Security and Medicare, also contributed positively to the overall revenue growth. These taxes increased by $48 billion, or 3%, totaling $1.615 trillion in the first 11 months of the fiscal year. This rise is consistent with employment growth and wage increases across the economy. It indicates a healthy, albeit slower, expansion in the payroll tax base compared to individual income taxes. This demonstrates consistent contributions to essential social programs.

However, not all federal revenue streams followed an upward trajectory. Corporate income taxes notably fell by $32 billion, or 8%, when compared with the same period last year. The CBO clarified that this apparent decline was largely influenced by the timing of payments. Specifically, natural disasters declared in fiscal year 2023 caused approximately $35 billion in corporate tax payments to shift into fiscal year 2024. Therefore, this decline is more of an accounting anomaly resulting from timing shifts rather than a fundamental weakening of corporate tax generation. This implies the underlying corporate tax base remained relatively stable.

7. August 2025 Monthly Deficit Performance

The federal government’s budget deficit for August 2025 registered at $345 billion, as reported by the Treasury Department. This monthly outcome represents a 9 percent decline compared to August 2024, demonstrating a noteworthy improvement against the year’s broader fiscal challenges. This specific reduction provides valuable data for short-term economic analysis.

This monthly performance slightly diverged from initial projections; the CBO had estimated an August deficit of $360 billion. The reported $345 billion suggests certain revenue streams or expenditure patterns performed better than anticipated. Understanding these subtle shifts is crucial for assessing federal financial health.

Further dissecting August figures reveals total government receipts increased significantly, rising by $38 billion (12 percent) to a new monthly record of $344 billion. This robust surge in revenue collection points to underlying economic activities that bolstered federal coffers, offering a partial counterbalance to ongoing spending pressures.

Concurrently, government spending also marked a new monthly record, increasing by $2 billion to $689 billion. The simultaneous growth in receipts and outlays, culminating in a reduced monthly deficit, underscores the complex interplay of federal finances. It illustrates how exceptional revenue components can, in the short term, temper the overall shortfall.

Read more about: Buyer’s Remorse Hits Hard: 15 Cars Drivers Regretted Purchasing According to Latest Survey Findings

8. The Substantial Role of Tariff Revenues

A primary catalyst behind August’s improved budget performance was a sharp rise in tariff revenues, directly attributable to tariffs initiated under President Donald Trump’s administration. These customs duties have rapidly transformed into a significant, albeit volatile, source of federal income, playing a pivotal role in the recent monthly deficit reduction. Their growing impact highlights a direct link between international trade policy and domestic fiscal outcomes.

The Treasury Department’s report specifically emphasized a remarkable surge in net customs receipts for August. These receipts increased by approximately $22.5 billion, propelling total collections to an unprecedented monthly record of $29.5 billion. This represents a substantial leap from just $7 billion recorded in August of the previous year, clearly demonstrating the profound effect of these trade levies.

This exceptional spike in customs duty collections largely results from specific tariff policies, initially implemented in April 2025 and expanded in early August. These measures impacted a wide array of U.S. trading partners. The precise timing and broad scope of these adjustments correlate directly with the observed revenue surge, establishing a clear causal link between trade interventions and enhanced federal receipts.

Therefore, what was once a relatively minor revenue stream has, through these policy interventions, become a considerably larger and more impactful contributor to the federal budget for August. This development makes tariff revenue a critical element in analyzing the August deficit reduction and evaluating the short-term efficacy of specific policy levers.

Read more about: Beyond the Hue: Unpacking the Complex Layers of Donald Trump’s Public Persona and Enduring Impact

9. Treasury Secretary’s Projections and Debt Management

Looking beyond immediate monthly figures, U.S. Treasury Secretary Scott Bessent presented an optimistic projection for annual tariff revenues, estimating they could surpass $500 billion. This figure substantially exceeds previous forecasts, suggesting a strong belief within the Treasury that tariffs will serve as a potent and expanding source of federal income. This ambitious outlook underlines the administration’s strategic emphasis on leveraging trade policies for fiscal gain.

Secretary Bessent further clarified the primary objective for these robust revenue collections, explicitly stating these funds are dedicated primarily to paying down the U.S. national debt. With the national debt having swelled to approximately $37 trillion, this strategic decision signals a direct commitment to addressing the nation’s burgeoning financial liabilities and fostering long-term fiscal stability.

However, amidst discussions surrounding tariff revenue utilization, Treasury officials provided important clarifications regarding their immediate application. They definitively stated there are no immediate plans to distribute these tariff revenues as direct rebate checks to Americans, despite existing political pressures advocating for such measures.

This strategic allocation, prioritizing substantial debt reduction over immediate popular appeals, underscores a commitment to fortifying the nation’s financial foundation. It reflects governmental acknowledgment of the national debt’s gravity and an intention to leverage new revenue streams for structural fiscal improvement, aiming to enhance the country’s economic resilience.

10. Limitations of Tariffs for Overall Deficit Reduction

While tariff revenues provided a temporary boost to government receipts, economic experts caution these revenues alone are insufficient to offset the overall, persistent growth in the federal deficit. Fundamental drivers like high spending on mandatory programs and escalating debt servicing costs are too substantial and structural to be fully mitigated by tariffs in isolation.

Analysts point to a deep-seated imbalance between federal expenditures and revenues that extends beyond customs duties. Key spending areas, including entitlements like Social Security and Medicare, and critically, burgeoning interest payments on public debt, represent massive, non-discretionary outlays that expand irrespective of tariff collections. These systemic pressures require more comprehensive solutions.

A stark illustration of this limitation emerged in July 2025. During that month, interest payments on the national debt alone reached nearly $61 billion. This amount significantly exceeded total tariff revenues collected for the same period. This comparison powerfully demonstrates that debt servicing costs can dwarf benefits from new tariff income.

Therefore, while tariffs represent a valuable, though contentious, revenue stream, they are not a panacea for the nation’s profound fiscal woes. The relentless rise of the federal government’s gross national debt and the inherent growth of mandatory expenditures necessitate that policymakers pursue a multifaceted and robust approach to achieve genuine fiscal sustainability.

Read more about: Unpacking Trump’s Latest Tariffs: The Looming Cost to American Households and Businesses as Import Levies Reach Decades-High Levels

11. Fiscal Year 2025 Projections and Historical Context

Despite August’s localized improvement, the overall fiscal year 2025 deficit-to-date remains significantly elevated, underscoring persistent fiscal pressures. With only one month left, the deficit increased by $76 billion (4 percent) to a substantial $1.973 trillion. This places the current 11-month deficit among the highest in recent history, emphasizing the magnitude of the ongoing financial imbalance.

The Congressional Budget Office (CBO) recently provided an updated projection for the entire fiscal year 2025, estimating the final budget deficit will total $1.9 trillion. This revised figure, while marginally lower than some initial broad estimates, still represents an exceptionally massive shortfall. The CBO’s meticulous analysis offers a critical benchmark for evaluating the nation’s financial trajectory.

This projected $1.9 trillion deficit would rank as the third-largest in U.S. history. It is surpassed only by the fiscal year 2020 and 2021 deficits, incurred during the unprecedented economic disruptions and emergency spending of the COVID-19 pandemic. This historical context vividly underscores the severity of the current fiscal situation.

Looking ahead, analysts anticipate September, traditionally a month with higher federal revenues due to quarterly tax deadlines, could provide further deficit reduction. However, even with this potential influx, consensus remains that the full fiscal year deficit is still widely expected to approach or surpass the formidable $2 trillion mark.

Read more about: The PLA’s Ascent: Unpacking China’s High-Tech Military Modernization and Strategic Ambitions for a New Global Order

12. Broader Economic Implications and Sustainability Challenges

The recent rise in tariff-driven revenues has fostered short-term market optimism concerning the U.S. fiscal outlook. The perception that new, substantial revenue streams can help mitigate the federal deficit has resonated positively with segments of the financial community, offering momentary reassurance about government’s capacity to manage its finances.

However, beneath this optimism, significant concerns about the long-term sustainability of deficit financing persist among economists and institutional investors. Increased government borrowing remains a powerful economic force, consistently influencing interest rates, inflation expectations, and Treasury yields. This creates ongoing scrutiny.

For instance, astute investors observe rising gold prices. This phenomenon often signals caution regarding the perceived safety and stability of government bonds, particularly U.S. Treasuries. This flight to traditional safe-haven assets suggests underlying apprehension about the nation’s continued fiscal challenges, signaling uncertainty.

Furthermore, while tariff revenues offered temporary improvement in receipts, their longer-term economic impacts spark considerable debate. Many economists caution that sustained tariffs could lead to higher consumer prices, supply chain disruptions, and retaliatory trade measures from partners, potentially slowing economic growth.

Ultimately, balancing deficit reduction with robust national economic performance presents a multifaceted challenge for policymakers. Navigating these interconnected forces requires a nuanced, strategic, and far-sighted approach, ensuring short-term fiscal gains do not inadvertently undermine long-term economic prosperity.

**An Ending Look at Fiscal Trajectories**

Read more about: The Dynasty Architect: Unveiling Kris Jenner’s Unexpected Rule and the Empire-Building Playbook Behind the Kardashian-Jenner Fortune

The journey through the federal budget reveals a landscape marked by persistent challenges and temporary successes. While recent tariff surges offered fleeting fiscal relief, it is clear these measures alone are insufficient to fundamentally alter the long-term trajectory of the nation’s expanding deficit. The confluence of escalating mandatory spending, rising interest payments on a colossal national debt, and broader economic implications of trade policies demands a comprehensive, sustained commitment to fiscal discipline. Vigilance of policymakers and informed public engagement will be paramount in steering the nation towards genuine fiscal sustainability and economic resilience, ensuring a stable financial future.