Alright, let’s get real for a sec: the word ‘budget’ often gets a bad rap. It conjures images of spreadsheets, sacrifices, and saying ‘no’ to everything fun. But what if we told you it’s actually your secret superpower to financial freedom, less stress, and more control over your hard-earned cash? Seriously, a budget is your personal plan for how you use your money, a custom organization system that helps you stay on top of your bills, savings, and all those big money goals. Think of it as self-care for your wallet, a decision that you care about where every single dollar goes!

No matter how much you earn or how often you get paid, a well-crafted budget is the roadmap to living within your means and planning for the future. It’s about making smarter money moves, seeing the full picture of your savings, debt, investments, and more. While it might sound daunting, especially when thinking about feeding a whole family, mastering your money can be incredibly empowering. It’s not about strict deprivation; it’s about making intentional choices that align with your family’s dreams, whether that’s a big purchase, a secure retirement, or simply navigating unexpected life events with ease.

So, if you’re ready to transform your financial life and ditch the money stress, you’ve come to the right place! We’re about to dive deep into 14 essential budget categories that every family needs to master. These aren’t just dry financial terms; they’re the building blocks for a healthier, happier financial future for you and your loved ones. Get ready to uncover practical insights, smart strategies, and maybe even a few ‘aha!’ moments that will empower your family to save big and stress less. Let’s tackle these categories, one smart step at a time, and get you feeling pumped about your money!

1. **Housing: Your Home Base for Financial Stability**

This is often the big one, the cornerstone of your monthly expenses, whether you’re renting or have a mortgage. The general rule of thumb suggests that housing costs, including the mortgage or rent, property taxes, homeowner association (HOA) fees, and home maintenance, should ideally hover around 25–30% of your monthly gross income. It’s a significant chunk, so getting this right is crucial for a balanced budget.

If your housing costs feel like they’re eating up too much of your income, don’t despair! There’s often leeway to make adjustments. Consider options like refinancing your mortgage to a lower rate, exploring more budget-friendly locations if relocation is on the table, or even downsizing to a smaller home. For those with extra space, renting out a spare room could also generate some valuable rental income, directly easing the burden on your budget.

Beyond the big numbers, there are smaller, smart moves that can add up to big savings. Think about transitioning to energy-efficient technologies, like programmable thermostats or LED lightbulbs, which can significantly reduce your utility bills over time. Even the installation of solar panels, while a larger upfront investment, can lead to long-term savings on electricity, freeing up more cash for other family priorities. Every little bit counts when you’re building a rock-solid family budget.

Keeping tabs on all the housing-related expenses, from furniture and decor to renovations and repairs, helps you paint a clear picture. By diligently tracking these costs, you empower yourself to make informed decisions, ensuring your home remains a source of comfort, not financial strain. Remember, a stable housing budget creates the foundation for all other financial goals.

Read more about: The Paradox of Empty Homes: Unpacking the Complex Reasons Investors Withhold Properties Amidst a Housing Crisis

2. **Transportation: Getting Your Budget on the Right Track**

Next up, we’re talking about how you move around, which for many families, means car payments, fuel, maintenance, and insurance. Auto loans are a common expense, and the retail prices of vehicles vary greatly, offering significant leeway to make budget-friendly choices. A good guideline is to keep monthly car payments to less than 10% of your gross income, and total transportation costs generally below 15%.

But owning a car isn’t the only way to get from point A to point B! Depending on where you live, you might have fantastic alternative transportation options. Public transport, carpooling, biking, or even walking can slash your expenses, plus they often come with added benefits like being eco-friendly and providing great exercise. Imagine the savings on gas and vehicle maintenance alone!

If car ownership is a must for your family, smart choices still reign supreme. Opting for a more fuel-efficient vehicle can make a noticeable difference in your monthly gas budget. And don’t forget the power of routine upkeep: properly inflating tires, getting regular oil changes, and tuning your engine can keep your car in optimum condition, preventing costly repairs down the line. Plus, knowing traffic laws and driving safely helps you avoid fines that can hike up your auto insurance premiums.

Even your driving habits can impact your budget. Aggressive acceleration, for instance, consumes more fuel. By adopting a smoother driving style, you’re not just being safer on the road; you’re also being kinder to your gas tank and your wallet. Track expenses like gas, maintenance, public transportation passes, registration fees, repairs, and rideshare costs to truly understand and control your family’s transportation spending.

3. **Food and Beverage: Feeding Your Family (and Your Budget!) Wisely**

Ah, food – the daily necessity that can quickly become a budget buster if not managed mindfully! Stocking up on groceries, grabbing snacks, and especially dining out can really add up. Experts suggest that your combined expenses for food (groceries) and meals out should ideally be less than 15% of your income. It’s a category with a lot of wiggle room, meaning there are many opportunities for savings.

One of the biggest game-changers for your food budget is embracing home cooking. Preparing meals at home is generally significantly more cost-efficient than eating out, whether that’s at a restaurant or through food delivery services. Making this shift, even a few times a week, can potentially reduce your living expenses by a large amount. Plus, you get to control the ingredients, which is a win for both your health and your budget!

Meal planning is your secret weapon here. By planning your family’s meals for the week, creating a grocery list, and sticking to it, you can avoid impulse buys and reduce food waste. You might even find that using credit cards that offer cash back on groceries can provide a little extra boost to your budget, making every trip to the supermarket a bit more rewarding. It’s all about smart strategy!

Consider what falls into your ‘Food and Beverage’ category: coffee and tea runs, dining out, food delivery, groceries, meal kits, and even work lunches. Separating these out helps you see where your money is really going. If your ‘Meals Out’ column is looking a bit hefty, that’s your cue to fire up the stove more often. It’s a simple change that can have a massive impact on your family’s financial well-being and free up funds for other priorities.

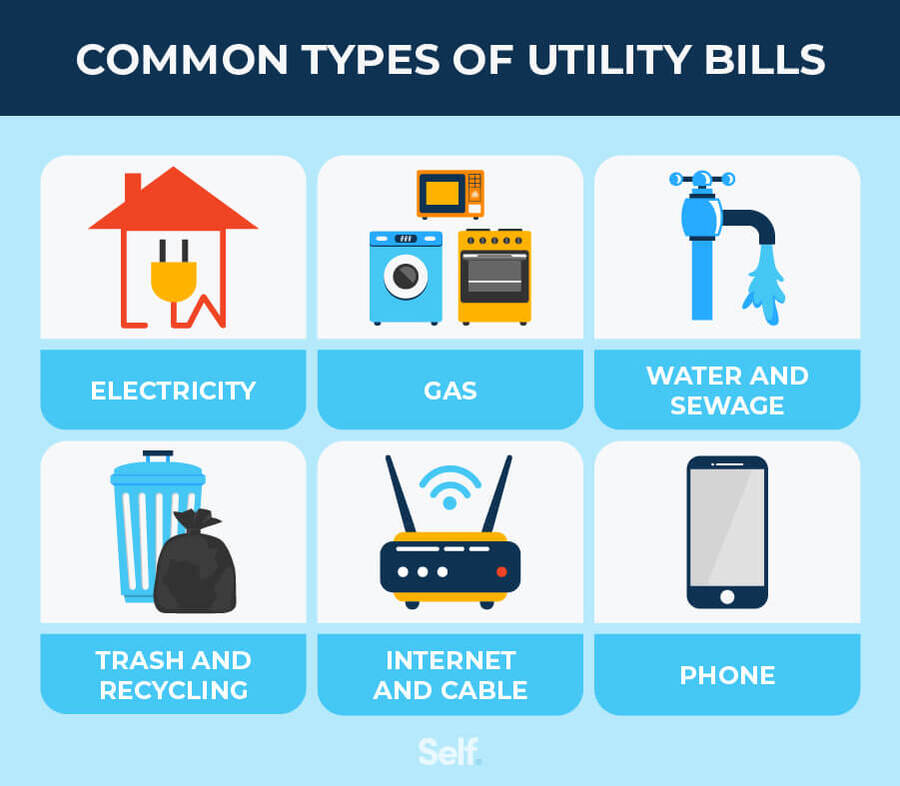

4. **Utilities: Keeping the Lights On (Without Breaking the Bank)**

Utilities are those absolute, non-negotiable necessities that keep your home running smoothly – think electricity, gas, water, internet, phone, cable, trash, and recycling. These essential bills typically make up about 5–10% of your total expenses. The interesting thing about utilities is that their costs can vary seasonally, like your water bill potentially increasing during spring and summer as gardening season kicks in.

While these are mostly fixed expenses, there are definitely smart ways to trim them down. The context mentions that transitioning to new, smart technologies can lead to significant energy savings. Programmable thermostats, for example, allow you to regulate your home’s temperature more efficiently, cutting down on heating and cooling costs when you’re not around. Energy-efficient lightbulbs are another easy switch that adds up over time.

Even seemingly small changes in household habits can contribute to savings. Being mindful of water usage, turning off lights when leaving a room, or unplugging electronics that draw phantom power can all make a difference on your monthly statements. These collective efforts from every family member can create real breathing room in this essential budget category.

Don’t forget to regularly review your service providers. Are you on the best internet or phone plan for your family’s needs? Sometimes a quick call or a bit of research can uncover a better deal, potentially saving you a decent chunk of change each month. By actively managing your utilities, you ensure you’re not overpaying for essential services, making your family’s budget even stronger and more resilient.

5. **Insurance: Your Family’s Financial Safety Net**

Insurance might not be the most exciting budget category, but it’s absolutely vital for protecting your family, your pets, and your hard-earned assets. Whether it’s a requirement for your vehicle or housing, or a smart choice for healthcare and life planning, insurance payments typically account for 5–10% of your total budget. It’s the safety net that catches you when unexpected life events happen, preventing minor inconveniences from becoming major financial disasters.

There are numerous types of insurance that a family might consider. Beyond the common vehicle and homeowner’s or renter’s insurance, you might also be looking at healthcare insurance, life insurance to protect your loved ones’ future, or even disability insurance to safeguard your income. And let’s not forget our furry (or scaled or feathered) family members; pet insurance can be a lifesaver for unexpected vet bills, preventing those costs from derailing your carefully planned budget.

It’s not enough to just have insurance; it’s crucial to have the *right* insurance for your family’s specific needs. Regularly reassessing your health insurance requirements, for instance, can ensure you’re not paying for coverage you don’t need, or conversely, that you’re adequately protected. Life changes, and your insurance coverage should evolve with you, always providing optimal protection without unnecessary expenditure.

By budgeting for insurance, you’re not just covering a bill; you’re investing in peace of mind. You’re mitigating sudden misfortunes, as the context wisely points out, and preparing for the unexpected. Understanding and allocating funds for disability, healthcare, homeowners’ or renters’, life, pet, and vehicle insurance ensures that your family’s financial future is secure, even when life throws a curveball.

6. **Medical: Prioritizing Health While Staying on Budget**

Healthcare is an undeniably crucial expense, averaging about $10,000 a year per person in the U.S. Unfortunately, it’s a category that often has little pliability in a budget, meaning there isn’t much room to cut corners without potentially compromising your family’s well-being. That’s why it’s so important to budget for out-of-pocket expenses like medications, urgent care visits, and even mental health services, typically setting aside 2–5% of your income.

While insurance covers some medical costs, it won’t cover everything, so having a dedicated budget for these expenses is key to avoid financial surprises. But even with limited pliability, there are still smart strategies to help manage and potentially reduce healthcare costs. Embracing healthy lifestyle choices, like not smoking, eating healthier, getting enough sleep, and exercising regularly, can significantly impact your long-term health and reduce the need for costly medical interventions.

When you do need medical care, being a savvy consumer helps. Always try to use in-network doctors, hospitals, and facilities to maximize your insurance benefits and avoid higher out-of-pocket costs. Regularly reassessing your health insurance needs ensures you have the most appropriate and cost-effective plan for your family, adapting as your circumstances change. Utilizing tax-advantaged accounts, like a Health Savings Account (HSA) in the U.S., can also provide a smart way to pay for healthcare expenses with pre-tax dollars.

Another practical tip is to buy generic drugs whenever possible; they often contain the same active ingredients as their brand-name counterparts but at a fraction of the cost. For seniors, modifying their home environment to reduce the risk of falls can prevent one of the most common events leading to large healthcare bills. Budgeting for medical expenses, including devices, supplies, medications, primary care, specialty care, urgent care, vision, and dental, is about proactive financial and physical health management.

7. **Household Supplies: The Small Buys That Add Up**

This category might seem minor compared to housing or transportation, but household supplies are one of those easily overlooked expenses that can discreetly add up and throw your budget off-kilter. Dedicating around 2–5% of your budget to these everyday necessities, like cleaning supplies, laundry detergent, light bulbs, toiletries, batteries, air filters, and even laundromat fees, ensures you’re prepared without scrambling when you run out of something essential.

It’s common to wonder where your money went if a big supply run happened earlier in the month and you didn’t budget for it specifically. This is exactly why having a clear line item for household supplies is a game-changer. It helps you anticipate these recurring costs, allowing you to stock up strategically, perhaps by buying in bulk when items are on sale, or by choosing more budget-friendly brands.

Think about all the bits and bobs that keep your home running smoothly: from the detergent that keeps clothes fresh to the tools needed for minor repairs, these items are essential. Budgeting for them means you won’t be dipping into other categories unexpectedly, maintaining the integrity of your overall financial plan. It brings a sense of calm knowing these small but necessary purchases are accounted for.

By being intentional about this category, your family can avoid those surprise trips to the store that often lead to impulse purchases. It’s about planning ahead and acknowledging that even the smallest items contribute to your overall financial picture. Keeping a watchful eye on household expenses ensures that your budget remains robust and capable of supporting your family’s needs without a hitch.

8. **Personal Expenses: Your ‘Me-Time’ Money, Smartly Spent**

Okay, so we’ve covered the big stuff, the absolute must-haves for your family. But what about *you*? Your personal expenses are those essential “self-care” items that keep you feeling human, from a much-needed spa day or a gym session to those subscription services that make life a little easier. It’s super easy for these costs to slip under the radar, but giving them a dedicated spot in your budget means you’re consciously investing in your well-being without derailing your financial goals.

We’re talking about everything from new clothing that makes you feel great to your favorite cosmetics, hobbies that spark joy, or that salon visit that just makes you feel refreshed. These are the expenses that often fall into the “want” category, but they’re still vital for mental health and personal enjoyment! The trick is to be intentional with this spending. Dedicate a manageable 5–10% of your budget to this category, and you’ll find it much easier to stay on track.

You can even automate your personal finances by setting aside a specific amount each month, making sure your “fun money” is always there without guilt. This helps you avoid those moments of wondering where your money went after a shopping spree or a splurge on a new gadget. By acknowledging these personal needs and planning for them, you create a balanced budget that supports both your family’s big goals and your individual happiness.

9. **Family Expenses: Investing in Your Loved Ones’ Future**If you’ve got kids or other dependents, you know that “family expenses” can feel like a budget category all on its own! This isn’t just about daily needs; it’s about investing in their growth, education, and well-being. Think about everything from daycare costs and babysitters to school supplies, extracurricular activities, and even saving up for camp tuition. These are huge parts of family life, and they deserve a clear allocation in your financial plan.

If you’ve got kids or other dependents, you know that “family expenses” can feel like a budget category all on its own! This isn’t just about daily needs; it’s about investing in their growth, education, and well-being. Think about everything from daycare costs and babysitters to school supplies, extracurricular activities, and even saving up for camp tuition. These are huge parts of family life, and they deserve a clear allocation in your financial plan.

The context mentions that having a child is “generally one of the costliest (and time-consuming) expenses for any adult,” underscoring why planning for this financially is so crucial. Experts suggest allocating about 5–10% of your budget to this essential category. This covers not just the immediate costs, but also those long-term goals like education funds or child support payments, ensuring you’re ready for whatever comes your way.

By carving out a specific amount for family expenses, you’re building a buffer for those inevitable “back-to-school” seasons or unexpected needs, preventing them from becoming budget-busting surprises. It’s about being proactive, ensuring your children have the resources they need to thrive, and providing for their future without causing financial strain on the household. This dedicated fund helps you breathe easier, knowing you’re providing the best for your loved ones.

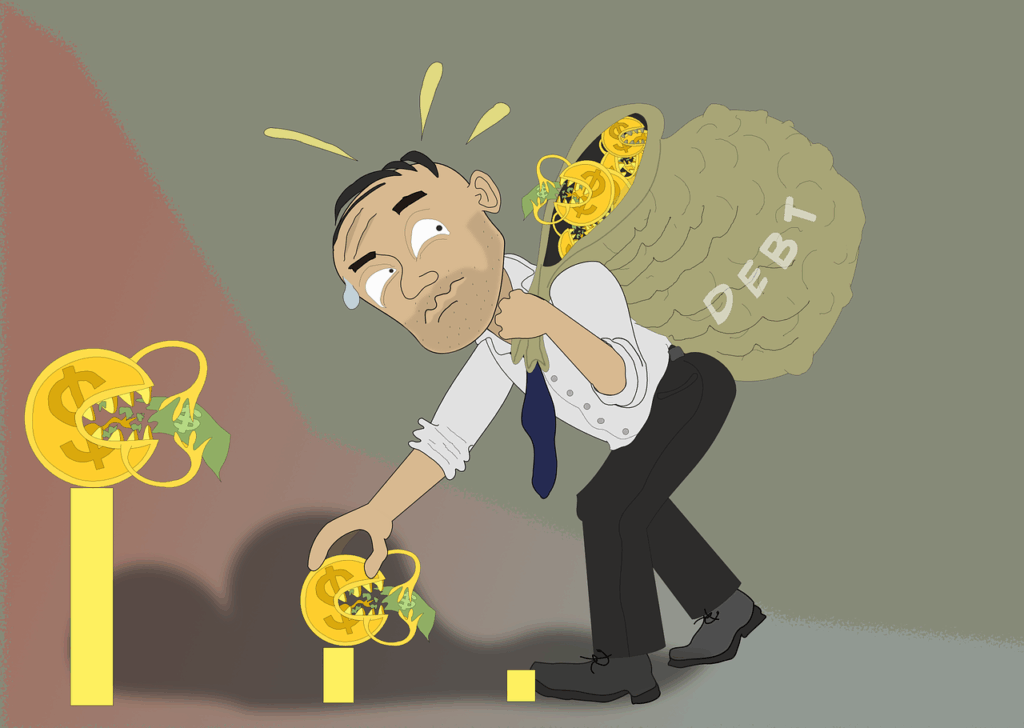

10. **Debt: Taming the Beast and Reclaiming Your Freedom**

Let’s be honest: debt can feel like a heavy weight, and for many families, tackling it is a top priority on the road to financial independence. This category is where you budget for payments on everything from auto loans and credit cards to education loans and personal loans. The goal? To not just make minimum payments, but to strategically pay down balances and free up your income for other dreams.

It’s common to hear that credit cards carry negative connotations, and for good reason! “People tend to use them to spend more than they can afford,” and “they must be repaid in a timely manner to avoid large interest payments.” So, dedicating 5–10% of your monthly budget to debt repayment – *beyond* just the minimums – is a powerhouse move. This strategy, especially focusing on high-interest debts like credit cards, can save you a ton of money in interest over time.

Remember the budget priorities we touched on earlier? Paying off high-interest debt is Priority No. 3 for a reason! Once those are under control, you can then tackle other debts like student loans. By consciously allocating funds here, you’re not just chipping away at numbers; you’re actively reclaiming your financial freedom, bit by bit. It’s a journey, but with a clear plan, you’ll feel more in control and less stressed about those outstanding balances.

11. **Retirement: Your Future Self Will Thank You!**

Who doesn’t dream of kicking back, relaxing, and enjoying their golden years without a financial worry in the world? Making that a reality starts right now, with a dedicated retirement savings plan. This category is all about building that nest egg so your future self can live comfortably. Financial experts recommend putting aside a solid 5–15% of your monthly income for retirement savings, and trust us, starting early makes a massive difference!

Consider all the avenues available: 401(k) contributions (especially if your employer offers a match – that’s essentially free money, so grab it!), Roth IRAs, traditional IRAs, annuities, or even brokerage accounts. “Saving for retirement early maximizes any returns,” which means the magic of compound interest gets to work for you for longer. Even if it feels like a small amount now, those contributions really add up over the decades.

The context wisely points out that “it is recommended for the total of this section to be 15% or higher.” So, if you’re getting a 401(k) match, remember that counts towards your total! By consistently funneling funds into retirement, you’re securing a future where you have the freedom to enjoy your time without financial constraints. It’s a long-game strategy, but one that promises immense rewards down the line for you and your family.

12. **Savings: Building Your Financial Fortress**

Beyond retirement, general savings are the bedrock of a resilient financial life. This category is your go-to for everything from building up an emergency fund – seriously, this is Priority No. 1! – to saving for big purchases, a college fund, or that dream family vacation. Aiming to set aside 10–15% of your budget for personal savings can create a powerful financial fortress around your family.

An emergency fund is your first line of defense against life’s curveballs, whether it’s an unexpected car repair or a medical bill. “NerdWallet suggests starting an emergency fund of at least $500, which could be enough to cover small emergencies and repairs.” The goal is to eventually build up three to six months of basic living expenses. It might take time, but every dollar you put away makes your family more secure.

You can use various tools for your savings, like a dedicated savings account, CDs, or even a “sinking fund” for specific goals like a new car or a down payment on a house. Automating your savings, by setting up regular deposits on payday, makes it super easy to stick to your goals. The more you save, the more flexible and stress-free your family’s financial future becomes, paving the way for those exciting big purchases and experiences.

Read more about: Tens of Thousands of Epstein Emails Unearthed: A Deep Dive into the Architect of a Shadow Network

13. **Gifting: Spreading Joy Without the Financial Surprise**

Here’s a category that often gets overlooked until the last minute, leading to unexpected budget headaches: gifting! Birthdays, holidays, baby showers, weddings, teacher appreciation – the occasions pile up, and suddenly you’re scrambling for cash. But with a smart budget, you can spread joy throughout the year without any financial surprises.

The good news is you don’t need a massive chunk of change for this. Setting aside just 1–5% of your budget each month can make a huge difference. Imagine having a dedicated “holiday savings” pot that fills up gradually, so when December rolls around, you’re ready to celebrate without dipping into your emergency fund! It’s all about planning ahead, rather than reacting to last-minute gift emergencies.

This category also includes donations or tithes if that’s part of your family’s giving strategy. By consciously budgeting for gifting, you ensure that expressing your love and generosity doesn’t come at the cost of your financial stability. It empowers you to give thoughtfully and joyfully, knowing every gift is accounted for, rather than causing a dent in other crucial categories.

14. **Pets: Budgeting for Your Furry (or Scaly!) Family Members**

For many families, pets aren’t just animals; they’re cherished members of the household! And just like any family member, they come with their own set of expenses. From vet visits and pet food to new toys and grooming sessions, these costs can add up. But don’t worry, budgeting for your beloved companions is totally doable!

Allocating a modest 1–5% of your budget to your pets ensures you can provide them with the best care without any financial stress. This covers routine check-ups, necessary medications, and even boarding or pet sitting if you plan to travel. The context also reminds us that “pet insurance can be a lifesaver for unexpected vet bills,” preventing those sudden large costs from derailing your budget.

So whether your family member has fur, scales, feathers, or anything in between, planning for their needs is a smart move. Things like collars, leashes, training, and even those fun squeaky toys all fit here. By including your pets in your family budget, you’re ensuring they live a happy, healthy life right alongside you, proving that every member of the household, big or small, is accounted for.

**The Bottom Line: Your Budget, Your Power, Your Future!**

Wow, you’ve just unlocked the secrets to mastering your family’s finances, category by category! From the roof over your head to the wagging tail of your furry friend, we’ve walked through every essential area where your money works for you. No more guessing games, no more money stress – just smart, intentional choices that build a rock-solid financial foundation.

This isn’t about deprivation; it’s about empowerment. It’s about knowing exactly where every dollar goes and making conscious decisions that align with your family’s biggest dreams, whether that’s an incredible vacation, a secure retirement, or simply the peace of mind that comes with being financially prepared. You’ve got this!

Remember, your budget is a living, breathing tool, ready to adapt as your life changes. Keep tracking, keep adjusting, and keep celebrating every win, big or small. You’re not just managing money; you’re crafting a healthier, happier, and more secure future for everyone you love. Now go forth and budget like the financial rockstar you are!

.png)