Planning for retirement is one of the most critical financial journeys you’ll embark on, yet for many, it can feel like navigating a dense, uncharted forest. The sheer volume of information, coupled with the long-term nature of the goal, often leaves individuals wondering where to begin or if they’re even on the right track. This comprehensive guide aims to illuminate that path, offering practical, actionable advice that cuts through the complexity and empowers you to make informed decisions about your financial future.

Retirement planning isn’t merely about reaching a certain age; it’s about strategically building the financial foundation that allows you to live the life you envision once you step away from full-time work. It involves a careful consideration of various income streams, understanding governmental benefits, and making smart choices with your savings and investments over decades. Our goal here is to demystify these elements, providing you with a clear understanding of the components that will shape your post-working years.

From pinpointing your full Social Security retirement age to grasping the intricacies of different savings vehicles and protecting your nest egg from inflation, we’ll break down the essential aspects of retirement planning. This article is designed to be an educational resource, equipping you with the knowledge to approach retirement with confidence, ensuring you’re well-prepared for the significant financial decisions that lie ahead.

1. Understanding Your Social Security Full Retirement Age

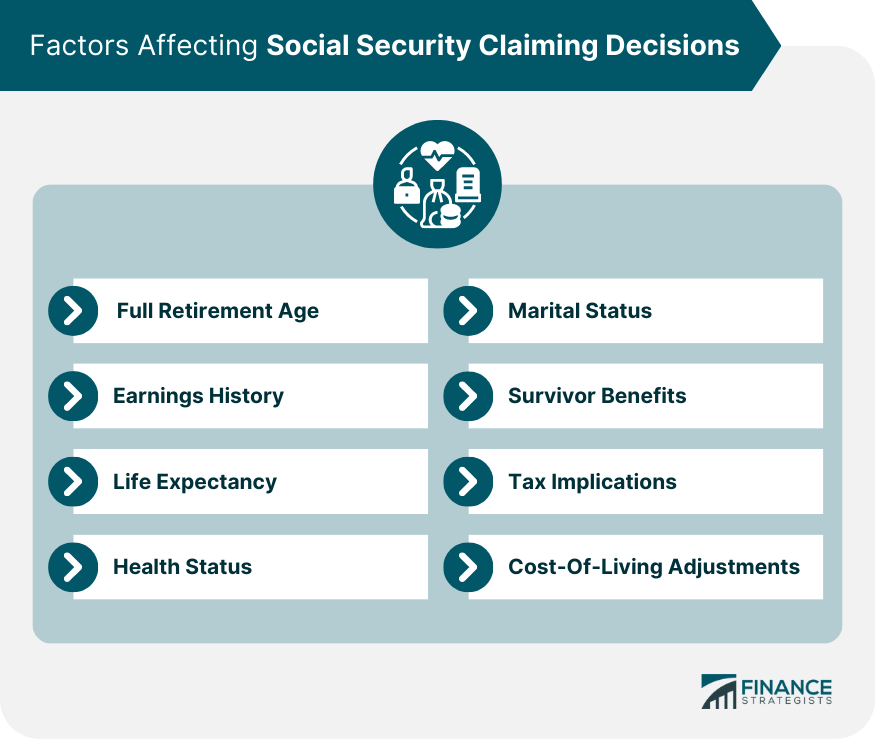

One of the foundational elements of retirement planning, particularly in the U.S., is understanding your Social Security full retirement age (FRA). This isn’t just a number; it’s the age at which you become entitled to 100% of the Social Security retirement benefits you’ve earned through your working life. While you can begin receiving benefits as early as age 62, or delay them up to age 70 for increased amounts, knowing your specific full retirement age is paramount for strategic planning.

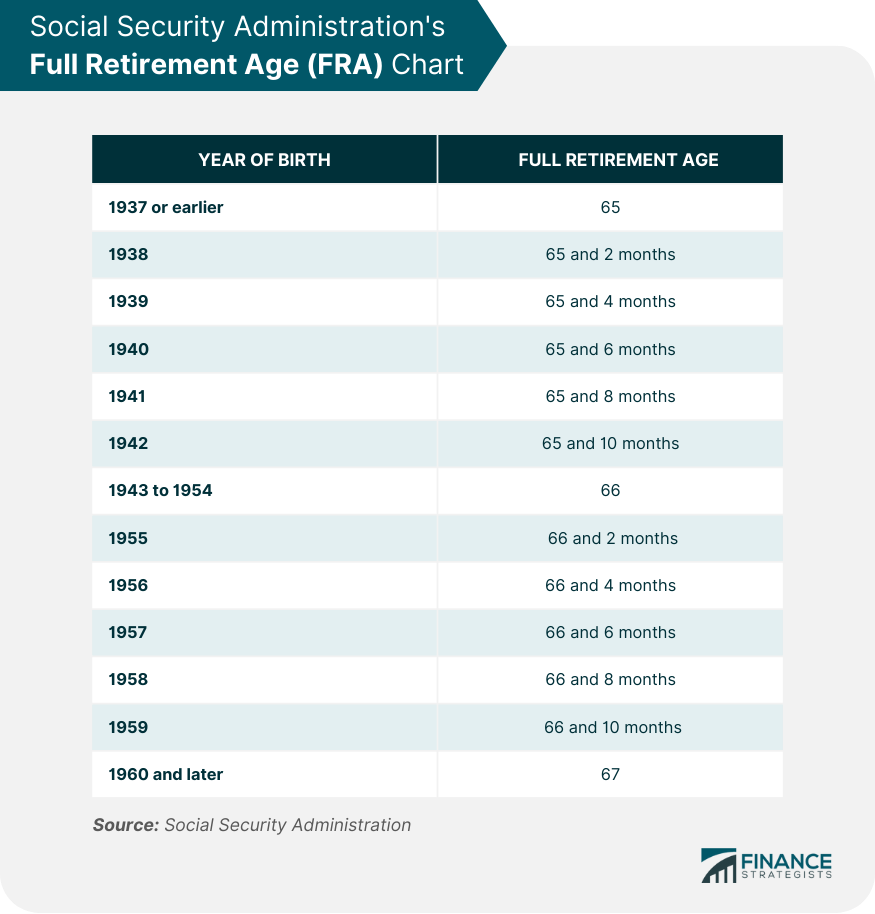

Your full retirement age is not a universal constant; it varies based on your year of birth. For instance, individuals born between 1943 and 1954 have a full retirement age of 66. For those born in 1960 or later, this age rises to 67 years. The Social Security Administration (SSA) gradually increases this age by a few months for birth years in between, such as 66 and 2 months for those born in 1955, and 66 and 10 months for those born in 1959. This gradual adjustment underscores the importance of consulting official guidelines or using a specialized calculator tailored to your birth year.

It’s also worth noting specific nuances, such as the rule for those born on January 1st. If your birthday falls on January 1st, the SSA figures your benefit and full retirement age as if your birthday was in December of the previous year. This small detail can have a meaningful impact on your eligibility timeline, so careful calculation is always advised. Being aware of your precise full retirement age provides a critical benchmark around which you can structure your other retirement income strategies.

Read more about: America’s Defining Eras: A Showdown of 10 Pivotal Moments that Shaped the Nation (And Why They Still Matter)

2. The Impact of Starting Social Security Benefits Early or Late

Deciding when to start collecting your Social Security retirement benefits is a deeply personal financial choice with significant long-term implications. The earliest you can begin receiving benefits is age 62, but doing so before your full retirement age comes with a permanent reduction in your monthly benefit amount. This reduction is a small percentage for each month before your full retirement age, and it can significantly impact your total lifetime benefits.

To illustrate, consider an estimated monthly benefit of $1,000 at full retirement age. For someone born between 1943-1954, whose full retirement age is 66, taking benefits at 62 would mean collecting 48 months early. This results in a 25.00% reduction, bringing their monthly benefit down to $750. For those born in 1960 or later, with a full retirement age of 67, starting at 62 (60 months early) leads to a 30.00% reduction, meaning that same $1,000 benefit would be reduced to $700. Similar reductions apply to a spouse’s benefit, where a $500 spouse’s benefit could be reduced to $350 or $325, depending on the birth year and early claiming period.

Conversely, if you delay taking your benefits from your full retirement age up to age 70, your benefit amount will increase due to delayed retirement credits. This offers a powerful incentive for those who can afford to wait, as it means a larger monthly check for the rest of their lives. Each person’s situation is unique, presenting both advantages and disadvantages. The main advantage of early collection is receiving benefits for a longer period, while the disadvantage is a permanently reduced monthly sum. It is crucial to weigh these factors carefully, considering your personal health, financial needs, and other retirement income sources, as percentages are approximate due to rounding.

Read more about: Gone But Not Forgotten: 14 Beloved Cars That Vanished Unexpectedly from Production

3. Why Retire? Defining Your Personal Retirement Goals

At its core, to retire means to withdraw from active working life, and for most, this period lasts for the remainder of their lives. The decision to retire is a complex tapestry woven from various personal, financial, and health-related threads. While some individuals may be forced into retirement due to unforeseen circumstances, most have the opportunity to make a conscious choice about when and why they will cease full-time employment.

Physical or mental health often plays a significant role in this decision. A worker who is no longer physically strong enough, succumbs to a disability, or experiences a mental decline that impedes job performance might reasonably consider retirement or a less demanding occupation. Beyond health, the cumulative stress associated with an occupation can become unbearable, leading to a decline in job satisfaction and prompting a desire for a change of pace. While retirement theoretically can happen at any normal working age, it commonly occurs between the ages of 55 and 70, though some choose to “semi-retire” by gradually reducing their work hours.

Perhaps one of the most important, and often daunting, factors influencing a person’s decision to retire is financial feasibility. While it is theoretically possible to retire with minimal savings, relying solely on Social Security benefits, this is generally considered an ill-advised strategy for most. Social Security in the U.S. is designed to replace approximately 40% of the average worker’s wages during retirement, meaning it’s intended as a safety net, not a full income replacement. Therefore, the ability to financially support oneself is a paramount consideration, and when not compelled by health or other factors, most people choose to retire when they are genuinely ready and comfortable with their financial preparedness.

Read more about: The Software Guru Behind a Viral Retirement Calculator Reveals Her ‘Boring’ Secrets to Financial Independence

4. The ‘How Much to Save’ Question: Key Rules (10%, 80%, 4%)

The question of “how much should a person save for retirement?” is indeed a loaded one, with very few definitive answers that apply universally. The ideal savings amount is highly dependent on individual circumstances, including anticipated income needs in retirement, eligibility for Social Security, health and life expectancy, personal preferences regarding inheritances, and a host of other unique factors. However, financial experts have developed several general guidelines to help individuals estimate their targets and begin their savings journey.

One popular guideline is the **10% Rule**, which suggests consistently saving 10% to 15% of your pre-tax income each year throughout your working life. For example, someone earning $50,000 annually would aim to set aside between $5,000 and $7,500 for retirement in that year. Starting this discipline early, perhaps at age 25, can potentially enable a person to accumulate a $1 million nest egg by the time they reach retirement, thanks to the power of compound interest.

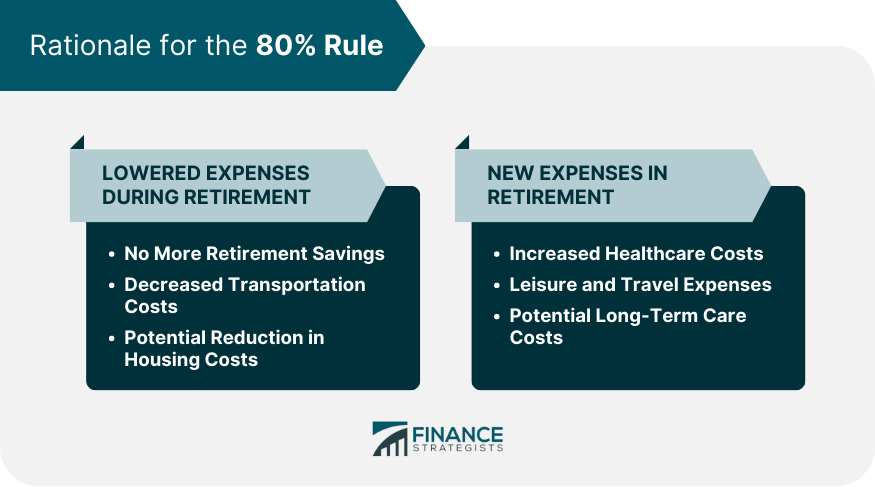

Another widely cited principle is the **80% Rule**. This rule posits that maintaining 70% to 80% of your pre-retirement income can allow you to sustain a similar standard of living after you stop working. If your average annual income during your working life was $100,000, you might aim for $70,000 to $80,000 in annual income during retirement. This percentage can, of course, fluctuate significantly based on individual retirement aspirations—whether you dream of sailing around the world or living a simpler life in a quiet cabin.

Finally, for those who have a clearer vision of their annual income needs in retirement, the **4% Rule** offers a method to calculate the required nest egg. By dividing your estimated annual retirement expenses by 4%, you can determine the total savings needed. For instance, if you anticipate needing $100,000 per year in retirement, the 4% rule suggests a nest egg of $2.5 million ($100,000 / 0.04). While these rules provide helpful starting points, some experts also claim that saving 15 to 25 times your current annual income may suffice. Ultimately, utilizing retirement calculators and consulting licensed professionals can provide tailored guidance for your specific financial situation.

5. Navigating Inflation’s Bite on Your Retirement Savings

Inflation, often an overlooked factor in long-term financial planning, represents the general increase in prices and a corresponding fall in the purchasing power of money over time. It’s a subtle yet powerful force that can significantly erode the value of your retirement savings if not adequately accounted for. In the United States, the average inflation rate over the past 30 years has hovered around 2.6% annually. This seemingly small percentage has a dramatic cumulative effect: one dollar today holds less than 50 cents of the purchasing power it had 30 years ago.

This continuous decline in purchasing power is precisely why many people tend to underestimate the amount of money they will truly need to save for retirement. What seems like a comfortable sum today might fall far short of providing the desired lifestyle decades down the road, as the cost of living—from groceries to healthcare—will have substantially increased. Ignoring inflation can lead to a significant shortfall in retirement funds, necessitating a drastic cutback in lifestyle or a return to work.

While inflation is largely unpredictable and often beyond an individual’s direct control, it shouldn’t be entirely disregarded. Most people focus on achieving the largest and steadiest total return on investment possible, with some strategies specifically designed to mitigate inflation’s impact. These include investments like Treasury Inflation-Protected Securities (TIPS) in the U.S., or similar instruments internationally. Traditionally, gold and other commodities have also been favored as hedges against inflation, as have dividend-paying stocks, which can offer more protection than short-term bonds. Leveraging financial calculators that factor in inflation can also provide a more realistic projection of your future financial needs.

6. Maximizing Employer-Sponsored Retirement Plans: 401(k), 403(b), 457

Employer-sponsored retirement plans stand as one of the most popular and effective avenues for saving for retirement in the U.S., primarily due to their significant tax advantages and often, the invaluable benefit of employer matching contributions. The 401(k) is the most widely recognized, typically offered by for-profit companies. Its counterparts include the 403(b), prevalent in non-profit, religious organizations, and school districts, and the 457 Plan, found in governmental organizations.

A key feature of many of these plans, particularly the 401(k), is the employer matching program. This is essentially free money for your retirement. Many employers will match a certain percentage of your contributions, up to a specified limit. For instance, an employer might match 3% of an employee’s contribution to their 401(k). If that employee earns $60,000 a year, the employer would contribute a maximum of $1,800 to their account that year. It’s notable that only about 6% of companies offering 401(k)s do not make some form of employer contribution, making it almost universally advisable to contribute at least enough to receive the full employer match.

The tax benefits of these plans are substantial. Contributions are typically made using pre-tax dollars, meaning they reduce your taxable income in the year you make them. The funds then grow tax-free, compounding over decades, until they are distributed in retirement. At that point, distributions are taxed as ordinary income, but most retirees often fall into a lower tax bracket, further enhancing the net benefit. For 2025, contribution limits for 401(k)s are expected to be around $23,000 annually, adjusted for inflation, highlighting the significant capacity these plans offer for building a robust retirement fund. Leveraging these employer-sponsored plans to their maximum potential is a cornerstone of effective retirement planning.

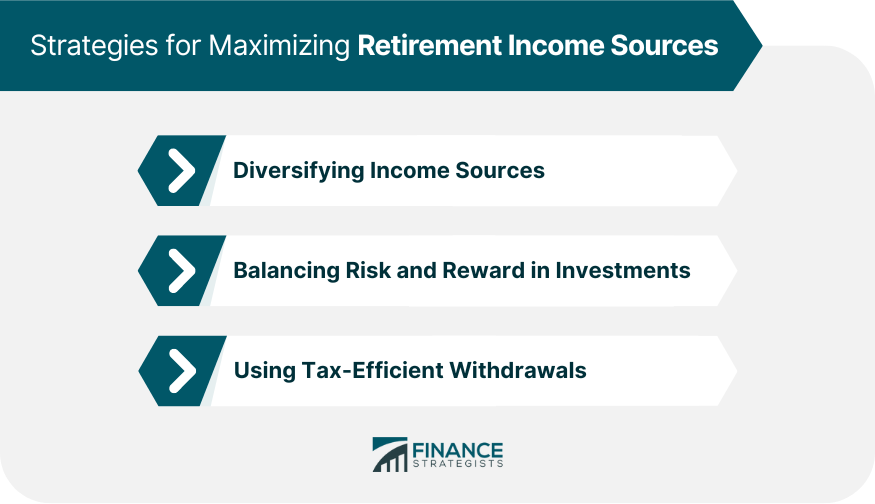

As we move beyond the foundational aspects of retirement planning, it’s time to explore the diverse avenues available for building a robust and resilient retirement portfolio. While employer-sponsored plans and understanding Social Security are critical starting points, a truly secure retirement often necessitates a broader strategy, leveraging various savings vehicles and income streams. This section will delve into additional, yet equally vital, components that can fortify your financial future and help you achieve your long-term goals. We’ll examine individual retirement accounts, the modern relevance of pensions, and strategies for diversifying your investments beyond traditional tax-advantaged options, ultimately helping you piece together a comprehensive retirement income mosaic.

7. Leveraging Individual Retirement Accounts: IRAs and Roth IRAs

Beyond employer-sponsored programs, Individual Retirement Accounts (IRAs) and Roth IRAs stand as highly popular and effective tools for retirement savings in the U.S. These accounts offer distinct tax advantages, making them appealing choices for individuals looking to supplement their 401(k)s or save independently. Understanding the fundamental differences between a traditional IRA and a Roth IRA is crucial for aligning your savings strategy with your personal financial outlook and future tax expectations.

Traditional IRAs operate on a pre-tax contribution model, similar to many 401(k)s. This means that the money you contribute typically reduces your taxable income in the year you make the contribution. Your investments then grow tax-deferred over the decades, accumulating wealth without annual tax implications. When you eventually withdraw funds in retirement, these distributions are taxed as ordinary income. This structure is often advantageous for individuals who anticipate being in a lower tax bracket during retirement than they are in their working years.

In contrast, Roth IRAs are funded with after-tax dollars. This means your contributions do not provide an immediate tax deduction. However, the significant benefit of a Roth IRA comes at the point of withdrawal: qualified distributions in retirement are entirely tax-free. This makes Roth IRAs particularly attractive if you expect to be in a higher tax bracket in retirement, or if you simply prefer to pay your taxes now and enjoy tax-free income later. For 2025, the contribution limits for IRAs are expected to be around $7,000-$7,500 for those under 50, providing substantial capacity for dedicated savers.

Choosing between a traditional or Roth IRA often boils down to your current income level, your projected income in retirement, and your personal philosophy on paying taxes now versus later. Many financial experts recommend considering a blend of both types of accounts to provide flexibility and tax diversification in retirement. Understanding these mechanisms empowers you to make an informed decision that best suits your long-term financial plan.

8. Exploring Traditional Pension Plans and Their Modern Relevance

Once a cornerstone of retirement security, traditional pension plans represent a different model of retirement funding compared to the self-directed accounts common today. In a pension plan, employers pool together and manage retirement funds for their employees, taking on the investment risk and administrative burden. Upon retirement, employees are typically entitled to fixed payouts for the remainder of their lives, providing a predictable and stable income stream.

While pensions have largely fallen out of favor in the private sector due to increasing longevity and a shifting workforce dynamic, they still maintain significant relevance, particularly within the public sector. Most public servants in the United States, including teachers, police officers, and government employees, are still covered by robust pension programs. Some traditional corporations may also continue to offer these benefits to their employees, albeit less commonly than in decades past.

For retirees fortunate enough to have a pension, there are usually choices to be made regarding how benefits are received. Individuals can opt for fixed periodic payouts, ensuring a steady income flow, or in some cases, they may choose to sell their share of the pension pot as a lump sum to an insurance company. This lump sum can then be converted into an annuity, providing another avenue for guaranteed income. Although less widespread, understanding the mechanics and continued existence of pension plans remains an important part of the broader retirement landscape.

Read more about: The Unyielding Workhorses: 13 Legendary Pickup Trucks and Engines Engineered to Conquer Half a Million Miles (and Beyond) with Proper Care

9. Diversifying Beyond Tax-Advantaged Accounts: Investments and CDs

While employer-sponsored plans like 401(k)s and individual retirement accounts (IRAs) offer incredible tax benefits, they often come with annual contribution limits. For individuals who have maximized these tax-advantaged options and still have additional funds they wish to earmark for retirement, diversifying into other investment vehicles becomes a crucial strategy. These additional investments serve the vital purpose of continuing to grow wealth and help ensure that retirement goals are met.

Various investment options are available in the U.S. that can supplement your primary retirement accounts. These include mutual funds, which pool money from many investors to buy a diversified portfolio of stocks, bonds, and other securities. Index funds, a type of mutual fund, aim to replicate the performance of a specific market index. Individual stocks offer potential for higher returns but also carry higher volatility and risk. Real estate properties, bonds, and commodities like gold are also popular choices, each with their own risk-reward characteristics.

When considering these investments, it’s essential to understand their differing risk profiles. Individual stocks, for example, tend to be more volatile, while gold and other commodities can fluctuate significantly based on economic conditions. Real estate also has its own market dynamics. For those nearing or in retirement who prioritize stability and low risk, Certificates of Deposit (CDs) and fixed income investments offer lower returns but provide a steady and predictable income stream. It’s important to remember that these non-tax-advantaged accounts can hold the same types of investments found within a 401(k) or IRA, but without the specific tax shelters associated with those accounts.

10. Understanding Social Security: A Core Retirement Pillar

Social Security, a vital social insurance program administered by the U.S. government, stands as a fundamental pillar of financial support for millions of Americans in retirement. Designed to provide protection against poverty, old age, and disability, it serves as a critical income source, particularly for those who have contributed to the Federal Insurance Contributions Act (FICA) tax throughout their working lives. Understanding its role and how benefits are calculated is paramount for any comprehensive retirement plan.

While commonly perceived as a retirement savings plan, Social Security was primarily designed to replace approximately 40% of an average worker’s wages during retirement. This crucial detail underscores that it is intended as a safety net and a foundational income stream, rather than a full replacement for pre-retirement earnings. Despite this, a significant portion of the population relies heavily on it, with approximately one-third of the working population and 50% of retirees expecting Social Security to be their major source of income after retirement.

It is interesting to note that future Social Security proceeds are only loosely based on past income levels, and the benefit structure is not strictly proportional. For instance, a person earning $20,000 per year might receive around $800 per month in benefits, while someone earning $100,000 per year might receive approximately $2,000 per month. This progressive formula means that lower-income earners tend to gain more from their initial investments into Social Security relative to higher-income earners, highlighting its role in providing a more equitable safety net. For detailed calculations and more information, specific Social Security calculators can be incredibly helpful resources.

Read more about: Navigating the Future of American Retirement: Unpacking the Critical Social Security Reforms and What They Mean for Your Financial Horizon

11. Harnessing Home Equity and Real Estate for Retirement Income

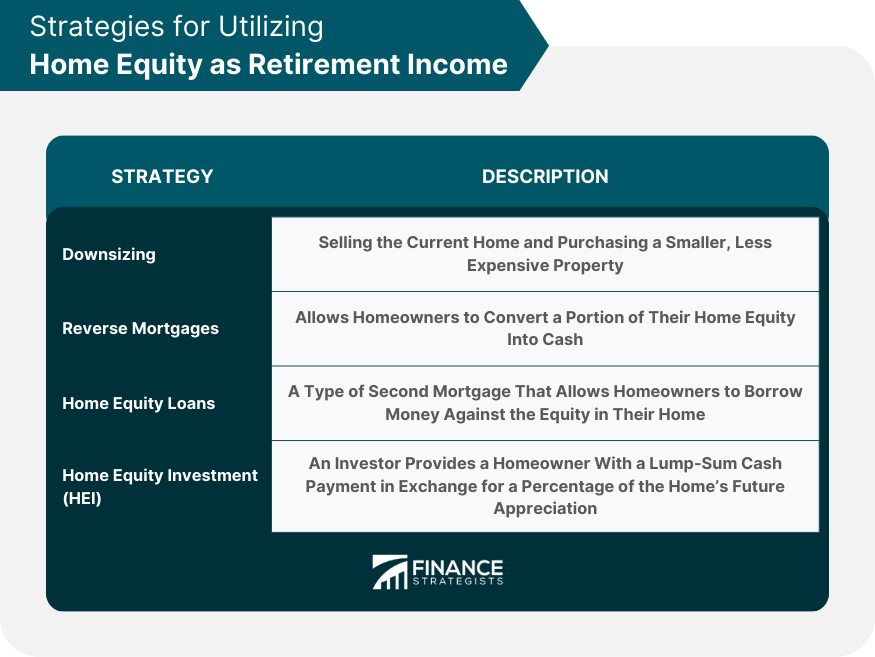

For many retirees, the family home represents not just a place of comfort, but also a significant financial asset. In specific scenarios, the equity built up in a home can be strategically leveraged to generate disposable income during retirement. This is particularly relevant for those with existing mortgages and substantial homeownership, where the property’s value can be tapped into without necessarily selling the home outright. A primary method for achieving this is through a reverse mortgage.

A reverse mortgage is precisely what its name implies: a reversal of the traditional mortgage concept. Instead of making monthly payments to a lender, the homeowner receives payments from the lender, typically as a lump sum, monthly installments, or a line of credit. The loan is secured by the home equity, and interest accrues over time. Essentially, retirees are paid to live in their homes, allowing them to convert a portion of their home equity into cash without having to sell the property or take on new monthly mortgage payments.

The critical aspect of a reverse mortgage is that ownership of the home is eventually transferred to the entity that bought the reverse mortgage, usually at a fixed point in the future or when the last surviving homeowner permanently moves out or passes away. This can be a complex financial product, and it’s imperative for homeowners to fully understand the terms, fees, and implications before considering it. However, for those looking to access capital from their home equity to supplement retirement income, it can be a valuable, albeit nuanced, option.

12. Tapping into Annuities and Passive Income Streams

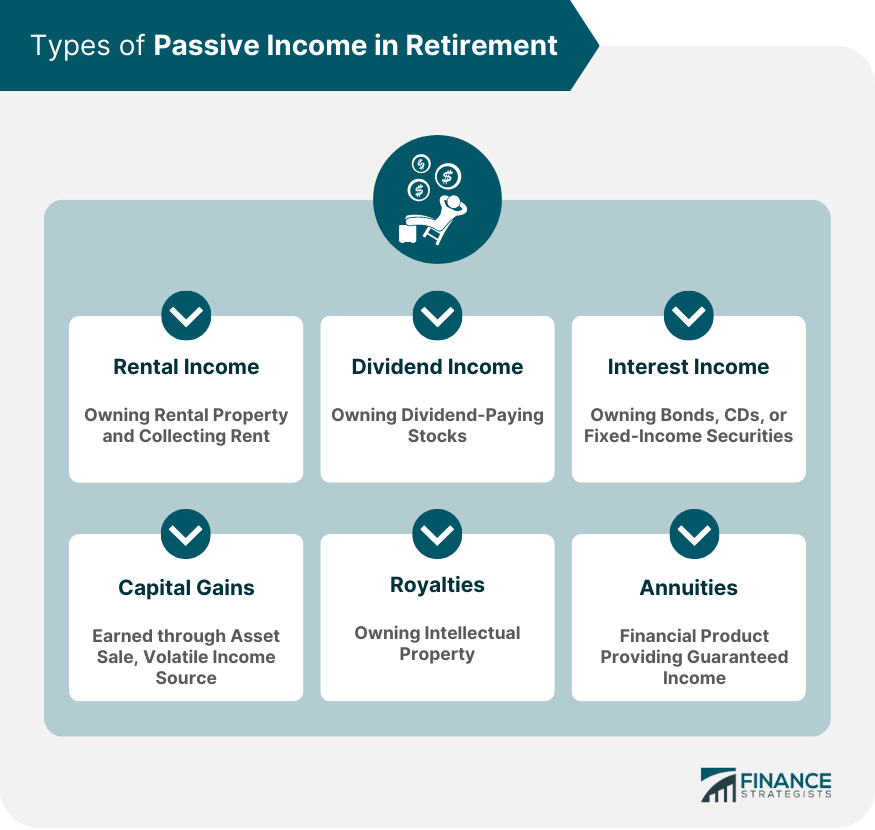

Beyond traditional investment accounts and Social Security, annuities and various forms of passive income offer additional strategies for generating consistent cash flow during retirement. These options can be particularly appealing for individuals seeking guaranteed income or looking to diversify their income sources once their tax-advantaged accounts have been maximized.

Annuities are contracts, typically with an insurance company, designed to provide a fixed sum of periodic cash flows, often for the rest of the annuitant’s life. There are two primary types: immediate and deferred. Immediate annuities require an upfront premium payment, with payouts starting as early as the next month, providing almost instant income. Deferred annuities, on the other hand, have two phases: an accumulation or deferral phase where money is contributed, followed by a distribution or annuitization phase where periodic payments are received. Exploring annuity calculators can help determine if these guaranteed income streams could be a viable option for your specific retirement needs.

Passive income streams represent another powerful avenue for supplementing retirement funds. These are earnings derived from an enterprise in which an individual is not actively involved. When 401(k) and IRA accounts have reached their contribution limits, passively-held investments offer an excellent alternative for placing any remaining money. Common forms of passive income during retirement include rental income from real estate properties, earnings from a business in which you are not actively working, stock dividends, and royalties from creative works or intellectual property. These diverse streams can provide valuable financial resilience, helping to ensure a comfortable and secure retirement, even when unexpected expenses arise. They offer a continuous flow of funds, allowing your meticulously built portfolio to work for you long after you’ve stopped working.

Securing your retirement is undeniably a multi-faceted endeavor, much like building a magnificent structure brick by brick. By diligently exploring and strategically combining these various financial tools—from Social Security and employer plans to IRAs, pensions, diverse investments, home equity strategies, annuities, and passive income—you’re not just saving; you’re actively constructing a robust, resilient financial future. Each component plays a vital role in creating a comprehensive income mosaic, designed to support the lifestyle you envision and provide peace of mind in your golden years. The journey to a confident retirement is a marathon, not a sprint, and with the right knowledge and consistent action, you can confidently chart your course to financial independence.

:max_bytes(150000):strip_icc()/business-people-walking-and-talking-in-office-corridor-1008498816-45cef5a655924c6ebc4f1427051815a2.jpg)