Looking to buy a used car? You are certainly not alone in this endeavor. Each year, over 37 million used vehicles change hands between private parties and dealerships, a staggering number that underscores the enduring appeal of pre-owned automobiles. With used car sales prices climbing to near record highs, it’s more important than ever to approach this significant purchase armed with comprehensive information to ensure you make a smart, informed decision and avoid any potential pitfalls or financial regrets. This guide is designed to empower you with the knowledge and actionable steps you need to navigate the used car market successfully.

Considering the current economic landscape, where brand-new cars are becoming increasingly expensive—with the average transaction price just shy of $50,000 in the U.S.—shopping for a used car presents a far more budget-friendly alternative. For instance, three-year-old vehicles currently hover around an average transaction price of $31,000, offering significant savings without necessarily compromising on features or performance. The variety of used cars available can, however, make the process feel overwhelming, which is why we’ve meticulously crafted this basic, step-by-step buying guide to help you traverse the process with confidence.

In the following sections, we will delve into critical preparatory steps, from understanding your financial boundaries and securing financing to thoroughly researching potential vehicles and identifying the best places to make your purchase. We’ll also guide you through the vital process of checking prices and uncovering a car’s hidden history. Our goal is to make the experience of buying a used car less daunting than a root canal, ensuring you can save serious cash and drive off in a reliable vehicle that perfectly meets your needs.

1. Determine Your All-In Budget

Before you even begin to browse online listings or set foot on a dealership lot, the most crucial first step is to definitively figure out how much car you can realistically afford. If you’re taking out a loan to pay for your car, a sound rule of thumb is to cap your total car expenses—including your car payment and other ongoing ownership costs such as fuel and insurance—at 10% of your take-home pay. While you might feel comfortable adjusting this percentage slightly based on your other financial commitments, it’s vital to remember that the car payment is only one component of the broader budget.

Beyond the monthly payment, it’s essential to estimate and budget for ongoing monthly costs. These can easily add a few hundred dollars to your expenses, covering everything from routine maintenance to unexpected repairs. If you plan to buy a car that’s out of warranty, setting aside a “just-in-case” fund is a particularly prudent idea. One clever way to build this fund is to pocket any savings you make by purchasing a used car versus a comparable new car each month—for example, if your used purchase saves you $100 compared to a new model, you’re effectively putting away $1,200 a year to keep your vehicle in optimal condition.

All told, a comprehensive financial strategy suggests that you should aim to spend no more than 20% of your take-home pay on total monthly car expenses. This holistic view ensures you account for all associated costs, providing a more accurate picture of your true financial commitment. Furthermore, you’ll want to calculate how much to put down on a used car, with an ideal range typically falling between 10% to 20% of the vehicle’s price. This down payment can also strategically include the value of a trade-in if you are purchasing from a dealership, further easing your upfront expenditure.

When calculating your budget, remember to factor in additional unavoidable expenses beyond the vehicle’s price. These include taxes, title, and registration fees, which generally depend on your location; most states will collect sales tax on your purchase, and title and registration fees typically run between $200 and $500. Don’t forget insurance costs, the potential for immediate repairs or maintenance items like new tires or brakes, oil changes, and worn-out parts that used cars might require sooner than new ones. Ongoing fuel and maintenance costs should also be integrated into your calculations. As a broad rule, and depending on your state, tax, license, assorted fees, and other costs can add roughly 10% to the purchase price, meaning a $30,000 car could effectively cost $33,000, and if financed, you’ll be paying interest on that additional amount.

Read more about: Talk About Dedication! These Actresses Got Absolutely Shredded for Their Roles, and You Won’t Believe the Work They Put In

2. Secure Financing Before You Shop

Once you have a clear understanding of how much car you can afford, the next strategic step is to secure financing before you even begin actively shopping. Having a pre-approved loan for a used car can provide significant advantages, primarily by potentially offering a less expensive interest rate than what a dealership might provide. More importantly, it equips you with strong leverage during price negotiations, as you’re perceived as a cash buyer, ready to close the deal without relying on the dealer’s financing options.

To find the most favorable terms, it’s wise to research used-car loan rates at various institutions. Your current bank or local credit union is an excellent place to start, but also explore online-only banks that often offer competitive rates. While dealerships do offer financing, and sometimes even enticing deals on Certified Pre-Owned (CPO) vehicles, having your own pre-approved loan in hand gives you a crucial benchmark and a strong fallback. If you know your credit score at this point, you can effectively gauge which rates you would likely qualify for, further empowering your decision-making.

When you’re ready to apply for a loan, gather all necessary paperwork in advance to streamline the process. This typically includes a personal ID, such as your driver’s license, your Social Security Number, and proof of employment and income. After researching and identifying a few promising options, narrow your search to three or four good choices and apply for a loan at each, either online or in person. Be prepared for each application to take at least 15 minutes to fill out, but this investment of time can result in substantial savings over the life of your car loan.

Read more about: Greta Garbo: Unveiling the Enigma – The Luminous Life and Profound Legacy of Hollywood’s Most Mysterious Star

3. Research and Build Your Target Vehicle List

With your budget firmly established and financing options explored, it’s time to dive into the exciting part: researching and building a concise target list of vehicles. This phase involves narrowing your options to three to five vehicles that not only fit your budget but also genuinely meet your needs and preferences. Whether you prefer a traditional pencil and paper, a detailed spreadsheet, or simple notes on your phone, the method isn’t as important as the systematic comparison of contenders.

When compiling your list, you’ll want to compare the features of each car that matter most, both to your wallet and to your daily driving experience. On the financial side, critically evaluate factors like fuel economy and estimated insurance costs, as these are significant ongoing expenses. Beyond the numbers, consider the features that enhance your comfort and convenience, such as cargo space, the sophistication of the infotainment technology, or the inclusion of advanced safety features. Thinking about both present and future needs—for instance, if you anticipate growing your family—is crucial; a two-seat sports car might not be the most practical choice if a third child is on the horizon, warranting a look at three-row SUVs or minivans instead.

Certain vehicles generally make for excellent used car choices, partially because they are highly regarded by consumers for their reliability and resale value. Models like the Honda CR-V and Toyota RAV4 are prime examples. However, their popularity often makes them a more expensive choice compared to solid alternatives like the Ford Escape or Kia Sportage. If saving money is a key priority, it’s wise to consider more than one brand. For vehicles less than five years old, you might consider one that’s Certified Pre-Owned (CPO), which often come with long-term warranties backed directly by the automaker, offering greater peace of mind than a standard dealership warranty. Remember, only franchised dealerships selling new models of a particular brand can offer CPO cars of that same brand.

To guide your choices, resources like Edmunds reviews offer extensive information, helping you understand how a vehicle’s features and design can change significantly from one year to the next. The Edmunds used car inventory page is an excellent starting point for building your target list, allowing you to filter your search by various factors such as price, miles on the odometer, specific features, and the dealer’s distance from you. While private-party sales on platforms like Craigslist or Facebook Marketplace can offer deals, they may not provide the same detailed search parameters or factual accuracy as dedicated automotive sites. Additionally, Kelley Blue Book offers extensive information on virtually every major vehicle make and model, including expert and unbiased reviews, horsepower figures, and even dimensions to help you determine if a car will fit in your garage.

Read more about: Watch Out: 12 Compact Cars Prone to Major Engine Issues Before 80,000 Miles – A Consumer Guide

4. Decide Where to Buy: Dealership, Private Seller, or Online Retailer

The decision of where to purchase your used car significantly impacts the buying experience, the price you pay, and the level of protection you receive. There are several common avenues, each with its own set of advantages and considerations. These include the used car sections of new car dealerships, independent used car lots, national used car retailers like CarMax, online platforms such as Carvana, and direct private-party sales through classifieds or social media sites. The prices you encounter will often vary considerably depending on the source.

Buying a Certified Pre-Owned (CPO) car at a dealership offers distinct benefits. These vehicles typically have lower mileage and often only one previous owner, having undergone a rigorous multi-point certification process by the dealership to ensure they are in tip-top shape. A key advantage of CPO vehicles is that they usually come with an extended warranty, often backed by the automaker itself, providing an added layer of security. However, this enhanced quality and warranty coverage also means that CPO vehicles tend to be more expensive than non-CPO used cars due to their newer condition and comprehensive backing.

For those looking for a slightly more budget-friendly option at a dealership, non-CPO used cars are available. These vehicles are generally less expensive than their CPO counterparts, and reputable dealerships will have performed required inspections and likely any necessary repairs to ensure they are sale-ready. While they tend to have more miles on the odometer and a warranty is not always included, buying from a dealership typically simplifies the process. A single retailer can offer dozens or even hundreds of used cars, providing ample options for test drives and making financing easier to secure, especially if you’re not paying cash.

Opting to buy from a private seller can often lead to significantly lower prices. These cars, however, can come with higher mileage and may have had multiple owners. A major difference is that you, the buyer, will be entirely responsible for inspecting the car before purchase, and any financing or warranties will need to come from third parties. Private-party sales also involve a bit more legwork, such as coordinating schedules with sellers and potentially navigating challenges if the seller isn’t keen on facilitating a pre-purchase inspection. While the seller usually just wants to get the car’s fair value without overhead, be aware that some private parties may only accept cash, which could limit your options if you’re seeking a loan.

Finally, online retailers such as Carvana, CarMax, and TrueCar provide a convenient way to shop for and buy used cars. These platforms make the process incredibly easy, often offering a return policy (usually within a week) for added peace of mind, and the company will typically deliver the car directly to your home, eliminating the need for dealership visits. The trade-off for this convenience, however, is that prices tend to be higher compared to both dealership sales and, particularly, private sellers, as these companies also have overhead costs to cover.

5. Check Vehicle Prices

With your target list in hand and an understanding of the various sales channels, the next crucial step is to diligently check vehicle prices. The cost of a used car is significantly influenced by where you choose to shop. As previously noted, Certified Pre-Owned (CPO) cars typically command the highest prices. This is largely due to their generally lower mileage, often superior condition, and the valuable warranty coverage they usually include, offering a premium for reduced risk and enhanced reliability.

Conversely, if your primary goal is to save money and you’re prepared to invest a little more legwork, private-party sales often present the most economical option. While finding used cars for sale by owner requires sifting through classified ads or hunting around social media sites, the price difference can be substantial—ranging from several hundred to a couple thousand dollars less than retail dealership prices. This direct seller-to-buyer interaction cuts out dealership overheads, which translates into potential savings for you.

Regardless of the route you choose, you may notice that current used car prices are generally higher than what you might recall from previous purchases. Unfortunately, prices for both new and used vehicles are expected to remain elevated for the foreseeable future. This market reality means that if you’re considering purchasing a vehicle, the present moment is likely as good a time as any, as significant price drops are not anticipated soon. To ascertain what others are paying for your preferred model, consult resources like the Edmunds Suggested Price, though it’s important to remember this figure primarily accounts for retail sales. For a broader market value, also look at the Kelley Blue Book or Edmunds True Market Value figures, which provide a more comprehensive view of fair pricing.

Read more about: Tricolor’s $200M Fraud: Unpacking the Collapse of a Subprime Auto Giant and Its Ripple Effects on US Banking

6. Find Available Cars and Check Their History (VHR)

Once you’ve honed in on specific models and understood market pricing, the next critical phase involves actively finding available cars and, most importantly, immediately checking their history. You’ll want to look for used cars being sold by reliable sources. Websites like U.S. News have extensive listings of millions of vehicles nationwide, which you can conveniently narrow down by entering your zip code. Dealership websites will also prominently list their current inventory, including any CPO vehicles they offer. National sites such as Autotrader, Kelley Blue Book, and Edmunds are excellent resources with numerous options, and online used car sellers like Carvana and CarMax also maintain robust inventories.

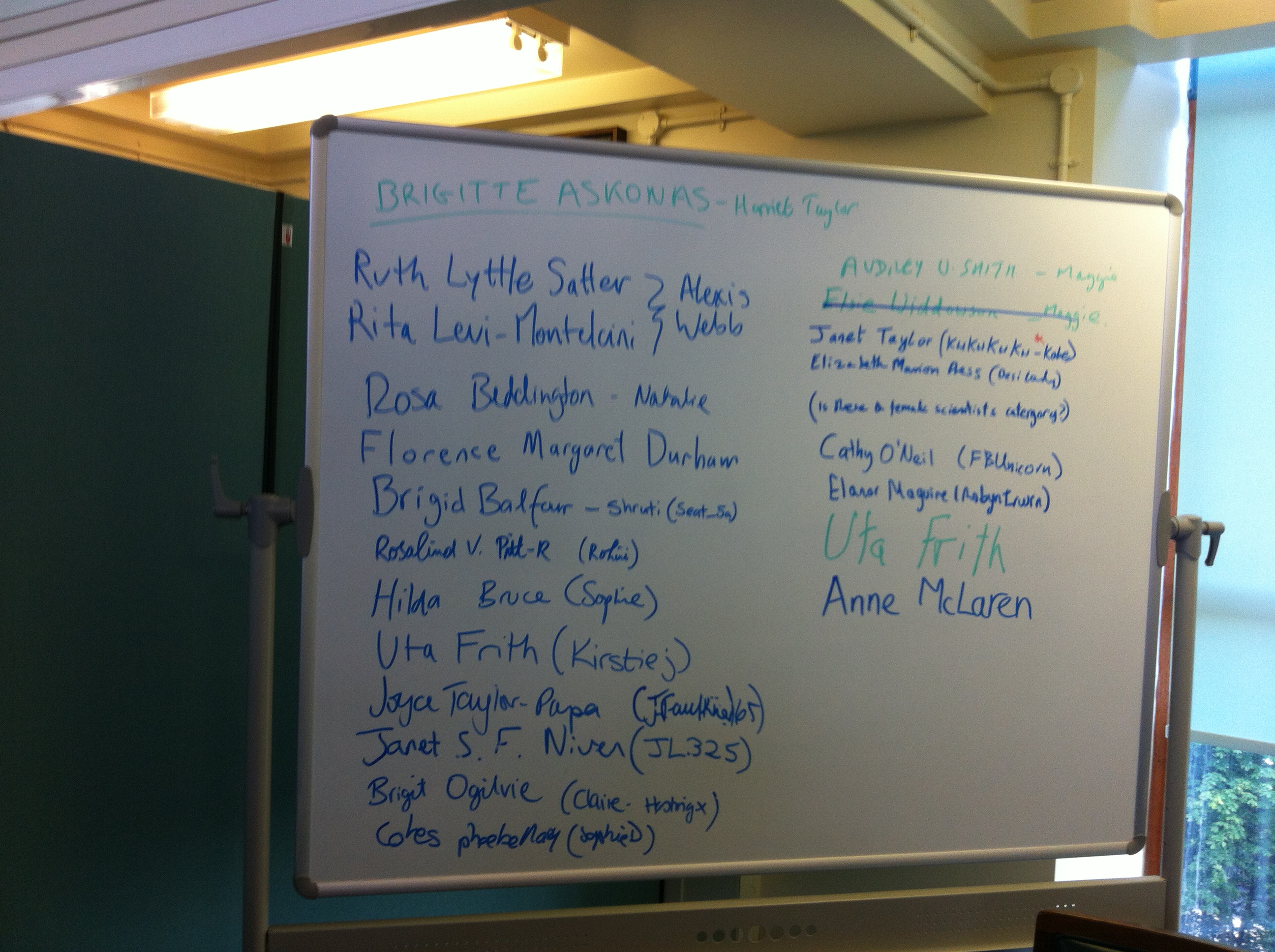

An absolutely essential early step, even if you’re considering buying from a close friend or family member who can personally vouch for a car’s history, is to obtain a comprehensive Vehicle History Report (VHR) for any vehicle you are seriously considering. AutoCheck and Carfax are the most recognized and authoritative sources for these reports. Many major dealers will generously offer these reports for free if the vehicle is part of their inventory, making it convenient to access vital information right away.

If the retailer doesn’t readily provide a report, or if you are exploring a private-party vehicle, you will need the car’s Vehicle Identification Number (VIN) or license plate number to acquire this information. The VIN is typically found on a badge inside the driver-side door sill or on the dashboard near the windshield. For those who are shopping for multiple vehicles, some VHR websites offer package discounts, allowing you to get up to four (Carfax) or five (AutoCheck) reports for a discounted rate compared to purchasing them individually, making it a cost-effective approach to thorough research.

What exactly does a VHR reveal? These reports provide a wealth of crucial information about the car’s life up to now. They can disclose whether the odometer has been rolled back, if the car has a salvage title (meaning it was declared a total loss by an insurance company following a major incident like an accident, flood, or fire), or its general title status (clean, salvaged, junk). You’ll also learn when and where the car was sold and registered, detailed odometer readings, whether it was used as a rental, taxi, or even a getaway car, its accident history, any open recalls, and maintenance history reported by participating shops. This deep dive into the car’s past is indispensable for making an informed and confident purchase, helping you avoid models with issues such as mileage over 200,000, inconsistencies on the odometer, or a complete lack of maintenance records.

7. Contact the Seller

Once you have identified a prospective vehicle, initiating contact with the seller is crucial. Rather than rushing out, a preliminary call or text serves to establish a relationship and verify key information. For dealership vehicles, this ensures the car is still in stock, preventing a wasted trip. Importantly, request an emailed copy of the vehicle history report (VHR) beforehand, providing valuable insights before an in-person visit.

When contacting a private owner, inquire about the car’s current condition, its history, and the seller’s reason for selling. Ask if a VHR has been obtained or if service records are available to confirm maintenance. This documentation offers peace of mind and highlights potential issues. Resist the urge to negotiate price during this initial discussion; an offer tied to the car’s actual condition will be more credible and effective later.

If the conversation progresses well, schedule a test drive. Aim for daylight hours to better assess the car’s true condition. A useful tip is to ask the seller not to start or move the car before your arrival. This allows you to check for any cold-start issues, such as exhaust smoke or sluggish ignition, which could indicate underlying problems.

Read more about: The Unforgettable Legacy of Tim Conway: A Deep Dive into the Brilliant Mind of a Comedy Icon

8. Test-Drive the Car

The test drive offers the most comprehensive assessment of a used car’s suitability and condition. Tune out distractions and focus entirely on the vehicle’s performance and feel. Before starting, evaluate entry and exit ease, and confirm adequate headroom, hiproom, and legroom, including the back seat. Ensure a comfortable driving position, with adjustable steering wheel and supportive seats offering lumbar support, as these details impact long-term comfort.

During the drive, remain highly attentive. Verify the “check engine” light is off; if illuminated, address this immediately. Assess visibility through mirrors and identify blind spots. Use your nose to detect odors like gas, burning oil, or cigarette smoke. Visually inspect tires for age and tread, and test brakes for responsiveness and noise. Pop the hood to look for leaks, steam, oil residue, and check the integrity of hoses and clamps—cracking hoses signal needed replacements, impacting your negotiation.

Turn off the radio to better hear the engine’s sounds, noting any irregularities in acceleration or braking. Test all electrical components: air conditioning, heater, headlights, brake lights, and turn indicators. Drive for at least 10 minutes, covering both surface streets and highways to gauge overall handling. After the drive, request service records from the owner or dealer. Documented maintenance history is invaluable, and its absence, particularly from a private seller, should influence your negotiation.

Read more about: The Unbiased Truth: Your Definitive Guide to Over 14 Critical Checks Before Buying a Used Car

9. Have the Car Inspected

An independent pre-purchase inspection (PPI) by a trusted mechanic is vital for any used car. Even if a vehicle appears flawless, its prior mileage and history warrant a professional evaluation. This small investment, typically $100-$200, can uncover hidden problems, saving significant future repair costs or providing strong negotiation leverage. A mechanic at their shop has optimal tools and lighting for a comprehensive assessment.

The PPI checklist covers critical items like tire wear, evidence of regular oil changes, body imperfections, and identifies major necessary repairs or signs of neglected maintenance. For private sales, most sellers will allow a PPI if you’re serious. A reasonable compromise, if a seller is reluctant to hand over keys, is for them to meet you at your mechanic’s shop. Seller resistance can be a red flag for deeper mechanical issues.

Dealerships generally accommodate independent PPIs, though you cover the cost. However, for Certified Pre-Owned (CPO) vehicles, an independent inspection is less critical, as these cars undergo rigorous dealer checks and come with automaker-backed warranties. Nonetheless, for any non-CPO vehicle, or for added peace of mind, a PPI remains a highly recommended safeguard against unexpected issues.

Read more about: 15 Classic Cars You Might Want To Skip: An Expert Guide for Discerning Collectors

10. Negotiate a Good Deal

Negotiating a used car price doesn’t have to be daunting; it becomes a reasonable process with preparation and a plan. First, establish your absolute maximum spending limit, but don’t reveal this as your opening offer. Your initial proposal should be lower than your maximum, yet within a realistic range informed by your research on average prices from sources like Edmunds or Kelley Blue Book. Clearly stating that your offer is backed by factual research adds credibility.

Crucially, leverage information from the vehicle history report (VHR) or pre-purchase inspection (PPI) to strengthen your position. If an outstanding recall or impending tire replacement was identified, present these objectively to justify a lower offer, as they represent immediate costs or diminished value. This transforms subjective bargaining into a data-driven discussion.

When dealing with a dealership, focus negotiations on the “out the door” price, as if paying cash, rather than being drawn into discussions about monthly payments. If you have a trade-in, negotiate its value separately, only after settling on the used car’s price. Your most potent tool is the willingness to walk away if the seller cannot meet your terms. This signals seriousness and can often prompt a more favorable resolution, as sellers, like buyers, often prefer a swift and fair conclusion.

Read more about: Hollywood’s Unsung Heroines: 15 Women Who Shattered Ceilings and Rewrote the Rules of the Entertainment Industry

11. Finalizing the Paperwork

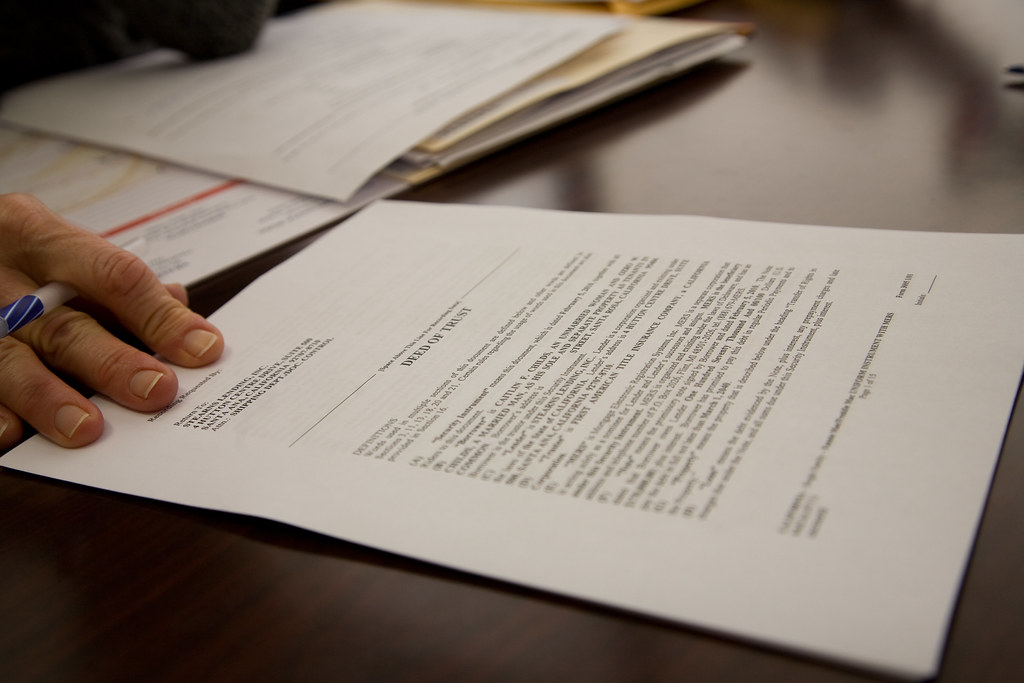

The finalization of paperwork is a critical stage demanding meticulous attention. At a dealership, this occurs in the finance and insurance (F&I) office, where you’ll review the sales contract and likely encounter offers for extended warranties, anti-theft devices, or prepaid service plans. While an extended warranty might offer peace of mind for non-CPO cars, carefully scrutinize all additional items to understand their cost and true value before committing.

Thoroughly review the dealership sales contract. It typically itemizes the vehicle’s cost, documentation fees, potential smog certificate charges, sales tax, and license fees, which vary by state. Do not hesitate to ask questions about any unclear charges. For private-party purchases, the responsibility for proper title and registration transfer falls to you. This is crucial to avoid post-sale complications, so ensure the seller properly signs over the title, sometimes called the “pink slip,” before any money changes hands.

If a lien exists on the title due to an outstanding loan, you must coordinate with the lienholder, usually the seller’s bank. They will not release their interest until the loan is paid off. This transaction can often be completed at the seller’s bank, or the bank may handle the paperwork and mail the title directly to you. Essential documents for any used car purchase include the Title (proof of ownership), a Bill of Sale (receipt of payment), and an Odometer Disclosure Statement.

The Federal Trade Commission’s (FTC) Buyer’s Guide, required to be displayed by dealerships, is another vital document. It clearly states whether the car is sold “as-is” – meaning no warranty and no seller responsibility for repairs – or with a specified warranty outlining its coverage. Understanding these documents is fundamental to protecting your rights and ensuring clear legal ownership, preventing future disputes or unexpected liabilities.

Read more about: Unmasking the True Price: 14 Hidden Costs That Turn Car Ownership into a Financial Maze for Every Driver

12. Transfer Title, Register, and Insure

With the paperwork finalized, the concluding administrative steps involve officially transferring the title, registering the vehicle, and securing insurance. These actions are essential for legally establishing your ownership and complying with state regulations before driving your used car home. For private sales, the title will be in the seller’s name; you are responsible for transferring it to yours at your state’s Department of Motor Vehicles (DMV) or equivalent agency.

If you financed the purchase, your lender will be recorded as the lienholder on the title, maintaining an interest until the loan is fully repaid. The clean ownership title will then be issued to you. Alongside title transfer, you must register the car with your state’s DMV, often involving new license plates. Research your local DMV’s specific requirements and check for any outstanding registration fees to avoid unexpected costs or legal issues.

Crucially, you must have adequate insurance coverage in place before driving your newly acquired vehicle. This is a legal mandate in virtually all states, providing vital protection for yourself, other drivers, and your investment in the event of an accident or theft. Contact your insurance provider ahead of time to arrange coverage starting the moment you take possession, ensuring seamless transition and legal compliance.

Read more about: Beware! The Escalating Digital Scams Ravaging the Auto Industry and How We’re Fighting Back

The journey to purchasing a used car, from careful budgeting to the final administrative steps, can indeed feel like a multi-faceted challenge. However, by embracing a methodical approach and arming yourself with the comprehensive information detailed throughout this guide, the process transforms from a daunting task into an empowering experience. You’re not just buying a vehicle; you’re making a financially astute decision, saving serious cash without compromising on the features or performance that truly matter to you. Drive away with confidence, knowing you’ve navigated the market with expertise and secured a reliable ride that perfectly suits your needs.