The music industry is currently navigating a period of profound transformation, marked by a seismic shift in how artists manage and monetize their life’s work. A growing number of successful musicians, from rock legends to pop sensations, are making headlines by selling their entire song catalogs or significant stakes in their music rights. This trend, once thought to be reserved for long-retired icons, has now become a central topic of discussion, driven by substantial upfront cash infusions, potential financial security for artists, and compelling tax advantages stemming from specific capital gains laws. The financial incentives are clear, offering artists a way to divest themselves of ongoing financial pressures, while simultaneously transforming their creative output into a highly liquid asset.

This burgeoning market is dominated by a new breed of acquisition companies, entities such as Concord Music, Primary Wave, Round Hill, Eldridge Industries, and most notably, Hipgnosis, which is led by Quebec-born Merck Mercuriadis. These firms have collectively spent billions of dollars over the last two years alone, acquiring the intellectual property associated with popular music. Their business model revolves around the strategic exploitation of these song catalogs, leveraging various revenue streams—including streaming royalties, licensing for film and television, and synch rights for commercials—to generate returns and profit for their investors. The proliferation of streaming, which now accounts for a significant majority of all music industry revenue, makes catalog music a particularly attractive and stable asset for these investors.

As this phenomenon accelerates, it compels a closer look at the monumental deals that are reshaping the music landscape. We embark on an in-depth exploration of some of the most significant and financially impactful music catalog sales in history, examining the scale of these transactions and the legendary artists at their center. Each sale tells a story of artistic legacy meeting contemporary financial strategy, revealing the intricate dynamics of a market that values timeless melodies and enduring influence in unprecedented monetary terms. The sheer volume of capital being poured into these assets underscores a broader recognition of music as a robust and diversified investment.

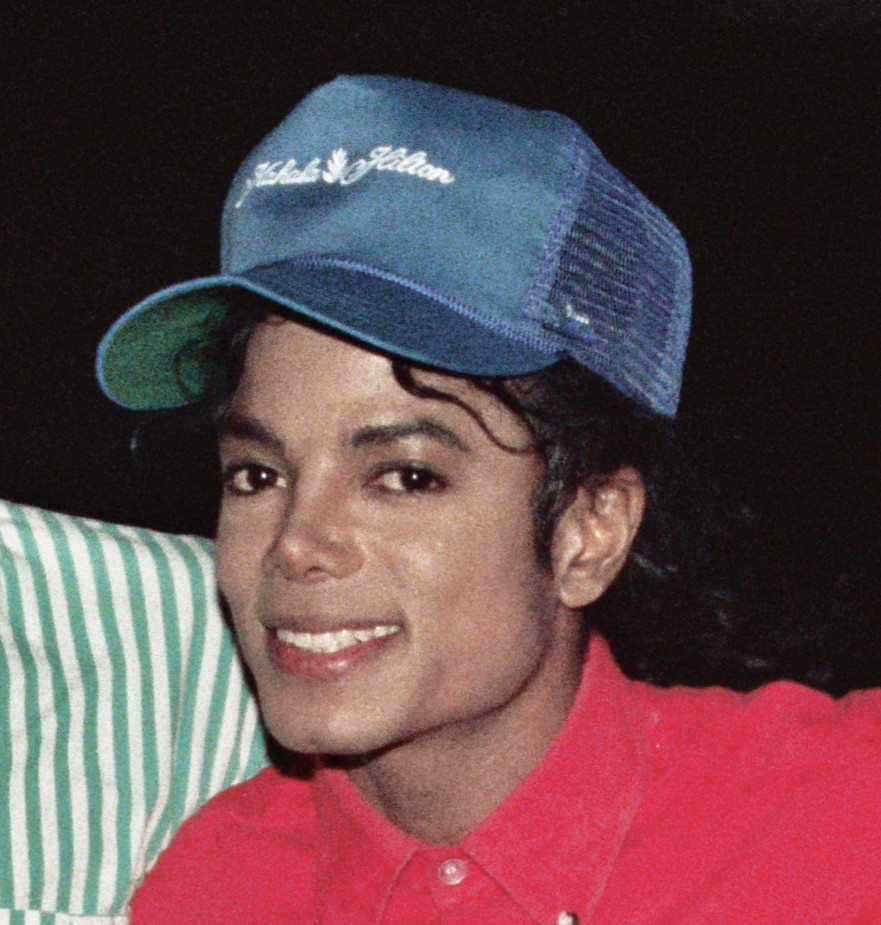

2. **Michael Jackson**: The legendary ‘King of Pop,’ Michael Jackson, continues to command immense financial value decades after his passing, a fact profoundly underscored by a colossal catalog sale in early 2024. Sony Music acquired half of Michael Jackson’s extensive catalog for at least $600 million, a transaction that immediately drew global attention to the enduring power of his musical legacy. This deal for a partial stake implies that the full worth of his music catalog is estimated to be more than $1.2 billion, placing it on par with Queen’s record-setting valuation.

Jackson’s catalog is an unparalleled treasure trove of timeless hits, including global anthems like ‘Thriller,’ ‘Smooth Criminal,’ ‘Beat It,’ and ‘Billie Jean.’ These songs have not only defined generations but continue to resonate with new audiences through various media, streaming platforms, and cultural touchstones. The sheer volume and quality of his work cement his status as one of the most prolific and influential artists of all time, making his music assets among the most valuable in the world.

This significant acquisition by Sony Music reflects a strategic investment in an artist whose influence shows no signs of waning. It highlights how major labels are keen to secure assets that offer sustained, predictable revenue streams from an artist whose work generates consistent global demand. The deal for Michael Jackson’s catalog serves as a powerful testament to the long-term financial viability and cultural significance of truly iconic musical artists, whose legacies continue to appreciate over time.

2. **Bruce Springsteen**: Affectionately known as ‘The Boss,’ Bruce Springsteen cemented his status not only as one of America’s most prolific and successful singer-songwriters but also as a titan in the music catalog market. In late 2021, Springsteen sold his entire music catalog to Sony Entertainment Music for an astounding $500 million, a deal that, at the time, was widely considered the priciest music catalog acquisition in history. This transaction validated the immense commercial and artistic value of his extensive body of work.

The landmark agreement granted Sony complete rights over some of the most iconic songs in American music history, including anthems that have come to define generations. Hits like ‘Born in the USA,’ ‘The River,’ and ‘Born to Run’ were all included in this comprehensive package. These songs are not merely popular tunes; they are cultural touchstones that continue to be played, streamed, and licensed across various platforms, generating substantial and consistent revenue.

Significantly, the deal encompassed both Springsteen’s master recordings and his songwriting rights, a crucial distinction that aggregates all potential income streams associated with his music. This dual acquisition by Sony underscored a growing trend in the industry: securing not just the recorded performance but also the underlying compositions. The acquisition ensured that all aspects of Springsteen’s creative output would be centrally managed, offering a cohesive strategy for future monetization and preservation of his unparalleled legacy.

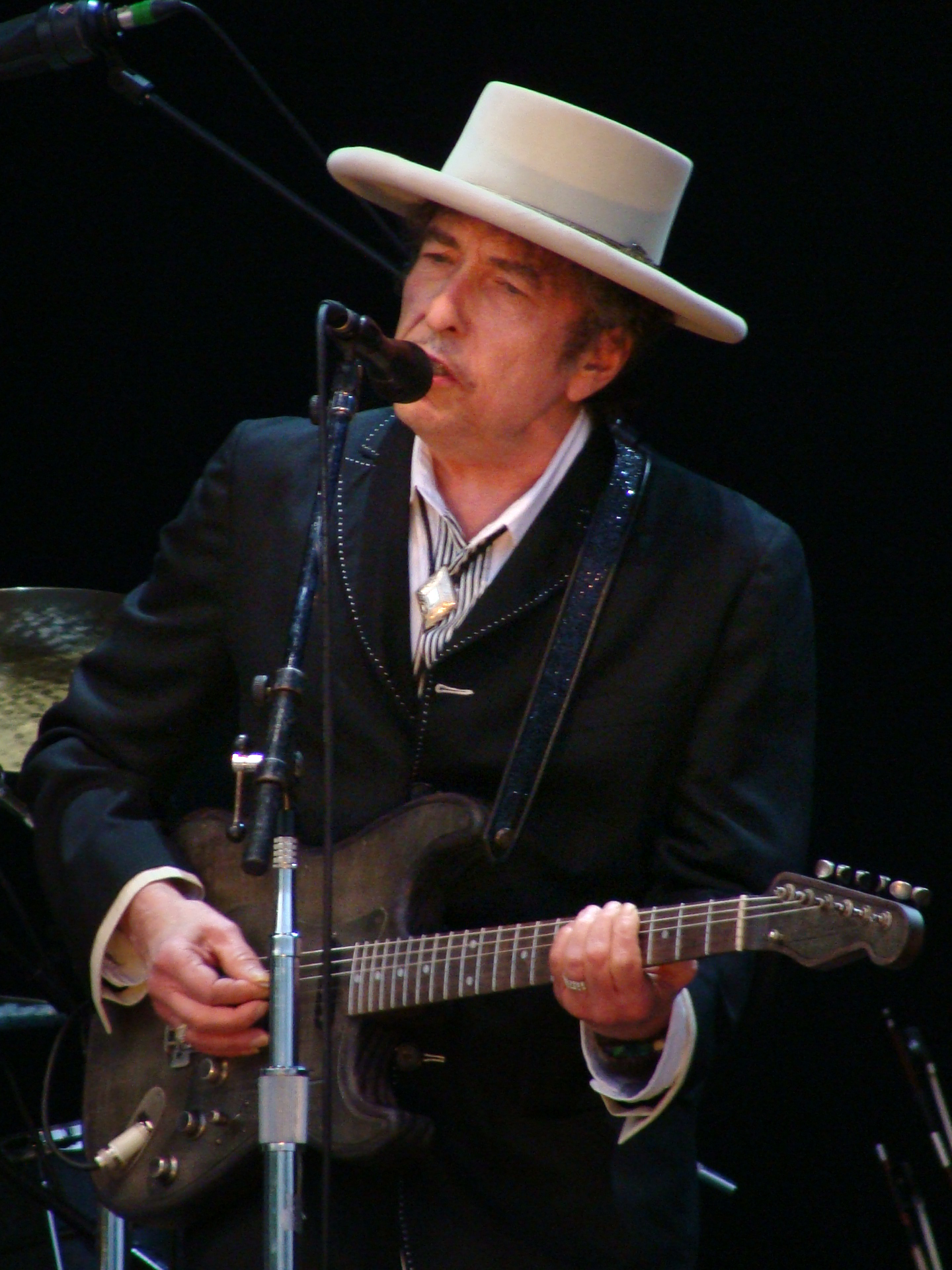

3. **Bob Dylan**: Bob Dylan, a figure synonymous with lyrical genius and cultural impact, added another distinguished chapter to his storied career with a series of high-value music catalog sales totaling an estimated $500 million. A Nobel Prize winner and Academy Award recipient, Dylan demonstrated the layered value of a musician’s intellectual property through two distinct, yet equally significant, transactions that cemented his place among the top-earning artists in this new market.

The initial groundbreaking deal occurred in late 2020 when Dylan sold his entire songwriting catalog to Universal Music Publishing Group for approximately $300 million. This acquisition granted Universal the rights to his vast collection of compositions, including seminal works such as ‘Like a Rolling Stone’ and ‘Blowin’ in the Wind.’ This segment of his catalog represents the foundational creative work – the lyrics and melodies – that has influenced countless artists and resonated deeply with audiences worldwide.

Just one year later, in 2021, Dylan further capitalized on his musical assets by selling the rights to his recorded works, commonly known as master rights, to Sony Music Entertainment. This portion of the deal was reported to be worth $200 million. The separation and subsequent sale of songwriting and master rights to different entities highlights the complex and multi-faceted nature of music intellectual property, allowing artists to maximize value from each distinct component of their creative output. Combined, these sales underscored Dylan’s financial acumen and the enduring market demand for his profound artistic contributions.

4. **Tina Turner**: Tina Turner, the legendary ‘Queen of Rock ‘n’ Roll,’ made a significant move in 2021 by selling a substantial portion of her musical assets. BMG Rights Management acquired a huge chunk of her catalog in a deal valued at $300 million, a transaction that solidified the financial recognition of her unparalleled legacy. This comprehensive agreement included rights to her recordings, publishing, and even her name, image, and likeness, reflecting the holistic approach many acquisition firms now take when investing in iconic artists.

Turner’s career, spanning over six decades, produced a formidable collection of hits that transcended genres and generations, including ‘What’s Love Got to Do with It,’ ‘Private Dancer,’ and ‘Proud Mary.’ These songs have not only achieved immense commercial success but have also become enduring cultural anthems, continually streamed, licensed, and celebrated worldwide. The sale to BMG underscores the enduring revenue-generating power of such a critically acclaimed and commercially successful body of work, even as the artist enters a new phase of her life.

This acquisition by BMG aligns with the broader industry trend of major rights management companies investing in established catalogs that offer predictable and substantial returns. For Turner, the deal provided significant financial security and streamlined the management of her extensive intellectual property. It serves as a powerful testament to her indelible impact on music and her enduring market value, demonstrating that legendary status translates directly into considerable financial assets in the modern music economy.

5. **Taylor Swift**: Taylor Swift’s catalog sales represent a unique and complex chapter in the history of music rights, defined by both substantial financial transactions and an unprecedented artist-led movement to reclaim ownership. In June 2019, her original master recordings for her first six albums were controversially acquired by Scooter Braun’s Ithaca Holdings, through its purchase of Big Machine Label Group, for an estimated $300 million to $350 million. This initial sale sparked a widely publicized dispute over artist ownership and control.

In a resolute response to this acquisition, Swift embarked on a monumental effort to re-record and release new versions of these albums, famously labeled ‘Taylor’s Version,’ directly challenging the traditional music industry power structures. Her strategic initiative was not merely a symbolic gesture but a powerful business move aimed at devaluing the original masters and creating new, artist-owned versions for fans and licensees. This bold undertaking garnered immense public support and shifted industry discourse around artists’ rights.

The narrative further evolved in 2020 when Scooter Braun sold Swift’s catalog to private equity firm Shamrock Capital for more than $300 million, with some reports citing a resale value of $405 million. Despite these multi-million dollar transactions, Swift’s re-recording project continued, demonstrating an artist’s ability to exert significant influence over their work’s value and legacy, even when their original masters are no longer under their direct control. Her case has become a landmark example of how artists can actively engage in the financial and ownership aspects of their creative output.

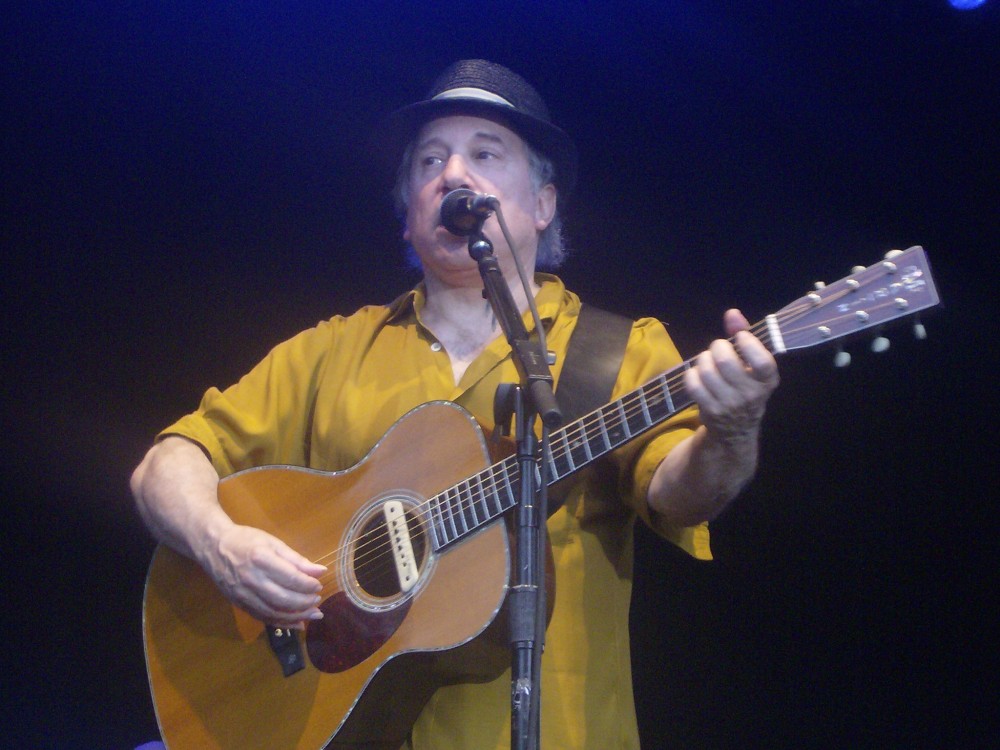

6. **Paul Simon**: Paul Simon, one of America’s most celebrated singer-songwriters, solidified his financial legacy in 2021 by selling his extensive music catalog to Sony Music Publishing. While the precise financial terms were initially undisclosed, subsequent reports and industry estimates have placed the value of this comprehensive deal at $250 million, reflecting the enduring artistic and commercial power of his compositions. This acquisition by Sony encompasses a vast array of his creative output.

The catalog includes not only Simon’s illustrious solo career works but also the timeless hits from his influential partnership with Art Garfunkel, as part of Simon & Garfunkel. Iconic songs such as ‘The Sound of Silence,’ ‘Mrs. Robinson,’ ‘Bridge Over Troubled Water,’ and ‘Graceland’ are all part of this prestigious collection. These compositions have resonated globally for decades, becoming integral parts of the cultural fabric and consistently generating revenue through myriad channels, including streaming, radio play, and licensing for film and television.

Sony Music Publishing’s acquisition of Simon’s catalog represents a significant investment in a body of work that is both critically acclaimed and commercially robust. For Simon, this transaction offers financial finality and simplifies the management of his intellectual property, allowing his legacy to be stewarded by a major publishing house. The deal underscores the high value placed on songwriters with profound lyrical depth and melodic genius, affirming the stable and long-term financial returns associated with timeless musical compositions.

7. **David Bowie**: David Bowie, the quintessential chameleon of rock and a profound artistic innovator, saw his illustrious music catalog acquired by Warner Chappell Music in 2022 for a reported $250 million. This momentous deal covered his entire publishing catalog, which includes a vast and diverse collection of songs that have shaped popular culture and continue to inspire artists across the globe. The acquisition underscores Bowie’s unparalleled impact and the lasting commercial viability of his groundbreaking work.

The acquired catalog spans nearly six decades of Bowie’s creative output, encompassing some of his most iconic and genre-defining compositions. Hits such as ‘Space Oddity,’ ‘Changes,’ ‘Heroes,’ ‘Ziggy Stardust,’ and ‘Let’s Dance’ are among the many works that have captivated audiences worldwide. These songs are not merely tracks; they are cultural touchstones that consistently generate revenue through streaming, synch licensing, and various media placements, cementing their status as evergreen assets within the music industry.

Warner Chappell Music’s investment in Bowie’s catalog reflects a strategic move to secure one of the most revered and financially potent collections in modern music history. For the Bowie estate, this transaction provides a comprehensive framework for managing and further monetizing his artistic legacy under the stewardship of a major publishing entity. The deal serves as a powerful testament to David Bowie’s enduring influence and the sustained demand for his extraordinary musical contributions, proving that innovative art retains immense financial value over time.

8. **Katy Perry**: Katy Perry, a global pop sensation known for her vibrant anthems and chart-topping success, joined the growing roster of artists selling their music rights in 2023. She sold a significant bundle of her music rights to Litmus Music for an estimated $225 million. This substantial transaction highlights the immense financial value inherent in the catalogs of contemporary pop stars who have achieved widespread global recognition and consistent hit-making success.

Perry’s catalog is replete with undeniable pop hits that have dominated airwaves and streaming platforms worldwide, including ‘Firework,’ ‘Roar,’ ‘Dark Horse,’ and ‘I Kissed a Girl.’ These songs have not only generated billions of streams but have also been extensively licensed for various commercial uses, from film and television to advertising campaigns. The consistency of her chart performance and the universal appeal of her music make her catalog a highly attractive asset for investment firms seeking reliable, long-term revenue streams.

Litmus Music’s acquisition of Perry’s catalog signals a strategic focus on modern pop intellectual property, recognizing the robust and enduring monetization potential of globally popular tracks in the digital age. For Katy Perry, this deal provides significant financial liquidity and strategic management of her extensive body of work, ensuring her music continues to reach new audiences and generate income for years to come. It underscores that top-tier contemporary artists, much like legendary figures, are significant players in the burgeoning market for music catalog acquisitions.

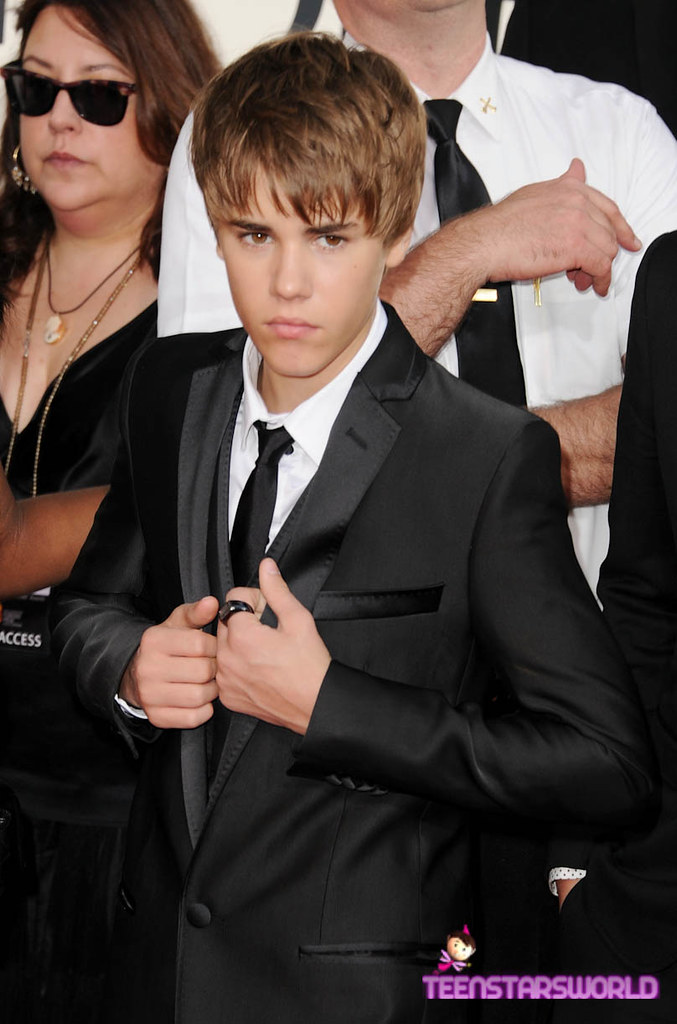

9. **Justin Bieber**: Justin Bieber, one of the most commercially successful artists of the 21st century, made a monumental entry into the catalog sales market in 2023. He sold interests in his publishing and recorded music catalog to Hipgnosis Songs Capital for a reported sum of over $200 million. This nine-figure deal encompassed his entire output through 2021, marking a significant financial milestone for the Canadian pop superstar.

Bieber’s catalog is a powerhouse of global hits that have defined a generation, including ‘Baby,’ ‘Sorry,’ ‘Love Yourself,’ and ‘Despacito’ (his feature on the remix). His music has amassed unprecedented streaming numbers, dominated charts worldwide, and maintained consistent popularity across diverse demographics. The sheer volume of streams, coupled with extensive licensing opportunities, makes his body of work an exceptionally valuable asset in the contemporary music landscape.

Hipgnosis Songs Capital’s investment in Bieber’s catalog underscores its strategy of acquiring high-performing, culturally relevant assets with proven long-term revenue potential. For Bieber, this transaction provides substantial financial security and strategic oversight for his artistic legacy, while allowing him to continue his creative endeavors. The deal highlights that even relatively young artists with immense global reach are leveraging the current market conditions to capitalize on the enduring value of their musical intellectual property.

10. **Dr. Dre**: Dr. Dre, a seminal figure in hip-hop and a hugely influential producer and artist, completed a significant catalog sale in 2023. His catalog assets were acquired by a joint venture between Shamrock Holdings and Universal Music Group for an estimated sum of over $200 million. This deal underscores the immense and multifaceted value embedded in the work of an artist whose influence extends far beyond his own recordings to encompass groundbreaking production and entrepreneurial ventures.

Dre’s catalog includes his seminal solo albums like ‘The Chronic’ and ‘2001,’ as well as his foundational contributions to N.W.A. and his extensive work as a producer for a multitude of artists, including Snoop Dogg, Eminem, and 50 Cent. His productions have defined the sound of hip-hop for decades, consistently generating substantial royalties from streaming, radio play, and licensing for film, television, and video games. The breadth and depth of his influence ensure a robust and diversified revenue stream from his intellectual property.

This joint acquisition by Shamrock Holdings and Universal Music Group reflects a recognition of Dr. Dre’s unique position at the intersection of music, culture, and business. For Dre, the sale provides substantial liquidity and a strategic framework for managing his legacy, while for the acquiring entities, it secures a powerhouse catalog with enduring commercial appeal and cultural significance. The deal serves as a powerful testament to the long-term financial viability and profound impact of artists who not only create hit songs but also shape entire musical movements.

The current wave of music catalog sales, as exemplified by these monumental transactions, represents a profound re-evaluation of intellectual property in the digital age. It is a testament to the enduring power of music as both an artistic expression and a stable, income-generating asset. Far from being a fleeting trend, these acquisitions signal a fundamental recalibration of value, offering artists unprecedented financial security and enabling investors to tap into consistent revenue streams derived from timeless melodies and influential compositions. As this market matures, it promises to continue shaping the financial destinies of artists and the operational strategies of the music industry for decades to come, ensuring that the legacies of these musical titans are preserved and monetized with renewed strategic vision.