Mark Cuban, the outspoken “Shark Tank” star and self-made billionaire, is renowned for his candid views and actionable advice across finance and business. While he isn’t exactly the sit-back-and-let-it-happen type, his approach to wealth creation involves strategically selecting investments that can grow in the background. This allows money to flow in while he focuses on bigger moves, embodying a smart leverage approach where his capital works harder than he does. He truly has a knack for turning investments into money-printing machines.

Cuban’s investment philosophy often echoes that of another financial titan, Warren Buffett. Buffett, the “Oracle of Omaha,” famously stated, “Diversification is a protection against ignorance. [It] makes very little sense for those who know what they’re doing.” Cuban wholeheartedly embraces this, asserting that a profound understanding of an investment significantly mitigates risk. He’s known to endorse opportunities that might seem aggressive or counter to mainstream analyst opinions, but he believes that deep knowledge diminishes the risk involved.

For anyone looking to build lasting financial support and move beyond traditional active income models, exploring Cuban’s endorsed strategies offers a solid starting point. He doesn’t believe in get-rich-quick schemes; rather, he champions working smart and setting up systems that generate wealth over time. His strategies are often simple, scalable, and realistic, proving that even a billionaire finds immense value in foundational, yet powerful, income streams. Let’s dive into some of the top passive income ideas that have his stamp of approval.

1. **Dividend-Paying Stocks**Mark Cuban champions dividend-paying stocks as a prime example of generating real-world value and immediate passive income for investors. He emphasizes that “dividends put actual cash into investors’ pockets,” providing a tangible benefit. This direct cash flow distinguishes them from non-dividend stocks, which, in his view, offer only a “vague notion derived from various market metrics.”

These stocks represent perhaps the closest investment Cuban truly has to “passive income.” In addition to their potential for capital gains, dividend stocks consistently pay quarterly dividends. This commitment to returning cash to shareholders ensures a steady income stream, guaranteeing income even when the broader markets might be experiencing downturns or volatility. It’s about getting paid regularly just for owning them.

Cuban recommends dividend-paying stocks for consistent, long-term income, but with a crucial condition: “only if you know what you’re doing.” Reinvesting these dividends, especially from companies known as “dividend aristocrats” with a history of increasing payouts for 25+ years, can significantly boost total returns. This strategy focuses on steady accumulation and compounding, rather than speculative, short-term gains, creating a consistent cash flow that is highly attractive for passive wealth builders.

Read more about: Your Personalized Roadmap to Retirement: A Kiplinger Guide to Financial Independence

2. **AI-Centric Companies**While Mark Cuban isn’t “a big believer in owning individual stocks” generally, famously stating, “I believe non-dividend stocks aren’t much more than baseball cards. They are worth what you can convince someone to pay for them,” his stance dramatically shifts when it comes to AI-related companies. He knows the field well and believes strongly in AI’s future, suggesting that “every company will need it to thrive or survive.” This conviction makes AI a significant part of his individual stock selection process.

Cuban is “watching where the train tracks are being laid” in technology, and he identifies AI as its engine. Investing in AI-centric companies, even those that don’t currently offer dividends, is about staying ahead of the curve. He sees it as a strategic move, predicting that investing now could be akin to buying Apple stock in the 1980s. The long-term growth potential in this sector is what attracts him, understanding that fundamental technological shifts drive massive wealth creation.

AI stocks are not typically known for generating current income. However, their appeal lies in their potential for explosive growth in value. If they perform as Cuban anticipates, they “can turn into a generous source of income when needed,” by realizing significant capital gains. In the interim, investors can simply invest in them “passively in your portfolio, waiting for them to perform,” allowing their value to appreciate in the background without requiring active management or trading. This is a bet on the transformative power of a technology Cuban believes will be ubiquitous.

Read more about: A Microsoft Engineer’s Proven Playbook: How to Accelerate Your Career with 4 Promotions in 5 Years

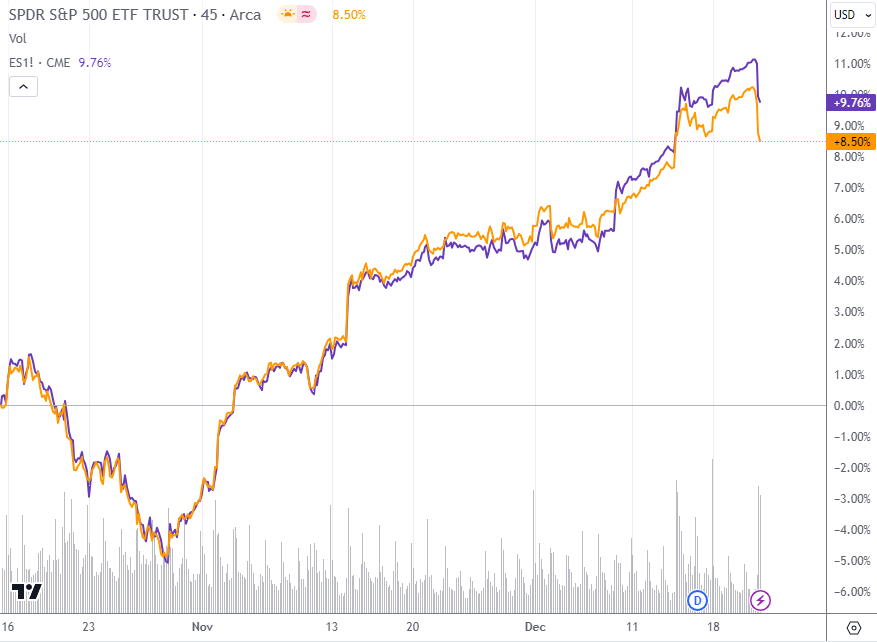

3. **S&P 500 Index Funds**Both Mark Cuban and Warren Buffett are vocal proponents of the S&P 500 index fund, and their shared endorsement speaks volumes about its effectiveness as a passive income strategy. Cuban’s “go-to advice for passive investing is a low-cost S&P 500 index fund.” These funds are designed to reflect the performance of the entire market, tracking the 500 largest U.S. companies, which minimizes the need for active management and makes them incredibly accessible for the average investor.

The beauty of S&P 500 index funds lies in their simplicity and historical consistency. Historically, these funds have brought in about 10% annually. While “it’s boring, yes,” Cuban acknowledges, “But it’s consistent and it works.” This steady, albeit not flashy, performance aligns perfectly with a passive investment philosophy, allowing compound interest to do its work over the long term. For most investors, Cuban and Buffett agree that “this is a solid passive income strategy,” serving as a sturdy vessel for long-term wealth accumulation.

Their shared advice is clear: “stay away from active trading unless you’ve mastered the strategy.” For those less versed in financial intricacies, the S&P 500 index fund offers a stress-free way to let capitalism “do its thing” while you focus on other pursuits. While its current annual yield of approximately 1.39% may not churn out “rivers of passive income” in terms of high immediate payouts, it provides a steady stream of returns, serving as a reliable foundation for any financial portfolio, allowing investors to “set it, forget it, and come back years later to a rich, savory portfolio.”

4. **Licensing Intellectual Property**Instead of building an entire business around a new idea, Mark Cuban suggests a more passive route: licensing your invention, app idea, or other intellectual property to companies. These companies can then handle the production, marketing, and distribution. This strategy allows you to “earn royalties with fewer costs” and significantly less operational burden, as you create the concept, protect it, and let someone else do the selling and legwork.

Cuban has a track record of backing entrepreneurs who have found success through this model. Even if a formal patent isn’t immediately secured, “strong concepts can get licensed,” paving the way for recurring revenue. Products like Velcro and Post-it notes famously became billion-dollar brands through licensing, demonstrating the immense potential of this often-overlooked passive income stream. It capitalizes on innovation without requiring the inventor to become a full-fledged business operator.

This principle extends effectively to digital innovations, such as mobile app ideas. You don’t need to “build the next viral game to profit from apps.” A helpful app concept, when licensed to experienced developers or businesses, can generate “recurring revenue through ads or subscriptions.” Outsourcing the build process keeps the income truly passive, and utility-focused apps tend to provide the strongest and most reliable income streams over time, aligning perfectly with Cuban’s preference for smart, scalable approaches.

Read more about: The Streaming Wars: How Hollywood’s Content Bubble Burst Led to a New Era of Sustainable Growth and Industry Resilience

5. **Tokenized Assets with Built-in Income**Mark Cuban is closely observing the emerging field of tokenized assets, which leverages blockchain technology to allow fractional ownership of real-world assets. These are not merely speculative digital collectibles; they are “digital slices of real-world things” like property, music royalties, or even fine art, structured to generate steady income for their holders. This innovative approach makes once-exclusive and high-barrier-to-entry assets significantly more accessible to a broader range of investors.

Platforms such as Royal and Rally are at the forefront of this trend, distributing earnings directly to token holders. For instance, owning a fraction of music royalties means you could “just earn mailbox money from a beat you didn’t write.” Similarly, tokenized real estate can provide a share of rental income. Cuban recognizes that while this approach is “in its early days,” if it gains widespread traction, it could become a significant source of passive income, democratizing access to revenue-generating assets.

Some blockchain projects are specifically designed with “embedded revenue models” that reward token holders with a share of platform revenue. Cuban backs “digital platforms where tokenomics reward long-term holders,” indicating a strategic interest in the underlying mechanisms that ensure sustained returns. This high-risk, high-reward space requires a deep understanding of the technology and the project’s utility, but for those who choose wisely, it presents a potentially lucrative and truly passive income stream as the platform grows.

6. **Subscription-Based Newsletters**Email newsletters have rapidly evolved into a serious and increasingly lucrative income source, a trend that aligns well with Mark Cuban’s appreciation for scalable digital assets. With user-friendly platforms like Substack, writers, experts, or even just passionate individuals can effectively “earn through brand deals or paid subscriptions.” This model capitalizes on niche interests and direct audience engagement, creating a powerful channel for recurring revenue.

The power of a subscription-based newsletter lies in the “total control over audience reach,” a significant advantage over social media platforms that often limit organic visibility. Many successful writers and content creators are now bringing in impressive annual incomes, with some reportedly earning “$50,000 to $100,000 a year.” Once the initial content is created and the subscriber base established, the income can become increasingly passive, relying on regular, but not necessarily intensive, updates.

Cuban is “big on owning digital real estate,” and a subscription newsletter fits perfectly within this vision. It requires upfront effort to build a valuable audience and deliver consistent quality, but once it’s established, it acts as an evergreen asset. This form of digital publishing allows for direct monetization of expertise and a loyal following, turning knowledge into a steady stream of income that can operate with minimal ongoing management, making it an attractive passive play.

7. **Peer-to-Peer Lending**Peer-to-peer (P2P) lending offers a straightforward way for individuals to earn passive income by directly lending money to borrowers through online platforms. Mark Cuban supports models that “cut out traditional banks,” as P2P lending platforms do, allowing for a more direct and often more efficient capital flow. This model democratizes lending, enabling everyday investors to act as miniature banks and earn interest on their funds.

Returns from P2P lending typically “range from 6% to 10%,” though this can vary depending on the credit risk associated with the borrower. The accessibility of P2P platforms is a key advantage; minimum investments can be “as little as $25 on some sites,” making it a highly flexible and accessible passive income path for a wide range of investors. This low barrier to entry allows individuals to start small and gradually scale their investments as they gain experience and comfort.

While P2P lending does involve assessing borrower credit scores and managing risk, once the initial investment is made and loans are diversified, it can become a relatively hands-off income stream. The platforms handle the administrative aspects, from loan origination to payment collection. Done right, you become a miniature bank. For those who “read the room” (or the credit scores) well, it presents a compelling opportunity to generate consistent interest income, allowing your money to work for you without constant supervision.

Navigating the complexities of wealth accumulation means going beyond the obvious and exploring the less trodden paths where significant returns often lie. Mark Cuban, ever the strategic investor, isn’t just about the foundational plays; he delves into more advanced avenues that, while sometimes requiring deeper insight or higher risk tolerance, promise substantial passive income. These strategies are about smart leverage, calculated risks, and setting up systems that continue to generate wealth with minimal ongoing intervention, turning capital into a diligent, tireless employee.

Cuban’s foresight extends to identifying opportunities that might seem aggressive to some but represent solid bets for those who truly understand the landscape. He champions a mindset where knowing your investment inside and out diminishes perceived risk, allowing for bolder moves. For anyone serious about building a formidable financial future, understanding these advanced passive income streams offers a critical edge, showing how to make capital work harder and smarter.

Read more about: Beware! The Escalating Digital Scams Ravaging the Auto Industry and How We’re Fighting Back

8. **Buy Cash-Flowing Small Businesses**One of the most appealing, yet often overlooked, passive income strategies that aligns with Mark Cuban’s philosophy is the acquisition of already profitable small businesses. Instead of starting from scratch, which demands immense upfront effort, purchasing an existing operation allows you to tap into an established revenue stream immediately. This approach leverages existing infrastructure and customer bases, significantly reducing the typical risks associated with new ventures.

Cuban understands the power of systems already in place. Businesses like laundromats or vending routes are classic examples of operations that can generate steady income with limited daily oversight once proper management is established. These types of ventures are often sold for under $500,000, presenting an accessible entry point for investors looking to deploy capital strategically without needing to be an active operator.

The appeal intensifies when considering the potential returns, which often exceed 20%. With the right systems and potentially an outsourced manager, owners can step back, allowing the business to continue generating revenue. This transforms an active business into a passive income engine, perfectly embodying Cuban’s preference for smart leverage where your money works tirelessly in the background, freeing up your time for other pursuits.

Read more about: The Apps Redefining Online Earning: How Technology Is Changing How People Make Money – And Why Some Are Wary

9. **Create a Niche Online Course**In today’s digital age, knowledge is currency, and Mark Cuban is a huge proponent of monetizing expertise through scalable digital products. Creating a niche online course allows individuals to package their specialized knowledge and sell it repeatedly, turning a single effort into an ongoing income stream. This strategy aligns perfectly with the concept of building ‘digital real estate’ that generates revenue around the clock.

Platforms such as Teachable and Udemy have democratized online education, handling critical aspects like payments, hosting, and even some promotion. This infrastructure significantly reduces the technical barriers to entry, enabling creators to focus on what they do best: developing valuable content. Once a course is launched and gains traction, it can become a remarkably passive source of income, requiring only occasional updates or promotional efforts.

Instructors who tap into specific, in-demand niches often find remarkable success, with some reportedly generating six-figure incomes annually. Educational content, particularly evergreen topics, possesses a unique longevity; learners are perpetually seeking expert guidance and structured knowledge. This scalability and enduring relevance make online courses an exceptionally attractive passive income play, allowing creators to earn from their intellectual assets with minimal ongoing management.

Read more about: Totally Rad or Totally Retrograde? 15 Wild ’80s Moments That Were Basically Forgotten Comedy Gold

10. **Cryptocurrency (High-Risk, High-Reward)**While a significant departure from traditional passive income streams, Mark Cuban’s stance on cryptocurrency positions it as a high-risk, high-reward venture with substantial long-term potential for those who understand it. Unlike Warren Buffett’s skeptical views, Cuban believes in the underlying technology, particularly smart contracts, seeing them as foundational for future digital applications. This isn’t about speculative gambling; it’s about investing in a transformative technological shift.

Cuban emphasizes that his interest lies in the utility and efficacy of blockchain and smart contracts, which can unlock versatile applications across various industries. For him, cryptocurrencies tethered to functional smart contracts possess formidable value, distinguishing them from mere speculative ‘baseball cards.’ He isn’t blindly throwing money at the space; his investments are deeply rooted in comprehending the technology and its enduring practical worth.

However, Cuban issues a clear and crucial warning: “If you’re not a true adventurer, stay away.” He advises potential investors to allocate only funds they are willing to lose, underscoring the extreme volatility and inherent risks of the crypto market. For those who choose to delve in, it’s a strategic, long-term bet on a technology that, if successful, could yield significant returns, but it absolutely demands a profound understanding and prudent risk management.

11. **Buy and Rent Out Digital Real Estate**Just as physical real estate generates income through rentals, Mark Cuban sees immense value in owning and monetizing ‘digital real estate’ such as high-demand domain names or established websites. This concept leverages the online world’s vast traffic and attention, turning digital assets into steady income generators with often surprisingly minimal upkeep. It’s about securing prime online locations and letting them work for you.

This strategy involves acquiring valuable digital properties and then renting them out for a fee. A highly sought-after domain name, for instance, can be leased to businesses for thousands of dollars per month, providing a hands-off revenue stream. Similarly, established niche websites that generate consistent traffic can be monetized through advertising, affiliate sales, or direct rentals, with owners collecting a steady income for minimal daily effort.

Even smaller niche websites often earn between $500 and $5,000 monthly with relatively low ongoing maintenance, making them attractive for investors looking for scalable, background income. Once these digital assets are set up and performing, they require far less active management than physical properties. Cuban’s emphasis on owning digital real estate underscores its potential as a robust, long-term passive income source that can appreciate in value while simultaneously generating consistent cash flow.

Read more about: Beyond the Hype: Dissecting the Complex Reasons Why Americans Are Buying Fewer Tablets and What This Means for the Future of Digital Devices

12. **Angel Investing / Be the Money Behind Someone Else’s Idea**For those with significant capital and a keen eye for nascent opportunities, angel investing presents a high-risk, high-reward path to passive income that Mark Cuban exemplifies through his role on ‘Shark Tank.’ This strategy involves backing promising entrepreneurs and their innovative ideas, providing the necessary capital for them to build their businesses. While not entirely hands-off, the goal is for the founder to execute the vision while the angel investor primarily provides financial support and occasional strategic guidance.

Angel investing is inherently different from traditional passive income streams due to its speculative nature and the high potential for both exponential gains and complete loss. It demands rigorous due diligence and a deep understanding of the market, the team, and the proposed business model. Cuban’s success in this area stems from his ability to identify disruptive potential and invest in founders he believes can deliver.

The passive aspect emerges when the investor can truly stay hands-off, allowing the entrepreneur to manage daily operations. If the chosen venture succeeds, the investor’s capital grows significantly, often through equity appreciation or lucrative exits, providing substantial returns without continuous active management. This avenue allows experienced investors to leverage their capital and insights to fuel innovation, ideally profiting from the sidelines as the businesses they back flourish.

13. **Preferred Stock for Higher Yield**Preferred shares occupy a unique and advantageous position in the investment landscape, bridging the gap between traditional bonds and common equities. For investors prioritizing consistent income and stability over significant capital appreciation, preferred stock offers a compelling passive income solution. They are designed to deliver a higher yield than many common stocks, providing a predictable stream of dividends that are typically fixed.

What sets preferred shares apart is their dividend structure and payout priority. Holders of preferred stock receive fixed dividend payments before common stockholders, and in the event of liquidation, they also have a prior claim on assets. This built-in security makes them a more reliable source of income, particularly attractive during periods of market volatility when consistency is highly valued.

While preferred stocks generally do not experience the same level of price fluctuation as common shares, this stability is precisely their strength for passive investors. Their price tends to remain relatively stable, ensuring that the primary return comes from the consistent dividend payouts rather than speculative market movements. This consistency means you can set it, largely forget it, and rely on regular income, requiring minimal daily attention or trading decisions.

Preferred shares are a solid choice for leveraging existing capital to generate steady returns. They offer a comfortable zone for income-focused investors who value predictable cash flow and a degree of insulation from market gyrations. It’s a strategy focused on reliable payouts, allowing your money to generate consistent income with a relatively low level of ongoing effort or concern.

Read more about: Decoding Crispiness: A Comprehensive Guide to the Best Air Fryers for Unbeatable Results

14. **REITs and Rental Properties (indirect)**Real Estate Investment Trusts, or REITs, offer a sophisticated yet highly accessible pathway to investing in real estate without the direct hassles of property ownership and management. Mark Cuban appreciates strategies that efficiently leverage capital, and REITs fit this bill perfectly, allowing investors to participate in the lucrative real estate market indirectly. They are essentially companies that own, operate, or finance income-producing real estate across various sectors.

By investing in REITs, individuals can own a piece of diversified portfolios of properties, such as shopping malls, apartment complexes, data centers, or warehouses, without having to buy or manage entire buildings. REITs are legally required to distribute a significant portion of their taxable income to shareholders, typically 90%, in the form of dividends. This mandate makes them a consistent source of income for investors.

This structure effectively allows you to earn like a landlord without the traditional responsibilities – no late-night maintenance calls, no tenant disputes, and no property taxes to directly manage. It’s a truly passive way to gain exposure to real estate’s income-generating potential, providing regular dividend payouts that contribute to a steady stream of wealth. The liquidity of REIT shares, traded on major exchanges, also offers an advantage over direct property ownership.

REITs align perfectly with Cuban’s emphasis on smart, scalable financial strategies. They represent an efficient method for leveraging existing capital into a tangible asset class that historically generates consistent returns and dividends. For those seeking to diversify their portfolio and tap into real estate’s benefits with minimal effort, REITs serve as an excellent, hands-off solution, allowing capital to grow and generate income while you focus on other pursuits.

Mark Cuban’s journey from a self-made entrepreneur to a billionaire titan isn’t merely a tale of aggressive deal-making; it’s a masterclass in financial strategy, driven by an unwavering commitment to understanding, leveraging, and automating wealth creation. His endorsement of these diverse passive income streams underscores a core belief: true financial freedom comes not from endless toil, but from setting up intelligent systems where your capital works harder than you do. Whether it’s the steady hum of dividends, the explosive potential of cutting-edge tech, or the reliable payouts from shrewd real estate plays, the common thread is always strategic insight. The path to building lasting financial support might begin with a single, smart investment, but it’s sustained by continuous learning and the courage to make your money, and your mind, an unstoppable force.