Drivers across the United States are once again confronting a significant uptick at the pump, as the average price for a gallon of regular gasoline has surged to $3.82. This represents a nearly 30-cent increase from just a month ago, marking a notable shift in the energy market landscape. While these figures do not yet approach the record highs of $4.62 per gallon seen in June 2022, a period when gas prices neared $5.00 nationally and severely impacted summer travel plans, the current trajectory is a cause for considerable economic attention.

The resurgence of climbing gas prices arrives with broader implications for the American economy, echoing past periods where such increases played a major role in surging inflation, as data from the Federal Reserve Bank of Kansas City has previously indicated. Understanding the multifaceted dynamics at play is crucial for businesses and consumers alike, as these costs permeate various sectors, influencing everything from supply chain logistics to household budgets. The shift away from the downward trend observed in mid-August as summer concluded signals a complex interplay of factors driving this renewed escalation.

This in-depth analysis will meticulously unpack the immediate market observations and the distinct regional impacts of these rising fuel costs. We will delve into how various states and regions are experiencing these price hikes, setting the stage for a comprehensive examination of the underlying causes, both domestic and international, that are collectively shaping the current landscape of gasoline pricing across the nation.

1. **The Current Landscape: A Nationwide Price Surge**

The recent sharp increase in the national average price of gasoline serves as a stark reminder of the volatility inherent in the energy markets. With the average gallon of regular gasoline now at $3.82, the nation has seen an approximate 30-cent jump over the past month. This upward movement contrasts sharply with the seasonal pattern observed last year, where national average prices began to fall in mid-August as summer travel waned.

This latest surge highlights how quickly market conditions can shift, impacting millions of drivers and businesses nationwide. Such significant and rapid changes at the pump directly translate into increased operational costs for industries reliant on transportation, from logistics and delivery services to agriculture. The ripple effect of higher fuel expenses often extends to consumer goods, potentially contributing to broader inflationary pressures across the economy.

The Federal Reserve Bank of Kansas City has previously underscored the substantial role that rising gas prices can play in exacerbating inflation. While current prices remain below the peak of $4.62 per gallon witnessed in June 2022, when gas prices across the nation were inching toward $5.00 and notably cramping American summer travel plans, the current acceleration warrants close monitoring. The rapid escalation in recent weeks suggests that several powerful forces are converging to exert upward pressure on fuel costs, demanding a closer look at the specific regional manifestations and underlying drivers.

Read more about: Consumer Alert: The 14 Car Models Most Frequently Regretted by Owners, and Why They Fall Short

2. **Regional Impact: The Midwestern Spike**

While the national average price has seen a considerable increase, specific regions are experiencing even more pronounced surges. Midwestern states, in particular, have borne the brunt of some of the steepest increases, with their average gas prices climbing between 18 cents and 25 cents in recent weeks. This regional acceleration indicates localized market dynamics or vulnerabilities that amplify the broader national trends.

Such concentrated increases in the Midwest are not merely statistical anomalies; they represent tangible financial challenges for residents and businesses within these states. Agricultural operations, a cornerstone of many Midwestern economies, face higher input costs for machinery and transportation, potentially influencing food prices. Commuters in sprawling metropolitan and rural areas alike find their daily budgets stretched further.

The specific factors contributing to these elevated Midwestern spikes are complex, often involving regional supply chain disruptions, refinery issues, or pipeline constraints that can be more acutely felt away from coastal import hubs. The intensity of these increases underscores the uneven impact of market shifts, where some regions experience a disproportionately higher burden compared to the national average.

3. **California’s Premium Pump Prices**

California continues to hold its position as a state grappling with some of the nation’s highest gasoline prices, currently averaging a significant $5.00 a gallon. This figure consistently places California at the upper echelon of U.S. fuel costs, a reality that has long been familiar to its residents. The state’s unique market conditions, including environmental regulations, taxes, and a somewhat isolated refinery infrastructure, contribute to these elevated prices.

The sustained $5.00 average price point in California means that residents and businesses are constantly navigating a higher cost of living and operating compared to much of the rest of the country. For the state’s expansive economy, which relies heavily on transportation for commerce, tourism, and daily life, these entrenched high fuel costs represent a perennial challenge. It affects everything from the viability of local businesses to the financial strain on individual households.

While the current national surge impacts all states, California’s starting point for these increases is already considerably higher. This means that any additional upward pressure from global oil markets or domestic refinery issues could push prices even further into unprecedented territory for Californians. The state’s experience serves as a benchmark for understanding the cumulative effect of various factors on consumer fuel expenses.

Read more about: Unearthing the Legend: How Dodge Forged the World’s First True Off-Road Pickup and Forever Changed Automotive History

4. **Washington State: At the Forefront of the Surge**

Washington state has emerged as a critical focal point in the current gas price escalation, registering the highest average price among all 50 states at $4.66 per gallon. This distinction is further underscored by the fact that the cost of a gallon in Washington leapt by 16.5 cents in the past week alone, marking the largest single-week increase nationally. Such rapid and substantial hikes highlight a particular vulnerability within the state’s fuel market.

The dramatic ascent in Washington’s prices suggests a confluence of factors that are particularly impactful on the Pacific Northwest region. For Washingtonians, this translates into immediate and significant financial adjustments, affecting daily commutes, recreational travel, and the operational costs for a diverse range of industries. The rapid climb can quickly erode discretionary income and business profitability.

The AAA Oregon/Idaho spokesperson, Marie Dodds, noted that drivers in both Oregon and Washington are being impacted by what she termed a “triple whammy” when it comes to gas prices. While the full elucidation of this “triple whammy” was not detailed in the provided context, the sheer scale of Washington’s price surge clearly indicates intense market pressures are at play, making it a bellwether for the broader challenges facing consumers in the western U.S.

Read more about: The Hottest Tattoo Trends Across Every State: A Journey Through Ink and Innovation

5. **Oregon’s Steep Ascent: A Companion to Washington’s Woes**

Mirroring the challenges faced by its northern neighbor, Oregon has also experienced a rapid and significant increase in gasoline prices, with the average now standing at $4.28 per gallon. This represents a rocketing 15 cents upward in the past week, making it the second largest price increase in the nation over the last seven days, according to AAA data. This simultaneous surge with Washington highlights a regional rather than isolated phenomenon.

The rapid elevation of prices in Oregon places considerable strain on its economy and residents. The tourism sector, a vital component of Oregon’s economic fabric, could face headwinds as potential visitors reconsider travel plans due to escalating fuel costs. For local businesses and agricultural producers, higher fuel expenses can compress profit margins and potentially lead to higher prices for goods and services.

As with Washington, Oregon’s market is subject to intense pressures that are amplifying the national trend. The mention of a “triple whammy” affecting drivers in both states by AAA’s Marie Dodds underscores that shared regional challenges, possibly involving supply, distribution, and demand dynamics specific to the Pacific Northwest, are contributing to these steep and synchronized price hikes.

6. **Refinery Strain: Extreme Heat’s Toll (Arizona, Texas, New Mexico)**

One of the most immediate and impactful domestic factors contributing to the recent surge in gas prices has been the unprecedented extreme heat witnessed across various parts of the nation. July, in particular, was recorded as one of the hottest months for states such as Arizona, Texas, and New Mexico. Phoenix, for instance, endured a record-breaking 31 consecutive days where temperatures soared to 110 degrees or higher.

Such blistering heat has a direct and detrimental effect on oil refinery operations. According to CBS News senior transportation correspondent Kris Van Cleave, many refineries are designed to operate efficiently only within a specific temperature range, typically between 32 and 95 degrees. When ambient temperatures exceed this upper limit, refineries are compelled to reduce their output to prevent equipment damage and ensure safety. This curtailed production capacity directly translates into a tighter supply of refined gasoline, pushing prices upward.

Andrew Gross, a spokesperson for AAA, affirmed this connection, stating in a recent analysis that “Last month’s extreme heat played a role in the recent spike in gas prices due to some refineries pulling back.” While he added that refineries are now beginning to return to normal operations, the temporary reduction in output from these key production hubs, particularly affecting states like Arizona, Texas, and New Mexico, created a significant supply bottleneck that reverberated through the wholesale and retail fuel markets, contributing substantially to the current price increases.”

The intricate web of global energy markets means that the factors influencing fuel costs at the pump extend far beyond domestic refining capacity or regional supply disruptions. While extreme heat has certainly played a role in recent localized surges, a more profound and persistent upward pressure on gasoline prices stems from strategic decisions made by major oil-producing nations and fundamental shifts in international crude oil dynamics. This section will meticulously unpack these global macroeconomic drivers, providing a comprehensive analysis of how they are poised to keep gas prices elevated, impacting consumers and businesses across the United States, including the 10 states experiencing the most significant price escalations.

7. **Global Crude Oil Dynamics: Russia’s Production Cuts**

At the heart of the current surge in gasoline prices lies the escalating cost of crude oil, which has recently hovered around $80 per barrel, marking a notable increase from approximately $70 a barrel just a month prior. This upward trajectory is a critical indicator for fuel prices globally, as crude oil serves as the primary raw material for gasoline production. When global oil prices climb, the cost of refined products, including what consumers pay at the pump, typically follows suit, often with a lag.

A significant contributor to this global price increase is the strategic decision by Russia, recognized as the world’s third-biggest oil producer. Last month, Russia announced its intention to cut production starting in August, a move that immediately tightened the global supply outlook. Such a large-scale reduction from a major producer can swiftly absorb any existing surplus in the market, driving benchmark crude prices higher in anticipation of decreased availability.

This deliberate curtailment of output creates a pronounced impact on the delicate supply-demand equilibrium of the international oil market. For nations reliant on imported crude, including the United States, these external supply shocks translate directly into higher acquisition costs. The ripple effect extends through the refining process and distribution networks, ultimately manifesting as elevated gasoline prices for businesses and individual drivers across the U.S.

The interplay of global geopolitical strategies with fundamental market economics underscores the vulnerability of domestic fuel costs to international decisions. Russia’s production cut is not merely an isolated event but a powerful component of the broader international crude oil price dynamics shaping the current energy landscape. It illustrates how geopolitical considerations can override other market forces to exert substantial upward pressure on prices.

8. **Strategic Supply Reduction: Saudi Arabia’s Extended Cuts**

Compounding the effects of Russia’s actions, Saudi Arabia, the world’s second-largest oil producer, has also implemented significant production cuts that are directly influencing global oil prices. Last month, the kingdom slashed its oil exports by 1 million barrels per day, a substantial volume intended to bolster crude values and maintain price elevation in the international market. This unilateral decision by such a dominant producer has considerable sway.

Adding further pressure, Saudi Arabia announced this week its intention to extend this reduced production until the end of September. This prolongation of supply constraint signals a sustained commitment to tighter oil markets, removing any short-term hope for a swift return to higher output levels. Such an extended commitment sends a clear message to traders and consumers alike about the kingdom’s intent to uphold higher price points.

A Saudi Energy Ministry official clarified the rationale behind these ongoing cuts, stating, “This additional voluntary cut comes to reinforce the precautionary efforts made by OPEC+ countries with the aim of supporting the stability and balance of oil markets.” This statement not only justifies the current cuts but also introduces the possibility that the reduction “can be extended or deepened” if market conditions dictate. This flexibility allows Saudi Arabia to maintain significant control over global supply.

The direct link between this strategic, large-scale production reduction and the upward trajectory of crude oil prices is undeniable. Each barrel withheld from the market contributes to scarcity, which in turn drives up prices. For American consumers, this directly translates into higher gasoline costs, as refiners pay more for crude, and those increased expenses are passed along at the pump.

9. **The OPEC+ Calculus: Supporting Market Stability**

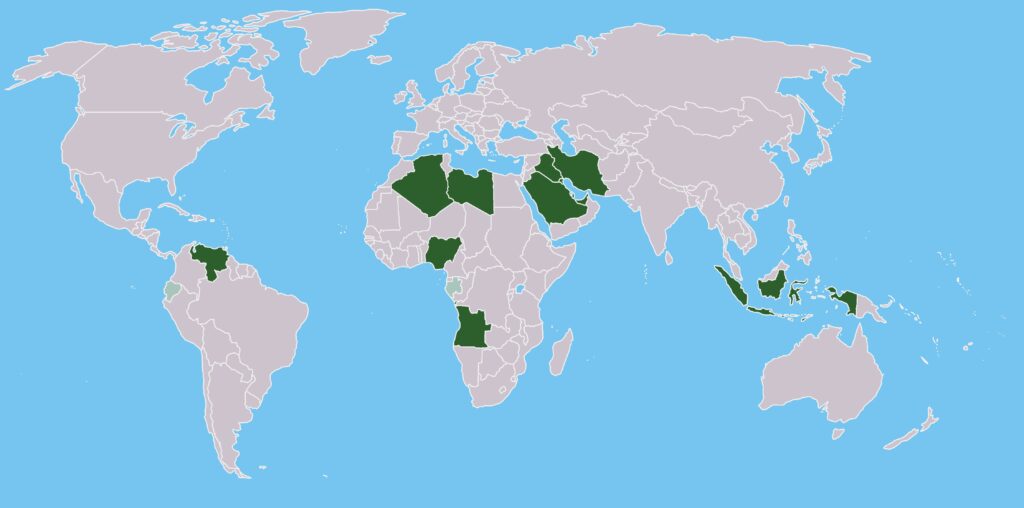

Beyond the individual actions of Russia and Saudi Arabia, their production cuts are framed within the broader strategy of the OPEC+ alliance, a powerful coalition of oil-producing nations. The Saudi Energy Ministry’s reference to “precautionary efforts made by OPEC+ countries” underscores a coordinated approach to influencing global oil supply and pricing. This collective decision-making amplifies the impact of any individual member’s cuts.

The primary objective for OPEC+ in the current market environment appears to be supporting what they term “the stability and balance of oil markets.” In practical terms, this often translates to preventing prices from falling to levels deemed unprofitable or undesirable by the member states. By managing output, the alliance aims to ensure a floor for crude oil prices, which directly benefits their national economies and funding objectives.

When such a formidable group, which collectively controls a significant portion of the world’s oil supply, agrees on production adjustments, their actions can effectively override other market forces that might otherwise lead to price declines. The combined impact of these coordinated cuts creates a global supply-demand equilibrium that is intentionally tighter than it might otherwise be, thereby sustaining higher price levels for crude oil.

These strategic decisions by OPEC+ are far from isolated market fluctuations; they represent a deliberate, unified strategy to manage and influence global oil prices. This approach ensures that a consistent, elevated value for crude oil can be maintained, reflecting a collective commitment among key producers to dictate terms rather than merely react to market conditions. The implications are clear for consumers worldwide, including those in the U.S., facing higher fuel costs.

10. **Economic Motivations: Saudi Vision 2030’s Influence**

The strategic decisions made by Saudi Arabia, particularly its persistent efforts to keep oil prices elevated, are deeply intertwined with its ambitious domestic economic agenda. The kingdom is actively pursuing “Vision 2030,” a sweeping plan designed to transform its economy. This initiative seeks to significantly reduce Saudi Arabia’s long-standing dependence on oil revenues and diversify its economic base.

Funding such a monumental national overhaul requires substantial financial resources. Elevated oil prices are critical to generating the necessary capital to invest in new industries, infrastructure projects, and social programs outlined in Vision 2030. For a nation that has historically relied heavily on oil exports, securing higher prices ensures a steady and robust revenue stream to fuel this extensive economic diversification and modernization.

Therefore, Saudi Arabia’s strategic oil production decisions are not merely reactions to global market conditions but are proactive measures driven by its long-term economic imperatives. The kingdom’s desire to boost oil prices provides a clear and compelling “why” behind its ongoing and potentially extended production cuts. This aligns its national development goals directly with its energy policy.

The funding requirements of Vision 2030 cast a long shadow over future oil supply decisions. As long as the kingdom is committed to this ambitious transformation, there will be an inherent incentive to maintain oil prices at favorable levels. This underlying economic motivation suggests that strategic production management by Saudi Arabia and its allies could continue to be a defining feature of the global energy market for years to come, impacting fuel costs worldwide.

11. **Future Market Projections: Analyst Expectations for Crude**

Looking ahead, market analysts are forecasting continued upward pressure on crude oil prices, reinforcing expectations for sustained high gasoline costs. Investment bank UBS, for instance, has projected that crude prices are likely to “increase $85 to $90 in coming months.” This forward-looking assessment provides critical insights into the anticipated trajectory of global energy markets.

This forecast is underpinned by a confluence of factors, notably “rising oil demand.” As global economies continue to recover and expand, and as seasonal travel patterns intensify, the demand for crude oil typically strengthens. When this increased demand meets a market where supply is intentionally constrained by major producers like Russia and Saudi Arabia, the natural outcome is an upward movement in prices. The balance between supply and demand is inherently delicate.

Such projections from credible financial institutions play a significant role in shaping market sentiment among traders and investors. When analysts anticipate higher prices, it can influence trading strategies, inventory decisions, and overall market speculation, often creating a self-fulfilling prophecy where prices indeed climb. This forward momentum adds another layer of upward pressure on the cost of crude.

For consumers, these analyst expectations are a stark reminder that the current surge in gas prices may not be a temporary anomaly. Instead, it appears to be part of a broader, anticipated trend. The convergence of strategic supply management and robust demand, as foreseen by market experts, indicates that elevated fuel costs are likely to persist, necessitating adaptive financial planning for households and businesses alike across the nation.

12. **The Broader Economic Impact: Gas Prices and Inflation**

The cumulative effect of these global macroeconomic drivers extends far beyond individual fuel purchases, profoundly impacting the broader U.S. economy. As the Federal Reserve Bank of Kansas City has previously indicated, rising gas prices have “played a major role in the surging inflation Americans experienced most of last year.” This historical correlation highlights the significant inflationary pressure that current fuel cost escalations are poised to reintroduce or exacerbate.

Elevated fuel expenses permeate nearly every sector of the economy. Businesses reliant on transportation—from logistics and freight services to agriculture and retail—face increased operational costs. These higher input costs are often passed on to consumers in the form of higher prices for goods and services, contributing to a general rise in the cost of living. This ripple effect touches everything from “supply chain logistics to household budgets.”

For individual households, higher gas prices directly erode discretionary income, forcing difficult budgetary choices. Commutes become more expensive, and the cost of daily necessities, impacted by transportation costs, also rises. This creates a challenging economic environment where consumer purchasing power is diminished, potentially slowing economic growth in other areas as spending is diverted to essential fuel.

In essence, the confluence of strategic oil production cuts, the geopolitical motivations behind them, and rising global demand creates a challenging economic headwind. The current higher gas prices are not an isolated market phenomenon but a significant contributing factor to broader inflationary pressures and economic strain, particularly for the states experiencing the most acute price escalations. Understanding these multifaceted global forces is crucial for comprehending the economic landscape facing the nation today.

Read more about: 9 Legendary Muscle Cars That Vanished: A Nostalgic Drive into an Era’s Fading Glory

The confluence of these factors paints a clear picture: the current climb in gas prices is not merely a transient fluctuation. It represents a deeper alignment of global supply constraints, strategic production policies, and robust demand. For consumers and businesses alike, understanding these complex dynamics is paramount. The journey through these intricate market forces underscores the interconnectedness of global energy policies with everyday economic realities, signaling that vigilance and adaptive strategies will be essential in navigating the evolving landscape of fuel costs.