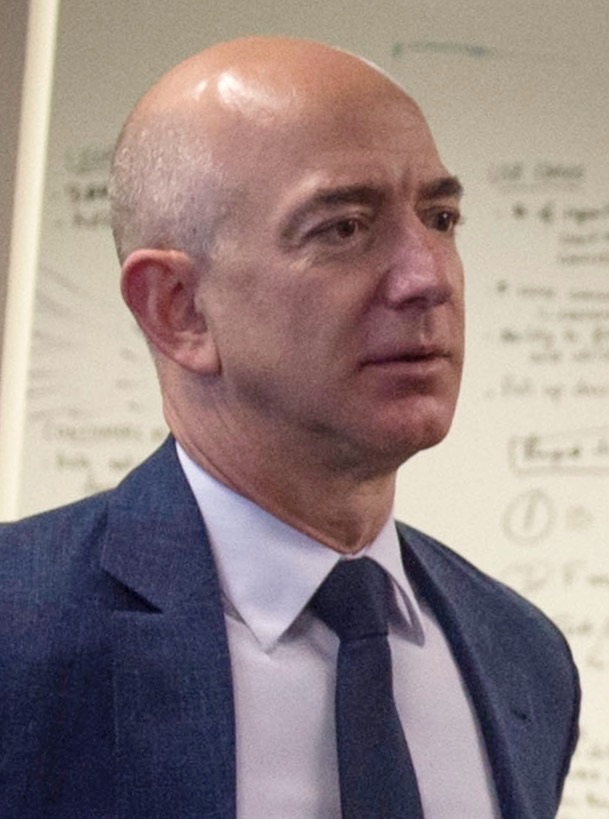

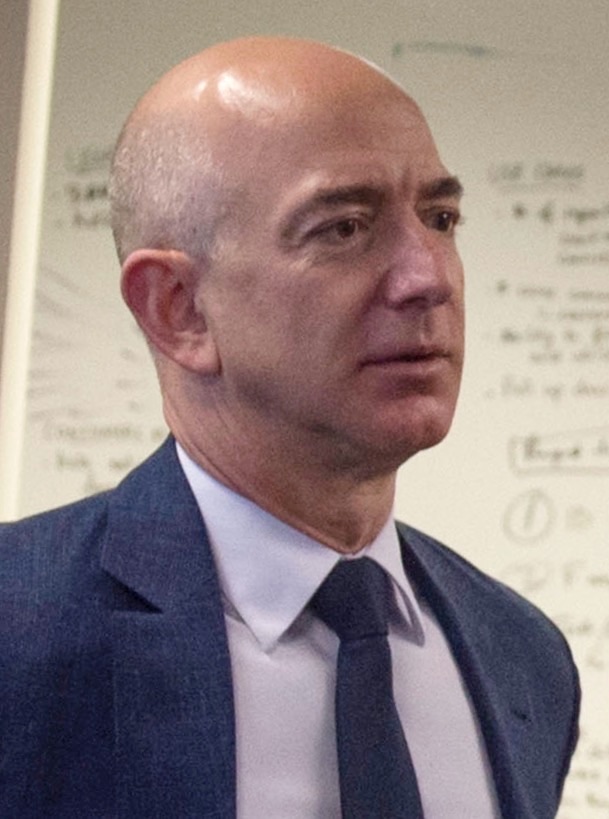

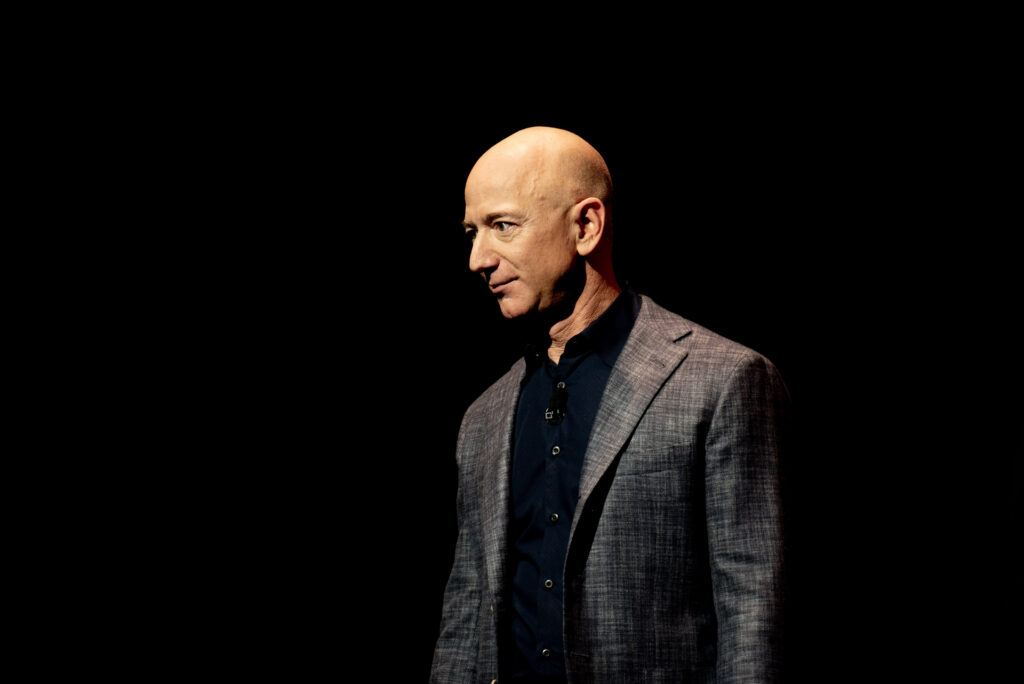

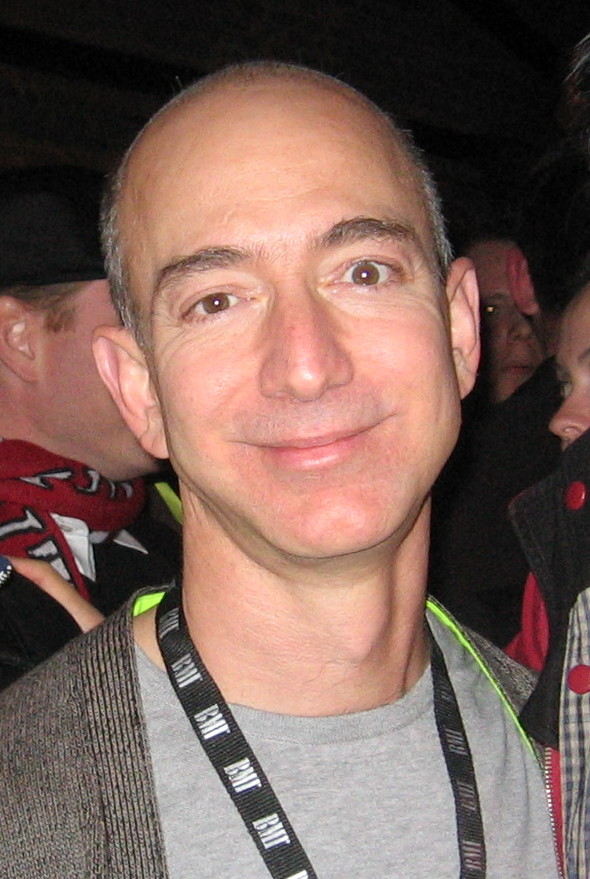

In the modern economic landscape, few individuals command as much attention, admiration, and, at times, intense public scrutiny as Jeff Bezos. As the founder, executive chairman, and former president and CEO of Amazon, the world’s largest e-commerce and cloud computing company, Bezos has amassed a fortune that places him among the wealthiest people in history. This unprecedented level of success and wealth inherently positions him at the center of global discussions about capitalism, corporate responsibility, and the societal impact of big tech.

Recent discussions frequently turn into broader debates about the nature of immense personal wealth and its implications. While specific recent events might capture headlines, the underlying ‘international outrage’ or public concern surrounding figures like Bezos is often a complex tapestry, woven from various long-standing criticisms, ethical debates, and questions about the power concentrated in the hands of a few. These sentiments reflect a public grappling with the rapid shifts in economic power and technological advancement.

This article delves into several foundational aspects of Jeff Bezos’s career, business empire, and public life that have historically contributed to widespread public discussion, criticism, and, in some instances, ‘outrage.’ Drawing exclusively from documented facts, we will explore the multifaceted reasons behind the significant public sentiment surrounding one of the most transformative, yet controversial, figures of our time.

1. **The Astounding Accumulation of Wealth: From Early Ambition to Centi-Billionaire Status**Jeff Bezos’s journey from a Wall Street professional to a global business magnate is intrinsically linked to the unprecedented scale of his personal wealth, which has become a persistent focal point of public discourse. Having first become a millionaire in 1997 after Amazon’s initial public offering, his net worth surged from an estimated $10.1 billion in 1999 to exceeding $220 billion by May 2025, according to Forbes. This meteoric rise designated him the “richest man in modern history” after his net worth reached $150 billion in July 2018 and marked him as the first registered centi-billionaire, not adjusted for inflation.

The sheer magnitude of his fortune often prompts comparisons that highlight the vast economic disparities in the world. For instance, in 2017–18 terms, Bezos’s wealth was estimated to equal that of 2.7 million Americans. Furthermore, the increase in his net worth by $33.6 billion from January 2017 to January 2018 alone outstripped the economic development, in terms of GDP, of more than 96 countries globally. Such figures illuminate why the accumulation of his wealth, even when generated through entrepreneurial innovation, becomes a source of significant public debate and questions about economic fairness.

This extraordinary wealth accumulation is fundamentally tied to Amazon’s expansive growth from an online bookstore to a dominant force in e-commerce, cloud computing, and more. His early strategic investments, such as a $250,000 stake in Google in 1998, which later grew to be worth billions, further cemented his financial ascendancy. The public’s perception of such vast personal wealth, particularly when set against broader societal challenges, inevitably fuels discussions about wealth distribution, corporate responsibility, and the ethical implications of modern capitalism.

2. **Amazon’s Business Practices Under Scrutiny: Accusations of Tax Avoidance and Anti-Competitiveness**

Amazon, under Bezos’s leadership, has frequently faced scrutiny over its business practices, drawing accusations that have contributed to public and political discontent. A notable instance occurred in March 2018 when U.S. President Donald Trump publicly accused Amazon and Bezos of “sales tax avoidance, misusing postal routes, and anti-competitive business practices.” These allegations, even if contested, highlighted a broader societal concern about the practices of large corporations and their impact on fair competition and public infrastructure.

In immediate response to these high-profile accusations, Amazon’s share price experienced a significant dip, falling by 9%. This directly impacted Bezos’s personal wealth, which saw a reduction of $10.7 billion. While academic reports from Stanford University weeks later suggested that the President could do little to meaningfully regulate Amazon, leading to Bezos recouping his losses, the incident underscored the financial and reputational vulnerability of even the largest companies to public and political criticism regarding their operational ethics.

Such accusations, particularly concerning practices like sales tax avoidance, resonate deeply with the public and smaller businesses, who often perceive a disparity in how large tech giants operate compared to traditional enterprises. The ongoing debate around whether Amazon leverages its scale to gain unfair advantages or circumvent certain obligations contributes to a pervasive sense of unease. These practices, irrespective of their legal standing, feed into a narrative of corporate behavior that prioritizes profit over broader societal contributions, thus fueling public scrutiny and criticism.

3. **The “World’s Worst Boss” Label: Amazon’s Labor Conditions and Worker Welfare**Perhaps one of the most pointed criticisms leveled against Jeff Bezos and Amazon pertains to the company’s labor practices and working conditions. In May 2014, the International Trade Union Confederation (ITUC) notably named Bezos the “World’s Worst Boss.” Sharan Burrow, the ITUC’s general secretary, articulated this sentiment by stating, “Jeff Bezos represents the inhumanity of employers who are promoting the North American corporate model,” reflecting widespread concerns about the treatment of Amazon’s global workforce.

These concerns gained significant political traction with Senator Bernie Sanders, who introduced the “Stop Bad Employers by Zeroing Out Subsidies (Stop BEZOS) Act” in September 2018. Sanders’s initiative was spurred by revelations from the non-profit group New Food Economy, which found alarming statistics: “one third of Amazon workers in Arizona, and one tenth of Amazon workers in Pennsylvania and Ohio, relied on food stamps.” Highlighting the stark contrast between Bezos’s immense wealth and the struggles of some of his employees, Sanders provocatively opined, “Instead of attempting to explore Mars or go to the moon, how about Jeff Bezos pays his workers a living wage?”

Amazon responded to these criticisms by pointing to the 130,000 jobs it created in 2017 and calling the $28,446 median salary figure “misleading” as it included part-time workers. However, Sanders countered that companies targeted by his proposal increasingly focus on part-time workers precisely to avoid benefit obligations, further escalating the debate. In a significant move on October 2, 2018, Bezos announced a company-wide wage increase, raising the minimum wage for American workers to $15 per hour, a decision widely interpreted as support for the “Fight for $15” movement and applauded by Sanders.

Despite this wage increase, the persistent focus on Amazon’s working conditions continues to impact its public image. The Harvard Business Review, which had previously ranked Bezos as the best-performing CEO for four consecutive years, omitted him from its top 100 in 2019, citing Amazon’s “relatively low ESG (environment, social, and governance) scores.” This reflection of “risks created by working conditions and employment policies, data security, and antitrust issues” underscores how critical labor practices are to broader public perception and corporate responsibility, serving as a consistent source of “international outrage.”

4. **A Public Perception Challenge: The Shift from Geeky Innovator to “Corporate Titan”**Jeff Bezos’s public image has undergone a significant transformation over the decades, evolving from that of a seemingly unassuming, albeit brilliant, entrepreneur to a figure often caricatured as an “enterprising supervillain.” In the 1990s and early 2000s, Bezos cultivated a reputation for prudence and parsimony, with journalist Nellie Bowles of The New York Times describing his persona as that of “a brilliant but mysterious and coldblooded corporate titan.” Despite being worth $10 billion in 1999, he famously drove a 1996 Honda Accord, contributing to an early perception of him as “geeky or nerdy.”

During this period, criticisms focused more on his intensely data-driven and quantitative leadership style. Alan Deutschman characterized him as “talking in lists” and “enumerating the criteria, in order of importance, for every decision he has made.” Brad Stone, in his book, further detailed Bezos as a “demanding boss” and “hyper-competitive,” noting his opportunistic CEO approach with little concern for obstacles or externalities. These portrayals, while highlighting his strategic acumen, also laid the groundwork for a public image that some found relentless and detached from broader human concerns.

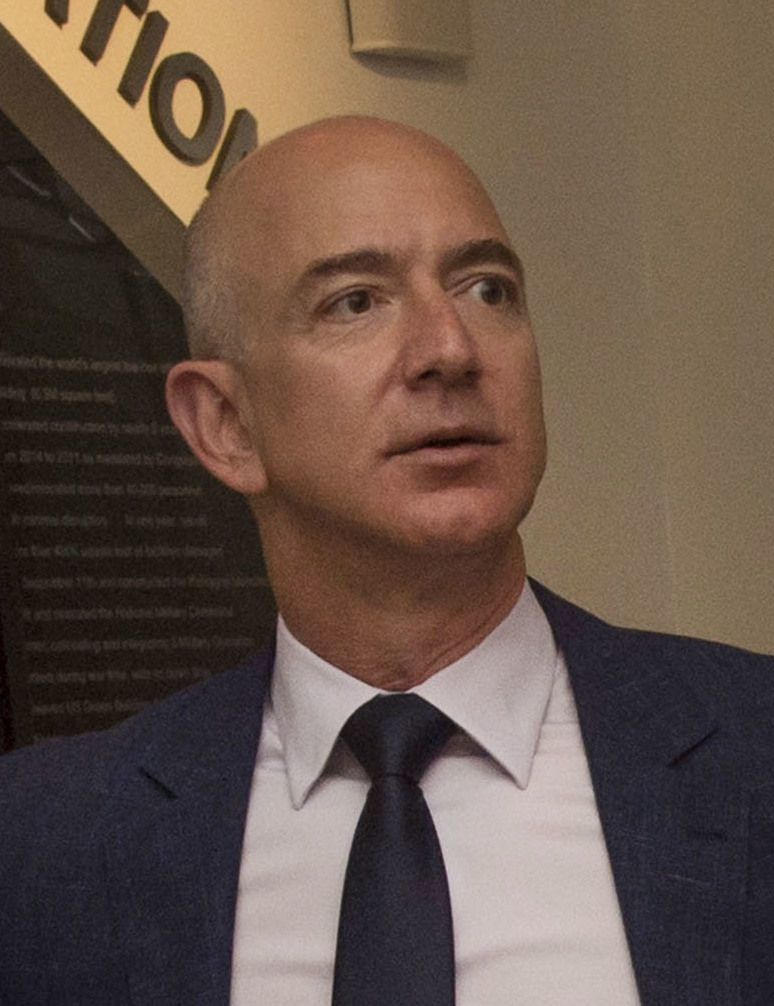

However, the early 2010s marked a distinct shift in Bezos’s public persona. He began to exhibit a more polished and aggressive demeanor, characterized by wearing tailored clothing, engaging in weight training, and adhering to a regimented diet. This physical transformation was often metaphorically linked to the equally dramatic growth and expansion of Amazon itself, with Bezos frequently becoming a metonym for the company. This more dominant appearance coincided with, and perhaps amplified, perceptions of him as a powerful, almost unyielding, force in the business world.

This evolution, coupled with the increasing scale of Amazon’s influence and the aforementioned business controversies, led to a public image where he was increasingly parodied as an “enterprising supervillain” on shows like Saturday Night Live. This portrayal, often depicting him as an “undercutting, domineering figure,” cemented his status as a symbolically dominant, yet controversial, figure in both business and popular culture. The contrast between his humble beginnings and his current titan-like stature, combined with aggressive corporate actions, fuels a narrative that contributes to public unease and criticism.

5. **The Philanthropy Paradox: Bezos’s Giving Versus Public Expectations**Despite his extraordinary wealth, Jeff Bezos’s philanthropic efforts have frequently come under public scrutiny, with many critics highlighting a perceived “relative lack of philanthropy compared to other billionaires.” This observation, which has drawn a “negative response from the public since 2016,” contributes to the broader narrative of international outrage, as societal expectations for ultra-wealthy individuals often include significant contributions to social good. The contrast between his immense fortune and the perceived slowness or scale of his charitable giving has been a persistent point of contention.

While this criticism is widespread, it is important to acknowledge that Bezos does support philanthropic efforts, primarily through direct donations and non-profit projects funded by Bezos Expeditions, his venture capital vehicle. Examples include funding an Innovation center at the Seattle Museum of History and Industry and the Bezos Center for Neural Circuit Dynamics at Princeton Neuroscience Institute. In a unique historical endeavor, Bezos Expeditions also funded the recovery of two Saturn V first-stage Rocketdyne F-1 engines from the floor of the Atlantic Ocean in 2013, which were later identified as belonging to the Apollo 11 mission’s S-1C stage and are now on display at the Seattle Museum of Flight.

However, these endeavors have not fully placated public opinion. The core of the criticism often lies not in the absence of giving, but in its perceived proportion to his unprecedented net worth and the urgency of global challenges. Compared to other billionaires who have pledged significant portions of their fortunes to charitable foundations early in their careers, Bezos’s approach to philanthropy has been viewed as less proactive or impactful relative to his capacity. This perceived discrepancy sustains a narrative where his wealth is seen as primarily self-serving, rather than a resource actively deployed for widespread societal benefit, thereby fueling public discontent.

6. **The Washington Post: Media Ownership and Editorial Influence**In August 2013, Jeff Bezos announced his purchase of the venerable American newspaper, The Washington Post, for $250 million in cash. This acquisition, made at the suggestion of his friend Don Graham, marked a significant foray into the media landscape and immediately brought his considerable influence into a crucial pillar of democratic society. To facilitate the purchase, he established Nash Holdings, a limited liability company through which he would own the newspaper, with the sale closing on October 1, 2013.

Initially, Bezos’s ownership appeared to bring about a revitalization of the struggling newspaper. In March 2014, he made his first significant change, lifting the online paywall for subscribers of several U.S. local newspapers. By January 2016, Bezos explicitly stated his aim to reinvent The Washington Post as a media and technology company, focusing on reconstructing its digital media, mobile platforms, and analytics software. These strategic investments proved fruitful, as a surge in online readership in 2016 led the paper to profitability for the first time since his purchase in 2013.

Despite these successes, Bezos’s ownership of such a prominent news organization has not been without its critics and has contributed to the broader public scrutiny he faces. The context explicitly mentions “scrutiny and criticism regarding his treatment of employees as well as his influence on the paper’s content, in particular 2024-25 interference with the editorial and opinion pages.” The notion that a single individual, particularly one with vast business interests and a history of public disputes, could potentially influence the editorial direction of a major news outlet raises significant concerns about journalistic integrity and impartiality.

This dynamic feeds into a public discourse about media consolidation and the potential for wealthy owners to shape public narratives, whether intentionally or implicitly. The perceived “interference” with editorial and opinion pages, even if localized to specific periods, can undermine public trust in unbiased reporting. Therefore, Bezos’s role as the proprietor of The Washington Post remains a notable point of discussion, contributing to the complex tapestry of public opinions and concerns surrounding his power and influence.

Read more about: Megyn Kelly’s Radical Evolution: How a Fox News Star Became an Independent Media Powerhouse and Unflinching Conservative Voice

7. **Blue Origin’s Space Ambitions: Public Excitement and Ethical Quandaries**Jeff Bezos’s long-standing fascination with space travel, evident since his 1982 high school graduation speech where he articulated a dream of humanity colonizing space to preserve Earth, materialized with the founding of Blue Origin in September 2000. This aerospace manufacturer and sub-orbital spaceflight services company initially maintained a low public profile, only gaining broader attention in 2006 with the purchase of a vast tract of land in West Texas for a launch and test facility. His stated ambition for Blue Origin has been to reduce the cost and increase the safety of extraterrestrial travel, aiming to make humanity a multi-planetary species and preserve Earth’s natural resources from overuse through inter-space energy and industrial manufacturing.

Key milestones in Blue Origin’s development include the New Shepard vehicle’s successful rocket flight into space and vertical landing in 2015, followed by Bezos himself flying into space on Blue Origin NS-16 in 2021. While these achievements underscore significant technological advancement, they also highlight a stark contrast that fuels public discussion. The pursuit of grand, futuristic space endeavors by one of the world’s wealthiest individuals often draws scrutiny when juxtaposed with persistent criticisms regarding labor conditions and social responsibility within his primary enterprise, Amazon. This duality creates a complex public perception, where awe for technological achievement coexists with questions about resource allocation.

Funding for Blue Origin largely stems from Bezos’s personal wealth, specifically through the strategic sale of his Amazon stock. Since 2016, he has reportedly been selling $1 billion in Amazon stock each year to capitalize Blue Origin. This deliberate channeling of vast personal wealth into a private space venture has sparked debates about the societal implications of such investments. When commercial spaceflight tickets were priced between $200,000 and $300,000 per person in July 2018, it underscored the exclusive nature of these ambitions, further drawing attention to the disparity between immense personal fortunes and broader economic challenges.

This continuous investment in space, particularly in light of Senator Bernie Sanders’s earlier critique — ‘Instead of attempting to explore Mars or go to the moon, how about Jeff Bezos pays his workers a living wage?’ — positions Blue Origin as a significant contributor to the international dialogue surrounding Bezos. The grand vision of humanity’s future in space, while inspiring to some, becomes a point of contention for others who view it as a distraction or an ill-prioritized luxury in the face of pressing terrestrial issues, thereby feeding into the multifaceted ‘outrage’ narrative.

8. **Ethical Concerns Over Amazon’s Technology: Surveillance and Data Practices**Beyond its e-commerce and cloud computing dominance, Amazon’s foray into advanced technological solutions has generated its own set of ethical dilemmas, contributing to the broader public scrutiny of Jeff Bezos. The company’s development and deployment of sophisticated technologies, while innovative, often intersect with fundamental concerns about privacy, data security, and the potential for misuse. These issues are increasingly central to public discourse regarding the unchecked power and influence of large technology firms.

A prominent example of these ethical concerns emerged in July 2018, when members of the U.S. Congress publicly called on Bezos to provide detailed information regarding the applications of Amazon’s facial recognition software, Rekognition. This direct inquiry from legislative bodies underscores the gravity of the anxieties surrounding such powerful surveillance technologies. Public and political apprehension often centers on who has access to these tools, how the collected data is protected, and the potential for their deployment in ways that could infringe upon civil liberties or enable unwarranted monitoring by various entities.

The broader implications of Amazon’s technological footprint extend to its extensive data collection practices. While the context specifically mentions ‘data security’ and ‘antitrust issues’ as contributors to Amazon’s ‘relatively low ESG (environment, social, and governance) scores’ in 2019, these points implicitly highlight the pervasive nature of ethical concerns surrounding its operations. The sheer volume of consumer data Amazon collects across its diverse services, from purchasing habits to voice commands via virtual assistants, raises questions about data privacy, algorithmic bias, and the transparency of its data handling policies.

Ultimately, the ethical debates surrounding Amazon’s technology contribute significantly to the narrative of public scrutiny surrounding Bezos. The perceived lack of transparency or adequate safeguards in the deployment of advanced surveillance and data-intensive technologies by a company with such global reach can erode public trust. This fuels a pervasive sense of unease, adding another layer to the complex tapestry of ‘international outrage’ directed toward Amazon and its founder.

9. **The CIA Contract: Intertwining Corporate Power and National Security**A significant factor contributing to the public discussion surrounding Jeff Bezos and Amazon’s influence is the company’s deep integration with government and national security apparatuses. In a notable development in 2013, Amazon Web Services (AWS) secured a substantial $600-million contract with the Central Intelligence Agency (CIA). This agreement marked a pivotal moment, positioning a private corporation, under Bezos’s leadership, as a critical technology provider for one of the United United States’ primary intelligence agencies.

The implications of this contract extend beyond a simple commercial transaction. It highlights the growing reliance of national security institutions on the advanced computing infrastructure and expertise offered by private tech giants. While a testament to AWS’s technological capabilities and reliability, this partnership also raised questions about the appropriate boundaries between corporate interests and governmental functions. The direct involvement of a company like Amazon in sensitive intelligence operations can spark debates regarding the concentration of power in the hands of a few and the potential for technological capabilities to be utilized in ways that are not always transparent to the public.

For a segment of the public, the intertwining of Amazon, a company already facing scrutiny for its business and labor practices, with the CIA, a traditionally secretive agency, served as a source of unease. This convergence can fuel existing apprehensions about surveillance, data control, and accountability within both corporate and government spheres. The contract underscored the breadth of Bezos’s influence, demonstrating how his commercial empire extends into areas with profound societal and ethical considerations, far beyond traditional e-commerce.

Therefore, the CIA contract represents a specific instance where Amazon’s corporate endeavors ventured into highly sensitive territory, drawing particular attention to the ethical dimensions of technology provision in national security contexts. It contributes to the overall narrative of ‘international outrage’ by adding a layer of complexity concerning transparency, power dynamics, and the far-reaching impact of Bezos’s enterprises on public institutions and citizen privacy.

10. **Strategic Stock Sales: Fueling Personal Ventures and Public Scrutiny of Wealth Management**Jeff Bezos’s management of his immense personal wealth, particularly through strategic sales of Amazon stock, has also become a subject of intense public scrutiny, amplifying the broader narrative of ‘international outrage.’ While stock sales are a common practice for corporate executives, the sheer scale of Bezos’s divestments, and the stated intentions behind them, draw significant attention, reflecting a societal interest in how the ultra-wealthy deploy their capital.

Examples of these significant financial maneuvers include the sale of slightly over one million shares for $671 million in May 2016, followed by another million shares for $756.7 million in August of the same year. More recently, in February 2024, Bezos sold 24 million shares totaling $4 billion, announcing an intention to sell 50 million shares over the subsequent year. Crucially, these sales were explicitly cited as a means to ‘raise cash for other enterprises,’ with Blue Origin specifically mentioned as a beneficiary.

This direct linkage between Amazon’s commercial success, Bezos’s personal fortune, and his ambitious non-Amazon ventures, such as Blue Origin, serves as a recurring flashpoint in public discourse. When billions of dollars are channeled from a highly profitable company into private space exploration or other personal passions, it often sparks renewed debate about wealth distribution, corporate responsibility, and the ethical implications of concentrating such vast resources in individual hands. This situation is particularly salient when criticisms about Amazon’s labor practices or tax contributions persist.

The pattern of strategic stock sales, therefore, contributes significantly to the ‘international outrage’ by highlighting a perceived prioritization of personal and futuristic ambitions over more immediate societal needs or obligations. It provides a tangible demonstration of how Bezos deploys his wealth, often leading to public discussion about whether these vast resources could be better utilized for broader public good, rather than funding endeavors that, for many, appear as exclusive pursuits of the ultra-rich.

11. **Investments in Longevity Research: The Pursuit of Immortality and Ethical Dilemmas**Among Jeff Bezos’s diverse and often ambitious investments, his significant foray into longevity research stands out as a frontier that sparks both scientific fascination and profound ethical debate, further contributing to the complex tapestry of public scrutiny. Through his venture capital vehicle, Bezos Expeditions, and new ventures, he is actively supporting efforts to push the boundaries of human lifespan and health.

His involvement in this cutting-edge field includes an investment in Unity Biotechnology, described as a ‘life-extension research firm hoping to slow or stop the process of aging.’ A more recent and substantial commitment to this area is his co-founding of Altos Labs in September 2021 with Mail.ru founder Yuri Milner. This biotechnology company, launched with an impressive initial capital of $3 billion, is explicitly ‘dedicated to harnessing cellular reprogramming to develop longevity therapeutics’ and has attracted prominent scientists in the field, including a Nobel Prize winner.

These investments, while potentially transformative for human health, inevitably raise significant ethical and societal questions that resonate deeply with the public. Critics and observers often ponder the implications of such advanced medical interventions becoming primarily accessible to the ultra-wealthy. The prospect of a future where only a select few can afford to significantly extend their lives or reverse aging processes can exacerbate existing anxieties about social stratification and economic inequality, thereby fueling a distinct form of ‘outrage’ or intense ethical discussion.

The pursuit of “immortality” or radical life extension by one of the world’s richest individuals invites philosophical scrutiny about fairness, access, and the appropriate allocation of immense resources. It places Bezos at the center of a debate about not just corporate power, but also the very future of human existence and who gets to shape it. This area of his investment portfolio adds another layer of public and ethical complexity to the perception of a figure who already commands substantial global attention and criticism.

Jeff Bezos remains a figure of immense influence, whose ventures consistently provoke broad international discussion. The scrutiny surrounding his wealth, business practices, and societal impact is not singular but a complex interplay of various factors. From the monumental scale of his personal fortune and Amazon’s far-reaching corporate policies to his media ownership, ambitious space projects, and controversial investments in longevity research, each facet of his empire contributes to a nuanced public narrative. This ongoing dialogue underscores a collective grappling with the profound economic, technological, and ethical transformations spearheaded by one of the most powerful figures of our time. The ‘outrage’ is therefore less about a single event and more about a persistent examination of the responsibilities and ramifications inherent in unparalleled wealth and power in the 21st century.