Retirement is a stage of life that many of us eagerly anticipate, envisioning a time to finally bid farewell to the daily grind and enjoy the fruits of our labor. It’s a journey filled with possibilities, offering newfound freedom to pursue passions, travel, or simply relax. However, navigating the path to a confident and comfortable retirement often means confronting a landscape dotted with common myths and misconceptions that, if believed, can severely hinder your ability to plan effectively for this important life transition.

The information we encounter about retirement can be a mixed bag, sometimes helpful, sometimes outdated, and sometimes just plain wrong. These pervasive myths get started easily, and believing them can lead to unnecessary stress, unexpected higher taxes, and financial surprises down the road. The truth is, a strong retirement plan isn’t merely about accumulating savings; it’s fundamentally about knowing how to use your money wisely once you reach those golden years.

To help you approach retirement from a more realistic and informed perspective, we’re going to shine a light on some of the most widespread and potentially costly lies retirees need to stop believing. By understanding the reality behind these misconceptions, you can make smarter decisions, gain clarity, and build confidence in your financial future. Let’s dive into the first five, equipping you with the knowledge to make your retirement dreams a tangible reality.

1. You will pay less in taxes in retirement

It’s a common belief that your tax bill will decrease once you retire, a notion many people hold dear as they approach their golden years. The idea is simple: if you’re not earning a regular salary, your income must be lower, and thus, your taxes will follow suit. However, this doesn’t always hold true, and the reality is that your tax situation in retirement could become more complex and may not necessarily result in lower taxes than during your working life.

For many retirees, while their earned income from a job may disappear, other sources of income emerge that can still be subject to taxation. For example, some people face unexpected tax liabilities due to Required Minimum Distributions (RMDs) from their retirement accounts, pensions, or even a portion of their Social Security benefits. If you’ve diligently saved in tax-deferred accounts like your 401k and IRAs, these withdrawals in retirement become taxable income, which can add up significantly.

High-net-worth individuals, in particular, may find themselves with substantial retirement savings in these tax-deferred vehicles. When they start withdrawing from these accounts, they’ll owe income tax on those distributions, potentially leading to a considerable tax liability. It’s crucial to understand that simply having a lower *working* income does not guarantee a lower *overall* tax burden.

To navigate this intricate landscape, consider a diversified tax strategy that includes a mix of tax-deferred, tax-free, and taxable accounts. Working with a financial advisor can help clients within five years of retirement or those already retired to develop a tax-efficient drawdown approach. This strategy aims to maximize your after-tax wealth by strategically making upfront tax payments, which can optimize your tax situation and potentially reduce your overall tax burden throughout retirement.

Read more about: Beyond the Average: A Comprehensive Guide to Understanding and Planning for the $172,500 Healthcare Costs Facing Retirees

2. You can expect your expenses to decrease in retirement.

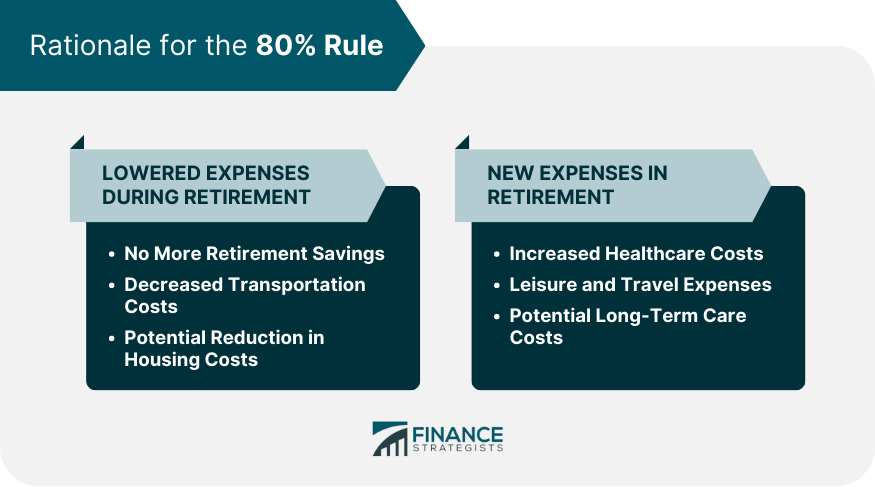

Another deeply ingrained myth suggests that once you stop working, your overall expenses will naturally shrink, allowing your retirement savings to stretch further. Many people assume they can maintain the same lifestyle in retirement as they did during their working years, or even a slightly reduced one, without much financial stress. However, retirement often entails a significant shift in spending habits, and while certain expenses may indeed decrease, others tend to rise, sometimes unexpectedly, into and through retirement.

While work-related costs like commuting, professional attire, and even daily lunches might disappear, new or increased expenses often take their place. High-net-worth individuals, for instance, may choose to continue maintaining a comfortable lifestyle that frequently includes travel, hobbies, and various leisure activities, all of which come with their own price tags. These lifestyle choices can easily consume any savings from reduced work-related spending.

Moreover, a major factor that often gets underestimated is healthcare. Health care expenses tend to rise significantly with age and grow faster than annual inflation, becoming a substantial financial consideration for retirees. Additionally, it may be necessary to plan for long-term care costs, which are typically not covered by Original Medicare and can be incredibly expensive. These planned and unplanned expenses can quickly offset or even outweigh any reductions in housing, child care, or community-related costs.

It’s also important to remember that retirement can span several decades, and inflation can be a silent but powerful force, eroding the purchasing power of your savings over time. This can significantly impact your retirement income, making it harder to cover living costs years down the line. With your goals and risk tolerance in mind, it’s essential to invest in assets that have the potential to outpace inflation and regularly review your retirement plan with your financial advisor to make necessary adjustments to your expense projections.

Read more about: Beyond the Average: A Comprehensive Guide to Understanding and Planning for the $172,500 Healthcare Costs Facing Retirees

3. You should always stay in the lowest possible tax bracket

The idea of always staying in the lowest possible tax bracket sounds intuitively appealing. Why pay more in taxes than you absolutely have to, right? While it’s true that minimizing your tax burden in any given year seems like a smart financial move, this single-year perspective may turn out to be suboptimal when viewed through the lens of a multiyear strategy for retirement. This is a common pitfall that can limit your financial flexibility and result in missed opportunities for more efficient tax planning over the long term.

A strategy focused solely on the lowest possible bracket each year could mean you miss out on opportunities to strategically pay taxes at a lower rate now to avoid paying significantly higher rates later. For example, by incurring slightly higher taxes in one year, perhaps through Roth conversions, you could potentially set yourself up for several subsequent years of much lower taxes in retirement. This approach considers your entire retirement timeline, not just individual tax years.

Paying at a higher rate in some years, when carefully planned, may ultimately result in a lower overall tax burden over time. This requires a nuanced understanding of current and projected tax laws, as well as your personal income trajectory throughout retirement. Striving to always stay in the lowest tax bracket without considering future implications can limit your ability to proactively manage your tax situation.

A comprehensive financial plan, developed with the guidance of an advisor, can help you look beyond the immediate tax year. It can uncover opportunities for strategic tax management, such as utilizing different types of accounts or implementing a tax-efficient drawdown strategy, to optimize your after-tax wealth across your entire retirement. This thoughtful, multiyear approach is often more beneficial than a rigid focus on the lowest bracket each year.

4. Everyone should take Social Security at their full retirement age.

Waiting until your full retirement age to claim Social Security benefits can indeed result in higher monthly payments, a fact often highlighted as the ideal strategy for maximizing retirement income. While this can be a beneficial choice for many, it’s not a universal truth that applies to everyone. The reality is that individuals have unique circumstances, varying financial goals, and diverse life expectancies that might warrant a completely different approach to claiming their Social Security benefits.

Consider factors like your overall financial health, the presence of other sources of retirement income, and your personal life expectancy when deciding when to claim Social Security. Delaying benefits, for instance, can provide a guaranteed income boost that may be particularly beneficial for individuals who have sufficient other savings and wish to maximize their fixed income later in life. This strategy can offer long-term financial security, especially if you anticipate a long retirement.

However, for others, claiming Social Security early might be the more sensible option. If you are not able to work past age 62 – perhaps due to health issues, caregiving responsibilities, or unexpected job loss – or simply do not want to work longer, and you need the Social Security income to withstand accelerated withdrawals and protect you from unforeseen events like medical expenses, taking your benefits earlier may be crucial. This flexibility is key to personalizing your retirement income strategy.

While Social Security provides essential income during retirement, it’s important to remember it’s not intended to be your sole source of support. The average Social Security benefit is modest, and relying solely on it may leave you with an insufficient income to maintain your desired lifestyle. Your comprehensive retirement plan should include drawing on your additional retirement savings to complement your Social Security benefits, ensuring you have the resources to meet your lifestyle needs.

Read more about: Robert Kiyosaki’s 10 Blueprint Ideas for a Stronger, Smarter Retirement Future

5. Social Security benefits cannot be taxed.

Speaking of Social Security, we should also dispel the notion that your benefits can’t be taxed. This is a myth that can lead to significant financial surprises for retirees, especially for those with other substantial sources of income. The truth is, your Social Security benefits can indeed be subject to federal income tax, and they often are, depending on your combined income. This is a critical detail that many overlook, mistakenly believing their Social Security income is entirely untouchable by the IRS.

The portion of your benefits that may be taxed – up to 85% – depends directly on your combined income. This combined income includes your adjusted gross income, any tax-exempt interest, and half of your Social Security benefits. If this combined income exceeds certain thresholds, a portion of your Social Security benefits will become taxable, adding to your overall income tax liability. This can be a shock for retirees who haven’t factored this into their financial planning.

For high-net-worth individuals, or even those with moderate incomes from pensions, investments, or withdrawals from traditional retirement accounts, hitting these thresholds is quite common. The taxation of Social Security benefits can impact your overall financial picture, potentially increasing your taxable income more than anticipated. This makes strategic planning all the more important to manage your tax burden effectively during retirement.

Understanding how Social Security benefits are taxed and planning accordingly with your financial advisor can help you manage your tax liability. Utilizing a tax-efficient drawdown strategy with your investment accounts, for instance, can sometimes help to manage your combined income in a way that potentially avoids paying taxes on Social Security whenever possible. This proactive approach ensures you’re prepared for the tax realities of receiving Social Security benefits, preventing unwelcome financial surprises.

Navigating retirement successfully means equipping yourself with accurate information and a flexible mindset. As we continue our journey to debunk common retirement myths, we’ll uncover more critical insights that can transform your financial future. Let’s delve into the next five misconceptions that retirees often encounter, providing you with the clarity and confidence to make sound financial decisions. From withdrawal rates to RMDs and critical planning for long-term savings, understanding these realities is paramount.

Read more about: A New Era for Retiree Taxes: Examining the Legislative Proposals Reshaping Social Security Benefits

6. Once I choose my withdrawal rate, it’s set in stone.

Many retirees are introduced to the concept of a withdrawal rate—a predetermined percentage of their savings they can spend each year. While some financial advisors might use a single withdrawal rate and a fixed account source as a simple way to project cashflows, relying solely on this rigid approach can be a costly mistake. The world of retirement isn’t static, and neither should your financial plan be. Life is full of unforeseen twists and turns, making a flexible approach to withdrawals not just beneficial, but essential.

Life circumstances are constantly evolving; your health might change, new travel opportunities could arise, or family needs might shift. These changes directly impact your spending requirements. Furthermore, tax laws are consistently changing, which can significantly alter the most tax-efficient way to access your funds. A set-in-stone withdrawal rate fails to account for this inherent dynamism, potentially leaving you either underspending or overspending in different phases of your retirement.

Instead of rigidly sticking to an initial withdrawal rate or always drawing from the same account source, a more proactive and effective strategy involves periodic assessments and adjustments. This means regularly reviewing your financial plan, perhaps annually or whenever a major life event occurs, to ensure it continues to align with your current needs and goals. Such flexibility helps your plan remain robust and responsive to market fluctuations, tax law changes, and your personal circumstances.

Working with an advisor who understands the importance of this flexibility can be incredibly empowering. They can help you adapt your withdrawal strategy, adjusting the amounts and even the types of accounts you draw from each year. This adaptive approach gives you the confidence that your financial plan can evolve with you, helping to maximize your after-tax wealth and ensuring your savings effectively support your desired lifestyle throughout your entire retirement journey.

Read more about: Beyond the Limelight: 10 Pioneering Black Actresses Whose Legacies Redefine Hollywood History

7. You have no control over your Required Minimum Distribution amounts.

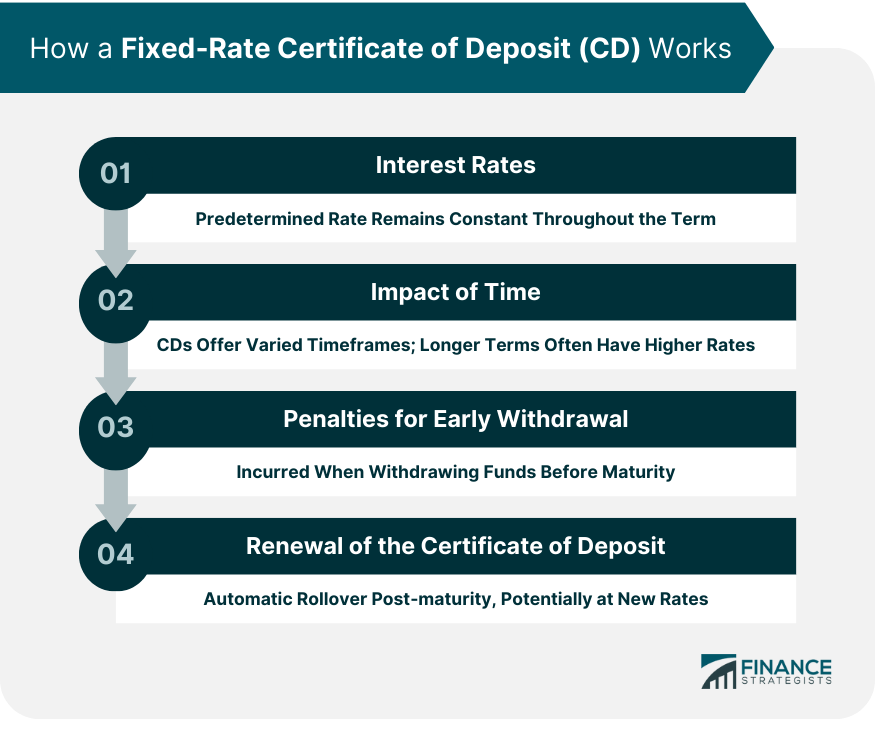

Required Minimum Distributions, or RMDs, are a fundamental component of retirement planning, often perceived as an unavoidable tax burden that retirees have little to no power over. These are mandatory annual withdrawals from tax-deferred retirement accounts, such as traditional IRAs and 401(k)s, imposed by the Internal Revenue Service once you reach a certain age—currently 72 (or 73 if you reach age 73 in 2023-2032, and 75 if you reach age 74 after December 31, 2032). Their purpose is straightforward: to ensure that the government eventually collects taxes on your tax-deferred savings, preventing indefinite deferral.

The amount of your RMD is directly tied to the balance in your tax-deferred accounts. A higher account balance inevitably leads to a larger RMD, which is then taxed as ordinary income, just like wages. This influx of taxable income can have several ripple effects. It can potentially push you into a higher income tax bracket, increase the taxable portion of your Social Security benefits, and even trigger income-related monthly adjustment surcharges (IRMAA) on your Medicare premiums, adding unexpected costs to your retirement budget.

Despite the mandatory nature of RMDs, the belief that you have absolutely no control over them is a significant misconception. While you must take them, strategic planning can significantly mitigate their impact. You can work with a financial advisor and even an in-house tax planning expert to implement a tax-efficient drawdown strategy. This approach focuses on optimizing how and when you take withdrawals, not just from tax-deferred accounts, but from your entire portfolio.

Tactics such as strategic Roth conversions, where you pay taxes on a portion of your retirement savings now at potentially lower rates, can reduce the future balance of your tax-deferred accounts, thereby lowering subsequent RMDs. Charitable contributions, especially Qualified Charitable Distributions (QCDs) directly from an IRA, can also satisfy RMDs without being counted as taxable income. By proactively managing your RMDs, you can anticipate and significantly reduce their potential impact on your taxable income and overall financial health, turning a seemingly inflexible rule into an opportunity for smart planning.

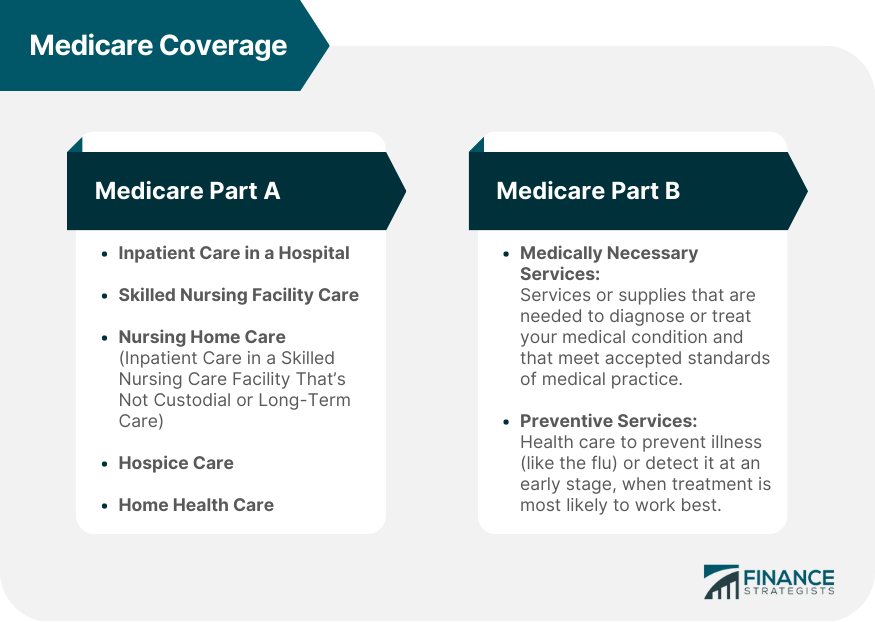

8. Medicare will cover all of your health care costs.

Medicare is a cornerstone of health coverage for millions of retirees, providing invaluable assistance with medical expenses. However, a widespread and costly lie many retirees believe is that Original Medicare will fully cover all their health care needs once they qualify. While it provides a vital safety net, relying solely on Original Medicare without understanding its limitations can lead to substantial and unexpected out-of-pocket costs that can quickly drain retirement savings.

Original Medicare—Parts A and B—does not cover everything. Retirees are still responsible for various expenses, including Medicare premiums, copayments, and deductibles. Moreover, essential services like routine dental, vision, and hearing exams are typically not covered. Many individuals opt for supplemental insurance, such as Medigap policies or Medicare Advantage plans, to bridge these gaps, but these also come with additional costs that must be factored into your budget.

Perhaps the most significant overlooked expense is long-term care. Original Medicare generally does not cover long-term care costs, which can be incredibly expensive and are increasingly common as we age. Planning for potential long-term care needs, whether through dedicated insurance, personal savings, or other strategies, is a crucial part of retirement planning that Medicare alone cannot address. It’s an expense that demands careful consideration and proactive budgeting.

Furthermore, retirees can be surprised to discover that their adjusted gross income, often impacted by Required Minimum Distributions, can subject them to income-related Medicare surcharges. These surcharges mean higher premiums for Medicare Parts B and D. A comprehensive and tax-efficient drawdown strategy can help account for these potential surcharges and even assist in managing your income levels to potentially avoid triggering them, ensuring your health care costs remain as predictable and manageable as possible throughout your retirement.

Read more about: Beyond the Average: A Comprehensive Guide to Understanding and Planning for the $172,500 Healthcare Costs Facing Retirees

9. A tax-efficient drawdown strategy is the same as doing aggressive Roth IRA conversions.**The term “tax-efficient drawdown strategy” often conjures images of aggressive Roth IRA conversions, leading many retirees to believe these two concepts are interchangeable. While Roth conversions are indeed a powerful tool within a broader tax-efficient strategy, equating the two is a misconception that can lead to an incomplete and potentially suboptimal financial plan. A true tax-efficient drawdown strategy encompasses a much wider array of considerations and tactics than just moving funds to a Roth account.

The term “tax-efficient drawdown strategy” often conjures images of aggressive Roth IRA conversions, leading many retirees to believe these two concepts are interchangeable. While Roth conversions are indeed a powerful tool within a broader tax-efficient strategy, equating the two is a misconception that can lead to an incomplete and potentially suboptimal financial plan. A true tax-efficient drawdown strategy encompasses a much wider array of considerations and tactics than just moving funds to a Roth account.

Fundamentally, a tax-efficient drawdown strategy is a holistic approach to managing your retirement withdrawals. It involves carefully determining the types of accounts from which your withdrawals should come each year—whether tax-deferred, tax-free, or taxable—as well as the optimal amounts to take from each. This strategic sequencing is designed to minimize your overall tax burden throughout your retirement years, taking into account current tax laws, your projected income, and future financial needs.

This sophisticated strategy helps retirees maximize their after-tax wealth by strategically reducing taxation across multiple fronts. It aims to minimize the portion of Social Security benefits that become taxable, mitigate income-related monthly adjustment surcharges on Medicare premiums, and manage capital gains tax and net investment income tax. Aggressive Roth conversions, while valuable, are just one piece of this intricate puzzle, best applied when they fit into a larger, multi-year tax optimization plan.

Therefore, understanding that a tax-efficient drawdown strategy goes far beyond simple Roth conversions is vital. It requires a nuanced understanding of your entire financial landscape and future projections. Collaborating with a financial advisor who can help you craft and implement such a comprehensive strategy can ensure you’re not leaving money on the table, allowing you to withdraw your savings in the most tax-advantageous way possible and preserve more of your hard-earned money for your desired retirement lifestyle.

10. You can wait to start saving for retirement.

The final, and arguably most perilous, myth that retirees need to stop believing is the idea that there’s always plenty of time to start saving for retirement. This notion, often fueled by optimism or a sense of invincibility, can lead to dangerous procrastination. The belief that you can simply “figure things out as you go along” or easily catch up on savings later in life is a costly lie that jeopardizes long-term financial security and peace of mind.

Life is inherently unpredictable, and waiting to save can expose you to numerous unforeseen challenges. Unexpected expenses, such as medical emergencies or family obligations, can quickly derail even the best intentions to save later. Health issues, caregiving responsibilities, or an unexpected job loss can force an early retirement, leaving you without the crucial working years you anticipated for catch-up contributions. The power of compound interest, the greatest ally in long-term savings, is also severely diminished when you delay, making every year lost an exponential financial setback.

This is precisely why having a clear retirement roadmap is not just helpful, but essential. Your planner is there to help you create this map, guiding you through the complexities and helping you establish a consistent savings discipline from an early age. Without this structured approach, you risk making costly mistakes, reacting emotionally to market fluctuations, and potentially paying more in fees and taxes than necessary, ultimately compromising your ability to enjoy the retirement you envision.

Therefore, the imperative to start saving for retirement early and consistently cannot be overstated. It’s wise to save as much as you can, for as long as you can. Proactive planning, rather than procrastination, builds resilience against life’s uncertainties and ensures that you have the resources to meet your lifestyle needs. It’s about securing your future, turning potential financial stress into confidence, and enabling you to retire not just comfortably, but with clarity and peace of mind.

Read more about: Maximize Your Future: The Salary & Strategies to Claim Social Security’s Top $6,450 Monthly Benefit

Retirement planning is undeniably a complex, multi-faceted process, constantly influenced by a myriad of factors. By meticulously identifying and dispelling these ten pervasive retirement myths, we hope to have illuminated a path towards a more realistic, informed, and confident approach to your golden years. These insights are not just about avoiding pitfalls; they are about empowering you to make smarter, more strategic financial decisions. Remember, knowledge is your most valuable asset when it comes to securing a vibrant and fulfilling retirement. If any of these discussions sparked questions or you wish to tailor a strategy to your unique circumstances, never hesitate to reach out to a trusted financial planner. Their expertise is an invaluable resource in transforming your retirement dreams into a tangible, secure reality. After all, a well-planned retirement isn’t just a destination; it’s a journey best traveled with foresight and informed confidence.