In the world of personal finance, certain adages gain traction, sometimes without a full understanding of the underlying opportunities. One such notion might lead you to believe that utilizing your hard-earned credit card points for something as mundane as gas is a misstep, an oversight in maximizing your rewards. However, our deep dive into the mechanics of credit card rewards at the pump reveals a completely different picture.

Far from being a category to avoid, gas station spending is, in fact, a “goldmine for points” as highlighted by experts. The reality is that for savvy consumers, every trip to the gas station presents a significant chance to accumulate valuable rewards, whether those are cash back, transferable points for luxury travel, or even airline miles. Understanding how to leverage the right credit cards and loyalty programs can transform routine fill-ups into significant steps towards your financial goals.

This comprehensive guide will debunk common misconceptions and arm you with the actionable insights you need to make every gallon work harder for you. We’ll explore why gas purchases are an essential part of everyday life that credit card companies strategically reward, and we’ll begin by showcasing a selection of the best credit cards tailored to put more points, miles, or cash back into your pocket, ensuring you never leave money on the table again.

1. The Untapped Potential: Why Gas Station Spending is a Goldmine for Points

Gas station purchases are an undeniable and essential part of everyday life for most households, a fact well-recognized by credit card companies. This ubiquity in consumer spending is precisely why many issuers offer some of their most lucrative rewards for transactions at the pump. It’s a category that consistently sees high volume, making it an attractive target for reward incentives.

The context states unequivocally that “Gas station purchases are an essential part of everyday life, and credit card companies know this. That’s why many of them offer lucrative rewards for spending at the pump.” This isn’t just about small, infrequent savings; it’s about a consistent opportunity to earn. Over the course of a year, these rewards can truly add up, contributing significantly to your overall financial well-being and reward balances.

Whether your preference leans towards using points for dream travel experiences, acquiring desirable merchandise, or simply receiving cash back to offset daily expenses, every single trip to the gas station can bring you one step closer to achieving your reward goals. It’s a foundational spending category that, when managed strategically, can become a powerful engine for accumulating valuable credit card rewards. Ignoring this potential means leaving tangible value on the table.

2. Chase Sapphire Preferred® Card: The Traveler’s Choice for Versatile Rewards

The Chase Sapphire Preferred Card frequently tops lists as a “staff favorite at TPG” and is lauded as an excellent choice for those new to credit card rewards, especially individuals ready to delve into the world of valuable transferable points. Its welcome offer allows new cardholders to “Earn 75,000 bonus points after you spend $5,000 on purchases in the first three months from account opening,” providing a substantial initial boost to your rewards balance. While there is a $95 annual fee, the benefits often outweigh this cost for many users.

While gas is not a specific bonus category on this card, you will consistently “earn a flat rate of 1 point per dollar spent when you pay with this card at the pump.” What truly elevates the Sapphire Preferred, even with its standard gas earning rate, is the inherent value of its Ultimate Rewards points. “Every point you earn on this card is valuable since Chase has lots of great airline and hotel transfer partners,” and critically, “there are often several opportunities to take advantage of transfer bonuses throughout the year,” maximizing the redemption value of your accumulated points significantly.

Beyond gas, the Sapphire Preferred shines across popular spending categories, making it a versatile “chameleon.” Cardholders “earn 5 points per dollar spent on travel booked through Chase Travel,” alongside an “up to $50 annual hotel statement credit on hotels booked through this portal.” Furthermore, you’ll “enjoy 3 points per dollar spent on dining, select streaming services and online groceries and 2 points per dollar spent on all other travel purchases,” enhancing its appeal as a comprehensive travel rewards card. Its lack of foreign transaction fees also makes it “the perfect travel companion.”

This card is particularly well-suited for those whose spending is concentrated in dining, streaming, and travel, complementing its basic gas earning. By combining the points earned on gas with those from its bonus categories, cardholders can quickly build up a valuable stash of Ultimate Rewards points, easily transferable to partners like Hyatt or United for luxurious redemptions. It’s a powerful tool for optimizing travel dreams from everyday spending.

3. **Blue Cash Preferred® Card from American Express: A Cash Back Powerhouse for Everyday Essentials**

The Blue Cash Preferred Card from American Express stands out as a “fantastic starter card for those just getting into credit card rewards,” offering straightforward earning and redemption options. However, its robust reward structure also makes it “great for the more seasoned credit card veteran seeking to maximize their spending across multiple categories.” It comes with a compelling welcome offer: “Earn $250 in the form of a statement credit after spending $3,000 on eligible purchases within the first six months of account opening.” The card boasts a “$0 introductory annual fee for the first year, then $95,” making it accessible for new users.

This card is a champion for cash back enthusiasts, particularly excelling in everyday spending. It provides a “decent rate of 3% cash back at U.S. gas stations” and features the “crown jewel reward category on this card — 6% cash back at U.S. supermarkets (on up to $6,000 per year, then 1%).” This combination has allowed the card to “more than paid for itself thanks to the hundreds of dollars I’ve earned in cash-back rewards” for its long-time holders, proving its consistent value over the years.

Redemption options for the Blue Cash Preferred are designed for convenience, with “Cash back… received in the form of Reward Dollars that can be redeemed as a statement credit and at amazon.com checkout.” This flexibility allows cardholders to easily offset expenses or cover online purchases. For example, a cardholder noted, “In May 2024, I reserved a private room at a Manhattan karaoke bar for a birthday celebration for around $300; more than half that figure was covered by the cash back I had earned on my Blue Cash Preferred.” This illustrates the direct and tangible impact of its cash back.

Beyond its primary earning categories, the card offers additional benefits that cement its place in a wallet. These include “the up to $120 annual Disney Streaming statement credit (up to $10 back per month, valid for U.S. websites only; subject to auto-renewal; enrollment required)” and “3% cash-back rate on transit.” These perks, combined with its strong gas and grocery earning, ensure the Blue Cash Preferred earns “a well-deserved spot… year after year for over a decade.”

4. **Bank of America® Customized Cash Rewards credit card: Flexibility for Tailored Earnings at the Pump**

For those who prioritize earning cash back without the burden of an annual fee, the Bank of America Customized Cash Rewards credit card presents a compelling option. “The Bank of America Customized Cash card doesn’t charge an annual fee, so you can keep it year after year without worrying about that additional expense.” It also offers an attractive welcome bonus: “Earn a $200 online cash rewards bonus after spending $1,000 on purchases within the first 90 days of account opening.”

The standout feature of this card is its remarkable flexibility in earning. “Each month you get to select which category you want to earn 6% cash back (for the first year, then 3%) in” from a diverse list that includes “Gas and EV charging stations.” This allows cardholders to adapt their reward strategy to their fluctuating spending habits, ensuring they always get an elevated rate in their most relevant category. Other choices include online shopping, dining, travel, drugstores, and home improvement/furnishings.

In addition to the chosen category, cardholders “also earn 2% cash back on grocery store and wholesale club purchases,” a significant perk that extends value to another essential spending area. It’s important to note that “Both the elevated categories noted above are limited to a $2,500 maximum each quarter,” after which the earning rate reverts to 1% cash back on purchases. This cap encourages strategic planning for maximizing quarterly returns.

A truly unique advantage for Bank of America customers is the potential to “qualify for the Bank of America Preferred Rewards® Program.” This program can significantly boost earning rates, with bonuses ranging “between 25% and 75% depending on which tier you’re in.” For example, a Platinum Honors, Diamond, or Diamond Honors member could receive a “75% bonus for a total of 5.25% cash back” on their chosen category, including gas, demonstrating the profound impact this program can have on your rewards.

5. **Costco Anywhere Visa Card by Citi: The Ultimate Card for Warehouse Club Members and Road Warriors**

For individuals with a Costco membership, the Costco Anywhere Visa Card by Citi is an almost indispensable tool for maximizing rewards, especially at the pump. “Costco fans can easily benefit from holding the Costco Anywhere Visa.” Crucially, “If you have a Costco membership, getting — and keeping — this card costs nothing thanks to its lack of an annual fee,” making it a highly attractive, no-cost addition for members who frequent the warehouse.

This card truly excels in its gas earning rates, making it a top contender for drivers. Cardholders “earn 5% cash back on gas at Costco, and earn 4% cash back on other eligible gas and EV charging purchases for the first $7,000 combined spend per year, and then 1% thereafter.” This impressive rate not only covers traditional gasoline vehicles but also extends to electric vehicle charging, demonstrating its versatility and forward-thinking design for various types of commuters.

The value of the Costco Anywhere Visa extends well beyond just fuel. It also offers “solid cash-back rates in other popular categories, like 3% at restaurants and on eligible travel purchases.” For Executive members, “the travel rate can be stacked on top of the 2% cash back Executive members get with their premium membership for a combined 5% cash back on travel purchases,” though this additional 2% does not apply to the gas category. Even so, the gas rewards alone are substantial.

While the card offers exceptional earning potential, its redemption process is unique. Rewards are issued annually “each February” in the form of a certificate, which can then be redeemed for cash or merchandise at Costco. “I can see how this calendar may be off-putting to some,” particularly those who prefer more frequent access to their rewards. However, for those who don’t mind the annual payout, the significant cash back earned makes it a “no-brainer” for maximizing spending at Costco and on fuel.

6. Chase Freedom Flex®: Mastering Rotating Categories for Elevated Gas Rewards

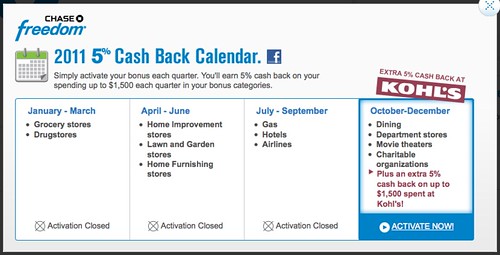

The Chase Freedom Flex is widely regarded as “easily one of the best cash-back cards on the market,” primarily due to its innovative rotating bonus categories. It offers “generous rates in key spend categories, including 5% cash back in rotating bonus categories (on up to $1,500 in combined purchases each quarter you activate) and at least 1% cash back across all other purchases.” This structure provides incredible opportunities for maximizing rewards throughout the year, all without an annual fee.

One of the most appealing aspects for drivers is that “Gas has been included as a bonus category one quarter per year since TPG began tracking the bonus categories for this card in 2014.” This means that “chances are that you’ll be able to take advantage of earning 5% on gas expenses three months out of the year as a Freedom Flex cardholder.” Timing your significant gas purchases during these quarters can lead to substantial rewards accumulation.

Beyond its rotating 5% categories, the Freedom Flex ensures you’re always earning. It offers “5% cash back on travel purchased through Chase Travel℠,” “3% on dining (including takeout and eligible delivery services),” and “3% on drugstore purchases,” complementing its 1% cash back on all other purchases. This comprehensive earning structure ensures that “you’re earning rewards every time you pay, no matter the purchase.”

Moreover, the Freedom Flex comes with impressive perks for a no-annual-fee card, elevating its value beyond just cash back. These benefits include “cellphone protection, shopping protections and trip cancellation and interruption insurance.” Crucially, when paired “with another Chase card that earns Ultimate Rewards points — like the Chase Sapphire Preferred Card, the Chase Sapphire Reserve®… or the Ink Business Preferred® Credit Card — you can convert your cash back to this valuable point currency,” unlocking even greater potential for travel or other high-value redemptions.

Our journey through the landscape of credit card rewards for gas has already highlighted how strategic card usage can turn routine fill-ups into significant reward gains. We’ve seen how various cards offer distinct advantages, from robust cash back to valuable transferable points. Now, let’s delve even deeper into more excellent credit card options and sophisticated strategies that can further optimize your gas spending, ensuring every dollar spent at the pump contributes meaningfully to your financial and travel goals. These next selections and tips are designed to provide even more versatility, whether you’re a casual driver, a small business owner, or a dedicated traveler.

This continued exploration will unveil additional powerful tools and actionable advice. We’ll introduce more top-tier cards and then equip you with advanced techniques, such as stacking rewards with loyalty programs, effectively activating bonus categories, and critically, how to choose the ideal gas credit card that perfectly aligns with your individual spending patterns and reward preferences. The goal remains clear: to ensure you are maximizing every single opportunity to earn and save.

7. Chase Freedom Unlimited®: Flexible Cash Rewards for Diverse Spending

The Chase Freedom Unlimited stands as an incredibly flexible option for cardholders who appreciate straightforward cash back across a wide array of purchases. It’s often lauded as an excellent card for both credit card novices and seasoned pros, adept at filling any gaps in an existing reward-earning strategy. With a compelling welcome offer, new cardholders can “Earn a $200 bonus after spending $500 on purchases in your first three months of account opening.”

One of the most appealing features for everyday spending is its consistent earning rate. Chase Freedom Unlimited cardholders will “enjoy earning at least 1.5% cash back across all purchases outside of the bonus categories featured on this card.” This means every fill-up, whether at your local station or on a long road trip, automatically earns a respectable 1.5% back. Such a flat cash-back rate ensures that you are always accumulating rewards without needing to track rotating categories or specific merchant types.

Beyond its strong baseline earning, the Freedom Unlimited offers elevated rewards in key spending areas. Cardholders can “earn 5% cash back on travel purchased through Chase Travel,” making it a valuable companion for booking trips. Additionally, it provides “3% cash back on drugstore purchases” and “3% cash back on dining at restaurants — including takeout and eligible delivery services.” These categories cover frequent expenses for many households.

Crucially, as a no-annual-fee card, “getting and keeping it is a net positive year after year assuming responsible card usage.” For those who also hold another Chase card that earns Ultimate Rewards points, like the Chase Sapphire Preferred or Sapphire Reserve, the Freedom Unlimited offers even greater potential. You can “transfer your cash rewards into Chase Ultimate Rewards points,” unlocking higher redemption values for travel or other premium experiences.

8. Wyndham Rewards Earner Business Card: A Powerful Tool for Business Owners on the Go

For small-business owners with a penchant for Wyndham properties and a need for robust gas rewards, the Wyndham Rewards Earner Business Card presents a compelling proposition. This card is designed to cater specifically to the needs of business travel and everyday operational expenses. Its welcome offer allows cardholders to “Earn up to 75,000 bonus points: 50,000 points after spending $4,000 on purchases and paying the annual fee in full within 90 days of account opening and earn another 25,000 points after spending $12,000 on purchases within 365 days of account opening.” While it carries a $95 annual fee, its benefits can easily justify the cost for the right user.

This card truly shines with its earning potential on essential business expenditures, particularly gas. It offers a “generous 8 points per dollar spent” on gas purchases, making it a standout option for those who frequently fuel up for business travel or operations. This impressive rate ensures that every gallon bought contributes significantly to your rewards balance, turning a necessary expense into a valuable asset.

Beyond gas, the Wyndham Rewards Earner Business Card is a powerhouse for Wyndham loyalists, earning an equally robust “8 points per dollar spent on Hotels by Wyndham.” This dual earning capability on both gas and hotel stays makes it an ideal choice for business owners whose travel often involves stays at Wyndham properties. Additionally, cardholders can “maximize their business expenses by earning 5 points per dollar spent on marketing, advertising and utilities,” covering a broad spectrum of common business costs.

The card sweetens the deal with a “reward balance boost of 15,000 bonus points each anniversary year,” providing a consistent stream of additional rewards. Business owners also benefit from “automatic Diamond elite status that confers perks like suite upgrades and a welcome amenity at check-in.” Other valuable features include “complimentary employee cards for easier expense tracking” and the “absence of foreign transaction fees,” which is a significant advantage for international business travel.

9. Wyndham Rewards Earner Plus Card: Rewarding Loyal Wyndham Guests and Commuters

If you’re a frequent guest at Wyndham properties but prefer a consumer-focused card with a slightly lower annual fee, the Wyndham Rewards Earner Plus Card could be an excellent fit. This card offers a fantastic balance of hotel and everyday spending rewards, making it a compelling option for those who want to maximize their points on both travel and gas. Its welcome offer is a solid “Earn 45,000 bonus points after spending $1,000 on purchases in the first 90 days of account opening.” The card comes with a $75 annual fee, which is lower than its business counterpart.

The Wyndham Rewards Earner Plus Card truly stands out for its strong earning rates in categories important to many consumers. It allows cardholders to “enjoy earning 6 points per dollar spent at Hotels by Wyndham and on gas purchases.” This makes it a formidable choice for your everyday commute and any leisure travel involving Wyndham properties. For a no-nonsense approach to earning substantial points on two major spending categories, this card is a “sleeper hit.”

Further enhancing its appeal, the card also provides elevated earning on dining and groceries. You’ll “earn 4 points per dollar spent on dining and at grocery stores,” covering even more of your routine household expenses. This comprehensive reward structure ensures that your card is working hard for you across multiple facets of your daily life, making every purchase an opportunity to accumulate valuable points.

Moreover, the Wyndham Rewards Earner Plus Card comes with valuable loyalty benefits that enhance the travel experience. Cardholders receive “automatic Platinum elite status” with Wyndham, which can unlock perks like preferred rooms and late checkout. Additionally, you’ll receive “7,500 bonus points each anniversary year,” consistently boosting your rewards balance simply for maintaining the card. It’s a solid choice for those seeking integrated travel and gas rewards.

10. U.S. Bank Altitude® Connect Visa Signature® Card: No-Annual-Fee Travel and Gas Rewards

For a no-annual-fee option that doesn’t skimp on impressive perks and earning rates, especially for travelers, commuters, and foodies, the U.S. Bank Altitude Connect Visa Signature Card is a strong contender. It’s a versatile card designed to cater to a broad range of spending habits, providing valuable points without the burden of an annual fee. New cardholders can “Earn 20,000 bonus points after spending $1,000 on net purchases in the first 90 days of account opening.”

This card delivers exceptional rewards in travel-related categories, making it a particularly attractive choice for those who frequently book trips. Cardholders will “earn 5 points per dollar spent on prepaid hotels and car rentals booked directly in the Altitude Rewards Center.” Furthermore, it offers “4 points per dollar spent on travel purchases made directly with airlines, hotels and car rentals,” ensuring robust earnings whether you book through the portal or directly with providers.

Crucially for this discussion, the Altitude Connect Visa also shines brightly in the gas category. You’ll “earn 4 points per dollar spent at gas and EV charging stations (up to your first $1,000 each quarter; excludes discount stores, supercenters and wholesale clubs).” This high earning rate, coupled with its inclusion of EV charging, makes it a valuable asset for a wide range of drivers. It’s an excellent way to accumulate points on a routine expense without paying an annual fee.

Beyond travel and gas, the card extends its elevated earning to other popular categories. You can “earn 2 points per dollar spent on dining, on streaming services and at grocery stores (excluding discount stores, supercenters and wholesale clubs).” Additionally, cardholders can “enjoy up to $100 in statement credits toward their TSA PreCheck or Global Entry application fee (every four years)” and a “complimentary Priority Pass membership that allows four no-cost visits to over 1,600 airport lounges all over the world.” While its points may not be as universally transferable as some currencies, its impressive benefits make it a solid choice if its bonus categories align with your spending.

11. Stacking Rewards: American Airlines Teams Up with Shell and the Fuel Rewards® Program

Maximizing your gas rewards isn’t just about using the right credit card; it’s also about intelligently layering different loyalty programs. One powerful example of this synergy is the partnership between American Airlines AAdvantage® and Shell’s Fuel Rewards® program. This collaboration allows savvy travelers to “earn 3 AAdvantage® miles for every gallon of Shell fuel you purchase,” transforming routine fill-ups into significant boosts for your flight mileage.

Participating in this program is straightforward. First, you need to “Join the AAdvantage program if you’re not already a member.” Then, simply “Link your AAdvantage account to your Fuel Rewards account” and “Ensure your Fuel Rewards account name matches your AAdvantage account.” Once set up, every eligible Shell fuel purchase will automatically accrue AAdvantage miles, helping you get closer to your next dream vacation.

There’s an added incentive for new members: “AAdvantage members can earn 250 AAdvantage miles when they join Fuel Rewards.” However, an important consideration for existing Fuel Rewards members is that “When you choose to earn AAdvantage miles, you’ll forfeit your Gold or Silver status fuel savings.” For individuals who prioritize travel, however, “earning miles may be more valuable in the long run” than a few cents off per gallon.

The real power of this program comes from its stacking potential. As a critical “Stacking Tip,” you can “combine the 3x AAdvantage miles from Shell with the 5% cash back on gas purchases from the Chase Freedom Flex℠ to double-dip your rewards.” This strategy allows you to earn both valuable airline miles and cash back simultaneously, truly making every gallon work harder and accelerating your reward accumulation substantially. It’s an effective way to leverage multiple programs for enhanced returns.

12. Advanced Tips to Maximize Your Gas Station Reward

Beyond selecting the right credit card, there are several advanced techniques and smart habits you can adopt to squeeze even more value from your gas station spending. These proactive measures can significantly boost your overall reward accumulation, turning every trip to the pump into a strategic financial move. Implementing these tips ensures you’re not leaving any rewards on the table.

One crucial strategy revolves around activating bonus categories, particularly with cards like the Chase Freedom Flex. As the context notes, “To make sure you’re earning the total 5% cash back, you’ll need to activate the bonus category.” This simple but essential step is required each quarter and can be done conveniently “Online: Go to Chase Ultimate Rewards and log in to your account,” via the “Chase Mobile App,” “Phone: Call the number on the back of your card,” or even “In-Person: Visit any Chase branch or ATM.”

Strategic planning for your purchases can also yield substantial benefits. If you anticipate hitting the spending cap on a bonus category, such as the Freedom Flex’s $1,500 limit, consider “maxing it out and then continue the Chase Freedom Unlimited for 1.5x points or the Capital One Venture X.” This ensures you always earn at an elevated rate. Furthermore, remember to “Stack with Fuel Rewards Programs” beyond airline partnerships; many gas stations have their own loyalty initiatives that can be used in conjunction with your credit card.

Don’t overlook the power of combining points from partner cards. “If you also hold a Chase Sapphire Preferred® Card, you can combine your Ultimate Rewards points and maximize your redemption value by transferring points to travel partners like Hyatt, United, or one of the many other travel transfer partners.” This synergy between cards can unlock significantly higher value for your accumulated points, particularly for travel redemptions.

Finally, explore additional savings avenues. “Use Mobile Payment Apps” as some gas stations offer discounts for in-app payments. Always “Join Fuel Rewards Programs” like Shell Fuel Rewards, which “can help you save a few cents per gallon,” adding up over time. Also, consider “Cashback Apps: Apps like Dosh or Rakuten often have additional cash-back offers for gas station purchases,” providing another layer of savings on top of your credit card rewards.

Read more about: Unlock Hundreds in Savings: The Essential Guide to Maximizing Your Car’s Fuel Efficiency and Debunking Gas Myths

13. Key Considerations for Selecting Your Perfect Gas Credit Card

Choosing the ideal credit card for gas rewards can seem daunting given the multitude of options available. However, by focusing on a few key factors, you can narrow down your choices and find a card that perfectly aligns with your financial habits and goals. The good news is that there’s a card out there for every type of spender and every budget.

Your “Preferred rewards” currency should be a primary consideration. If you’re passionate about “transferable credit card points and want a multipurpose product that earns solid rewards across several categories, a card like the Chase Sapphire Preferred is an excellent option.” Conversely, “If you’re a cash-back enthusiast, consider an option like the Amex Blue Cash Preferred or the Capital One Quicksilver Cash Rewards.” For newcomers to rewards, a cash-back card often provides “a more comfortable introduction” to earning and redeeming.

Another critical factor is the “Welcome bonus.” This initial offer can provide a substantial jumpstart to your rewards balance. When evaluating a gas-specific credit card, always “factor in whether the welcome bonus offers you decent value in addition to the main reward categories featured on the card you’re considering.” A generous welcome bonus can significantly enhance the overall value proposition of a new card, making it worthwhile to meet spending requirements.

Understanding your “Spending habits” is paramount. “The best reward strategy is one that covers the categories you spend the most money in.” For many, this includes “groceries, travel, dining, streaming and gas.” When selecting your gas credit card, consider a card that not only offers “elevated reward rates each time you fuel up” but also provides strong earnings “across other categories, too.” A well-rounded card simplifies your reward strategy.

Lastly, consider the “Annual fee.” These fees “run the gamut from $0 to sky-high.” Your willingness to pay an annual fee will influence your options. Many excellent no-annual-fee cards are available, providing great value without an extra cost. However, some cards with an annual fee offer benefits and earning rates that can easily outweigh the cost, especially for high spenders or those leveraging premium perks.

Read more about: Beyond the Sticker Price: Uncovering the True Financial Commitment of Car Ownership

14. Final Thoughts: Fill Up Your Tank and Your Rewards Balance

Dispelling the myth that gas station purchases are a poor category for credit card rewards, our exploration has clearly demonstrated that the opposite is true. With the right strategy and the right cards in your wallet, every trip to the pump can be a significant opportunity to maximize your points and cash back. It’s about being informed and intentional with your spending.

According to the U.S. Bureau of Labor Statistics, the average household dedicates “more than $3,000 on gas purchases each year.” In a climate of fluctuating and often climbing pump prices, transforming these essential expenditures into a consistent stream of “travel rewards or cash-back” is simply smart financial management. It’s a substantial amount of spending that no savvy consumer should overlook.

Whether you’re taking advantage of “5% cash back on gas station purchases this quarter” with the Chase Freedom Flex, leveraging the high earning rates of a Costco Anywhere Visa, or combining rewards with programs like American Airlines’ partnership with Shell, the opportunities are abundant. The ultimate goal is to ensure you’re “getting the most value out of every fill-up,” aligning your rewards with your personal financial goals.

In essence, “if you drive a vehicle that runs on gas or needs to be charged, you need a gas credit card.” Failing to utilize a card optimized for gas spending means you’re “leaving money on the table.” With a diverse range of flexible options available, from no-annual-fee cards to premium travel cards, you have the power to turn a routine necessity into a powerful engine for building your rewards balance and achieving your financial aspirations. Choose wisely, activate your bonuses, and watch your rewards grow.