In an era where urban centers are increasingly dense and dynamic, the ownership of a personal vehicle, once a symbol of freedom and convenience, is progressively transforming into a complex liability. This shift extends far beyond the familiar woes of traffic congestion or scarce parking; it delves into the very fabric of city infrastructure and the intricate legal pathways drivers must navigate when that infrastructure fails them.

Indeed, the financial burdens and profound frustrations associated with vehicle damage directly attributable to municipal negligence are becoming an undeniable aspect of city life. Drivers often find themselves caught in a predicament where a city’s failure to maintain its public assets can lead to significant repair costs, unforeseen expenses, and a challenging legal battle to seek redress. Understanding the specific legal avenues available, as well as the formidable hurdles posed by governmental immunity, is no longer merely advantageous but essential for any urban motorist.

This in-depth exploration illuminates the multifaceted landscape of municipal liability, offering a comprehensive understanding of the legal grounds for claims, the procedural intricacies of filing a lawsuit against a city, and the common scenarios where vehicle damage occurs. It also meticulously details the potential defenses that municipalities might employ, providing a critical framework for affected parties to make informed decisions and pursue appropriate compensation.

1. **Legal Grounds for Suing a City**When drivers consider legal action against a city for damage sustained by their vehicles, identifying the precise legal foundation for such a lawsuit is paramount. The most frequently cited basis for claims against a municipality is negligence. A city may be deemed liable if it demonstrably fails to uphold its infrastructure to a reasonable standard of maintenance, thereby creating hazardous conditions for the public.

For instance, if a city has knowledge of a hazardous pothole but neglects to repair it, and this oversight directly results in vehicle damage, a negligence claim can be justified. To successfully pursue such a claim, the plaintiff must meticulously demonstrate three key elements: that the city possessed a duty to maintain the road, that it breached this duty through its inaction or insufficient action, and that this breach was the direct and proximate cause of the vehicle’s damage.

Beyond negligence, cities can also face liability for violating specific statutory duties. Many municipalities are governed by statutes or ordinances that explicitly mandate certain maintenance and safety standards for public infrastructure. Should a city fail to comply with these explicit obligations, it may be held legally accountable for any damages that arise as a direct consequence.

An example of this might involve a city ordinance requiring routine roadway inspections. If the city neglects to conduct these mandated inspections, and vehicle damage subsequently occurs due to an undetected hazard, this failure to adhere to its statutory duties could form a robust basis for a lawsuit. Such regulatory breaches highlight a clear deviation from established legal requirements.

In certain circumstances, a city’s liability might be established under the legal doctrine of nuisance. This principle applies when a city’s actions, or indeed its inactions, unreasonably impede the public’s fundamental use and enjoyment of property. For instance, if a city is aware of a persistently flood-prone area but fails to implement measures to address this known hazard, and this oversight leads to vehicle damage, affected individuals could potentially pursue a nuisance claim. This type of claim underscores the city’s responsibility to prevent conditions that substantially interfere with public welfare.

Read more about: The Shocking Truth Behind Late-Night TV’s Free Speech Showdowns: 14 Untold Tales of Executive Pressure and Comedian Crackdowns

2. **Understanding Governmental Immunity**One of the most formidable obstacles encountered when initiating legal action against a city for vehicle damage is the principle of governmental immunity. This long-standing legal doctrine shields government entities from being subjected to lawsuits unless very specific exceptions are applicable. The underlying rationale for this protection is to prevent an overwhelming volume of litigation that could significantly impede essential governmental functions and exhaust vital public resources.

However, it is crucial to understand that governmental immunity is not an absolute shield; its application and extent vary considerably across different jurisdictions and can be limited or expressly waived under certain conditions. Numerous states, recognizing the need for accountability, have enacted what are known as Tort Claims Acts. These legislative frameworks precisely delineate the circumstances under which a city or other governmental entity can be held liable for damages.

These Tort Claims Acts typically impose stringent procedural requirements on claimants. A common and critical stipulation is the necessity of providing timely notice of the claim to the city, often within a relatively short period following the incident. This formal notification serves a dual purpose: it alerts the city to the potential for legal liability and affords it a crucial opportunity to investigate the issue and potentially address the underlying problem before further incidents occur.

Furthermore, immunity may be waived if the city’s activities are classified as proprietary functions rather than governmental ones. Governmental functions are those traditionally associated with the essential duties of governing, such as maintaining public roads or providing police services. In contrast, proprietary functions encompass activities that could realistically be performed by private entities, such as the operation of a public utility or a municipal parking garage.

The distinction between these two types of functions can often be complex and is frequently a point of contention in litigation, but it remains a critical determinant in assessing whether governmental immunity applies to a specific claim. Courts typically scrutinize the nature of the activity and whether it generates profit or serves a more commercial purpose, which often indicates a proprietary function, thus potentially nullifying the city’s immunity defense.

Read more about: Samantha Ruth Prabhu: An Unfiltered Look at the Reign and Resilience of a South Indian Icon

3. **Filing a Claim Against a Municipality**The process of formally filing a claim against a municipality for vehicle damage demands a meticulous and structured approach, as it is governed by distinct procedural requirements that differ significantly from typical lawsuits. The foundational first step in this process is to meticulously gather comprehensive documentation pertaining to the incident. This evidence should include, but is not limited to, clear photographs of the vehicle damage, detailed repair estimates from reputable garages, official police reports if the incident warranted one, and any and all correspondence exchanged with city officials.

Such an exhaustive collection of evidence is indispensable; it serves to substantiate the full extent of the damage incurred and clearly delineates the circumstances that led to the event. Without robust documentation, the credibility and strength of the claim can be severely undermined, potentially leading to delays or an outright denial of compensation.

The next crucial step involves accurately identifying the specific municipal department or entity that is designated to handle such claims. This vital information is often readily available and accessible through the city’s official website, or it can be obtained by directly contacting city hall for guidance. Once the responsible entity is identified, the submission of the claim typically requires the completion of a formal claim form.

These forms, which may be provided either online or in a physical paper format, demand detailed information regarding the incident, the claimant’s contact particulars, and a precise outline of the specific compensation being sought. Accuracy, thoroughness, and consistency in completing this form are not merely advised but essential, as any errors, omissions, or discrepancies can invariably introduce significant delays into the processing timeline or, more severely, lead to the claim’s eventual denial.

Following the submission of the formal claim, the municipality will undertake a thorough review process, which frequently involves a detailed investigation into the incident’s specifics. During this investigatory phase, the city may well request additional information or seek clarification on various aspects of the claim. Claimants must be prepared to actively engage with city representatives and to readily provide any further evidence or documentation that may be requested to bolster their case.

Should the city acknowledge liability after its internal review, it may extend a settlement offer to the claimant. However, it is important to understand that such an offer is not a guaranteed outcome. When a settlement is proposed, claimants are strongly advised to meticulously scrutinize its terms and, critically, to consult with a qualified legal professional. This expert review ensures that the offered compensation is fair and adequately addresses all losses incurred, safeguarding the claimant’s interests in what can often be a complex negotiation.

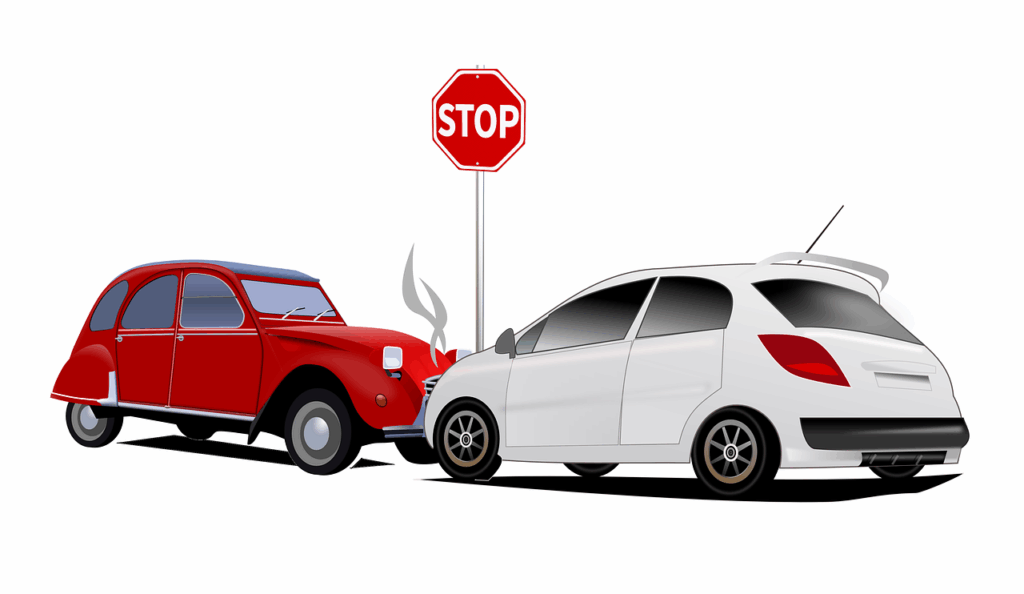

4. **Common Scenarios: Poorly Maintained Roads**Among the most frequent scenarios giving rise to vehicle damage claims against a city are those stemming from poorly maintained roadways. The pervasive issue of potholes, coupled with uneven road surfaces and eroded pavement, can inflict substantial damage on vehicles, often resulting in severe consequences such as tire blowouts, wheel damage, or significant suspension system issues. Municipalities bear a fundamental duty to maintain their roadways in a safe and passable condition for all drivers, and any failure to uphold this duty can directly result in liability.

To successfully pursue a claim predicated on poorly maintained roads, claimants must compellingly demonstrate that the city was not only aware, or reasonably should have been aware, of the road’s hazardous condition but also failed to undertake timely and appropriate corrective action. This requires a focused effort to gather evidence that establishes the city’s negligence.

Instrumental in establishing such a claim can be various forms of evidence, including official maintenance records, documented reports of previous complaints lodged by other citizens regarding the same road defect, and high-quality photographs that vividly depict the perilous state of the road. Additionally, meticulously documenting the exact location of the incident, along with the precise date and time it occurred, can significantly strengthen the claim. This specificity allows for a direct correlation with known problem areas that the city may have systematically neglected, painting a clear picture of municipal oversight.

5. **Common Scenarios: Construction Zone Hazards**Construction zones, while essential for urban development and infrastructure improvement, regrettably represent another prevalent source of vehicle damage claims against municipalities. These temporary environments often present a unique array of hazards that can lead to accidents or significant vehicle damage. Such dangers typically include the presence of loose gravel, abrupt and uneven surfaces, improperly marked detours, or even inadequate signage that fails to sufficiently warn drivers of changing conditions. The onus is on municipalities to ensure that these active construction zones are not only clearly marked but are also maintained in a manner that is safe for all motorists traversing them.

Should a city fail to implement adequate safety measures within these zones, it may very well be held liable for any resulting damages or injuries. Claimants who find their vehicles damaged in such circumstances should prioritize gathering comprehensive evidence. This includes, but is not limited to, photographs of the specific construction site, particularly highlighting any inadequately marked hazards or insufficient signage. Collecting witness statements from individuals who observed the incident or the hazardous conditions can also provide crucial corroboration.

Furthermore, reviewing the construction permits and associated safety plans that are typically filed with the city can offer invaluable insights into whether proper procedures and safety protocols were diligently followed. Demonstrating that the city, or its contracted agents, deviated from these established plans can substantially bolster a claim of negligence, illustrating a clear failure to adhere to prescribed safety standards and thereby increasing the likelihood of successful legal recourse.

6. **Common Scenarios: Fallen Trees or Debris**Another significant cause of vehicle damage that can lead to claims against a city involves fallen trees or various forms of debris on public roadways. This scenario is particularly prevalent and hazardous during periods of adverse weather conditions, such as severe storms or high winds. Cities are generally entrusted with the responsibility of maintaining public spaces, which explicitly includes the proactive removal of hazardous debris and the care of public trees. If a city is aware of potential risks, such as dead or precariously overhanging trees, and fails to promptly address these known dangers, it may be held liable for any resulting vehicle damage.

To effectively support such a claim, it is essential for the claimant to demonstrate unequivocally that the city had prior knowledge of the potential hazard and, despite this knowledge, neglected to take timely and appropriate action to mitigate the risk. This crucial element can often be established through various forms of evidence, including official maintenance logs that document inspections or complaints, reports of previous incidents involving similar hazards in the vicinity, and, if available, expert assessments pertaining to the condition of the fallen tree or the nature of the debris.

Moreover, meticulously documenting the precise timeline of events is paramount. This includes recording when the city was first notified of the hazard—whether through a citizen complaint or internal reporting—and the exact time when the damage to the vehicle occurred. Establishing this temporal sequence helps to paint a clear picture of municipal negligence, underscoring the city’s failure to act decisively within a reasonable timeframe to prevent foreseeable harm.

7. **Potential Defenses by the City**When confronted with a claim for vehicle damage, municipalities frequently employ a range of defenses designed to either mitigate or entirely deny liability. These defenses can be intricate, and claimants must possess a clear understanding of them as they meticulously prepare their legal case. A commonly invoked defense is the assertion that the city lacked prior knowledge of the hazard. Municipalities may argue that they were genuinely unaware of the specific issue, such as a newly formed pothole, and therefore could not reasonably have been expected to remedy it in a timely manner. To counteract this, claimants are tasked with presenting compelling evidence of the city’s actual or constructive knowledge, such as records of prior citizen complaints, internal inspection reports that clearly highlight the defect, or even widespread public awareness of the hazard.

Another defense frequently raised by cities attributes the damage to an “act of God.” This legal concept refers to natural and unavoidable catastrophes that are demonstrably beyond human control or foresight, such as exceptionally severe weather events like hurricanes or earthquakes. In such instances, the city might contend that it could not have reasonably foreseen or prevented the incident, thereby absolving itself of responsibility. Claimants must carefully differentiate between truly unforeseeable natural phenomena and situations where the city’s negligence contributed to the damage—for example, by failing to promptly clear debris after a storm, thus exacerbating a hazard that could have been mitigated.

Furthermore, the defense of contributory negligence is a frequent strategy employed by municipalities. This involves the city asserting that the driver’s own actions or inactions significantly contributed to the vehicle damage. For example, if it can be demonstrated that a driver was exceeding the speed limit, operating their vehicle recklessly, or blatantly disregarding posted road signs when the incident occurred, the city may argue that these actions were the primary, if not sole, cause of the damage. To effectively overcome this defense, claimants must provide robust evidence demonstrating that their driving conformed to all applicable traffic laws and that the city’s negligence was, in fact, the predominant and direct factor leading to the damage, thereby establishing clear responsibility on the part of the municipality. Understanding these potential defenses is critical for claimants, enabling them to anticipate challenges and meticulously fortify their case during the legal process.

The preceding discussion illuminated the complex legal terrain urban drivers face when city infrastructure leads to vehicle damage. Yet, the liabilities of city car ownership extend beyond direct claims against municipalities, encompassing a broader spectrum of financial challenges, most notably the escalating costs of vehicle insurance. In dense urban environments, the mere act of owning and operating a car introduces a unique set of risks that directly translate into significantly higher premiums, transforming what was once a simple expense into a substantial financial burden. This section delves into the multifaceted financial implications of urban driving, unpacking the dynamics of high car insurance rates, the specific timelines that can dictate a driver’s ability to seek redress, and strategic approaches to mitigate these ever-increasing costs, painting a comprehensive picture of the true price of urban mobility.

Read more about: Beyond the Shadows: An In-Depth Look at Why Modern Cars Are Being Stolen in Broad Daylight

8. **The High Cost of Urban Car Insurance**In an increasingly congested urban landscape, the financial commitment of owning a vehicle extends far beyond its purchase price and routine maintenance. For many city residents, car insurance premiums represent an unexpected, yet substantial, portion of their annual expenses, contributing significantly to the perception that having a car can be a liability.

Indeed, car insurance rates in major urban centers consistently tend to be higher than those in less populated small towns. This disparity is rooted in a confluence of factors inherent to city life, including elevated accident rates, a greater volume of claims filed, and increased risks such as vehicle thefts, all of which insurers meticulously factor into their premium calculations.

Moreover, the cost of car insurance is not uniform across a city; it can vary significantly even between different ZIP codes within the same municipality. This micro-level variation underscores the granular detail with which insurance companies assess risk, often leading to stark differences in premiums for drivers living just a few miles apart.

Given these dynamics, securing affordable coverage in an urban environment necessitates a proactive approach. Comparing car insurance quotes from multiple providers is not merely advisable but essential, as it helps drivers find the most cost-effective policy tailored to their specific location and unique circumstances.

Read more about: Unpacking Excellence: The Definitive Guide to 2025’s Most Coveted Luxury SUVs and Their Unrivaled Safety Innovations

9. **Location, Location, Location: How Cities and ZIP Codes Drive Premiums**The adage of “location, location, location” profoundly impacts car insurance rates, with a driver’s address being one of the most significant determinants of their personalized premium. From the state level down to individual cities and even specific ZIP codes, geographical factors play a critical role in how insurers assess risk and, consequently, set prices.

For instance, the data clearly illustrates a dramatic variance in costs across the nation’s urban centers. Cities like North Miami Beach in Florida, with an average monthly cost of $297, Tarzana, California, at $286, and Marksville, Louisiana, at $285, exemplify the highest echelons of car insurance expenses in the U.S. These figures highlight how locale directly translates into financial burden for city motorists.

This trend persists at an even finer resolution, demonstrating that car insurance premiums can fluctuate significantly depending on one’s ZIP code within a major metropolis. For example, some of the most expensive ZIP codes for car insurance are found in the heart of major cities, such as 90010 in Los Angeles, 11235 in New York, and 19125 in Philadelphia.

Insurers are keenly focused on accurately assessing risk, and “every city has its own unique set of risks as it relates to crime rates, frequency of accidents, population density, weather, road conditions, and average claims history.” These multifaceted local conditions directly influence the likelihood of a policyholder filing a claim, thereby dictating the ultimate cost of their insurance coverage.

10. **Beyond Location: Other Key Factors Influencing Your Rates**While location undeniably plays a pivotal role in determining car insurance premiums, it is by no means the sole factor. The cost of car insurance is ultimately individualized, differing for every driver based on a complex interplay of personal and vehicular characteristics that contribute to an insurer’s overall risk assessment.

Among the most impactful personal factors are age and gender. Generally, teens and younger drivers face the highest rates, reflecting their statistically higher accident involvement; premiums typically decrease as drivers mature. Additionally, because female drivers tend to have fewer accidents than their male counterparts, women often pay slightly less for car insurance.

One’s driving record stands as a critical indicator of risk. Drivers with a history marred by accidents, speeding tickets, or other traffic violations are consistently charged higher rates than those who maintain a clean record. This directly reflects the insurer’s perception of a driver’s propensity for future claims.

Furthermore, in many states, a driver’s credit score is utilized by car insurance companies to establish a “credit-based insurance score,” which directly influences the cost of their policy. A strong credit history can, therefore, contribute to securing more favorable insurance rates, underscoring the broad impact of financial responsibility.

The type of vehicle being insured also plays a significant role. Brand new or high-performance cars generally cost more to insure than older, more utilitarian models, primarily due to higher repair or replacement costs. Moreover, the specific types of coverage chosen and their associated limits, along with any optional endorsements, directly impact the final premium amount, allowing drivers a degree of control over their policy costs.

Read more about: Classic Car Showdown: 7 Icons That Soar in Value & 7 That Struggle to Hold Their Own

11. **Why Urban Environments Elevate Insurance Risk**Cities, by their very nature, present a magnified risk profile for car insurers, contributing significantly to the elevated premiums faced by urban drivers. This inherent risk is a primary driver behind the designation of car ownership as a financial liability in these densely populated areas. As Justin Yoshizawa, director of product management state at Mercury Insurance, notes, insurers are intently “focused on assessing risk when determining rates, and every city has its own unique set of risks.”

These unique urban risks include a markedly “higher frequency of accidents” due to increased traffic volume, narrower streets, and complex intersections. The sheer number of vehicles and pedestrians in close proximity translates into a greater likelihood of collisions, from minor fender-benders to more serious incidents, thereby increasing the probability of claims.

Beyond accident frequency, cities often face higher rates of “vehicle thefts” and vandalism, adding another layer of risk that insurers must account for. Densely packed neighborhoods and public parking areas can present more opportunities for criminal activity, prompting insurers to levy higher premiums to offset potential payouts for stolen or damaged vehicles.

Furthermore, factors such as localized “weather, road conditions, and average claims history” are closely scrutinized. Cities with persistently poorly maintained roads, as highlighted in the preceding section, often lead to more claims for tire, wheel, and suspension damage. These localized environmental hazards contribute to a higher baseline risk, affecting premiums for all drivers in the area.

Less obvious, but equally significant, are the elevated systemic costs associated with urban claims. These include the “cost and frequency of litigation, medical care, and the prevalence of auto insurance fraud” which tend to be higher in urban settings. Additionally, the generally “higher repair costs” in certain metropolitan areas mean that when a claim is filed, the payout is often larger, further justifying higher premiums to maintain insurer solvency.

Read more about: Unpacking Excellence: The Definitive Guide to 2025’s Most Coveted Luxury SUVs and Their Unrivaled Safety Innovations

12. **Navigating the Municipal Claim Timeline: A Critical Factor**The “price of urban driving” extends beyond insurance premiums to encompass the stringent procedural timelines involved in seeking redress for vehicle damage caused by municipal negligence. While Section 1 detailed the legal steps, understanding these deadlines is crucial from a financial liability standpoint, as missed timeframes can result in drivers bearing significant, unexpected costs.

When a municipality is potentially liable for vehicle damage, “special statutes of limitation apply,” which differ markedly from standard personal injury or property damage claims. These specific timelines are designed to protect city entities from perpetual claims while also allowing them time to investigate incidents thoroughly.

For instance, in jurisdictions like New York, a critical initial step is serving a “Notice of Claim” on the city and the relevant agency, which must occur within a strict “90 days of the accident.” This window is non-negotiable, and a failure to comply can unequivocally “forever bar you from later bringing a lawsuit against the City for your accident-related injuries,” leaving the driver fully responsible for all repair costs.

Following the submission of this notice, there is typically a waiting period—for example, “at least 30 days must pass before a lawsuit can be commenced.” Critically, a further “one-year and 90-day statute of limitations” is in place for filing the actual lawsuit in court. These tight, layered deadlines necessitate immediate and meticulous action from affected urban drivers, transforming adherence to legal procedure into a direct determinant of financial recovery.

13. **Finding Affordable Coverage in Expensive Urban Hubs**Given the substantial car insurance costs prevalent in many urban environments, drivers must become savvy consumers when seeking coverage. It is “essential to compare rates from several companies” to identify “the most affordable policy for your location and unique driver profile,” particularly in cities notorious for high premiums.

Research indicates that even within the same expensive city, certain insurance providers consistently offer more competitive rates. For instance, in New York, which features some of the nation’s highest premiums, companies like Progressive and NYCM Insurance are frequently found to offer the cheapest car insurance options.

Similarly, drivers in Los Angeles, another high-cost urban area, can often find more affordable coverage through providers such as GEICO and CSAA Insurance (AAA). In Chicago, Progressive and Auto Club Group – ACG (AAA) stand out for offering some of the most economical policies, demonstrating that diligent comparison shopping is key to mitigating urban insurance expenses.

These examples underscore the wide disparity in pricing among different insurance carriers, even for comparable coverage. By actively seeking out quotes from a diverse range of companies, urban motorists can strategically navigate the costly landscape of city car insurance, potentially uncovering significant savings that make car ownership more financially sustainable.

Read more about: The $2,000 European Dream: How Americans Are Redefining a Richer Life and Finding a Permanent Home Abroad

14. **The Impact of Neighborhood Shifts on Your Premium**A factor often overlooked by urban residents, yet one with direct financial implications for car owners, is the effect of moving to a “different neighborhood within the same city” on car insurance premiums. This seemingly minor change in address can, in fact, cause your rate to fluctuate, highlighting the granular level at which insurers assess risk.

Insurance companies continuously update their risk models based on hyper-local data. If you relocate to a neighborhood characterized by a lower crime rate, fewer traffic accidents, or better road conditions than your previous area, it is entirely “possible that your rate could decrease,” offering an unexpected financial reprieve.

Conversely, a move to a new neighborhood “where more insurance claims are filed” — perhaps due to higher traffic density, increased instances of vandalism, or a history of specific weather-related damages — could unfortunately lead to an increase in your premium. This variability emphasizes that urban insurance costs are not just city-wide averages but are deeply tied to specific sub-localities.

Therefore, for any urban driver contemplating a move, it is prudent to proactively investigate the potential impact on their car insurance costs. The “only way to know how much you will pay for car insurance in a new neighborhood is to get personalized rate quotes for your new address.” If an increase is projected, obtaining new quotes from alternative carriers might reveal more favorable rates, allowing for informed financial planning.

Read more about: The Future Is Now: 13 Game-Changing 2026 Car Models That Are Absolutely Worth the Wait

15. **Proactive Strategies to Slash Your Insurance Costs**Navigating the high cost of car insurance in an urban environment requires a strategic approach. Fortunately, several proactive measures can significantly help drivers reduce their premiums, making car ownership in the city a more manageable expense regardless of where they reside.

Firstly, drivers should diligently explore and take advantage of the numerous discounts offered by car insurance companies. These can include savings for good driving records, multiple cars, anti-theft devices, or even completing defensive driving courses, all designed to help motorists lower their auto insurance policy costs.

Secondly, the importance of “shopping around” cannot be overstated. Since “every insurance company charges different rates, even for the same types and amounts of coverage,” securing quotes from at least three carriers is paramount. This practice is especially critical when personal circumstances change, such as adding a new driver, receiving a speeding ticket, or acquiring a different vehicle.

Another impactful strategy involves improving one’s financial standing. In most states, a robust “credit history is one of the factors that can affect your premium.” Consequently, enhancing your credit score can contribute to locking in a lower annual rate, reflecting an insurer’s perception of greater financial responsibility.

Finally, consider bundling policies and adjusting deductibles. Many insurers provide discounts to drivers who “bundle their car insurance with another policy, like home insurance or renters insurance.” Furthermore, for coverages that require a deductible, such as collision and comprehensive insurance, selecting a “higher deductible will result in a lower premium,” though it is vital to ensure you have the chosen deductible amount readily available in savings should a claim arise.

Read more about: Unlock Hidden Savings: An Expert’s Guide to Slashing Your Car Insurance by 30% Annually – No Company Switch Required!

Ultimately, while the allure and dynamism of urban living are undeniable, the unexpected liabilities associated with car ownership—from the arduous process of seeking recompense for municipal negligence to the often-staggering costs of car insurance—present a significant challenge for city residents. Navigating this landscape effectively demands not only an acute awareness of one’s legal rights and procedural obligations but also a proactive, informed approach to managing vehicular expenses. By understanding the intricate factors that drive up costs and diligently exploring avenues for mitigation, urban drivers can reclaim a measure of control, ensuring that their vehicle remains an asset rather than an unforeseen burden in the bustling metropolis.