Home Box Office (HBO) has long stood as a titan in American premium television, synonymous with groundbreaking original programming, unedited cinematic experiences, and a commitment to commercial-free viewing. Since its pioneering launch on November 8, 1972, HBO has not only shaped the evolution of pay television but has consistently adapted to an ever-changing media environment. Its journey is a masterclass in strategic innovation, marked by both monumental successes and the calculated cessation of services or programming that no longer aligned with its overarching vision, each decision reflecting complex industry dynamics.

In the fiercely competitive world of entertainment, even established networks must continuously re-evaluate their offerings, leading to transformative decisions that can reshape their entire identity. These shifts, often driven by intricate business realities, technological advancements, or evolving subscriber demands, represent pivotal moments in a network’s history. Understanding these strategic imperatives provides deep, insider perspective into how an industry leader like HBO navigates its path forward, balancing creative ambition with commercial viability.

This in-depth analysis delves into the foundational ethos of HBO, tracing its origins and early expansions, before dissecting the strategic decisions behind the discontinuation of some of its pioneering, albeit short-lived, channel experiments. We will explore how astute business acumen and market realities shaped the very fabric of HBO’s offerings, laying the groundwork for the premium television empire we know today. This examination reveals the strategic shifts that were critical in defining HBO’s enduring legacy and its path through a dynamic media landscape.

1. **HBO’s Pioneering Vision: The Birth of a Premium Television Giant**The story of Home Box Office begins with a bold concept that fundamentally revolutionized how Americans consumed television, setting a new standard for premium content. Charles Dolan, through Sterling Information Services, founded Manhattan Cable TV Services in September 1966. This marked the first urban underground cable television system in the United States, yet this initial venture grappled with consistent financial losses, pushing Dolan to conceive a radical new approach to entertainment for its survival.

While on a family vacation in the summer of 1971, Dolan devised a comprehensive proposal for a cable-originated television channel. This conceptual service, initially codenamed “The Green Channel,” was designed to offer unedited theatrical movies licensed from major Hollywood studios and live sporting events. Crucially, all programming would be presented without advertising, a stark contrast to broadcast television, and sold for a flat monthly fee directly to prospective subscribers.

This innovative model was explicitly intended to help Sterling Manhattan Cable Television turn profitable and prevent Time-Life, Inc. from withdrawing its vital investment. Dolan’s foresight recognized an unmet demand for high-quality, uninterrupted entertainment, a niche traditional television was failing to fill. His vision was not just about content delivery, but about creating an entirely new value proposition to secure financial stability and growth.

On November 2, 1971, Time Inc.’s board of directors approved the “Green Channel” proposal, granting Dolan a $150,000 development grant. The eventual name, “Home Box Office,” was carefully chosen to convey that the service would be their “ticket” to movies and events they could experience in their own home. This pioneering spirit ultimately laid the groundwork for modern pay television, setting HBO apart from its inception as a truly premium offering.

2. **The ‘Green Channel’ Blueprint: Charles Dolan’s Innovation and Time Inc.’s Investment**Charles Dolan’s “Green Channel” proposal was more than just an idea; it served as a meticulously crafted blueprint for an entirely new form of television distribution and consumption. His strategic vision for a subscription service, offering unedited movies and live sports free from traditional advertising, was revolutionary and daring, directly challenging the prevailing broadcast television model. This forward-thinking approach aimed to capture an audience hungry for superior quality and an uninterrupted viewing experience.

The crucial approval from Time Inc.’s board of directors, underscored by the significant $150,000 development grant, clearly demonstrated the perceived potential of Dolan’s concept. This substantial financial commitment from a major publishing unit was a powerful testament to the belief in the long-term viability of a subscription-based model, particularly during a period when Sterling Manhattan Cable Television continued to face financial struggles. It represented a calculated yet confident investment in an untapped market.

Discussions leading to the service’s official nomenclature were equally strategic. While “Sterling Cable Network” was initially considered, the executive staff ultimately settled on “Home Box Office.” This choice was deliberate, designed to immediately communicate to potential subscribers the unique value proposition: unparalleled access to premium entertainment from the comfort of their residences, signifying a departure from public theaters and crowded arenas.

The momentous launch of Home Box Office occurred at 7:30 p.m. Eastern Time on November 8, 1972. It initially became available to subscribers of Teleservice Cable in Wilkes-Barre, Pennsylvania, starting with an inaugural telecast of an NHL game. This was immediately followed by its first movie presentation, the 1971 film “Sometimes a Great Notion.” This dual-content strategy of combining live sports and feature films established the core programming identity HBO would build upon for decades, unequivocally proving the soundness of Dolan’s initial “Green Channel” conceptualization.

3. **The Genesis of Multiplexing: Expanding Content Choices to Combat Churn**As HBO firmly established itself as a leading premium network, a new strategic challenge emerged: subscriber churn. To effectively mitigate this and enhance value, Home Box Office Inc. made a pivotal announcement on May 8, 1991, detailing plans to launch two additional channels for both HBO and its sister network, Cinemax. This move was groundbreaking, positioning them as the very first subscription television services to introduce “multiplexed” companion channels.

The then-CEO, Michael Fuchs, coined the term “multiplexed” to draw an analogy between the expanded programming choices offered by the new channels and the diverse viewing options available in multi-screen movie theaters. The underlying objective was transparent: to provide subscribers with a significantly broader array of content, critically available at no extra charge, thereby substantially enhancing the perceived value and appeal of their existing subscriptions. This strategic initiative represented a direct response to the escalating need for greater programming diversity.

On August 1, 1991, this innovative vision began to materialize through a carefully orchestrated test launch. TeleCable customers in select markets, including Overland Park, Kansas; Racine, Wisconsin; and suburban Dallas, who subscribed to either service, started receiving two additional HBO channels, HBO2 and HBO3, as well as a secondary Cinemax channel, Cinemax 2. These new channels were designed to offer distinct schedules, drawing from the networks’ extensive movie and original programming libraries. This diversification provided compelling alternative viewing options and strategically bolstered subscriber retention.

In the years that followed, HBO further expanded its multiplex offerings, evolving its channel suite. HBO2, for instance, would later be known as HBO Plus and eventually HBO Hits (rebranding on September 4, 2025), while HBO3 transformed into HBO Signature and then HBO Drama (also rebranding on September 4, 2025). This continuous evolution underscored HBO’s commitment to adapting its service structure, always seeking to optimize its content delivery and maintain its competitive edge in a rapidly evolving premium television market.

4. **The Short-Lived Experiment of Take 2: Unpacking Early Family Niche Failure**Long before multi-channel offerings became standard, HBO embarked on an early experiment to broaden its audience with a companion service named Take 2, informally “HBO Take 2.” Launched on April 1, 1979, this network was specifically marketed to a family audience, meticulously structuring its theatrical inventory to strictly exclude R-rated films. It represented HBO’s inaugural attempt at creating a family-oriented pay service, strategically designed to cater to prospective customers who harbored reservations about HBO’s cost or its primary channel’s content.

Take 2 sought to differentiate itself by introducing distinct showcase blocks throughout its schedule. These included “Movie of the Week,” “Center Stage,” “Family Theater,” “Passport,” and “Merry-Go-Round.” G- and PG-rated movies shown on Take 2 typically made their debut no less than 60 days after their initial telecast on the main HBO channel, ensuring a curated, family-appropriate experience. The strategic intent was for Take 2 to serve as a “mini-pay” premium service, marketed as a lower-priced add-on.

Despite its well-intentioned strategies, Take 2 proved to be a short-lived venture, ceasing operations on January 31, 1981. The official reasons cited for its closure were “slow subscriber growth and difficulties leveraging HBO’s increasingly wide cable carriage to ensure supportable distribution.” This challenge highlighted the difficulties of establishing a niche channel without sufficient market penetration and strong affiliate support.

At the time of its shutdown, HBO was already strategically bolstering Cinemax, its secondary, lower-cost “maxi-pay” service, which launched in August 1980. Cinemax experienced significantly greater success with its diverse mix of recent and older movies, quickly surpassing Take 2 in viability and effectively replacing it as an add-on on many cable systems. This illustrated a critical shift in HBO’s strategy for companion channels and the unforgiving nature of the early pay-TV market for services unable to rapidly scale.

5. **Festival’s Fading Signal: The Constraints of Channel Capacity and Niche Limitations**Building on lessons from Take 2, Home Box Office, Inc. made another dedicated foray into family-oriented programming with Festival, a premium cable television network operating from 1986 to 1988. Festival’s strategic objective was distinct: aimed at older audiences objecting to violence and ual content on other premium services, and targeting non-cable or basic cable subscribers without existing premium services. It offered a carefully curated selection.

Festival’s programming slate focused on classic and recent hit movies, documentaries, and original stand-up comedy, concert, nature, and ice skating specials sourced from the parent HBO channel. A particularly notable and innovative aspect was its decision to air re-edited R-rated movies, meticulously adapted to fit a PG rating. This bespoke approach underscored a clear commitment to its family-friendly mandate, aiming to create a comfortable viewing environment for its specific target demographic.

The channel commenced test-marketing on April 1, 1986, on six cable systems owned by its then-sister company, American Television and Communications Corporation. This controlled launch intended to gauge audience reception and refine its distribution strategy. Festival represented a determined effort by HBO to diversify its premium offerings and capture a market segment that felt underserved or alienated by more explicit content.

However, Festival, like Take 2, also faced an untimely demise, shutting down definitively on December 31, 1988. Home Box Office, Inc. explicitly cited “the inability to expand distribution because of channel capacity limitations at most cable company headends” as the decisive factor. With an estimated 30,000 subscribers, Festival lagged significantly behind HBO’s 15.9 million subscribers, underscoring the formidable technical and market barriers that even a thoughtfully designed niche offering could encounter in the still-developing premium cable industry of the late 1980s, particularly when infrastructure was a limiting factor.

6. **Cinemax’s Bold Debut: A Companion Channel’s Rise with a Distinct Identity**Amidst the experimental launches and short-lived operations of channels like Take 2 and Festival, HBO concurrently conceived and launched a companion service that achieved much greater longevity and success: Cinemax. Debuting on August 1, 1980, Cinemax was strategically developed as a direct competitor to existing movie-focused premium channels like The Movie Channel and Home Theater Network, aiming to vigorously carve out its own share of the burgeoning pay television market.

Cinemax’s early success was demonstrably attributed to its shrewd programming strategy. This concentrated on a rich selection of classic movie releases spanning the 1950s to the 1970s, interspersed with curated more recent films. Crucially, all content was presented entirely uncut and without commercial interruption, a significant and highly valued draw in an era characterized by limited headend channel capacity. This focused, commercial-free movie offering resonated strongly and immediately with discerning audiences.

Unlike its flagship counterpart, HBO, Cinemax distinguished itself by proactively maintaining a 24-hour schedule from its very launch, making it one of the pioneering pay cable services to transmit around the clock. This round-the-clock availability, combined with its carefully curated movie library, made Cinemax an exceptionally attractive proposition. It was very frequently sold in a combined package with HBO, often at a discounted rate, a strategic bundling that proved mutually beneficial.

Even in its initial years, Cinemax proactively sought to diversify its programming beyond just movies. Beginning in 1984, the channel judiciously incorporated music specials and some limited original programming, including “SCTV Channel” and “Max Headroom,” into its evolving schedule. This early diversification hinted at the channel’s dynamic approach to content, setting the stage for future shifts and adaptations within the competitive premium entertainment sector and demonstrating an early willingness to experiment beyond its core movie offering.

7. **Cinemax’s Content Evolution: From “Max After Dark” to Action and Back**Cinemax, strategically launched as HBO’s companion channel, has undergone a particularly striking transformation in its programming identity, reflecting broader industry trends and the evolving demands of its audience. Initially focused on a robust library of classic and contemporary films, presented commercial-free and uncut, Cinemax began to diversify by 1984, tentatively exploring music specials and original programming. This early experimentation paved the way for more dramatic shifts in its content strategy as competition intensified and new revenue streams were sought.

A pivotal, and perhaps most widely recognized, aspect of Cinemax’s evolution was the introduction of its adult-oriented softcore pornographic films and series. Airing in varying late-night slots, initially under the “Friday After Dark” banner and later expanded to “Max After Dark,” this content became strongly associated with the channel, distinguishing it in the crowded premium cable landscape. This programming block contributed to Cinemax’s distinct identity and subscriber draw for many years, becoming an unexpected cultural touchstone that capitalized on a specific market segment.

The channel’s trajectory began to shift significantly around 2011, as Cinemax commenced a gradual scaling back of its adult programming. This strategic pivot was a deliberate effort to reorient its focus towards mainstream films and, notably, high-octane original action series, with “Strike Back” premiering in August 2011 and becoming its longest-running original program. This move showcased Cinemax’s ambition to be a serious player in the scripted drama space, leveraging its premium brand association with HBO to attract new viewers and creative talent.

However, this era of original action programming also proved to be finite. In a significant industry-wide reallocation of resources by WarnerMedia, Cinemax eventually eliminated scripted programming after its remaining action series concluded in early 2021. This decision marked a dramatic return to its original structure as a movie-exclusive premium service. The channel’s content strategy was directly impacted by the company’s broader focus on building out the HBO Max streaming service, demonstrating how quickly established linear brands can be reshaped by corporate strategic imperatives.

8. **The Expanding HBO Multiplex: Niche Channels and Thematic Brands**HBO’s strategic vision for “multiplexing” truly blossomed in the years following its initial foray in 1991, propelled by the advent of digital compression codecs. Recognizing the potential for expanded channel capacity, Home Box Office, Inc. announced ambitious plans in February 1996 to grow its multiplex offerings across both HBO and Cinemax to a total of twelve channels. This comprehensive expansion signaled a robust commitment to diversifying content and catering to a wider array of demographic segments within its growing subscriber base, anticipating the demands of an increasingly sophisticated market.

This ambitious vision began to materialize with the launch of HBO Family on December 1, 1996. Specifically designed for family-oriented feature films and television series, including programming for younger children, it carved out a dedicated safe space within the HBO ecosystem. Its debut also coincided with the significant introduction of Mountain Time Zone feeds for key HBO and Cinemax channels, marking a new era of granular regional service for subscription television and enhancing accessibility across diverse geographical locations.

Strategic refinements continued throughout the late 1990s, seeing the umbrella brand “MultiChannel HBO” evolve into “HBO The Works” in April 1998. Concurrent with this rebranding, HBO2 transformed into HBO Plus, and HBO3 became HBO Signature. HBO Signature notably adopted a refined focus, curating content—movies, series, and specials—targeted specifically at a female audience, while still incorporating broader theatrical films and selections from HBO’s extensive original made-for-cable movie and documentary libraries. These shifts demonstrated a sophisticated understanding of audience segmentation and a proactive approach to channel positioning.

The multiplex expansion continued to enrich HBO’s diverse offerings in 1999. On May 6, two more thematic channels debuted: HBO Comedy and HBO Zone. HBO Comedy became the definitive destination for comedic feature films, reruns of HBO’s original comedy series, and both recent and archived stand-up specials. HBO Zone, aimed at young adults aged 18 to 34, presented a mix of theatrical movies, alternative series, documentaries, and music videos. This channel also notably carried some softcore pornographic films in late-night until 2018, underscoring its distinct, edgier positioning for a specific demographic.

The final major piece of this multiplex puzzle arrived on November 1, 2000, with the launch of HBO Latino. This dedicated Spanish-language network was a crucial addition, designed to cater specifically to Hispanic and Latino American audiences. It offered a thoughtful blend of dubbed simulcasts from the primary HBO channel, exclusive Spanish-originated programs, and Spanish and Portuguese series, alongside a selection of domestic and imported Spanish-language films. HBO Latino, succeeding HBO en Español, cemented HBO’s commitment to serving diverse linguistic and cultural communities, ensuring its premium content reached an even broader demographic across the United States.

9. **HBO Family’s Farewell: A Sign of Shifting Priorities**The recent announcement regarding the impending closure of HBO Family serves as a stark illustration of the seismic shifts occurring within the premium television landscape, particularly as legacy channels grapple with the rise of streaming platforms. Launched on December 1, 1996, HBO Family was a deliberate and important addition to the HBO multiplex, crafted with a singular purpose: to provide a safe, curated viewing environment for children and broader family audiences. Its programming was meticulously selected to feature movies and series strictly rated PG-13 and below, ensuring content appropriate for all ages.

Central to HBO Family’s appeal was its dedicated “HBO Kids” block, which aired weekdays from 6:00 to approximately 8:00 a.m., targeting the 2–11 age demographic. This segment, alongside a daily schedule dominated by family-oriented original specials and feature films, solidified its position as the premier destination for wholesome entertainment within the HBO suite. By 2001, HBO Family had fully embraced its role, allowing the flagship HBO channel and other multiplexes to intensify their focus on programming for older, adult audiences without concern for content suitability.

However, the evolving media consumption habits, heavily influenced by the proliferation of on-demand streaming services, have rendered dedicated linear channels like HBO Family increasingly superfluous. On June 11, 2025, it was officially announced, initially by Spectrum and subsequently confirmed by Warner Bros. Discovery two days later, that HBO Family, alongside three of its Cinemax sister networks, would cease operations on August 15, 2025. This decision unequivocally directs viewers towards HBO Max, the company’s comprehensive streaming platform.

The closure of HBO Family is more than just a discontinuation of a channel; it represents a significant streamlining of Warner Bros. Discovery’s content delivery strategy. With a robust library of family-friendly content already available on HBO Max, maintaining a separate linear channel with its associated operational costs becomes redundant. The final programming scheduled to air on the channel—the movie “Igor,” followed by the HBO-produced short documentary “David McCullough: Painting with Words”—will mark the end of an era.

10. **The Great Rebrand: HBO Channels Get a Fresh Look for 2025**The entertainment industry is in a perpetual state of evolution, and HBO, ever at the forefront, continues to demonstrate its adaptability through significant strategic initiatives, including a comprehensive rebranding of several key multiplex channels slated for September 4, 2025. This move is not merely a cosmetic change but a deliberate realignment of its linear channel offerings to better reflect their distinct programming identities and optimize their appeal in an increasingly segmented market. Such rebrands are crucial in clarifying content propositions for subscribers and maintaining relevance in a dynamic media environment.

The upcoming changes will see familiar names transform to better articulate their core programming. HBO2, a channel with a history of rebranding (having previously been HBO Plus and then reverting to HBO2), will once again evolve, this time to HBO Hits. This new moniker clearly positions the channel as a destination for “hits”—likely referring to a steady rotation of popular theatrical and original made-for-cable movies, alongside same-week rebroadcasts of newer films and marathons of original series, providing a high-volume complementary viewing experience to the main HBO channel.

Similarly, HBO Signature, which was launched as HBO3 and then refined to cater to a female audience, will transition to HBO Drama. This rebranding signifies a sharper focus on high-quality dramatic narratives, encompassing premium films, HBO’s acclaimed original series, and specials, appealing to an audience seeking compelling storytelling. The change from “Signature” to “Drama” suggests a more direct and impactful communication of its content offering, moving away from a demographic-specific target to a genre-specific one, which may resonate more broadly with premium drama enthusiasts.

Rounding out this strategic overhaul is the rebranding of HBO Zone to HBO Movies. HBO Zone, originally aimed at young adults and notably carrying some adult-oriented content in its late-night schedule until 2018, will now embrace a clearer, more universal identity as a pure movie channel. This shift suggests a desire to streamline its offering, focusing exclusively on theatrical films and original HBO programs that appeal to a broad adult audience, shedding any lingering associations with its past “zone” or adult programming content. These collective rebrands represent a calculated effort to optimize HBO’s linear portfolio for the future.

11. **HBO Max’s Game-Changing Influence: Reshaping the Linear Landscape**The launch and subsequent evolution of HBO Max, now simply Max, represent the most profound strategic shift in Home Box Office’s recent history, fundamentally altering the calculus for its linear television channels. Conceived as an expanded streaming platform, HBO Max was designed to be the ultimate destination for HBO’s acclaimed content, while also integrating a vast array of programming from other Warner Bros. Discovery properties and exclusive originals. This platform quickly became the centerpiece of HBO’s content strategy, signaling a powerful pivot towards direct-to-consumer digital distribution.

The impact of HBO Max on the traditional linear channels has been significant and multifaceted. One of the most telling consequences was WarnerMedia’s strategic reallocation of programming resources. This led to decisions like Cinemax eliminating all scripted programming after early 2021, shifting the channel back to a movie-exclusive format. Such moves underscore a clear directive from corporate leadership: invest heavily in the streaming platform to drive subscriber growth and engagement, even if it means streamlining or re-prioritizing content on legacy linear channels.

Furthermore, HBO Max has blurred the lines between linear television and streaming, offering unprecedented integration for subscribers. Since December 4, 2024, livestreams of most of HBO’s linear feeds—with the exception of HBO Latino—have become directly accessible on the Max streaming app for American subscribers to its Ad-Free and Ultimate Ad-Free tiers. This innovative feature provides a seamless viewing experience, allowing audiences to consume linear HBO content on their terms, whether through a traditional cable subscription or directly via the streaming platform. It effectively transforms Max into a comprehensive hub for all things HBO.

This strategic convergence extends beyond mere livestreams. Max serves as the primary repository for HBO’s entire catalog of original series, documentaries, and movies, offering them on-demand. This instant accessibility to a deep archive, combined with exclusive streaming-only content, fundamentally changes the value proposition of the linear channels. While the linear feeds still offer curated schedules and premiere windows, the ultimate destination for discovery and re-watching for many is now the streaming service. This dual-pronged approach ensures HBO’s content remains ubiquitous, adapting to how modern audiences prefer to consume premium entertainment.

12. **The Enduring Legacy: HBO’s Adaptability in the Streaming Era**HBO’s remarkable journey, from its pioneering launch in 1972 to its current intricate balance between linear channels and a dominant streaming platform, is an unparalleled testament to its strategic adaptability. Throughout decades of technological evolution and shifting consumer habits, HBO has consistently redefined what constitutes “premium entertainment.” Its history, rich with calculated decisions and innovative experiments, reveals a continuous cycle of reinvention that has been critical to its enduring leadership in the industry.

The strategic maneuvers detailed in this analysis—from the dramatic content reorientation of Cinemax to the necessary rationalization of channels like HBO Family, and the overarching, transformative influence of the HBO Max streaming platform—collectively underscore this unwavering commitment to innovation. HBO has consistently demonstrated a willingness to dismantle or reinvent components of its service when market realities demand it, always with an unwavering focus on reinforcing its position as a purveyor of high-quality storytelling and exclusive content. This proactive approach, even when it means disrupting established models, is a hallmark of its unparalleled success.

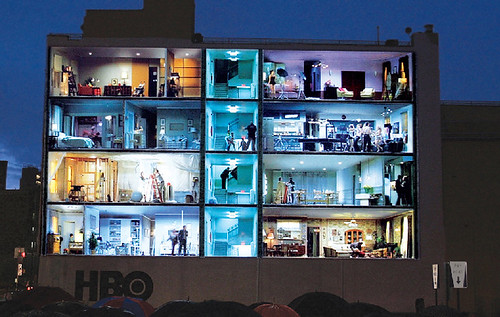

Today, HBO operates a sophisticated, multi-layered ecosystem comprising its six 24-hour linear multiplex channels, the traditional HBO On Demand platform, and its formidable streaming arm, Max. This comprehensive approach allows HBO to effectively cater to a diverse subscriber base, ranging from those who value the curated experience of linear television to the rapidly growing segment that demands on-demand access to an expansive, personalized library. With an impressive subscriber base—approximately 35.656 million U.S. households as of September 2018, and an estimated 140 million cumulative subscribers worldwide—HBO firmly maintains its status as the premium channel with the largest subscriber total in America.

As the media landscape continues its rapid and unpredictable transformation, HBO’s strategic path remains one of calculated agility. The forthcoming rebrands of channels like HBO2 to HBO Hits and HBO Signature to HBO Drama in 2025 further exemplify this proactive foresight, ensuring that even its traditional linear offerings remain fresh, relevant, and clearly defined. The overarching strategy is clear: leverage the brand’s unparalleled reputation for quality and originality across all platforms, guaranteeing that whether consumed through traditional cable, on-demand, or streaming, HBO remains the ultimate destination for groundbreaking entertainment. This unwavering dedication to innovation, in the face of seismic industry shifts, is truly the profound reason why HBO continues not just to survive, but to lead and define the future of premium content.