Amazon Music’s recent acquisition of Art19, a prominent podcast distribution and monetization platform, marks a significant escalation in the tech giant’s ambitions within the rapidly expanding audio advertising landscape. While financial terms remain undisclosed, this move underscores Amazon’s intent to aggressively compete in a sector increasingly vital to the broader digital economy. It’s a clear signal that the company, known for its vast e-commerce and cloud services, sees a crucial strategic advantage in owning a comprehensive suite of podcasting tools and content.

This latest acquisition is not an isolated incident but rather a calculated step in Amazon’s broader strategy to solidify its position in audio. Following closely on the heels of its reported $300 million-plus deal for podcast network Wondery late last year, Amazon is rapidly assembling the pieces necessary to challenge established players and newcomers alike. The landscape of digital audio, particularly podcasts, is witnessing an intense land grab, with major tech firms investing heavily to capture listener attention and, more importantly, advertising dollars.

To truly understand the implications of Amazon’s aggressive push, one must dissect the specific capabilities and assets it is acquiring, examine the robust growth of the podcast market, and contextualize these moves within the fiercely competitive environment dominated by rivals like Spotify and Facebook. This strategic alignment reveals a company intent on leveraging its formidable digital advertising infrastructure to carve out a dominant share in the evolving audio space.

1. **Art19’s Advanced Ad Tech and Monetization Platform**Art19, founded in 2015, represents a sophisticated acquisition for Amazon Music, offering a robust, all-in-one platform for content management and ad operations. The platform’s core strength lies in its ability to provide clients with a centralized hub for podcast distribution and monetization, a capability that immediately enhances Amazon’s advertising toolkit. This integration is critical for Amazon’s stated goal of “rounding out its podcast advertising suite,” equipping it with advanced tools to serve both publishers and advertisers more effectively.

The platform’s performance dashboards are a standout feature, enabling real-time tracking of listener engagement. This includes precise measurement of impressions and downloads, all certified by the IAB Tech Lab standards. Such granular, verifiable data is invaluable in the advertising world, allowing for campaign optimization and demonstrating clear return on investment. It brings a level of transparency and measurability to podcast advertising that is common in digital marketing but has traditionally been more challenging in audio.

Beyond data analytics, Art19 also operates an Ad Creative Studio, which offers assistance with creative strategy and production. This holistic approach means that Amazon isn’t just acquiring a distribution network; it’s gaining capabilities to help advertisers craft more effective campaigns, ensuring premium, host-read ads are seamlessly inserted across various programs. Examples of Art19’s reach include podcasts like the “Late Night with Seth Meyers” podcast, Bravo TV’s “The Daily Dish,” and “Watch What Happens Live with Andy Cohen” audio tie-ins, alongside “Doug Loves Movies.”

Furthermore, Art19’s WarpFeed tool is a notable innovation. It intelligently tracks whether listeners are downloading older episodes of a program and then dynamically inserts up-to-date messaging. This technology addresses a common challenge in podcast advertising, ensuring that ads remain relevant regardless of when an episode is consumed, thereby maximizing advertiser impact and revenue potential. The company’s goal, as stated on its website, is to bring the same level of granular marketing capabilities common across digital to the podcast space, sitting precisely at the intersection of publishers and advertisers.

2. **Wondery’s Premium Content & Exclusivity**The acquisition of Art19 follows a prior, equally significant move: Amazon’s purchase of the podcast network Wondery. This deal, reportedly valued at over $300 million, was fundamentally centered on securing exclusive premium content. Wondery is renowned for producing popular shows such as “Dirty John,” which has captivated millions of listeners and garnered critical acclaim. The strategic imperative here is clear: content is king, and exclusive, high-quality content drives audience engagement and, consequently, advertising revenue.

Amazon Music had only introduced a dedicated podcast section in September, making it a relatively late entrant into the podcast content landscape. The Wondery acquisition immediately elevated Amazon’s standing, providing it with a robust catalog of established hits and a pipeline for future premium productions. This bolsters Amazon Music’s offering, making it a more compelling destination for podcast listeners and, by extension, a more attractive platform for advertisers seeking engaged audiences.

Securing exclusive content is a proven strategy to differentiate a platform in a crowded market. Just as streaming wars are fought over exclusive movie and TV rights, the audio space sees similar battles for exclusive podcast series. Wondery’s popular shows provide Amazon Music with a distinct competitive edge, drawing listeners to its platform and away from competitors. This not only increases listener stickiness but also provides Amazon with proprietary content inventory to monetize through its burgeoning advertising capabilities, now further enhanced by Art19.

3. **Amazon Music’s Broader Podcast Ambitions**Taken together, the Art19 and Wondery acquisitions paint a picture of Amazon aggressively “ramping up podcast dealmaking” with a singular purpose: to close the gap in an area where it has been a “relative latecomer.” For a company that prides itself on market leadership across various sectors, being behind in the burgeoning podcast space was likely an unacceptable position. These strategic purchases are designed to rapidly accelerate its growth and influence in audio.

Amazon’s deeper ambition extends beyond simply offering podcasts; it is a clear attempt to diversify revenue streams, particularly in audio advertising, which is distinct from its traditional music streaming services. While Amazon Music offers music streaming, the podcast market presents a unique opportunity for ad revenue generation. By owning both content (Wondery) and the underlying advertising technology (Art19), Amazon is building an integrated ecosystem designed for maximum monetization efficiency and audience reach.

This integrated approach allows Amazon to control more of the value chain, from content creation and distribution to ad insertion and analytics. Such control enables better ad targeting, more personalized listener experiences, and ultimately, higher revenue per impression. It’s a classic Amazon strategy: build comprehensive infrastructure and services to support a new vertical, then scale rapidly to capture market share.

4. **The Exploding Podcast Advertising Market**Amazon’s significant investments are anchored by the undeniable growth and financial attractiveness of the podcast advertising market itself. According to a recent analysis by the Interactive Advertising Bureau (IAB) and PricewaterhouseCoopers (PwC), advertising revenue for podcasts experienced a substantial 19% year-on-year growth, reaching $842 million in 2020. This growth was particularly robust in the fourth quarter, which saw a 37% gain, underscoring the accelerating momentum towards the end of the year.

These figures are not just historical data; they point to a future rich with opportunity. The IAB and PwC predict that the podcast advertising category at large is expected to surpass an impressive $2 billion in revenue by 2023. Such projections highlight a market ripe for investment and innovation, where early and aggressive movers stand to capture significant portions of future revenue. For Amazon, a company known for its long-term strategic vision, tapping into a market with this kind of projected growth is a logical imperative.

The allure of podcast advertising extends beyond mere financial growth; it represents a unique channel for advertisers to reach engaged audiences. Listeners often form deep connections with podcast hosts and content, leading to higher ad recall and conversion rates, especially for host-read ads, which Art19 specializes in. This combination of rapid market expansion and effective advertising mechanisms makes the podcast space an undeniable frontier for digital advertising giants.

5. **Rival Spotify’s Aggressive Expansion**Amazon’s recent acquisitions do not occur in a vacuum; they are directly influenced by and, in many ways, mirror the aggressive moves made by its rival, Spotify. Spotify, which began as a music streaming service, has in recent years made a massive pivot into audio advertising beyond music, seeing it as a critical means to diversify its revenue streams and reduce its dependence on music licensing fees. This competitive pressure from Spotify is a key driver for Amazon’s accelerated dealmaking.

Spotify’s strategy has involved purchasing a slew of podcasting companies, creating a formidable ecosystem. These acquisitions include major publishers like Gimlet, known for its narrative storytelling; The Ringer, a sports and pop culture network; and Parcast, a true-crime and mystery content producer. Additionally, Spotify acquired the production studio Anchor, which simplifies podcast creation, and audio advertising company Megaphone, a direct competitor to Art19, strengthening its ad tech capabilities.

Just last week, Spotify further expanded its toolkit by acquiring Podz, a startup that leverages machine learning to boost podcast discovery. This acquisition targets a fundamental challenge in the podcast space: helping listeners find new content they love. By improving discovery, Spotify aims to increase overall listening time and, consequently, ad inventory and effectiveness. These moves illustrate a comprehensive strategy to dominate every aspect of the podcast lifecycle, from creation and distribution to monetization and discovery.

Furthermore, Spotify is actively building out its advertising infrastructure. In February, it introduced the Spotify Audience Network, an audio advertising marketplace designed to simplify campaign management across its diverse properties. The company is also integrating podcast listening tools into Facebook, a move designed to broaden the reach of its programs and tap into existing fan communities, further extending its competitive footprint. This aggressive, multi-pronged expansion by Spotify leaves Amazon with no choice but to respond decisively to avoid being outmaneuvered in the rapidly consolidating audio market. While some analysts remain skeptical about podcasts’ ultimate payoff for Spotify, Amazon, which doesn’t “really need podcasts to thrive,” is clearly viewing the category as a way to further fortify its already booming digital advertising business.”

The initial strategic moves and the competitive landscape paint a clear picture of Amazon’s aggressive entry into podcasting. However, to truly grasp the monumental scale of these investments and the underlying rationale, we must delve deeper into the foundational ‘why.’ This involves understanding the intricate synergy with Amazon’s already booming digital advertising business, the enduring influence of its ‘Everything Store’ philosophy, and the profound impact of Jeff Bezos’s unique entrepreneurial journey and builder mentality on the company’s strategic DNA.

6. **The Synergy with Amazon’s Booming Digital Advertising Business**Amazon’s ventures into podcasting are not merely about content or distribution; they are a direct extension of its highly successful and rapidly expanding digital advertising operations. The company’s “other” revenue segment, which predominantly includes advertising sales, experienced a substantial 77% year-on-year surge, reaching $6.91 billion in the first quarter of 2021. This explosive growth underscores advertising as a critical, burgeoning pillar of Amazon’s overall financial health.

Podcasts offer a uniquely fertile ground for digital advertising, distinct from traditional music streaming. The deep engagement listeners often have with podcast hosts and content translates into higher ad recall and conversion rates, particularly for premium, host-read ads—a specialty that Art19 brings to the table. By integrating Art19’s advanced ad tech, Amazon is positioning itself to capture a significant share of this high-value advertising spend, optimizing for effectiveness and measurable outcomes.

The Art19 acquisition specifically allows Amazon to “round out its podcast advertising suite,” providing robust tools for both publishers and advertisers. Its performance dashboards offer real-time tracking of listener engagement, impressions, and downloads, certified by IAB Tech Lab standards. Such granular, verifiable data is invaluable for campaign optimization and demonstrating clear return on investment, aligning perfectly with the data-driven nature of Amazon’s broader digital advertising machine.

Furthermore, the Ad Creative Studio and the WarpFeed tool from Art19 enhance Amazon’s capabilities to craft and deliver highly relevant and up-to-date messaging across diverse programs. This holistic approach ensures that Amazon can not only distribute ads but also actively assist in their creation and ensure their timely delivery, maximizing impact for advertisers. This integrated advertising ecosystem is designed for maximum monetization efficiency and audience reach, leveraging Amazon’s formidable existing infrastructure.

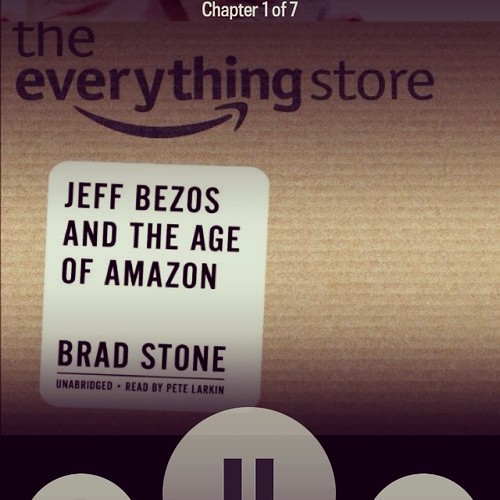

7. **The Enduring ‘Everything Store’ Ethos Applied to Audio**The concept of “The Everything Store” was not just a catchy moniker for Amazon’s book-selling origins; it was a foundational vision articulated even in the brainstorming sessions at D. E. Shaw. This ethos defines Amazon’s relentless pursuit of comprehensive market offerings, whether in e-commerce, cloud computing, or now, audio. The podcast strategy is a prime example of this philosophy being applied to a new and rapidly growing vertical.

When Jeff Bezos and David Shaw conceptualized “The Everything Store,” the idea was to create a new intermediary layer that bypassed traditional retailers. In the audio realm, Amazon is replicating this by building a comprehensive ecosystem that controls content creation (Wondery), distribution, and monetization technology (Art19). This integrated approach allows Amazon to manage more of the value chain, offering a seamless experience for both content creators and advertisers.

By acquiring both a premium content network like Wondery and a sophisticated ad tech platform like Art19, Amazon isn’t just buying pieces of the puzzle; it’s assembling the entire infrastructure for a new “Everything Store” within the audio space. This mirrors its historical strategy of building out end-to-end services and infrastructure to support a new vertical, then scaling rapidly to capture market share.

The goal is not simply to offer podcasts but to become the definitive destination for audio content and advertising, much as it became the definitive destination for online retail. This comprehensive ambition is a direct descendant of the original vision of aggregating vast selections and services under one powerful, integrated platform, extending the “Everything Store” beyond physical goods to encompass the burgeoning world of digital audio.

8. **Jeff Bezos’s Early Entrepreneurial Journey and Builder Mentality**Amazon’s current strategic moves in podcasting are deeply rooted in the foundational experiences and distinct ‘builder mentality’ of its founder, Jeff Bezos. From his earliest days, a clear throughline emerges that explains Amazon’s approach to innovation, problem-solving, and relentless expansion into new domains.

Bezos’s formative years, particularly his summers spent on his grandparents’ 24,000-acre ranch in West Texas, instilled a profound sense of self-sufficiency and practical problem-solving. Living 100 miles from the nearest retail outlet, he witnessed and participated in the necessity of building, fixing, and maintaining everything from tools to farm equipment. This environment cultivated a hands-on, engineering-focused mindset that valued creation and resourcefulness, a stark contrast to mere consumption.

His maternal grandfather, Lawrence Preston Gise, or Pop Gise, a former head of Sandia National Laboratories and an original member of DARPA, significantly influenced young Jeff. Pop Gise introduced him to science fiction and the realms of space, further nurturing an inquisitive and inventive spirit. This intellectual guidance from a figure deeply involved in groundbreaking technological development undoubtedly shaped Bezos’s understanding of large-scale problem-solving and long-term vision.

Bezos’s professional trajectory further cemented this builder mentality. After graduating from Princeton, he first worked for Fitel, a startup developing early network technology for high-speed trading. This experience provided him with an intimate understanding of cutting-edge networked computing and its practical applications. Subsequently, at D. E. Shaw, a firm that viewed itself as entrepreneurial and creative rather than just a quant hedge fund, Bezos flourished. He quickly became a Senior Vice-President, tasked with brainstorming and launching new Internet-based businesses.

It was during his time at D. E. Shaw that Bezos, alongside David Shaw, explored “Internet opportunities” and conceived the idea of “The Everything Store.” They also launched early online ventures like Juno, one of the first free email services, and an online retail brokerage. This period was crucial; it demonstrated Bezos’s ability to identify disruptive technological trends, conceptualize new businesses from scratch, and execute their launch. This history shows that Amazon’s expansion into podcasts is not an anomaly but a consistent application of a deep-seated entrepreneurial drive to build comprehensive solutions in emerging digital spaces.

9. **The Strategic Imperative: Fortifying Digital Advertising and Long-Term Vision**Ultimately, Amazon’s aggressive push into podcasting, marked by the acquisitions of Art19 and Wondery, solidifies a critical strategic imperative: to further fortify its booming digital advertising business. While analysts may debate the ultimate payoff for competitors like Spotify, Amazon is approaching this market from a position of strength, not necessity. The company “doesn’t really need podcasts to thrive,” yet it views the category as a powerful accelerator for an already explosive revenue stream.

This long-term strategic vision is characteristic of Amazon. The company is not merely chasing trends; it is investing in foundational infrastructure and premium content to secure future revenue streams in a market predicted to surpass $2 billion in revenue by 2023. By establishing a robust presence now, Amazon ensures it is well-positioned to capitalize on the continued growth of audio advertising, integrating it seamlessly into its vast digital ecosystem.

The diversification of revenue streams beyond music streaming and e-commerce is a key outcome of this strategy. Podcasts offer a distinct, high-engagement channel that complements Amazon’s existing advertising platforms, allowing for expanded reach and more sophisticated targeting capabilities. This controlled, integrated approach—from content creation to ad delivery and analytics—allows Amazon to maximize monetization efficiency and deliver superior value to both creators and advertisers.

In essence, Amazon’s multi-billion dollar bet on podcasting is a calculated move to reinforce its advertising stronghold and extend its ‘Everything Store’ philosophy into the burgeoning world of audio. It reflects a company driven by a builder mentality and a relentless pursuit of comprehensive market leadership, ensuring its long-term dominance across an ever-expanding array of digital frontiers.