So much of Princess Diana’s life was lived under the intense glare of the public eye, a narrative she herself often shared with remarkable candor. From her complex marriage to then-Prince Charles to the echoes of childhood instability, her story has been told and retold. Yet, even for someone so thoroughly documented, there are still layers to uncover, private moments that offer a glimpse into the woman beneath the beloved public figure. It’s these less explored aspects, captured in rare and intimate photographs, that truly illuminate the journey of a princess who captured hearts around the world.

We often remember Diana as the global icon, the humanitarian, the fashion trendsetter, or the devoted mother. But before the tiaras and the royal engagements, there was Diana Spencer—a girl, a teenager, a working woman navigating the everyday. These extraordinary images take us on a captivating journey back in time, revealing the candid snapshots that chronicle her transformation from Lady Diana Spencer into the formidable Princess of Wales.

Prepare to rediscover the People’s Princess through a collection of photos that invite us behind the velvet ropes, offering an intimate look at the moments that shaped her. Each image tells a story, a chapter in a life lived with grace, compassion, and an unwavering spirit. Let’s delve into these precious memories, celebrating the enduring legacy of a woman who truly changed the world simply by being herself.

1. **A Glimpse into Early Childhood (1962-1965)**Our journey begins with the earliest photographs, taking us back to Diana’s first birthday in 1962. A newly one-year-old Diana Spencer is seen sitting on a blanket at her home at Park House, Sandringham. While she wasn’t born into the Royal Family, she was undeniably a member of British nobility, growing up intimately close to the royal estate, leasing their house directly from Queen Elizabeth, whom Diana affectionately called “Aunt Lillibet” from childhood onward. These images offer a delightful peek into her earliest days, showcasing a future royal long before she knew her destiny.

Just a year later, in 1963, another charming image captures Diana peering out from an old-fashioned pram, still at Park House, Sandringham. At this point, she would have been merely one or two years old. She was the fourth of five children, a family dynamic shaped by the earlier loss of her older brother, John, who died shortly after his birth, and the later arrival of her younger brother, Charles, in 1964. These glimpses into her baby and toddler years paint a picture of innocence and the foundations of a privileged yet complex family life.

According to an original caption from July 1963, we see “Princess Diana aged two at Park House in Sandringham.” Even at this tender age, her family life was marked by significant strain. Her parents harbored a strong desire for a male heir, which would later become a contributing factor to their eventual divorce, despite eventually having a son. These early photos, while sweet, hint at the underlying pressures that would subtly influence her upbringing.

By 1964, a toddler Diana is captured pushing a pram, wearing a bright red quilted hooded jacket and blue trousers, complete with darling checkered socks and matching red shoes. This playful image shows a vibrant child, full of life. A year later, around the age of four, a portrait reveals a self-composed young Diana, embodying the quiet dignity often found in children of the nobility. She was initially home-schooled by a governess, a common practice of the time, before eventually being sent to a traditional school, illustrating the structured yet protected environment of her early years.

2. **The Impact of Divorce & ‘Duch’ (1969-1971)**The mid-to-late 1960s brought significant upheaval to young Diana’s life, an experience that undoubtedly shaped her future resilience and empathy. By 1969, when this photo was taken, Diana would have been around eight years old. Crucially, she was only seven when her parents’ divorce proceedings began, a period marked by intense contention over the custody of the children. Her father, for instance, famously refused to let her go live with her mother, a deeply acrimonious situation that left an indelible mark on the young Diana and her siblings.

Summer 1970 brings a more relaxed image: a barefoot Lady Diana posing with a croquet mallet while on holiday in Itchenor, West Sus. This snapshot provides a window into a more carefree side of her childhood, contrasting with the domestic turmoil she was experiencing. It’s perhaps no surprise that Diana excelled at many activities, including piano and ballet, showcasing a multifaceted talent that extended beyond academic achievements, as she was known not to be an A-grade student.

Interestingly, within her family, Diana was informally known as “Duch” from childhood onward, a nickname hinting at her duchess-like attitude. This familial foresight would prove to be quite prophetic, all things considered. This particular nickname, captured in family anecdotes, speaks volumes about a certain regal bearing or perhaps a strong will that was evident even in her youth. This photo, like others from her summer holidays in Itchenor, West Sus in 1971, captures a seemingly idyllic moment, yet it carries the weight of her family’s complex history.

The casual setting of these holiday pictures, with Diana enjoying her time in West Sus, belies the deeper emotional landscape of her formative years. The nickname “Duch” offers a charming insight into how her family perceived her, a testament to an innate quality that would one day define her public persona. These images are more than just photographs; they are fragments of a life being molded, preparing her, in unforeseen ways, for the extraordinary path ahead.

3. **Pre-Royal Life: Work and Independence (1974-1980)**Moving into her teenage years and early adulthood, Diana began to take on a more mature appearance, which we would eventually recognize in the adult princess. In 1974, photographed on the Isle of Uist in the Western Isles of Scotland, she shows signs of the poised young woman she was becoming. At this stage, she was likely engaged in voluntary work at the psychiatric Darenth Park Hospital, a quiet act of service that foreshadowed her future humanitarian endeavors and her inherent compassion.

Some family photos from this period also highlight Diana’s deep affection for animals, including a heartwarming image of her being kissed by her pet pony, “Scuffle.” While she wasn’t known as an avid horse-rider throughout her life, a fact some might find surprising given her royal connections, she did partake in the activity occasionally after becoming a member of the Royal Family. These candid moments reveal a nurturing side, a genuine connection to the natural world and its creatures.

By 1980, Diana’s life took a turn towards more independent living and work. These photos served as many people’s introduction to the future Princess Diana, showing her as a young woman making her own way. She was working diligently as a nanny for an American family, alongside her role as a nursery teacher’s assistant at the Young England School. During this time, she shared a flat in West London with three roommates, embracing a relatively normal, self-sufficient life before the whirlwind of royal duties consumed her.

One particularly charming and relatable image captures her leaving the Young England kindergarten, giggling and blushing after having gently reversed her car into a tree. The incident occurred while she was attempting to drive and simultaneously shield her face from the ever-present photographers. This delightful anecdote, accompanied by the photo, beautifully illustrates her burgeoning independence and the early, sometimes awkward, encounters with the media scrutiny that would define her existence. It’s a genuine moment of human vulnerability and charm, proving she was just like anyone else in many ways.

4. **The Paparazzi Storm & Budding Romance (1980)**The year 1980 marked a seismic shift in Lady Diana Spencer’s life, as her relationship with Prince Charles became public knowledge, unleashing an unrelenting barrage from the paparazzi. Suddenly, her everyday activities, previously private, became front-page news. This aggressive snapping of photos became a constant companion, a practice that, tragically, would continue throughout her entire life. Before their marriage, countless images like this one captured Diana simply walking around London, her every move scrutinized and documented.

Amidst this burgeoning media frenzy, Diana could often be seen attending the Wimbledon tennis tournament, a quintessential royal and aristocratic summer activity. In 1980, with public attention on her relationship with Charles reaching a fever pitch, her presence at such events only amplified the speculation. The pair would eventually get engaged in February of 1981, but these earlier photos capture the nascent stages of their high-profile courtship, played out under the flashbulbs.

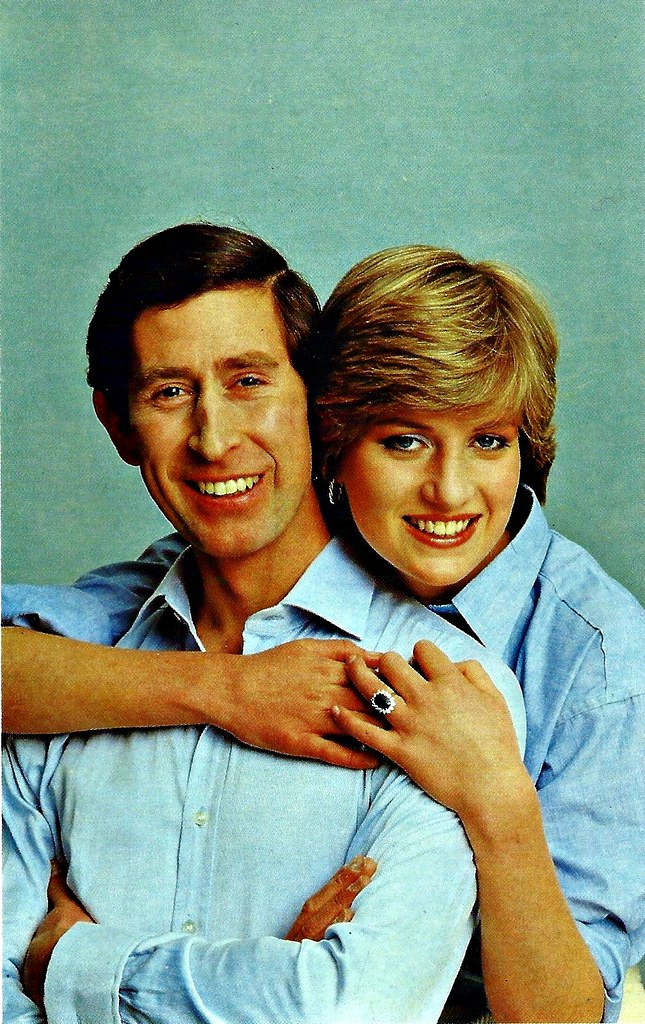

One poignant photograph from 1980 shows Diana and Charles holding hands while walking around London, a seemingly simple gesture imbued with immense significance given the circumstances. They had first met in 1977 when Charles was dating her sister, Sarah Spencer, a detail that adds another layer to their intertwined history. By this point, they were firmly in the official “courting period,” a whirlwind romance that would culminate in their engagement just months later, and their grand wedding in July 1981.

Another telling image captures Diana surrounded by press photographers and reporter Howard Foster, shortly before the official announcement of her engagement to Charles, Prince of Wales. The caption reveals the palpable tension and the sheer scale of the attention that had grown to be nearly unbearable for the young woman. Even before her royal marriage, the spotlight was intense, hinting at the immense pressures she would face as she stepped into her destiny as a future queen consort, becoming one of the most photographed women in the world overnight.

5. **Engagement & The Nation’s Embrace (1980-1981)**As 1980 drew to a close and 1981 dawned, the world held its breath in anticipation, culminating in the dazzling announcement of Diana Spencer’s engagement to Prince Charles. These photos from this pivotal period capture the excitement and the nation’s burgeoning affection for their future princess. One image, taken in December 1980, just a few months before the official announcement, shows Diana outside her London flat, confidently accessorized with a pearl necklace, scarf, and a woven wicker basket tote bag. This pic, as the text describes, cemented her as a style icon for every generation, even before her royal title.

Following the joyous engagement announcement on February 24, 1981, Diana and Prince Charles posed for pictures at Craigowan Lodge on the royal family’s Balmoral Estate in Scotland. While Diana’s sapphire and diamond engagement ring was an undeniable showstopper, it was her cozy sweater that became instantly famous, sparking a global scramble among ladies to purchase it themselves. This early example of the “Diana Effect” underscored her immediate and powerful influence on fashion and public sentiment, marking her as a true trendsetter from day one.

Further solidifying her iconic status, a month before her wedding, Diana attended a polo match in Windsor after the Ascot races, on June 16, 1981. This moment, captured in a relaxed photo, shows her taking a brief respite from the pre-wedding whirlwind, a stunning vision even in a casual setting. These images illustrate the rapidly increasing public affection, as she transformed from Lady Diana Spencer into the beloved “People’s Princess” even before her nuptials. Her ability to connect with the public was already palpable.

One particularly touching photo from 1981 shows schoolboy Nicholas Hardy kissing Lady Diana Spencer’s hand after presenting her with a daffodil during her visit to Cheltenham. This spontaneous display of affection from the public was a harbinger of the deep connection she would forge with people worldwide. It was clear from these early days that Diana possessed a unique charm that drew people to her, a warmth that transcended the formal barriers of royalty and set the stage for her enduring legacy.

6. **The Royal Wedding & Early Marital Bliss (1981)**The summer of 1981 brought the world to a standstill for the grand spectacle of the Royal Wedding, a day that etched Princess Diana into global consciousness forever. One iconic moment captures her sparkling in a red Bellville Sassoon dress at the London premiere of the 1981 James Bond film *For Your Eyes Only*. With her wedding to Prince Charles just weeks away, thousands of adoring fans waited for hours outside the theater, desperate to catch a glimpse of the soon-to-be princess. This event was a prelude to the unprecedented global attention that was about to descend upon her.

Then came July 29, 1981, the day Diana officially tied the knot with Prince Charles. A truly unforgettable image from that day shows the Prince and Princess of Wales sharing their first kiss as husband and wife on the Buckingham Palace balcony, in front of a roaring, adoring crowd. This moment, witnessed by a global television audience of 750 million people in 74 countries, was pure fairy-tale magic. Diana’s wedding dress, an elaborate confection, also later inspired a wave of imitations worldwide, cementing her status as a global fashion icon.

As they prepared to depart for their honeymoon cruise, Prince Charles and Princess Diana were photographed on board the Royal yacht Britannia, leaving Gibraltar. This romantic image captures them amidst what appeared to be early marital bliss, embarking on a new chapter together. However, as the original caption presciently noted, attention and scrutiny of the couple only increased after their wedding. The world watched their every move, and this honeymoon departure was no exception, marking the beginning of a life lived under an unimaginable microscope.

Royal duties, as Diana would soon discover, could be utterly exhausting, even during the early days of her marriage. A telling photograph from November 1981 captures Princess Diana famously nodding off during a gala at the Victoria and Albert Museum. The exhaustion she displayed was soon explained, as the very next day, the palace announced the joyous news: she was pregnant with Prince William! This humanizing moment, captured in a rare photo, offered a glimpse into the physical demands of royal life, even as it foreshadowed the incredible journey into motherhood that lay ahead for the young princess.

7. **Motherhood Redefined: Breaking Protocol with Baby William**As the fairy tale began, Diana’s journey into motherhood quickly became a defining chapter, one she approached with both grace and an unwavering determination to do things her way. The exhaustion she famously displayed at a gala in November 1981 was soon explained: the palace jubilantly announced her pregnancy with Prince William the very next day! This rare, humanizing snapshot offered a glimpse into the physical demands of royal life, even as it foreshadowed the incredible adventure into motherhood that lay ahead for the young princess, forever cementing her relatability with women worldwide.

Her first pregnancy was not without its struggles; Diana experienced hyperemesis gravidarum, a severe form of morning sickness that often led to a necessary reduction in her public appearances. Despite this, she made a striking statement in a red David Sassoon maternity gown, a testament to her burgeoning maternity style even before Prince William’s birth just three months later. Her choices instantly captured the public’s imagination, showcasing that royal elegance could beautifully intertwine with the realities of pregnancy.

Then, in a move that truly broke the mold, during her first official royal tour of Australia and New Zealand in 1983, Princess Diana insisted that baby William accompany them. This was a radical departure from royal protocol, which typically saw royal parents leave their young children behind during official trips. Yet, Diana’s conviction paved the way, making it standard practice for royal babies to join their parents on such tours, a testament to her deep commitment to hands-on parenting.

Captured in a heartwarming moment, young Princess Diana and Prince Charles took a much-needed break from their demanding royal duties to play with baby William and even answer questions from reporters. These candid scenes painted a vivid picture of a mother deeply devoted to her child, demonstrating her ability to blend royal responsibilities with the most tender aspects of family life, setting a new precedent for royal parenthood that endures to this day.

8. **From Demure Duchess to Daring Dame: Diana’s Style Evolution**Even as she navigated her early royal life and motherhood, Princess Diana’s evolving fashion sense became a powerful form of self-expression, captivating the world with every ensemble. From the early 1980s, she demonstrated a particular fondness for polka dots, a classic print that she infused with her youthful charm. While often seen in these familiar patterns, she also experimented with accessories, such as a slightly more unusual floppy wide-brim black hat, showcasing an early willingness to push stylistic boundaries even subtly.

By 1983, her style truly began to blossom, exemplified by a striking blue velvet suit with a mandarin collar designed by Caroline Charles, perfectly complemented by a veiled hat from John Boyd. This sophisticated look, captured during a visit to the International Spring Fair, demonstrated a growing confidence and an appreciation for tailored elegance. She was clearly becoming more comfortable in her royal role, and her wardrobe reflected this newfound poise, moving beyond merely conservative choices.

Just a year later, in 1984, Diana continued her sartorial explorations, sporting a gray, almost menswear-adjacent Jan Van Velden coat during a visit to a Dr. Barnardo’s children’s home. This bold choice highlighted her willingness to embrace more unconventional, yet utterly chic, designs. Her experimentation was constant, embracing the trends of the time, from wide-shouldered blazers to bold stripes and patterns, constantly mixing and matching to create her distinctive look.

As the decade progressed, Diana continued to express herself more freely through fashion. She was seen in everything from a vibrant pink coat while guiding Harry on a pony to a green satin evening gown by David and Elizabeth Emanuel during a gala in Australia in 1985. Her choice of the same designers who created her iconic wedding dress for a glamorous evening gown underscored her trust in and loyalty to designers who understood her vision. Her wardrobe, a chronicle of her journey, showcased a woman becoming increasingly confident and adventurous with her personal style, solidifying her status as a global fashion icon.

9. **Raising Her Boys: Harry’s Early Years and Diana’s Hands-On Love**Diana’s dedication to motherhood continued to shine brightly with the arrival of her second son, Prince Harry, in 1984. Just 23 years old at the time, she was a glowing young mother, photographed stepping out of the hospital to greet reporters and adoring fans, holding her newborn with immense joy. During both her pregnancies, Diana made fashion history with her maternity style, opting for elegant yet comfortable ensembles, such as the pretty pastels and light, loose-fitting Jan Van Velden maternity suit she wore during her pregnancy with Harry, proving that even royal maternity wear could be both chic and practical.

She consistently strove to give her children a normal upbringing, despite their extraordinary royal titles. This commitment was wonderfully captured in moments like dressing a young Prince Harry in a precious “flying suit” for one of his first plane rides to Aberdeen, Scotland, in 1985. She encouraged her boys to dress up in costumes and enjoy the simple pleasures of playing outside on swing sets and slides, much like any non-royal parent would, fostering a sense of normalcy amidst their unique lives.

One particularly charming and relatable moment, captured in 1988, shows a three-and-a-half-year-old Harry cheekily sticking out his tongue at the camera while watching the Trooping the Colour ceremony from the Buckingham Palace balcony. Diana is seen holding him, almost as if shushing him, a scene that resonates with any parent navigating a public moment with a spirited toddler. This photo beautifully illustrates her hands-on, loving approach, always present to guide and comfort her children, embracing their personalities while teaching them appropriate behavior.

From guiding Prince Harry on one of his very first pony rides through the royal estate of Sandringham to ensuring they waited in line for rides at Thorpe Park, treating them like everyone else, Diana’s mothering was refreshingly down-to-earth. She truly believed in immersing her sons in the realities of life outside palace walls, fostering resilience and empathy in them from a very young age. These tender moments, caught on camera, reveal the profound bond she shared with her boys and her unwavering commitment to their emotional well-being and grounded upbringing.

10. **A Princess with a Purpose: Diana’s Unwavering Humanitarian Heart**Beyond her royal duties and family life, Princess Diana’s profound humanitarian impact left an indelible mark on the world, a legacy of compassion that continues to inspire. Her work with charitable organizations was not just a duty but a deeply personal mission. In 1992, she made headlines by visiting Sylvia Killick, the only female resident at the London Lighthouse, a center for people with AIDS. At a time when HIV and AIDS patients were often ostracized, Diana courageously raised awareness for the crisis, famously hugging and shaking hands with those afflicted, publicly challenging the stigma and fear surrounding the disease. This powerful gesture of empathy resonated globally, reshaping public perception and advocating for dignity and understanding.

Diana’s commitment to the vulnerable extended far beyond the UK. In 1993, wearing a safari suit by one of her favorite designers, Catherine Walker, she was photographed spooning soup into the bowls of waiting children at the Nemazura feeding center, a Red Cross project for refugees in Zimbabwe. These vivid images captured her active involvement and deep care, demonstrating her willingness to get her hands dirty for a good cause. Her actions spoke louder than any words, showcasing a genuine desire to alleviate suffering wherever she found it.

Closer to home, in 1993, Diana visited Centrepoint, an organization providing housing for homeless youth in England. Dressed in a pinstripe power suit and her signature pixie cut, she met with young people, offering a listening ear and support. Fans flocked to see her, often presenting her with flowers, a testament to her immense popularity and her unique ability to connect with people from all walks of life. She truly was the People’s Princess, her presence bringing comfort and hope to those in need, validating their struggles and drawing essential attention to their causes.

Perhaps one of her most iconic and courageous acts was her visit to a minefield in Angola. Donning protective body armor and a visor, she walked through cleared paths, drawing global attention to the devastating impact of landmines and advocating for their ban. Even after her divorce from Prince Charles, which meant losing official patronage of some charities, her resolve remained unbroken. She continued to passionately support and advocate for crucial causes, including the Royal Marsden and Great Ormond Street hospitals, the National Aids Trust, and the Leprosy Mission, dedicating her life to helping the most vulnerable people in society, a goal she described as “a kind of destiny.”

11. **Iconic Moments: Dancing Queens and Runway Runs**Princess Diana’s captivating presence often turned ordinary events into extraordinary moments, whether she was gracing a dance floor or competing in a school race. During a visit to Australia in 1985, she and Prince Charles charmed gala guests by tearing up the dance floor. Diana, radiant in a green satin evening gown designed by David and Elizabeth Emanuel, moved with a grace that suggested her past as a former ballerina. This enchanting spectacle, amidst the glitz of a formal event, provided a poignant glimpse into moments of joy within their complex relationship, a vivid memory for all who witnessed it.

Another indelible image from 1985 saw Diana stunning the White House during a visit, where she famously danced with Hollywood icon John Travolta. Dressed in a breathtaking dark blue Victor Edelstein gown, which stands as iconic as her future ‘revenge dress,’ all eyes were on the Princess. She was not just a spectator but a central figure, her elegance and approachable demeanor making her the true belle of the ball. Her groovy moves captivated everyone, further cementing her status as a global phenomenon whose charm transcended continents and cultures.

Even in less formal settings, Diana’s natural charisma shone through. Take, for instance, her appearance in the 1980s, where she made a long plaid skirt look utterly couture, challenging traditional fashion norms often associated with such a style. Her early fashion sense, sometimes described as demure, steadily evolved into a more expressive and risk-taking approach. She wasn’t afraid to make bold choices, embracing a vibrant pink coat for a casual outing or a sleek, tuxedo-inspired ensemble during a visit to Florence in 1985, consistently influencing trends and inspiring women worldwide.

Her competitive spirit was equally charming, demonstrated fiercely during a Mother’s Day run at a local children’s school in 1991. With her hair flying as fast as her feet, she came in second place, proving that dangly earrings, a blazer, a skirt, and even stylish shoes couldn’t dampen her drive. These spirited moments, coupled with her impeccably chic attire—whether casual or formal—continuously solidified her place as an enduring style icon, whose every outfit was scrutinized and admired, making her a trendsetter for generations.

12. **The Enduring Spirit: A Legacy of Love and Reality**Above all else, Princess Diana’s legacy is profoundly woven into her role as a loving and hands-on mother. Family outings, though often rare, were cherished moments where she truly soaked up time with her boys. A family bike ride during a holiday in the Scilly Isles in June 1989 inevitably turned into a delightful photo shoot, capturing her joy in these precious, simple moments away from the palace formality. She was the anchor for her sons, comforting a teary-eyed William at the Royal Sports Day in Richmond in 1990, always there to offer support and unconditional love, a sentiment echoed in the numerous photos of her embracing her boys.

Diana actively fostered William’s love for tennis, attending many matches together during his childhood. It’s a sweet connection that lives on, as Prince William now watches tennis with his own children, explaining the rules to them during the match, a subtle yet powerful way of keeping his mother’s memory alive. Her profound unconditional love for both Princes William and Harry was undeniable, reflected in every excited reunion, every shared laugh, and every moment of comfort, a bond that transcended their royal status.

Her final years continued to reflect her dedication to giving her children a grounded reality. From bringing Prince Harry along for William’s first day at Eton College in 1985, dressed to look the part, to sharing big laughs with her boys during the V-J Day 50th Anniversary celebrations in London in 1995, Diana ensured her sons understood a “real life outside of palace walls.” Prince William himself fondly recalled his mother’s informal nature and how she “really enjoyed the laughter and the fun,” a characteristic that fostered a deep, relatable connection with her children and the public.

Read more about: Elizabeth Taylor: Unpacking the Legend’s Seven Marriages and Unforgettable AIDS Activism – Did She Ever Truly Find Her Happily Ever After?

The world truly lost an English rose with Diana, Princess of Wales. In her 36 years, she became one of the most cherished and photographed women globally, yet there are still these rare photos that offer a fresh, intimate perspective on her life. Her compassion, grace, and fearless advocacy continue to inspire, cementing her as the ‘People’s Princess’—a humanitarian, fashion icon, and above all, a devoted mother. As fashion photographer Mario Testino, who famously captured her, noted: “I wanted the world to see her kindness, her humility: I think she realised that would be her way.” Her enduring legacy is not just in the grand gestures but in the countless tender moments and the unwavering purpose that defined a life lived with extraordinary heart. She remains, in every sense, a true symbol of strength, elegance, and profound human connection, forever remembered for simply being herself.