Apple Wallet has quietly become one of the most critical applications on our iPhones, evolving far beyond a simple repository for payment cards. With iOS 26, it’s undergoing an especially packed update, not just receiving the system-wide Liquid Glass UI changes, but also a significant overhaul that fundamentally redefines its role in our daily digital lives. This isn’t just a cosmetic refresh; it’s a strategic move by Apple to transform the Wallet into an indispensable hub for identity, travel, and even package logistics.

For years, the promise of a truly digital wallet has hovered on the horizon, but with iOS 26, Apple is making a solid, tangible step towards fulfilling that vision. The new features aren’t merely incremental improvements; they are foundational shifts that could realistically replace several physical items currently residing in your pocket or purse. Imagine breezing through an airport without fumbling for documents, verifying your age online with a tap, or tracking every online order from a single, secure app—all powered by the device you already carry everywhere.

This article will delve deep into the initial set of groundbreaking features arriving in Apple Wallet with iOS 26, offering a critical and user-centric perspective on how these advancements integrate into our lives. We’ll explore the underlying technology, the practical user experience, and the broader implications for privacy and convenience. Get ready to discover how your iPhone is poised to become a more powerful, personal, and profoundly integrated tool than ever before.

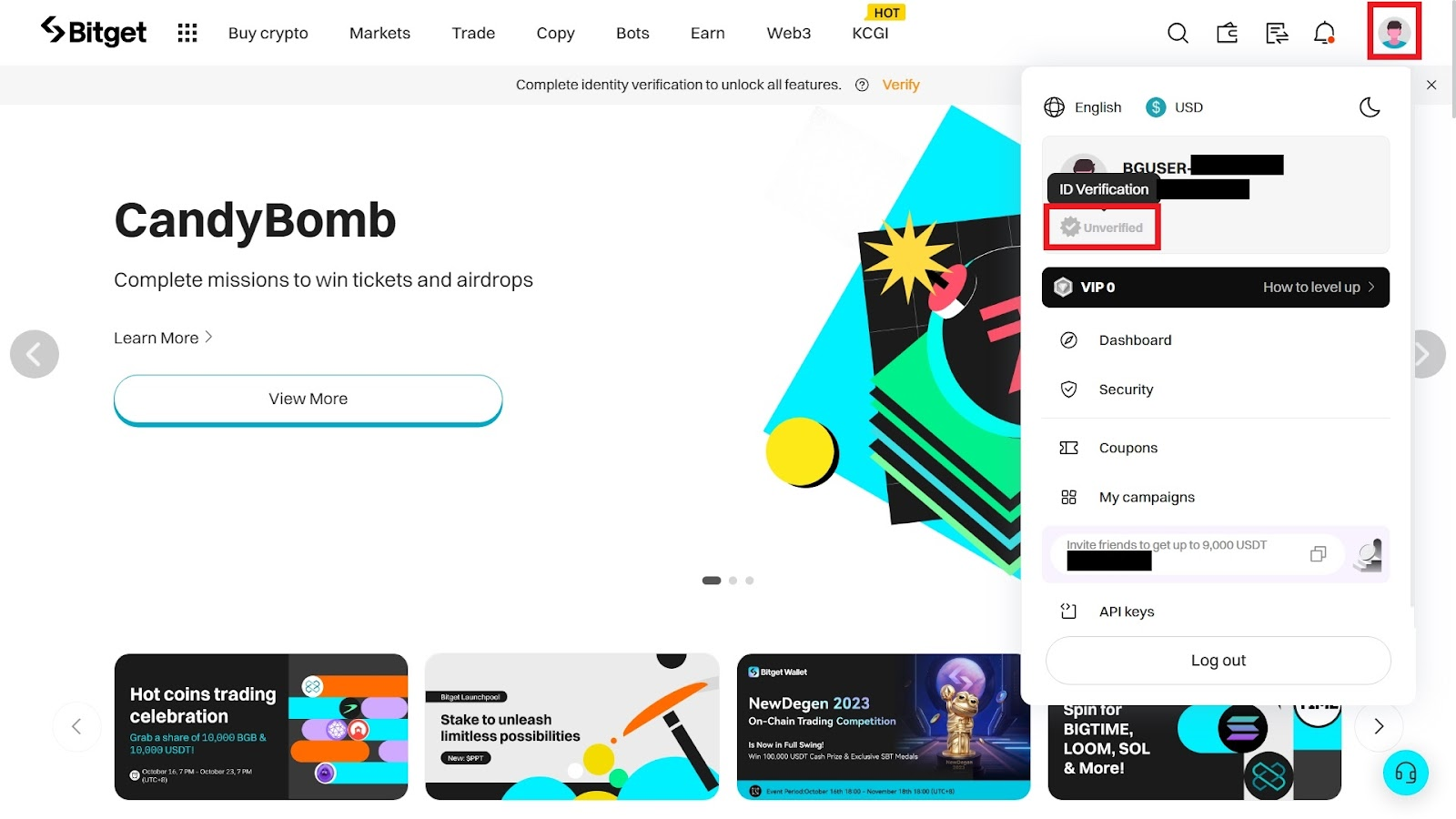

1. **Digital Passport and ID Integration**One of the most anticipated and significant additions to Apple Wallet in iOS 26 is the robust support for digital identification, particularly the ability to add your U.S. passport. This marks a substantial expansion of Apple’s ongoing efforts to integrate digital IDs into Wallet, moving beyond state driver’s licenses to a universally recognized travel document. The core idea is to provide a secure and private new way for users to store and present their ID information, making daily verifications and domestic travel notably smoother.

One of the most anticipated and significant additions to Apple Wallet in iOS 26 is the robust support for digital identification, particularly the ability to add your U.S. passport. This marks a substantial expansion of Apple’s ongoing efforts to integrate digital IDs into Wallet, moving beyond state driver’s licenses to a universally recognized travel document. The core idea is to provide a secure and private new way for users to store and present their ID information, making daily verifications and domestic travel notably smoother.

Adding your U.S. passport to Wallet is designed to be a straightforward process: you simply take a photo of your physical passport using your iPhone. Apple’s secure system then verifies this information with the issuing authorities. Once approved, your digital passport is encrypted and stored locally on your device, accessible only via biometric authentication like Face ID or Touch ID, ensuring a high level of security for this sensitive data. This careful implementation underscores Apple’s commitment to privacy and data protection, a crucial consideration for any identity-related feature.

The immediate and most impactful use case for the digital passport is at TSA checkpoints for domestic air travel. Users will be able to tap their iPhone against an NFC reader to verify their identity, potentially streamlining the security process and reducing the need to constantly pull out physical documents. This convenience upgrade could save time and reduce the anxiety often associated with air travel, aligning with the broader cultural push for more efficient and secure identity verification methods in a post-REAL ID world.

It’s important to note the critical distinctions and limitations, however. While the digital passport is a powerful tool for domestic travel and identity verification in apps and in person, Apple and the TSA both explicitly state that it is not a replacement for your physical passport for international travel or border crossings. In those scenarios, your physical document will still be required. This nuance is crucial for user understanding, ensuring that while the digital ID offers immense convenience, it doesn’t lead to misguided assumptions about global portability.

Read more about: Financial Scrutiny: High Stakes and Hard Lessons from 14 Music Icons’ Ventures into the Volatile World of NFTs and Crypto

2. **Verify with Wallet on the Web**Building on the foundation of digital ID integration, iOS 26 introduces a groundbreaking feature that extends identity verification beyond the physical world and even beyond specific apps: “Verify with Wallet on the Web.” This capability allows users to leverage their securely stored digital ID to confirm their age or identity directly on participating websites, bridging the gap between digital credentials and online interactions. It represents a significant step towards a more seamless and secure online experience, eliminating the need to upload sensitive documents or re-enter personal data repeatedly.

The mechanism for this online verification is elegantly simple and secure. When a website requests verification—perhaps for renting a car, purchasing age-restricted items like alcohol, or completing other identity-sensitive online transactions—users are prompted to scan a QR code using their iPhone. Authentication is then completed with Face ID or Touch ID, mirroring the secure process used for Apple Pay. Crucially, the system is designed to be privacy-first, sharing only the essential details required by the website, such as your age or name, while keeping all other personal data private and secure within the Wallet ecosystem.

This feature boasts broad compatibility, working not only within Safari 26 but also across any web browser that supports the W3C Digital Credentials API and FIDO CTAP protocol. This open standards approach ensures that “Verify with Wallet on the Web” has the potential for widespread adoption across the internet, rather than being confined to Apple’s own browser. The initial list of partners already supporting this feature—including Chime, Turo, Uber Eats, U.S. Bank, Arizona MVD, and Georgia DDS—demonstrates its immediate relevance and diverse applications, from financial services to ride-sharing and government interactions.

From a user perspective, this is a clear convenience upgrade that promises to save time and reduce friction in online transactions requiring identity checks. It centralizes and secures the process, minimizing the risk associated with manually entering personal information or uploading images of physical documents to various websites. This strategic integration solidifies Wallet’s role as a comprehensive hub for managing and presenting personal identity, extending its utility into the vast landscape of the web and enhancing both security and user experience for countless online interactions.

Read more about: Unmasking the Price Tag: 11 Sneaky Smart Home Costs That Can Quietly Drain Your Wallet

3. **AI-Powered Package Tracking**For anyone who regularly shops online, the disparate world of package tracking has long been a source of frustration. Historically, Apple Wallet’s initial foray into order tracking in iOS 16 was compelling in theory but fell short in practice, largely due to its reliance on third-party vendor support that proved challenging to secure. With iOS 26, Apple has finally delivered a robust and ubiquitous solution, leveraging the power of Apple Intelligence to transform Wallet into a truly centralized hub for monitoring all your online orders, regardless of the payment method.

The genius of this new feature lies in its independence from specific merchant integrations or Apple Pay usage. Instead, the Wallet app now intelligently identifies and summarizes order tracking details directly from your Mail app. It uses on-device Apple Intelligence to scan your emails for information from merchants or delivery carriers such as USPS, FedEx, or UPS, automatically extracting tracking numbers and order details. This means that if an email with tracking information lands in your inbox, Wallet can likely pull that data in, offering a universal tracking solution.

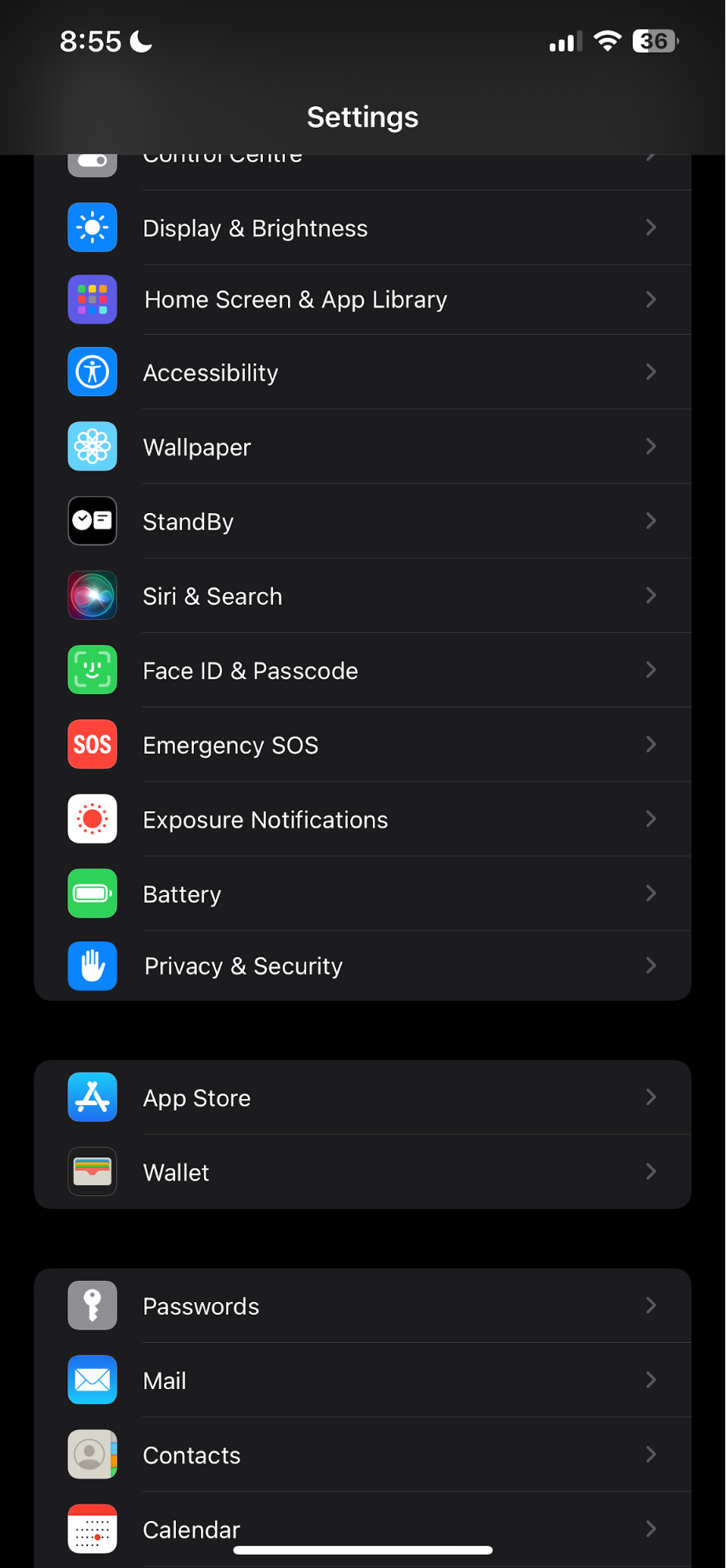

This intelligent aggregation means you no longer need to juggle multiple tracking apps or repeatedly visit carrier websites to check on your parcels. Wallet provides real-time updates on your package’s status, progress notifications, and the ability to see full order details, all within one secure and convenient location. To enable this feature, users simply navigate to the Settings app on their iPhone, tap Wallet & Apple Pay, select Order Tracking, and toggle ‘On Orders Found in Mail.’ This opt-in approach gives users control over their data while offering a significant boost in convenience.

While this feature is a monumental step forward, it’s also being rolled out in a beta capacity, as Apple acknowledges. The company notes that it’s “not perfect yet,” and users might occasionally encounter instances where “some orders don’t update properly and need to be manually marked as complete, and some don’t show up in the app.” This transparency is characteristic of The Verge’s analytical style, highlighting that even groundbreaking technology has its initial kinks to work out. However, the promise of a single, intelligent hub for all package tracking is undeniably transformative.

The cultural impact of such a feature cannot be overstated. In an era dominated by e-commerce, the ability to seamlessly track every purchase, from a single secure app, significantly reduces consumer friction and anxiety. It embodies a user-centric design philosophy, anticipating and solving a common pain point with a sophisticated, AI-driven solution that integrates deeply into the user’s existing digital habits, making online shopping inherently more organized and less stressful.

Read more about: The AI Eye on Our Roads: How New Traffic Cameras Are Reshaping Enforcement and Safety

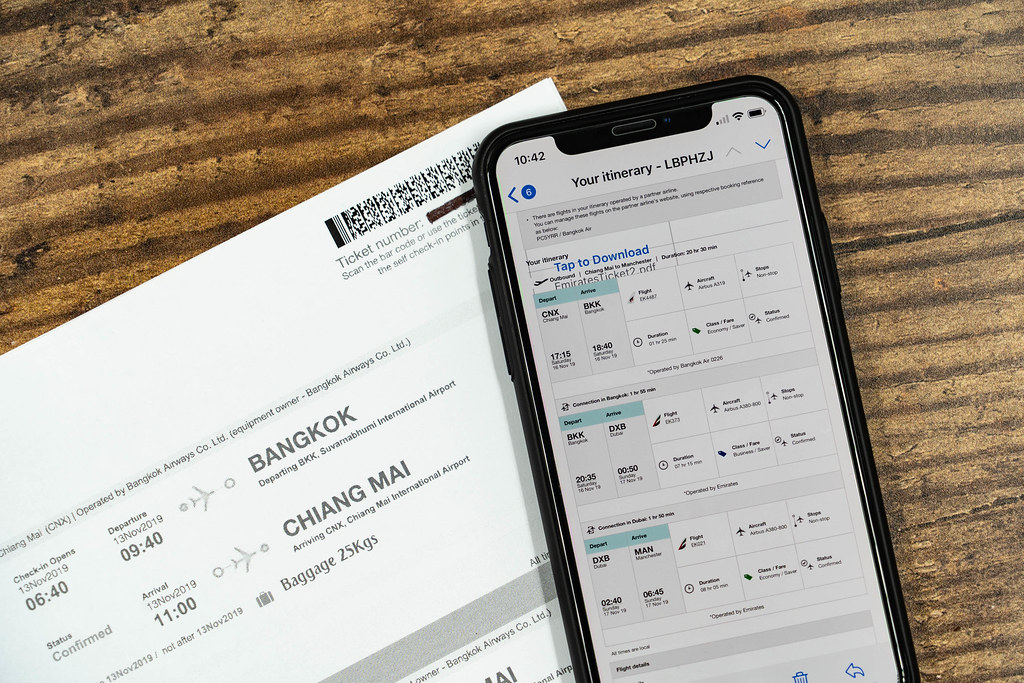

4. **Smarter Boarding Passes and Travel Tools**Apple Wallet has long been a convenient place to store digital boarding passes, but with iOS 26, it receives a comprehensive travel-friendly facelift, transforming these passes into dynamic and highly interactive travel companions. The goal is clear: to make air travel smoother, more informed, and significantly less stressful for the modern road warrior. These enhancements push beyond simple storage, integrating real-time data and other Apple ecosystem services to provide an unparalleled travel experience.

One of the standout improvements is the integration of Live Activities support directly into boarding passes. When you add a flight pass to Wallet, your gate information, departure and arrival times, and boarding status update in real-time. This crucial information is not only visible within the Wallet app but also dynamically displayed on your Lock Screen and within the Dynamic Island, providing glanceable updates without needing to unlock your phone or open any specific app. Furthermore, the ability to easily share your flight’s Live Activity with family or friends adds a thoughtful layer of convenience for those waiting or picking you up.

Navigation within sprawling airports is another common pain point that iOS 26 addresses with new Airport Maps embedded directly into boarding passes. Once your pass is added, it will feature a detailed map showing your current location within the airport and the best route to your gate. Beyond just gate directions, these terminal maps also indicate the locations of essential amenities like restrooms, lounges, and shops, empowering travelers to make the most of their time before boarding. This contextual awareness significantly reduces pre-flight stress and helps travelers navigate complex environments with ease.

Luggage tracking receives a significant boost through integration with the Find My network. For users who have attached an AirTag to their luggage, Wallet now adds a convenient shortcut to the Find My app directly from their boarding pass. This allows travelers to easily view their bag’s last known location and, in the unfortunate event of a lost bag, report it directly from this centralized hub. This proactive approach to luggage management provides an invaluable layer of reassurance and control, transforming a potentially stressful situation into a manageable one within Apple’s ecosystem.

Finally, the updated Wallet app also promises one-tap access to various airline services. This means users may soon be able to quickly access options for seat upgrades, check standby lists, and engage with other airline services directly from their boarding pass, alongside receiving contextual suggestions based on their flight and airport amenities. This holistic approach to air travel, centralizing information and services within Wallet, significantly enhances convenience and control, making the journey itself almost as seamless as the digital experience.

While the first half of our deep dive into iOS 26’s Apple Wallet focused intently on innovations in identity, travel, and logistics, the story of its transformation is far from complete. Apple is also making significant strides in refining how we manage our finances, access personal data, and seamlessly interact with our connected world, all from the familiar interface of the Wallet app. These updates collectively underscore a broader, ambitious vision: to solidify the iPhone’s position as an even more indispensable tool for daily financial control and deeply integrated digital living.

Read more about: Your Family’s Ultimate Money Makeover: 14 Essential Budget Categories You Can’t Afford to Ignore!

5. **Saved Full Credit Card Details**For years, managing credit card details for online purchases that don’t support Apple Pay has often been a fragmented experience, frequently compelling users to rely on third-party password managers to securely store sensitive financial information. Apple’s own Passwords app, which launched last year, notably lacked this crucial functionality, thereby creating a minor but persistent friction point for users deeply embedded in the Apple ecosystem. With iOS 26, the Wallet app finally steps up to fill this long-standing gap, offering a native and deeply integrated solution for storing full credit card details securely.

This new capability empowers users to add and view their complete credit card information, encompassing the full card number, expiration date, and CVV code, directly within the Wallet app. While by default, Apple Pay transactions might only display the last four digits of an identifier for security, users now have the explicit option to securely input and store all physical card details. This process is meticulously designed with Apple’s stringent security protocols in mind, ensuring that once added, these sensitive details are encrypted and stored within the iCloud Keychain.

Accessing these details is designed to be as straightforward and secure as any other sensitive Wallet function. To retrieve your full card information, you simply tap on the specific card within Wallet and then authenticate using Face ID or Touch ID. This biometric gateway ensures that your financial data remains private and rigorously protected, visible only to you. Crucially, Apple explicitly states that these saved details are not used for Apple Pay transactions, reinforcing a clear separation of function and thereby enhancing overall user trust.

The true utility and convenience of this feature particularly shine in scenarios where Apple Pay isn’t readily an option. Imagine needing to make a purchase on a smaller online store that hasn’t yet integrated Apple Pay, or perhaps needing to dictate your card details over the phone for a specific service or reservation. Instead of fumbling for a physical card, potentially exposing it to prying eyes or simply having it out of reach, all the necessary information is securely and instantly available on your iPhone. This strategic addition significantly boosts convenience while maintaining a high bar for security, solidifying Wallet’s expanding role as a comprehensive financial hub.

Read more about: The True Cost of ‘Peace of Mind’: 13 Critical Reasons Why Extended Warranties for Your Appliances Are Rarely Worth It

6. **Apple Pay In-Store: Installments and Rewards**Apple Pay has already revolutionized how we make in-store purchases, offering unparalleled convenience and robust security with a simple tap of your iPhone or Apple Watch. In iOS 26, Apple is further enhancing this experience by integrating powerful financial management tools directly into the in-store payment process: the option for installment payments and the seamless redemption of loyalty rewards. These additions represent a significant evolution, pushing Apple Pay beyond just a secure transaction method to a more comprehensive financial control panel accessible right at the point of sale.

The introduction of installment payments, which users may recognize from other contexts as ‘Apple Pay Later,’ allows individuals to choose to pay off their purchase over time in fixed, manageable payments, rather than requiring a single, immediate lump sum. This financial flexibility is made possible through deep integration with a growing roster of existing financial partners, creating a broad and accessible network of support. In the U.S., eligible providers now include prominent names like Affirm, Afterpay/Cash App, Klarna, Synchrony, and U.S. Bank. For our international users, Klarna is supported in the UK and Canada, with Monzo also available in the UK, demonstrating Apple’s global vision for accessible financial options.

Alongside these flexible payment solutions, iOS 26 also allows users to tap into and directly redeem loyalty rewards tied to their chosen Apple Pay card. This means that when you’re checking out, the payment sheet can transparently display how many reward points, miles, or cashback you’ve accumulated through that specific card. Crucially, it provides the convenient option to apply these rewards directly to your current purchase, instantly reducing the total amount you owe. Initially, this highly anticipated feature is supported in the U.S. by Synchrony and U.S. Bank, streamlining a process that previously often required navigating separate apps or visiting specific websites.

The undeniable beauty of these sophisticated integrations lies in their utterly seamless presentation to the user. All the relevant information—whether it’s your available installment options, the precise amount of your redeemable rewards, or the final adjusted price after applying benefits—appears transparently and intuitively on the payment sheet itself. There’s absolutely no need to open additional apps or engage in complex, multi-step processes; both the decision-making and the execution are integrated directly into the natural Apple Pay flow. This user-centric design effectively removes significant friction, empowering consumers with unparalleled control over their spending and loyalty benefits, all within the familiar, secure environment of Apple Wallet.

7. **Goodbye Ads: Turn Off Offers and Promotions**In an age where digital notifications frequently feel like an overwhelming deluge, users are increasingly demanding greater, more granular control over precisely what pings their devices. Apple, a company typically lauded for its unwavering commitment to user-focused privacy and an uncompromised experience, faced some notable criticism recently following a promotional Wallet notification related to an F1 movie. It stands as a testament to Apple’s remarkable responsiveness that, seemingly in direct response to this widespread feedback, iOS 26 quietly introduces a crucial and long-awaited feature: the ability to disable promotional notifications within the Wallet app.

This isn’t a feature Apple prominently highlighted in its official announcements or during its highly anticipated keynote presentations, a detail readily noted by those who meticulously scour beta releases for hidden gems. Its discovery was, therefore, a particularly pleasant surprise for many, emerging directly from the user backlash against unexpected marketing alerts appearing in an app fundamentally designed for financial transactions and secure digital credentials. This strategic move subtly, yet effectively, acknowledges the profound user expectation that an app like Wallet, handling sensitive personal and financial data, should remain a clean, functional utility, rather than becoming yet another channel for unsolicited advertising.

Implementing this newfound control is, refreshingly, incredibly simple and intuitive. Users can navigate directly to the Wallet app’s notification settings, where they will now discover a distinct and clearly labeled ‘Offers & Promotions’ category. With a straightforward toggle, this entire category of notifications can be disabled or, if preferred, enabled according to individual user preference. This granular level of control is a profoundly welcome addition, ensuring that users can maintain the critical utility of Wallet for essential alerts—such as payment confirmations or real-time boarding pass updates—while simultaneously opting out of less relevant or unwanted commercial messages.

This seemingly small update carries significant and far-reaching implications for the overall user experience. By empowering users to proactively silence promotional alerts, Apple effectively reinforces its steadfast commitment to a privacy-first, user-controlled ecosystem. It means no more surprise advertisements emanating from what should fundamentally be a purely financial-focused application. For the discerning user, this thoughtful refinement helps to preserve the integrity and deep trust associated with Apple Wallet, allowing it to remain a secure, uncluttered, and highly efficient hub for essential digital items without the unwelcome distraction of unwanted marketing content.

8. **More Digital Car Keys in Wallet**Building extensively on the concept of a truly connected life, Apple Wallet in iOS 26 expands its utility far beyond mere payments and personal identification to encompass even more integral aspects of our physical world: our automobiles. The initial introduction of Digital Car Keys represented a bold, innovative step toward seamlessly integrating vehicles into the broader digital ecosystem, and with iOS 26, Apple is significantly broadening its reach by adding support for an impressive 13 new automakers. This substantial expansion dramatically increases the sheer number of vehicles that can now be unlocked, started, and even securely shared with just an iPhone or an Apple Watch.

These advanced digital car keys leverage a sophisticated combination of cutting-edge technologies, primarily NFC (Near Field Communication) for close-range interactions and Ultra-Wideband (UWB) for exceptionally precise spatial awareness. UWB technology, in particular, allows for highly convenient passive entry, meaning you might not even need to physically take your phone out of your pocket or bag to unlock your car, and it significantly enhances security by actively preventing sophisticated relay attacks. Together, these technologies enable a truly seamless and intuitive experience: users can effortlessly unlock, start, and even securely share their car key with trusted individuals, all from the remarkable convenience of their Wallet app.

The comprehensive list of newly supported brands eloquently underscores Apple’s aggressive and strategic push into the rapidly evolving automotive sector. Enthusiasts of a diverse range of automakers, including Acura, Cadillac, Chevrolet, GMC, Porsche, Rivian, Smart, Lucid, Tata, Hongqi, Voyah, Chery, and WEY, can now eagerly anticipate the integration of their vehicles into the expanding Wallet ecosystem. This eclectic collection of manufacturers, spanning various market segments and geographical regions, highlights a concerted global effort to make digital car keys a mainstream, universally accessible feature, moving far beyond initial, exclusive luxury vehicle partnerships to embrace a much wider audience.

The implications for sheer convenience and daily practicality are profound and transformative. Imagine the freedom of leaving your bulky physical car keys at home, knowing with absolute certainty that your iPhone is literally all you need for vehicle access. The inherent ability to securely share a car key digitally completely eliminates the cumbersome hassle of physical key handoffs, making it perfect for family members, professional valets, or modern car-sharing and rental situations. This significantly expanded support transforms the iPhone into an even more versatile personal device, truly becoming the central control hub for your entire connected life—encompassing everything from your payments and identity to your smart home and, now, an ever-growing array of sophisticated vehicles. This is more than just an incremental convenience; it’s a tangible, exciting step towards a truly keyless and effortlessly integrated future.

Read more about: Financial Scrutiny: High Stakes and Hard Lessons from 14 Music Icons’ Ventures into the Volatile World of NFTs and Crypto

Apple Wallet in iOS 26 isn’t just an update; it’s a profound redefinition of what a digital wallet can be. From empowering global travel with the secure integration of digital passports to streamlining the complexities of online shopping with AI-driven package tracking, and now enhancing personal financial control with securely saved card details, flexible installment payments, and the crucial ability to silence unwanted notifications, the Wallet app is maturing into an incredibly powerful, versatile, and deeply integrated hub. Its significant expansion into Digital Car Keys further solidifies the iPhone’s role as the central nervous system of our modern, increasingly digital lives. These groundbreaking features, while some are still in their nascent stages of rollout, collectively paint a compelling picture of a near future where your physical wallet and cumbersome key ring become increasingly redundant, seamlessly replaced by the secure, integrated power of your iPhone. It’s an exciting glimpse into a more seamless, profoundly controlled, and ultimately, more connected digital existence.