I know you love your family. There’s not a thing you wouldn’t do to help them. But I also know that what’s in your heart is not enough. At this stage of your life, preparing these must-have documents is one of the most profound acts of love you can bestow. This paperwork can shield your family from needless heartache, hassle, and expense, providing not just financial protection but invaluable peace of mind.

Many people often think of estate planning as a complex, daunting task reserved only for the wealthy or those in their later years. This couldn’t be further from the truth. An estate plan, at its core, is a vital roadmap designed to ensure your wishes are honored, your assets are protected, and your loved ones are cared for, no matter what life brings. It’s about taking control of your legacy and making proactive decisions that safeguard your family’s future.

Understanding which essential documents you need for your estate plan is a critical first step. The goal is to demystify the process, breaking down complex financial concepts into easy-to-understand language so you can make informed decisions. By getting these key documents in order, you are creating a lasting gift for your loved ones, sparing them potential delays, costs, and uncertainties during what will already be a difficult time.

1. **Will (Last Will and Testament)**

A Last Will and Testament stands as the foundational cornerstone of most estate plans. It is the legal document where you explicitly state your desires for who will manage your estate, known as your executor, and how your property and assets should be distributed upon your death. This is where your voice truly dictates what happens to all you’ve accumulated throughout your life, ensuring it ends up in the right hands according to your specific wishes.

With a will, you can designate precisely who will receive your assets, which can include specific items like your home, car, cherished keepsakes, or even an institution or charity. This clear outlining of beneficiaries helps head off potential family squabbles or worse, providing clarity during a sensitive time. Crucially, if you have dependents, your will is also the place to designate a guardian for them, ensuring that you decide who will care for your children should you and your spouse pass away simultaneously.

The importance of a will cannot be overstated, especially when considering the alternative. If you pass away without a valid will — a situation known as dying intestate — your assets will be distributed not by your wishes, but according to state law. This means that provisions for your family are taken out of your hands and put into the probate court, a process that can be lengthy, costly, and may lead to outcomes you never intended. Your spouse might have to split assets with your children, or distant relatives could inherit if you have no immediate family, creating unnecessary complications and stress for those you leave behind.

Beyond asset distribution and guardianship, a will allows you to name your personal representative to serve without bond, potentially saving your estate money, and identify how estate settlement costs would be covered. It’s important to remember that a will takes effect upon your death and must go through probate, the court process of validating it. However, having a will ensures your voice is heard throughout this process. Furthermore, major life events such as marriage, divorce, the birth of a child, or acquiring significant assets are all compelling reasons to review and revise your will, ensuring it always reflects your current wishes and family situation.

2. **Durable Power of Attorney for Finances**

A Durable Power of Attorney (POA) for finances is an indispensable document that empowers a person you implicitly trust, often referred to as your ‘agent’ or ‘attorney-in-fact,’ to manage your property and financial affairs. The term ‘durable’ is key here; it means this authority continues even if you become mentally incapacitated due to illness, accident, or age-related decline. This document ensures that your financial responsibilities don’t fall by the wayside if you’re unable to manage them yourself.

Without a durable POA, should you become incapacitated, your family might face the burdensome and time-consuming inconvenience of going to court. They would need to petition for a guardianship or conservatorship to gain the legal authority to handle your bills, bank accounts, investments, and other assets. This judicial process can be emotionally draining, expensive, and the judge might not even choose the person you would have preferred, adding another layer of stress during an already difficult period for your loved ones.

With a durable POA in place, your chosen agent can seamlessly step in to perform a wide range of financial tasks on your behalf. This could include paying bills, managing investments, filing taxes, accessing IRAs or pension accounts, or even running your business, depending on the specific authority you grant within the document. You have the flexibility to make the powers as broad or as limited as you deem appropriate for your circumstances. Furthermore, you can structure it to become effective immediately or ‘spring’ into effect upon your incapacity, although many experts recommend immediate POAs for simplicity and to avoid disputes about the timing of incapacity.

It’s crucial to understand that a financial power of attorney only applies to the specific types of matters and transactions you authorize, and it is only effective during your lifetime. This document ends automatically upon your death and does not replace a will or trust for post-death asset transfers. Therefore, think of the durable POA as a robust shield designed to protect you and your finances during your lifetime, ensuring continuity and proper management, allowing you to have peace of mind that your affairs are in capable hands even if you cannot act for yourself.

Read more about: Navigating Retirement at 61: Is Your $1.65 Million Nest Egg Enough for Financial Freedom?

3. **Health Care Power of Attorney**

Similar in concept to the durable financial power of attorney, a Health Care Power of Attorney (also known as a Durable Power of Attorney for Health Care or a Health Care Proxy) is a document that allows you to appoint someone to make medical decisions on your behalf. This is absolutely critical for situations where you are unable to communicate your own healthcare wishes, whether due to a temporary, long-term, or permanent incapacitation. It ensures that your medical care aligns with your values and preferences, even when you cannot express them.

The person you name in this document, your health care agent or proxy, is tasked with prioritizing your desires and best interests when it comes to medical treatments and procedures, selecting providers, and discussing your care with doctors. This is why choosing a trusted individual who knows your wishes intimately is paramount. They will act as your advocate, making tough decisions from electing specific treatments to discontinuing care, all in accordance with what you would have wanted, thereby alleviating an immense burden from your family during times of crisis.

This document is regularly included as a component of a broader advance directive. While some states allow the health care power of attorney and a living will to be combined into one comprehensive document, other states require them to be separate. Regardless of the state-specific format, the core function remains the same: to provide a legal framework for someone to speak for your health when you cannot. It’s an essential part of a comprehensive estate plan, ensuring that your right to informed consent in your health care is maintained, even in vulnerable situations.

Read more about: The Tragic End of a Rising Star: Rebecca Schaeffer’s Legacy in the Fight Against Stalking

4. **Advance Directive (Living Will)**

An Advance Directive, often referred to as a Living Will, is a pivotal document that clearly states your medical treatment preferences. This is where you, as an adult, exercise your right to informed consent regarding your health care, even for situations when you are unable to make your own care decisions. It acts as a comprehensive guide for your family and health care professionals, detailing how far you want your medical treatment to go should you become seriously ill or terminally incapacitated.

Within your Living Will, you can spell out exactly what you do or do not want concerning various medical interventions. For example, you can specify your wishes regarding the use of ventilators, feeding tubes, resuscitation attempts, or when you might want pain relief, even if it might hasten your death. By documenting these intensely personal decisions now, you effectively ease the immense burden on your loved ones later. They won’t have to struggle with agonizing choices, knowing that their actions are in direct alignment with your documented desires and values.

While a Health Care Power of Attorney designates *who* will make decisions, an Advance Directive or Living Will specifies *what* those decisions should be. These two documents are intrinsically linked and together form a robust Advance Healthcare Directive. They holistically address what should happen in case you are incapacitated and require medical care, ensuring that your designated proxy has clear, written instructions about your preferences. This provides an invaluable layer of confidence and reassurance, knowing that your end-of-life wishes are clearly articulated and legally binding.

5. **Revocable Living Trust**

If the word ‘trust’ immediately conjures images of immense wealth, it’s time to rethink. A revocable living trust is an incredibly powerful and versatile document, far from being exclusively for the rich, and it can be a significant benefit for nearly any adult with assets. Fundamentally, this document creates a legal entity that can hold title to your assets during your lifetime. Crucially, you typically name yourself as the initial trustee, meaning you remain fully in control of your property and finances for as long as you wish, and you can make changes to your trust as often as you want—that’s what ‘revocable’ means.

One of the most compelling advantages of a living trust is its ability to bypass probate at your death. Probate, the court process of validating a will and overseeing estate administration, can be a lengthy, public, and sometimes expensive endeavor. Assets titled within your trust are not considered part of your probate estate, allowing your successor trustee—the person you appoint to manage the trust after you can no longer do so—to distribute assets directly to your beneficiaries according to your instructions, often much more quickly and privately than a will allows. This saves time, maintains the privacy of your estate details, and can significantly reduce legal costs for your heirs.

Furthermore, a revocable living trust offers robust provisions for managing your finances if you become unable to do so yourself. The trust specifies who you’ve appointed to take over, along with who determines your incapacitation. This mechanism saves a loved one from the time-consuming inconvenience of court proceedings to gain access to your financial accounts. Beyond incapacity, a living trust provides a greater level of control over your assets even after your death. You can set specific conditions or requirements that must be met before beneficiaries receive distributions, such as reaching a certain age or achieving specific milestones, allowing your legacy to continue guiding and supporting your family for years to come.

It’s vital to understand that simply signing a trust document isn’t enough; the trust must be ‘funded’ by transferring ownership of your assets into it. This involves retitling deeds for real estate, changing ownership of bank accounts, investment portfolios, and other valuables to the name of the trust. Any assets accidentally left outside the trust when you die may still have to go through probate. To mitigate this, many people create a ‘pour-over will’ alongside their living trust, which acts as a safety net, directing any un-titled assets at death to be ‘poured over’ into the trust and distributed according to its terms. For many, combining a will and a living trust offers the best of both worlds, ensuring comprehensive protection.

Read more about: The Royal Exodus: When Love and Liberty Led Princes and Princesses to ‘Quietly Divorce’ Royal Life in America

6. **Beneficiary Designations**

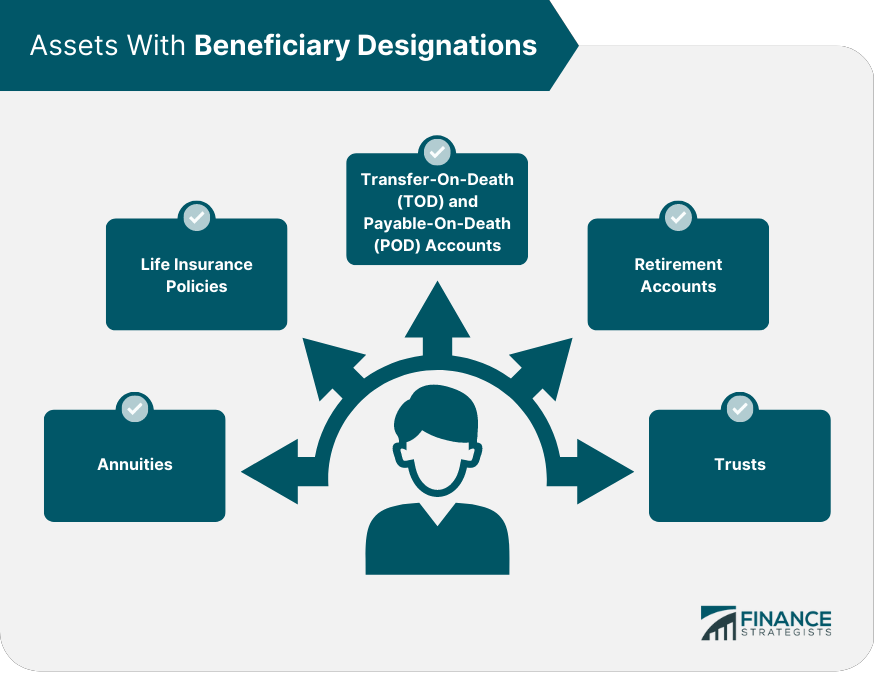

While not a literal ‘document’ in the same way a will or trust is, beneficiary designations are an absolutely critical aspect of effective estate planning, often overlooked but immensely powerful. When you establish various financial accounts—such as bank accounts, retirement accounts like 401(k)s or IRAs, or life insurance policies—you are given the crucial option to name a beneficiary directly on that account. This simple act can have profound implications for how those assets are transferred after your death.

The significant advantage of properly executed beneficiary designations is that these assets are typically not included in your probate estate. Instead, they pass directly to the named beneficiaries outside of the probate process, often much more swiftly and efficiently than assets distributed via a will. This direct transfer can save your loved ones considerable time, legal fees, and emotional stress, ensuring they receive needed funds without undue delay. It’s a clear, straightforward path for these specific assets to reach your intended recipients.

It’s easy to set up beneficiary designations when you first open an account and then forget about them, but it’s essential to review and update these designations regularly. Life changes—marriages, divorces, births, deaths, or even just a change of heart—can all impact who you want to receive these funds. An outdated beneficiary designation can lead to unintended consequences, diverting assets away from your current wishes. Therefore, actively managing these designations across all your relevant financial accounts is a non-negotiable step in maintaining an up-to-date and effective estate plan.

Read more about: Is Your Will Up to Date? A Comprehensive 10-Point Checklist for a Secure Estate Plan

7. **Guardianship Designations**

For parents of minor children, the designation of a guardian is arguably one of the most vital, and often emotionally charged, aspects of estate planning. This isn’t just about financial inheritance; it’s about ensuring the ongoing care, upbringing, and well-being of your most precious loved ones should something unforeseen happen to both parents. Without your explicit designation, a court would be left to decide who raises your children, a process that can be protracted and may result in a choice that doesn’t align with your family’s values or relationships.

While commonly associated with minor children, the concept of guardianship extends to other dependents as well. This could include an elderly parent who relies on you, an adult child with special needs, or even your beloved pets. A legal guardian is someone who will step in and provide comprehensive care for anyone you love who cannot care for themselves. They are responsible for providing for all necessary aspects of their charge’s wellbeing, including food, shelter, education, medical needs, and, ideally, an abundance of love, empathy, and attention.

Choosing a guardian requires careful consideration, encompassing not just their capacity to provide care but also their alignment with your parenting philosophies and the comfort level your children or dependents have with them. It’s also wise to name successor guardians in case your primary choice is unable or unwilling to serve. This designation is typically made within your Last Will and Testament, making the will an indispensable document for families with dependents. Having this difficult decision made in advance offers immense peace of mind, knowing that your children will be cared for by someone you trust implicitly, minimizing disruption during a time of profound loss.

While the foundational documents we’ve discussed are crucial for every American adult, a truly comprehensive estate plan often benefits from additional components. These supplementary documents and considerations help refine your legacy, optimize financial outcomes, and provide even greater clarity for your loved ones. They address specific assets, potential challenges, and personal values, ensuring every detail of your wishes is meticulously covered.

Read more about: Is Your Will Up to Date? A Comprehensive 10-Point Checklist for a Secure Estate Plan

8. **Life Insurance Policies**

Life insurance policies are more than just a financial product; they are a critical component of estate planning, offering a substantial safety net for your loved ones. While beneficiary designations for these policies were touched upon earlier, understanding the broader role and nuances of your life insurance contract is essential. Upon your death, a life insurance contract pays out a benefit directly to the beneficiaries listed on the contract, providing immediate financial liquidity during a challenging time.

This payout can serve multiple vital purposes. It can replace lost income, cover outstanding debts, fund future education expenses for children, or even provide resources for your family to maintain their current lifestyle. The beauty of life insurance is that these death benefits are typically income tax-free to your beneficiaries and generally bypass the often-lengthy probate process, making them an efficient way to transfer wealth and provide security.

However, simply having a policy isn’t enough. It’s imperative to regularly review your life insurance coverage amounts to ensure they still meet your family’s evolving needs. Major life changes, such as having more children, purchasing a new home, or starting a business, can significantly alter your financial obligations and, consequently, the amount of coverage you require. An underinsured estate can leave your family financially vulnerable, undermining the very purpose of the policy.

Furthermore, the type of life insurance you choose—term or permanent—can have different implications for your estate. Term life insurance provides coverage for a specific period, while permanent life insurance (like whole life or universal life) offers lifelong coverage and can accumulate cash value. Understanding how your chosen policy integrates with your overall financial strategy and specific estate planning goals is a conversation best had with a trusted financial advisor.

Read more about: Mastering Your Premiums: 12 Proven Ways to Slash Car Insurance Costs, Including Top Models and State-Specific Strategies for 2025

9. **Retirement Account Management**

For many Americans, retirement savings accounts like 401(k)s, IRAs, and other qualified plans represent a significant portion of their wealth. While we emphasized the critical importance of naming beneficiaries for these accounts in the first section, effective estate planning for retirement assets goes beyond just a name on a form. It involves strategic management to ensure these funds are distributed as tax-efficiently as possible, preserving more of your legacy for your heirs.

Understanding the various types of retirement accounts and their unique tax treatments is key. Traditional IRAs and 401(k)s, for example, are typically tax-deferred, meaning beneficiaries will pay income tax on withdrawals. Roth IRAs, on the other hand, offer tax-free withdrawals in retirement, which also extends to qualified distributions by beneficiaries. These distinctions can have substantial implications for how much your loved ones ultimately receive, making careful planning paramount.

Strategies for managing these accounts within your estate plan might include considering “stretch IRAs” (though rules have changed with the SECURE Act) or naming a trust as a beneficiary. While naming a trust can offer greater control over distributions, it can also complicate tax implications, necessitating expert guidance. Proactive management ensures that your retirement nest egg seamlessly transitions to your beneficiaries, rather than becoming entangled in unnecessary taxes or administrative hurdles.

Working with a financial advisor and tax professional is invaluable when integrating retirement accounts into your estate plan. They can help you navigate the complexities of required minimum distributions (RMDs), analyze the tax impact of different beneficiary choices, and explore options like converting traditional IRAs to Roth IRAs. The goal is to maximize the value of these assets for your heirs, allowing your carefully saved funds to continue supporting your family’s future.

Read more about: Navigating Car Loans: Why a Down Payment of Over 20% is Now Widely Recommended and What It Means for Your Finances

10. **Property Deeds and Titles**

Gathering and organizing all property deeds and titles might seem like a simple administrative task, but its importance in estate planning cannot be overstated. These documents legally establish ownership of your real estate, vehicles, and other valuable assets. When these essential papers are easily accessible and clearly documented, you spare your family immense hassle and potential delays during the estate administration process.

If your loved ones cannot readily locate deeds or titles, it can lead to frustrating and time-consuming efforts to reconstruct ownership records. This could delay the sale of a home, the transfer of a vehicle, or the distribution of other significant assets, adding unnecessary stress during an already difficult time. By proactively consolidating these documents, you provide a clear roadmap for your executor to efficiently manage and distribute your property according to your wishes.

Beyond mere location, reviewing your property titles is also critical. How your property is titled – for example, as ‘joint tenants with rights of survivorship,’ ‘tenants in common,’ or in the name of your revocable living trust – directly impacts how that property passes upon your death. Some titling methods allow assets to bypass probate entirely, while others ensure they are distributed according to your will. An outdated or incorrect title could inadvertently undermine your estate plan.

Therefore, take the time to gather all physical deeds and titles for your real estate, vehicles, and any other significant titled assets. Consider creating a secure, organized system, perhaps a fireproof safe or a well-labeled digital archive, that your executor knows how to access. This simple act of organization transforms a potential headache into a smooth, efficient transfer of your hard-earned assets.

Read more about: Financial Scrutiny: High Stakes and Hard Lessons from 14 Music Icons’ Ventures into the Volatile World of NFTs and Crypto

11. **Business Succession Documents**

For entrepreneurs and business owners, estate planning extends beyond personal assets to encompass the future of their enterprise. Business succession documents are an absolute necessity, detailing how your business will be managed, transferred, or dissolved in the event of your incapacitation, retirement, or death. Without a clear plan, your company’s future, its employees’ livelihoods, and the value it holds for your family could be jeopardized.

Key among these documents is a formal **Succession Plan**. This plan outlines who will assume leadership roles, what their responsibilities will be, and how ownership will transition. It addresses critical questions like who will take over decision-making, how daily operations will continue, and whether the business will be sold or passed down to family members. A well-crafted succession plan ensures continuity and minimizes disruption, preserving the value you’ve worked so hard to build.

Another vital component, particularly for businesses with multiple owners, is a **Buy-Sell Agreement**. This legally binding contract predetermines how ownership shares will be handled when a partner or owner leaves the business due to death, disability, retirement, or other specified events. It sets the terms for buying out the departing owner’s interest, often funded by life insurance, preventing disputes and ensuring a smooth transition of ownership without forced liquidation or undervaluation.

Developing these intricate business documents requires specialized legal and financial expertise. Collaborating with an attorney specializing in business law and an experienced financial advisor is paramount. They can help structure agreements that protect your legacy, provide for your family, and ensure the long-term viability of your business, turning potential chaos into a well-ordered transition.

Read more about: Unearthing the Thunder: 10 Forgotten Drag Cars That Dominated the Strip and Deserve a Roaring Comeback

12. **Liabilities Documentation**

Estate planning often focuses on assets, but it’s equally important to consider your liabilities. You may have various debts—mortgages, car loans, credit card balances, personal loans, or even business obligations—that must be settled even after your death. Documenting these liabilities provides your executor with a clear and comprehensive list of what needs to be paid, simplifying their task and preventing potential issues for your estate and beneficiaries.

Without a clear record of your debts, your executor might struggle to identify all creditors, leading to delays in settling your estate and potentially incurring penalties or interest. Worse, unknown liabilities could emerge later, creating unexpected burdens for your family. A meticulously compiled list of all outstanding debts, including creditor contact information, account numbers, and approximate balances, acts as an invaluable guide.

This documentation should extend beyond just the obvious loans. Consider less apparent liabilities such as unpaid taxes, potential legal judgments, outstanding medical bills, or even personal debts to friends or family members. Being thorough ensures that your executor can address all financial obligations systematically and efficiently, protecting your estate from complications and providing peace of mind to your heirs.

By consolidating all liability information, you empower your executor to handle your financial responsibilities effectively. This transparency helps them prioritize payments, avoid unnecessary expenses, and ultimately ensure that your estate is settled in an orderly fashion, preventing financial surprises for those you leave behind. This proactive step is an essential part of ensuring a smooth and responsible transition of your legacy.

Read more about: Taylor Swift’s Global Tax Playbook: 12 Key Strategies for International Income and Unlocking Expat Advantages

13. **Letter of Intent**

While legal documents like wills and trusts are legally binding and critical, a **Letter of Intent** offers a unique and invaluable avenue for conveying personal wishes, advice, and non-binding instructions that cannot be formally included in legal instruments. This personal document serves as a heartfelt message to your loved ones, detailing personal and private instructions regarding your assets, philosophy, and values.

A letter of intent can outline your funeral preferences, memorial service wishes, or even specific instructions for the care of your beloved pets. You can also use it to provide context for your legal decisions, explaining why you made certain choices in your will or trust, which can help prevent misunderstandings or disputes among beneficiaries. It’s a space to share your wisdom, your hopes for their future, or even the sentimental value of certain family heirlooms.

Crucially, a letter of intent is not a legally binding document, so it won’t override your will or trust. However, its immense value lies in its ability to communicate your personality, your intentions, and your love directly to your family in a way that formal legal language cannot. It offers emotional clarity and can be a powerful tool for family harmony, guiding your loved ones through the practical and emotional aspects of managing your estate.

This document can be as detailed and personal as you wish. You might include passwords to online accounts, locations of important papers, thoughts on family traditions, or even a personal farewell message. Store it in a secure place where your executor or trusted family members can easily find it, often alongside your other estate planning documents. A letter of intent ensures your voice, your values, and your heart continue to be present, providing comfort and guidance long after you’re gone.

Read more about: Text Message Turmoil: Inside the Explosive Feuds Rocking Pop Divas and Hollywood’s Elite

An estate plan isn’t a “set it and forget” process; it’s a dynamic, living document that evolves alongside your life’s journey. Major life events—marriage, divorce, the birth of a child, career changes, or significant asset acquisition—are all compelling reasons to review and revise your entire plan. To keep your plan robust and aligned with your current goals and values, regular consultation with your estate attorney, financial advisor, and tax professional is paramount. Imagine the profound peace of mind knowing you’ve meticulously cared for your family, securing their future and providing clarity during any unforeseen circumstances. By proactively putting your estate plan and these essential documents in order today, you create a lasting legacy of love and foresight, a true gift that continues to give for generations to come.