The landscape of Los Angeles’s ultra-luxury housing market is undergoing a significant transformation, characterized by steep price reductions and a palpable shift in market dynamics. What were once considered immovable, art-piece properties are now facing substantial markdowns, signaling a departure from the unchecked valuations of previous years. This recalibration is not merely a cyclical adjustment but a complex interplay of personal circumstances, economic pressures, and evolving buyer expectations.

Indeed, recent sales and listings across LA’s most exclusive enclaves reveal a stark reality where even marquee properties are being slashed by tens of millions of dollars. The perception that the city’s trophy market is wobbling has been fueled by these eye-popping reductions, challenging the long-held belief in ever-inflating prices. It’s a market where sellers, even the most prominent, are finding that the luster of celebrity or sheer size no longer guarantees a quick, top-dollar sale.

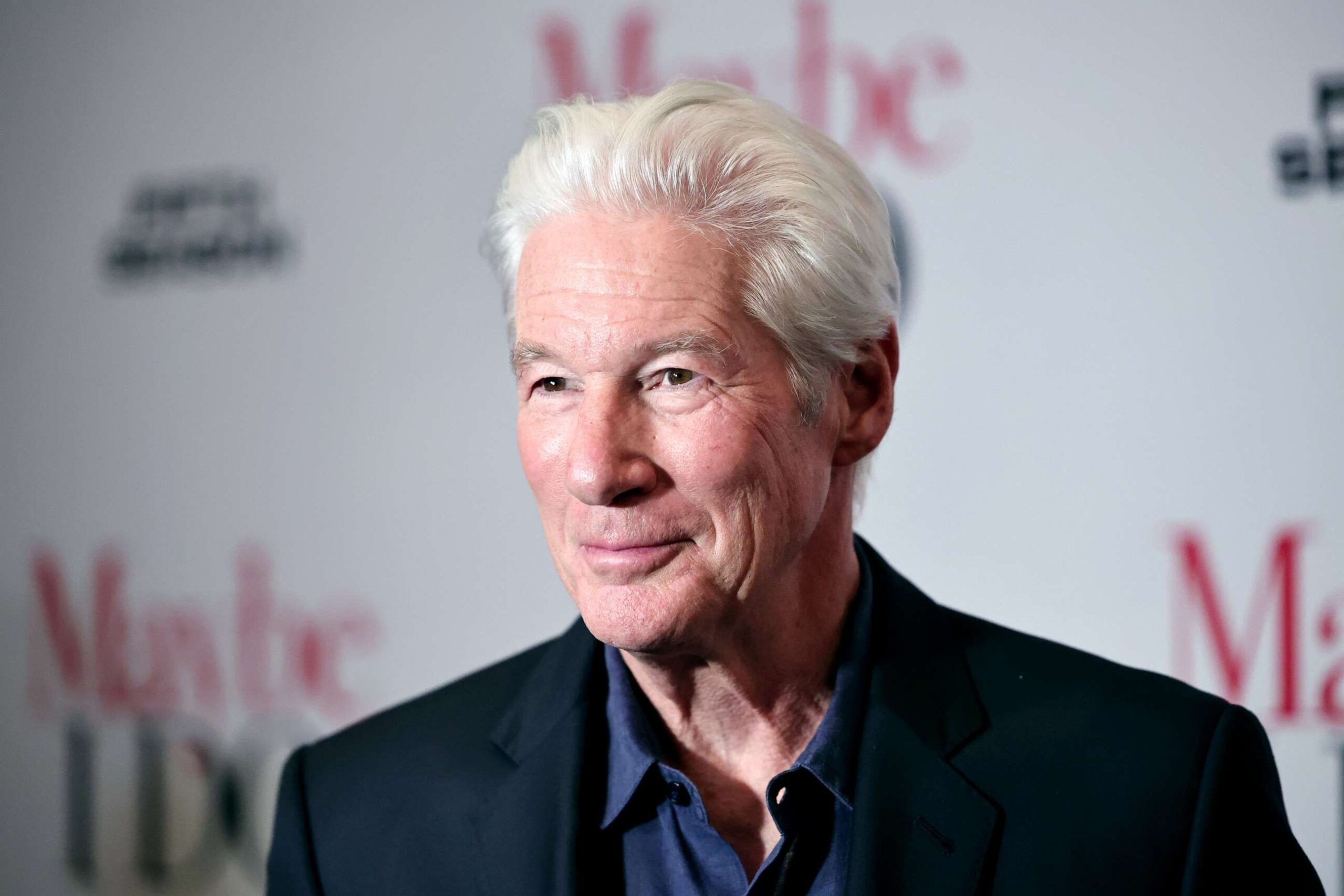

This authoritative analysis delves into the intricate factors driving this market correction, examining high-profile examples of celebrity real estate transactions and the underlying economic and regulatory forces at play. From multi-million dollar price cuts to the impact of new taxes and changing buyer sentiment, we uncover the forces reshaping the decisions of the wealthy in one of the world’s most coveted real estate arenas, setting the stage for understanding Jennifer Lopez’s own high-stakes financial crossroads.

1. **LA’s Ultra-Luxury Housing Market Trends: The Era of Steep Discounts**In Los Angeles’s high-end housing market, a phenomenon of steep discounts has taken hold, fundamentally altering the expectations of both buyers and sellers. Properties that once commanded astronomical asking prices, seemingly immune to market fluctuations, are now encountering a “colder reality.” This shift underscores a broader market correction where the opulence and sheer scale of a mansion no longer guarantee its original lofty valuation.

Recent data from Realtor.com reinforces this trend, indicating that homes initially listed at $50 million or more have, over the past three years, sold with average discounts reaching 32%. This is a significant indicator of buyer leverage increasing dramatically in the upper echelons of the market. The days of unquestioning acceptance of high valuations appear to be waning, replaced by a more discerning and opportunistic buyer base.

Rayni and Branden Williams, founders of Beverly Hills Estates, acknowledge these reductions but emphasize that the numbers often tell only part of a more intricate story. They suggest that many of these situations are “circumstantial,” influenced by a confluence of unique factors rather than solely a systemic market collapse. This nuanced perspective highlights the complexity behind each multi-million dollar markdown, urging a deeper look beyond surface-level figures.

For instance, the market’s current state can often be attributed to properties that were initially “bought too high,” setting an unsustainable benchmark for resale. This scenario, coupled with unexpected life events or prolonged market exposure, can force sellers into positions where significant price adjustments become inevitable. The narrative is therefore not uniform but a mosaic of individual sagas playing out against a backdrop of shifting economic tides.

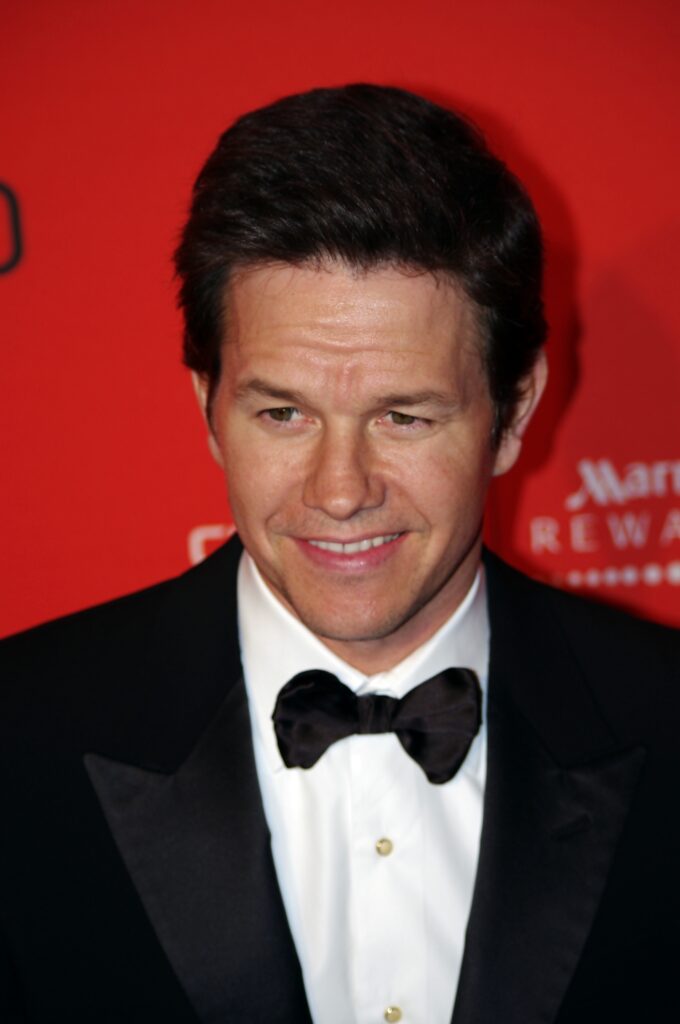

2. **Jennifer Lopez & Ben Affleck’s Beverly Hills Estate Sale: A Case Study in Market Reality**The saga of Jennifer Lopez and Ben Affleck’s Beverly Hills estate stands as a compelling illustration of the challenges currently facing LA’s ultra-luxury housing market. Their sprawling property, initially acquired for around $61 million in 2023, quickly became a focal point for market observers when it was put back on the market within a year, amid their highly publicized separation.

Originally listed at $68 million, the property did not attract a buyer, necessitating a significant price reduction. By fall, the asking price had been “trimmed to $52 million — a $16 million haircut in barely over a year.” This substantial markdown underscores the market’s unforgiving nature, particularly when personal circumstances intersect with ambitious pricing strategies. Later reports indicated further adjustments, with the Zillow listing showing the price dropped to $59.95 million, an additional cut of more than $8 million, after being on the market for about 10 months.

Rayni Williams specifically cited the J.Lo property as an example of a home “bought too high.” She elaborated, stating that “if it were a longer hold, it would have worked itself out. But then obviously she got a divorce and needed to sell it prematurely.” This analysis positions the sale not merely as a market failure, but as a “distress sale” driven by personal events, rather than a reflection of a systemic collapse.

Beyond the personal circumstances, criticisms have emerged regarding the estate itself. A West Coast real estate investor characterized the 12-bedroom, 24-bathroom mansion as “overpriced and poorly located,” suggesting its actual worth is “between $40 and $50 million.” This candid assessment highlights how even celebrity status and vast square footage no longer justify inflated pricing when intrinsic value and market conditions are out of alignment.

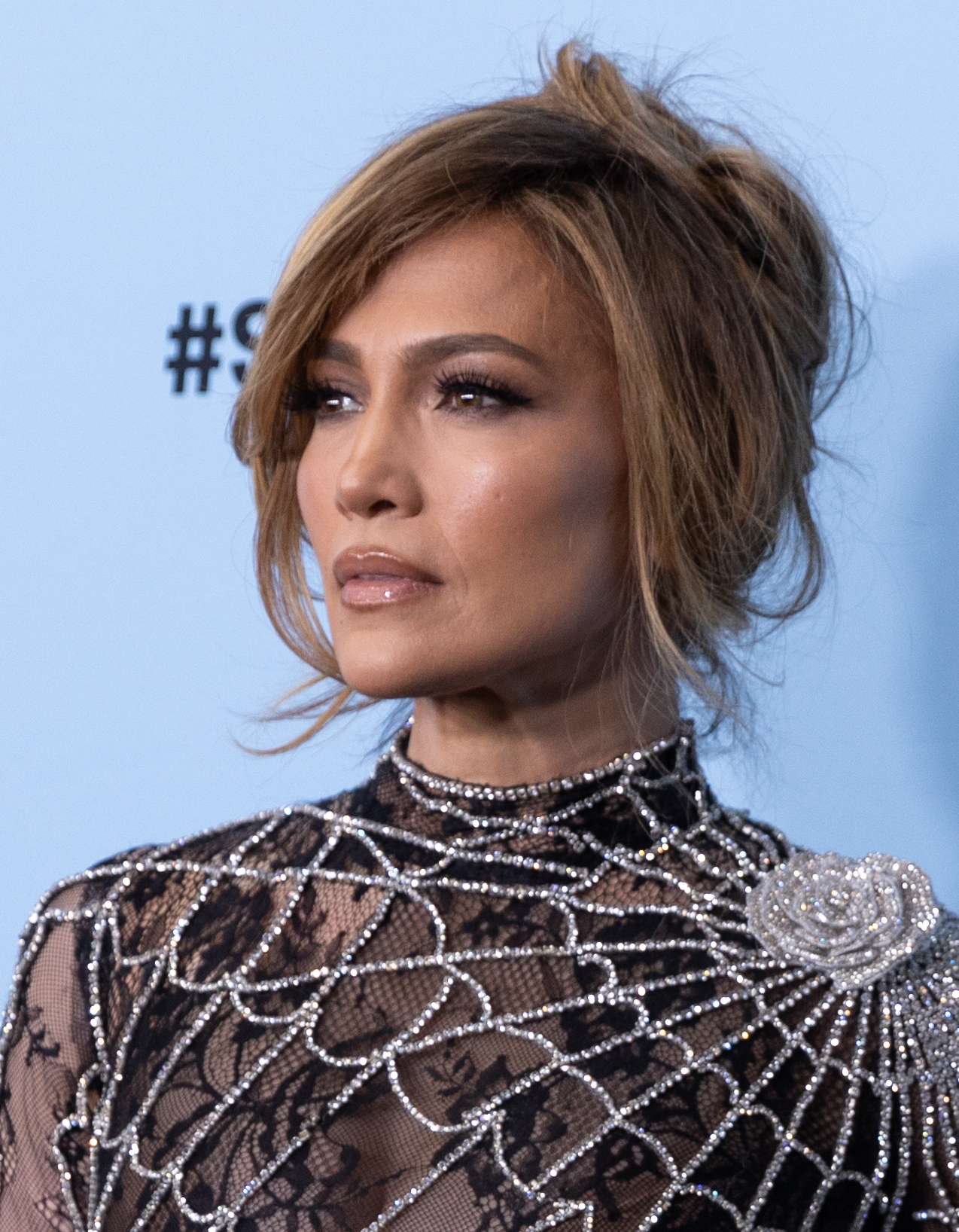

3. **Kanye West’s Malibu Mansion: A Near 60% Discount Illustrating Market Extremes**Kanye West’s experience in the luxury real estate market offers another dramatic example of the steep discounts now prevalent in Los Angeles. His oceanfront Malibu house, notably designed by the acclaimed Japanese architect Tadao Ando, was initially listed for $53 million in 2024. Despite its architectural pedigree and prime location, the property ultimately sold for a mere $21 million.

This represents a staggering “nearly 60% discount” from its asking price, serving as one of the most stark examples of the market’s current trajectory. The sheer magnitude of this reduction illustrates how even properties with unique design and celebrity provenance are not immune to the pressures of a cooling market and discerning buyers.

The significant price chop on West’s property reinforces the idea that unique design and a high-profile owner do not automatically translate into sustained high value in the current climate. It underscores that buyers are increasingly looking for tangible value and are less swayed by inflated celebrity-linked pricing.

This sale highlights the market’s increased scrutiny of pricing, especially for properties that might require additional investment or do not align perfectly with contemporary luxury tastes. The substantial discount on such a prominent property sets a precedent for what can occur when lofty expectations collide with market realities.

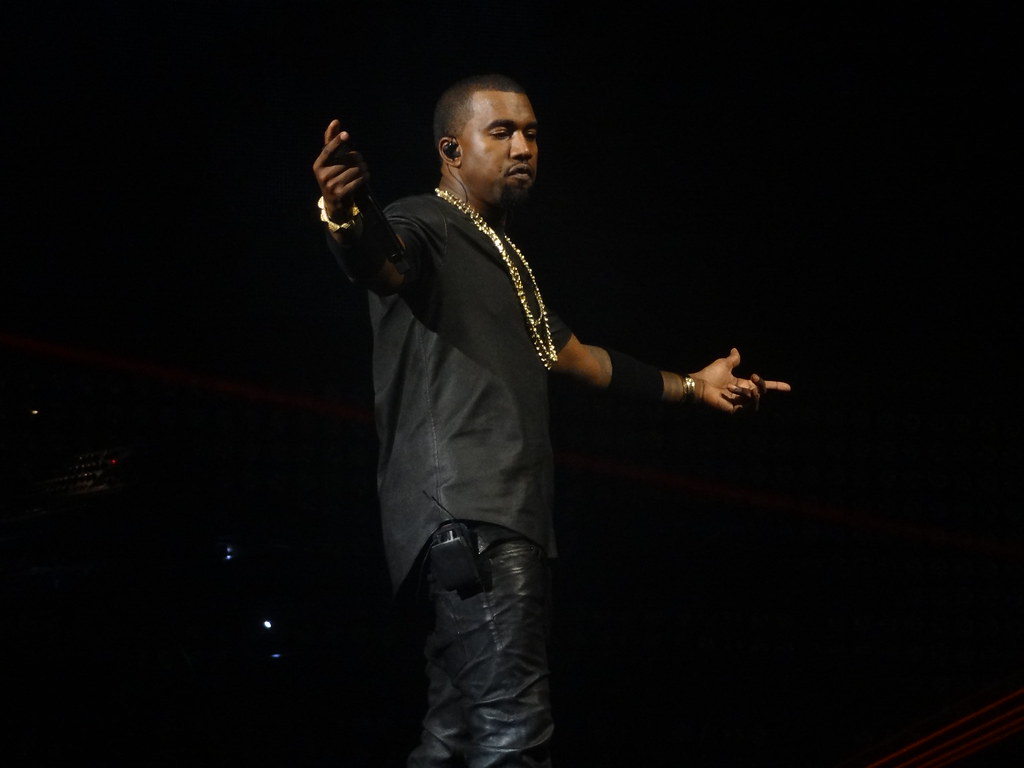

4. **Mark Wahlberg’s Beverly Park Compound: Navigating Price Expectations and Market Timing**Mark Wahlberg’s journey to sell his sprawling Beverly Park compound further illustrates the complexities of pricing and timing in the current luxury real estate market. Wahlberg initially listed his elaborate estate at $87.5 million in 2022, a price point reflective of the property’s scale and its exclusive location within a coveted celebrity enclave.

However, the market’s sentiment shifted, and a year later, the property ultimately “closed at $55 million.” This substantial reduction from the initial asking price underscores the challenges even high-profile sellers face in meeting their ambitious price expectations when market conditions soften. It reveals a gap between seller aspirations and buyer willingness, a recurring theme in today’s luxury segment.

Interestingly, the story of Wahlberg’s former home didn’t end there. Paris Hilton later acquired the property, picking it up “months later for $63.1 million.” While this was still a significant markdown from Wahlberg’s original ask, it was “just $5 million off its asking price” when Hilton purchased it. This transaction is considered one of the “rare cases where a mega-estate sold close to list,” albeit a subsequently revised list price.

This sequence of events offers valuable insights into market fluidity and the impact of fresh marketing or a new set of eyes on a property. It also highlights that while some properties take substantial hits, opportune timing and a motivated buyer, like Hilton, can still achieve a sale closer to a revised market valuation, contrasting with the more severe discounts seen elsewhere.

5. **The “Mansion Tax” (Measure ULA): A Major Market Disruptor**Beyond individual seller situations, the Los Angeles luxury market has been significantly impacted by external forces, none more prominent than the city’s “mansion tax.” Formally known as Measure ULA, this levy was enacted in 2023 and imposes an additional tax burden on high-value property sales, fundamentally reshaping transactional dynamics.

Under Measure ULA, sales over $5 million are subject to an extra 4% levy, while deals exceeding $10 million incur a 5.5% tax. This substantial financial obligation is added on top of the property’s sale price, creating a significant disincentive for potential sellers and buyers alike. Emma Hernan, a realtor with the Oppenheim Group, warns her clients about this tax, noting that for a $5 million home, an additional $200,000 tax can come as an unwelcome surprise.

Branden Williams emphasized the profound impact of this policy, stating, “The mansion tax has been a huge factor. It’s slowed down the market massively because a lot of people don’t want to sell.” This directly translates into fewer transactions and a more stagnant market, as sellers grapple with the reality of reduced net proceeds from their sales.

Rayni Williams further elaborated that this tax forces sellers into a difficult “standoff.” Many are reluctant to sell at a loss or even break even after factoring in the tax, leading them to “hold on to try to recoup their money.” This creates a “difficult conundrum,” where the belief that “you’re never going to see more later” clashes with the desire to avoid significant losses, largely driven by the ULA.

6. **External Pressures: Insurance Hurdles and Wildfires Adding to Market Challenges**Further complicating the already intricate landscape of LA’s luxury real estate are additional external pressures, notably “insurance hurdles after recent wildfires.” The increased frequency and intensity of wildfires in California have led to a tightening of the insurance market, making coverage more expensive and, in some cases, harder to obtain for properties in high-risk areas.

This heightened insurance burden layers atop the existing financial complexities, adding another significant cost to property ownership and, by extension, to the overall transaction process. For potential buyers, the prospect of exorbitant annual insurance premiums, in addition to property taxes and maintenance, makes certain properties less attractive and harder to finance.

For sellers, the challenges manifest in needing to disclose these rising costs, which can deter prospective buyers or lead to demands for further price reductions. The inability to secure comprehensive and affordable insurance can effectively take a property off the market for certain buyers, regardless of its inherent value or appeal.

These insurance difficulties, combined with the mansion tax, create a formidable barrier to entry and exit in the luxury market. They contribute to a slower pace of sales and add another layer of financial risk that buyers and sellers must carefully consider, making the process of transacting high-value real estate even more challenging and unpredictable. The annual cost of insuring a property like the Lopez-Affleck mansion, at $750,000, clearly illustrates the scale of these burdens, making annual upkeep a staggering $1.5 million when combined with property taxes.

While the broader LA luxury market grapples with a recalibration of values and buyer sentiment, Jennifer Lopez’s personal financial situation post-divorce offers a granular lens into the high-stakes decisions and potential costs facing prominent individuals in such a dynamic environment. Her strategies, ambitions, and the intricate details surrounding her real estate moves provide a compelling narrative of financial reckoning amidst personal transition.

7. **Jennifer Lopez’s Post-Divorce Financial Reckoning: A Potential $50 Million Payout Threat**Jennifer Lopez’s recent divorce filing from Ben Affleck has illuminated a significant financial vulnerability: the absence of a prenuptial agreement. This crucial oversight means that the substantial assets accumulated during their two-year marriage could be subject to equal division, posing a considerable threat to Lopez’s estimated $400 million net worth, which far eclipses Affleck’s approximate $150 million. The prospect of such a settlement has reportedly put her financial advisors on high alert, urging her to temper her spending habits.

Sources indicate that the divorce settlement alone could cost Lopez as much as $50 million, a figure that underscores the financial repercussions of an unprotected marriage in the entertainment world. Despite her undeniable wealth, this potential payout represents a significant portion of her assets, demanding a strategic and cautious approach to her finances. The financial implications extend beyond a mere division of wealth, touching upon her cash flow and future investment capacity.

However, Lopez, known for her resilience and tenacity, is reportedly preparing for a protracted legal battle. An insider conveyed her determination, stating, “She has enough money to drag this out, and frankly, she’d rather give the money to lawyers than Ben, so she’s given her team the go-ahead to stall as much as they can, no matter what it costs her in fees.” This stance suggests a fierce resolve to protect her financial interests, even if it means incurring substantial legal expenses in the interim.

Conversely, Ben Affleck is reported to be adopting a more understated approach, at least publicly. While the potential for a “pretty decent payday” is acknowledged, he is reportedly justifying any financial gain by asserting he “deserves every dime just for putting up with her and all her drama.” This perspective highlights the deeply personal and emotional dimensions that intertwine with the financial aspects of high-profile divorces, often complicating an already intricate legal process.

9. **The High Stakes of a No-Prenup Divorce: Lopez’s Coping Mechanism Through Spending**In the wake of her marital separation, Jennifer Lopez’s response has reportedly manifested in a lavish spending spree, perceived by some as a coping mechanism. While her financial advisors are advocating for restraint to preserve her impressive $400 million fortune, Lopez appears to be channeling her emotional upheaval into what she terms “retail therapy,” accumulating significant new expenses ranging from real estate to an expanded entourage. This pattern of expenditure, while seemingly alleviating personal distress, adds another layer of financial complexity to her post-divorce landscape.

A source noted her spending behavior, remarking, “She’s throwing around money like she’s a billionaire right now, which just isn’t the case.” This observation points to a disjunction between her financial reality, albeit a very wealthy one, and her current spending patterns. The advice from her financial team to “reign in her spending” if she wishes to maintain her wealth underscores the tangible impact of these choices on even the most robust personal economies.

This surge in spending is directly linked by insiders to her efforts to navigate the emotional turmoil of divorce. The desire to find happiness and comfort through material acquisitions, even if temporary, is a recognized psychological response to stress. However, when juxtaposed with a looming $50 million divorce settlement and other mounting costs, this approach presents a substantial financial risk, further complicating her already intricate financial situation.

The absence of a prenuptial agreement amplifies the financial stakes for Lopez. Without such a legal framework, the division of marital assets becomes a more contentious and potentially costly endeavor, especially given the disparity in wealth between her and Affleck. Her current spending spree, therefore, not only draws down her liquid assets but also occurs against a backdrop of potential future financial obligations that are not yet fully quantified, making prudent financial management paramount.

9. **Jennifer Lopez’s New Real Estate Ambitions: Eyeing the Azria Estate**Beyond her immediate financial reckoning, Jennifer Lopez is reportedly engaged in a major real estate play, signaling her intention to establish a new, independent domestic foundation. She is reportedly eyeing the magnificent Azria Estate in Holmby Hills, a move that exemplifies her continued pursuit of ultra-luxury living even amidst significant personal and financial transitions. This ambitious property acquisition stands as a testament to her enduring status and lifestyle aspirations.

The Azria Estate is described as a sprawling 14-bedroom mansion, boasting expansive gardens, a separate guest house, and an enviable infinity pool—features that epitomize the pinnacle of opulent living in Los Angeles. Such a property aligns with Lopez’s established taste for grandeur and space, providing an exclusive retreat suitable for her high-profile lifestyle. The scale and amenities of the estate underscore a desire for privacy and lavish comfort.

Currently listed at a substantial $55 million, the property represents a significant investment. However, Lopez is reportedly attempting to negotiate a considerable price reduction, aiming to acquire the estate for around $39 million. This strategic negotiation, while still representing a hefty sum, reflects an awareness of current market dynamics and a desire to secure value, even as she embarks on significant spending.

Should she succeed in this acquisition, the Azria Estate would become a cornerstone of her post-divorce real estate portfolio. However, combined with her other reported expenses, this potential purchase further accentuates the financial pressures on her, prompting scrutiny from her financial team. The pursuit of such a high-value asset underscores the intricate balance between maintaining a desired lifestyle and managing substantial wealth effectively.

10. **The Compounding Costs: Entourage Expansion and Extravagant Retail Therapy**Jennifer Lopez’s post-divorce financial outflows extend beyond real estate, encompassing a significant increase in her personal and professional support system. Reports indicate that she has substantially beefed up her entourage, an expansion that has direct and considerable financial implications for her weekly spending. This decision, while providing additional personal and logistical support, contributes significantly to her mounting expenses.

A source explained the immediate financial impact, noting, “That means her weekly spending has instantly tripled because when she goes anywhere, they all go with her.” This exponential increase in operational costs highlights how celebrity lifestyles inherently involve a large ecosystem of support, and any expansion directly translates into a heavier financial burden. The convenience and prestige of a larger team come with a hefty price tag.

Furthermore, Lopez’s penchant for “retail therapy” has reportedly escalated into extravagant shopping sprees, benefiting both herself and her expanded retinue. “She’s regularly spending a few hundred thousand dollars a day on designer clothes for her and her entourage,” an insider revealed. This level of daily expenditure on luxury goods is extraordinary, even for someone of her net worth, and draws concern from those managing her finances.

Despite the apprehension from her financial team, Lopez views these expenditures as essential for her well-being during this challenging period. The insider quoted her as saying the spending “makes her happy, so it’s worth it — end of story.” This statement encapsulates the tension between emotional needs and financial prudence, illustrating how personal decisions, particularly during times of stress, can profoundly impact an individual’s financial trajectory, even for a global icon.

12. **Analyzing the Beverly Hills Mansion’s Flaws: Beyond the Celebrity Premium**The protracted sale of Jennifer Lopez and Ben Affleck’s Beverly Hills mansion provides a compelling case study in how even properties with celebrity provenance can struggle when intrinsic flaws outweigh perceived value. Experts and insiders have been candid in their assessment, suggesting that the mansion’s significant price reductions are not merely market adjustments but a consequence of fundamental drawbacks that deter discerning ultra-luxury buyers, irrespective of its former A-list occupants.

A West Coast real estate investor offered a particularly harsh critique, characterizing the 12-bedroom, 24-bathroom mansion as “overpriced and poorly located.” The investor further elaborated that “Wallingford Estates is a gated community with no guard. Most homes in the area are from the 1970s and are worth between $5 to $10 million.” This assessment sharply contrasts the property’s ambitious $68 million listing, placing its actual worth closer to “between $40 and $50 million.” Such a discrepancy underscores a significant valuation misalignment.

Beyond its location and pricing, the mansion’s aesthetics and functionality have also come under fire. Described as a “huge white elephant,” “garish,” “too big,” and “dated with amenities that are just silly and and not necessary (like an indoor sports complex),” the property appears to suffer from a lack of cohesive, modern design. An insider noted its construction in 2001 by a “mediocre developer with just bad taste in architecture,” resulting in a “mish-mosh of styles with a faux French roof.”

Furthermore, the substantial annual upkeep costs — $762,000 in property taxes and $750,000 for insurance and maintenance, totaling over $1.5 million annually — present a formidable financial burden for any prospective buyer. This figure, combined with the need for “tens of millions of dollars to bring it up to speed,” means the true investment extends far beyond the sale price. Buyers in this segment, as another insider articulated, often prefer spending “$10 million on a (smaller) perfect diamond, rather than dropping $5 million on a huge diamond with visible flaws,” summarizing the mansion’s core dilemma.

12. **The Psychology of Ultra-Luxury Sellers: Ego, Greed, and the Peril of Overpricing**The current state of LA’s ultra-luxury market is not solely driven by economic factors or external pressures; it is also deeply influenced by the complex psychology of its sellers. As Branden Williams of Beverly Hills Estates eloquently puts it, “Buyers always think that their baby is the prettiest baby.” This inherent bias often leads sellers, particularly those with significant wealth and public profiles, to overvalue their properties, creating a disconnect between aspiration and market reality.

This phenomenon is often fueled by a mix of ego and greed. Williams further elaborated on this dynamic, observing that when presented with a strong initial offer, sellers often become “cocky and they get greedy and then they don’t get more.” This psychological trap can lead to a refusal of reasonable bids in pursuit of an even higher, often unrealistic, price, ultimately resulting in prolonged market exposure and, frequently, a significantly lower final sale price.

A stark illustration of this peril is the case of Bruce Makowsky’s 924 Bel Air Road estate. In 2019, the seller famously rejected an offer of $135 million, only to eventually settle for $94 million—a staggering $40 million less than the initially declined bid. This incident underscores the high-stakes gamble inherent in overplaying one’s hand in the luxury market and serves as a cautionary tale against succumbing to the temptation of maximizing every possible dollar at the expense of market timing.

For sellers like Jennifer Lopez, whose property was also initially listed at an ambitious $68 million despite an acquisition cost of $61 million, this psychological aspect plays a critical role. The desire to recoup investment, offset renovation costs, and perhaps even profit, can blind sellers to the market’s evolving demands. This emotional attachment to valuation, rather than a pragmatic assessment of current conditions, often results in the need for substantial price corrections, a pattern increasingly common in today’s recalibrated luxury real estate landscape.

13. **Buyer’s Leverage in Action: The Hunt for “Perfect Diamonds” and Extreme Discounts**In the prevailing climate of LA’s ultra-luxury real estate, buyers are wielding unprecedented leverage, transforming the market into a highly opportunistic arena. The shift is palpable, with discerning purchasers increasingly dictating terms and price points, moving away from past trends where inflated celebrity-linked pricing was often accepted. This new dynamic is characterized by a demand for tangible value, smart design, and the absence of significant hidden costs or required renovations.

Data from Realtor.com vividly illustrates this shift, revealing that over the past three years, homes initially listed at $50 million or more have sold with average discounts reaching an astounding 32%. This statistic is a powerful indicator of buyer power, demonstrating a collective refusal to meet overly ambitious asking prices. It suggests that even in the most exclusive segments, buyers are conducting thorough due diligence and are prepared to negotiate aggressively for fair value.

The most extreme example of this buyer leverage can be seen in the sale of a Four Seasons penthouse. Originally marketed at an eye-watering $75 million, this ultra-luxury residence ultimately sold for just $15 million, representing an extraordinary price reduction. Such a drastic markdown underscores the extent to which buyers are capitalized on market conditions, and their willingness to wait for properties that align with their revised expectations of value.

The prevailing sentiment among these affluent buyers is a preference for flawless, move-in-ready properties, or a substantial discount for those requiring significant investment. As one insider concisely put it, “People with that kind of money would rather spend $10 million on a (smaller) perfect diamond, rather than dropping $5 million on a huge diamond with visible flaws.” This encapsulates the current market philosophy: quality, location, and condition trump sheer size or celebrity association, granting buyers the upper hand in securing exceptional deals in a market ripe with opportunity.

The ongoing saga of Jennifer Lopez’s financial transitions and real estate endeavors serves as a powerful microcosm of the broader shifts occurring in the ultra-luxury market. From the challenges of an unprotected divorce settlement and the allure of new, costly properties, to the hard realities of selling a mansion deemed overpriced and flawed, her experiences illuminate the intricate interplay of personal circumstances, market forces, and astute buyer leverage. For the wealthy, this era demands not just capital, but acute strategic foresight to navigate a landscape where even the most glittering assets are subject to rigorous scrutiny and significant recalibration. The days of unquestioning acceptance of high valuations are behind us, replaced by a colder, more analytical reality that rewards patience and discernment, ultimately reshaping the very definition of luxury real estate success.