The allure of an A-list lifestyle often conjures images of endless luxury, red carpet events, and, of course, sprawling, opulent mansions that defy the imagination. It’s a world where money seems no object, and financial worries are a distant concept. Indeed, the rich and famous are privy to innumerable perks, from high-profile endorsement deals to bank accounts boasting tens, if not hundreds, of millions. Yet, beneath this glamorous veneer, even the most financially secure individuals can find themselves grappling with the harsh realities of the real estate market. The notion that celebrities are immune to market dynamics or the complexities of property ownership is, quite frankly, a myth.

While we might dream of purchasing homes with resort-sized gyms, wine cellars, or even personal waterparks, the upkeep alone for such abodes can be extortionate, not to mention the ongoing expenses associated with real estate ventures. It’s a classic trap: stars dish out bags of cash on luxury dwellings that wouldn’t be out of place in a royal palace, only for these eye-watering excesses to sometimes end in financial disaster. As a recent study highlighted, even high-profile figures like Steve Wynn, Rupert Murdoch, and Kanye West are not immune to high interest rates and broader market trends. Their substantial price cuts provide clear insights into how even the luxury segment must adapt.

Today, we’re taking an in-depth look at some of the biggest celebrity real estate flops of recent memory. These are the stories where dream homes turned into financial nightmares, where colossal investments led to staggering losses, and where, despite all the wealth and fame, the cold, hard forces of the market delivered a sobering lesson. Prepare to discover how even the most untouchable stars found themselves sadly left brokenhearted by their property ventures, proving that when it comes to real estate, no one is truly too rich to feel the pinch.

1. **Steve Wynn’s Beverly Hills Mansion**: Topping a recent study on celebrities who lost money in real estate in 2024, former Las Vegas casino mogul Steve Wynn’s experience serves as a stark reminder of the market’s unpredictability. His lavish Beverly Hills mansion, a truly grand estate, was initially listed in the spring of 2021 for an ambitious $125 million. Such a price tag reflects not just the property’s inherent luxury but also the aspirational heights of the ultra-luxury market.

However, market dynamics proved relentless. The property, an 11-bedroom, 27,150-square-foot mansion situated on a sprawling 2.7-acre property, found no immediate takers at its original asking price. It boasts impressive amenities including a pool, a wine cellar, a resort-sized gym, and a massage room, all located on a private road within the exclusive North of Sunset location. Despite these features and its prime location, the price had to be dramatically adjusted.

The current listing for Wynn’s mansion stands at $65 million, representing a staggering $60 million reduction from its initial asking price. This monumental price drop clearly demonstrates that even properties owned by figures of Wynn’s stature, designed for the pinnacle of luxury living, are subject to market corrections. As real estate agent Ryan Fitzgerald noted, “Celebrities like Steve Wynn… are not immune to these market dynamics. Their substantial price cuts reflect broader market trends and provide insights into how the luxury segment is adapting.” It’s a powerful illustration of how even the most extravagant listings can become a real estate flop.

2. **Rupert Murdoch’s Manhattan Apartment**: While Steve Wynn’s Beverly Hills estate represented a significant individual loss in California, media mogul Rupert Murdoch also faced substantial challenges in the competitive Manhattan luxury market. His apartment in New York was originally listed in 2022 for an impressive $62 million, a figure that speaks to its exclusivity and prime location in one of the world’s most expensive cities.

However, much like other high-end properties, it encountered resistance from buyers. The market, influenced by factors such as high interest and mortgage rates, was evidently not as robust as anticipated for such a premium offering. This forced a significant reassessment of its value to entice potential purchasers in a discerning market.

The apartment is now on the market for $28.5 million, marking a substantial $33.5 million drop from its initial listing price. This considerable reduction underscores the pressures faced even by properties associated with global billionaires. It serves as another compelling piece of evidence that even in the most sought-after urban centers, an inflated initial asking price, coupled with prevailing market conditions, can lead to celebrity sellers having to absorb considerable financial hits to move a property.

3. **Naomi Campbell’s Disastrous Spaceship House**: When a Russian billionaire gifts his supermodel lover a multimillion-dollar mansion, one expects nothing less than extraordinary. In 2012, Vladislav Doronin commissioned award-winning architect Zaha Hadid to design a truly unique abode for Naomi Campbell in a Moscow forest. The result was a futuristic space lair, a 36,000-square-foot property that genuinely looked like something out of a science fiction movie, complete with a 20-meter pool, a spa, and a nightclub.

The cost of this architectural marvel was a staggering $140 million. It was a testament to extreme wealth and avant-garde design, intended to be a one-of-a-kind sanctuary. However, the dream of this extravagant gift soon disintegrated when Doronin and Campbell split up just a year after building began, reportedly due to Doronin’s “penchant for partying.” This personal upheaval left a colossal, custom-built property in limbo without its intended occupant.

When the time came to sell the house, its unique nature and colossal price tag proved to be its undoing. There were no takers for such a specialized, high-cost property. Despite Doronin first putting it on the market in 2016, a sale proved elusive. The price was reduced multiple times, eventually being listed for an “utterly measly” $89.4 million in 2019. This represented a colossal loss of $50.6 million from its original construction cost, a stark reminder that even a “spaceship house” can come crashing down in the real estate market.

4. **Celine Dion’s Florida Mansion Nightmare**: The superstar songstress Celine Dion, known for her powerful vocals and enduring career, also faced a significant real estate ordeal when attempting to sell her extravagant Florida mansion. Back in 2013, she listed the property for $72.5 million, a price commensurate with its luxurious offerings. The home boasted three pools, a tennis/basketball court, two enormous guesthouses, and even its own waterpark – truly a dream home for many, but a logistical challenge for buyers.

Despite its lavish amenities and the celebrity cachet, the market proved unwilling to meet Dion’s asking price. As years passed, the property remained unsold, forcing a series of repeated price slashes. By 2017, the price had been reduced to a paltry $38.5 million, effectively halving its original valuation. This desperation to sell was reportedly exacerbated by Dion’s eagerness to offload the home following the death of her husband, René Angélil, adding a personal urgency to the financial challenge.

Even at this significantly reduced price, buyers were not lining up. The singer had to lower the price yet again. Finally, after four arduous years on the market, the property was sold for a mere $28 million. This amounted to a colossal loss of $44.5 million from its initial listing price, making it one of the most substantial celebrity real estate disasters. Though the financial hit was immense, Dion was likely relieved to finally be rid of the property that had become a symbol of personal sorrow and market frustration, and has since opted for a cozier Las Vegas abode.

5. **Sylvester Stallone’s Multi-Million Dollar LA Mansion Drop**: Sylvester Stallone, famous for portraying the underdog who triumphs against adversity, found himself in a prolonged battle with the real estate market that defied his cinematic persona. While his La Quinta, California, home also suffered a loss ($4.5 million purchase to $3.15 million sale), it was his Los Angeles mansion that truly underscored the brutal realities of luxury property sales.

Initially, Stallone listed his expansive Los Angeles mansion for an astronomical $110 million. This price reflected not just the property’s size and amenities, but also its prestige and the perceived value of an estate owned by such an iconic action star. However, even for a property of this caliber, the market proved to be highly selective and unforgiving of overvaluation. The listing remained on the market, enduring prolonged periods without a buyer, a situation that often signals an unrealistic asking price in the luxury segment.

Just over a year after its initial listing, Stallone was forced to significantly reduce the price of his Los Angeles mansion, dropping the tag from $110 million to $85 million. The market, however, continued to push back. Eventually, the property was snapped up by British singing sensation Adele for $58 million. This acquisition by Adele was hailed as a “bargain” – and indeed it was, representing a staggering $52 million loss for Stallone from his initial asking price. This massive hit clearly demonstrates that even for a multimillionaire, such a loss, while perhaps deemed “expendable,” is a significant financial setback in the high-stakes game of celebrity real estate.

6. **Kim Basinger’s Entire Town Flop**: In a truly unique and ambitious real estate venture, ’80s beauty Kim Basinger decided to purchase an entire town. Back in 1989, she bought Braselton, Georgia, from the Braselton family, who had owned the land for over a century, for a substantial $20 million. Her intention was to breathe new life into the settlement, and locals were initially hopeful about the prospect of revitalization under the “L.A. Confidential” star’s ownership.

However, this grand vision soon encountered significant obstacles. By 1991, Braselton remained in dire need of attention, and the complexities of developing a whole town began to surface. Basinger’s brother and business manager, Mick, explained the challenges, stating that “They didn’t really elaborate on the infrastructure problems we’ve had and the real estate downturn… The planning process is going to take a long time.” This statement revealed the profound underestimation of the project’s scale and difficulty.

A year later, the situation worsened, with reports indicating Braselton was struggling more than ever. Basinger herself attributed this to difficulties in finding suitable partners to aid in the area’s development, highlighting the immense capital and coordination required for such an endeavor. The venture spiraled into a disaster, ultimately leading to Basinger being declared bankrupt. She had to rid herself of Braselton, selling the town for a mere $4.3 million. This resulted in a mega loss of $15.7 million, proving that even buying an entire town is no guarantee of real estate success, and can, in fact, lead to an epic financial downfall.

7. **Rihanna’s Dilapidated Beverly Hills Pad**: Barely out of her teens, Rihanna, the global singing sensation, made a significant purchase in 2009, acquiring a Beverly Hills pad for $6.9 million. At the time, it seemed like a prime investment in a coveted location. However, what appeared to be a dream home quickly devolved into a protracted nightmare, revealing a dark side to the luxury real estate market that can ensnare even the savviest of buyers.

Just a year after her purchase, following a severe rainstorm in 2010, the building became totally flooded. This catastrophic event triggered an investigation that uncovered a multitude of construction-related problems with the house, exposing its structural vulnerabilities. It became clear that had she known about these severe issues, Rihanna would presumably never have committed to buying the property, which was later revealed to be worth only a fraction of the multimillion-dollar price tag she had paid.

In response to being misled about the property’s condition, Rihanna sued Prudential California Realty and the home’s previous owner. The litigation was lengthy, stretching over years. Ultimately, the home’s former owner confessed in 2014 that he had indeed known of the property’s structural damage and had informed Prudential about the problems, yet it was sold to Rihanna as a “dream home.” While the specific financial loss she incurred when she had to list the property for “millions less than she paid” and the settlement amount remain undisclosed, the entire ordeal was a significant and costly real estate flop, forcing her into legal battles and undoubtedly leaving a bitter taste about what should have been a celebratory first major home purchase. While not an umbrella from the rain, this story did, thankfully, have a silver lining in the eventual settlement.

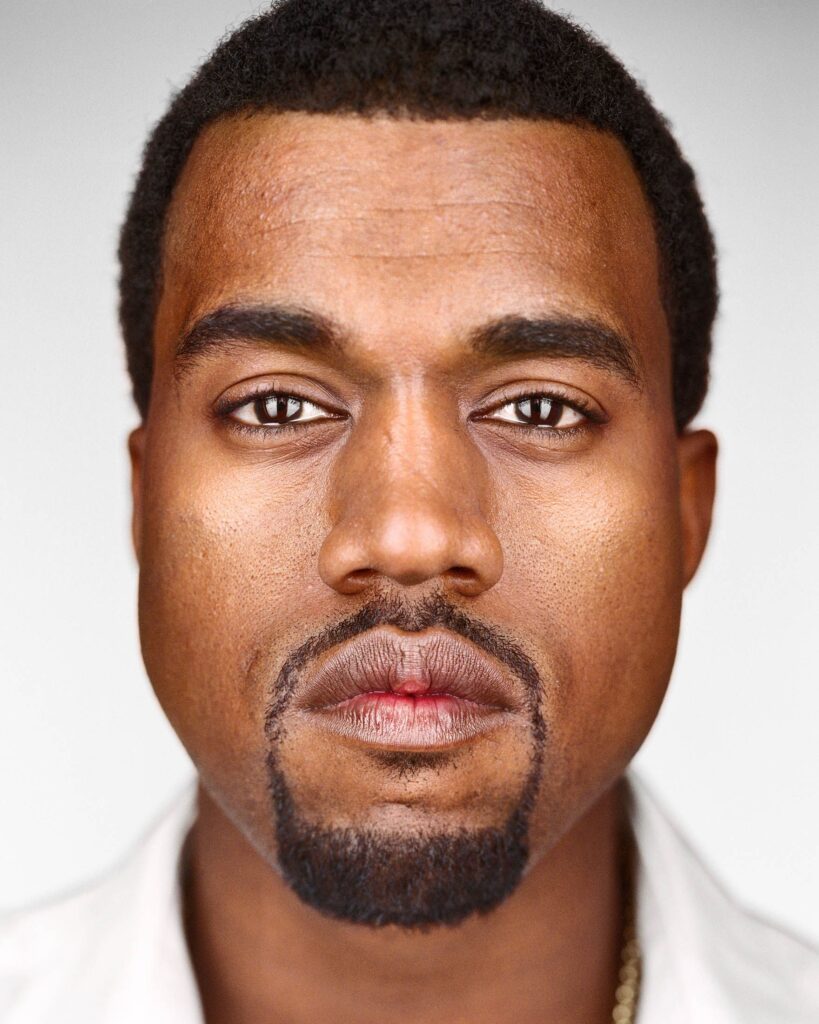

8. **Kanye West’s Gutted Malibu Mansion**Kanye West, a figure as prominent in headlines for his ventures outside music as for his artistic output, has also experienced a significant entanglement with the unpredictable real estate market. His Malibu, California, house, an architectural curiosity, first landed on the market in December 2023 with an initial asking price of $53 million. This substantial figure reflected the prime coastal location and the unique, albeit unfinished, nature of the property.

However, the market’s reception was lukewarm, signaling that even the allure of celebrity ownership couldn’t command such a premium for a property that still required considerable work. The house, known for being “gutted,” presented a unique challenge to potential buyers who were not only looking at the purchase price but also the significant investment needed for completion and customization. This factor likely contributed to its prolonged presence on the market.

Facing a lack of takers at its ambitious initial price, West was compelled to make a considerable adjustment. The listing price was subsequently reduced to $39 million, marking a substantial $14 million price drop from its original valuation. This reduction underscored the necessity of aligning the asking price with market realities, even for a property associated with a globally recognized star.

The journey of West’s Malibu property took another turn when real estate investor Bo Belmont, known for acquiring unique celebrity assets, made a public offer. Belmont’s company put forward an offer of $30 million for the mansion, a figure significantly below the initial listing. As Belmont himself pragmatically noted, “$30 million is better than no million,” highlighting the stark financial realities often faced when high-profile properties struggle to sell. This saga vividly illustrates how celebrity status doesn’t always translate into a smooth, profitable real estate transaction.

9. **Nicolas Cage’s Castle Calamity**Nicolas Cage, an actor renowned for his eclectic roles and sometimes equally eclectic life choices, embarked on a particularly ambitious real estate spree that ultimately led to substantial financial woes. In 2007, Cage indulged in his fascination with historical properties, purchasing not one, but two European castles. His first acquisition was Germany’s 16th-century Schloss Neidstein, which he bought for $2.3 million. This sprawling Bavarian landmark in the village of Etzelwang was in serious disrepair, demanding significant investment to make it habitable again.

Later the same year, Cage expanded his medieval portfolio by acquiring the 18th-century Midford Castle in Bath, England, for a reported £5 million (approximately $6.5 million at the time). These purchases reflected a grand vision, perhaps of living a life straight out of a fairytale. However, the immense costs associated with maintaining and restoring such ancient properties, coupled with his well-documented financial difficulties, quickly turned this dream into a financial burden.

Just two years after their acquisition, Cage’s overall fortune took a severe hit, reportedly due to a series of disastrous investments and economic hardship. This forced him to divest himself of his beloved castles. The rapid turnaround meant he was unable to recoup his investments, particularly with Midford Castle, which he sold for a mere £3.5 million (approximately $4.1 million). This transaction resulted in a significant loss of around $2.4 million, highlighting the perils of ill-timed, overly ambitious real estate ventures.

Cage later attributed much of his financial turmoil, including these unfortunate property deals, to alleged mismanagement by his business manager, whom he subsequently sued. This dramatic episode serves as a powerful cautionary tale: even for a successful Hollywood actor, indulging in grandiose real estate projects without solid financial oversight can lead to a less-than-fairytale ending, with beloved castles becoming symbols of financial distress rather than regal splendor.

10. **Pharrell Williams’ Unhappy Flip Attempt**Pharrell Williams, a name synonymous with meticulous production and trend-setting style in the music industry, surprisingly encountered a less harmonious outcome in the high-stakes world of luxury real estate. In 2018, Williams acquired a unique Beverly Hills mansion from fellow celebrity Tyler Perry for $15.6 million. Perry himself had only bought the house a few months prior for $15 million, managing a modest, quick flip. However, what proved to be a moderate success for Perry turned into a significant challenge for Williams.

The mansion, while undoubtedly a beautiful and architecturally distinct property, was described as feeling more like “a cross between Tony Stark’s mansion and a modern art museum” rather than a cozy family home. Its ultra-modern, somewhat austere aesthetic, coupled with its sheer scale, made it less appealing to a broader range of high-net-worth buyers, particularly those with families who might prioritize warmth and practicality over avant-garde design. This specific style proved to be a hurdle when it came time to sell.

After two years of residing in the distinctive abode, Williams placed it back on the market in 2020, likely hoping for a profitable flip, or at the very least, to break even. However, the property’s niche appeal and the prevailing market conditions meant that achieving his desired price was difficult. It eventually sold for $14 million, resulting in a $1.6 million loss for Williams from his original purchase price. This outcome demonstrates that even with impeccable taste and a celebrity profile, a property’s unique characteristics and market timing can decisively influence its financial performance.

This particular real estate venture left Williams “far from happy,” perhaps feeling like “a room without a roof” in terms of his investment. It’s a clear illustration that even for those accustomed to success and luxury, the real estate market demands a shrewd understanding of demand and broad appeal, especially when dealing with properties that stand out for their unconventional design.

11. **MC Hammer’s Mansion Meltdown**In the vibrant landscape of 1990s pop culture, MC Hammer was an undisputed titan, with his iconic track “U Can’t Touch This” propelling him to global superstardom and immense wealth. This financial success allowed him to indulge in the ultimate symbol of celebrity extravagance: a custom-built mansion that epitomized luxury. His lavish residence was reportedly equipped with multiple swimming pools, a state-of-the-art gym, and even a personal recording studio, making it a true monument to his success.

However, the rapid ascent to fame was tragically followed by an equally dramatic financial downfall. Despite his millions, Hammer found himself ensnared in a web of overspending and poor financial management, culminating in a staggering $13 million debt. The dream mansion, once a testament to his wealth, quickly transformed into a symbol of his darkest hours. The inevitable consequence of such financial turmoil was the loss of almost everything he owned, including his beloved custom home.

The Grammy-winning artist, who had once been among the wealthiest music stars in the country, was forced to confront the harsh reality of bankruptcy. He and his family had to move into rented accommodation, a stark contrast to their previous opulent lifestyle. The luxury pad, originally valued at $9.4 million, was sold for a mere $5.3 million to satisfy creditors, resulting in a colossal loss of $4.1 million. This forced sale underscored the brutal consequences of financial missteps, even for someone at the pinnacle of their career.

Reflecting on the experience with the Chicago Tribune, Hammer acknowledged the many happy memories made in the mansion but confessed to a profound sense of relief at vacating the property. “I’ve had six fun years living here. But it represents the turmoil I went through the past 2 1/2 years,” he stated. “It reminds me of the trials and tribulations. Yeah, I’m relieved and joyous that we’re going. But at the same time, I’m sad.” This candid reflection highlights the emotional toll of such a significant real estate disaster, a stark reminder that even the most elaborate homes can become financial burdens.

12. **Michael Jackson’s Neverland Ranch Nightmare**The Neverland Ranch, a property as legendary as its former owner, Michael Jackson, stands as one of the most famous, and perhaps infamous, celebrity real estate endeavors in history. Originally known as Sycamore Valley Ranch, Jackson purchased the expansive property for $19.5 million in 1988. He then invested a fortune, transforming it into a fantastical, child-friendly amusement park complete with a zoo and various rides, renaming it “Neverland” after the magical island in Peter Pan. It was meant to be a private sanctuary, a place where dreams could come alive.

However, following the singer’s untimely death in 2009, his estate faced the monumental and emotionally charged task of selling Neverland. The property, once a symbol of childhood wonder, had become inextricably linked to deeply troubling allegations of child ual abuse, casting a long, dark shadow over its appeal. This association proved to be an insurmountable obstacle in the luxury real estate market, turning what should have been a valuable asset into a profound liability.

Despite its unique features and celebrity history, Neverland Ranch struggled immensely to find a buyer. It first went up for sale in 2015 with an ambitious asking price of $100 million, but there were no takers. The property’s controversial history, exacerbated by the 2019 “Leaving Neverland” exposé detailing alleged serial ual abuse, further diminished its marketability. Consequently, the price was dramatically slashed by $69 million in a desperate attempt to attract interest.

Ultimately, in 2020, the ranch was sold to billionaire Ron Burkle, a former acquaintance of Jackson, for a mere $22 million. This paltry sum, only slightly above its initial 1988 purchase price and a fraction of its peak valuation, underscores the catastrophic impact of its association with alleged abuse. The Neverland Ranch saga is a chilling example of how non-financial factors—reputation and public perception—can utterly devastate a property’s market value, rendering a once-iconic estate almost unsellable at its true worth.

13. **David Cassidy’s Life and Home Unraveled**David Cassidy, the heartthrob who captivated millions during his “Partridge Family” days, experienced a meteoric rise to fame and an accumulation of substantial wealth, allowing him to enjoy a lavish lifestyle. Yet, like many young stars in the unforgiving world of showbiz, he ultimately squandered his millions, leading to the devastating loss of his dream home and a life marred by financial hardship. His story serves as a poignant reminder that early success does not guarantee lasting financial stability.

Cassidy openly discussed his financial woes in an interview with The Telegraph, revealing that as a young performer in the 1970s, he fell victim to “dodgy deals” orchestrated by business managers. Compounding these issues, he made a series of poor investments in the 1990s and endured significant personal turmoil, all of which contributed to the erosion of his fortune. “I was one of the wealthiest young male entertainers in the world then, but 10 years later I had nothing to show for it. By the 1980s I was broke and had to rebuild my life,” he confessed, illustrating a profound and rapid decline.

The unraveling of his personal life, particularly his divorce, forced Cassidy to confront the sale of his cherished Fort Lauderdale house. He initially attempted to sell the home for $4.5 million, later reducing the price to $3.9 million in hopes of attracting a buyer. However, his dire financial situation worsened, and the property was ultimately sold at a bankruptcy auction in 2015 for a mere $1.8 million. This represented a drastic reduction from his initial expectations, leaving him with a substantial financial shortfall.

The bankruptcy auction not only meant the loss of his home but also the majority of its contents, a truly heartbreaking outcome. By the time of his passing in 2017, Cassidy’s estate was valued at a meager $150,000, a stark contrast to the millions he once commanded. His real estate journey, from a prosperous purchase to a forced auction, exemplifies how a combination of poor financial advice, bad investments, and personal setbacks can lead to the complete dissolution of a once-impressive property portfolio.

14. **Jay-Z’s Ill-Fated Hotel Ambition**Even a mogul of Jay-Z’s caliber, widely celebrated for his business acumen, has encountered significant hurdles in the complex world of real estate development, proving that not every ambitious venture can evade market forces. In 2007, the rapper embarked on a high-profile hotel project in New York, partnering with real estate developer Charles Blaichman. Their grand vision was to transform the former Time Warner Cable warehouse into a sophisticated chain of “J Hotels,” targeting the luxury market in an enviable Chelsea location.

Jay-Z invested a substantial amount, acquiring the property for an eye-watering $66 million, a clear indication of the scale and ambition of the undertaking. Initial prospects seemed promising, with venture partners like Scott Shnay praising the location: “It’s a great piece of property adjacent to the High Line in a great neighborhood.” The duo aimed to secure an additional $370 million in funding to bring their elaborate hotel dream to fruition, projecting a lucrative return in a thriving market.

However, the timing of their ambitious project proved to be disastrous. This venture unfolded right in the midst of the 2008 financial crisis, a period characterized by extreme economic instability and a severe tightening of credit markets. As Blaichman lamented to The New York Times, “Even the banks who want to give us money can’t,” highlighting the immense difficulty in securing the necessary capital during such a challenging economic climate. The global financial meltdown effectively stifled their grand plans, turning a promising investment into a protracted struggle.

The project spiraled into legal battles, with Jay-Z suing Highland Capital in 2010, alleging he was swindled out of millions when he transferred the property to avoid foreclosure. Ultimately, almost a decade later, and tens of millions of dollars down the drain, the original building faced partial demolition. As New York Yimby reported, “The former five-story commercial building’s steel skeleton remains at the site of a planned 11-story, 137,081-square-foot commercial building,” a stark reminder of the unfulfilled vision and the financial losses incurred. This saga stands as a powerful testament to how even the most brilliant minds can be undone by unforeseen market upheavals in real estate.

**An Enduring Lesson from the A-List Market**

As we’ve journeyed through these fascinating and often humbling tales of celebrity real estate ventures, one resounding truth becomes abundantly clear: the property market respects no one, not even the most iconic, wealthy, or seemingly untouchable stars. From grand mansions bought with dreams of forever homes to ambitious commercial developments designed to redefine luxury, these stories reveal that the cold, hard forces of supply, demand, market timing, unforeseen costs, and even personal reputation can inflict significant financial pain. It’s a testament to the unpredictable nature of real estate that even a $100 million asking price can crumble, or a custom-built marvel can become unsellable. While the glamour of celebrity life often shields these figures from everyday worries, their property portfolios offer a stark, relatable lesson: a real estate flop is a universal experience, capable of leaving anyone, regardless of their star power, feeling utterly brokenhearted. These narratives are not just about numbers; they are vivid reminders that in the intricate dance of buying and selling property, even the most glittering dreams can sometimes turn into the biggest financial nightmares.