As we navigate the economic currents of 2025, a pervasive question weighs on the minds of businesses and consumers alike: why isn’t inflation letting up? Despite widespread hopes for a return to more subdued price growth, a complex interplay of factors continues to exert upward pressure across various sectors, signaling that the anticipated relief may remain elusive for the foreseeable future. This persistent inflationary environment is reshaping market dynamics and influencing strategic decisions from boardrooms to households.

While the discussion often centers on broad macroeconomic indicators, a closer look at specific industries, such as the automotive sector, provides a vivid illustration of the underlying forces at play. This industry, serving as a critical barometer for the overall health of the U.S. economy—employing over a million people and contributing approximately 3% to real GDP growth—is particularly sensitive to shifts in trade policy, supply chains, labor markets, and consumer financing.

In this in-depth analysis, we will explore 13 pivotal reasons why inflation is proving to be stubbornly persistent in 2025. This first section will unpack the initial seven key drivers, examining how global trade dynamics, production costs, consumer behavior, supply chain vulnerabilities, labor market shifts, and financing expenses are all conspiring to maintain elevated price levels across the economy.

1. **Global Tariffs on Imported Goods**The implementation of significant tariffs on imported goods stands as a primary driver of sustained inflationary pressures. The U.S. has notably imposed 25% tariffs on automotive imports, with a clear intent to encourage domestic manufacturing and reorient global supply chains. These tariffs directly elevate the cost of foreign-made products entering the market, leading to higher prices for consumers.

While there have been partial exemptions granted to imports from Canada, Mexico, and the U.K., the fundamental framework of these tariffs dictates that the levy applies to the content value of a vehicle produced outside the U.S. This means a substantial portion of imported vehicles, even from exempted partners, will still incur these additional costs. The mechanism effectively acts as a direct price hike at the point of entry.

For consumers, the financial implications are considerable. Experts estimate that these tariffs will increase the average price of an imported car by $5,500, with those from Canada and Mexico seeing an increase of approximately $4,900. Domestically-assembled vehicles are not immune, facing an estimated $1,000 in tariffs on imported components. These elevated costs, eventually passed on to the buyer, serve as a foundational element in keeping consumer prices from declining.

Furthermore, the reciprocal tariffs implemented by other nations, such as Canada’s 25% levy on U.S. vehicle imports, create a cascading effect. This tit-for-tat dynamic means that global trade becomes more expensive on multiple fronts, making it harder for businesses to source components or sell products internationally without incurring additional costs. Such trade friction inherently contributes to an environment where price reductions are difficult to achieve.

Read more about: Why American Pickup Trucks Became Colossal: Unpacking the Complex Web of Regulations, Culture, and Market Forces

2. **Increased Production Costs Due to Trade Policies**Beyond the direct impact on import prices, trade policies, particularly tariffs, are significantly driving up production costs for manufacturers. Businesses face a dual challenge: the direct cost of tariffs on imported components and the indirect costs associated with navigating an increasingly complex global trade landscape. These costs are ultimately reflected in the final price of goods.

For instance, domestically-assembled vehicles are subject to an additional $1,000 in tariffs on imported components, a cost that manufacturers must absorb or, more typically, pass on to the consumer. This isn’t just about the finished product; it’s about every stage of the supply chain where international components are used. The emphasis on mitigating these costs by “pushing tariff costs along to customers to keep things moving” is a recurring theme in industry feedback.

The uncertainty surrounding the duration and composition of these tariffs also adds a risk premium to production planning. Companies are hesitant to make long-term investment decisions when the cost of materials or market access could change unpredictably. This cautious approach can lead to less efficient production methods or delays in adopting cost-saving innovations, further contributing to higher overall production expenses.

This phenomenon represents a classic example of cost-push inflation, where the supply-side expenses of producing goods increase, compelling businesses to raise their selling prices to maintain profitability. Even if consumer demand were to soften, these embedded cost increases would act as a floor, preventing prices from falling back to previous levels and thereby ensuring that inflation persists.

Read more about: Understanding the Unprecedented Surge: The Multifaceted Forces Driving Your Homeowners Insurance Premiums Skyward

3. **”Borrowed Future” Consumer Spending Patterns**Recent consumer spending behavior, particularly in sectors like automotive, illustrates a pattern of demand front-loading that can temporarily mask or even exacerbate underlying inflationary pressures. Consumers, anticipating future price increases or the expiration of incentives, accelerated their purchases, effectively “borrowing from the future.” This created a surge in sales that, while seemingly robust, drew demand away from later periods.

The 12 months ending September 2025 saw a notable five percent increase in car and light truck sales compared to the preceding 12 months, with sales jumping first in November and December 2023, and again in March. Much of this increase was driven by buyers eager to make purchases before new tariffs were imposed or before tax credits for electric vehicles expired. This rush to buy, driven by a sense of urgency, temporarily inflated demand figures.

However, this anticipatory buying means that future sales are likely to face a corresponding decline. As the context points out, these sales “borrowed from the future,” and that future is now here. Such a dynamic can create a peculiar inflationary pressure: an initial demand surge drives prices up or keeps them elevated, but then, even as demand naturally recedes due to the pull-forward effect, the embedded costs and previous price increases remain sticky.

Rough estimates suggest that as many as 0.9 million units may have been sold sooner than they otherwise would have. This front-loading, while providing a short-term boost, makes it more challenging for inflation to subside organically. The market must then adjust to a period of lower actual demand, but with prices that have already been reset higher by the earlier surge.

4. **Persistent Supply Chain Challenges and Resourcing Efforts**Despite improvements in some areas since the pandemic, persistent supply chain challenges continue to exert inflationary pressure. The automotive industry, with its predominantly “just-in-time” manufacturing structure, remains particularly vulnerable. While this model allows for dynamism and minimizes inventory costs, it also means there’s little surplus stock on hand, making the system highly susceptible to even minor disruptions.

Client feedback within the industry, though “cautiously optimistic,” acknowledges significant challenges ahead. Companies are actively pursuing various “resourcing” strategies as a major cost mitigation effort. This includes renegotiating pricing contracts with existing suppliers in the short term, but also exploring more fundamental shifts, such as resourcing supply chains domestically and abroad to lessen the impact of tariffs and other vulnerabilities.

A more profound and long-term strategy involves bringing production back to the U.S. and relocating entire facilities. However, this is a highly “time- and labor-intensive process that takes years to launch appropriately and train employees adequately.” The substantial capital investment, the multi-year timelines, and the need for extensive labor training all represent significant upfront costs that will inevitably be factored into the price of goods over time.

These ongoing efforts to de-risk and reconfigure supply chains, while necessary for long-term stability, are inherently inflationary in the short to medium term. The costs associated with setting up new production, retraining workforces, and adapting logistics contribute directly to the cost of goods sold. Until these new, more resilient supply chains are fully operational and optimized, their transitional costs will continue to prevent inflation from letting up.

5. **Rising Labor Costs and Wage Pressures**The labor market remains a significant source of inflationary pressure, particularly in skilled trades within the automotive industry. Companies are facing “very challenging” conditions in finding the necessary skilled labor, especially for roles in machining or electrical engineering critical for the burgeoning electric vehicle (EV) sector. This scarcity of talent drives up the cost of labor as businesses compete fiercely for qualified individuals.

The competitive landscape for attracting and retaining top talent is intense, with companies offering increasingly attractive incentives and salary packages. On the production side, the challenge is even more acute, with reports of difficulty in recruiting new plant-level employees and a general decline in applicants for these roles. This creates direct “supply chain disruptions” as factories struggle to maintain optimal output levels.

Further compounding these pressures are substantial wage increases secured by labor unions. The United Auto Workers (UAW), for instance, negotiated a significant 25% wage increase with all U.S. Original Equipment Manufacturers (OEMs) two years ago. Such a substantial hike in labor costs directly impacts the operating expenses of automotive manufacturers, which, like other production costs, are eventually passed on to consumers in the form of higher vehicle prices.

These rising labor costs not only contribute to direct cost-push inflation but also incentivize companies to explore automation as a means of mitigating wage expenses. While automation promises long-term efficiencies, the initial investment in advanced machinery and hyperautomation software systems represents another significant capital outlay, adding to the overall cost structure before future savings can be realized.

Read more about: Navigating Your 2026 Social Security COLA: What Retirees and Beneficiaries Need to Know About Upcoming Benefit Changes

6. **Elevated Auto Loan Interest Rates and Financing Costs**While often a tool used by central banks to combat inflation, persistently elevated interest rates for auto loans are ironically contributing to the perception and reality of inflation not letting up for consumers. The cost of financing a vehicle has a direct and substantial impact on a buyer’s monthly budget, effectively raising the overall cost of ownership even if the sticker price of the car remains stable.

Auto loan rates did see a dip in late 2024 and early 2025 following Federal Reserve interest rate cuts, but they subsequently leveled off. As of mid-April, the average rate for a 48-month new auto loan stood at a significant 7.6%, with used car loans averaging between 10-15%. These high rates translate directly into larger monthly payments for consumers, making vehicle purchases less affordable.

Such high financing costs act as a deterrent for potential buyers, often forcing them to extend the duration of their loans, sometimes up to 8-10 years, to make monthly payments manageable. This prolongs ownership cycles of existing vehicles, which in turn can lead to a less dynamic market with fewer new sales, but it doesn’t alleviate the high total cost for those who do purchase.

In an environment where the cost of borrowing remains high, the ‘effective’ price of durable goods like automobiles is inflated by the financing component. This means that even if vehicle prices were to stabilize or modestly decline, the added burden of interest payments ensures that the total financial outlay for consumers remains high, contributing to the feeling that essential big-ticket expenses are not becoming more affordable.

Read more about: Why Are Used Car Prices Still Soaring? Unpacking the Economic Reasons No One Tells You

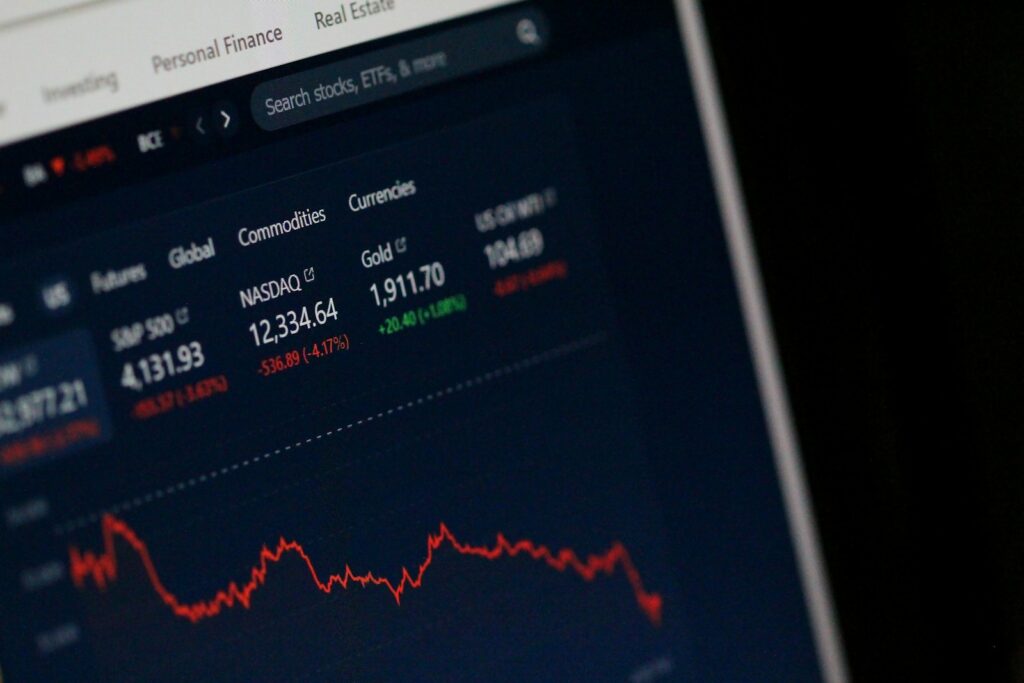

7. **Slower Economic Growth Amidst Cost Stickiness**The U.S. economy is projected to experience a notable slowdown in growth for 2025, with real U.S. GDP growth expected to fall to 1.5%—roughly half the pace seen in 2024. Traditionally, a cooling economy might be expected to ease inflationary pressures as demand softens. However, in the current landscape, this slower growth is occurring alongside persistent cost-side challenges, leading to a unique and sticky inflationary environment.

Despite the reduced economic momentum, businesses are still grappling with the increased cost of tariffs, higher labor wages, and ongoing supply chain reconfigurations. These structural cost increases are not easily reversed, even in the face of weaker consumer demand. Manufacturers, having invested significantly in new production strategies or absorbed higher input prices, are reluctant to lower prices, leading to price stickiness.

The automotive industry, often an important barometer, exemplifies this. While sales are projected to decline—by 4.0% in the U.S. and 7.5% in Canada—due to tariff impacts and broader economic slowdowns, the costs associated with producing these vehicles remain elevated. This dynamic creates a challenging scenario where companies face lower sales volumes but continue to operate with higher cost bases.

For consumers and businesses alike, this means that even if the overall economy is expanding at a slower rate, the everyday expenses and major purchases continue to feel the pinch of inflated prices. The combination of slower growth and stubborn cost pressures suggests that while demand might wane, the underlying factors preventing inflation from letting up remain firmly entrenched, making economic recovery feel less robust than growth figures might imply.

Navigating the complexities of 2025’s economic landscape reveals that inflation’s tenacity stems not only from immediate pressures but also from deeper structural shifts, evolving legislative impacts, technological advancements, and demographic trends. As we delve into the next set of pivotal reasons, it becomes clear that these interwoven factors are creating a unique, challenging environment where traditional economic responses often face unexpected resistance. The confluence of these forces continues to shape market dynamics, requiring businesses and consumers alike to adapt to a new normal of elevated price levels.

8. **Mixed Impact of Legislative Policies: The OBBBA’s Influence**Recent legislative actions, particularly the One Big Beautiful Bill Act (OBBBA), present a mixed bag of input that significantly influences the automotive industry’s cost structure and market dynamics. While seemingly designed to guide market behavior, the act’s various provisions create new forms of financial pressure and uncertainty, preventing a clear path to disinflation. Its multifaceted nature means that what might offer relief in one area could exacerbate costs in another.

One critical change under OBBBA involves the sunsetting of electronic vehicle (EV) credits before the end of the current year. This comes at a time when the industry has gone “full bore” into EV production and development, having anticipated robust governmental support. The level of industry investment in this space is now “too deep to turn back,” meaning manufacturers have sunk significant capital into electrification. The withdrawal of these credits removes a key incentive for consumers, potentially slowing EV adoption and making it harder for companies to recoup their substantial R&D and production costs, which could then keep overall vehicle prices higher.

Further complicating the landscape, OBBBA alters corporate average fuel economy (CAFE) standards and loosens U.S. Environmental Protection Agency (EPA) and miles-per-gallon (MPG) requirements for newly produced vehicles. Previously, a civil penalty was levied for non-compliance with CAFE, but the act reduced this penalty to zero, effectively eliminating it. This gives companies “more latitude to sell more economy cars if they are not meeting the higher or increasing MPG standards.” While this might seem to offer flexibility, it also changes the competitive landscape and investment priorities, potentially impacting the long-term cost benefits of fuel efficiency advancements.

Additionally, the act introduces an interest deduction on new auto loans for U.S.-made vehicles. This provision aims to stimulate domestic purchases, yet it arrives concurrently with expected price increases due to tariffs. While the deduction might partially offset the incentive to buy American-made cars by mitigating financing costs, the overall impact on demand remains hard to predict. The industry, still in a “wait-and-see environment,” is grappling with how these legislative shifts, combined with tariffs, will ultimately influence consumer buying decisions and price points.

9. **Deep Investments in Electrification and EV Development**The automotive industry’s profound and ongoing investments in electrification and electric vehicle (EV) development represent a structural shift with long-term inflationary implications. This commitment is not merely a passing trend but a strategic pivot driven by years of anticipation and substantial capital allocation. Companies across the sector are either creating their own versions of EVs, updating existing EV products, or significantly increasing hybrid offerings, demonstrating a universal push in this direction.

These extensive commitments mean that the industry’s investment in this space is “too costly for companies to turn back now.” Manufacturers have poured billions into research, development, and the retooling of facilities to support EV production. Such massive capital outlays are inherently inflationary in the medium term, as companies must factor these costs into their pricing strategies to achieve profitability and justify shareholder value. This creates a persistent upward pressure on vehicle prices as they seek returns on their deep financial commitments.

Beyond direct manufacturing costs, the push for electrification necessitates a balancing act between maintaining existing supply chains and building entirely new ones optimized for EV components. This dual operational challenge adds complexity and cost. Establishing new infrastructure for battery production, charging networks, and specialized EV parts requires significant upfront investment and can be subject to its own unique supply chain disruptions and input cost fluctuations. These transitional expenses contribute directly to the overall cost of bringing EVs to market.

Ultimately, while electrification promises long-term benefits in terms of fuel efficiency and environmental impact, its initial stages are characterized by substantial investment burdens. The industry’s deep dive into EVs means that these embedded costs will continue to exert upward pressure on prices for the foreseeable future. This is a clear example of how strategic, long-term technological transitions, though vital for future competitiveness, can contribute to sustained inflationary environments.

Read more about: The End of an Era: Decoding Why U.S. Auto Giants Are Abandoning Sedans Entirely

10. **The Costs and Implications of Advanced Automation and AI Integration**The accelerating adoption of advanced automation and artificial intelligence (AI) within the automotive industry, while promising future efficiencies, is currently a significant driver of persistent costs. This technological transition is often viewed as a strategic response to mitigate rising labor costs and overcome challenges in finding skilled labor, particularly for repetitive or precision-intensive tasks. However, the initial capital expenditures required are substantial, making it an inflationary factor in the short to medium term.

Companies are making considerable upfront investments in “advanced machinery and hyperautomation software systems.” These systems automate various processes, from manufacturing lines to supply chain management. While the long-term goal is to reduce operational expenses and improve productivity, the immediate need to acquire, install, and integrate these sophisticated technologies represents a hefty financial outlay. These costs are then incorporated into the overall cost structure of vehicles, contributing to higher selling prices as businesses seek to recover their investments.

In terms of AI, its application is becoming more prominent in specific automotive functions, primarily through “software systems that use hyperautomation.” Vehicle management and fuel management systems, for instance, are increasingly leveraging AI to optimize various functions and automate tasks that were previously manual. This integration requires significant investment in specialized software development, data infrastructure, and training for personnel, adding another layer of technological cost.

Furthermore, the discussion around AI inevitably “veers into autonomous driving systems.” While “self-driving cars and Waymo taxi programs are currently in use,” ethical and technical challenges continue to slow widespread adoption. This means companies are investing heavily in a technology that is still in its developmental and regulatory phases, with long lead times before widespread commercialization. These ongoing R&D costs and infrastructure investments for future autonomous capabilities further embed higher cost bases into the industry, contributing to an environment where price reductions are difficult to achieve.

Read more about: Unmasking the Price Tag: 11 Sneaky Smart Home Costs That Can Quietly Drain Your Wallet

11. **Demographic Shifts and Slowing Population Growth**Beyond immediate economic pressures, longer-term structural shifts, particularly in demographics, are quietly influencing the demand side of the automotive market and contributing to the stickiness of inflation. While population growth traditionally fuels demand for consumer goods, including vehicles, the current trends indicate a significant slowdown that will impact sales forecasts and market dynamics in the coming years.

The U.S. population is growing at a markedly slow pace, a demographic reality with direct implications for sectors reliant on a growing consumer base. A crucial factor in this slowdown is the change in net international migration. Previously, immigration contributed substantially to the country’s population increase. However, with the implementation of new policies, “net international migration into the United States is about nil, or possibly even negative by a small amount.” This reduction in population influx directly translates to fewer potential new car buyers over time.

This demographic shift fundamentally makes “increasing car sales unlikely as a long-run trend.” Fewer new residents mean a smaller pool of first-time car buyers or individuals expanding their household vehicle fleets. For an industry that has historically benefited from a growing domestic market, this represents a significant headwind. While existing vehicle owners may continue to replace their cars, the absence of robust underlying population growth limits the potential for significant demand-driven expansion, necessitating adjustments in production and sales strategies.

Consequently, even if other inflationary pressures were to ease, the structural dampening of demand from slower population growth means the market will face persistent challenges in absorbing new vehicle production at scale without price adjustments. Manufacturers, having invested in capacity based on prior growth projections, may face difficulties in maintaining sales volumes, potentially leading to a stagnation of prices or less aggressive discounting, contributing to the overall perception that inflation is not letting up.

Read more about: The $50,000 Electric Vehicle Nobody Is Buying: Unpacking the Market Disaster and Consumer Reluctance

12. **The Transformative Potential of Autonomous Driving Technology**The advent and gradual integration of autonomous driving technology represent another profound, long-term structural shift that is poised to redefine the automotive market, influencing demand, usage patterns, and ultimately, price structures. While mass adoption is still years away, the investments and anticipated changes are already factoring into the industry’s economic outlook, creating a unique set of inflationary dynamics.

As predicted, “Waymos and other autonomous vehicles are certainly coming,” signaling a future where personal vehicle ownership might look very different. The economic implications are significant: autonomous vehicles operated by ride services are expected to be “used more intensively than owner-driven cars.” This means that instead of a privately owned car sitting idle for much of the day, shared autonomous vehicles will accumulate far more mileage over their lifespan, serving multiple users.

This shift profoundly impacts the replacement cycle of vehicles. The “need for new cars is mostly driven by mileage, not age.” Therefore, while shared autonomous cars will be replaced after fewer years of service due due to their high mileage accumulation, the overall demand in terms of total miles driven could potentially increase. If autonomous vehicles lead to a substantial increase in miles traveled across the population, then annual car sales could, paradoxically, increase as fleets require more frequent replacements to maintain service levels.

However, this also implies a fundamental alteration of the sales process, with “more cars will be sold to fleets.” This change in the customer base, from individual consumers to large fleet operators, will influence pricing, product development, and the entire automotive value chain. The transition costs, R&D for advanced systems, and the shift towards a fleet-dominated market structure will undoubtedly exert unique pressures on pricing, contributing to the feeling that underlying vehicle costs are not receding, even if individual consumer purchasing patterns evolve.

Read more about: Steering Clear of Danger: The 14 Critical Mistakes People Make with Self-Driving Features and Why Autonomy Isn’t Always Safe

13. **Enduring Geopolitical Volatility and Trade Policy Uncertainty**One of the most overarching and unpredictable factors preventing inflation from letting up in 2025 is the enduring geopolitical volatility and the associated high degree of trade policy uncertainty. The automotive industry, being globally interconnected, is particularly vulnerable to the shifting sands of international relations and rapidly changing governmental decrees. This instability creates a challenging environment for long-term planning and investment.

It is considered “unwise to speak with a high degree of confidence regarding the geographic distribution of North American auto production over the next few years” precisely because the new U.S. administration has enacted “a series of trade policies over the past few months, with several subsequently altered or withdrawn shortly after being announced.” This unpredictable policy environment creates a pervasive sense of caution among businesses, who are hesitant to make significant investment decisions when the rules of engagement can change overnight. This hesitancy can lead to less efficient resource allocation and delayed adoption of cost-saving measures.

This uncertainty extends to the “duration, magnitude, and composition of the tariffs” and how ongoing “negotiated trade deals continue to alter the composition of U.S. tariffs.” Businesses struggle to project future input costs, market access, and profitability when these foundational elements are in constant flux. The absence of clear guidance from the administration means that “uncertainty is likely to remain elevated through 2025,” leading to a wait-and-see approach that stifles proactive strategies to lower costs.

Ultimately, this pervasive geopolitical and trade policy uncertainty acts as a continuous upward pressure on prices. Companies build risk premiums into their pricing to account for potential future costs or disruptions. Investment in new production capacity, which could alleviate supply constraints, is held back by the fear that current policies might be negated by future elections or altered trade agreements. This makes it difficult for any true disinflationary trend to take hold, as the underlying environment remains characterized by elevated risk and unpredictability.

Read more about: Beyond the Balance Sheet: 12 Billionaire Investment Strategies to Forge Generational Wealth

As we look ahead, the intricate web of these 13 factors paints a clear picture: the anticipated easing of inflation in 2025 faces significant headwinds. From direct tariff impacts to the complex interplay of consumer behavior, labor dynamics, technological transitions, and unpredictable geopolitical currents, the path to stable price levels remains arduous. For businesses, this means a continued imperative to adapt and innovate, while for consumers, it suggests that the pressure on household budgets is far from over. The economy is not merely recalibrating; it is undergoing a profound structural transformation, and the inflationary ripples from these changes will be felt for some time to come.