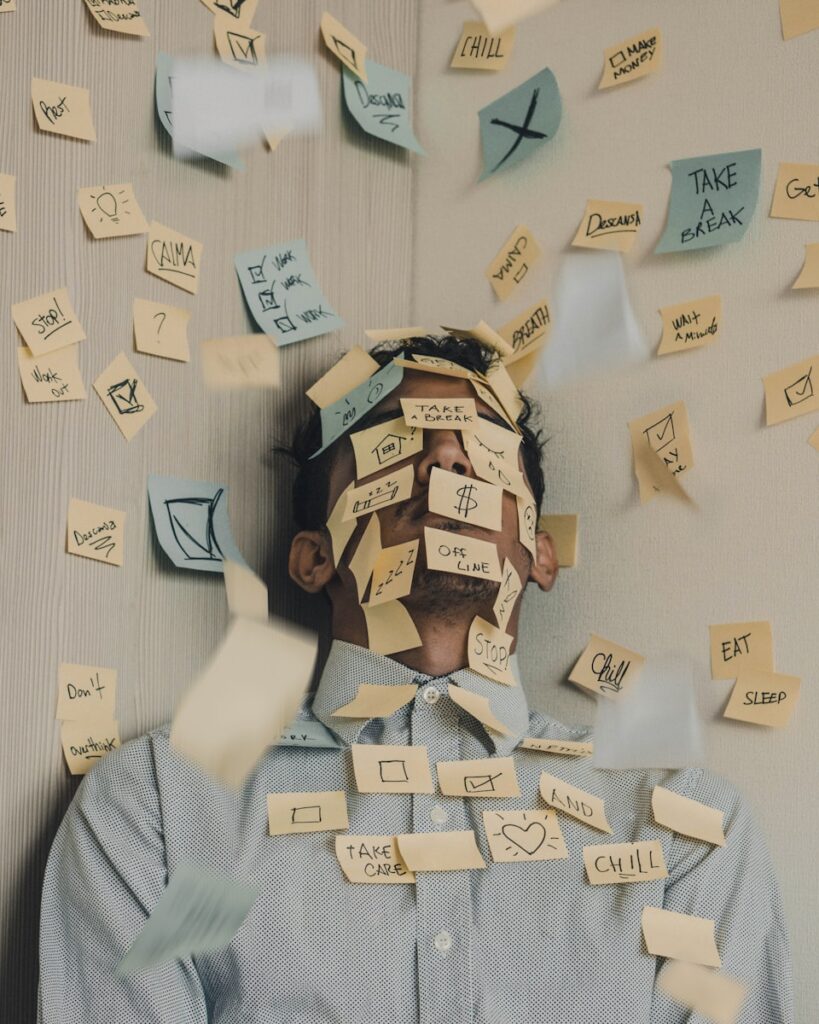

In our fast-paced world, it’s all too easy for our financial lives to become overwhelmingly complicated. From juggling multiple accounts to sifting through piles of paperwork, the sheer volume of financial responsibilities can leave us feeling controlled by our money, rather than in control of it. It’s a sentiment many can relate to, especially with how finance has evolved and the rapid changes it constantly presents.

Inspired by a journey into minimalism, the idea of applying these principles to our finances offers a refreshing perspective. Imagine a life where your financial situation is so straightforward you can track your assets and expenses without breaking a sweat, freeing up valuable time and mental energy for what truly matters to you. The goal isn’t just about saving money; it’s about simplifying, making things easier to remember, understand, and use, thereby avoiding potential mistakes and unnecessary fees.

Fortunately, transforming your financial life doesn’t require drastic, overnight changes. Even small, actionable steps can lead to significant improvements, empowering you to regain control and reduce financial stress. We’ve compiled 14 practical ways to streamline your financial world, starting with foundational changes that will set you on a path to greater financial clarity and peace of mind in 2025.

1. **Consolidate Bank and Investment Accounts**One of the most straightforward paths to simplifying your financial landscape begins with consolidating your accounts. Many individuals find themselves with numerous checking accounts, savings accounts, and investment portfolios accumulated over years, perhaps from different jobs or past financial decisions. The good news is that for most people, managing just one checking account and one savings account is perfectly sufficient and won’t lead to any loss in service quality.

Beyond basic banking, the same principle applies to your retirement savings. If you’ve had several jobs, you likely have multiple 401(k) plans scattered across different providers. Simplifying your life here involves rolling those old 401(k) plans over to a self-directed IRA account. This move not only significantly reduces the amount of paperwork you’ll receive but also helps eliminate various account fees and makes the overall management of your retirement assets much more straightforward.

Extending this consolidation to all your investments, putting them “in one basket” can make tracking them considerably easier, eliminating the need to reconcile multiple statements. This gives you a clear, holistic picture of what you’ve saved and how close you are to reaching your financial goals. While consolidating, it’s crucial to be mindful of potential tax consequences, transaction fees, or transfer charges. Often, you can avoid most charges by transferring assets “in kind” to the new account, but if shares need to be sold because your new firm doesn’t offer a specific mutual fund, you might incur a commission, redemption fee, or even a tax bill.

When rolling 401(k) funds into an IRA, your previous company might send you a check payable to the new firm. It’s imperative to deposit this check within 60 days, as failing to do so could result in income tax on the money, plus a 10% penalty if you’re under age 55. Opting for a single financial institution for your bank accounts offers substantial benefits, including quicker transfers between accounts and eligibility for perks such as waived monthly maintenance fees, reduced ATM fees, and potentially higher interest rates on your checking or savings accounts. For example, Bank of America’s Preferred Rewards program offers fee breaks and other benefits to customers who maintain a combined balance of $20,000 or more across eligible accounts.

Read more about: Navigating the Evolving Landscape: New Rules for Student Loan Forgiveness in 2025

2. **Go Paperless and Reduce Clutter**The sheer volume of financial paperwork can be a significant source of stress and mental clutter in many households. From credit card statements to utility bills, these documents can pile up quickly, often without ever being thoroughly read. One of the simplest yet most impactful ways to simplify your financial life is to aggressively get rid of any paperwork that isn’t absolutely necessary and shift all your account statements and notifications to online delivery.

Embracing paperless billing is a win-win: it reduces the clutter around your home, contributes to environmental sustainability by saving trees, and can even save you money. Many companies, including your bank, credit card issuer, cable TV provider, cellphone company, and insurance company, make it easy to opt for electronic bills. They save money on stationery and postage, sometimes offering bonuses for going paperless, or conversely, charging you if you insist on paper statements, with fees ranging from $2 to $10 mentioned in the fine print.

The process is typically straightforward: log into your online account, navigate to the settings or preferences menu, and select the option to opt out of paper statements, providing an email address for e-bill delivery. You can always print a hard copy if a need arises. For essential documents you must keep, such as tax returns (which you should generally hang on to forever) or medical expense receipts, consider digitizing them. Scanning documents and saving PDFs on your computer, backed up with an external hard drive, eliminates physical clutter while retaining necessary records. Always use a cross-cutting shredder to destroy anything containing personal information, like account numbers or your Social Security number, before discarding.

3. **Streamline Credit Card Use**Many of us, captivated by the allure of rewards programs or zero-interest rate promotions, accumulate an impressive collection of credit cards. While these cards might offer initial benefits, their value often diminishes once the promotional periods or unique rewards are exhausted. Managing multiple credit cards means keeping track of various due dates, minimum payments, and different rewards structures, which can quickly become a complicated and time-consuming endeavor.

To simplify this aspect of your finances, consider focusing your credit card usage on a single card. Choose the one that offers the best, most consistent benefits for your spending habits, and securely put the rest away. While it’s advisable to keep older, unused credit cards open to maintain a healthy credit score, concentrating your spending on one card makes it much simpler to manage your expenditures, track transactions for budgeting, and handle payments each month compared to juggling five or ten cards.

For those seeking a solid, all-around rewards card, options like the Citi Double Cash card are attractive, offering 1% back when you make a purchase and an additional 1% when you pay the bill, totaling 2% back on everything. Investors might prefer the Fidelity Rewards Visa, which provides 2% cash back on purchases when rewards are deposited into a Fidelity brokerage, retirement, checking, or 529 college-savings account. If you enjoy the rewards game but want to simplify, sticking with cards from a single issuer, such as those in the Chase Ultimate Rewards program, allows you to pool points for various redemptions like travel or cash back, without the complexity of managing disparate programs. However, it’s crucial to remember that closing a credit card, especially one with a long history or high limit, can negatively affect your credit score by reducing your total available credit, so careful consideration is key.

Read more about: Unlock Your Financial Freedom: 14 Smart, Actionable Ways to Pay Off Student Loans Faster

4. **Prioritize Debt Freedom**Debt is more than just a financial burden; it’s a profound source of complexity and stress in daily life. Beyond the tangible cost of interest payments, managing multiple debts requires significant time devoted to paying bills, tracking balances, and navigating varying terms and conditions. The mental toll of carrying debt, whether from credit cards, student loans, or personal loans, can be immense, contributing to anxiety and a feeling of being constantly overwhelmed.

Perhaps one of the most powerful and fundamental ways to simplify your financial existence is to systematically work towards becoming debt-free. Think of it this way: each debt that you eliminate effectively removes one significant complication from your life. The fewer financial obligations you have, the fewer bills to track, the less interest to pay, and the greater your financial flexibility.

Achieving debt freedom isn’t an overnight process, but the journey itself can be incredibly liberating. Even just establishing a clear, actionable plan to tackle your debts can go a long way toward simplifying your life. This plan might involve strategies like the debt snowball or debt avalanche method, focusing efforts on one debt at a time while making minimum payments on others. The clarity and control that emerge from knowing you’re actively reducing your liabilities can dramatically lessen stress and empower you to make more informed financial decisions.

Read more about: Unlock Your Financial Freedom: 14 Smart, Actionable Ways to Pay Off Student Loans Faster

5. **Simplify Investing with Funds**For many, the world of investing seems inherently complex, especially when it comes to individual stocks. Investing in individual stocks can be exhilarating and potentially rewarding, but it’s also undeniably “messy.” It demands substantial time and effort: you must thoroughly research each company, execute purchases, meticulously track performance, and decide when to sell. If your portfolio comprises dozens of individual stocks, this ongoing management can easily consume the equivalent of a part-time job, pulling focus from other important aspects of your financial life.

To circumvent this hassle and introduce a significant degree of simplicity, consider investing primarily in either mutual funds or exchange-traded funds (ETFs). These funds pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other assets, managed by professionals. Index funds, a type of mutual fund or ETF designed to track a specific market index like the S&P 500, are particularly attractive because very few actively managed funds consistently outperform the market over the long term, and index funds typically come with lower fees.

Beyond ease of management, funds are also much simpler when it comes to tax time. Individual stocks often require extensive tax-related documentation for capital gains and losses, which can complicate filing and potentially increase the cost of tax preparation. Funds, especially index funds, streamline this process with less paperwork and more straightforward reporting. For investors looking for ultimate simplicity, “do-it-all” asset-allocation funds or target-date funds offer a diversified portfolio that automatically adjusts over time.

Asset-allocation funds, such as the Fidelity Four-In-One Index Fund (FFNOX), hold a mix of other funds, providing exposure to various asset classes like large, midsize, and small U.S. companies, foreign companies, and corporate and government bonds, without you having to manage the individual components. Target-date funds take this a step further, automatically shifting towards a more conservative asset mix as you approach a specific retirement date. Even for hands-on investors, building a diversified portfolio with just a couple of low-cost ETFs, like Charles Schwab’s US Broad Market ETF (SCHB) and US Aggregate Bond ETF (SCHZ), can offer broad market exposure with minimal effort and expense.

Read more about: Navigating Your Future: A Comprehensive Guide to VA Housing Assistance Programs for Veterans

6. **Embrace Cash for Smaller Purchases**In an increasingly cashless society, advocating for the use of physical cash might “sound old school,” but it possesses distinct advantages that can significantly simplify your financial interactions. When you pay with cash, the transaction is immediate and complete. There’s no need to retain receipts for tracking expenses after the fact, a common practice when using debit or credit cards. With cash, you make your purchase, and then you can simply “move on.”

This method cuts down on the digital footprint and the mental energy required to reconcile statements or categorize expenses later. It promotes a clearer sense of your spending limits, as you’re physically handing over money, which can be a powerful psychological deterrent to overspending. For smaller, everyday purchases like a cup of coffee, groceries, or minor incidentals, using cash eliminates the need to review multiple credit card statements or sift through banking apps to understand where your money went.

Conversely, it’s prudent to continue using your credit card for larger purchases, especially those that may require buyer protection, extended warranties, or a potential refund situation. These benefits are valuable for significant expenditures. However, for the myriad of smaller transactions that often clutter our financial records, simplifying your financial life by making those purchases in cash can be surprisingly effective, giving you a tangible sense of control over your immediate spending and reducing the digital noise associated with countless small transactions.

Read more about: Navigating the Market with Ease: A Beginner’s Comprehensive Guide to Index Fund Investing

7. **Cut Unnecessary Services and Subscriptions**Take a moment to consider how many subscriptions and services you currently pay for each month. It’s highly probable that you’re funding several that you hardly use, or perhaps have even forgotten about entirely. From streaming services and gym memberships to software licenses and various online platforms, these recurring charges can quietly accumulate, draining your budget and adding needless complexity to your financial life.

Eliminating these unused or underutilized services is a straightforward way to declutter both your budget and your mental space. Each subscription you cancel not only frees up money that can be directed towards more meaningful goals but also removes yet another payment you need to track. The principle is simple: “The fewer payments you need to make, the simpler your finances will be.”

Read more about: Unmasking the Price Tag: 11 Sneaky Smart Home Costs That Can Quietly Drain Your Wallet

Beyond outright cancellation, you can also simplify by actively renegotiating fixed monthly costs for essential services like your cable or cell phone bill. If you’re no longer under contract, a quick call to customer service could yield a lower monthly rate. If your current provider isn’t willing to budge, the internet makes it incredibly easy to comparison shop for services. Finding better prices elsewhere gives you leverage to either switch providers or encourage your current one to match or beat those prices, simplifying your budget by reducing outgoing payments without sacrificing essential services.