For many drivers across Seattle and the broader Washington state, navigating the complex world of car insurance can feel like an intricate puzzle, often fraught with varying rates and an array of coverage options. As a seasoned insurance professional, I’ve seen firsthand how crucial it is for consumers to be armed with clear, data-driven information to make the most informed decisions about their policies. The goal isn’t just to meet legal requirements, but to find truly affordable, reliable coverage that fits individual needs without unnecessary financial strain.

Understanding your car insurance premium is more than just looking at a number; it involves recognizing the numerous underlying factors that contribute to that cost. From your personal demographics to your driving history and even your geographical location, each element plays a significant role in determining what you’ll pay annually. This article aims to demystify these variables, offering actionable insights derived from extensive analyses by leading consumer reporting agencies.

Drawing upon the latest analyses from sources like NerdWallet, ValuePenguin, and CarInsurance.com, we’ve compiled 15 crucial insights designed to empower you. These ‘agent’s picks’ will guide you through the intricacies of car insurance in the Pacific Northwest, highlighting how to identify the cheapest providers for various driver profiles and the most effective strategies to secure the best possible rates. Let’s delve into the first seven of these essential picks, setting the foundation for smarter insurance choices.

1. **The Paramount Importance of Shopping Around for Insurers**One of the most fundamental truths in the car insurance market, and indeed one that is consistently emphasized by experts, is that the company you choose is the single biggest variable in your insurance cost. This isn’t a minor factor; it can lead to substantial differences in premiums for identical coverage. Therefore, to be truly confident you’re getting the best rate, shopping around and comparing quotes from multiple insurers is not merely advised—it’s essential.

Multiple analyses, including NerdWallet’s most recent findings for Seattle, clearly illustrate this point. The median annual rate can fluctuate significantly between different providers for a 35-year-old driver with good credit and a clean driving record. For instance, Kemper consistently appears among the cheapest, while others like Allstate and Chubb are often on the higher end for this demographic, even with the same driver profile. This disparity underscores why relying on a single quote is rarely the optimal strategy.

Furthermore, this principle holds true across different age groups and driving records. Whether you are a 20-year-old new driver, a 60-year-old with decades of experience, or someone with a speeding ticket or even a DUI, the list of the ‘cheapest’ companies will vary. What might be the most affordable insurer for one demographic might not be for another. Using comparison tools, as suggested by NerdWallet, allows you to easily shop for cheap auto insurance online and ensures you’re not leaving money on the table. Prices can change over time, so checking roughly once a year is a smart habit.

Read more about: The Unexpected Urban Conundrum: Why Owning a Car in the City Can Become a Significant Liability

2. **Age’s Profound Impact on Premiums: From Novice to Experienced**Your age is another major factor that significantly influences the price you pay for car insurance, a reality consistently shown in analyses of Seattle rates. Younger drivers, particularly those in their teens and early twenties, typically face the highest premiums. This is primarily due to their relative inexperience on the road, which insurers correlate with a higher likelihood of accidents and, consequently, claims. The data from NerdWallet’s most recent analysis in Seattle paints a clear picture, showing a median rate of $5,839 for a 20-year-old, plummeting to $2,769 for a 35-year-old.

As drivers mature and accumulate more experience, their rates tend to decrease, eventually plateauing. By age 35, rates often stabilize, and this period is highlighted as an excellent time to compare rates again, as the cheapest insurer from your earlier years may no longer be the best deal. For 50-year-olds and 60-year-olds, rates can reach their lowest points, reflecting a history of established driving records and extensive experience. For example, 60-year-olds in Seattle show a median rate of $2,546, which is close to the lowest average for any age group.

However, this downward trend isn’t indefinite. Rates can begin to tick up slightly for drivers in their 70s, as seen with a median rate of $2,711 for 70-year-olds in Seattle. This reflects another shift in actuarial risk assessments. The key takeaway is that your age group dictates not only the baseline cost but also which companies might offer the most competitive rates for you at different stages of life, making it crucial to regularly reassess your options.

3. **Location, Location, Location: How Your Seattle ZIP Code Drives Your Rates**Even within the same city, the cost of auto insurance can vary significantly from one neighborhood to the next, a detail that many drivers often overlook. This granular variation is heavily influenced by local factors such as the frequency of accidents, the types of roads, crime rates like theft and vandalism, and even specific weather patterns. Insurers analyze these localized risks to tailor premiums to individual ZIP codes, ensuring their rates reflect the actual risk profile of a given area.

NerdWallet’s analysis of Seattle’s most populated ZIP codes clearly demonstrates this phenomenon. For instance, drivers in ZIP code 98118 face a median rate of $2,924, which is notably higher than the $2,525 median rate in 98155. These differences are not arbitrary; they are data-driven reflections of the varying risk factors present in each distinct community. Higher rates in certain areas, such as Rainier Valley, which averages $206 per month according to ValuePenguin, may reflect a reputation for higher property crime rates.

Conversely, neighborhoods like Downtown Seattle often see cheaper rates, averaging $173 per month. This is often attributed to the likelihood of downtown residents parking their vehicles in secured lots or garages, reducing the risk of theft or vandalism. Therefore, when considering a move or simply evaluating your current policy, understanding how your specific location impacts your premium is a vital component of securing affordable car insurance.

4. **The Unbeatable Advantage of a Clean Driving Record**For any driver aiming to secure the most affordable car insurance rates, maintaining a clean driving record is arguably the most impactful factor. Insurers base their rates on the potential risk of you filing a claim, and drivers without any marks on their records—no accidents, no speeding tickets, no violations—are consistently considered among the least risky. This translates directly into lower premiums compared to those with any driving incidents.

Analyses, such as those by NerdWallet and CarInsurance.com, unequivocally show that “good drivers” will almost always pay the lowest prices for auto insurance. For a 35-year-old with good credit and a clean record in Seattle, companies like Kemper offer median annual rates significantly lower than those for drivers with even minor infractions. State Farm, for instance, is highlighted as the cheapest for most people in Seattle, with a full coverage policy costing $118 per month, assuming a clean record.

This advantage isn’t just about avoiding penalties; it’s about establishing a history of responsible driving that builds trust with insurers. A spotless record demonstrates lower liability, leading to competitive pricing and access to a wider range of companies offering favorable terms. It’s a testament to the fact that safe driving habits are not only crucial for personal safety but also for your financial well-being when it comes to car insurance.

Read more about: Is the 2025 Mazda CX-50 the Best Compact SUV Bargain? A Detailed Consumer Reports Assessment

5. **Navigating the Aftermath of a Speeding Ticket**Receiving a speeding ticket carries consequences that extend beyond the immediate fine; it often leads to an increase in car insurance premiums. Insurers view speeding tickets as an indicator of increased risk, particularly if there are multiple offenses. The exact increase in cost will depend on several factors, including the specific insurance company, your overall driving record, and the severity of the offense. CarInsurance.com data indicates a speeding ticket can raise rates by up to 51% in Washington.

NerdWallet’s analysis for Seattle drivers with a single speeding ticket reveals how rates adjust. While all drivers will likely see an increase, some companies penalize less severely than others. State Farm, for example, is noted as having the cheapest coverage for Seattle drivers after a speeding ticket, charging an average of $128 per month for a full coverage policy. This is significantly lower than the citywide average of $242 per month for similar drivers.

This situation underscores the importance of shopping around even after an infraction. The difference between the most and least expensive companies post-ticket can be substantial, highlighting that loyalty may not always pay off in these circumstances. Additionally, revisiting quotes three to five years after an offense, once it may have dropped off your driving record, can lead to further savings.

Read more about: How to Safely Stop Tailgaters: 12 Expert Brake-Free Hacks for American Drivers

6. **Understanding the Costs of an At-Fault Accident on Your Record**An at-fault accident on your driving record will almost certainly lead to higher insurance premiums. While typically less severe than a DUI, it signifies a direct claim history and an elevated risk for future incidents. Insurers will usually ask for details about the accident to determine your new rate, understanding that a minor fender bender might be treated differently than an accident caused by running a red light. CarInsurance.com data shows an at-fault accident can increase rates by up to 41% in Washington.

In Seattle, drivers with an at-fault accident can expect to pay more than those with a clean record. NerdWallet’s analysis provides clear averages for this scenario. State Farm again stands out as having the cheapest coverage for Seattle drivers with an at-fault accident, with an average monthly rate of $139. This is less than half the Seattle average of $280 per month for such drivers, demonstrating a significant potential for savings by choosing the right provider.

After an at-fault accident, Seattle drivers typically see their rates increase by an average of $89 per month. This substantial jump emphasizes the need to actively compare quotes. The difference between the most expensive company (Farmers) and the cheapest (State Farm) after an accident can be as much as $241 per month, on average. This reinforces the agent’s advice: shop around diligently after any incident to mitigate the financial impact.

Read more about: Navigating Auto Insurance: 14 Key Factors Driving Costs Across States for Savvy Drivers

7. **The Steep Price of a DUI and Finding High-Risk Coverage**Among all driving violations, a DUI (Driving Under the Influence) carries the most severe consequences for your car insurance rates. Drivers with a DUI on their record will struggle significantly to find affordable insurance and often need to seek out high-risk car insurance companies. A DUI is seen as a major indicator of elevated risk, and as such, you should expect to pay substantially more than a driver without one. CarInsurance.com reports that a DUI can raise rates by 76% in Washington.

NerdWallet’s analysis in Seattle illustrates the dramatic increase, with the city average for a driver after a DUI being $295 per month. The cost of auto insurance typically rises by an average of $104 per month after a DUI in Seattle. However, even in this challenging situation, there are variations among insurers. American Family is identified as having the cheapest quotes for Seattle drivers who’ve gotten a DUI, averaging $207 per month. This figure is approximately one-third less than the overall Seattle city average for DUI drivers.

Despite the steep increase, the advice to compare quotes and utilize any available discounts remains critical. Bundling car insurance with home or renters insurance, pursuing safe driving discounts, or taking defensive driving courses can help to slightly offset these heightened costs. Navigating insurance after a DUI is difficult, but informed comparison shopping can still yield the most manageable rates available given the circumstances.”

Navigating the complexities of car insurance in Seattle and Washington involves more than just understanding the factors that influence your rates; it requires proactive strategies to actively manage and reduce those costs. As we continue our deep dive into securing truly affordable coverage, this section will equip you with eight practical steps—our agent’s picks for smarter savings—designed to empower you in your journey to optimal car insurance. From adjusting your coverage to leveraging life events and understanding state requirements, these insights will help you fine-tune your policy and protect your budget.

8. **Strategic Coverage Adjustments: Dropping Unnecessary Coverage**One of the most direct ways to potentially lower your car insurance premiums is by carefully evaluating your coverage levels, particularly after you’ve paid off your vehicle loan. When you no longer have an outstanding loan on your car, you gain the flexibility to adjust or even eliminate certain types of coverage that might no longer align with your financial situation or risk tolerance. This specific strategy can unlock significant savings, allowing you to tailor your policy more precisely to your current needs.

Comprehensive and collision coverage, while invaluable for protecting your investment against a wide array of potential damages, often represent a substantial portion of your premium. Comprehensive insurance typically covers non-collision incidents such as theft, vandalism, fire, or natural disasters. Collision coverage, on the other hand, pays for damage to your own vehicle resulting from an accident, regardless of who is at fault. For older, lower-value vehicles that are fully paid off, the cost of these coverages might outweigh their potential payout in the event of a total loss.

However, this decision should be approached with careful consideration. The context emphasizes that dropping comprehensive and collision coverage is only a viable option if you could comfortably afford to replace your car entirely out of pocket should it be totaled or stolen. If you’re not in a financial position to absorb such a cost, maintaining these coverages, even for an older vehicle, remains a prudent choice for financial protection.

9. **Leveraging a Spectrum of Discounts to Drive Down Costs**Car insurance providers offer a surprising array of discounts that can significantly reduce your premiums, yet many drivers overlook these opportunities. Actively inquiring about and applying for every discount you qualify for is a powerful strategy to make your policy more affordable. The key is to be proactive and communicate any relevant changes or qualifications to your insurer, as many discounts aren’t automatically applied.

The context highlights several common and impactful discounts. For instance, safe driving discounts are a popular way to reward responsible habits, such as GEICO’s Five-Year Accident-Free “Good Driver” Discount or their Drive Easy Discount, which monitors driving patterns for personalized feedback and savings. These programs encourage safer roads while putting money back in your pocket.

Beyond driving habits, discounts often extend to how you bundle policies or insure multiple vehicles. A multi-policy discount, where you combine auto insurance with homeowners or renters insurance, is frequently offered and can lead to substantial savings across both policies. Similarly, insuring multiple cars under the same policy can also qualify you for a multi-car discount, streamlining your coverage and reducing overall costs.

Other valuable discounts include those for good students who maintain a B average, new vehicle discounts for eligible cars, and anti-theft system discounts for vehicles equipped with security technology. These diverse savings opportunities underscore the importance of thoroughly reviewing your policy and discussing all potential discounts with your insurer to ensure you’re maximizing your savings.

Read more about: The DIYer’s Essential Guide: Unlocking Savings and Success with Used Car Parts

10. **Capitalizing on Major Life Changes for Reduced Premiums**Life is full of changes, and many significant life events can actually translate into opportunities for cheaper car insurance rates. Savvy drivers understand that these transitions are prime moments to shop for new quotes, as their risk profile in the eyes of insurers may have shifted favorably. Therefore, making it a habit to revisit your insurance options whenever something major changes in your life can yield unexpected savings.

One common example is getting married or entering a domestic partnership. Many insurance companies view married couples as less risky drivers, often leading to lower rates. This perception is often based on statistical data suggesting married individuals tend to be more financially stable and involved in fewer accidents, making them attractive policyholders. It’s a clear incentive to update your insurer about your marital status.

Another impactful life change is moving to a new residence. As Section 1 highlighted, your ZIP code profoundly affects your rates due to varying local factors like accident frequency and crime rates. If you move to a suburb or neighborhood with lower accident and crime rates, you could see a noticeable decrease in your premiums. Even if your new area happens to be more expensive for car insurance, shopping around diligently can still help you find a cheaper coverage option tailored to your new location.

Read more about: Unlock Hidden Savings: An Expert’s Guide to Slashing Your Car Insurance by 30% Annually – No Company Switch Required!

11. **Understanding and Adjusting Your Deductible for Savings**Your deductible, the amount you agree to pay out-of-pocket before your insurance coverage kicks in for a covered claim, is a critical component of your policy that directly impacts your premium. This relationship is generally inverse: the higher your chosen deductible, the lower your monthly or annual premium will be. This principle offers a flexible way to manage your upfront costs, provided you’re prepared for the potential implications.

Opting for a higher deductible means you’re taking on more of the initial financial risk yourself in the event of an accident or other covered incident. For example, increasing your collision deductible from $500 to $1,000 would typically result in a noticeable reduction in your premium. This trade-off can be particularly appealing for drivers with strong financial reserves or those who drive cautiously and rarely anticipate filing claims.

However, the practicality of a higher deductible hinges entirely on your ability to cover that amount comfortably if an incident occurs. The context strongly advises that when choosing your deductible, you must select one that accurately reflects the amount you are comfortable paying out of pocket to help repair your vehicle. A higher deductible chosen purely for lower premiums, without the corresponding savings to cover it, could lead to significant financial strain during a claim.

Read more about: 9 Expensive Pet Care Mistakes That Could Be Harming Your Dog: A Lifehacker’s Guide to Smarter Pet Ownership

12. **The Timely Review: Reevaluating Quotes After Driving Record Improvement**While violations like speeding tickets, at-fault accidents, or DUIs can significantly inflate your car insurance premiums, their impact is not necessarily permanent. Insurance companies typically consider your driving record for a specific period, and once certain incidents drop off your record, your risk profile can improve dramatically. This presents a prime opportunity to revisit your insurance quotes and potentially secure much lower rates.

Experts suggest that drivers should actively shop for cheap auto insurance quotes online three to five years after any accidents, tickets, or moving violations have occurred. This timeframe generally aligns with when many infractions may no longer be considered by insurers in their rate calculations. As these negative marks fade from your record, you are effectively reclassified as a lower-risk driver, making you eligible for more favorable pricing from a wider range of companies.

The context implicitly underscores this by showing how rates for drivers with clean records are consistently lower than those with violations. Therefore, even if you found a competitive rate immediately after an incident, it is highly beneficial to re-evaluate your options once your record clears. This proactive step ensures you’re not overpaying for past mistakes that are no longer impacting your current risk assessment.

13. **The Car You Drive: How Vehicle Choice Impacts Your Rates**Beyond personal factors and driving history, the type of vehicle you choose to drive plays a significant role in determining your car insurance premiums. This is not merely about the initial purchase price; insurers consider a multitude of factors related to the vehicle itself when assessing the risk and potential cost of covering it. Understanding these influences can help you make a more informed decision when buying a car or evaluating your current policy.

New and expensive cars, for instance, tend to cost more to insure than older or less expensive models. This is primarily due to several factors: their higher replacement cost if totaled, the expense of repairing advanced technologies and specialized parts, and the higher likelihood of theft for certain desirable models. A vehicle with costly components or advanced driver-assistance systems, while enhancing safety, can also elevate repair expenses, which translates to higher premiums.

Conversely, some vehicles are inherently cheaper to insure. These often include models that are statistically less likely to be stolen, have lower repair costs, or are equipped with robust safety features that reduce the likelihood of severe injury in an accident. The context advises checking out analyses like NerdWallet’s on the cheapest cars to insure. This research can provide valuable insights into which models consistently attract lower insurance rates, offering a practical consideration for cost-conscious drivers.

Read more about: Navigating Your Future: A Comprehensive Guide to VA Housing Assistance Programs for Veterans

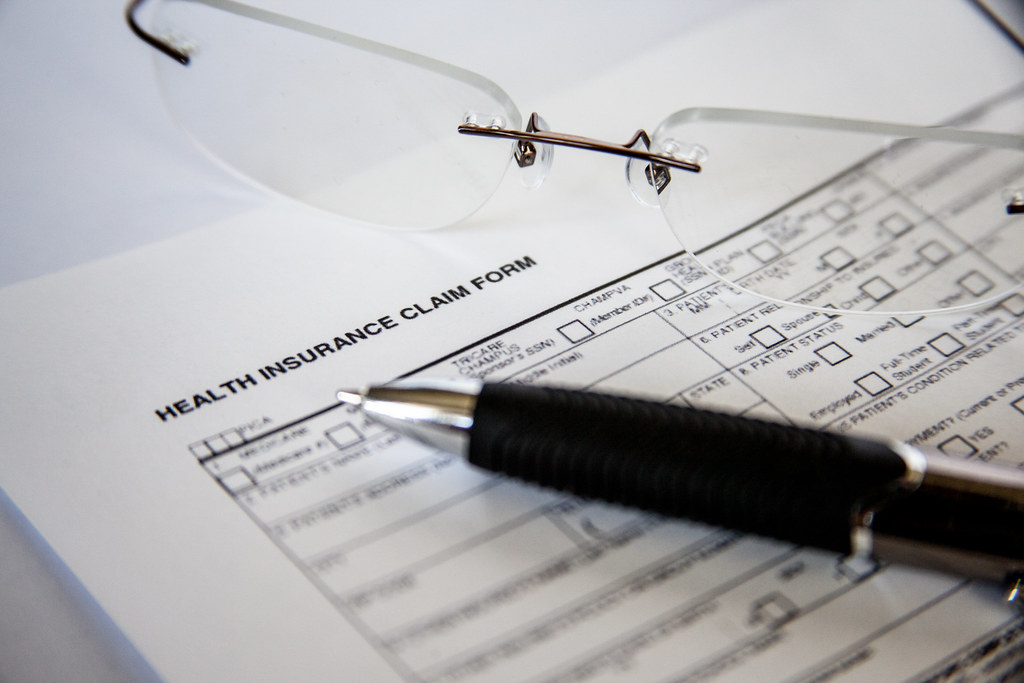

14. **Washington State’s Mandatory Auto Insurance Requirements**For every driver in Seattle and across Washington state, understanding and meeting the minimum auto insurance coverage requirements is not just a recommendation—it’s a legal obligation. Operating a vehicle without adequate insurance can lead to severe penalties, making compliance an absolute necessity. These requirements are in place to ensure that drivers can cover at least a basic level of financial responsibility for damages or injuries they might cause in an accident.

Washington drivers are mandated to purchase liability insurance, which covers others’ property damage and injury expenses if you are found at fault in a car accident. The minimum liability limits are specifically set at $25,000 for bodily injury liability per person, $50,000 for bodily injury liability per crash, and $10,000 for property damage liability per crash. This ensures that a basic financial safety net is in place to protect accident victims from out-of-pocket expenses resulting from your negligence.

While these minimum limits are sufficient to drive legally, the context strongly advises that it’s usually wise to select more than the bare minimum. A serious crash could easily result in damages or medical costs far exceeding $10,000 for property or $50,000 for bodily injury, leaving you personally responsible for the remainder. Many drivers also opt for common additional coverages such as collision, comprehensive, and uninsured motorist protection, along with basic personal injury protection (PIP), to enhance their financial security on the road. Understanding these options, and tailoring them to your personal risk and financial capacity, is paramount for truly comprehensive protection.

Read more about: Navigating Auto Insurance: 14 Key Factors Driving Costs Across States for Savvy Drivers

15. **Navigating Insurance with Poor Credit: Finding Affordable Options**While much of the discussion about car insurance rates focuses on driving history and demographics, your credit score also plays a surprisingly significant role in determining your premiums in Washington. Insurers in the state utilize a credit-based insurance score to assess the likelihood of you filing a claim, viewing your personal credit score as a reliable indicator. This means that drivers with lower credit scores often face higher insurance costs, presenting a unique challenge in finding affordable coverage.

For Seattle drivers, having a poor credit score can lead to substantially higher auto insurance rates. While rates on the page so far have often been based on drivers with good credit, those with poor credit will typically pay more. The Seattle city average for drivers with poor credit is approximately $247 per month, reflecting the increased risk perceived by insurers. This highlights the financial impact of credit standing on everyday expenses like car insurance.

However, even with poor credit, securing affordable car insurance is achievable through diligent comparison shopping. The context identifies American Family as having the most affordable auto insurance for Seattle drivers with a low credit score, with an average of $164 per month. This figure is notably about two-thirds of the Seattle city average for this demographic, underscoring that certain companies are more accommodating to drivers with less-than-perfect credit.

This crucial distinction means that even if you have a lower credit score, you shouldn’t assume that high premiums are inevitable. By actively comparing quotes from various providers, as you would for any other factor, you can identify insurers that offer more competitive rates for your specific credit profile. This empowers you to mitigate the financial impact of credit-based insurance scoring, ensuring you don’t overpay simply due to your credit history.

As we conclude this comprehensive guide, it’s clear that managing car insurance costs in Seattle and Washington is an ongoing process that demands proactive engagement and informed decision-making. By embracing these agent-approved strategies—from astute coverage adjustments and leveraging discounts to understanding your deductibles, capitalizing on life changes, and meeting state requirements—you can navigate the insurance landscape with confidence. Remember, the goal is not merely to find a policy, but to secure reliable, affordable coverage that truly aligns with your unique circumstances and protects you on every journey. Stay informed, stay vigilant, and keep saving!