Ever looked at your favorite country superstar, decked out in designer clothes, stepping off a private jet, and thought, “Wow, they must be rolling in it!”? Well, you’re not wrong to think that – many chart-topping musicians do achieve incredible wealth. But here’s the kicker: having a trophy case full of awards and shelves lined with platinum records doesn’t always guarantee a lifetime of financial stability. In fact, it’s a surprising, and sometimes tragic, truth that many hugely successful artists end up losing it all, blowing through their fortunes faster than a banjo solo.

There’s a saying in the music business that it’s easy to make a million dollars, but hard to hold onto one. This unfortunate pattern isn’t just for rock stars; plenty of country music legends have woken up to the harsh reality of being flat broke. Whether it was due to lavish lifestyles that spiraled out of control, a string of bad luck, or hard times that stripped them of everything, these beloved voices found themselves battling more than just heartbreak in their songs – they were fighting financial ruin.

But here’s the silver lining: the sheer talent and enduring appeal of these musicians often means that if they can weather the storm, they have a shot at a career resurgence and getting their finances back on track. We’re about to take a deep dive into the fascinating, and often heartbreaking, stories of some country stars who were poorer than you ever realized. Get ready to explore the wild rides from fortune to financial distress for these iconic figures.

1. **George Jones**George Jones, affectionately known as ‘The Possum,’ was more than just a country superstar; he was an icon so revered that even other country superstars were in awe of him. Waylon Jennings, another legend in his own right, once famously told Spin magazine, “If everybody sounded like they wanted to, they’d all sound like George Jones.” That’s some serious praise, highlighting his unparalleled talent and the raw, emotional power he brought to his lyrics and delivery.

However, it’s this very depth of talent and ability to connect with listeners that makes his lifelong battle with personal demons and the subsequent financial devastation all the more heartbreaking. For the better part of his career, Jones wrestled with addiction and tumultuous personal issues that consistently threatened to derail his life and his finances. Despite his incredible success, stability seemed to constantly elude him.

By the end of 1978, the situation had become utterly untenable for Jones. He found himself facing an arrest warrant in Tennessee, not for some wild rock-and-roll escapade, but for the hefty sum of $36,000 in child support payments he owed his ex-wife, the equally legendary Tammy Wynette. The banks were calling in loans, and he had nothing left of value to sell, having already resorted to hawking even his future royalty earnings for a mere pittance – a desperate move for any artist.

Adding to his monumental debt was a court order to pay $300,000 to promoters for the astonishing 54 shows he had failed to appear for in the previous two years. With no viable escape route from this financial abyss, Jones officially filed for bankruptcy. His petition laid bare the grim reality: $1.5 million in debts against a paltry $64,500 in assets. What truly baffled everyone during the bankruptcy proceedings was the discovery that despite earning an astounding $2 million in the two years leading up to his filing, Jones could only account for a mere $30,000 of it. It was a stark illustration of how quickly wealth could evaporate under the weight of addiction and mismanagement.

In a testament to his undeniable talent and the respect he commanded, the country stars who so admired Jones rallied to help him out. Fellow legends like Willie Nelson, Linda Ronstadt, and even Elvis Costello, among others, lent their voices and talents to an album of duets with Jones. This collaborative effort was a heartfelt attempt to generate much-needed funds, underscoring the camaraderie and deep respect within the country music community for one of its most troubled, yet undeniably brilliant, sons.

Read more about: Beyond the Red Carpet Smiles: 14 Celeb Co-Stars Who Flat-Out Refused to Film Together (And the Juicy Drama Behind It All!)

2. **Merle Haggard**The story of Merle Haggard’s financial downfall almost sounds like a classic country song, or perhaps even a cliché in the annals of musician woes. He was the quintessential hard-drinking, charismatic musician, complete with a couple of divorces under his belt – a narrative that often precedes a tale of both glory and eventual hardship. And the highs for Haggard were truly exceptional, marking him as one of country music’s most consistent hitmakers.

Between the years 1973 and 1976, an incredible run saw every single one of the nine singles he released soar straight to the No. 1 spot on the charts. His career wasn’t just a flash in the pan; it had the legs to span decades, proving his enduring appeal and prolific songwriting. By 1990, his impressive discography boasted 95 hit singles, with over a third of them proudly topping the country charts. He was, by all accounts, a living legend with an seemingly endless wellspring of success.

Despite this staggering commercial success, Haggard also admitted to engaging in some rather ‘creative accounting’ practices over the years. In one memorable anecdote, he recalled an instance when the IRS, clearly raising an eyebrow at his deductions, sent an agent to his home to discuss what they perceived as excessive business write-offs. Haggard, with his characteristic charm, explained his unique approach to inspiration, claiming he drew it from everything around him.

He recounted to the Tampa Bay Times that the agent, after listening to his explanations, finally looked at him and said, “Why, Mr. Haggard, everything you do is a write-off,” even going so far as to point out other things the musician should have declared. It’s a humorous tale that perhaps highlights the blurred lines between personal life and professional inspiration for a creative mind. However, even with such a seemingly understanding IRS agent, financial stability remained elusive.

By 1992, despite his long and successful career, Haggard’s money was gone. The weight of his financial situation culminated in him filing for bankruptcy in December of that year – a particularly poignant timing, as it was on the very same day his third wife gave birth to his sixth child. This confluence of events underscored the personal and professional upheaval he was experiencing, a true low point for a man who had reached such incredible heights in his career.

Reflecting on his decision to declare bankruptcy, Haggard expressed a pragmatic outlook to the Nashville Banner, as reported by the Orlando Sentinel: “I think this is all for my benefit, to stand back and appraise things where nobody can touch me for a little bit. Hopefully, I won’t be in there long.” To settle his substantial bankruptcy debts and find a path forward, Haggard made a difficult but necessary decision, selling the rights to a staggering 600 of his beloved songs for a reported $3 million. It was a clear demonstration of the sacrifices even the greatest artists sometimes have to make to regain financial footing.

Read more about: Talk About a Plot Twist! These 15 Famous Faces Said Goodbye on Their Own Birthdays!

3. **Lorrie Morgan**Lorrie Morgan, with her distinctive voice and commanding stage presence, carved out a significant niche in country music, especially throughout the late 1980s and 1990s. Her career was marked by consistent chart success, boasting an impressive 14 Top 10 singles on the Billboard Hot Country Songs chart between 1989 and 1999. Among these hits were three songs that soared all the way to No. 1, alongside seven Top 10 albums, solidifying her status as a major force in the genre.

While she continued to release music in the years that followed, the period of her greatest commercial success seemed to be behind her. Fast forward about a decade after her last Top 10 album, and Morgan found herself in a situation that few could have anticipated for such a successful artist: she filed for bankruptcy. It was a stark reminder that even sustained success doesn’t always translate into lasting financial security.

The timing of her financial troubles was particularly complex, as she was in the midst of a divorce from her country star husband, Sammy Kershaw, who himself had filed for bankruptcy not long before she did. Their financial destinies were intertwined, partly due to a shared, ill-fated venture into the restaurant business – a failed chicken restaurant that became a financial black hole. As the restaurant venture crumbled, lenders began calling in their loans, adding significant pressure to her already strained finances.

To compound her woes, the IRS asserted that they were owed money, and yet another bank claimed there were years-old outstanding loans that were entirely unrelated to the disastrous restaurant business. The situation escalated dramatically when U.S. Marshals arrived, poised to seize Morgan’s home. In a tense moment, a judge thankfully intervened and blocked the seizure, preventing her from being barred from her own residence – a close call that highlighted the severity of her predicament.

Morgan wasn’t oblivious to the broader economic climate, acknowledging that her struggles were part of a larger picture. Famously, 2008 was the year the Great Recession gripped the nation, devastating many American families and businesses. In a public statement, she empathetically noted, “It’s very important to me that my fans and business associates understand that I’m okay. Today’s economic times have affected many American families and businesses. I, along with many of you, am not immune to this fact,” as reported by The Hollywood Reporter. Her words offered a relatable perspective on her personal hardship, situating it within a universal experience of economic challenge.

Interestingly, this wasn’t Morgan’s first rodeo with financial distress. Back in 1992, she had previously filed for personal bankruptcy, listing debts totaling $846,000. On that occasion, she managed to navigate the challenges and successfully pay back her creditors, demonstrating a prior capacity for resilience and recovery. Her repeated encounters with bankruptcy highlight the volatile nature of finances in the entertainment industry and the ongoing struggle even successful artists can face in maintaining stability.

Read more about: Mary Martin, Country Music Icon & Unsung Hero, Dies at 85

4. **Randy Travis**Randy Travis, with his deep baritone and traditional country sound, became a monumental force in music, selling more than 20 million albums throughout his illustrious career. He achieved a staggering 16 No. 1 hits on the country charts, a testament to his undeniable talent and widespread appeal. Adding to his impressive list of achievements, he even managed a rare crossover No. 1 hit, topping the Billboard Hot 100 in 2009 with a collaboration with Carrie Underwood – a feat that cemented his status as a true music superstar.

However, despite this incredible professional success, the years following his crossover hit saw his personal life take a sharp downturn, leading to significant financial turmoil. Things outside of his recording studio and concert stages were, unfortunately, not looking great for Travis just a few years later. The public began to see a different side of the star, one grappling with very public struggles.

The singer was arrested twice in a particularly difficult year, 2012. One notable incident involved him attempting to buy cigarettes while both drunk and , a moment that shocked fans and garnered widespread media attention. Simultaneously, Travis was navigating a costly and emotionally draining divorce from his wife of almost two decades, an event that undoubtedly placed a considerable strain on his financial resources and personal well-being.

Then, in 2013, fate delivered another devastating blow: Travis suffered a severe stroke. The stroke left him with significant physical challenges, including the inability to sing – a cruel irony for a man whose voice had brought so much joy to millions. By 2019, the combination of medical expenses, legal fees, the divorce settlement, and a halted income stream had taken its toll, leaving Randy Travis in dire financial straits, effectively broke.

In a valiant attempt to improve his bleak financial situation and share his incredible life story, Travis decided to write a memoir. His co-author, Ken Abraham, shed light on the common misconception surrounding celebrity wealth when speaking to Taste of Country. Abraham stated, “I think that is part of the story of Randy Travis that a lot of people don’t know. They think that just because Randy has had such great success in the music business… that he’s just rolling in money and never has to have a concern. That’s just not the way the music business works.” This honest assessment underscored that even legendary status doesn’t always protect against financial vulnerability.

Remarkably, despite still being unable to sing due to the lasting effects of his stroke and therefore unable to earn back the fortune he once commanded through live performances, Travis has explored groundbreaking new avenues. He has turned to generative AI as a possible, innovative way to restart his career and, crucially, to regain his voice. Label executive Cris Lacy, speaking to CBS News, articulated the pioneering vision behind this move: “We started with this concept of, what would AI for good look like for us? And the first thing that came to mind was, we would give Randy Travis his voice back.” It’s a powerful and hopeful testament to his resilience and the industry’s evolving landscape.

Read more about: 13 Stellar Actors Who Didn’t Deserve Their ‘One-Hit Wonder’ Label – What Happened To Their Epic Careers?

5. **Waylon Jennings**Waylon Jennings, a towering figure in outlaw country music, had a story of financial loss that carries an especially poignant and tragic twist. This is because, not so long before his own monetary crisis, Jennings had been a loyal and incredibly generous friend to George Jones when ‘The Possum’ himself filed for bankruptcy in 1978. According to the Lubbock-Avalanche Journal, as soon as Jennings heard his good buddy was officially broke, he immediately went to Jones’s home and handed him a bag containing a substantial $26,000. It was a powerful act of friendship and solidarity.

At that time, Jennings certainly had the money to spare. He wasn’t just doing well; he was soaring. By then, he already had eight No. 1 songs on the Billboard country chart, a testament to his widespread popularity and commercial success. Adding to his financial comfort, he had even shrewdly secured an extra $25,000 from his record company in a memorable negotiation. The company had misinterpreted his brief departure to use the bathroom as him storming off because his demand hadn’t been met – a misunderstanding that inadvertently boosted his bank account.

However, the tides turned dramatically for Jennings within just a few short years of his generous act towards George Jones. Despite his earlier success, he found himself deep in debt, to the tune of an astonishing $2.5 million. A significant portion of this massive debt was tragically funneled into a debilitating drug addiction. He candidly revealed to Spin magazine the extent of his struggles, admitting, “I must have the constitution of 10 men, because right at the end I was doin’ like $1,500 a day in cocaine.” This raw confession paints a vivid picture of the destructive power of addiction on even the most robust finances.

Determined to avoid the ultimate ignominy of declaring bankruptcy, Jennings adopted a grueling strategy: he began touring like crazy, relentlessly performing to try and earn his way out of the financial hole. The road became his battleground against debt, a testament to his strong will and a desperate attempt to retain control of his financial destiny without resorting to formal insolvency.

Another avenue Jennings explored in his monumental effort to rebuild his fortune was writing his autobiography. However, he told the Las Vegas Sun that perhaps not writing the book might have actually made him more money, if he had been willing to exploit his relationships and secrets: “I could have owned Johnny Cash’s and Willie Nelson’s home by blackmailing ’em, but I didn’t do that.” This revealing quote offers a glimpse into the darker side of the music industry and the temptations for easy money, which Jennings, despite his struggles, apparently resisted. The book itself, nonetheless, did include candid stories about the many times Jennings had found himself completely broke, offering readers an unfiltered look into the volatile financial life of a country music legend.

Our journey through the surprising financial struggles of country music’s biggest names continues, proving that even the most enduring voices can find their bank accounts as empty as a dance hall on a Monday morning. From legal battles to business blunders, these next five legends faced their own unique paths from platinum records to serious financial distress, often showing remarkable resilience in the face of overwhelming odds.

Read more about: Mark James, Visionary Songwriter Behind ‘Suspicious Minds’ and ‘Always on My Mind,’ Remembered for a Profound Musical Legacy

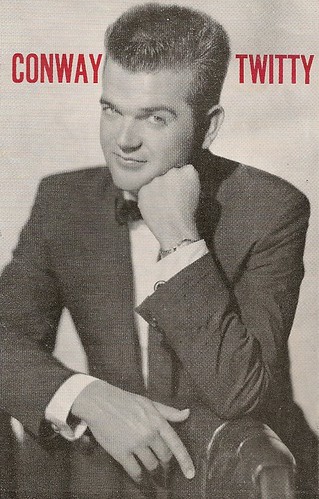

6. **Conway Twitty**Conway Twitty, a man who built a legendary career on his soulful voice, held his reputation in the highest regard, especially when it came to his financial dealings. For him, owing money to anyone was simply out of the question, a principle that would later test his resolve and his personal fortune in an unexpected way. This strong sense of responsibility became incredibly relevant when the country star decided to venture beyond music and try his hand at the fast-food business, a move he would openly admit was a monumental failure.

“What I know about is how to make records and how to sing songs, and I’m not too good at anything else, and Twitty Burger is a prime example,” Twitty famously stated, according to UPI. The unfortunate reality was that many people he knew and cared about had invested their own money into the Twitty Burger restaurant franchise, hoping to share in his entrepreneurial success. When the franchise ultimately went bust, Twitty refused to let his friends and associates suffer losses.

He personally paid back all the investors, a massive undertaking that drained a significant portion of his wealth. Always the shrewd businessman, he then attempted to write off these repayments on his taxes. However, the IRS, perhaps less swayed by sentimentality than Twitty, didn’t agree, leading to a precedent-setting lawsuit known as Jenkins vs. Commissioner (Twitty’s real name was Harold Lloyd Jenkins). The IRS argued that worrying about one’s reputation as a down-home country star did not qualify as a business expense for using personal money to settle debts. In a truly unique turn of events, the judge, seemingly inspired by the presence of country music royalty, decided in Twitty’s favor and even wrote some lyrics to sum up his decision, aptly named the “Ode to Conway Twitty.” The final line delivered the verdict: “Had Conway not repaid the investors/ His career would have been under cloud/ Under the unique facts of this case/ Held: The deductions are allowed.”

Read more about: Beyond the Spotlight: Unveiling the Enduring Realities of Country Music’s Iconic Married Duos

7. **Tammy Wynette**A decade after her ex-husband George Jones’s financial collapse, partly due to child support payments owed to her, Tammy Wynette, the ‘First Lady of Country Music,’ found herself facing her own formidable financial storm. By 1988, despite her immense success and countless hits, Wynette was in dire straits, owing a staggering $900,000 to the government and an additional $1 million to various other creditors. It was a shocking revelation for fans of an artist who had sold millions of records.

Amidst the chaos, there was significant disagreement among those involved regarding who was ultimately to blame for the financial quagmire. Wynette’s husband, George Richey, voiced their frustration to UPI, claiming, “Tammy and I are merely the victims of people who are sharper with the pencil than she and I are.” This statement suggested a belief that they had been taken advantage of or received poor financial advice, rather than being solely responsible for the spiraling debts. Adding to the gravity of the situation, negotiations to settle her substantial government debt eventually fell apart.

The severity of her predicament became terrifyingly clear when U.S. Marshals arrived, not just with paperwork, but with the intent to seize her home. This shocking move allegedly came without any prior warning, and to make matters worse, it occurred while Wynette was out of town, leaving her attorney to scramble. Her attorney, Ralph Gordon, expressed his dismay to UPI, stating, “We had been in negotiation with the [Federal Savings and Loan Insurance Corp.] attempting to resolve this. We were shocked when we found out this morning that rather than attempting to further negotiate the matter, a U.S. marshal showed up to levy the house and property.”

Despite these intense financial struggles, Wynette was able to gradually get her finances back in order over the next decade, ensuring she had some money to leave behind when she passed away suddenly in 1998. However, even in death, her financial legacy continued to be a source of strife. Her daughters and her husband, George Richey, engaged in a contentious battle over who would inherit Tammy Wynette’s fortune, a sad coda to a life marked by both artistic triumph and personal financial turmoil.

Read more about: Beyond the Spotlight: Unveiling the Enduring Realities of Country Music’s Iconic Married Duos

8. **Freddy Fender**Freddy Fender’s musical journey was anything but conventional, starting with his foray into rock music in the 1950s before a jail sentence temporarily halted his career. By the 1970s, he had pivoted to Tejano music, a genre change that would launch him to massive crossover success on the pop charts. This period, he told the Los Angeles Times, was “Music-wise, and art-wise, it was the best years of my life.” Yet, despite this creative and commercial peak, Fender was candid about the accompanying financial realities, admitting, “But I didn’t get the money.”

He openly confessed to the pitfalls that often plague successful artists, citing “a lot of drinking and drugging” and a failure to “keep my eyes on the money.” He also acknowledged, like many in the industry, that he “got ripped off.” Even as he enjoyed significant chart success, Fender famously claimed he wasn’t truly wealthy, a statement that would tragically prove to be an understatement when he later found himself flat broke due to a horrific turn of events.

In 1981, while on tour, Fender’s life took a devastating detour. After his tour bus dropped him off, it continued its journey without him. Just minutes later, the bus was involved in a terrible accident that claimed the lives of his 39-year-old drummer, Joseph Lambert, and his 45-year-old driver, Joseph Parker. Already deeply in debt by that point, the resulting lawsuits from this tragedy proved to be the final straw, utterly bankrupting him. He spent the remainder of the 1980s performing gigs for hardly any money, a stark contrast to his earlier chart-topping glory.

However, Fender’s story is also one of remarkable resilience. In 1989, he helped form the Texas Tornados, a Tejano supergroup that would bring him renewed chart success and Grammy wins. Reflecting on his arduous journey, Fender once shared his perspective with Nu Country: “I’m not one to think like ‘poor me.’ I’ve always accepted the ups and downs. Maybe I’ve had to start all over again a few times, but at least I’m not an old cup of stale coffee. I’ve had a few refills.” It’s a powerful testament to his enduring spirit and ability to find a fresh start.

Read more about: Tommy McLain, King of Swamp Pop, Dies at 85: A Legacy Etched in Louisiana’s Musical Soul

9. **Willie Nelson**November 9th, 1990, stands out as a particularly bleak day in the illustrious life of country icon Willie Nelson. On this day, the IRS, aggressively pursuing $16.7 million in back taxes it claimed he owed due to years of utilizing illegal tax shelters, launched a sweeping seizure of Nelson’s assets across multiple states. While Nelson, with his characteristic laid-back demeanor, famously quipped that he’d be fine as long as he still had his guitar, the reality for his family was far more stressful.

His wife, Annie D’Angelo, painted a more vivid picture of the ordeal for People magazine: “I know he came off as super calm, but he wasn’t that calm inside. We had two kids — it was super, super stressful. They seized our house. We were living in this little condo all four of us because Micah was a baby. It was frustrating.” Facing such monumental debt and the loss of almost everything he owned, Nelson explored various avenues to generate funds and avoid complete financial ruin. This included appearing in some rather unexpected Taco Bell commercials, showcasing his willingness to do what was necessary.

More significantly, Nelson turned to his greatest strength: his music. He began recording new material with the specific purpose of settling his debts, a story that became immortalized in his album, “The IRS Tapes.” Subtitled “Who’ll Buy My Memories?,” the project was an innovative and direct way to address his financial woes, with a portion of every sale funneling directly into the IRS’s coffers. It was a unique collaboration between an artist and his tax collector, driven by a pragmatic need.

Despite the immense pressure and the sheer amount of work required to extricate himself from this financial abyss, Nelson maintained a surprisingly sanguine perspective on the experience. He told Rolling Stone, “By the time everybody else heard about it, I was already on to other things. Mentally, it was a breeze. [The IRS] didn’t bother me; they didn’t come out and confiscate anything other than that first day, and they didn’t show up at every gig and demand money. I appreciated that. And we teamed up and put out a record.” This remarkable tale underscores Nelson’s resilience, his innovative spirit, and his ability to not only survive but thrive after facing what many would consider an insurmountable financial challenge.

Read more about: Mark James, Visionary Songwriter Behind ‘Suspicious Minds’ and ‘Always on My Mind,’ Remembered for a Profound Musical Legacy

These stories of country stars navigating the tumultuous waters of financial distress serve as potent reminders that the glitz and glamour of the music industry often hide a precarious reality. Whether it’s unchecked spending, addiction, bad business advice, or unforeseen tragedies, even the most talented and successful artists can find themselves in dire financial straits. Their tales, filled with both hardship and remarkable resilience, underscore the timeless lesson that in the world of high notes and platinum records, a keen eye on the balance sheet is just as crucial as a captivating melody. It’s a world where making a million is one thing, but holding onto it is a whole different country song.