It’s a tale as old as time, or at least as old as fame itself: people often assume celebrities, with their lavish lifestyles, multiple properties, and seemingly endless stream of income, are financially invincible. We see the red carpet glamour, the private jets, the sprawling mansions, and automatically equate it with bulletproof financial stability. But as the late Notorious B.I.G. sagely put it, “mo money mo problems” – and sometimes, those problems hit harder than anyone expects.

Behind the glitz and glam, high-profile figures are just as susceptible to the harsh realities of unexpected medical bills, crippling legal fees, or simply becoming accustomed to a lifestyle that makes it incredibly difficult to pull back when times get tough. While bankruptcy is often used as a legal protection, providing financial relief or a restructuring of debt, the path to get there, or to simply contend with the authorities, is rarely smooth. For some, it involves losing homes, seizing assets, or even worse, facing the long arm of the law with criminal charges.

Today, we’re peeling back the curtain on 15 household names who found themselves entangled in serious legal trouble over unpaid taxes and debt. From music legends who sold albums to pay off the IRS, to Hollywood stars who served jail time, these stories serve as stark reminders that nobody, not even the most celebrated among us, is truly above the law when it comes to financial obligations. Get ready for a deep dive into some of the most surprising and dramatic celebrity money woes you’ll ever hear about.

1. Willie Nelson: The $32 Million IRS Nightmare Turned Hit Album

Let’s kick things off with a country music legend who turned his biggest financial headache into an iconic part of his persona. Willie Nelson, the beloved outlaw singer, faced an absolutely staggering $32 million tax bill from the Internal Revenue Service (IRS) in 1990. This colossal sum included back taxes, penalties, and interest that had accumulated over many years, creating a crisis that would define a significant chapter of his life and career. It’s safe to say, 1990 was a pretty unpleasant year for Willie Nelson, as the IRS accused him of hiding income and demanded he pay up.

So, how did a music icon end up in such deep financial waters? Nelson’s tax troubles stemmed largely from questionable investments and accounting practices in the 1980s. He had invested heavily in complex financial structures known as tax shelters, which were marketed as legitimate ways to reduce tax liability. His accounting firm, Price Waterhouse, had recommended and set up these shelters, which involved ventures like real estate and commodities, designed to generate paper losses to offset his substantial music income. Unfortunately for Nelson, the IRS later declared many of these tax shelters illegal, leaving him exposed to massive tax liabilities.

When the hammer fell, the IRS took aggressive measures to recover the millions owed. On November 9, 1990, they seized all of Nelson’s assets, freezing his bank accounts and padlocking his real estate holdings. The government went as far as auctioning off many of his possessions, including gold records, clothing, and instruments, to pay down his debt. His Texas ranch, valued at $650,000, was also put up for auction. In a heartwarming display of loyalty, fans and friends purchased some items specifically to return them to the singer, showing the profound connection Nelson had with his audience.

But Willie Nelson, being the resilient spirit he is, didn’t just passively accept his fate. He devised an innovative and truly unique approach to tackle his debt through music. In 1992, he recorded “The IRS Tapes: Who’ll Buy My Memories?”, a 24-song compilation album featuring Nelson performing solo with his guitar, Trigger. This stripped-down album cleverly referenced his financial predicament, appealing to fans’ sympathy and support. He struck a deal with the IRS: for each $19.95 album sold, Nelson received $6, and of that, $3 went directly to the IRS to pay down his debt. By 1993, he had settled his $16.7 million tax debt for approximately $9 million, and his IRS saga became a defining, almost legendary, part of his public persona.

Nelson’s openness about his financial struggles endeared him to the public, reinforcing his reputation as an outlaw country artist. He even poked fun at his misfortune in a 2003 Super Bowl commercial, demonstrating his ability to bounce back from hardship. Today, Nelson’s story serves as both a cautionary tale about proper tax management and a testament to the power of creative problem-solving and fan support.

2. Wesley Snipes: The Blade Star Who Didn’t File

From a legendary mob boss to a modern-day action hero, the IRS shows no favoritism. Wesley Snipes, famously known for his role as the vampire hunter Blade, found himself in a deep legal bind that led to a significant period behind bars. His troubles stemmed from a willful failure to file income tax returns, a transgression that the federal government takes extremely seriously, particularly when it involves substantial sums of money. If they can get Al Capone, yes, they can probably get Wesley Snipes, too.

The “Blade” star was convicted in federal court in 2008 on three misdemeanor counts of willful failure to file income tax returns. These charges covered the period between 1999 and 2001, during which Snipes had reportedly schemed his way out of paying $2.7 million in taxes. This wasn’t a simple oversight; the “willful” aspect implied an intentional avoidance, which carries far graver consequences than an accidental mistake. His case became one of the most publicly recognized examples of celebrity tax evasion, often tied to common knowledge alongside that of Nicolas Cage.

The legal system handed down a severe punishment: a three-year prison sentence. Snipes began serving his time and was eventually released from federal prison in 2013. The case of Wesley Snipes stands as a particularly stark warning to others in the public eye, or anyone for that matter, about the serious repercussions of attempting to defraud the government by failing to meet their tax obligations. His experience underscores the fact that even a successful actor with a strong public profile cannot escape the consequences of such financial misdeeds.

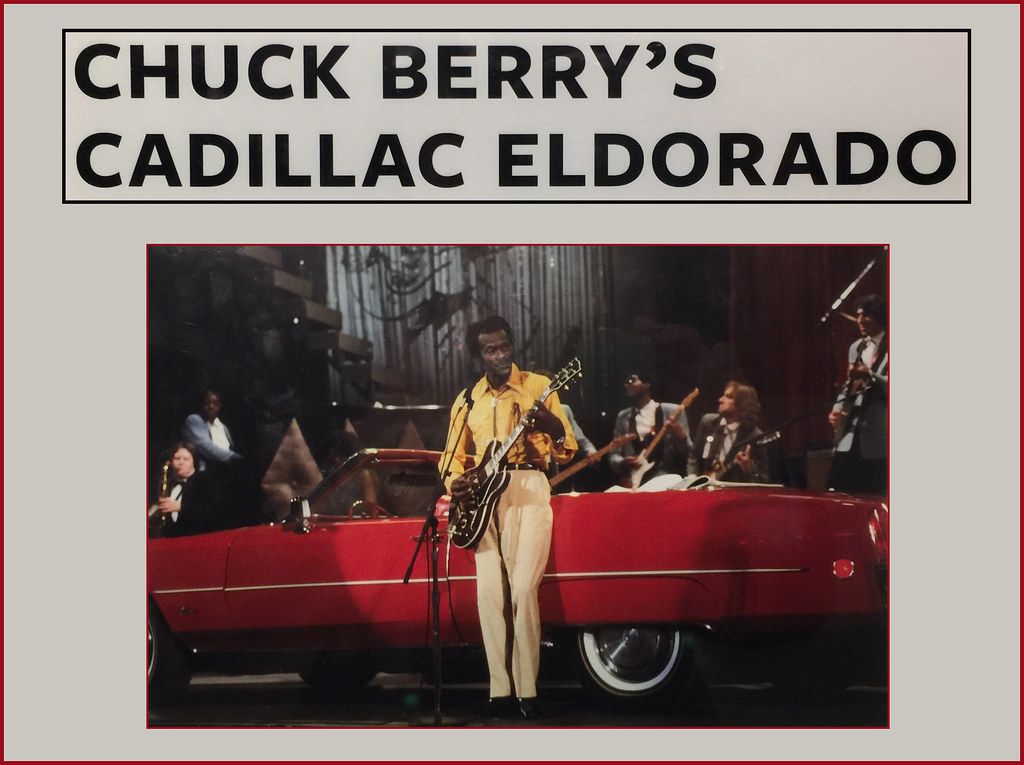

3. Chuck Berry: The Rock and Roll Pioneer Who Loved Cash Too Much

Chuck Berry, often hailed as the pioneer and arguable inventor of rock and roll, not only shaped music history but also inadvertently pioneered a less desirable trend: rock stars being less than upfront about their earnings. Berry was famously known for insisting on cash payments for his shows. While that might sound like a simple preference, it’s definitely “not something you want to be famous for unless you want to be audited posthaste.” It turns out, there’s a big difference between pocketing cash tips from a coffeeshop and receiving income from a highly publicized nationwide tour entirely in bills.

This penchant for cash, and the subsequent lack of transparent reporting, eventually caught the attention of the authorities. The IRS is notoriously diligent, and large, undeclared cash sums are a major red flag. Berry’s financial practices led to serious legal trouble, culminating in charges of tax evasion and filing false returns. These were not minor infractions; they directly challenged the integrity of the tax system and Berry’s obligations as a high-earning public figure. His case highlighted the severe consequences of attempting to sidestep tax responsibilities, even for a beloved icon.

The legal fallout for Chuck Berry was significant: he actually received prison time for his tax evasion offenses, together with filing false returns. This outcome sent a powerful message across the entertainment industry and beyond. It demonstrated that historical influence and cultural impact offer no shield against federal charges related to financial dishonesty. Even the architects of rock and roll were subject to the same laws as everyone else, proving that the government’s pursuit of its revenue is relentless and impartial.

4. Sophia Loren: Jailed for a Percentage Point

From rock and roll to classic Hollywood, the reaches of tax troubles extend far and wide, even touching the most elegant of stars. The legendary Italian actress Sophia Loren faced decades-long woes that included a brief stint in jail, all stemming from a seemingly minor discrepancy in her tax reporting. It’s a testament to the IRS’s (or, in this case, Italian tax authorities’) meticulous nature that such a case could drag on for so long and have such a dramatic outcome.

Loren’s troubles began in 1974, when she declared less income on her tax return than what officials demanded. Her contention was that the cash she earned from the film “Il viaggio” was deferred, which placed her in a lower tax bracket. Consequently, she paid taxes on 60% of her income instead of the 70% that tax officials insisted upon. While a 10% difference might seem negligible to some, to tax authorities, it represented a clear underpayment and a violation of tax law. She fought the charges for years, even leaving Italy for a period.

Despite her appeals and initial avoidance, Loren eventually made the courageous decision to voluntarily surrender in 1982. She returned to Italy to serve 17 days of a 30-day jail term, a startling consequence for a global superstar. Her choice to face the music head-on, even for a relatively short sentence, underscored the seriousness of the charges. This act of accountability made headlines worldwide, revealing the often-hidden pressures and legal battles faced by even the most revered public figures.

Remarkably, it took her an astonishing 39 years, but Sophia Loren was finally cleared in 2013 of the tax evasion charges that had briefly landed her in jail. Upon having her name cleared after decades, she reportedly said, “(When) it seems there is no longer any hope, it is still possible justice will be done.” Her long and arduous battle serves as a powerful reminder of the persistence of tax authorities and the enduring legal ramifications that can stem from financial disputes, even if justice, in her eyes, ultimately prevailed.

5. DMX: Hiding Income from Hit Songs

The world of hip-hop has also seen its share of financial woes and legal battles. Rapper-slash-actor DMX, known for his raw, intense delivery and hit songs like “X Gon’ Give it to Ya,” found himself facing significant prison time due to a years-old case involving substantial unpaid taxes. His story highlights how even successful artists can find themselves in serious legal trouble if they don’t properly manage their financial obligations and attempt to conceal income.

DMX was sentenced to one year in prison for tax fraud, a charge stemming from financial misdeeds that occurred between 2000 and 2005. During this period, he had accumulated $1.7 million worth of unpaid taxes. The authorities alleged that he intentionally shifted money to accounts owned by colleagues and actively hid income he earned from his successful music career. This wasn’t a simple matter of forgetting to pay; it involved a deliberate effort to obscure his earnings from the tax authorities, which constitutes fraud.

In November, DMX pleaded guilty to one count of tax fraud, acknowledging his role in the scheme. Just before he was handed his sentence, he offered a candid admission that shed light on his mindset at the time. He stated, “I knew that taxes needed to be paid. I hired people but I didn’t follow up. I guess I really didn’t put too much concern into it.” This quote provides a glimpse into the complexities of celebrity finances, where reliance on advisors can sometimes lead to detachment from personal responsibility, but ultimately, the buck stops with the individual.

DMX’s case underscores the critical importance of oversight and accountability, even when delegating financial tasks. Despite hiring professionals, his failure to ensure compliance resulted in a serious criminal conviction and a year in federal prison. It’s a sobering reminder that while fame and success can bring immense wealth, they also bring heightened scrutiny and significant responsibilities, particularly when it comes to financial dealings with the government.

6. Mike “The Situation” Sorrentino: A Jersey Shore Tax Fraud

From the chaotic shores of reality TV to the even more chaotic waters of a courtroom, Mike “The Situation” Sorrentino, star of MTV’s “Jersey Shore,” certainly got himself into, well, a bit of a situation. Not just once, but twice, he and his brother Marc were charged with tax fraud, culminating in a significant legal battle that saw him facing serious prison time. It turns out that fist-pumping and tanning weren’t the only things requiring attention; his finances needed a major overhaul.

The charges against the Sorrentino brothers involved nearly $9 million that Mike earned from his appearances on the massively popular MTV series. The core of the accusation was that they had concealed this income from the tax authorities. This wasn’t a small oversight; it was a substantial amount of money that was allegedly hidden through deliberate financial misdeeds. The IRS has a keen eye for undeclared income, especially from high-profile individuals whose earnings are often publicly known or easily traceable through media contracts.

In January, Sorrentino pleaded guilty to the charges, admitting that he had concealed his income back in 2011 by preparing bogus tax returns. This admission of guilt brought an end to the protracted legal battle but ushered in the consequences. Pleading guilty to tax fraud, especially involving such a large sum, is a serious matter with severe ramifications. It highlighted the risks associated with attempting to manipulate the tax system, regardless of one’s celebrity status.

At the time of the reporting, Mike “The Situation” Sorrentino was set to be sentenced on April 25, and he was facing up to five years in prison for his role in the tax fraud scheme. His case serves as a stark reminder that the consequences of financial misrepresentation are very real and can drastically impact one’s life and freedom. For many celebrities, the glamorous life sometimes comes with the harsh reality that legal troubles, especially over taxes, are no joke and can lead to situations far more serious than a bad tan.

Alright, so we’ve already taken a wild ride through the financial dramas of some major A-listers, proving that even the biggest stars aren’t immune to the long arm of the taxman or the harsh realities of debt. We saw how Willie Nelson turned his IRS nightmare into a hit album, how Al Capone was finally brought down by taxes, and the serious consequences faced by actors like Wesley Snipes and DMX. But believe it or not, the list of celebrity financial woes goes on!

Get ready to dive even deeper into the world of high-stakes financial battles. We’re pulling back the curtain on eight more household names, from iconic actors to global soccer legends and reality TV personalities, who found themselves in costly tax battles, facing bankruptcy, or grappling with massive debts that seriously rocked their worlds. These stories are not only shocking but serve as powerful reminders that managing your money is a full-time gig, no matter how famous you are. Let’s pick up right where we left off!

7. Nicolas Cage: A Hollywood Rollercoaster of Debt

Oh, Nicolas Cage. The man, the myth, the legend, and apparently, a frequent visitor to the IRS’s naughty list. While Wesley Snipes might be the first name that pops into your head when you think “celebrity tax evasion,” Cage is definitely right up there, his financial woes almost as famous as his unforgettable film roles. Turns out, acquiring ancient dinosaur skulls and European castles might be a bit costly, especially when the taxman comes knocking.

His troubles really hit the big screen in 2009 when the IRS slapped him with a federal tax lien. The accusation? Failing to pay over $6 million in income tax from just two years prior. Can you even imagine that kind of bill? But wait, there’s more! As if that wasn’t enough to make your jaw drop, Cage was then hit with a second lien, this time for allegedly “cheating his way out” of an additional $350,000 in taxes between 2002 and 2004. It seems his financial accounting was as dramatic as his on-screen performances.

The plot thickened with a lawsuit from Red Curb Investments in 2009. They weren’t too thrilled, alleging that Cage had committed fraud by not disclosing his significant debt to the IRS. This little detail apparently slipped his mind when they agreed to a hefty $3.5 million loan back in 2007, intended for a real estate deal. Talk about a sticky situation! It just goes to show that even Tinseltown’s royalty isn’t immune to the nitty-gritty details of financial disclosure.

These financial battles forced Cage into some pretty drastic measures, including selling off multiple properties to try and settle his towering debts. His story is a classic Hollywood cautionary tale, reminding us all that while the cameras might capture the glitz, they rarely show the intense pressure of balancing an extravagant lifestyle with the very real demands of tax season. It’s a tough lesson to learn, even for an Oscar winner.

8. Lindsay Lohan: Twice-Bitten, Still Tax Shy

Lindsay Lohan, a name synonymous with early 2000s pop culture, has certainly had her share of ups and downs, both personally and financially. It’s hard enough to navigate Hollywood, but when the IRS gets involved, things can get really complicated. Her journey with the tax authorities is a stark reminder that even after a financial wake-up call, learning to play by the rules can be a continuous challenge.

Back in 2012, amidst her many legal woes, the IRS decided enough was enough and literally took control of her bank accounts. This wasn’t a small fine or a stern letter; they actually seized her money in an effort to recover a hefty $233,904 in unpaid taxes from 2009 to 2011. There was also an unspecified amount owed from 2011, piling on to her already significant financial burden. Imagine waking up to find your bank account frozen – definitely not a “Mean Girls” moment, more like a real-life nightmare.

Now, you’d think that after having your bank accounts seized and eventually settling a quarter-million-dollar debt, anyone would get the message loud and clear: the IRS is not to be trifled with. However, it seems Lindsay Lohan apparently had no such thought. Even after managing to pay off that initial $233,000 debt and getting her bank accounts back, she reportedly continued to not pay her taxes.

The consequences, as you might expect, were swift and severe. In 2017, the IRS issued another tax lien against her, this time to the tune of $100,000. It’s a perplexing pattern, but her story undeniably highlights the persistent nature of tax obligations and the government’s unwavering commitment to collecting its due. For Lindsay, reclaiming her life has also meant learning some very expensive lessons about financial responsibility.

9. Dionne Warwick: “Say A Little Prayer” for Tax Relief

Dionne Warwick, the iconic voice behind classics like “Walk on By” and a true music legend, also found herself in a deeply unfortunate financial predicament. Even someone with her immense talent and success wasn’t immune to the complexities of managing wealth, especially when that wealth stretches back decades. Her story is a poignant reminder that even the most celebrated figures can face overwhelming debt.

In 2013, the “Say A Little Prayer for You” singer made headlines for a reason far removed from her Grammy-winning career: she filed for bankruptcy. The core issue was a staggering tax debt that dated all the way back to 1991, accumulating to more than $10 million. That’s a sum that could make anyone’s head spin! Her publicist, Kevin Sasaki, attributed this colossal debt to “several consecutive years (the late ’80s through the mid-’90s) of negligent and gross financial mismanagement.”

According to the bankruptcy petition, Warwick’s financial situation was precariously balanced, illustrating just how tight things had become. Her monthly income was listed at $20,950, while her monthly expenses clocked in at a nearly identical $20,940. This tiny margin meant there was practically no room for error, let alone a multi-million-dollar tax burden. It truly underscores the kind of intense financial pressure she was living under.

Sasaki clarified that by the time of the bankruptcy filing, Warwick had actually paid back the original taxes, but the massive $10 million figure represented the relentless accumulation of interest and penalties over two decades. It’s a crucial distinction, highlighting how quickly tax issues can snowball. Thankfully, for the esteemed artist, the case was eventually dismissed in 2019, allowing her to finally put this lengthy and stressful chapter behind her.

10. Lionel Messi: A Penalty Kick from Prison

Even the greatest soccer player of all time, the legendary Lionel Messi, couldn’t dribble his way past the tax authorities. While fans worldwide were captivated by his magic on the field, a very different kind of drama was unfolding off it – one that involved international tax agencies and a potential prison sentence. It turns out that other countries’ tax agencies are just as serious about collecting their money as the IRS, a lesson Messi learned the hard way in Spain.

Messi found himself staring down the barrel of a 21-month prison sentence. Can you imagine the greatest athlete in the world, renowned for his incredible agility and relentless running, facing time behind bars? He would no doubt have been envying the amount of running around he used to take for granted on the pitch, rather than being confined to a cell. It was a shocking development that captured headlines far beyond the sports world, highlighting the universal reach of financial accountability.

His legal troubles stemmed from accusations of tax fraud related to image rights. While the specifics of the complex case are lengthy, the bottom line was a significant outstanding balance that the Spanish authorities demanded. It was a high-stakes game that could have irrevocably altered his life and career, proving that even global superstardom offers no complete shield against legal repercussions.

Thankfully for Messi and his fans, he managed to pay off his outstanding balance of $285,000. This payment ultimately saved him from having to use a knotted blanket to keep his soccer skills sharp in prison. His case stands as a powerful testament to the fact that no one, not even a sporting icon of his caliber, is above the law when it comes to financial responsibilities.

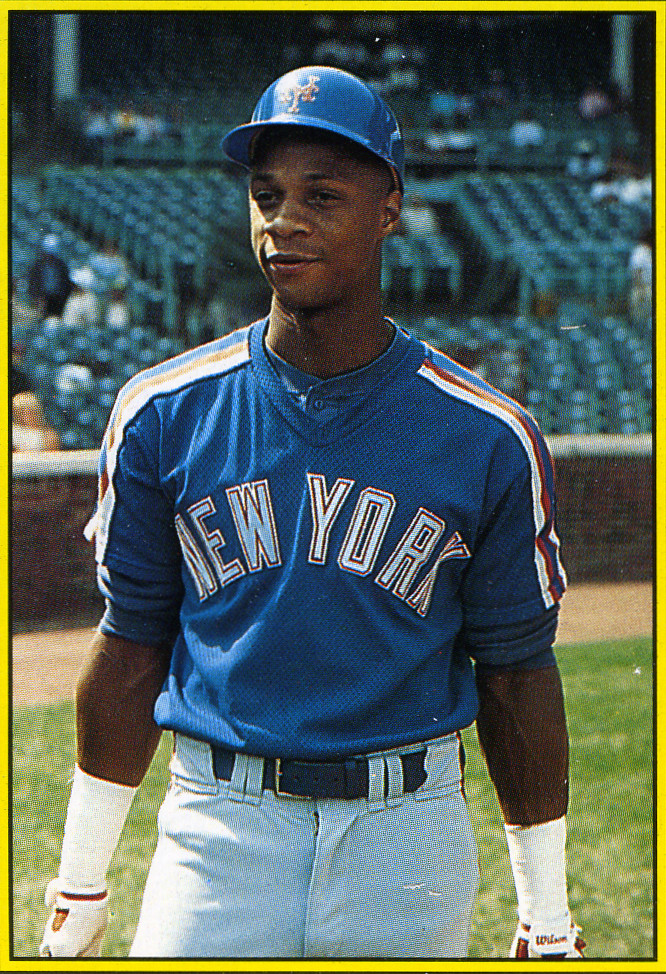

11. Darryl Strawberry: From Home Runs to Tax Troubles

Darryl Strawberry, a baseball legend known for his powerful swings and, for many “Simpsons” fans, his memorable animated tear, also had a less celebrated claim to fame: repeated tax crimes. It’s always a shock when beloved athletes, who seem to have it all, stumble into serious financial and legal troubles. His story reminds us that even heroes on the field are just human when it comes to managing their money.

Turns out, the baseball icon committed tax crimes more than once, leading to significant penalties that hit his wallet hard. This wasn’t a one-off mistake; it was a recurring issue that caught the attention of tax authorities on multiple occasions. It just goes to show that if you’re not careful with your finances, those unpaid bills can come back to haunt you, repeatedly.

The first major hit came in 1995 when Strawberry was forced to “pony up” a substantial $344,000. That’s a massive sum for anyone, even a professional athlete! But the financial setbacks didn’t end there. Just over a decade later, in 2007, he found himself in hot water with the taxman once again, this time owing another hefty $500,000. That’s nearly a million dollars in tax debts over two separate incidents.

Strawberry’s repeated run-ins with tax authorities underscore the critical importance of consistent and accurate financial reporting. While his career was filled with incredible highs, these financial lows serve as a stark reminder that staying on top of your taxes is just as crucial as staying on top of your game. It’s a hard lesson, but one that many public figures unfortunately learn in the spotlight.

12. Christie Brinkley: Supermodel’s Accounting Regrets

Christie Brinkley, the supermodel whose radiant smile graced countless magazine covers, found herself in an unexpected spotlight for a reason far from glamorous: a substantial tax lien. Even the most stunning and successful personalities can face mundane but serious financial hiccups. Her candid admission offers a glimpse into the pressures of managing a high-profile career alongside complex personal finances.

In 2011, the IRS hit Brinkley with a tax lien, demanding she “cough up” a whopping $531,000 in back taxes. That’s a significant chunk of change, even for a supermodel with a thriving career! The news made headlines, bringing an element of everyday financial stress into her otherwise picture-perfect public image. It was a situation that few would envy, regardless of their celebrity status.

Brinkley didn’t shy away from admitting her part in the oversight. Speaking to TMZ at the time, she openly stated, “I regret not paying more attention to my accounting.” This honest confession highlighted a common pitfall for many high-earning individuals who delegate their financial management – the ultimate responsibility still rests with them. It’s easy to assume professionals are handling everything, but a lack of personal oversight can lead to disastrous consequences.

True to her word, the supermodel vowed to have all the cash paid in full “within the week.” This quick resolution, while impressive, doesn’t diminish the initial shock and stress of such a large tax demand. Christie Brinkley’s experience serves as a valuable lesson that even with a team of advisors, staying informed and engaged with your financial details is absolutely essential to avoid costly regrets and unexpected tax liens.

13. Stephen Baldwin: A $350,000 State Tax Saga

Stephen Baldwin, a recognizable name from the famous Baldwin acting family, also faced his own dramatic run-in with tax authorities, specifically state income tax. It’s a reminder that it’s not just the federal government you need to keep happy; state taxes can pack a powerful punch too, leading to serious legal consequences and public scrutiny. No matter how many famous siblings you have, financial obligations are personal.

In 2012, Baldwin was arrested on charges of failing to pay state income tax for three consecutive years. The outstanding amount was significant: more than $350,000. An arrest over taxes is a serious matter, highlighting that these aren’t merely administrative oversights but can escalate into criminal charges. This public incident brought a harsh spotlight onto his financial dealings.

A year after his arrest, Baldwin pleaded guilty to the charges. The court, perhaps showing a touch of leniency, ordered him to pay back $300,000, “knocking off the extra $50 grand” from the original demand, as reported by CNN. This plea came with a strict condition: he was given one year to pay back the full amount, or he would risk facing five years of probation. It was a clear ultimatum, emphasizing the urgency of his financial situation.

Thankfully, by April 2014, Stephen Baldwin had successfully sent in the final $100,000 of what he owed, bringing an end to this stressful chapter. His case perfectly illustrates the serious ramifications of neglecting state tax obligations and the legal system’s commitment to ensuring all citizens, famous or not, fulfill their financial duties. It’s a compelling example of how tax troubles can truly put a star’s life on hold.

14. Shakira: When Your Hips Don’t Lie, But Your Taxes Might

The global superstar Shakira, whose hips famously don’t lie, found herself embroiled in a truly massive legal battle concerning her income tax reports in Spain. It’s another classic example of how international tax laws can become incredibly complicated, especially for celebrities who maintain residences and earn income across different countries. Her situation made waves across the globe, bringing light to the intricate world of cross-border finances.

The Colombian singer was revealed in January to be under intense investigation by Spanish authorities. The core accusation? Failing to pay income taxes from 2012 to 2014. This wasn’t a minor discrepancy; the sums involved were staggering, underscoring the seriousness of the allegations. The authorities were digging deep into her residency status and where she officially declared her tax home during those years.

Shakira’s defense revolved around her claim that she and her family had packed up and moved from the Bahamas to Barcelona in 2015. However, Spanish tax authorities begged to differ, believing she was already living in the vibrant Spanish city during the very years in question. This dispute over residency is often a critical factor in international tax cases, as it determines which country has the right to tax a person’s global income.

Despite the ongoing legal complexities, documents obtained by El Periodico in February revealed that Shakira had already started the monumental task of repaying the eye-watering $25 million she owed. That’s a truly staggering amount, even for a megastar of her caliber. Her case is a powerful reminder that tax laws, no matter how complex, demand meticulous adherence, and international stars face unique challenges in ensuring compliance across different jurisdictions.

So there you have it – a dazzling, and sometimes cringeworthy, tour through the financial minefields faced by some of the world’s most recognizable faces. From the country crooner who sang his way out of IRS debt to the soccer titan who narrowly avoided prison, these stories are far more than just celebrity gossip; they’re universal tales of human fallibility, the allure of easy money, and the undeniable power of the government’s pursuit of its revenue. It turns out, that old saying really holds true: “mo money mo problems” is a permanent headline, whether you’re walking a red carpet or just trying to manage your monthly budget. While we love to peek behind the velvet rope, these sagas serve as a grounded, humbling reminder: nothing is certain but death, taxes, and the occasional celebrity who thinks themselves above the law, only to learn that the taxman always bats last.