In an increasingly interconnected global economy, the concept of a ‘tax haven’ has become a point of both fascination and intense scrutiny. Defined as a country or state where foreign investors benefit from abnormally low, or even zero, tax rates, these jurisdictions offer a compelling proposition. By strategically moving funds into or through these offshore financial centers, businesses and high-net-worth individuals can legally reduce their tax burden in countries with higher taxation, often without needing a physical residency or business presence.

However, it’s crucial to understand that the landscape of tax havens exists in a nuanced legal gray area. While many activities, such as storing overseas earnings to avoid higher home-country taxes or funneling investments through trusts, are entirely legal, the line between legitimate tax avoidance and illegal tax evasion is clear. Concealing earnings entirely or laundering money obtained through illicit means are criminal offenses. Modern tax havens are increasingly aligning with guidelines from regulatory bodies like the Organization of Economic Cooperation and Development (OECD) and the U.S. Government Accountability Office, establishing bilateral tax treaties and sometimes using base erosion and profit shifting (BEPS) tools to achieve near-zero tax rates within legal frameworks.

This intricate dance between maximizing financial efficiency and adhering to international standards makes these jurisdictions particularly appealing to sophisticated investors and multinational corporations. As we delve deeper, we will explore some of the most prominent international tax havens, examining their unique characteristics, tax structures, and the specific advantages they offer. This will provide a clearer picture of how global wealth is managed and optimized in the modern financial world.

1. **Cayman Islands (Caribbean)**The Cayman Islands stand out as a premier global financial hub, renowned for its attractive tax regime and robust financial services sector. This British Overseas Territory imposes no direct taxes whatsoever, a significant draw for a wide array of international investors. This includes zero corporate income tax, zero personal income tax, zero capital gains tax, and even no inheritance tax, making it an exceptionally appealing domicile for wealth management and asset protection.

Its popularity extends significantly to the hedge fund industry. Fund managers are particularly drawn to the Cayman Islands because there are no corporate or income tax rates applied, even on interest or dividends earned on investments. This allows for substantial accumulation and growth of capital unimpeded by local taxation. The jurisdiction also hosts subsidiaries of numerous Fortune 500 companies, including giants like Pepsi, Marriott, and Wells Fargo, underscoring its pivotal role in global corporate finance.

Beyond its tax benefits, the Cayman Islands boasts strong financial secrecy laws, which safeguard beneficial owners and other financial assets from unnecessary disclosure. Coupled with a stable political environment and well-established financial infrastructure, it remains one of the world’s leading tax havens. Its banking assets have, at times, equaled one-fifteenth of the world’s total banking assets, solidifying its reputation as a major funds domicile and a favored choice for investors seeking privacy and robust asset protection, even amidst international scrutiny.

2. **Switzerland (Europe)**Switzerland’s name is synonymous with banking secrecy and precision, a reputation built on its banking sector’s unwavering commitment to client confidentiality. For decades, this attribute has made it a preferred destination for both individuals and corporations looking to safeguard and effectively manage their wealth away from the prying eyes of external authorities. This historical emphasis on privacy has cemented Switzerland’s position as a cornerstone of global wealth management.

While some of Switzerland’s more stringent banking secrecy laws have been adjusted in response to international transparency initiatives, the country’s tax rates largely remain highly favorable. The corporate tax rate, for instance, varies significantly by canton, generally falling between approximately 12% and 21% when combined with municipal taxes. Personal income tax is progressive and also canton-dependent, offering flexibility and potential advantages depending on one’s specific location within the country.

For individuals, capital gains on private securities are generally not taxed, which is a significant incentive for high-net-worth investors. Switzerland also benefits from an extensive network of bilateral tax treaties, designed to prevent double taxation and enhance its appeal for international wealth management. Its sophisticated financial infrastructure, combined with its long-standing expertise in banking, continues to attract those seeking stability, discretion, and effective wealth preservation strategies.

Read more about: More Than Skin Deep: 14 Great-Looking Vintage and Iconic Cars Mechanics Couldn’t Stand Fixing

3. **Luxembourg (Europe)**Luxembourg, a small yet incredibly wealthy European nation, also stands as one of the world’s preeminent tax havens. Its strategic location within the European Union and its sophisticated financial services sector have made it a critical nexus for international capital flows. The country has cultivated an environment that is highly attractive to multinational corporations and investment funds seeking to optimize their tax structures within a robust legal framework.

Evidence of its significant role can be seen in reports indicating that approximately 30% of U.S. Fortune 500 companies maintain subsidiaries in Luxembourg. A notable example highlighted in the context is web retailer Amazon.com, which has historically funneled all of its European sales through its official European headquarters in Luxembourg. This illustrates how major corporations leverage Luxembourg’s financial systems to manage their global profits efficiently.

The Grand Duchy’s advantages extend beyond corporate structuring. While its headline corporate tax rate, including municipal taxes, is around 24.9%, and personal income tax is progressive, it offers specific benefits as an EU holding hub with incentives for intellectual property (IP) and funds. These specialized frameworks, along with its extensive network of double taxation treaties, make Luxembourg a strategic choice for businesses looking for tax efficiency and access to the broader European market, despite capital gains tax applying with varying rules.

4. **Bermuda (North Atlantic)**Often recognized by the general public for its picturesque, tourist-friendly beaches, Bermuda holds an equally significant, though less visible, reputation within the financial sector as a notoriously popular tax haven. This U.K. island territory has meticulously crafted a fiscal environment that heavily favors corporate interests, leading to a substantial inflow of foreign investment and economic activity. It has become a magnet for specific industries seeking a favorable tax jurisdiction.

Bermuda’s economic prowess is evident in its abnormally high Gross Domestic Product (GDP) per capita, a direct consequence of its strategic tax policies. The island imposes no taxes on corporate income, interest, dividends, or royalties. This absence of key corporate levies has incentivized some of the world’s largest companies, such as Google and Nike, to park billions of dollars in accounts within Bermuda, effectively minimizing their U.S. tax liabilities through legal means. This strategy underscores the direct financial benefits available to multinational entities.

The jurisdiction excels as an insurance and reinsurance cluster, attracting a significant portion of the global industry. Its legal system, based on English common law, provides a familiar and robust framework, while its political stability and strong financial infrastructure further enhance its appeal. These elements combine to make Bermuda a preferred country for large corporations seeking substantial tax advantages alongside a secure and predictable operating environment, ultimately benefiting from its zero corporate income, personal income, and capital gains tax policies.

5. **Monaco (Europe)**Monaco stands as one of the world’s premier tax havens specifically tailored for high-net-worth individuals, offering an unparalleled combination of financial advantages and a luxurious lifestyle. The principality distinguishes itself with a policy of zero personal income tax, meaning residents retain 100% of their earnings. Furthermore, there is no capital gains tax, making it an ideal location for individuals focused on investment and wealth accumulation without incurring additional tax liabilities on their profits.

While certain businesses operating within Monaco are subject to corporate tax in limited cases, the vast majority of its residents, particularly those focused on personal wealth, enjoy minimal tax liabilities and highly favorable tax laws. This environment is complemented by a premium lifestyle characterized by high-end infrastructure, exclusive amenities, and a deeply secure banking system. These factors collectively contribute to Monaco’s status as a highly desirable base for affluent individuals.

The principality’s political stability and robust legal framework provide a sense of security for its elite residents. For those seeking maximum financial privacy, stringent asset protection, and an exceptionally high quality of life within a European context, Monaco offers a compelling proposition. It effectively combines significant tax benefits with a sophisticated, stable, and desirable living environment, making it a top choice for individual wealth optimization.

6. **United Arab Emirates (Middle East)**The United Arab Emirates (UAE) has rapidly ascended as a modern and prominent tax haven, catering to both corporate and individual wealth management. Its transformation into a global business and financial hub has been underpinned by highly competitive tax policies. Notably, the UAE imposes zero personal income tax, meaning individuals living and working there do not pay income tax on their earnings. Furthermore, there is no capital gains tax, attracting investors and entrepreneurs alike.

For corporations, while a mainland corporate tax rate of 9% has been introduced, the UAE continues to offer significant incentives within its designated free zones. These free zones provide competitive corporate tax rates, often still at 0%, alongside other business-friendly regulations such as 100% foreign ownership. This dual structure allows multinational corporations to strategically optimize their tax obligations depending on their operational needs and presence within the country.

Cities like Dubai and Abu Dhabi exemplify a potent combination of a dynamic business environment, remarkable political stability, and advanced infrastructure that connects Europe, Asia, and Africa. These attributes make the UAE particularly attractive to digital nomads, expatriates, and international investors who are actively seeking both tax efficiency and vast economic opportunities. The strategic location and progressive economic policies solidify the UAE’s position as a leading destination for global wealth.

7. **The Bahamas (Caribbean)**The Bahamas, a picturesque archipelago in the Caribbean, has long been recognized as a favored tax haven, particularly appealing to individuals. Its tax structure is remarkably straightforward and highly advantageous: there is no corporate tax, no personal income tax, and no capital gains tax. This complete absence of direct taxes on income and wealth makes it an exceptionally attractive jurisdiction for those looking to maximize their financial retention and growth.

International investors are drawn to the Bahamas not only by its favorable tax structure but also by its strong financial privacy laws, which provide robust asset protection for beneficial owners and bank accounts. The country boasts a stable political environment and a well-established offshore banking sector, further enhancing its reliability as a destination for wealth management. These factors contribute to its reputation as a secure and discreet financial center.

In addition to its tax advantages, the Bahamas offers various residency programs, allowing individuals to establish a long-term presence and benefit from the island lifestyle. While there have been notes on potential reforms for large multinational enterprises (MNEs) to ensure compliance with evolving international standards, for individuals and private wealth, the Bahamas continues to offer a compelling combination of tax efficiency, financial secrecy, and a desirable tropical environment.

Continuing our exploration of the world’s most strategic financial jurisdictions, we uncover additional tax havens that play pivotal roles in global wealth management and corporate structuring. These countries, much like those we’ve already discussed, offer distinct advantages that draw significant international investment, from flexible company laws to unique treaty networks. Understanding their specific offerings is crucial for comprehending the broader landscape of global finance.

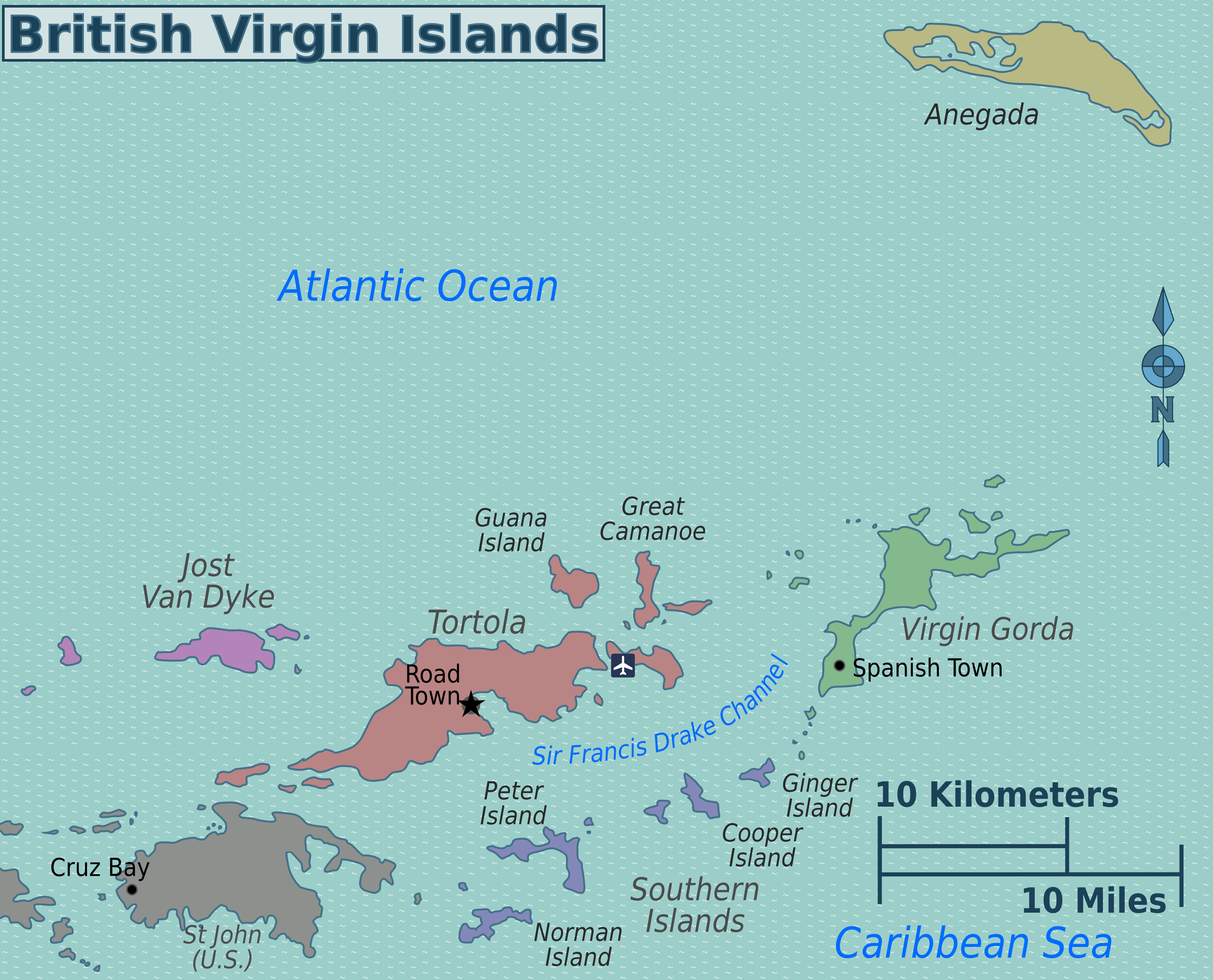

8. **British Virgin Islands (Caribbean)**Often considered a leading global tax haven, the British Virgin Islands (BVI) presents a striking economic paradox. Despite having a modest population of around 36,000 residents, its economy is extraordinarily robust, holding foreign investments estimated to be more than 5,000 times its local worth. This impressive inflow of capital is underscored by the fact that the BVI is the listed home for over 400,000 companies and holds approximately $1.5 trillion in assets. Such figures strongly suggest its integral role in international finance, even if local officials attempt to downplay its status as a tax haven.

What truly sets the BVI apart is its highly attractive tax regime. The territory imposes no corporate income tax, zero capital gains tax, and no inheritance tax, creating an exceptionally favorable environment for wealth accumulation and business operations. This absence of direct taxation is a primary driver for the massive influx of foreign investment and corporate registrations within the jurisdiction.

Moreover, the BVI is renowned for its straightforward and flexible company law, which facilitates fast incorporation processes. Combined with strong financial secrecy provisions, it remains a highly popular choice for establishing holding companies and international trading firms. These attributes make the British Virgin Islands a cornerstone for those seeking efficiency, privacy, and substantial tax advantages in their global financial strategies.

9. **St. Kitts and Nevis (Caribbean)**St. Kitts and Nevis stands out as a particularly attractive tax haven for high-net-worth individuals, distinguishing itself with a remarkably light tax burden. The federation imposes no income tax, no capital gains tax, and no wealth tax, allowing residents and investors to retain a significantly larger portion of their earnings and assets. This straightforward, low-tax environment makes it an exceptionally appealing destination for those focused on personal wealth optimization and preservation.

Beyond its tax advantages, St. Kitts and Nevis offers a globally recognized citizenship by investment program. This unique initiative provides investors not only with the benefits of a favorable tax system but also with enhanced global mobility through visa-free travel opportunities. It’s a dual advantage that combines financial efficiency with significant lifestyle and travel perks.

The appeal of St. Kitts and Nevis is further bolstered by its stable political environment, a well-established offshore banking sector, and robust asset protection structures. These elements collectively strengthen its position as a leading Caribbean tax haven, offering security, discretion, and comprehensive financial benefits for affluent individuals seeking a strategic offshore base.

10. **Singapore (Asia)**Singapore has firmly established itself as a leading global financial hub, renowned for its dynamic economy and highly competitive tax policies that appeal primarily to corporations. It offers a competitive corporate tax rate of 17%, which is further complemented by numerous tax incentives designed to encourage innovation, trade, and investment. This strategic approach ensures that businesses operating within Singapore can optimize their tax liabilities while benefiting from a pro-business environment.

A significant advantage for multinational corporations in Singapore is its extensive network of double taxation treaties. These agreements are crucial for preventing the same income from being taxed twice across different jurisdictions, thereby enhancing tax efficiency for international businesses. The country’s political stability and transparent legal system further solidify its reputation as a reliable and attractive destination for global enterprises.

Singapore operates on a territorial tax system, which, combined with its robust financial infrastructure, makes it one of Asia’s top modern corporate tax havens. Its focus on fostering a supportive ecosystem for international business, coupled with its strategic location and clear regulatory framework, positions it as a premier choice for companies looking to expand and optimize their operations across Asia and beyond.

11. **Ireland (Europe)**Ireland has carved a niche as a prominent corporate tax haven within the European Union, primarily due to its highly competitive corporate tax rate on trading income, which stands at an impressive 12.5%. This rate is among the lowest in the EU, making it an irresistible magnet for major multinational corporations, particularly those in the burgeoning tech and pharmaceutical sectors that seek to establish a European presence.

The country’s favorable tax laws are adeptly structured to allow for significant tax efficiency, often through sophisticated intellectual property (IP) structures. This enables companies to manage and leverage their IP assets in a manner that minimizes their overall tax burden while simultaneously gaining unrestricted access to the expansive European single market. Ireland’s commitment to tax efficiency is a key component of its economic strategy.

Crucially, Ireland balances these attractive tax incentives with a strong commitment to complying with international transparency standards. This dual approach ensures that while it remains a top-choice modern corporate tax haven for companies seeking low tax liabilities, it also maintains credibility and stability within the global financial community. This makes Ireland a strategically sound and legally compliant option for corporate tax planning.

Read more about: Rewind to the ’90s: 12 Game-Changing Moments That Shaped a Decade!

12. **Netherlands (Europe)**Despite claims from former finance minister Jan Kees de Jager that the Netherlands’ financial systems are less exploitable than those of Switzerland or the Cayman Islands, the country has long been recognized for its role in international tax planning. It is renowned for its extensive network of bilateral tax treaties, sophisticated holding company structures, and the infamous “Dutch Sandwich” tax planning mechanism. These tools have historically allowed multinational companies to significantly reduce their global tax burdens.

Indeed, major corporations such as Google, Fiat Chrysler, and IBM, alongside many other Fortune 500 companies, have leveraged Dutch subsidiaries to funnel profits and lower their taxes. While recent reforms have aimed to tighten regulations and increase transparency, the Netherlands continues to function as a corporate tax haven for multinational companies seeking profit shifting opportunities within legal frameworks.

The country’s advanced infrastructure and stable political environment further enhance its appeal as a strategic location for corporate operations. It offers a gateway to Europe with a sophisticated legal and financial system, ensuring that despite evolving international standards, it remains a crucial hub for global tax optimization and logistics, particularly for companies engaged in complex cross-border transactions.

Read more about: Post-Warranty Peril: 5 Vehicles That Fail Right After Coverage, And 5 That Go The Distance

13. **Panama (Latin America)**Panama operates under a territorial tax system, a key feature that distinguishes it as an attractive tax haven. This means that only income earned within Panama’s geographical borders is subject to taxation, while foreign-sourced income for both individuals and corporations remains entirely exempt. This policy offers significant advantages to international businesses and investors who conduct their primary revenue-generating activities outside of Panama.

The nation is widely known for its offshore company formation capabilities, robust banking secrecy laws, and generally low corporate tax rates. These attributes have cemented its reputation as a long-standing hub for international businesses seeking a discreet and tax-efficient environment. The ease of establishing entities and managing assets confidentially has drawn significant capital over the decades.

Despite facing heightened global scrutiny, particularly in the wake of events such as the Panama Papers, the country has maintained its appeal for many. Its relatively simple incorporation processes and established banking sector continue to make it a viable option for those looking to leverage its unique territorial taxation system and secure financial infrastructure for international operations and wealth management.

14. **Isle of Man (Europe)**The Isle of Man, a British Crown Dependency, distinguishes itself with a highly favorable tax regime that appeals to a diverse range of industries. For most companies, the island applies a zero corporate tax rate, meaning businesses can operate without incurring corporate income tax liabilities. Additionally, it imposes no capital gains tax and no inheritance tax, providing comprehensive tax efficiency for both corporate entities and high-net-worth individuals.

This robust tax framework makes the Isle of Man particularly attractive for specialized sectors such as aviation, shipping, and eGaming. These industries benefit immensely from the zero-tax policies, allowing them to maximize profits and reinvest capital without substantial fiscal burdens. The island has cultivated an environment tailored to support the growth and regulatory needs of these global sectors.

Crucially, while enjoying significant fiscal autonomy, the Isle of Man also cooperates with international tax standards, striking a balance between tax efficiency and regulatory credibility. Its stable regime and familiar legal system, based on English common law, provide a secure and predictable operating environment, making it a reliable jurisdiction for long-term strategic financial planning.

Read more about: The Road to Regret: 8 Sedans Owners Wish They Never Purchased

15. **Hong Kong (Asia)**Hong Kong maintains its status as a vital financial gateway to China and a significant player in international finance, largely due to its unique tax system. It operates on a territorial basis of taxation, meaning that only income sourced locally within Hong Kong is subject to taxation. Foreign-sourced income remains exempt, offering a significant advantage for multinational corporations with global revenue streams.

Further enhancing its appeal, Hong Kong imposes no tax on dividends or capital gains, creating a highly attractive environment for investors and shareholders. Its corporate profits tax rate is set at a competitive 16.5%, contributing to its reputation for a simple and business-friendly tax code. This combination of low taxes on profits and no taxes on key investment returns makes it a preferred location for Asian operations.

The city’s favorable business environment and advanced financial infrastructure make it a leading choice for multinational corporations operating across Asia. Despite increasing alignment with international transparency standards, Hong Kong remains a strategic tax haven, particularly for international trading companies seeking a stable and efficient platform for their cross-border commercial activities.

### The Overarching Benefits of Strategic Offshore Financial Centers

Beyond the specific allure of individual jurisdictions, the collective advantages offered by tax havens create a compelling proposition for high-net-worth individuals, digital nomads, and foreign investors globally. The primary motivation is often a significantly lower overall tax burden. Many of these havens implement zero income tax, no capital gains tax, and exemptions from inheritance or withholding taxes, allowing residents to retain a greater proportion of their wealth for reinvestment or personal use. This direct financial advantage is paramount.

Furthermore, many tax havens operate on a territorial tax system, an especially favorable arrangement where only locally earned income is taxed, leaving foreign income entirely untaxed. This is a critical distinction for individuals and corporations with income streams from multiple international sources. Coupled with strong financial privacy laws, these centers safeguard beneficial owners, bank accounts, and other financial assets from unnecessary disclosure, appealing greatly to those who prioritize confidentiality in their financial dealings.

Moreover, several tax havens, particularly in the Caribbean, seamlessly integrate favorable tax structures with attractive residency by investment or citizenship by investment programs. These initiatives offer not just financial benefits but also enhanced global mobility and opportunities for dual citizenship. Beyond the fiscal advantages, countries like Monaco, the UAE, Singapore, and Hong Kong also combine these benefits with robust financial infrastructure, stable legal systems, easy access to international markets, and a high quality of life, making them desirable destinations for long-term relocation and business growth.

### Navigating Legal Compliance and International Standards

While the prospect of reduced tax liabilities is attractive, it is crucial to understand that utilizing a tax haven country can be entirely legal, provided all tax obligations are diligently met in both the host jurisdiction and the taxpayer’s home country. Many multinational corporations, high-net-worth individuals, and foreign investors operate within these jurisdictions by adhering to international tax standards, aiming to legally reduce their overall tax burden. This distinction between legal tax avoidance and illegal tax evasion is a fundamental principle.

Key compliance considerations include adherence to international transparency frameworks. Many tax havens now actively participate in the OECD’s Common Reporting Standard (CRS) and the US FATCA law. These frameworks facilitate the sharing of account data with foreign tax authorities, a critical measure designed to prevent tax evasion and significantly increase financial transparency across borders. This shift reflects a global effort to regulate offshore finance more effectively.

Another significant requirement involves economic substance. Some countries now mandate that companies demonstrate real business activity within their borders, such as having local employees, physical office space, and active management. This is essential for qualifying for favorable tax laws and avoiding being labeled as engaging in corporate tax abuse. Additionally, the strategic use of double taxation treaties can be pivotal, as these agreements help prevent the same income from being taxed twice, thereby improving tax efficiency and reducing unnecessary tax liabilities. Working with qualified tax advisors and legal professionals is indispensable for ensuring compliance with all relevant laws and maximizing the benefits of these regimes while respecting international standards.

### Understanding the Risks and Reputational Factors

Despite the significant tax advantages offered by the best tax haven countries, both individuals and corporations must carefully consider the inherent risks and potential reputational concerns. One of the foremost risks is international scrutiny and the possibility of blacklisting. Organizations such as the OECD, EU, and G20 regularly assess jurisdictions for non-compliant tax practices, and being linked to a publicly blacklisted jurisdiction can increase exposure to foreign tax authorities and lead to higher compliance costs. This oversight highlights the evolving regulatory landscape.

Another critical concern is banking de-risking. Due to growing global pressures concerning money laundering, financial crime, and potential reputational damage, some international banks may choose to avoid opening or maintaining accounts in traditional tax havens. This can create substantial challenges for entities seeking to access the global banking system, potentially disrupting financial operations and limiting access to essential services.

Regulatory changes also present a continuous risk. Even established havens may introduce new corporate tax rates, apply withholding taxes, or tighten financial secrecy laws in response to international transparency standards. Such policy shifts can significantly impact long-term tax planning and diminish expected tax efficiency. Furthermore, reputation management is a pervasive issue; the use of tax havens is frequently linked to tax avoidance or even tax evasion in public perception, especially following high-profile leaks like the Panama Papers, Paradise Papers, and Pandora Papers. This negative association can severely harm the corporate or personal reputation of those involved.

Finally, compliance costs can be substantial. Meeting economic substance requirements, adhering to anti-money laundering (AML) obligations, and fulfilling other reporting rules add significant administrative and financial burdens to maintaining structures in a tax haven. Therefore, for individuals and companies alike, the challenge lies in meticulously balancing the potential financial benefits of utilizing tax havens against the very real risks of increased regulation, potential loss of privacy, and possible damage to their corporate or personal standing in an increasingly transparent global economy.