You’ve poured your heart, soul, and significant financial investment into transforming your vehicle. Whether it’s a sleek custom paint job, a booming premium sound system, or a powerhouse performance upgrade, these personal touches make your car uniquely yours. However, the passion that drives these modifications often overlooks a critical detail: the gap in protection provided by standard car insurance policies.

Many drivers assume their comprehensive and collision coverage automatically extends to every new component added to their vehicle. The reality, unfortunately, is often a costly surprise. Standard auto insurance policies typically offer limited protection for vehicle modifications, potentially leaving enthusiasts facing substantial out-of-pocket expenses when an accident or damage occurs.

Understanding the nuances of modified car insurance isn’t just about avoiding financial heartache; it’s about safeguarding the investment you’ve made in your automotive passion. This in-depth guide, presented in the authoritative and consumer-focused style you expect, will systematically break down the complexities, helping you make informed decisions to ensure your custom ride receives the protection it truly deserves. We’ll explore exactly what counts as a modification, why standard policies fall short, and the specialized coverages designed to bridge these gaps.

1. Understanding Car Modifications: What Qualifies?

At its core, a car modification is defined as any vehicle enhancement not made at the factory. This broad definition encompasses a wide array of changes, from purely aesthetic touches to significant performance overhauls, and even functional or accessibility-focused additions. Insurance companies develop specific guidelines to determine what qualifies as a modification, and these definitions can vary between providers. It is critical for vehicle owners to understand these distinctions, as they directly impact coverage needs.

Modifications generally fall into several distinct categories. Aesthetic modifications enhance the vehicle’s appearance, often including “chrome bumpers, special lights, custom paint jobs, and new stereo systems.” These upgrades are designed to personalize the car’s look and feel, making it stand out from its factory-issued counterparts. While they don’t directly impact performance, their cost and unique nature mean they often require specific insurance considerations.

Performance modifications, on the other hand, are aimed at improving the vehicle’s operational capabilities. Examples include “suspension enhancements, strut bars, or engine turbochargers.” These changes can significantly alter a car’s power, handling, or speed. Due to the potential increase in accident risk or the specialized nature of these parts, performance modifications are frequently viewed differently by insurers and may necessitate more robust coverage.

Beyond aesthetics and performance, modifications can also include functional additions like “running boards and side steps,” “truck bed liners and covers,” “utility boxes and cargo systems,” or “roll bars and roll cages.” Furthermore, accessibility modifications, such as “wheelchair lifts and ramps,” “hand controls for acceleration/braking,” or “voice-activated systems,” are crucial for many drivers. Each of these categories, by altering the vehicle from its original specifications, triggers the need for a re-evaluation of its insurance coverage.

2. The Limited Reach of Standard Auto Insurance Policies

It’s a common misconception that a standard auto insurance policy, with its comprehensive and collision coverage, automatically protects all aftermarket parts and custom upgrades. The unfortunate reality is that “most standard auto insurance policies offer limited protection for vehicle modifications.” This limitation often leads to unexpected financial burdens for drivers who have invested heavily in customizing their vehicles, only to find their investments are not fully covered after an incident.

Standard comprehensive and collision coverage typically includes aftermarket parts up to a predetermined, and often quite low, limit. This coverage usually ranges “between $1,000 and $3,000.” This amount is often a mere fraction of what many custom parts and equipment can cost, leaving a substantial gap in protection. Furthermore, this limited coverage often applies only to “permanently installed equipment” and may explicitly “exclude certain types of modifications entirely.”

The discrepancy often arises from how policies distinguish between original equipment manufacturer (OEM) components and aftermarket additions. While your base vehicle receives full coverage according to its actual cash value, custom parts face separate limitations and requirements. The policy language around “original equipment” frequently creates confusion for vehicle owners who assume comprehensive coverage protects everything within their vehicle, regardless of its origin.

Moreover, state regulations can also play a role in how insurers handle modified vehicles. While some states “require minimum coverage for aftermarket parts,” others “allow carriers complete discretion in setting coverage limits and exclusions.” This variability underscores the importance of not only understanding your specific policy but also being aware of the legal landscape in your region to ensure your vehicle’s custom elements are adequately protected.

Read more about: Fortify Your Remote Fortress: 12 Essential Cybersecurity Strategies for US Remote Workers

3. Crucial Coverages for Your Custom Vehicle: CPE, Stated Value, and Agreed Value

Given the inherent limitations of standard policies, safeguarding your custom vehicle requires specific, tailored insurance solutions. To get reimbursed for the full value of your car and its modifications in the event of an accident, you’ll need one of these specialized types of custom car insurance. These options provide the enhanced protection necessary to cover the unique and often expensive components of a modified vehicle, going far beyond what a basic policy offers.

One of the most common and accessible solutions is “Supplemental coverage,” also known as custom parts and equipment (CPE) coverage. This acts as “an endorsement to your standard auto policy,” providing additional protection for aftermarket components. It covers “the value of aftermarket components and other custom features up to a certain limit,” minus your deductible. Crucially, “you need to have comprehensive and collision coverage to add this supplemental coverage.”

For vehicles with extensive custom parts, “Stated amount coverage” is another option. This policy pays “the actual cash value of your vehicle (minus your deductible) or the amount you say it’s worth, whichever is less, in the event of a total loss.” This makes sense if you have many custom parts.

The most comprehensive protection, particularly for heavily modified or collectible vehicles, is an “agreed value policy.” These policies “establish predetermined payouts that account for modifications and customization.” Your insurer and an appraiser “will decide on the value of your car, including modification costs in case of total loss.” This ensures coverage of the “agreed-upon settlement amount,” offering superior financial protection.

Finally, for rare or collectible vehicles that are also modified, “Classic car insurance” is available. Offered “through carriers that specialize in assessing and protecting collectible and other rare vehicles,” it includes modified cars. These insurers understand the unique market value and repair intricacies of such vehicles.

4. The Undeniable Imperative: Why You MUST Disclose Modifications to Your Insurer

The single most critical piece of advice for any owner of a modified vehicle is to inform your insurance provider about all modifications. “If you fail to notify the company, the custom elements may not be covered, and any repairs or part replacements will be your financial responsibility.” This is not merely a recommendation; it is an absolute necessity to ensure your policy remains valid and provides the coverage you expect.

Withholding information about your car’s modifications carries severe consequences. “If you don’t tell your insurance company about your car’s modifications, your policy could be canceled.” This cancellation means that in the event of an accident, “no coverage” would be provided, forcing you to “pay out of pocket for damage, injuries and even legal costs.” This can happen regardless of the type of upgrade, “from engine changes to custom paint or sound systems.” The financial implications of an invalidated policy can be devastating.

The danger of non-disclosure extends even to situations where you are not at fault. “If you’re in an accident and your insurer discovers undocumented modifications, your policy could be invalidated, even if the accident wasn’t your fault.” This is often due to “material misrepresentation,” where the undisclosed modifications materially change the risk profile of the insured vehicle, leading the insurer to void the policy retroactively. This leaves you completely exposed to financial liability.

It’s also essential to remember this rule applies if you purchase a vehicle that is already modified. The “MoneyGeek expert tip” strongly advises, “If you bought a car that’s already been modified, inform your insurer. Insurance companies don’t automatically assume there are modifications.” This proactive communication ensures that the insurer has a complete and accurate understanding of the vehicle they are insuring, thereby safeguarding your coverage and preventing future disputes. Transparency is paramount when dealing with custom vehicles and insurance.

Read more about: Tesla Ownership: Avoiding Costly Pitfalls That Could Drain Your Wallet and Your Patience

5. Navigating the Claims Process: Essential Documentation for Aftermarket Parts

A smooth and successful insurance claim for damaged aftermarket parts hinges almost entirely on one crucial factor: comprehensive documentation. “Document all modifications with purchase receipts, installation records, and professional appraisals before any damage occurs to ensure smooth claims processing.” This meticulous record-keeping forms the bedrock of proving both the existence and the value of your custom investments, allowing adjusters to properly assess your claim.

Essential documentation includes “original purchase receipts showing part costs,” “professional installation invoices,” and detailed “photographs of modifications” from multiple angles. For high-value custom work, “current appraisal documents” from a qualified specialist are invaluable, providing an objective third-party valuation.

Maintaining organized records isn’t just for claims; it “demonstrates responsible ownership and helps justify replacement values.” Adjusters need clear, verifiable evidence for compensation. Without documentation, insurers might only cover stock component value or deny coverage for custom parts due to lack of proof.

The claims process for modified vehicles can be intricate. Adjusters may “require specialized knowledge to properly evaluate custom parts,” potentially extending timelines. Ready documentation streamlines this. Working with repair facilities “experienced in modified vehicles” ensures proper assessment and quality repairs.

6. Maximizing Your Protection: Proactive Steps for Custom Vehicle Coverage

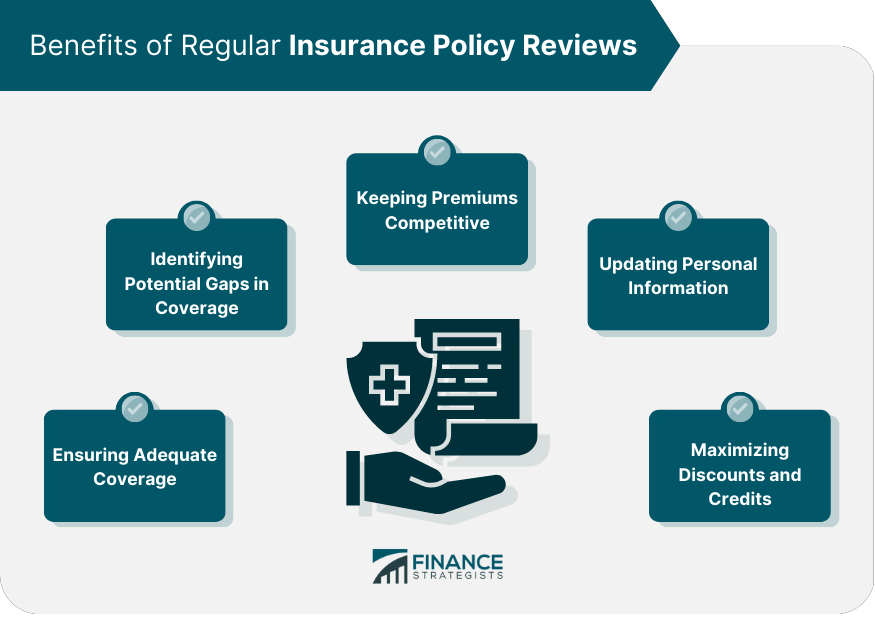

Ensuring optimal protection for your modified vehicle is an ongoing process that extends beyond merely acquiring the right policy. It requires continuous vigilance and proactive engagement with your insurance provider. “Professional documentation, clear communication with your insurance agent, and regular policy reviews ensure optimal protection for your modified vehicle.” By taking these steps, you can safeguard your investment before any problems arise.

Begin by creating a “comprehensive modification inventory.” Include “detailed descriptions, purchase dates, costs, and current values” for every custom part. Supplement this with “professional photography from multiple angles.” “Update this inventory regularly as you add new modifications or as parts appreciate or depreciate in value.”

Working closely with a “knowledgeable insurance agent” is crucial. They help you “understand coverage options and limitations.” “Ask specific questions about modification coverage, policy limits, and exclusions.” An annual policy review is also recommended to “ensure your protection keeps pace with ongoing modifications and changing vehicle values.”

Consider upgrading your coverage whenever significant changes occur. This includes situations “when modification values exceed standard policy limits,” “when adding high-value custom work,” or “when transitioning from daily driver to show car use.” The additional “cost of enhanced coverage often proves minimal compared to potential out-of-pocket expenses following an uninsured loss,” making it a wise investment for peace of mind. Proactive adjustments to your policy ensure your custom ride is always adequately protected against unforeseen circumstances.

7. How Modifications Influence Insurance Costs and Potential Discounts

The decision to modify your vehicle often has a financial ripple effect on your insurance premiums. Generally, aftermarket modifications typically increase insurance costs. This is primarily due to the added value they bring, making the vehicle more expensive to repair or replace. Insurers also consider factors such as increased theft risk, as custom parts can make a car more appealing, or the potential for increased accident risk, especially with performance enhancements that might make a car “prone to speeding.”

The extent of this increase can vary significantly, but often ranges “by 10-25%, depending on the type and extent of customization.” While this might seem like a considerable jump, it often represents excellent value compared to potential “out-of-pocket expenses” if these investments were uninsured. This pragmatic approach safeguards your passion, acknowledging the higher repair costs inherent to modified vehicles.

However, it’s not all about increased costs. Certain modifications can actually lead to insurance discounts. “Modifications that boost the safety and security of the vehicle may earn you special discounts from your insurance company.” Examples include installing advanced anti-theft systems like GPS tracking or kill switches, adding safety upgrades such as roll cages or racing harnesses to reduce accident severity, or integrating defensive technology like backup cameras and collision avoidance systems that may prevent accidents entirely.

Even basic security tools such as immobilizers and steering wheel locks offer extra protection and can positively influence your rates. It’s also worth noting that in some instances, “certain modifications may reduce your car’s overall value,” which, counterintuitively, “can lower your premium.” A thorough discussion with your insurer about any planned changes is always the best course of action to understand the precise impact on your rates.

Read more about: $20,000 Difference: 12 Luxury Cars Primed for Massive Price Drops in 2025

8. Understanding Common Coverage Exclusions

While specialized policies aim to bridge the gap in coverage for modified vehicles, it’s crucial to be aware of common exclusions that could still leave your custom investments vulnerable. Insurance providers approach modified vehicles cautiously, and certain types of alterations are frequently deemed too risky or uninsurable under standard or even some custom policies. Understanding these limitations is crucial.

Several common exclusions can lead to denied aftermarket parts claims. For instance, “racing modifications,” purely cosmetic upgrades “without functional value,” and “DIY installations lacking professional documentation” often fall outside standard coverage. Insurers are wary of modifications that significantly alter the vehicle’s original purpose or risk profile without proper oversight. This underscores the need for certified installation and proper record-keeping for any custom work.

Furthermore, “performance modifications that increase the vehicle’s power or alter its handling characteristics may void coverage entirely or require special disclosure.” This is particularly true if these modifications are deemed to substantially increase the likelihood of an accident. It’s a fine line that insurers walk, balancing performance desires against actuarial risks.

Perhaps the most straightforward exclusion concerns illegal modifications. “Most insurers will not provide coverage for modifications that violate federal or local laws, such as emissions tampering or illegal performance enhancements.” Tampering with emissions control systems, for instance, is “federally illegal and can void insurance coverage.” Ensuring all modifications comply with applicable regulations is not just a legal necessity, but critical for valid insurance protection.

Read more about: When Your Premium Coffee Machine Fails: A Comprehensive Guide to Troubleshooting, Repair, and Replacement

9. Spotlighting Leading Traditional Insurers Offering Custom Coverage

For many drivers with moderately modified vehicles, the most accessible route to comprehensive protection lies with traditional insurance carriers that offer specific add-ons. These companies understand the growing demand for coverage beyond factory specifications and have developed endorsements. These options integrate seamlessly with your existing auto policy.

Many major providers, such as “21st Century,” “Allstate,” “Elephant,” “Esurance,” “Farmers,” “Progressive,” and “The General,” offer what is commonly known as Custom Parts and Equipment (CPE) coverage. This acts as “an endorsement to your standard auto policy,” providing essential additional protection for aftermarket components. For instance, “Elephant policyholders automatically get up to $1,000 in custom parts and equipment coverage (CPE),” with the option to purchase a CPE add-on for higher coverage.

These add-ons are designed to cover “damages to equipment, not included in the vehicle manufacturer’s standard specifications.” For example, “Allstate Policyholders may opt for custom parts coverage in their car insurance for $102 per year,” specifically covering “losses to custom equipment due to a comprehensive or collision claim.” Similarly, “Progressive Policyholders can purchase CPE as an add-on to get coverage for the repair or replacement of items added to their car, or those considered after-market accessories.”

The key benefit of these offerings is their ability to extend comprehensive and collision coverage to your custom investments, up to a specified limit. While the exact coverage amount and cost will vary by insurer and the extent of your modifications, opting for these endorsements can significantly reduce your “out-of-pocket costs when something goes wrong.” It’s a crucial step to ensure your custom elements are not an uninsurable liability.

10. Specialty Insurers for High-Value Custom Vehicles

While traditional carriers offer valuable endorsements, owners of extensively modified, high-value, or collectible vehicles often find superior protection and understanding with specialty insurers. These companies are uniquely equipped to assess and cover the intricate value of custom cars, offering tailored policies that go far beyond standard offerings. They recognize that these vehicles are often more than just transportation; they are significant investments and often works of automotive art.

For heavily modified or collectible vehicles, an “agreed value policy” often represents the “best protection.” These policies “establish predetermined payouts that account for modifications and customization.” Instead of relying on rapidly depreciating actual cash value calculations, “your insurer and an appraiser will decide on the value of your car, including modification costs in case of total loss.” This ensures you receive the “agreed-upon settlement amount” in the event of an accident, providing superior financial protection.

Several specialty providers excel in this niche. “Hagerty,” for example, is “Best For Classic and collector cars,” offering “Agreed value coverage, guaranteed repair network, roadside assistance.” Similarly, “J.C. Taylor” focuses on “Antique and custom vehicles” with “Flexible usage policies, restoration coverage, spare parts coverage.” These features are paramount for owners requiring more than basic coverage.

Other notable specialty insurers include “Grundy,” which caters to “Classic cars and hot rods” with “No depreciation, guaranteed value, low premiums,” and “American Collectors,” which specializes in “Modified and performance cars” and offers “Track day coverage, modification-friendly policies.” Even traditional carriers like “SAFECO” offer specialized solutions such as “Custom equipment coverage up to $5,000” and “agreed value options” for performance modifications. These providers are invaluable for truly protecting your unique automotive investment.

Read more about: Unlocking Affordable Dreams: 9 Classic Car Types That Reveal the Surprising Truth About Cheaper Insurance Premiums

11. Addressing Pre-Purchase and Legal Considerations

Before embarking on any modification project or purchasing a vehicle that has already been customized, it’s paramount to consider the legal and insurance implications. Proactive research and due diligence can prevent costly mistakes and ensure your vehicle remains insurable and compliant. Ignorance of regulations can lead to severe consequences for your coverage and finances.

A crucial first step involves understanding “Legal Compliance Requirements.” Tampering with emissions control systems, for instance, is “federally illegal and can void insurance coverage,” leading to significant fines and potential policy invalidation. Furthermore, all modifications “must comply with Federal Motor Vehicle Safety Standards (FMVSS),” and modified vehicles “may face additional scrutiny during state inspections.” Even exhaust modifications must adhere to “local noise regulations,” highlighting the need for comprehensive legal awareness.

The “MoneyGeek expert tip” strongly advises, “If you bought a car that’s already been modified, inform your insurer. Insurance companies don’t automatically assume there are modifications.” This is critical because “if your insurer discovers undocumented modifications, your policy could be invalidated.” Beyond insurance disclosure, when buying a pre-modified car, it’s wise to “document all modifications by obtaining receipts, installation records and part specifications.”

Furthermore, it’s highly recommended to “have a qualified mechanic conduct a professional inspection to assess the quality of modifications and verify all modifications meet local and federal regulations and state insurance requirements through a legal compliance check.” For high-value custom work, “consider getting a professional appraisal” to establish an agreed-upon value for your policy, providing a clear financial safeguard. These steps ensure you are not only legally compliant but also fully covered from the outset.

Read more about: Beyond the Bargain Bin: Why Retail Giants Like Walmart and Target Are Reshaping Return Policies to Combat Billions in Losses

12. Expert Tips for Maintaining Optimal Protection for Your Custom Investment

Protecting your custom vehicle upgrades is an ongoing commitment requiring vigilance and strategic action. Beyond selecting the right policy, proactive engagement and meticulous habits are essential to ensure your investment remains fully covered, year after year. These expert tips empower you to consistently safeguard your automotive passion.

A cornerstone of optimal protection is professional installation and thorough documentation. Always “keep all receipts” for custom parts and labor, and obtain “professional installation certificates.” Documenting your modifications with “before-and-after photos” from various angles provides irrefutable evidence for insurers. This comprehensive record-keeping not only “demonstrates responsible ownership” but also streamlines claims, helping “justify replacement values” and prevent disputes.

Working closely with a “knowledgeable insurance agent” is also paramount. They can help you “understand coverage options and limitations” for your modifications. “Ask specific questions about modification coverage, policy limits, and exclusions” to ensure there are no surprises. Regularly scheduled “annual policy reviews” are vital to “ensure your protection keeps pace with ongoing modifications and changing vehicle values,” reflecting any new additions or market fluctuations.

Furthermore, be selective about your service providers. Work with “insurance-approved repair facilities familiar with modified vehicles” to ensure quality repairs and smoother claims processing. Establishing relationships with reputable shops beforehand can save considerable stress. Finally, be acutely aware of “red flags that may compromise coverage,” such as “using vehicles for racing or track events,” “improper installation or maintenance,” or, critically, “failing to disclose material changes to your insurer.” Transparency remains your strongest ally for robust insurance protection.

Read more about: Your Ultimate Guide: 14 Rust-Resistant Gas Grills and Essential Tips for Lasting Durability

Your customized vehicle is more than just transport; it’s a testament to your personal style and engineering passion, representing countless hours and significant financial outlay. To ensure this cherished investment is truly safeguarded, a deep understanding of specialized insurance options is essential. Don’t let the excitement of customization overshadow the critical need for comprehensive protection. Take the time to speak with a specialist, meticulously document every enhancement, and proactively manage your policy. By doing so, you can drive with confidence, knowing your extraordinary ride is protected against the unforeseen, allowing you to fully enjoy every mile of your uniquely crafted journey.