For many vehicle owners, car insurance is a necessary, often expensive, component of vehicle ownership. The standard auto insurance policy, designed for daily commuting and regular use, is what most consumers are familiar with, covering vehicles that endure frequent driving and the associated risks. However, the world of automotive insurance encompasses a specialized category that often presents a more economical option for a particular type of vehicle: classic car insurance.

Classic car insurance, tailored for enthusiasts and collectors, operates under a distinct set of principles compared to its daily driver counterpart. While both policy types offer comprehensive coverage for vehicle damages, the underlying assumptions about vehicle usage, value, and risk exposure vary significantly. These differences directly contribute to the generally lower premiums associated with insuring a collector vehicle, often leading to substantial savings for owners who qualify.

Understanding these fundamental distinctions is crucial for classic car owners, or those considering purchasing a collector vehicle, to ensure appropriate coverage and optimize costs. This in-depth analysis will meticulously examine the key differences between classic car and regular auto insurance, providing consumers with the factual information necessary to make informed decisions about protecting their valuable automotive investments.

1.*Driving Frequency and Accident Susceptibility

One of the most fundamental factors contributing to the lower cost of classic car insurance is the stark difference in how frequently these vehicles are driven compared to daily drivers. Standard auto insurance policies are priced with the expectation of regular vehicle use, including daily commutes, errands, and various other journeys that expose the vehicle to a higher probability of incidents on the road. This frequent exposure inherently translates to a greater statistical likelihood of accidents, leading to higher premium costs for standard policies.

In contrast, classic cars are typically not used for daily commuting. They are collector vehicles, often driven only on special or rare occasions. This limited usage significantly reduces their time on the road, thereby decreasing their susceptibility to collisions and other road-related hazards. Insurance providers recognize this reduced risk, which is a primary driver for the lower premiums offered for classic car policies.

The consequence of fewer accidents extends beyond mere property damage. With classic cars spending less time in traffic and high-risk driving scenarios, the potential for injury claims and at-fault third-party collision claims is also substantially diminished. These types of claims are often among the most expensive for insurance companies, and their reduced incidence in classic car policies directly translates into savings for the policyholder.

Studies and insurer statements corroborate this significant cost advantage. For example, American Collectors and Heacock state that their classic car rates can be up to 40% less than standard auto insurance rates, while Hagerty reports an average of 34% less. This cost reduction is a direct reflection of the lower risk profile associated with less frequent driving and consequently, fewer potential claims.

Read more about: Navigating Auto Insurance: 14 Key Factors Driving Costs Across States for Savvy Drivers

2. Vehicle Eligibility and Age Requirements

The criteria for what vehicles qualify for classic car insurance represent a distinct departure from the eligibility parameters of standard daily driver policies. Classic car insurance is specifically designed to cover vehicles of a certain age and type, often with an emphasis on their collectible nature and potential for appreciating or stable values. This specialization allows for a more tailored and often more cost-effective approach to insuring these unique assets.

Generally, classic car insurance specializes in insuring vehicles that are at least 25 years old, encompassing categories such as classic, vintage, and antique cars. Beyond age, it also extends to collector and exotic cars that are considered collectible and exhibit either appreciating values or stable prices over time. This contrasts sharply with regular auto insurance, which is primarily intended to cover newer vehicles prone to depreciation, as well as older cars that function as “daily drivers” for everyday transportation.

It is important to note that the specific age criteria can vary among different insurance providers. While a common benchmark is 25 years, some insurers may offer classic car coverage for vehicles between 15 and 40 years old. Companies like Chubb and State Farm, for instance, define “classics” as cars between 10 and 24 years old, and “antiques” as those 25 years or older. Hagerty further specifies classic cars as those from 1979 or earlier, though they also offer policies for “modern classics” from 1980 and newer.

This varying eligibility underscores the importance of discussing specific vehicle details with an insurance agent to determine the most appropriate policy type. For daily driver insurance, the age of the vehicle is not a restrictive factor; it covers vehicles of any age, from brand-new models straight off the dealership lot to older cars used for regular, everyday transportation, without the same collectible value considerations.

Read more about: Hyundai-Kia Crisis: Towing Hitch Fire Risk Threatens Telluride and Palisade SUVs

3. Total Loss Claim Valuation: Agreed Value vs. Actual Cash Value

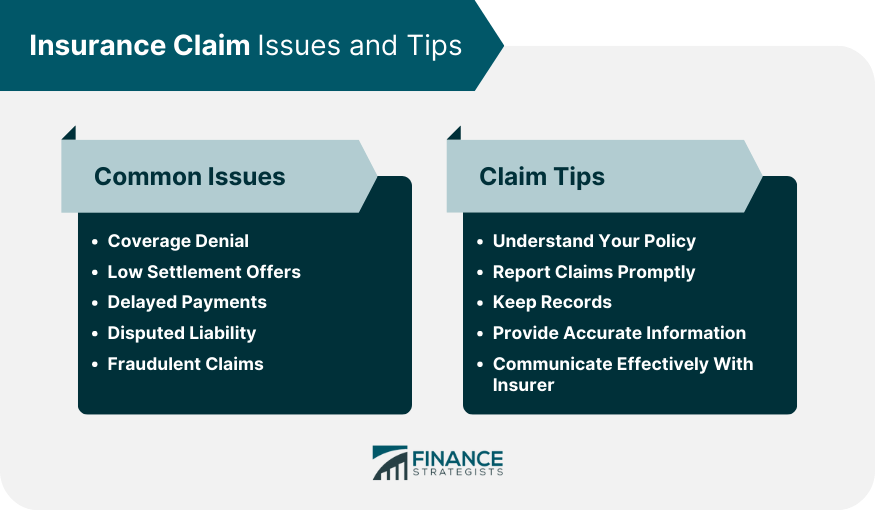

A critical distinction that profoundly impacts a vehicle owner in the event of a total loss is the method by which insurance companies determine the settlement value. Classic car insurance typically offers “Agreed Value” coverage, a specialized approach that provides significantly more predictability and protection for owners of appreciating assets. This method stands in stark contrast to the “Actual Cash Value” (ACV) system commonly employed by regular auto insurance policies.

With Agreed Value insurance, the financial worth of the classic vehicle is established and agreed upon by both the customer and the insurance company at the very beginning of the policy period, before any potential claim occurs. This upfront valuation is based on the vehicle’s true market value, taking into consideration its unique attributes, any significant modifications, or upgrades that have been made. In the unfortunate event of a total loss, the policyholder receives this agreed-upon, fixed value, providing maximum protection and eliminating uncertainty regarding the payout.

This system is particularly advantageous for collectible cars because their values often appreciate over time, or at least remain stable, unlike most standard vehicles. The agreed value ensures that the payout accurately reflects the vehicle’s true, often increasing, worth rather than a depreciated figure. This foresight protects the classic car owner’s investment against the inherent volatility of a market value assessment post-incident.

Conversely, regular auto insurance policies typically determine the value of a total loss claim after the loss has occurred. The settlement is estimated based on the Actual Cash Value (ACV) of the vehicle on the date of the accident. ACV is calculated by taking the replacement cost of the vehicle and subtracting depreciation due to age, mileage, and wear and tear. This means the payout for a standard vehicle will almost always be less than its original purchase price, as depreciation is a constant factor in the valuation of daily drivers.

4. Maximum Vehicle Value Limits

The approach to setting maximum vehicle value limits further distinguishes classic car insurance from standard auto policies, reflecting the differing financial trajectories of the vehicles they cover. For classic cars, the valuation methodology acknowledges and accommodates their potential for appreciation, offering a more dynamic and often higher maximum value limit than typically seen with depreciating daily drivers.

In classic car insurance, the agreed-upon vehicle values can be significantly higher than the original purchase price. This is because the valuation process accounts for various factors that enhance a classic car’s worth over time, such as meticulous restoration efforts, valuable upgrades, or the inherent appreciation characteristic of certain collector models. The policy limit, chosen at the start of the policy period, is designed to reflect this potential for increased value, providing comprehensive protection for a growing asset.

This system allows for adjustments based on improvements. If a classic car undergoes restoration or receives significant upgrades, its value can change, and the insurance policy can be updated to reflect this enhanced worth. Some insurers even offer ‘inflation guard’ features, which automatically increase the agreed value limit by a certain percentage annually, such as up to 6%, further protecting against underinsurance as the vehicle’s market value potentially climbs.

Regular auto insurance, on the other hand, operates on the premise that vehicles generally depreciate. The maximum vehicle value is typically determined by the current selling price of similar year, make, and model vehicles. Adjustments to this fair market value are made based on the vehicle’s relative mileage, overall conditioning, and any betterment. This approach ensures that the payout reflects the vehicle’s market value at the time of the loss, which, for a standard car, almost invariably means a lower figure than its original cost.

Read more about: Decoding the $300 Rule: Practical Steps to Finance Your Car Without Financial Strain

5. Vehicle Usage Restrictions and Annual Mileage Limits

The very purpose for which a vehicle is insured fundamentally dictates its insurance policy’s structure, particularly regarding usage restrictions and annual mileage limits. Classic car insurance is meticulously crafted for vehicles that are “collected” rather than relied upon for routine transportation. This premise directly influences the terms of coverage, differentiating it significantly from policies for daily drivers.

Classic car policies are designed for limited use. They explicitly state that these vehicles should not be used for daily commuting. Instead, acceptable uses typically include participation in parades, car shows, club activities, exhibitions, or occasional pleasure drives. This restricted usage is a cornerstone of the lower risk profile that allows insurers to offer more affordable premiums. For example, Hagerty generally won’t insure a classic car if it’s used for daily commuting, off-road activities, or commercial purposes.

Most classic car insurance policies come with explicit annual mileage limits, which usually range from 3,000 to 5,000 miles per year. These limits reinforce the expectation that the vehicle is not a primary mode of transport. While some providers offer flexible mileage plans or even “unlimited” options, even these “unlimited” plans often come with an implicit understanding that mileage exceeding a certain threshold, such as 7,500 or 10,000 miles annually, may require an explanation, as it deviates from the expected occasional use of a classic vehicle.

In stark contrast, daily driver insurance policies have no such usage restrictions or mileage limits. They are specifically designed for vehicles that are used for everyday journeys, commuting to work, running errands, and any other regular transportation needs. This unrestricted use is factored into their higher premiums, as constant road exposure inherently increases the risk of accidents and wear and tear. If a classic car owner intends to use their vehicle as a daily driver, a standard car insurance policy without mileage restrictions would be the appropriate, though likely more expensive, choice.

Read more about: Decoding America’s Automotive Stratification: An In-Depth Look at Vehicle Classifications

6. Secure Storage Requirements

Another significant differentiating factor between classic car insurance and daily driver policies involves the expectations and requirements for vehicle storage. Due to the inherent value and often delicate nature of collector vehicles, classic car insurance policies frequently stipulate secure storage conditions as a prerequisite for coverage and to access lower premiums. This contrasts sharply with the minimal storage requirements for standard daily driver insurance.

Most classic car insurance companies mandate that the insured vehicle be stored securely in an enclosed and locked garage or under a similar protective cover when not in use. This requirement aims to mitigate risks such as theft, vandalism, and environmental damage from weather exposure. By ensuring the vehicle is safely housed, insurers reduce their exposure to claims, which in turn contributes to the more favorable premium rates offered to classic car owners.

Some providers, while generally adhering to this principle, might offer slight flexibility. For instance, American Collectors Insurance is noted for allowing alternative vehicle storage methods other than a fully enclosed, locked garage or structure, though this is an exception rather than the rule, as most classic car insurers typically require such a secured environment. This demonstrates a balance between strict requirements and accommodating specific customer situations, yet the core principle of secure storage remains paramount.

Conversely, standard car insurance policies for daily drivers typically do not impose any strict storage requirements. A daily driver can be parked on a driveway, on the street, or in an open carport without impacting its eligibility or premium rates significantly. The assumption is that these vehicles are exposed to various parking scenarios as part of their regular use, and the policy’s pricing already reflects this broader range of risk factors associated with less controlled storage environments. The absence of stringent storage mandates for daily drivers underscores their role as utilitarian vehicles rather than high-value, protected collector items.

Read more about: Investing in Excellence: A Wirecutter Guide to the 7 Best High-End Grills for Unparalleled Outdoor Cooking

7. Requirement for a Separate Daily Driver

One of the most defining prerequisites for obtaining classic car insurance is the mandate that the policyholder maintains a separate vehicle for daily transportation. This is not merely a suggestion but a contractual obligation for many insurers, serving as a critical indicator that the classic vehicle will indeed be used for limited, occasional purposes rather than as a primary mode of transport. The existence of a “daily driver” confirms the low-risk usage profile that underpins the lower premiums of classic car policies.

This stipulation helps insurance providers accurately assess the risk associated with insuring a collector vehicle. By ensuring that another vehicle handles the rigors of everyday commuting, classic car insurers can confidently assume their covered assets will face significantly less exposure to the common hazards of traffic, road wear, and potential accidents. This arrangement effectively segregates the higher risks of constant use onto a standard auto insurance policy, leaving the classic car protected under terms suited to its specialized status.

For consumers, this means that even if their classic car is fully functional and capable of daily operation, its insurance policy will likely require proof of a separate, regularly insured vehicle. This requirement helps manage expectations regarding the classic car’s usage and reinforces the economic benefits derived from its limited road time. It’s a practical measure that underscores the distinct operational philosophies behind classic versus standard automotive insurance offerings.

Read more about: Buyer Beware: These 10 Popular Cars Are Known Money Pits After 100,000 Miles, According to Automotive Experts

8. Specialized Coverage Options

Beyond the fundamental distinctions in valuation and usage, classic car insurance policies frequently offer a suite of specialized coverage options tailored to the unique needs of collectors. These bespoke protections are designed to address specific concerns that arise with rare, valuable, or undergoing restoration vehicles, distinguishing classic policies from the more generalized offerings of standard auto insurance. Such specialized add-ons often prove invaluable in preserving the owner’s investment and passion.

Among the most practical and frequently sought-after specialized coverages is spare parts coverage. Companies like American Collectors Insurance offer up to $500 in spare parts coverage, while others such as American Modern, Leland-West, and Heacock provide up to $2,000. This coverage recognizes that maintaining a classic vehicle often involves accumulating and storing valuable components, which themselves require protection against theft or damage. Additionally, restoration coverage is a critical feature, with insurers like Hagerty and American Modern offering policies that protect vehicles actively undergoing restoration, often automatically increasing the agreed value as progress is made.

Further demonstrating their specialized nature, some classic car insurers provide coverage for disaster relocation expenses, such as American Collectors, American Modern, Chubb, Hagerty, and Leland-West, which helps cover costs to move a classic car out of the path of catastrophic events like hurricanes. Chubb, for example, prioritizes the integrity of the vehicle by covering original equipment manufacturer (OEM) parts repair or the fabrication of parts if OEM components are unavailable, even allowing for repairs at preferred shops, potentially overseas. Hagerty’s ‘cherished salvage’ option even permits owners to retain their totaled vehicle without deducting its salvage value from the payout, acknowledging the emotional and historical value beyond mere monetary worth.

Other notable specialized options include motorsports advantage endorsements for race cars, as seen with Hagerty and Heacock, and car show reimbursement that compensates owners if they miss a show due to an accident or mechanical breakdown. These detailed coverages highlight the deep understanding specialized insurers have of the classic car community, providing peace of mind for enthusiasts whose vehicles are far more than just transportation.

Read more about: Unmasked: 9 Fishing Rod Frustrations That Drive Anglers to Seek Superior Quality

9. Distinct Discount Structures and Incentives

The avenues for reducing insurance premiums also diverge significantly between classic car and daily driver policies, reflecting the differing risk profiles and community involvement of their respective vehicle owners. Classic car insurance often presents unique discount opportunities that reward responsible ownership, specialized storage, and active participation in the collector car hobby, offering advantages not typically found in standard auto insurance policies.

Many insurers catering to classic vehicles provide multi-car discounts, recognizing that collectors often own more than one specialty vehicle, in addition to their daily driver. Furthermore, active membership in classic car clubs or specific marque clubs can unlock additional savings. For example, Heacock Classic offers special discounts for membership in particular marque clubs, acknowledging the care and community support often associated with such affiliations. These types of discounts are structured around the collector lifestyle, rather than just driving history.

Another significant incentive unique to classic car insurance is the “lay-up discount,” which specifically benefits vehicles that are stored and not driven during certain periods, such as winter months. Condon Skelly, for instance, provides a lay-up discount for not driving cars from December through March, although this particular discount may not apply to restoration vehicles. This reflects the reality of seasonal use for many classic vehicles and directly translates into cost savings for owners who adhere to such seasonal storage.

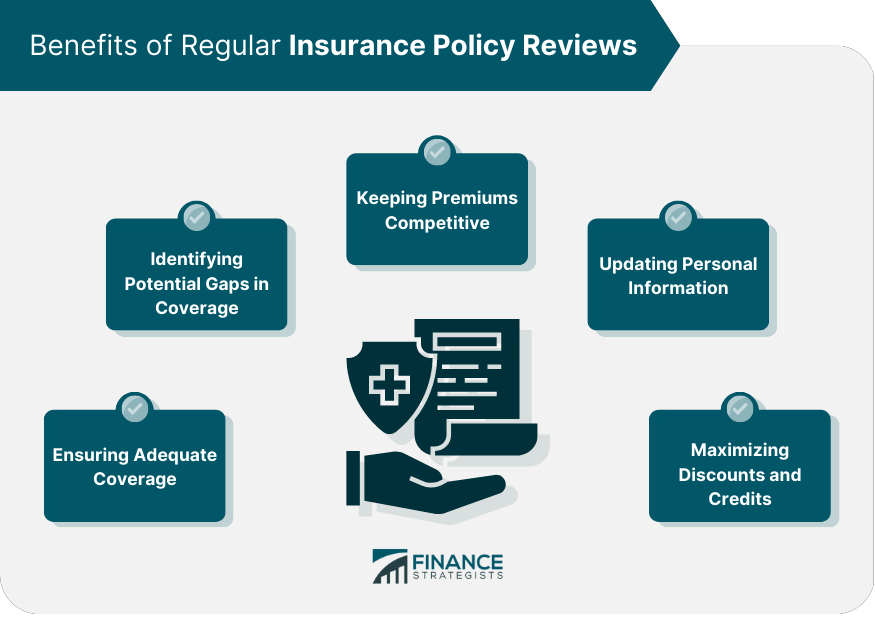

Beyond these specialized discounts, bundling opportunities can also contribute to overall savings. Insurers like American Collectors (partnered with USAA), American Modern (partnered with Geico), and Hagerty (with alliances including Allstate, Nationwide, and Progressive) offer potential bundling discounts when a classic car policy is combined with a standard auto or home insurance policy. While standard auto insurance typically relies on factors like no-claims bonuses for discounts, classic car policies leverage a broader, more tailored spectrum of incentives that align with collector car ownership.

Read more about: Why Electric Cars Still Struggle With Road Trips: An In-Depth Look at the Current Hurdles

10. Deductible Choices and Their Impact

Deductibles are a standard component across most insurance policies, and classic car insurance is no exception. However, the flexibility and considerations surrounding deductible choices for classic vehicles often differ from those for daily drivers, providing owners with more tailored options to manage their premiums and out-of-pocket expenses in the event of a claim. Understanding these nuances is key to optimizing a classic car insurance policy.

While classic car insurance policies will feature a deductible for repair expenses, the range of choices can be quite broad. For highly valuable vehicles, some insurers allow for substantial deductibles, such as American Modern which offers options up to $10,000, or American Collectors which permits deductibles up to 20% of the car’s agreed value. Opting for a higher deductible can significantly reduce premium costs, as the policyholder assumes a greater portion of the initial risk in the event of a claim, making it a viable strategy for owners of particularly prized assets.

Conversely, some classic car insurers also offer a zero-deductible option, as seen with Leland-West, and Chubb even offers no deductible for total loss settlements. While a zero-dollar deductible eliminates any out-of-pocket expense for a covered claim, it typically comes with a higher premium. Consumers are advised to weigh the trade-off between premium cost and immediate out-of-pocket expense, as a deductible of $250 or $500 often strikes a more balanced approach for many owners.

For daily driver insurance, deductibles are generally more standardized and less tied to the vehicle’s appreciating value or specific restoration costs. The choice of deductible for a classic car, therefore, involves a more strategic decision, directly impacting both the monthly premium and the financial implications of potential repairs or a total loss, especially when paired with an ‘Agreed Value’ policy that removes market value uncertainty.

Read more about: Decoding True Cost to Own: 9 Critical Factors That Drain Your Wallet After Five Years of Vehicle Ownership

11. Comprehensive Range of Eligible Vehicle Types

While age is a primary factor in qualifying for classic car insurance, the scope of vehicles considered eligible extends far beyond mere vintage automobiles. Specialized classic car insurance providers recognize and cater to a diverse and often unique array of specialty vehicles, reflecting the breadth of automotive enthusiasm and collecting. This comprehensive coverage for niche vehicles is a significant differentiator from standard auto policies, which are generally focused on mainstream consumer vehicles.

Classic car insurance encompasses traditional categories such as classic hot rods, street rods, and muscle cars, which are celebrated for their performance and aesthetic appeal. Exotic cars, known for their rarity and high value, also frequently qualify, along with show-worthy modern classics that, despite being newer than typical classic cars, possess significant collector appeal and stable or appreciating values. These types of vehicles are often meticulously maintained and driven under limited circumstances, fitting the classic insurance model perfectly.

Beyond these more common collector vehicles, the policies extend to remarkably specific and unique categories. This includes antique farm tractors, vintage military vehicles, and classic fire trucks, as offered by insurers like American Collectors and Condon Skelly. Even kit cars and replicas, as long as they meet general eligibility requirements such as age (e.g., 25 years or older for replicas), can often be covered. Additionally, modified and custom cars are frequently accommodated, reflecting the personalization and craftsmanship that many enthusiasts invest in their vehicles.

Furthermore, vehicles undergoing restoration are a prime candidate for classic car insurance, with many companies offering specific coverage designed to protect the asset throughout its rebuilding process. This wide array of eligible vehicles underscores the specialized nature of classic car insurance, providing tailored protection for nearly any vehicle deemed collectible or historically significant, a flexibility not found in standard daily driver policies.

Read more about: The Insurance Agent’s Essential Picks: 15 Key Insights for Affordable Car Insurance in Seattle and Washington

12. Specialized Insurer Expertise and Claims Handling

The final, yet arguably most crucial, distinction between classic car and daily driver insurance lies in the specialized expertise of the insurers themselves and the nuanced approach to claims handling for collector vehicles. While standard insurers process claims based on depreciating market values and readily available parts, classic car insurers operate with an understanding of unique valuations, rare components, and the emotional attachment owners have to their treasured automobiles.

Companies that specialize in classic car insurance are often referred to as ‘experts’ for good reason. Their teams possess in-depth knowledge of collector car markets, restoration processes, and the specific needs of these vehicles. This expertise is invaluable when it comes to accurately valuing a vehicle under an ‘Agreed Value’ policy, particularly after significant restoration or upgrades. This contrasts sharply with standard insurers, who may struggle to assign appropriate value to a highly customized or rare classic using typical Actual Cash Value methodologies.

This specialized knowledge translates directly into a more supportive and effective claims process. For instance, Chubb’s commitment to using OEM parts or fabricating unavailable components ensures that the vehicle’s originality and integrity are maintained during repairs. Hagerty’s ‘cherished salvage’ option, allowing owners to keep their totaled vehicle, is another testament to this tailored approach, recognizing that some classics hold value beyond their repair cost. These options are rarely, if ever, available through standard auto insurance policies.

Choosing a specialized classic car insurer means opting for a partner who understands the unique investment and passion behind your vehicle. While some traditional companies offer classic car coverage, they may not fully appreciate that a collector vehicle is not a daily driver, potentially leading to less comprehensive or less favorable terms. Consumers are advised to thoroughly evaluate an insurer’s proven track record, specific coverage options, and reputation for handling classic vehicle claims to ensure their cherished asset receives the comprehensive protection and expert care it deserves.

Read more about: The 15 Most Expensive Cars to Insure Right Now: Essential Insights for Savvy Budget Planners from Brokers and Claim Records

The decision to opt for classic car insurance over a standard daily driver policy is rooted in a clear understanding of fundamental differences that extend far beyond initial cost savings. From distinct usage patterns and specialized valuation methods to unique coverage options, flexible deductibles, and the necessity of a separate daily driver, each facet is meticulously tailored to the unique world of collector vehicles. These specialized policies are crafted to protect not just an asset, but a passion, offering peace of mind to enthusiasts and collectors. By recognizing these pivotal distinctions, owners can ensure their prized possessions receive the precise, comprehensive protection they truly deserve, reflecting their intrinsic and often appreciating value within the automotive landscape.