The images of the Great Depression are etched deep into our collective consciousness, haunting the pages of history with their stark portrayal of despair and destitution. We picture men selling apples on street corners, anxious crowds making runs on banks, and the endless lines of women and children waiting for bread. It was a decade of extreme economic downturn, both domestically and internationally, where the 1929 stock market crash, intensified isolationism, and sky-high unemployment conspired to create compounding fiscal nightmares that lasted from 1929 to 1939. For most, these were not the ‘good times rolling,’ but rather a relentless struggle for survival, where even people of considerable means often found themselves selling off all their property and possessions just to get by.

Yet, within this grim narrative of widespread loss and hardship, there lies a fascinating, often surprising, counter-story. While countless families faced unprecedented challenges, a select few not only weathered the storm but emerged from it with even greater wealth. These were the individuals and families who, through cunning, foresight, luck, or sometimes questionable ethics, managed to accumulate or preserve massive fortunes when the world around them seemed to be collapsing. Their stories offer a perplexing glimpse into the mechanisms of wealth accumulation and retention during one of history’s most challenging economic periods.

We’re about to embark on a journey through a dozen such tales, unraveling the intriguing ways these massive fortunes were made, secured, or even controversially acquired during the Great Depression. From audacious investments and groundbreaking entrepreneurial spirit to the scandalous reality of tax avoidance and the daring escapades of notorious criminals, these are the narratives that challenge our perceptions of an era defined by scarcity. Prepare to discover how some individuals found pathways to prosperity, or simply held onto their riches, while millions grappled with poverty, forever shaping the landscape of American wealth.

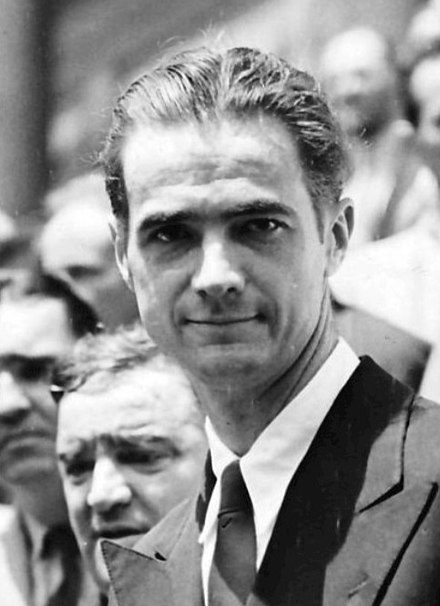

1. **Howard Hughes: The Tycoon Who Soared Above the Economic Downturn**Howard Hughes, a name now perhaps more synonymous with eccentricities and a Leonardo DiCaprio-starring biopic, was far more than just a peculiar multi-business tycoon. He was a man who grew up rich and, remarkably, managed to get even richer during the Great Depression. The seeds of his eventual billion-dollar aerospace and defense empire were not just sown during this tumultuous time; they truly began to flourish, setting the stage for his stratospheric wealth long after the dust settled on the economic crisis.

His journey into monumental wealth began early. In 1923, at the tender age of 18, Hughes inherited the lion’s share of his father’s oil-tool business, along with a fortune that was just shy of a million dollars. While many heirs of extreme wealth might have been content to simply fund a flashy playboy lifestyle, Hughes was different. He brilliantly paired that extravagant lifestyle with a keen engineer’s mind and an unyielding entrepreneurial spirit, demonstrating a drive that would define his legacy.

Throughout the roaring ’20s, Hughes leveraged his inherited capital, pouring it into groundbreaking ventures like filmmaking in Hollywood and the thrilling world of aviation. As the nation plunged into the Great Depression, with most of the U.S. population waiting in breadlines, this would-be billionaire, then a millionaire, was quite literally taking to the skies. It was in the early 1930s that his aviation obsession truly took flight, leading him to create a new business division within his father’s tool company: the Hughes Aircraft Company.

Even as the country struggled, Hughes spent the 1930s meticulously designing planes for his burgeoning company to build and, most thrillingly, for himself to fly. He wasn’t just building a business; he was breaking records. Howard Hughes consistently shattered speed records throughout the Great Depression with his innovative aircraft, cementing his place as a visionary and laying the crucial groundwork for the future expansion of his wealth, which would swell even further into the 1940s with major defense manufacturing subcontracts.

2. **J. Paul Getty: The Master of Buying Low When Everyone Else Panicked**J. Paul Getty, the astute oil businessman, provides a classic example of how to grow an already considerable fortune during an economic downturn: buying low when others were selling desperately. As the Great Depression seized the nation, Getty utilized his millions to snap up stocks from panicky sellers, acquiring them for mere pennies on the dollar. This strategic opportunism was the cornerstone of his Depression-era success, a stark contrast to the financial devastation experienced by so many.

His foresight was eloquently captured in a letter he penned to his mother in 1932, quoted by University Archives, where he declared, “It is the opportunity of a lifetime to get oil companies for practically nothing.” This sentiment perfectly encapsulated his ruthless, yet undeniably effective, investment philosophy. His background was rooted in oil, with his father, George Getty, moving the family to Bartlesville, Oklahoma, in the early 1900s to purchase and profit off oil fields, before relocating to California in 1905, where J. Paul eventually joined the family business.

Getty inherited what might be considered a relatively small fortune in 1930 – $500,000 – especially when compared to the vast wealth he would meticulously build for himself. However, this initial sum served as his crucial seed money. According to his New York Times obituary, he leveraged this inheritance with unparalleled patience, systematically acquiring various oil stocks and even financially troubled companies to dramatically expand his personal wealth, showing a remarkable ability to see value where others saw ruin.

His shrewdness extended beyond simple acquisitions. During the Depression, J. Paul Getty significantly expanded his empire by acquiring the Pacific Western Oil Corporation, cementing his position in the industry. But Getty’s legendary reluctance to part with his cash, unless it was for further investments, was equally famous. He infamously negotiated with his grandson’s kidnappers over a $16 million ransom, quoted in his obituary as saying, “I have 14 other grandchildren and if I pay one penny now, then I’ll have 14 kidnapped grandchildren.” This anecdote, while chilling, perfectly illustrates the mindset that enabled the rich to stay rich – a relentless focus on preserving and expanding capital, even if it meant being dubbed, perhaps, not the ‘favorite grandparent.’

3. **Mae West: The Bombshell Who Built a Fortune from Scandal and Wit**Not every individual who struck it rich during the Great Depression was born into privilege; some clawed their way to the top through sheer talent, wit, and a healthy dose of scandal. Mae West, the iconic bombshell writer-actor whose lips famously inspired Salvador Dali’s Lips sofas, was born poor but defied all odds to amass a significant fortune during one of America’s bleakest economic periods. Her journey from the vaudeville circuit to Hollywood stardom is a testament to her unique appeal and business acumen.

West was a quintessential Jazz Age It Girl, captivating audiences and enraging moralists with her risqué humor and voluptuous physique. She spent a considerable portion of her early career navigating the demanding vaudeville circuit, honing her craft and developing the persona that would eventually make her a legend. Her breakthrough into wider success came when she took control of her own destiny, writing and starring in her own plays, refusing to be confined by conventional expectations.

Her audacious nature truly came to the fore in 1926 when she scandalized Broadway with a seductive play that critics decried as ‘smut.’ Despite the moral outrage, audiences flocked to the theaters, eager for her brand of entertainment. This success, however, was not without its consequences. After an astonishing 375 performances, Mae West was arrested for obscenity, leading to a 10-day prison sentence on Welfare Island, now known as Roosevelt Island. Far from being deterred, West famously ‘vamped for the press’ during her incarceration, transforming potential disgrace into a publicity coup.

This bold move paid off handsomely. By 1932, West had become a bonafide movie star, gracing the silver screen as unforgettable bad girls with impeccable humor. Her business savvy was as sharp as her wit; she negotiated an unprecedented contract with Paramount Pictures that granted her the rare privilege of writing her own lines, including the immortal “come up and see me sometime.” This lucrative deal propelled her to earn upward of $300,000 a year, making her the second-highest-salaried person in the entire country at the time, second only to the powerful newspaper magnate William Randolph Hearst. Despite the Hays Code and constant censorship attempts, West’s smart-mouthed and y underdog characters resonated deeply with Depression-era audiences, providing a relatable and ‘va-va-voom’ reflection of their own resilient spirit onscreen.

4. **Gene Autry: The Singing Cowboy Who Crooned His Way to Millions**While many during the Great Depression literally sang for their supper, Gene Autry transformed his crooning into doubloons, becoming a legendary musician and actor whose fortune grew exponentially during these trying times. His story is a classic American tale of starting from the most humble beginnings and rising to superstardom, demonstrating that talent, hard work, and a knack for diversification could pave a path to immense wealth even in an era of scarcity.

Autry’s early life was rooted in the rugged simplicity of Oklahoma, where he ranch-handed for his father and later worked as a telegraph operator. It was during these industrious years that his singing began to echo through his daily tasks. His melodious voice eventually led to various gigs in the late 1920s, culminating in a significant signing with the American Record Corporation, a label that would later evolve into the renowned Columbia Records. These early steps were crucial in establishing his presence in the burgeoning entertainment industry.

The true turning point in his career arrived in 1934 when he landed his biggest gig: becoming the beloved ‘singing cowboy’ on Chicago’s immensely popular “National Barn Dance” radio show. Autry’s unique blend of heartfelt songs and engaging comedic stylings quickly captured the nation’s attention, and it wasn’t long before Hollywood came calling. He swiftly transitioned into a movie star, cementing his status as a music icon and a cinematic presence.

Gene Autry’s film career flourished during the Great Depression, with appearances in over 30 movies, beginning with “In Old Santa Fe.” The money he earned from these roles was vastly more considerable than his telegraph operator days, but it was his shrewd popularization of a refined cowboy persona – attractive and well-dressed in Western wear, distinctly moving away from the ‘hillbilly’ stereotype – that truly captivated a massive audience. More powerful than his sartorial choices was his compelling ‘everyman-made-good story,’ which resonated deeply with a public yearning for hope. After the Depression, Autry continued to diversify his investments with the seed money from his movie-magic range, even installing a permanent home for his traveling rodeo in Berwyn, Oklahoma, in 1939, an effort to revitalize a town battered by the Dust Bowl. Such was his impact that the town soon renamed itself Gene Autry, Oklahoma.

5. **John Dillinger: The Public Enemy Who ‘Stole’ Both Cash and Debt Relief**In the grim landscape of the Great Depression, the concept of ‘one man’s loss being another man’s gain’ took on a particularly stark meaning, especially in the criminal underworld. While millionaires legally scooped up foreclosed homes and businesses for a song, American gangster John Dillinger and his notorious gang were making headlines as ‘Public Enemy Number One’ for their brazen bank robberies. Born and destined to die in Chicago, a hotbed of semi-organized crime, Dillinger’s life embodied the darker, more illicit pathways to wealth during a period of national desperation.

Dillinger’s formative years were spent engaging in petty crimes and serving jail time, a common trajectory for many individuals marginalized by societal circumstances. However, by the early 1930s, he was determined to escalate his criminal enterprises and accumulate ‘real money.’ He quickly gained notoriety alongside other infamous criminals like Baby Face Nelson and Harry ‘Pete’ Pierpont, becoming known for his gang’s sophisticated approach to bank heists.

Utilizing a meticulously organized network of accomplices and employing military-style tactics, Dillinger’s gang executed bank robberies with a chilling efficiency and effectiveness. Over a series of a dozen audacious heists in the mid-1930s, Dillinger personally amassed a take of $300,000, a sum equivalent to nearly $7 million in today’s money. This ill-gotten fortune was a direct result of his willingness to exploit the vulnerabilities of the financial system, a system that many ordinary citizens felt had already failed them.

Despite his violent methods and eventual violent end, John Dillinger paradoxically became a beloved figure to a segment of the public during the Great Depression. His exploits, filling the daily papers, offered a form of vicarious rebellion against a seemingly unfair world. Crucially, it wasn’t just cold, hard cash he stole. In an act that endeared him to thousands, Dillinger, in the course of his bank heists, also stole and destroyed thousands of mortgage records. This audacious act effectively freed countless strangers from the crushing burden of debt, blurring the lines between villain and folk hero in the eyes of a desperate populace, making his ‘stolen’ fortune a complex narrative of loss for the banks and unexpected relief for the indebted.

6. **The McKee Family (Little Debbie): Baking the Seeds of a Sweet Future**The Great Depression, while annihilating countless businesses and established fortunes, also paradoxically served as fertile ground for the birth of new enterprises. Against a backdrop of widespread economic collapse, some visionary individuals and families, armed with ingenuity and resilience, were able to plant the foundational seeds of American businesses that would one day blossom into household names, creating massive fortunes long after the Depression’s end. The McKee family and their creation of Little Debbie snacks stand as a compelling testament to this unique phenomenon.

While the context doesn’t delve into the minute details of the McKee family’s struggles and triumphs during the Depression, their story is cited as a prime example of an American business that began to take root during this incredibly challenging period. The very existence of such a venture, successfully launched and grown amidst the deepest economic trough of the 20th century, speaks volumes about their entrepreneurial spirit and acute understanding of consumer needs during a time when affordability and comfort were paramount.

The establishment and initial growth of what would become the Little Debbie brand represents a fortune made not through inheritance or shrewd market speculation in existing industries, but through the hard-won creation of an entirely new, successful product line. This required an immense leap of faith, careful management of scarce resources, and an unwavering commitment to meeting a market demand that was both constrained by budget and yearning for small pleasures.

This kind of entrepreneurial success during the Great Depression is truly remarkable. It highlights how, even when the economy seemed to offer no quarter, opportunities could be forged by those with the foresight and courage to innovate. The McKee family’s story, therefore, isn’t just about baking cakes; it’s about baking a future of prosperity and establishing a legacy that would thrive for generations, proving that even in the darkest economic hours, the groundwork for massive future fortunes could be diligently laid.

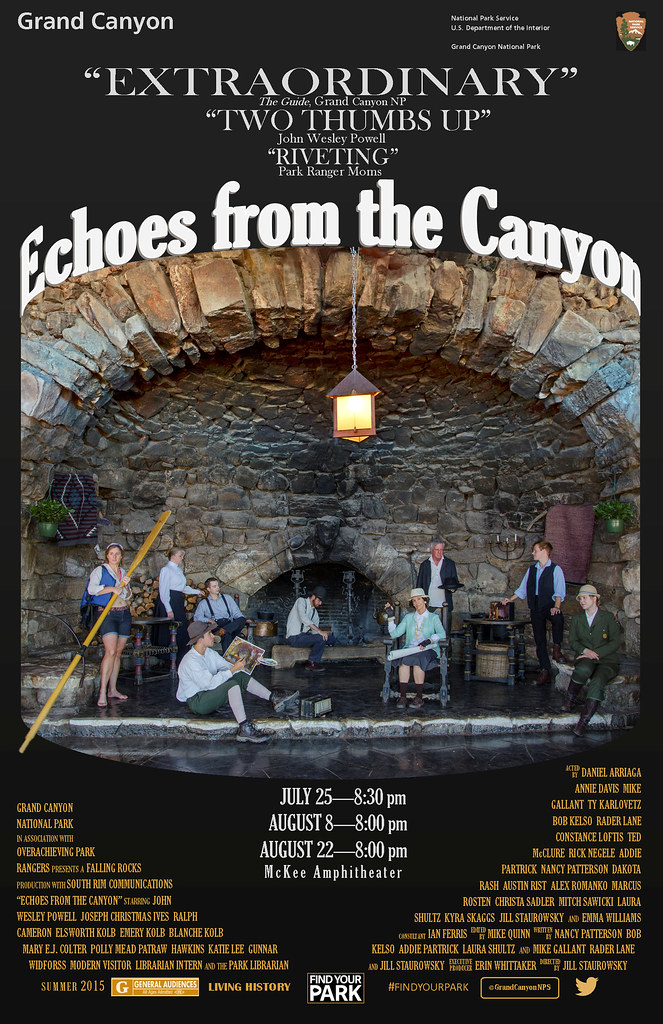

7. **E.W. Scripps: The Newspaper Magnate Who Championed and Skirted Taxes**E.W. Scripps emerges as a profoundly contradictory figure in the narrative of Depression-era wealth. He was a powerful newspaper magnate who, despite amassing immense personal wealth, often espoused radical sympathies and positioned his newspaper empire to serve the working class. Co-founding his empire in 1878, Scripps sold his papers for a penny when others charged five cents, publishing news that he believed helped ordinary Americans “protect themselves from the brutal force and chicanery of the ruling and employing class.” This strategy undeniably made him incredibly rich, yet it fueled deep misgivings about his own affluence.

Initially, Scripps was a fervent advocate for progressive taxation, seeing it as a crucial mechanism to prevent social unrest and ensure the wealthy contributed their fair share. He passionately campaigned for income and inheritance taxes, pressing President Woodrow Wilson to implement legislation where “people who made more than $100,000… should pay the most.” Scripps even declared that such measures “would cost me much more than half my present income,” showcasing an apparent willingness to sacrifice his own fortune for societal balance.

However, Scripps’ enthusiasm for progressive taxation significantly dimmed as his own tax liabilities began to swell dramatically. By 1921, he complained to President Warren G. Harding that his taxes had risen almost 30-fold, deeming it “absurd” and “unreasonable.” Despite his earlier public stance, Scripps confessed to Harding that he had been successful in avoiding taxes by keeping profits within his business, thereby ensuring a much larger estate for his heirs. He acknowledged that while it wasn’t outright tax evasion, it certainly constituted avoidance, and he openly criticized how the “rascality of the rich man has been used to influence Congress to rig the tax law with purposeful defectiveness to provide loopholes for the wealthy.”

In 1922, Scripps took a decisive step to protect his legacy, placing all of his newspaper stock into a trust for his heirs. Trusts, already a favored tax-dodging tool among the affluent, would become a cornerstone of dynastic wealth preservation. This move, years before his death, effectively set the stage for generations of his descendants to navigate around the estate tax that he himself had championed. Although his estate faced a tax bill because he retained control during his lifetime, the trust eventually allowed his heirs to avoid such burdens, ensuring his “instrument of power” and source of massive fortune endured for 86 more years, a testament to the effectiveness of strategic financial planning.

8. **Andrew Mellon: The Industrialist Who Redefined Tax Avoidance**Andrew Mellon stands as a monumental figure in the history of American wealth and taxation, embodying the ultimate paradox of a powerful industrialist turned Treasury Secretary who vehemently opposed the very taxes designed to curb dynastic fortunes. Descended from a family that immigrated from Northern Ireland due to “oppressive taxes,” Mellon inherited his deep antipathy for taxation. His father, Thomas Mellon, built an immense fortune through law, real estate, and banking, a legacy that Andrew would expand exponentially.

Mellon’s worldview was steeped in social Darwinism, viewing wealth as a mark of merit and poverty as a character flaw. He expressed concerns that expanded voting rights would inevitably lead to higher spending, borrowing, and, consequently, higher taxes. In 1869, he founded the Mellon bank, which became an early venture capitalist, investing in and ultimately controlling a vast network of steel, oil, aluminum, and chemical firms. By the time his father died in 1908, the Mellon children were “making money hand over fist,” their financial power soon matching their political influence.

As Treasury Secretary under three Republican presidents, Mellon became a prophet of “trickle-down” economics, arguing that lowering taxes for the wealthy and corporations would stimulate investment and lead to national prosperity. When he assumed his cabinet post, the top income tax bracket was a staggering 73%, a figure Mellon found punitive. He famously wrote that “Taxes which are inherently excessive are not paid,” suggesting that high rates only encouraged avoidance rather than compliance. He even instructed the Bureau of Internal Revenue, which he controlled, to compile a list of legal tax avoidance schemes, later admitting under oath to using five of the ten tricks himself to reduce his taxes.

Mellon particularly despised the estate tax, which he sought to eliminate entirely, arguing that “The social necessity for breaking up large fortunes in this country does not exist.” He decried legislative efforts to raise the estate tax on the wealthiest Americans as “economic suicide,” likening the actions of senators to “the revolutionists of Russia.” Despite his public pronouncements, the Mellon family’s fortune, now pegged by Forbes at an astonishing $114 billion alongside Scripps and Mars, proved remarkably durable. It unequivocally debunked the adage that “there are three generations from shirt sleeves to shirt sleeves,” demonstrating how entrenched wealth, aided by strategic tax avoidance, could endure and grow for centuries.

9. **The Mars Family (Ethel Mars): Sweet Success and Strategic Asset Protection**The Mars family, founders of the ubiquitous candy empire, represents another compelling case study in the longevity of massive fortunes and the sophisticated strategies employed to preserve them through challenging periods like the Great Depression and beyond. While the foundational business was established before the Depression, its continued success and the family’s ability to maintain immense wealth became a focal point during President Roosevelt’s efforts to reform the tax system. Ethel Mars, the widow of candymaker Frank Mars, specifically became a public example of aggressive tax avoidance.

During congressional hearings aimed at exposing the tax schemes of the wealthy, Ethel Mars was singled out for her innovative, albeit controversial, method of “equine tax avoidance.” She notably deducted the losses generated from her “Milky Way horse racing stables” from the corporate taxes of the candy manufacturing enterprise. This intricate maneuver effectively reduced the company’s taxable income, illustrating how personal ventures, even seemingly unrelated ones, could be strategically woven into a broader financial framework to minimize tax obligations.

This specific instance of tax avoidance, alongside others, deeply enraged Roosevelt, who described such tricks as “so widespread and so amazing both in their boldness and their ingenuity that further action without delay seems imperative.” The Mars family’s use of such a loophole allowed a portion of their massive fortune to be “lost” from public coffers, essentially shielding it from the very taxes intended to fund public services. It highlighted the vast discrepancies between the tax burdens faced by ordinary citizens and the intricate methods employed by the ultra-rich.

Today, the Mars family fortune remains a testament to the triumph of such strategies and the enduring power of dynastic wealth. Their combined wealth, along with that of the Scripps and Mellon families, is pegged by Forbes at $114 billion, proving the effectiveness of long-term asset protection. While spokespeople for the family affirm their compliance with all tax laws, the historic context reveals a pattern where legal, albeit aggressive, tax planning enabled their immense wealth to be retained and passed down through generations, effectively sidestepping congressional efforts to prune large fortunes.

10. **The Nordstrom Family: From Founding Principles to Enduring Legacy**The Nordstrom family, synonymous with its prominent department store chain, provides another powerful example of a pioneering business family whose fortune demonstrated remarkable resilience and growth, even through the tumultuous years of the Great Depression. While the detailed specifics of their direct actions during the Depression are not exhaustively documented within our context, their continued prominence as a family whose wealth persists through generations speaks volumes about the foundational strength of their enterprise and the strategic preservation of their assets.

The existence of such multi-generational wealth directly contradicts the common refrain that fortunes inevitably dissipate within three generations, the so-called “shirt sleeves to shirt sleeves” narrative. The Nordstrom family’s enduring success implies that the groundwork laid by the department store founder was not only solid but also adaptable enough to navigate severe economic downturns. This allowed their business to thrive and continue creating wealth when countless other enterprises crumbled, reflecting astute management and an understanding of consumer needs.

A crucial element in the persistence of fortunes like Nordstrom’s, as highlighted by the broader discussion in the context, lies in the sophisticated use of dynastic trusts and other tax-avoidance strategies. These legal instruments, refined over decades, became key mechanisms for shielding significant wealth from taxation across generational transfers. Heirs such as Bruce Nordstrom, grandson of the founder, are noted for collecting substantial trust income, illustrating how these structures ensured a continuous stream of wealth, effectively making the estate tax “voluntary” for the ultra-wealthy.

The Nordstrom family’s journey underscores how pioneering businesses, when coupled with astute financial planning and the utilization of legal loopholes, could ensure that massive fortunes not only survived periods of national hardship but were also protected and propagated for future generations. Their story, therefore, represents a facet of how wealth was handled during and after the Great Depression, contributing to the broader pattern of concentrated dynastic power and challenging the democratic ideal of equitable wealth distribution.

11. **The Wrigley Family: Chewing Gum Empire’s Lasting Sweetness**The Wrigley family, renowned for its global chewing gum empire, offers another compelling narrative of a pioneering business whose fortune proved exceptionally resilient and capable of enduring through the Great Depression and far beyond. While our specific context highlights the massive trust income reaped by later generations like William Wrigley Jr., the great-grandson of the chewing gum pioneer, it implicitly underscores the robust foundation established by the family’s original enterprise that allowed this dynastic wealth to flourish across the century.

The ability of the Wrigley business to not only survive but also continue generating substantial wealth during an era of extreme economic downturn speaks volumes about its market dominance, brand recognition, and innovative spirit. In a time when discretionary spending was severely curtailed, the widespread appeal and affordability of chewing gum likely ensured consistent demand, positioning the company for long-term stability and growth. This steadfastness enabled the family’s fortune to remain largely intact and continue expanding through careful stewardship.

Like many other ultra-wealthy families mentioned in the context, the Wrigley fortune significantly benefited from sophisticated financial strategies, particularly the establishment and utilization of trusts. These instruments were vital in safeguarding assets from taxation and facilitating the seamless transfer of wealth across generations. The considerable trust income collected by heirs like William Wrigley Jr. is a direct consequence of these meticulously crafted plans, which allowed family wealth to bypass many of the taxes designed to prune large fortunes.

Thus, the Wrigley family’s story provides a sweet, albeit complex, illustration of how pioneering entrepreneurial ventures, when strategically managed and legally protected through mechanisms like dynasty trusts, could build and maintain immense fortunes through historical economic upheavals. Their lasting legacy exemplifies how certain family empires not only weathered the storms of the Great Depression but solidified their dynastic power, ensuring that wealth continued to cascade down, fundamentally shaping the landscape of American economic privilege.

12. **The Sackler Family: Building and Protecting a Dynastic Fortune**The Sackler family, associated with a pharmaceutical empire and noted for its immense wealth, stands as a stark and powerful contemporary example of dynastic fortunes whose origins and preservation strategies resonate with the themes explored throughout the Great Depression era. While the context primarily points to the present-day massive trust income of heirs like Mortimer Sackler’s youngest son, it inherently speaks to a fortune that was cultivated and rigorously protected over generations, utilizing the very mechanisms discussed for earlier families.

Although specific details of the Sackler family’s direct actions *during* the Great Depression are not elaborated in our provided text, their inclusion within the larger discussion of “cascading riches” and the efficacy of “dynasty trusts” implies a deliberate and successful long-term strategy for wealth retention. Their fortune, like those of Mellon and Scripps, demonstrates how vast sums of money can be insulated from the economic turbulence of an entire century, including significant downturns.

The core of this wealth preservation lies in the sophisticated application of legal instruments, predominantly trusts, designed to shield assets from taxation and ensure an uninterrupted flow of income to heirs. These trusts allowed the Sackler family’s fortune to grow and be transferred without incurring the full bite of estate taxes or other levies intended to redistribute wealth. This strategic financial engineering highlights a pattern where the ultra-rich consistently find ways to remain “one step ahead” of legislative efforts to curb dynastic power.

Ultimately, the Sackler family’s history, as glimpsed through the lens of their heirs’ trust income, serves as a poignant illustration of how enduring family fortunes are not merely accumulated but actively preserved through complex legal and financial maneuvers. Their story reinforces the article’s central argument: that while millions faced poverty during periods like the Great Depression, certain families leveraged or exploited systemic loopholes to maintain and grow their immense wealth, forever shaping the trajectory of dynastic power and contributing to the concentration of wealth in a select few hands.

The narratives of these twelve fortunes, from the audacious entrepreneurs to the shrewd investors and the cunning tax avoiders, paint a vivid and complex picture of wealth during the Great Depression. This period, often remembered solely for its widespread economic devastation, also became an unexpected crucible for ingenuity, ruthless opportunism, and systemic privilege. These stories reveal that for a select few, the deepest economic trough of the 20th century was not just a time of loss, but also an era ripe for accumulating or fiercely safeguarding immense wealth, often in ways that continue to echo through dynastic fortunes today. The mechanisms of wealth preservation, particularly through sophisticated tax avoidance and the strategic deployment of trusts, became a well-oiled machine, ensuring that riches continued to cascade down through generations, leaving an indelible mark on the landscape of American prosperity and inequality.”}

,{“_words_section2”: “2104