Embark on a transformative journey into the literary realms that have meticulously shaped the financial destinies of the world’s most successful individuals. In a dynamic landscape where time is undeniably a precious resource, the books we choose to absorb become indispensable guides on our personal path to unparalleled success and enduring wealth. This curated collection unveils the must-read books, not merely as texts, but as profound reservoirs of insights and strategies, meticulously paving the way for financial mastery and strategic brilliance.

For billionaires and successful individuals, books transcend their role as mere sources of knowledge; they are potent tools for continuous personal and professional development. Reading profoundly expands horizons, offering perspectives that reach far beyond our immediate experiences and daily routines. These titans of industry understand that an expansive knowledge base better equips one to navigate the intricate complexities of life, business, and investment with unparalleled foresight. Through the pages of these carefully selected works, you can virtually sit at the feet of the greatest minds, gleaning invaluable insights from those who have masterfully walked the path before.

When billionaires—individuals often regarded as modern-day visionaries—lend their endorsement to a book, it carries immense weight. Their recommendations are not simply casual suggestions; they represent curated insights into the literature that has demonstrably impacted their lives, contributed significantly to their achievements, and refined their decision-making processes. By incorporating these recommended readings into your own journey, you gain direct access to a wealth of knowledge instrumental in shaping today’s financial landscape, providing guides that can be directly applied to your most ambitious pursuits.

1. **”Thinking, Fast and Slow” by Daniel Kahneman**Nobel laureate Daniel Kahneman’s seminal work, “Thinking, Fast and Slow,” offers a captivating and profound exploration into the dual systems that fundamentally govern human thought processes. This book meticulously delves into the intricate interplay between our fast, intuitive, and emotional thinking system (System 1) and our slow, deliberate, and logical thinking system (System 2). Kahneman masterfully unravels the cognitive biases and inherent errors that profoundly shape our decision-making, providing an invaluable lens through which to understand our own mental shortcuts.

Understanding the nuanced mechanisms behind effective decision-making is unequivocally crucial for anyone aspiring to achieve significant personal and professional growth. This book precisely equips readers with deep insights into the myriad factors that subtly influence our choices, offering a comprehensive roadmap to significantly enhance critical thinking and refine decision-making skills in both high-stakes financial scenarios and everyday life. It teaches us to recognize when our intuition might lead us astray and when to engage in more deliberate thought.

Renowned investor Warren Buffett, an individual celebrated for his rational and disciplined approach to investment, has explicitly endorsed “Thinking, Fast and Slow.” He emphasizes the profound and transformative impact this book can have on shaping a more rational and effective approach to decision-making, particularly in the volatile world of finance. For Buffett, understanding human psychology is as vital as understanding market fundamentals, making Kahneman’s work a cornerstone for any serious investor.

Read more about: The 12 Books That Bill Gates Says Fundamentally Changed How He Sees the World

2. **”The Innovator’s Dilemma” by Clayton M. Christensen**Clayton M. Christensen’s “The Innovator’s Dilemma” stands as a groundbreaking and indispensable exploration of disruptive innovation and its far-reaching implications for established companies. In this highly influential work, Christensen introduces and thoroughly explains the core concept of the dilemma faced by successful, well-managed companies when disruptive technologies or business models emerge. These innovations often appear inferior at first but ultimately challenge and redefine traditional business models, forcing established players to adapt or risk obsolescence.

For individuals actively aspiring to navigate the perpetually evolving business landscape, this book delivers invaluable insights into the challenges inherently posed by disruptive innovation. It illuminates why even the most competent and customer-focused companies can falter when faced with new market entrants that serve different needs or employ novel technologies. Understanding how to proactively adapt and continuously innovate in the face of such profound change becomes an absolutely key skill for those aiming to thrive, rather than merely survive, in dynamic and competitive industries.

The late Steve Jobs, co-founder of Apple Inc. and a true titan of innovation, recognized the transformative power and prescience of “The Innovator’s Dilemma.” His endorsement powerfully highlights the book’s enduring relevance for visionaries and entrepreneurs who are striving not just to compete, but to lead and redefine industries. Jobs’ own career, marked by radical product introductions and strategic pivots, exemplified the very lessons Christensen outlines, making this book a testament to Apple’s enduring success.

Read more about: Beyond the Boardroom: Mark Cuban’s Essential Reading List for Entrepreneurs and Visionaries

3. **”Zero to One” by Peter Thiel**”Zero to One” by Peter Thiel, a co-founder of PayPal and a prominent venture capitalist, delves deep into the often-unconventional secrets of building a successful startup and, more importantly, creating truly groundbreaking innovations. Thiel boldly challenges conventional thinking, urging entrepreneurs to shift their focus from merely competing in existing markets to instead concentrating on creating unique value and establishing defensible monopolies. He argues that true progress comes from creating something entirely new, moving from ‘zero to one,’ rather than simply improving existing solutions.

For aspiring entrepreneurs, business leaders, and forward-thinking investors, this book provides profoundly unconventional yet highly actionable insights into achieving startup success. Thiel’s contrarian perspectives are designed to inspire readers to think creatively, question established norms, and discover genuinely untapped opportunities that others might overlook. It emphasizes the importance of a clear vision, deep strategic thought, and the courage to build category-defining companies.

Renowned entrepreneur and co-founder of Tesla and SpaceX, Elon Musk, has extensively praised “Zero to One” for its unconventional yet remarkably practical advice on building companies that matter. Musk’s endorsement vividly highlights the enduring relevance and profound impact of Thiel’s insights for those ambitious individuals aiming to make a significant, disruptive, and lasting impact in the global business world. For Musk, a figure synonymous with pioneering innovation, this book resonates deeply with his own philosophy of radical invention and future-building.

Read more about: Fuel Your Entrepreneurial Journey: The 12 Essential Business Books Every Aspiring Founder Must Read by 25

4. **”Sapiens: A Brief History of Humankind” by Yuval Noah Harari**Yuval Noah Harari’s “Sapiens: A Brief History of Humankind” embarks readers on an intellectually captivating and expansive journey through the entire history of Homo sapiens. The book explores the pivotal key milestones and transformative events that have profoundly shaped human societies, cultures, and civilizations from our earliest ancestors to the present day. Harari skillfully provides a thought-provoking and often surprising perspective on the evolution of our species, examining how shared myths and collective fictions have enabled our remarkable progress.

For those who are deeply intrigued by the complex origins and subsequent development of human societies, “Sapiens” offers a comprehensive, engaging, and highly accessible narrative. Harari’s distinctive approach skillfully weaves together insights from anthropology, history, and sociology to present a compelling and cohesive overview of the entire human story. It forces readers to reconsider long-held assumptions about humanity’s past, present, and potential future, offering a macro-level understanding of the forces that drive civilizations.

Entrepreneur and tech visionary Mark Zuckerberg, the co-founder of Facebook, has publicly recommended “Sapiens” for its deep exploration of the human journey and its insights into how societies function. Zuckerberg’s endorsement powerfully underscores the book’s broad appeal and its intellectual value for anyone interested in understanding the broader context of human history, societal structures, and the powerful narratives that bind us. For leaders shaping global platforms, this understanding is invaluable.

Read more about: The 12 Books That Bill Gates Says Fundamentally Changed How He Sees the World

5. **”Shoe Dog” by Phil Knight**”Shoe Dog” is the profoundly personal and candid memoir of Phil Knight, the visionary co-founder of Nike, offering an intimate recounting of the founding and arduous evolution of one of the world’s most iconic and universally successful companies. The book provides a rare, firsthand account of the monumental challenges, exhilarating triumphs, and significant personal growth experienced by Knight throughout his audacious entrepreneurial journey. It details the early struggles, the relentless pursuit of innovation, and the sheer grit required to build a global athletic empire from scratch.

For aspiring entrepreneurs, seasoned business enthusiasts, and anyone captivated by the spirit of innovation, “Shoe Dog” offers an abundance of invaluable lessons in perseverance, unwavering belief, and the often-unpredictable nature of building a business from the ground up. Knight’s narrative is both profoundly inspirational and refreshingly candid, providing deep insights into the core founding principles and unyielding drive that indelibly shaped Nike into the cultural and commercial powerhouse it is today. It’s a testament to the power of a clear vision and tenacious execution.

Billionaire entrepreneur and co-founder of Microsoft, Bill Gates, has enthusiastically recommended “Shoe Dog” as a definitive must-read for anyone with a keen interest in business and the entrepreneurial spirit. Gates specifically appreciates the raw authenticity and unflinching honesty of Knight’s storytelling, recognizing the profound and valuable lessons deeply embedded within the extraordinary Nike story. For Gates, a builder of an equally monumental company, Knight’s journey provides a relatable and inspiring blueprint for enduring success.

Read more about: Fuel Your Entrepreneurial Journey: The 12 Essential Business Books Every Aspiring Founder Must Read by 25

6. **”The Outsiders” by William N. Thorndike**”The Outsiders” by William N. Thorndike offers a compelling and insightful examination of the often-unconventional strategies and distinctive management styles employed by eight highly successful CEOs who achieved truly remarkable long-term value creation. Thorndike’s meticulous research explores the unique, rational, and frequently contrarian approaches these leaders adopted to generate exceptional value for their companies and, by extension, their shareholders. It delves into their capital allocation strategies, which often defied mainstream corporate wisdom.

For discerning business enthusiasts and astute investors, “The Outsiders” provides a refreshingly new and thought-provoking perspective on effective corporate leadership. Thorndike brilliantly highlights the paramount importance of unconventional thinking, astute capital allocation strategies, and a singular focus on long-term shareholder returns—qualities that unmistakably set these exceptional CEOs apart from their more conventional peers. The book teaches that sometimes the best path to success is to deliberately diverge from the beaten track.

Warren Buffett, arguably the most celebrated investor of our time, has enthusiastically endorsed “The Outsiders” for its valuable and practical insights into highly successful capital allocation. The book’s core recommendations and case studies align remarkably well with Buffett’s own deeply ingrained investment philosophy, making it an indispensable read for anyone profoundly interested in mastering the intricate dynamics of business and sophisticated finance. His seal of approval speaks volumes about its enduring wisdom.

7. **”Principles: Life and Work” by Ray Dalio**”Principles: Life and Work” is Ray Dalio’s exhaustive and deeply personal guide to the foundational principles and practical practices that have rigorously shaped his unparalleled success in both life and his professional career. Dalio, the visionary founder of Bridgewater Associates, which grew to become one of the world’s largest and most successful hedge funds, generously shares his profound insights on systematic decision-making, effective leadership, and the art of cultivating a truly successful and principled life. It’s a blueprint for an intensely meritocratic and transparent culture.

For those earnestly seeking comprehensive guidance on profound personal and professional development, “Principles” offers an extraordinary wealth of wisdom derived directly from an accomplished and influential figure in the exacting world of finance. Dalio’s unwavering emphasis on embracing radical truth and radical transparency, alongside the imperative of incorporating a principled, rule-based approach to decision-making, positions this book as an absolutely invaluable resource for navigating complex challenges and fostering continuous improvement. He advocates for deeply understanding one’s own biases and leveraging collective intelligence.

Elon Musk, another prominent billionaire known for his bold and ambitious ventures, has praised “Principles” for its incisive insights into effective decision-making and transformative leadership. Musk explicitly appreciates Dalio’s thoughtful, systematic approach to dissecting challenges, fostering innovative solutions, and ultimately forging a successful and principled life and career. For leaders operating at the bleeding edge of innovation, Dalio’s frameworks provide a robust methodology for navigating unprecedented complexities and achieving audacious goals.

Diving deeper into the literary goldmine that fuels financial acumen, we now explore a selection of practical guides for investors and entrepreneurs. These books offer robust frameworks, innovative methodologies, and timeless principles essential for accumulating and effectively managing wealth, ensuring that every strategic move is underpinned by profound insight and foresight. They move beyond foundational mindset shifts to offer actionable strategies for real-world application in today’s dynamic financial landscape.

8. **“Good to Great” by Jim Collins**Jim Collins’ seminal work, “Good to Great,” stands as a cornerstone in business literature, meticulously dissecting the trajectories of companies that transcended mere competence to achieve and sustain enduring greatness. Collins and his dedicated research team embarked on an exhaustive study, pinpointing the precise principles and transformative strategies that distinguish truly great organizations from their industry counterparts. It’s a compelling blueprint for understanding sustained excellence.

The book profoundly delves into critical factors such as Level 5 Leadership, the disciplined application of the Hedgehog Concept, and the unwavering commitment to a culture of discipline. For business leaders, aspiring entrepreneurs, and dedicated enthusiasts alike, “Good to Great” delivers invaluable insights into the inherent characteristics and actionable practices that propel companies towards unparalleled, long-term success. It’s not just about what to do, but how to think about building a truly great enterprise.

Collins’ findings offer a clear, albeit challenging, roadmap for organizational development, emphasizing that true transformation begins internally with disciplined people, disciplined thought, and disciplined action. It’s a powerful argument against quick fixes and for systematic, sustained effort. The meticulous research provides a credible foundation for its recommendations, making it a highly respected guide.

Renowned investor Warren Buffett has enthusiastically praised “Good to Great” for its insightful analysis of successful companies, recognizing its practical applicability. The book’s timeless principles align seamlessly with Buffett’s own investment philosophy, which consistently favors businesses with strong fundamentals and excellent management, making it an indispensable read for anyone profoundly interested in business growth and organizational development. His endorsement underscores its enduring relevance in the world of high finance.

Read more about: Beyond the Boardroom: Mark Cuban’s Essential Reading List for Entrepreneurs and Visionaries

9. **“The Lean Startup” by Eric Ries**”The Lean Startup” by Eric Ries has revolutionized the approach to building and scaling successful businesses, particularly for entrepreneurs and startup innovators. Ries meticulously introduces and expounds upon core concepts such as the Minimum Viable Product (MVP) and validated learning, providing a systematic methodology to navigate the inherent uncertainties of entrepreneurial ventures with agility and efficiency. It’s a pragmatic guide for rapid development and iteration.

This groundbreaking book delivers an indispensable framework for developing and managing startups more effectively, advocating for a scientific approach to product development. Ries passionately champions a continuous cycle of building, measuring, and learning, empowering founders to validate their core ideas, swiftly glean insights from both successes and perceived failures, and continually adapt to evolving customer feedback with remarkable speed. This iterative process dramatically reduces waste and accelerates market fit.

For those venturing into the competitive world of startups, “The Lean Startup” offers crucial strategies to conserve resources, minimize risk, and ensure that valuable time and capital are directed towards solutions that genuinely resonate with the market. It teaches how to pivot when necessary and persevere when validated, fostering a resilient and responsive organizational culture. The emphasis on data-driven decisions helps de-risk innovation.

Entrepreneur and investor Mark Cuban, a figure synonymous with sharp business acumen and dynamic market responsiveness, has openly expressed his deep admiration for “The Lean Startup.” Cuban’s endorsement powerfully highlights the book’s eminently practical approach to constructing thriving businesses. The principles articulated by Ries resonate profoundly with Cuban’s unwavering emphasis on agility, rapid iteration, and an uncompromising responsiveness within the fiercely competitive startup ecosystem.

Read more about: Fuel Your Entrepreneurial Journey: The 12 Essential Business Books Every Aspiring Founder Must Read by 25

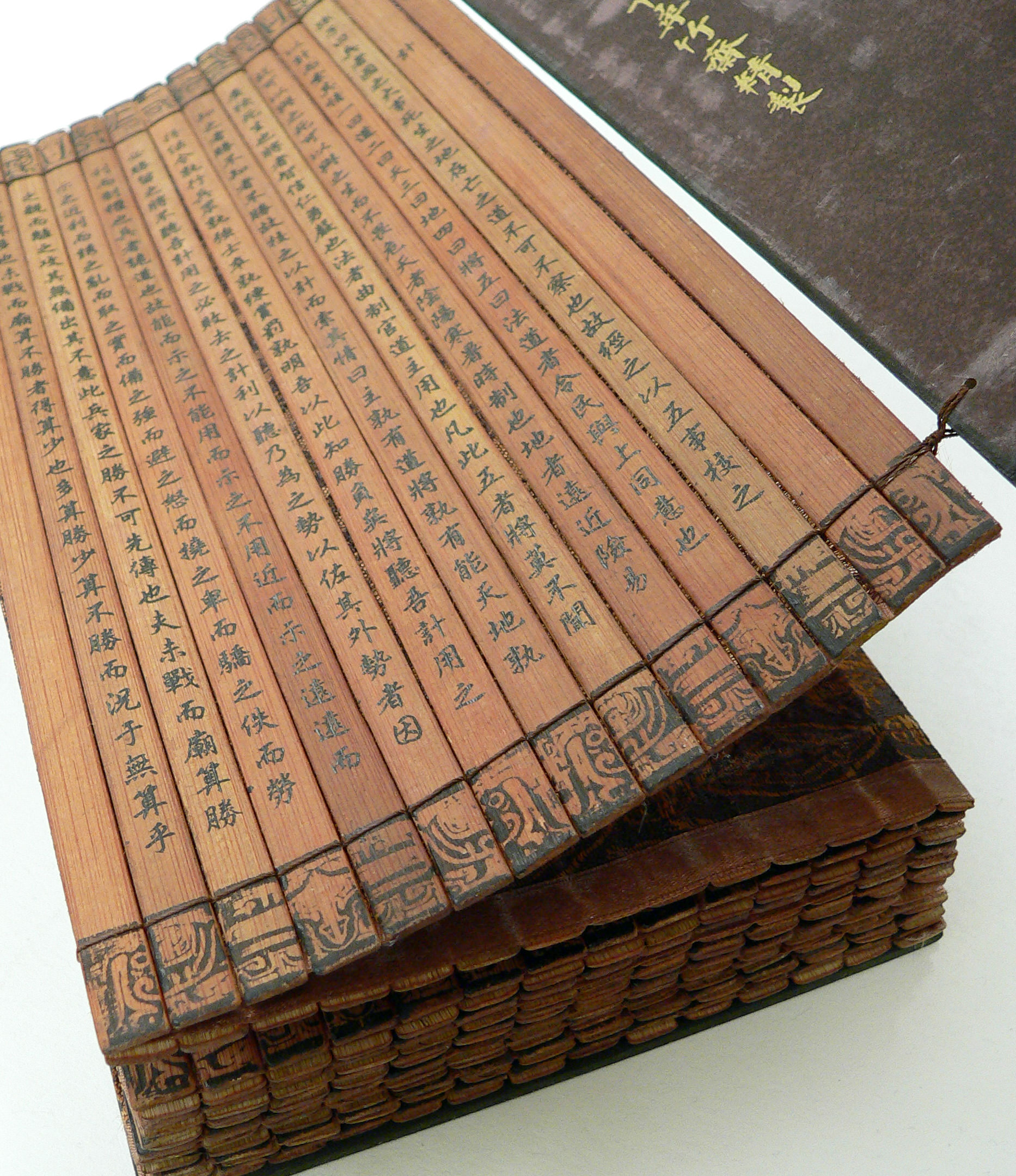

10. **“The Art of War” by Sun Tzu**Authored more than two millennia ago, “The Art of War” is an ancient Chinese military treatise universally attributed to Sun Tzu, a legendary military strategist and philosopher. Despite its origins firmly rooted in the historical context of military conflict and ancient warfare, this profound book has transcended its original purpose, with its enduring principles of strategy, tactics, and conflict resolution finding widespread and often unexpected applications in diverse fields far beyond the battlefield.

The enduring wisdom contained within “The Art of War” provides timeless and remarkably relevant insights for anyone deeply engaged in strategy, leadership, and the nuanced art of conflict resolution. Sun Tzu’s profound teachings emphasize the paramount importance of comprehensive situational awareness, including a deep understanding of the terrain, an intimate knowledge of oneself and one’s adversaries, and the crucial ability to adapt strategies fluidly to changing circumstances. These principles are as vital in the boardroom as they are on the battleground.

This classical text meticulously outlines how to achieve victory through cunning, foresight, and strategic planning, often advocating for winning without direct engagement. Its emphasis on indirect approaches, psychological warfare, and the exploitation of weaknesses has made it a foundational text not only in military academies but also in top business schools globally. It champions the power of intelligence and preparation over brute force.

The pervasive influence of “The Art of War” is evident in its widespread adoption by numerous distinguished business leaders, including the unparalleled investor Warren Buffett. Figures like Buffett have cited this ancient text as a profoundly influential guide in shaping their approach to high-stakes strategy and complex decision-making, demonstrating its remarkable capacity to inform modern commercial conquests. The book’s principles resonate with the calculated, long-term strategic thinking required for enduring financial success.

The journey to wealth building is multi-faceted, often requiring a blend of strategic insight, psychological understanding, and practical execution. While the preceding books have laid a robust foundation for visionary thinking and entrepreneurial endeavor, the next set of titles offers equally critical guidance for refining investment strategies, achieving financial independence, and mastering the enduring principles of accumulating and managing wealth with unparalleled effectiveness. These are the tools that translate ambition into tangible financial freedom.

Read more about: Beyond the Boardroom: Mark Cuban’s Essential Reading List for Entrepreneurs and Visionaries

11. **“The Psychology of Money” by Morgan Housel**Morgan Housel’s “The Psychology of Money” offers a refreshingly candid and profoundly insightful exploration into the often-overlooked emotional and behavioral dimensions of financial success. This book masterfully argues that achieving wealth isn’t solely about possessing advanced financial knowledge or mathematical prowess; it is, more profoundly, about understanding and mastering the nuanced intricacies of human behavior. Housel uses compelling narratives to illustrate how our inherent psychological biases shape our financial destinies.

The book delves into timeless lessons, presenting complex financial concepts through engaging stories that resonate with readers from all walks of life. Key takeaways are profoundly practical: “Wealth is what you don’t see,” emphasizing that true financial security is built through diligent saving and investing, not conspicuous consumption. Furthermore, it asserts that “Time matters more than timing,” advocating for consistent, long-term investing over speculative market predictions.

A critical aspect of Housel’s wisdom lies in its focus on how “Emotions drive financial decisions.” By helping readers recognize and understand their own financial biases, the book equips them with the tools to sidestep costly mistakes, such as panic-selling during market downturns, fostering a more disciplined and rational approach to their portfolios. It’s an essential guide to self-awareness in finance.

In an era where social media perpetually bombards us with images of luxury lifestyles and tempting “get rich quick” schemes, “The Psychology of Money” serves as an urgently needed dose of reality. For anyone aspiring to cultivate lasting wealth without succumbing to the relentless pressure of keeping up with societal expectations, this book offers a transformative perspective, fundamentally altering how one perceives and manages their money for the better.

12. **“Die With Zero” by Bill Perkins**Bill Perkins’ “Die With Zero” boldly challenges the deeply ingrained, traditional mindset of endlessly saving for retirement, proposing instead a revolutionary philosophy: that money should be purposefully utilized to generate meaningful life experiences while one is still young and vibrant enough to genuinely enjoy them. The book’s central and provocative objective is to maximize not only financial wealth but, more importantly, holistic life satisfaction. It’s a powerful call to seize the present.

Perkins passionately argues for an intentional approach to optimize one’s financial resources for experiences, urging readers not to defer their enjoyment of life until a distant retirement. He advocates for investing in moments and adventures that truly matter, right here and now. This perspective liberates individuals from the conventional shackles of perpetual deferral, encouraging a richer, more engaged life today.

A core tenet of the book highlights that “The value of money changes over time.” Perkins vividly illustrates how a significant sum, such as $10,000 at the age of 30, possesses the potential to unlock far greater happiness and transformative experiences than a tenfold amount, $100,000, might at 80. This provocative insight encourages a reconsideration of when and how wealth is deployed.

“Die With Zero” is a compelling read for an increasing number of individuals who are actively rejecting the conventional “work until you’re 65” paradigm in favor of pursuing financial independence and early retirement. For those grappling with the delicate balance between judicious saving and intentional spending, this book offers a profound opportunity to fundamentally rethink how financial resources can be strategically leveraged to lead an exceptionally fulfilling and purpose-driven life.

13. **“The Simple Path to Wealth” by JL Collins**Originally conceived as a heartfelt letter from JL Collins to his daughter, “The Simple Path to Wealth” has evolved into an exceptionally clear, no-nonsense guide for building enduring prosperity through judicious financial choices. This book demystifies the often-intimidating world of investing, advocating for a remarkably straightforward and effective strategy: low-cost index fund investing, meticulously devoid of speculative stock-picking or complex market timing. It’s an accessible roadmap for everyone.

The book’s wisdom is encapsulated in several highly actionable takeaways, most notably the mantra: “Index funds are king.” Collins unequivocally champions investing in broad-market, low-cost index funds, such as VTSAX, as the superior approach for achieving steady, long-term growth, outperforming the vast majority of actively managed funds. This principle liberates investors from the futile pursuit of beating the market.

Collins also introduces the empowering concept of “FU money,” articulating that diligently saving and investing wisely bestows upon individuals the ultimate freedom to confidently disengage from undesirable jobs, unsupportive bosses, and challenging life situations. This financial independence translates directly into enhanced personal autonomy and self-determination. Furthermore, he underscores the critical importance of “Avoid lifestyle inflation,” reminding readers that true wealth accumulation stems from diligently keeping expenses in check, regardless of increasing income.

In a financial landscape frequently characterized by market volatility and pervasive economic uncertainty, “The Simple Path to Wealth” provides an invaluable, stress-free investment strategy. This book is widely regarded as one of the very best wealth-building guides, offering solid, pragmatic financial advice with the approachable and candid tone reminiscent of a wise, yet perhaps slightly sarcastic, trusted uncle. Its clarity makes it a standout.

14. **“The Path” by Peter Mallouk**”The Path” by Peter Mallouk, one of the foremost financial advisors in the United States, presents a refreshingly clear and coherent strategy for cultivating wealth without succumbing to the incessant noise of financial news or the unpredictable volatility of stock market fluctuations. For anyone seeking to build substantial wealth with clarity and confidence, this book serves as an indispensable guide, cutting through the complexity to offer tangible direction.

Mallouk meticulously outlines a pragmatic approach to investing, future planning, and making astute financial decisions that are purposefully aligned with one’s overarching life goals, rather than merely chasing arbitrary returns. Key takeaways from the book underscore that “Financial success is about discipline, not luck,” asserting that sustained wealth is a direct outcome of intelligent investing and diligent long-term planning, not market timing or speculative gambles.

A cornerstone of Mallouk’s philosophy emphasizes that “Your money should support your life goals.” This means actively using wealth to cultivate freedom, security, and the life one genuinely desires, moving beyond mere hoarding of assets. The book also passionately advocates to “Avoid financial noise,” explaining that the vast majority of daily media headlines are irrelevant to long-term success, and a steadfast focus on strategic goals is paramount.

In an environment where individuals are constantly inundated with fleeting “hot” investing tips and pervasive financial fear-mongering, “The Path” imparts a profoundly calm, steady, and resilient approach to wealth accumulation. For those in pursuit of a transparent, drama-free blueprint for achieving long-term financial security and prosperity, this book stands out as an absolute must-read, offering unparalleled peace of mind alongside actionable strategies.

Exploring the recommended books from billionaires offers a valuable journey into the minds of successful individuals. Each book carries unique insights, providing readers with perspectives on business strategy and personal development. Whether you’re an aspiring entrepreneur, a seasoned professional, or simply keen on continuous learning, these profound works serve as indispensable guides to success.

Remember, the journey to financial freedom is not merely about accumulating wealth; it is fundamentally about continuous learning, strategic thinking, and profound personal growth. Billionaires don’t read to pass time—they read to pass limits. As you embark on your own path to financial enlightenment, choose one or more of these titles and immerse yourself in the profound wisdom they offer. Engage with the material, reflect on its lessons, and diligently apply these insights to your personal and professional life. This is how you don’t just turn pages; you unlock your true potential for enduring financial success and a life of purpose.