Have you ever paused to consider the intricate journey behind the price tag of a product you’re about to purchase? Pricing, from its earliest forms to the complex algorithms of today, is far more than just a number; it’s a dynamic reflection of human ingenuity, economic evolution, and societal shifts. Understanding how prices have been determined throughout history offers invaluable insights into the very fabric of commerce and consumer behavior. It’s a fascinating narrative of adaptation, innovation, and constant reinvention.

We often perceive pricing as a simple, straightforward decision: a business sets a price, and a consumer decides whether to pay it. However, this seemingly simple exchange is built upon centuries of strategic thinking, economic realities, and evolving market dynamics. As human shopping habits have transformed, so too has the art and science of pricing, continually striving to stay at the forefront of sales and meet the demands of an ever-changing marketplace.

Join us on an insightful journey as we delve into the historical evolution of pricing, exploring the fundamental strategies that have shaped industries, influenced economies, and ultimately defined how value is perceived and exchanged. From the most basic forms of trade to the sophisticated models of the digital era, these milestones reveal the enduring importance of pricing in the grand tapestry of business.

1. **The Importance of Pricing in Business**Pricing has always stood as a cornerstone of any business, irrespective of its industry or the specific products or services it offers. It’s not merely about slapping a number on an item; it’s the intricate process of determining a product’s inherent value and setting a price that strikes a harmonious balance between benefiting the business and satisfying its customers. The profound impact of pricing on a business’s profitability, its competitive standing, and its long-term sustainability simply cannot be overstated.

A business’s pricing strategy directly dictates its profitability. The difference between generating substantial profits and incurring losses often hinges on setting the right price for a product or service. This crucial decision requires careful consideration of myriad factors, including the costs associated with production, the prevailing market demand, the intensity of competition, and, significantly, how customers perceive the value of the offering. For instance, a luxury brand can command a premium price, confident in its market position, while a discount retailer strategically opts for lower prices to cast a wider net and attract a larger customer base.

Pricing also plays a pivotal role in shaping a business’s competitiveness within its market. To remain relevant and continuously draw in customers, a company must ensure its prices are competitive relative to others operating in the same industry. Striking an optimal balance between pricing and the quality offered is essential for maintaining a significant competitive edge. A business might strategically deploy discounts or run promotions during quieter seasons, or as a direct tactic to rival a competitor, effectively adjusting its market posture.

The chosen pricing strategy profoundly influences the long-term sustainability of a business. Setting prices excessively low can lead to an unsustainable lack of profitability, jeopardizing the company’s future. Conversely, setting prices too high can result in a significant drop in demand, leaving products unsold and services unutilized. Businesses must meticulously craft a pricing strategy that is viable over the long term and perfectly aligned with their overarching business goals, ensuring continuous operation and growth.

There exist numerous pricing strategies at a business’s disposal, such as cost-plus pricing, which calculates price based on cost plus a markup; value-based pricing, which aligns price with perceived customer value; penetration pricing, used to quickly gain market share; and dynamic pricing, which adjusts prices in real-time. Each strategy comes with its own set of advantages and disadvantages. A company’s success often hinges on selecting the strategy that best suits its specific business goals and target market, ensuring optimal market penetration and profitability.

Read more about: Inside the Mind of a Billionaire: 14 Strategic Moves That Propelled Jeff Bezos to 12-Figure Deals

2. **Bartering and Trading**Long before the introduction of standardized currency, human societies relied on the fundamental practices of bartering and trading to acquire necessary goods and services. Bartering, at its core, involves the direct exchange of goods or services without the use of money, representing a pure form of direct value swap. Trading, while similar, encompasses a broader scope that includes exchanging goods or services for money once currency became established. These foundational methods of exchange were widespread in the earliest stages of civilization and, remarkably, continue to be employed in certain regions around the globe today.

One of the most significant advantages of bartering and trading is their ability to facilitate the acquisition of goods and services without any monetary transaction. This aspect proves particularly beneficial in environments where physical currency is scarce, or where individuals lack access to formal banking infrastructure. Furthermore, these methods enable people to obtain items or services that might otherwise be financially out of reach if they were solely dependent on money, thus opening avenues for diverse resource allocation.

However, bartering and trading are not without their drawbacks. A notable disadvantage lies in the inherent difficulty of accurately determining and agreeing upon the equivalent value of different goods and services being exchanged. This ambiguity can frequently lead to misunderstandings, disagreements, and even outright disputes between the involved parties. Additionally, the process of finding someone willing to exchange specific goods or services can be considerably time-consuming and inefficient, making these methods less practical for large-scale or rapid transactions.

Historically, the practices of bartering and trading have been integral to countless cultures and societies worldwide. In ancient Egypt, for example, farmers would routinely exchange their agricultural produce for essential items such as clothing or tools, demonstrating a basic yet effective economic system. During medieval Europe, bustling trade fairs became central hubs where merchants from various regions convened to exchange a wide array of goods and services. Even in the contemporary world, bartering and trading maintain their relevance, especially in rural areas where access to monetary systems may be limited, underscoring their enduring practicality.

Read more about: Unlock Your Financial Potential: 14 Actionable Strategies to Save $10,000 in a Single Year

3. **From Coins to Bills**Currency has played an indispensable role in the progression of human civilization, serving as a vital medium of exchange since ancient times. Its journey, evolving from rudimentary bartering systems to sophisticated digital forms, has been driven by a continuous quest for efficiency and convenience. This historical exploration delves into the birth and subsequent evolution of currency, specifically tracing its transformation from physical coins to paper bills, and the profound ways in which this evolution has shaped our modern world.

The fundamental concept of currency can be traced back to the earliest known civilizations, such as ancient Egypt and Mesopotamia. In these societies, precious metals like gold and silver were highly valued and used as a common medium for exchanging goods. Over time, these metals were meticulously shaped into standardized coins, which quickly became a popular and practical form of currency. Coins gained widespread acceptance due to their ease of transport, inherent durability, and the ability to be consistently standardized in terms of weight and purity, making them a reliable measure of value.

As trade networks expanded and commerce intensified across civilizations, there emerged a growing necessity for a more portable and less cumbersome form of currency. This critical demand spurred the revolutionary development of paper currency, which first emerged in China during the illustrious Tang Dynasty. Paper currency offered distinct advantages; it was significantly lighter, far more portable, and generally easier to handle than its metallic predecessors. However, this innovation also brought a new challenge: the increased ease of counterfeiting, which in turn catalyzed the development of sophisticated security features such as watermarks, unique serial numbers, and specialized inks to protect its integrity.

When contemplating the various forms of currency, a spectrum of options presents itself, each with its unique benefits and drawbacks. Coins, while enduring and simple to use, can be heavy and inconvenient in large quantities. Paper currency offers portability and ease but remains susceptible to counterfeiting risks. Understanding these distinctions helps illuminate the path of economic progress and the ongoing adaptation of exchange methods to suit societal needs.

Read more about: The 13 Best Financial Investments Made by 14 Retired NFL Players

4. **The Rise of Mass Production and Fixed Pricing**The Industrial Revolution represented a profound and transformative watershed moment in the history of pricing. Prior to this era, pricing was largely an organic process, dictated predominantly by the direct cost of production and the immediate availability of goods. However, with the advent and widespread adoption of mass production techniques during the late 18th and early 19th centuries, a monumental shift occurred towards the concept of fixed pricing. Under this new model, goods were consistently sold at a predetermined, unchanging price, decoupling it from the individual production cost. This section will explore how the rise of mass production solidified fixed pricing and its lasting impact on the evolution of commerce.ce.

The Industrial Revolution was characterized by the groundbreaking development of mass production techniques, which revolutionized manufacturing by enabling goods to be produced on an unprecedented scale. Among the most significant innovations was the assembly line, famously introduced by Henry Ford in the early 20th century. This method allowed the production of goods to be systematically broken down into smaller, more specialized, and easily manageable tasks, each performed by dedicated workers. The result was a dramatic surge in overall productivity and a substantial reduction in the unit cost of production, making goods more accessible than ever before.

Hand-in-hand with the rise of mass production techniques came the widespread adoption of fixed pricing. Under this system, goods were consistently sold at a pre-established price, which was often considerably lower than what individual, handcrafted items would cost. This affordability was made possible by the vastly increased efficiency inherent in mass production, allowing for goods to be manufactured at a significantly reduced cost per unit. Fixed pricing also provided businesses with greater predictability, enabling them to plan their operations, revenues, and expenses with enhanced accuracy, which was crucial for large-scale enterprise management.

Fixed pricing profoundly impacted consumers by making a wider array of goods far more affordable and accessible than ever before. In the era preceding fixed pricing, prices could fluctuate wildly, influenced by the immediate availability of goods and the variable costs of production. The establishment of fixed prices ensured a consistent price point for goods, simplifying consumers’ budgeting processes and purchase planning. It also empowered consumers to easily compare prices across different businesses, which fostered heightened competition among producers and, consequently, led to even lower prices, benefiting the general public significantly.

However, despite the clear benefits of fixed pricing, it has also garnered criticism for its potential ethical ramifications. A primary concern is that fixed pricing can, in some scenarios, contribute to the exploitation of workers. Businesses, in their relentless pursuit of efficiency and cost-cutting to maintain competitive fixed prices, might prioritize these goals over ensuring fair wages or maintaining adequate working conditions. This delicate balance between economic efficiency and social responsibility remains a continuous point of debate and consideration within business ethics.

Read more about: Your No-Nonsense Guide to Scoring the Sweetest JDM Parts Directly from Japan

5. **The Emergence of Dynamic Pricing and Price Discrimination**The 20th century witnessed a significant and transformative shift in pricing strategies, marked by the emergence and widespread adoption of dynamic pricing and price discrimination. As new technologies became available and consumerism surged, businesses found themselves in an increasingly competitive environment, compelling them to innovate their pricing approaches. Dynamic pricing and price discrimination emerged as two powerful strategies that numerous businesses embraced to effectively achieve their objectives in this evolving market landscape.

Dynamic pricing is an agile strategy that empowers businesses to adjust their prices in real-time, responding fluidly to fluctuations in both demand and supply. This sophisticated approach enables companies to optimize their profits by charging varying prices to different customers at different times. A classic illustration of this is the hotel industry, where rooms command higher prices during peak tourist seasons and are offered at lower rates during off-peak periods, maximizing revenue potential based on market conditions.

Price discrimination, another strategic approach, involves businesses charging distinct prices to different customers for what is essentially the same product or service. This strategy operates on the core principle that individual customers possess varying degrees of ‘willingness to pay.’ Airlines provide a prime example: the cost of a flight can vary significantly depending on when the ticket is booked, the specific time of day of travel, and even the chosen day of the week, tailoring prices to perceived customer segments.

Dynamic pricing offers several compelling advantages for businesses. Firstly, it provides the agility to respond almost instantaneously to shifts in market demand and supply. Secondly, it serves as a powerful tool for maximizing profits by enabling higher charges during periods of peak demand and lower prices to stimulate sales during troughs. Thirdly, it significantly enhances a business’s competitive edge, allowing it to offer prices that are often more attractive than those of its rivals.

However, dynamic pricing also presents certain disadvantages. One key issue is the potential for price volatility, which can lead to confusion and frustration among customers who observe prices changing rapidly. Furthermore, if customers perceive that they are being charged unfairly, dynamic pricing can erode customer loyalty. There’s also the risk of exacerbating price discrimination if businesses use this strategy to charge different prices without a clear, valid justification.

Price discrimination also provides distinct benefits to businesses. Primarily, it allows companies to capture greater value from customers who demonstrate a higher willingness to pay for a product or service. Secondly, it helps businesses maintain their competitive stance by enabling them to offer more attractive, lower prices to customers who are highly price-sensitive. Thirdly, this strategy can effectively boost overall revenue by facilitating increased sales volumes to customer segments willing to pay less, thereby broadening market reach and optimizing sales across diverse groups.

Yet, price discrimination is not without its drawbacks. A significant risk is the potential loss of customer loyalty if consumers feel that the pricing structure is unfair or arbitrary. If customers perceive that they are being overcharged compared to others, this can lead to a noticeable decrease in sales. Moreover, price discrimination might result in diminished customer satisfaction if individuals believe they are not receiving commensurate value for the money they are spending, fostering a sense of inequity.

6. **The Impact of E-commerce and Online Markets on Pricing**The pervasive rise of the internet and the subsequent explosion of e-commerce have fundamentally reshaped the operational landscape for businesses and dramatically altered how they engage with their customers. With online shopping steadily gaining immense popularity, businesses have been compelled to radically adapt their traditional pricing strategies. This evolution is crucial to maintaining a competitive edge within the dynamic and ever-expanding digital marketplace. In this section, we will delve into the profound impact of e-commerce and online markets on pricing, exploring various pricing models and their inherent advantages and disadvantages.

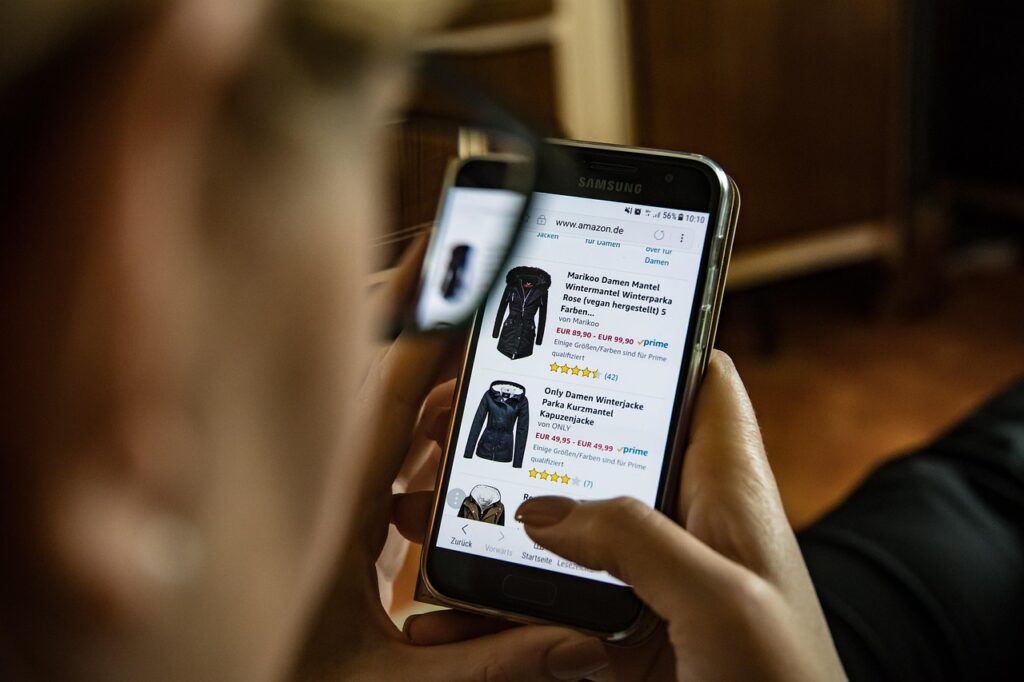

Dynamic pricing has found a particularly potent application within the e-commerce realm. This strategy allows businesses to adjust prices in real-time, based on a continuous analysis of supply and demand fluctuations. It is a commonly employed model by online businesses, where prices can shift multiple times within a single day. For instance, Amazon adeptly utilizes dynamic pricing, constantly recalibrating prices in response to competitor pricing, the time of day, and specific customer behaviors. While this can significantly boost profits, it also raises concerns about potential price discrimination and a lack of pricing transparency for consumers.

Freemium pricing represents another popular strategy within the digital landscape, where businesses offer a basic version of their product or service completely free of charge, while simultaneously charging for access to premium features or advanced upgrades. This model is extensively used by online software companies and gaming platforms. Dropbox, for example, provides a free tier of its cloud storage service with limited capacity, incentivizing users to upgrade to a paid subscription for expanded storage. While effective for attracting new users, a challenge lies in maintaining customer loyalty and managing potential high churn rates.

Subscription pricing has become a cornerstone for numerous online services, requiring customers to pay a recurring fee for continuous access to a product or service. This model is prominently featured in online streaming services like Netflix and Spotify, which provide entertainment on a monthly or annual basis. For businesses, subscription pricing offers the invaluable benefit of a predictable revenue stream and significantly enhances customer loyalty through continuous engagement. However, the onus is on the business to consistently deliver value to its subscribers to ensure their ongoing retention and satisfaction.

Bundling pricing is a strategic approach where businesses offer multiple products or services together as a package at a reduced price, often lower than purchasing each item individually. This model is frequently adopted by e-commerce businesses as a means to increase overall sales volume and boost the average order value for each customer. Amazon, again, provides excellent examples with its bundle deals on various electronics and home goods. While bundling can effectively increase revenue and deliver perceived value to customers, businesses must carefully ensure that the bundled products are genuinely complementary and do not inadvertently cannibalize sales of individual items within their inventory.

In the ever-evolving digital age, businesses must proactively adapt their pricing strategies to remain robustly competitive in the online marketplace. Dynamic pricing, freemium models, subscription services, and bundling strategies all present viable and powerful options for businesses to consider. Ultimately, the most effective pricing strategy is not a one-size-fits-all solution; it depends critically on a business’s specific goals, its carefully defined target market, and the unique characteristics of its product or service offerings.

Read more about: Inside the Mind of a Billionaire: 14 Strategic Moves That Propelled Jeff Bezos to 12-Figure Deals

8. **Predicting the Evolution of Pricing Strategies**Pricing strategies, from the ancient barter system to the nuanced dynamic models of today, have undergone a remarkable transformation. As businesses continue to adapt to a rapidly changing global landscape, their pricing approaches must evolve in tandem. The integration of advanced technology, coupled with the power of data and analytics, is now enabling businesses to make profoundly informed decisions regarding how they value and sell their products and services. This exciting future of pricing demands a keen understanding of the trends actively shaping the landscape.

One significant trend is the increasing personalization of pricing, a practice that meticulously tailors prices to individual customers based on their unique preferences and past behaviors. This sophisticated approach involves a deep dive into customer data, allowing businesses to pinpoint an individual’s ‘willingness to pay’ and then adjust prices accordingly. The e-commerce industry has particularly embraced this, with giants like Amazon leveraging their vast databases to provide not only personalized product recommendations but also custom pricing that resonates more directly with each shopper.

Another powerful and increasingly prevalent model is subscription-based pricing, where customers commit to a recurring fee for continuous access to a product or service. This model has seen immense traction, particularly within the software industry. A prime example is Adobe, which has transitioned from selling perpetual software licenses to offering its entire suite on a subscription basis. This shift provides businesses with a stable and predictable revenue stream, making it an incredibly attractive and sustainable option in the long term.

Beyond traditional models, ‘pay-what-you-want’ pricing offers a novel approach, granting customers the freedom to decide what they are willing to pay for a product or service. This strategy fundamentally relies on the customer’s goodwill and their perception of a fair price. While inherently risky, it has been successfully employed, notably in the music industry. Radiohead famously released their album “In Rainbows” under this model, demonstrating that it can foster exceptional customer loyalty and engagement when executed thoughtfully.

Dynamic pricing, a strategy that continually adjusts prices in real-time based on market demand and other influential factors, remains a cornerstone. Industries such as airlines and hotels have utilized this for years, recalibrating ticket and room prices based on demand, time of day, and availability. Furthermore, freemium pricing, where a basic version of a product or service is offered free with limited features, enticing users to upgrade for a fee, continues to thrive. Dropbox, for instance, provides a free tier for its cloud storage, encouraging users to opt for premium versions for expanded space and functionalities. The optimal pricing strategy truly hinges on a business’s specific objectives and industry context, demanding constant vigilance and adaptation to market trends.

Read more about: Navigating the Future: 12 Automotive Marketing Trends Driving Success in 2025

9. **The Role of Pricing in Shaping Business and Society**Pricing is undeniably a fundamental cornerstone of any commercial enterprise, exerting a profound and far-reaching influence that extends well beyond mere transactional value, deeply shaping both the fabric of business and broader society. The price affixed to a product or service serves as a direct reflection of its perceived worth, directly determining the profitability and financial viability of a business. Moreover, pricing strategies wield considerable power over consumer behavior and purchasing decisions, ultimately impacting the health and direction of the overall economy. Consequently, a comprehensive understanding of pricing’s multifaceted role is absolutely crucial for navigating its intricate dynamics.

In the competitive arena, pricing stands as a critical determinant of market rivalry. Businesses strategically deploy various pricing tactics to carve out a distinct competitive advantage, effectively attracting new customers, and significantly expanding their market share. The price of an offering also inherently communicates its quality, features, and comparative benefits against rival products. This direct correlation means that pricing can powerfully influence how consumers perceive the value and quality of a brand, either elevating its status or positioning it as a more accessible option, thereby dictating its standing in the market.

Pricing profoundly impacts consumer behavior and meticulously guides purchasing decisions. Consumers are, by nature, highly price-sensitive, often engaging in thorough comparisons before committing to a purchase. Recognizing this, businesses ingeniously utilize diverse pricing strategies to captivate customers and actively encourage them to buy their products or services. This can manifest through appealing discounts, compelling promotions, or thoughtfully curated bundle deals, all designed to entice consumers to make larger or more frequent purchases, thus driving sales volume.

Beyond immediate commercial gains, pricing also bears a significant capacity to promote social responsibility and champion sustainability initiatives. Businesses can ingeniously leverage their pricing strategies to gently steer consumers towards making more environmentally conscious choices. For example, by offering attractive discounts on eco-friendly products or services, companies can effectively incentivize consumers to opt for sustainable alternatives. Such strategically implemented pricing strategies not only foster social responsibility but also actively contribute to addressing pressing environmental challenges, aligning profit with purpose.

Finally, pricing policies exert a substantial and widespread impact on the broader economy. The price of a product or service directly influences its market demand, which in turn has ripple effects on production levels, employment rates, and the entire distribution network of goods and services. Government-imposed price controls, for instance, can significantly alter the equilibrium of supply and demand, thereby affecting overall economic growth and stability. Thus, understanding and strategically managing pricing is not just a business imperative but a key driver for economic health and societal well-being.

Read more about: Inside Tom Brady’s Strategic Play: Why the NFL Legend is Backing AI-Powered Health Technology Through Aescape

10. **Auction**The auction stands as perhaps the most venerable method of selling a product, tracing its origins back to 500 B.C. in ancient Greece where it facilitated the majority of item transactions. From these ancient roots, the auction mechanism has undergone substantial evolution, transforming into a distinctly unique selling approach. Today, its market is notably narrow, largely due to the inherently high transaction costs associated with its operation. This exclusivity has shaped its modern application in commerce, requiring careful consideration of its suitability.

Products that are still commonly sold through the auction technique are typically seasonal, unique items characterized by high demand coupled with low supply. This particular niche arises from the inherent lack of standard or readily available fixed prices for such goods. Consequently, individuals keen on acquiring these items often exhibit a greater willingness to pay premium prices, primarily because the auction format frequently represents the sole avenue through which they can secure these coveted goods, emphasizing their perceived scarcity and value. This highlights the psychological aspect of urgency and rarity in auction dynamics.

Among the various forms, the English auction is undoubtedly the most familiar, the one most people have likely encountered or witnessed. It proves exceptionally effective for rarer items such as fine wines, original art pieces, classic cars, or antique collectibles. In this popular format, buyers openly declare increasing bids for the item, beginning at a lower reserve price and escalating until the highest bidder ultimately claims the prize. A truly revolutionary moment for this method came in 1995 when Pierre Omidyar launched eBay, effectively bringing the thrill and accessibility of English-style auctions to a global online audience, forever changing e-commerce.

In stark contrast, the Dutch auction operates as the inverse of its English counterpart. Instead of incrementally increasing bids from a low starting point, the seller initially announces the highest price they desire for the item. From this peak, the price is systematically lowered until a bidder steps forward, willing to pay the current asking price. This specific type of auction is famously employed in the Netherlands for the swift sale of farmers’ produce, where rapid transactions of perishable goods are essential. However, owing to its highly specialized application, this particular form of auction is gradually being observed with less frequency in broader commercial contexts.

The auction market, often referred to as the double action market, presents a less organized yet intensely competitive environment. What distinguishes this format is the simultaneous bidding from both the buy and sell sides of the transaction. Multiple buyers and sellers each submit their competitive bids, and based on the alignment of these proposed prices, a buyer and a seller with closely matched numbers are strategically paired, culminating in the transaction’s completion. Prominent real-world examples that vividly illustrate the dynamic application of this auction type include the New York Stock Exchange and the US Treasury auction, showcasing its efficacy in high-volume, liquid markets.

Read more about: Unlocking Dealership Gold: 15 Proven Strategies Car Dealers Use to Maximize Profit on Every Sale and Secure Their Future

11. **Posted Price**The concept of “Posted Price” signifies a pivotal and enduring transformation in how commercial transactions are conducted, fundamentally reshaping the valuation and exchange of goods. It wasn’t until the 1840s that an Irish immigrant, Alexander Turney Stewart, conceived of “a more efficient wa” to conduct business, seeking to move beyond the often-protracted and uncertain processes of bartering and auctioning. His visionary insight laid the crucial groundwork for a standardized approach where prices were clearly displayed and non-negotiable, providing a stark contrast to the prevalent haggling and bidding mechanisms of the era.

Stewart’s innovative concept centered on establishing a fixed, transparent price for merchandise, enabling consumers to instantly grasp the cost without the need for cumbersome negotiation. His pioneering department store in New York City became a prominent example of this novel retail model, showcasing an extensive variety of goods, all accompanied by their explicit price tags. This commitment to transparency fostered significant consumer trust and drastically streamlined the entire shopping experience, rendering it both faster and far more predictable for all parties involved. It effectively democratized access to products by eliminating the necessity for specialized bargaining skills.

The advent of posted pricing also brought about substantial improvements in operational efficiency for businesses. With prices pre-determined, sales transactions became standardized, which in turn facilitated higher sales volumes and quicker inventory turnover. This model proved to be exceptionally well-suited for the rapidly expanding era of mass production, empowering retailers to effectively manage larger inventories and cater to a swiftly growing customer base with greater ease. The simplified sales interactions allowed staff to dedicate more attention to customer service, moving away from protracted price negotiations.

Moreover, the widespread adoption of the posted price system played a crucial role in formalizing the retail sector, thereby establishing a foundational pillar for modern consumer culture. This transparency allowed for straightforward comparison shopping across various establishments, cultivating a new paradigm of market competition. This competition was no longer solely based on a merchant’s ability to out-bid or out-haggle, but rather on value, consistency, and a clear presentation of goods. It propelled commerce toward a more predictable and scalable framework, an indispensable factor for the proliferation of large retail enterprises and the global expansion of consumer markets.

While the original context unfortunately concludes abruptly, curtailing a full exploration of “a more efficient wa”, it is unequivocally clear that the transition from flexible, often opaque, pricing methods like bartering and auctions to the transparent, fixed “Posted Price” marked an indelible moment in commercial history. This shift ushered in an epoch characterized by greater consumer confidence, heightened business efficiency, and established core principles for the vast majority of retail transactions we engage with today, representing a critical and enduring leap in the evolution of pricing strategies.

Read more about: 15 Critical Traffic Laws: How 12 States Are Intensifying Enforcement Right Now

As we journey from the rudimentary exchanges of ancient civilizations to the sophisticated algorithms governing today’s global marketplaces, the evolution of pricing stands as a testament to human innovation and relentless adaptation. What began as simple bartering has blossomed into a complex ecosystem of strategies, each designed to define value, drive commerce, and respond to the intricate dance between supply and demand. Understanding these historical shifts isn’t just an academic exercise; it offers invaluable practical insights for entrepreneurs and business leaders navigating the ever-evolving challenges of the modern economy. The brilliance of historical merchants, whether through the chaos of an auction or the clarity of a posted price, continues to illuminate the path forward, reminding us that at the heart of every transaction lies a thoughtful strategy, constantly refined to meet the pulse of society.