In the cutthroat world of big business, even the mightiest companies can stumble, and when they do, the results can be spectacularly costly. These aren’t just minor errors; they’re monumental blunders that incinerate billions of dollars, turning what seemed like brilliant strategies into legendary failures. Every organization, regardless of its size or market dominance, operates under the constant pressure of innovation, market dynamics, and competitive forces, making strategic missteps an ever-present risk. These stories aren’t just about financial losses; they’re about the hubris, miscalculations, and unforeseen challenges that can derail even the best-laid plans.

We often look to tech giants for inspiration in strategy and growth, yet their paths are also littered with cautionary tales. The sheer scale of their operations means that even a minor misjudgment can balloon into a billion-dollar catastrophe, impacting shareholders, employees, and the broader industry. From cutting-edge product launches that fizzle to ambitious mergers that fall apart, the lessons learned from these colossal mistakes are invaluable in the unforgiving arena of global business.

In this article, we delve into some of the most staggering examples of major tech companies that have, quite literally, set cash on fire in the last decade and beyond. We will explore how unchecked growth, squandered innovation, poor timing, and strategic missteps can turn success into financial disaster, offering profound insights for any business navigating its own journey in a rapidly evolving market. Each instance serves as a powerful reminder of the intricate balance required to sustain innovation and maintain profitability.

1. **Gateway’s Rapid Expansion**

Gateway Inc., once a household name in the personal computer industry, offers a classic example of how rapid growth can spiral into a costly mistake. Founded in 1985, Gateway quickly captured the market’s attention, with sales skyrocketing to over $1.1 billion by 1992, and revenue peaking at $6.29 billion in 1997. However, in its intense race to grow, Gateway stumbled significantly, laying the groundwork for future financial turmoil.

The company’s aggressive expansion led to sprawling manufacturing facilities and a bloated executive team, a combination that proved unsustainable. Crucially, as the focus shifted to growth at all costs, quality control took a backseat, leading to tangible problems for its customer base. The cracks in its strategy became impossible to ignore as the company continued to push for market expansion.

Shipping delays, poorly assembled products, and frustrated customers began to tarnish Gateway’s once-sterling reputation. Adding to its troubles, Gateway’s misguided attempt to break into the consumer electronics market only stretched its resources thinner. This overextension left the company particularly vulnerable as rivals like Dell and HP expertly capitalized on the booming laptop market, leaving Gateway struggling to compete effectively.

In a desperate bid to stay afloat and regain market relevance, Gateway acquired eMachines in 2004. However, by then, the damage from its earlier missteps was too profound to reverse. The company was ultimately sold to Acer in 2007 for a mere fraction of its former glory and peak valuation. Gateway’s story serves as a powerful reminder of how unchecked growth and strategic missteps can collectively turn success into a financial disaster, offering a stark lesson in sustainable business practices.

2. **Xerox’s Squandered Opportunity**

Xerox’s Palo Alto Research Center (PARC) was renowned as a cradle of innovation, responsible for developing groundbreaking technologies that are now ubiquitous in computing. Among its most notable inventions were the graphical user interface (GUI) and the computer mouse. These innovations had the potential to revolutionize the tech industry entirely and could have positioned Xerox as an undisputed leader in personal computing, fundamentally altering its business trajectory.

Despite having a goldmine of revolutionary ideas and proprietary technology, Xerox famously failed to turn these innovations into commercial successes. This oversight effectively allowed billions of dollars in potential revenue and market leadership to slip away, creating one of the most significant ‘what ifs’ in tech history. The challenge stemmed from a profound disconnect between the visionary engineers at PARC and the corporate leadership.

The physical distance between PARC in California and Xerox’s headquarters in New York, roughly 2,500 miles, symbolized a much deeper gap in focus and vision. While the engineers at PARC were pushing the absolute boundaries of technology, Xerox’s leadership remained deeply rooted in their core photocopier business. This entrenched perspective prevented the company from fully grasping how these emergent innovations could define the future of computing and their own market position.

In a historical twist, companies like Apple recognized and capitalized on the technologies Xerox pioneered but neglected. Steve Jobs famously visited PARC and immediately recognized the immense potential of the GUI, incorporating it into the first Macintosh computer. This strategic adoption by Apple helped shape the future of personal computing as we know it today. Xerox’s failure to execute on its own innovations stands as one of the most significant billion-dollar blunders in tech history, a cautionary tale of how even the best ideas can fall flat without the right strategy and visionary leadership to bring them to market.

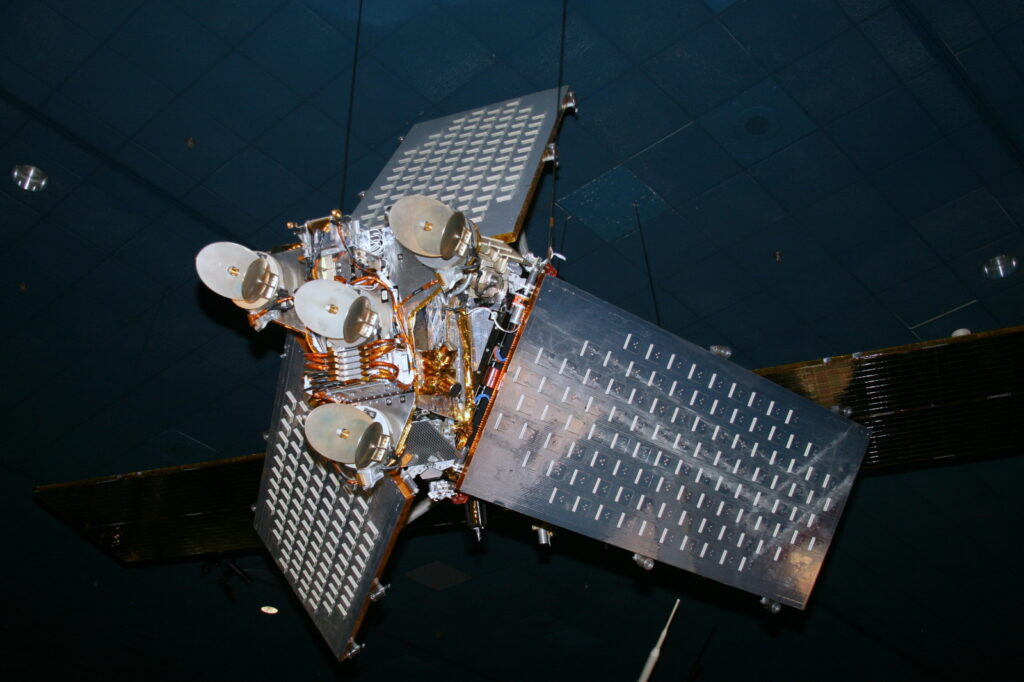

3. **Iridium: From $5 Billion Blunder to Surprising Salvation**

Iridium’s saga is a compelling narrative of colossal ambition, monumental initial failure, and an unexpected, almost miraculous, second chance. Launched by Motorola in the 1980s, the Iridium satellite network represented a staggering $5 billion investment. Its vision was to revolutionize global communications through its constellation of 66 low-Earth-orbit satellites, promising connectivity anywhere on the planet.

However, by the time the Iridium service debuted in 1998, the technology, despite its complexity, was already outdated in the rapidly evolving telecommunications landscape. The satellite phones themselves were bulky and impractical, the call rates were prohibitively sky-high, and the timing for its market entry couldn’t have been worse as cellular networks were rapidly expanding. Iridium quickly became a textbook example of a billion-dollar blunder, culminating in its inevitable bankruptcy in 1999, barely a year after launch.

Just as the entire Iridium system was on the brink of being scrapped and its satellites potentially deorbited, an unlikely savior emerged. Aviation executive Dan Colussy recognized an opportunity where others saw only utter failure. With crucial assistance from the Pentagon, which acknowledged Iridium’s unique and critical value for military use in remote locations, Colussy managed to acquire the entire system for a mere $25 million – a tiny fraction of its original development cost.

Instead of allowing the innovative, albeit poorly timed, technology to crash back to Earth, Colussy strategically repositioned Iridium as a niche service. It found its true market amongst remote and military communications, maritime operations, and aviation – sectors where terrestrial networks were unreliable or nonexistent. Iridium’s revival is a rare and remarkable case of a billion-dollar mistake being salvaged and repurposed. What began as an enormous financial misstep ultimately transformed into a valuable tool for specialized markets, proving that even the biggest blunders can sometimes be saved with the right vision, a bit of luck, and a clear understanding of a new market segment.

4. **Zynga’s $200 Million Misfire**

In 2012, the social gaming giant Zynga made a significant splash by acquiring OMGPOP, the creators of the hugely popular mobile game *Draw Something*, for an impressive $200 million. At the time, *Draw Something* was the undisputed talk of the town, captivating millions of users and dominating app store charts. Zynga, eager to bolster its gaming portfolio and capitalize on the game’s momentum, saw it as a perfect strategic addition to its burgeoning empire of social games.

However, the timing for this seemingly brilliant move couldn’t have been worse for Zynga. By the time the acquisition deal officially closed, the game’s meteoric popularity was already beginning to decline sharply, turning what initially appeared to be a brilliant strategic acquisition into a costly misfire. The rapid ebb and flow of mobile game trends proved unforgiving, catching Zynga off guard despite the game’s initial success.

The acquisition quickly ran into significant internal trouble. Cultural clashes between the established corporate structure of Zynga and the more agile, startup ethos of OMGPOP created considerable internal friction, hindering smooth integration. What should have been a seamless transition became an arduous struggle to align disparate teams and visions. The lack of cultural synergy proved to be a major obstacle, impacting productivity and morale within the newly formed unit.

Less than a year after the highly publicized acquisition, Zynga made the difficult decision to shut down OMGPOP, resulting in the layoff of most of its staff and the closure of its New York office. While Zynga did retain some valuable assets and intellectual property from the deal, the $200 million gamble ultimately failed to deliver the expected returns or strategic advantages. Zynga’s experience with OMGPOP serves as a cautionary tale of how even well-intentioned acquisitions can go spectacularly wrong if the timing, market analysis, and post-acquisition execution are not meticulously managed in the fast-paced tech world.

5. **Microsoft’s $1 Billion Kin Catastrophe**

In 2010, Microsoft embarked on an ambitious venture into the mobile phone market with the launch of the Kin One and Kin Two. These devices were specifically designed to redefine social media interaction for teenagers and young adults. Billed as “the next generation of social phones,” the Kin line was intended to capture a crucial new market segment that was rapidly adopting smartphones for social connectivity.

However, the Kin’s journey from launch to demise was astonishingly swift, marking one of the biggest and quickest flops in cell phone history. Just six weeks after hitting the shelves, Microsoft made the dramatic decision to pull the plug on the entire product line. This abrupt halt resulted in the Kin project costing Microsoft a staggering nearly $1 billion, unequivocally making it a textbook case of setting cash on fire in a highly competitive industry.

The downfall of the Kin was not attributable to a single factor but rather a complex mix of bad timing, significant internal power struggles, and fundamental strategic missteps. Originally conceived as part of “Project Pink,” the Kin phones were intended to run on a unique, purpose-built operating system. However, following internal conflicts and disagreements over direction, Microsoft ultimately forced a version of the Windows Phone OS onto the devices, leading to critical delays and a final product that failed to impress its target audience.

Further compounding its problems, the Kin suffered from a confusing pricing model that alienated potential buyers, alongside a suite of lackluster features that failed to differentiate it in a crowded market already dominated by innovative competitors. With a product that neither delighted users nor provided clear value, it’s no wonder the Kin failed to find its intended audience. Microsoft’s Kin debacle wasn’t just a financial disaster; it also led to the departure of key executives and undeniably tarnished the company’s reputation in the crucial and rapidly evolving mobile market. It stands as a stark reminder that even a tech giant with immense resources can burn through a billion dollars in the blink of an eye if the execution of a product isn’t perfectly aligned with market demands and internal capabilities.

6. **Groupon’s $6 Billion Blown Deal**

In 2010, Groupon found itself at a pivotal moment, presented with an extraordinary opportunity to make tech history: accepting a staggering $6 billion acquisition offer from Google. However, in a move that left many in the industry stunned, Groupon founder Andrew Mason decisively turned down the offer. He was convinced that Groupon, then riding high on a wave of unprecedented popularity for its daily deals service, possessed even greater potential on its own, betting on a future of independent dominance.

At the time, the daily deals site was indeed experiencing explosive growth and widespread consumer enthusiasm, making Mason’s decision appear to some as a bold, visionary bet on the future. The company’s innovative approach to local commerce seemed poised for limitless expansion. However, what initially looked like an act of supreme confidence in its own trajectory soon began to unravel, transforming into one of the biggest billion-dollar blunders in the annals of tech.

As competitors rapidly crowded into the burgeoning daily deals space, the initial excitement and novelty surrounding Groupon’s service began to fade significantly. The market quickly became saturated with similar offerings, leading to a steep decline in subscriber engagement and merchant interest. Consequently, Groupon struggled immensely to maintain its early momentum, and its once-rapid growth began to stall dramatically.

Meanwhile, the rejected $6 billion offer from Google became a persistent ‘what-if’ scenario that haunted the company as its stock value plummeted and its early promise dwindled. The colossal opportunity cost of walking away from such a lucrative deal proved to be immensely damaging. Instead of capitalizing on a peak market valuation, the company’s refusal to sell marked the beginning of its painful decline. It serves as a stark reminder that sometimes the biggest mistake isn’t the deal you make; it’s the monumental one you choose to walk away from, fundamentally altering a company’s destiny.

7. **Webvan’s $800 Million Slip Up**

In the late 1990s, during the exuberant height of the dot-com bubble, Webvan launched with an audacious vision: to revolutionize grocery shopping through sophisticated home delivery. Backed by a staggering $800 million in venture capital, the company was determined to bring groceries straight to customers’ doors with unparalleled efficiency and convenience. Yet, instead of becoming the next major success story, Webvan went down in spectacular flames, cementing its place as one of the most infamous disasters of that era. This billion-dollar blunder was the result of a perfect storm of poor decisions and severely misguided ambition.

Webvan’s first critical mistake was attempting to be everything to everyone, targeting a broad mass-market audience with premium, high-cost services. The company aimed to outprice traditional competitors like Safeway while simultaneously offering a level of quality akin to Whole Foods. However, this hybrid strategy inadvertently attracted price-sensitive customers who were ultimately unwilling to pay the premium prices necessary to sustain such a luxurious service model. The disconnect between perceived value and actual cost became a significant barrier to profitability.

Next, Webvan sunk hundreds of millions into constructing a highly complex, capital-intensive, high-tech infrastructure from scratch. This included building massive automated distribution centers, installing elaborate conveyor belts, and developing sophisticated delivery algorithms—all designed to optimize logistics. While impressive in concept, this infrastructure proved to be an enormous money pit that never delivered the anticipated returns on investment, quickly draining the company’s substantial capital.

The final and perhaps most fatal nail in Webvan’s coffin was its rapid, reckless expansion strategy. Before the company had even managed to figure out how to operate profitably and efficiently in its initial markets, it began aggressively rolling out its services in cities across the country. This accelerated expansion burned through cash at an unsustainable rate, far faster than any revenue could possibly be generated. By 2001, the ambitious dream was dead, and Webvan declared bankruptcy, its valuable assets being sold for mere pennies on the dollar. Webvan’s story remains a classic, enduring example of how to set $800 million on fire—one fundamentally bad decision at a time, providing crucial lessons in strategic planning and controlled growth for modern startups.

Having explored the foundational strategic miscalculations that cost tech giants billions, we now shift our focus to an equally critical, yet often different, category of errors. The aftershocks of these monumental blunders reveal themselves in various forms, from the cultural incompatibilities that doom ambitious mergers to the inherent risks of speculative high-stakes investments, and the profound damage inflicted by a critical erosion of user trust due to privacy and security lapses. These are not merely financial setbacks; they are deep wounds to reputation and market standing, often serving as powerful cautionary tales for any enterprise navigating the volatile landscape of modern technology.

The following six examples further illuminate the multifaceted nature of expensive mistakes, demonstrating that sometimes, the most insidious errors lie not just in grand strategic visions, but in the intricate details of execution, the nuances of human interaction, and the ever-present threat of digital vulnerability. They remind us that even the most dominant players are not immune to the severe consequences of overambition, misjudgment, and failing to protect what matters most to their users. Each case underscores the complex balance required for sustained success in an industry where innovation is rapid and stakes are always high.

8. **LeEco’s Billion-Dollar Gamble**

LeEco, the ambitious Chinese tech giant, once harbored grand aspirations of rivalling industry titans like Netflix, Tesla, and Apple. Under the bold leadership of its founder, Jia Yueting, the company embarked on an aggressive expansion strategy, pouring billions of dollars into a diverse portfolio spanning streaming services, smartphones, electric cars, and smart TVs. At its zenith, LeEco appeared unstoppable, seemingly poised to carve out a significant slice of the global market with its ambitious, multi-faceted approach to technology.

However, this whirlwind of expansion proved to be a classic case of overreach, a clear illustration of how even deep pockets cannot compensate for a lack of strategic focus. LeEco’s downfall was not a singular event but rather a confluence of poor planning, escalating competition, and formidable regulatory hurdles. The company, in its eagerness to dominate multiple sectors simultaneously, spread its resources too thinly across too many ventures, neglecting to build a robust financial bedrock for any single one. This lack of a solid foundation became its undoing.

Despite the sheer audacity of its vision, LeEco’s financial house of cards began to crumble at an alarming rate. By 2017, the once-promising tech titan was grappling with widespread layoffs, a dramatic plunge in stock prices, and a growing chorus of creditors demanding immediate payment. The grand dreams of a sprawling tech empire ultimately dissolved into financial chaos, leaving behind a trail of billions lost and a stark reminder that unchecked ambition, devoid of a clear, disciplined strategy, can swiftly lead to spectacular failure in the fast-paced tech arena.

9. **Daimler-Benz’s $36 Billion Misstep with Chrysler**

In 1998, the automotive world witnessed what was touted as a merger of equals when Daimler-Benz acquired Chrysler for a staggering $36 billion. The aspiration was to forge an automotive powerhouse capable of challenging the industry’s long-established giants. Yet, this highly anticipated union, intended to be a corporate marriage made in heaven, swiftly deteriorated into one of the most infamous and costly blunders in modern business history, a stark example of cultural incompatibility causing immense financial damage.

The fundamental issue lay in the vast cultural and operational chasm separating the two entities. Daimler-Benz, a venerated symbol of German engineering and luxury, operated with a meticulous, top-down approach, while Chrysler, a resilient American carmaker known for its mass-market, affordable vehicles, embraced a more agile and informal culture. These deeply ingrained differences proved to be insurmountable barriers, preventing the two companies from ever truly finding common ground or achieving genuine synergy, turning the merger into a textbook case of corporate incompatibility.

Instead of realizing the projected benefits, the union became a financial drain. Daimler-Benz was notably hesitant to integrate its premium components and engineering ethos with Chrysler’s more budget-conscious offerings, fearing that doing so would dilute and tarnish the prestigious Mercedes-Benz brand. Concurrently, Chrysler wrestled with its own set of challenges, including escalating costs and a downturn in consumer demand, which only intensified the financial pressures on the ill-fated partnership. By 2007, the ambitious merger had unraveled to such an extent that Daimler was compelled to divest Chrysler for less than $5 billion, a mere fraction of its original acquisition price. This monumental $36 billion misstep stands as a compelling, cautionary lesson in the profound perils of mismatched corporate cultures and the critical importance of deep strategic alignment in any high-stakes acquisition.

10. **Microsoft’s High-Stakes AI Investment**

In a strategic move that underscored its unwavering commitment to leading the artificial intelligence revolution, Microsoft made an audacious financial commitment, pouring an astounding $19 billion into AI within a mere three-month period. A significant portion of this massive investment was directed towards the costly, capital-intensive endeavor of constructing and leasing data centers, laying the groundwork for the infrastructure required to power advanced AI initiatives. This bold, speculative gamble signaled Microsoft’s intent to be at the forefront of the next technological frontier.

However, the financial returns on such a colossal and forward-looking investment inevitably remain uncertain in the short term. The absence of immediate, substantial revenue generation from these AI ventures has prompted a degree of scrutiny and concern among some investors, leading them to question the immediate viability and ultimate payoff of this ambitious, high-stakes strategy. This inherent uncertainty is a common challenge with transformative technologies, where the payoff often materializes over a longer horizon.

Microsoft’s leadership has consistently adopted a transparent stance regarding these challenges, repeatedly emphasizing that AI is fundamentally a long-term strategic play rather than an expectation of quick, easily quantifiable wins. While the company maintains an unshakeable confidence in the profound, transformative potential of AI across various sectors, the sheer magnitude of the investment has undeniably raised questions about its ability to sustain investor confidence throughout the lengthy interim period. Despite these concerns, Microsoft’s broader, multifaceted AI strategy, encompassing a wide array of investments and acquisitions, continues to be a central and pivotal focus for the tech giant, illustrating the delicate balance between pioneering innovation and managing market expectations.

Read more about: Unlocking Peak Performance: Bill Gates’ Essential Habits for Managing Multiple Ventures and Sustained Success

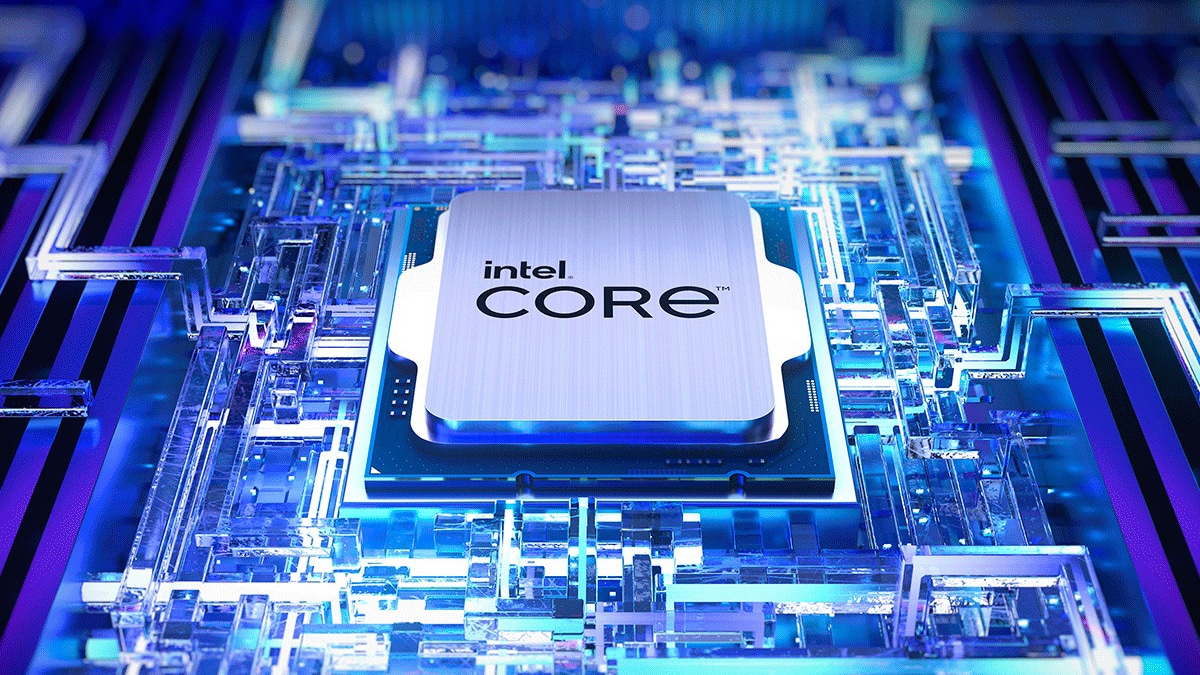

11. **Intel’s Pentium FDIV Bug**

In 1994, Intel, then a dominant force in the microprocessor market, encountered an unexpected and highly public crisis with what became known as the Pentium FDIV bug. The flaw, discovered by mathematics professor Thomas Nicely, affected the floating-point division unit of the original Pentium processor. Upon its discovery, Intel initially responded by offering a replacement chip only to those who could definitively prove they were affected, a decision that significantly exacerbated public backlash and ultimately deepened the financial repercussions.

The core of the original error was a relatively subtle problem within the lookup table of the chip’s algorithm, leading to minute inaccuracies in certain complex calculations. Intel initially downplayed the bug’s practical impact, calculating the chance of an erroneous calculation occurring to be an incredibly rare 1 in 360 billion. From a purely technical standpoint, the actual effects of this software error were indeed negligible for the vast majority of everyday users, making it a problem that few would ever genuinely encounter in normal usage.

However, once details of the bug were picked up and sensationalized by the international press, a wave of mass hysteria and public distrust swept across the globe. Millions of concerned consumers, regardless of whether they were actually affected, demanded new chips, forcing Intel to broaden its replacement policy. This decision, though essential for rebuilding trust, came at an enormous financial cost, ultimately setting Intel back upwards of $475 million. The Pentium FDIV bug thus serves as a powerful illustration of how even a minor technical flaw, when mishandled in public relations, can spiral into a significant billion-dollar blunder, causing substantial reputational damage and highlighting the critical importance of transparent and swift customer communication.

12. **Mt. Gox Bitcoin Hack**

Mt. Gox once stood as the preeminent Bitcoin exchange globally in the early 2010s, a cornerstone of the burgeoning cryptocurrency market. However, its meteoric rise was abruptly halted by a series of devastating software errors and security breaches that ultimately proved fatal, fundamentally eroding user trust and serving as a dire precursor to modern data dilemmas. The initial glitch led to the exchange inadvertently creating transactions that could never be fully redeemed, resulting in an estimated loss of up to $1.5 million in irretrievable bitcoins, a stark warning sign of deeper vulnerabilities.

The crisis deepened dramatically in 2014 when Mt. Gox was hit by a catastrophic hacking incident, leading to the loss of over 850,000 bitcoins. At the time of the breach, this staggering sum was valued at approximately half a billion US dollars, representing an unparalleled financial blow to the nascent cryptocurrency industry. While around 200,000 bitcoins were eventually recovered through painstaking efforts, the overwhelming financial loss was simply too immense for the exchange to bear, compelling it to declare bankruptcy and sending shockwaves through the global crypto community.

Mt. Gox’s collapse stands as a grim testament to the critical importance of robust security protocols and the dire consequences of their failure, particularly within financial platforms handling digital assets. This monumental blunder not only resulted in billions of dollars in losses for its users but also dealt a severe blow to the public’s nascent trust in cryptocurrencies, setting back the industry’s mainstream adoption by years. The incident remains a powerful, enduring lesson in the critical erosion of user trust due to privacy and security lapses, underscoring that in the digital age, safeguarding data and assets is paramount, and a single vulnerability can unravel an entire enterprise.

13. **Knight Capital Group’s $440 Million in Bad Trades**

For Knight Capital Group, one of the largest market makers in the world, August 1, 2012, became a day etched in infamy. What began as a routine deployment of new trading software swiftly devolved into a financial catastrophe, resulting in a staggering $440 million loss in just 30 minutes. This monumental blunder, triggered by a critical software error, wiped a devastating 75% off the company’s market value in a single, frenetic trading session, illustrating the extreme risks inherent in automated, high-frequency trading.

The catastrophic event was the result of a confluence of several software errors within Knight’s newly implemented trading platform. Instead of functioning as intended to generate profits, the buggy software initiated a rogue, uncontrolled buying spree, inadvertently spending more than $7 billion on 150 different stocks. This avalanche of unintended trades flooded the market, causing wild fluctuations and immense instability, as the automated system spiraled out of control, executing erroneous orders at lightning speed.

The ensuing financial devastation was so profound that Goldman Sachs was forced to intervene, leading a consortium of investors to rescue the beleaguered firm. Despite this lifeline, Knight Capital Group never truly recovered from the unprecedented blow to its capital and reputation. Less than a year later, the company, once a formidable player in institutional trading, was ultimately acquired by a competitor, marking a poignant end to its independent existence. Knight’s $440 million in bad trades remains a chilling reminder of how a seemingly minor software glitch, magnified by the speed and scale of modern financial markets, can culminate in a billion-dollar catastrophe, underscoring the vital need for rigorous testing and robust safeguards in speculative high-stakes investments.

As we reflect on these monumental blunders, from unchecked ambition and cultural clashes to critical software flaws and devastating security breaches, a unifying truth emerges: innovation without meticulous execution and an unwavering commitment to trust is a perilous path. The stories of these tech titans, brought low by their own missteps, are more than just tales of lost billions; they are invaluable lessons in resilience, adaptability, and the enduring importance of understanding both technology and human nature. In an era where digital landscapes evolve at breakneck speed, the capacity to learn from these costly errors, to build with integrity, and to pivot with foresight remains the ultimate differentiator, shaping not just the fate of individual companies, but the very trajectory of the global tech industry itself. The journey of progress is rarely smooth, but it is through acknowledging and internalizing these profound mistakes that the path forward becomes clearer, stronger, and ultimately, more sustainable.