Getting denied a student loan can feel like a major setback—but it doesn’t have to end your college plans. It’s a moment that can spark anxiety, confusion, and a flurry of ‘what now?’ questions, especially when you’re counting on financial aid to achieve your educational dreams. But here’s the good news: whether the issue is credit, paperwork, or eligibility, there’s usually a fix. This comprehensive guide is designed to shed light on exactly why financial aid applications, particularly federal student loans and Parent PLUS loans, might get denied and, more importantly, what actionable steps you can take next to get back on track.

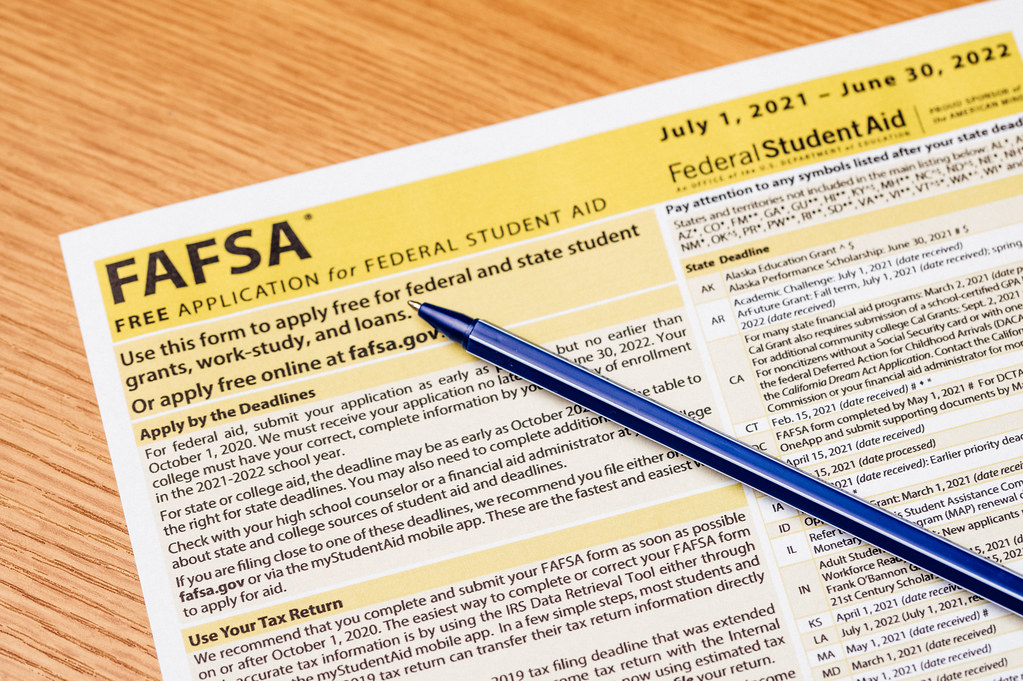

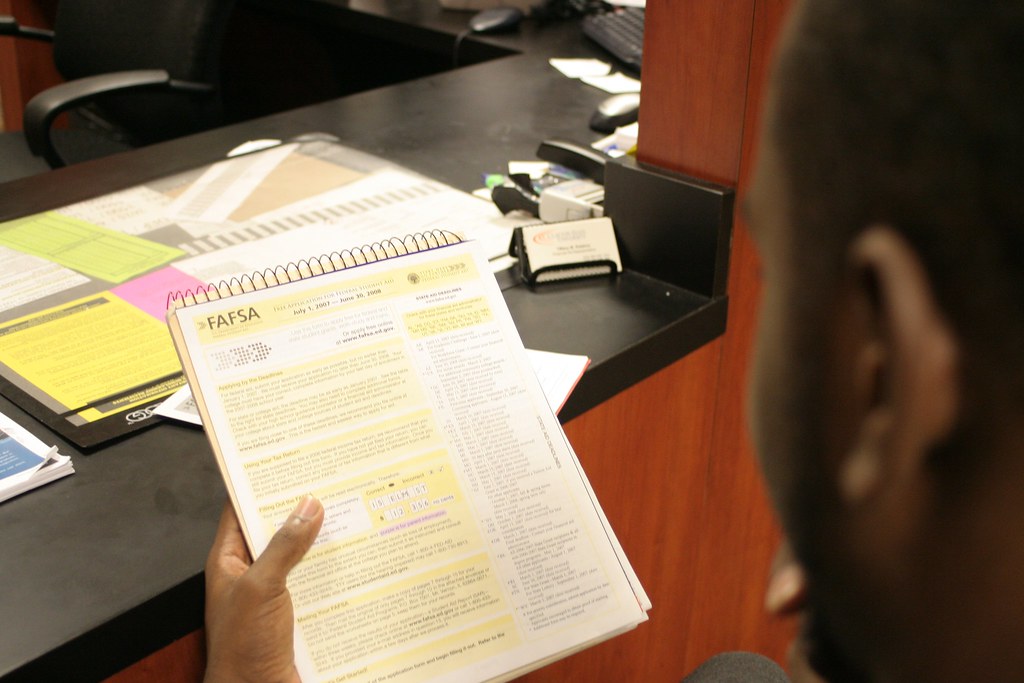

Federal student loans, in particular, are often considered the bedrock of college funding for many students. They come with significant advantages, offering fixed interest rates, a variety of income-driven repayment plans, and even potential forgiveness options after a certain period. So, when your Free Application for Federal Student Aid (FAFSA) application comes back with a denial or an indication that you don’t qualify for federal loans, it can be incredibly confusing and stressful. However, this isn’t necessarily the end of your financial aid journey; often, it simply means you need to make a few corrections or clear up some paperwork.

The FAFSA itself doesn’t approve or deny anything; it’s the foundational form used by the Department of Education to calculate your eligibility for various federal student aid programs, including loans, grants, and work-study. If you’ve been told you’re not eligible for federal loans, you’re certainly not alone, and there’s almost always a way forward. In this first section, we’ll dive into the initial eligibility hurdles and common application slip-ups that can lead to a federal student aid denial, providing clear explanations and practical advice to help you navigate these challenges and secure the funding you need for your education.

1. **Not a U.S. Citizen or Eligible Non-Citizen**

One of the most fundamental requirements for federal student aid is that you must be a U.S. citizen or an eligible non-citizen. This isn’t just a formality; it’s a core eligibility criterion designed to ensure federal funds are directed appropriately. An ‘eligible non-citizen’ typically includes permanent residents (Green Card holders), those with an I-94 record, or individuals in specific humanitarian statuses such as asylum or refugee status.

If you don’t meet this specific requirement, your federal student loan application will, unfortunately, be denied. The system is designed to flag applications that do not confirm this status, making it a critical first check. It’s essential to understand that without this foundational eligibility, other aspects of your application become moot for federal aid purposes.

The clear path forward if this is your reason for denial is to work toward becoming an eligible non-citizen or a permanent resident. This can be a lengthy process, but it is the prerequisite for federal aid eligibility. In the interim, you might need to explore other funding avenues, such as private student loans, scholarships specifically for international students, or institutional aid offered by your college.

Before you even begin filling out the FAFSA, it’s a smart move to verify your citizenship or eligible non-citizen status. A quick consultation with an immigration expert or your school’s international student office can help clarify your standing and prevent wasted effort on an application that won’t qualify.

Read more about: Navigating SNAP (Food Stamps) in 2025: A Comprehensive Guide to Eligibility, Application, and Interview Success

2. **No Valid Social Security Number**

Your Social Security Number (SSN) is more than just a nine-digit identifier; it’s a crucial piece of information for your FAFSA application. The Department of Education uses your SSN to identify you, track your federal student aid history, and cross-reference your financial data, including tax information, to accurately determine your eligibility and award amounts.

Without a valid SSN, or if there’s an error in the SSN provided on your FAFSA, your application cannot be processed correctly. This will almost certainly lead to a denial or, at the very least, a significant delay in receiving your financial aid package. Even a single transposed digit can render your SSN ‘invalid’ in the system, causing a major holdup.

Should you find that your denial stems from an SSN issue, the primary solution is to meticulously review your FAFSA. “Log back in and fix any errors, or refile completely if needed.” Ensure that the SSN you’ve entered matches your official record exactly. If you’ve never had an SSN and are an eligible non-citizen, you will need to apply for one before completing the FAFSA.

This highlights the importance of thoroughness when completing the FAFSA. Double-check, triple-check, and perhaps even have a trusted individual review your application before submission. A few moments of careful review can save you weeks of frustration and delays in your financial aid process.

Read more about: Decoding the Price Tag: 11 Historical Pricing Strategies That Shaped Modern Business and Society

3. **Not Enrolled At Least Half-Time in an Eligible Program**

Federal student aid is specifically designed to support students who are genuinely committed to pursuing a recognized degree or certificate program. This means that to qualify for most federal loans, you must be enrolled at least half-time in an eligible degree or certificate program. Casual enrollment, auditing classes, or pursuing hobbies don’t typically meet these stringent requirements.

If your enrollment status falls below the half-time threshold, or if the program you’re pursuing isn’t recognized as ‘eligible’ by federal standards, your federal aid eligibility will be impacted. This is a common scenario for students who might reduce their course load due to personal circumstances or change their academic focus without realizing the financial aid implications.

The proactive step here is to verify your enrollment status and ensure your chosen program’s eligibility with your school’s financial aid office. Don’t assume your program qualifies; confirm it. Your academic advisor and financial aid counselor are your best resources for understanding these specific criteria and how they apply to your unique situation.

Maintaining communication with your financial aid office is paramount, especially if you anticipate any changes to your enrollment. They can provide guidance on how to adjust your academic plan to maintain eligibility or explore alternative funding options if your circumstances prevent full-time or half-time enrollment in an eligible program.

Read more about: Navigating SNAP (Food Stamps) in 2025: A Comprehensive Guide to Eligibility, Application, and Interview Success

4. **Failure to Maintain Satisfactory Academic Progress**

To continue receiving federal student aid, students are generally required to make ‘Satisfactory Academic Progress’ (SAP). This isn’t just about passing classes; it’s a comprehensive measure that includes maintaining a minimum cumulative GPA, successfully completing a certain percentage of the credit hours you attempt, and finishing your degree within a maximum allowable timeframe, typically 150% of the published program length.

Failing to meet your school’s SAP standards can lead to the suspension of your federal student aid. Schools are obligated to enforce these policies, and if your academic performance drops below the required benchmarks, you’ll be notified of your aid suspension. This can be a significant setback, especially for students who rely heavily on federal funding.

If you find yourself in this situation, there are often solutions. The context explicitly advises, “Ask about academic plans or appeal options at your school.” Many institutions have an appeal process where you can explain any extenuating circumstances that contributed to your academic struggles. If approved, you might be placed on academic probation, with a clear plan to regain good standing.

It’s important to remember that your school wants you to succeed. By understanding and proactively addressing SAP requirements, or by utilizing the appeal process, you can work towards re-establishing your eligibility for the financial aid crucial to your educational journey.

Read more about: Mastering the Nuances: A Business Insider’s Guide to Differentiating ‘Worse’ and ‘Worst’ for Precision Communication

5. **In Default on a Previous Federal Loan or Owe a Grant Refund**

This reason for denial is a serious one, indicating past issues with federal financial obligations. If you are currently in default on a previous federal student loan, or if you owe a refund on a federal grant that you received but did not fully earn (for example, by withdrawing from school before completing the term for which the grant was awarded), your eligibility for new federal aid will be suspended.

Being in default means you have failed to make payments on your federal student loan for an extended period, typically 270 days. This has significant consequences beyond just a financial aid denial, including damaged credit and potential wage garnishment. Owing a grant refund means the Department of Education or your school expects you to return funds that were disbursed but not earned based on your attendance.

The good news is that there are defined pathways to resolve these issues and regain eligibility. The most effective course of action for defaulted loans is to “Apply for student loan consolidation or rehabilitation.” These programs are specifically designed to help borrowers get out of default, clean up their credit, and restore their eligibility for federal student aid. For grant refunds, contact your school’s financial aid office or the Department of Education to make arrangements for repayment.

Addressing these past financial responsibilities head-on is not only crucial for future financial aid but also for your overall financial health. Taking these steps demonstrates a commitment to resolving your obligations and can open doors to new educational opportunities.

Read more about: Student Loan Relief Unpacked: Navigating Eligibility for Up to $20,000 in Federal Forgiveness, State Programs, and Upcoming Changes

6. **Currently Incarcerated**

This is a clear-cut eligibility criterion: “You’re currently incarcerated, which generally disqualifies you from federal loans.” This policy is in place for federal student loans, meaning that if you are serving a prison sentence, you will typically not be eligible to receive federal student loan funds while incarcerated.

The rationale behind this stipulation is related to the allocation of federal funds and the specific purposes federal loans are intended to serve. While the goal is to promote education, certain circumstances, such as current incarceration, can limit eligibility for specific types of aid, including loans.

However, a denial for federal loans due to incarceration doesn’t necessarily mean all educational opportunities are closed. The context suggests that you should “Explore federal grants or education programs available while incarcerated.” There may be specific grant programs or state-funded educational initiatives designed to support individuals pursuing education during incarceration.

It’s important for individuals and their families to research these alternative funding sources thoroughly. Connecting with prison education coordinators or non-profit organizations focused on re-entry programs can provide valuable information on available grants and educational pathways that do not rely on federal student loans.

Read more about: Legacies Etched in Time: Remembering Famous Black Celebrities Who Succumbed to HIV/AIDS

7. **Left Part of the FAFSA Blank**

It might seem like a small oversight, but leaving even a single required field blank on your FAFSA can lead to significant delays or even an outright denial of your financial aid application. The FAFSA is a comprehensive document that relies on complete and accurate information to generate your Expected Family Contribution (EFC) and determine your federal aid eligibility.

When information is missing, the Department of Education’s processing system simply cannot complete its assessment. It’s akin to submitting an incomplete puzzle—you won’t get the full picture, and therefore, no accurate determination of aid can be made. This common application problem underscores the importance of meticulousness when filling out the form.

The immediate and most effective solution if your denial is due to an incomplete FAFSA is to “Log back in and fix any errors, or refile completely if needed.” The FAFSA online platform typically allows you to make corrections to your submitted application. Take your time to review every section, question by question, and ensure all required fields are populated.

To avoid this pitfall, consider setting aside dedicated time to complete the FAFSA without rushing. Have all necessary documents, such as tax returns and bank statements, readily available. A thorough review before clicking ‘submit’ can save you weeks of anxiety and ensure your application moves forward smoothly.”

Navigating the financial aid landscape can feel like a maze, and even after addressing initial eligibility concerns, other application pitfalls can trip you up. This second section will illuminate further common reasons for federal student aid denials, especially concerning FAFSA submission accuracy and crucial deadlines. We’ll also transition to a significant area of denial specific to Parent PLUS loans: adverse credit history. Understanding these often-overlooked details is key to securing the funding necessary for your academic journey.

Read more about: Navigating Debt After Death in the US: What Every Family Needs to Know

8. **Incorrect or Mismatched Information on FAFSA**

Accuracy on your FAFSA is not just a suggestion; it’s a fundamental requirement. Even minor discrepancies, such as an incorrectly entered name or a mismatched Social Security Number, can trigger significant processing delays or an outright denial. The Department of Education relies on the precision of the data you provide to accurately assess your eligibility and calculate your financial need.

When information is incorrect or doesn’t match official records, the processing system flags it, preventing your application from moving forward. This can lead to an inaccurate Expected Family Contribution (EFC) or simply a halt in the determination of your federal aid. Such errors, though seemingly small, can effectively make your application unreadable by the system.

The most direct solution for this common issue is to meticulously review your FAFSA. “Log back in and fix any errors, or refile completely if needed.” Compare every piece of personal identification and financial data against your official documents, like your Social Security card and tax returns, to ensure absolute consistency.

To avoid this pitfall, allocate ample time to complete the FAFSA, ensuring all necessary documents are at hand. Consider having a trusted individual review your application before submission. This careful approach can save you from weeks of frustration and keep your financial aid process on track.

9. **Unsigned FAFSA Application**

It might seem like a basic step, but forgetting to sign your FAFSA, whether electronically with your FSA ID or physically if you’re mailing a paper form, is a surefire way to get your application denied. An unsigned FAFSA is an incomplete FAFSA, and federal regulations require a complete and authenticated submission.

Without a valid signature, the Department of Education cannot legally process your application. This immediately halts any assessment of your eligibility for federal student loans, grants, or work-study programs. It’s a critical missing piece that prevents the entire aid determination process from even beginning.

If your denial notice indicates an issue with your signature, promptly log back into the FAFSA website. Navigate to the signature section and ensure you complete the electronic signature process using your FSA ID. If you submitted a paper FAFSA, you would need to resubmit a correctly signed version.

Always double-check the final submission confirmation page for an electronic signature. For paper forms, visually confirm your signature is present and legible before mailing. This simple, yet vital, step acts as a gatekeeper to your potential financial aid.

10. **Missed FAFSA Deadlines**

While many focus on the federal FAFSA deadline, it’s crucial to understand that there are multiple deadlines for financial aid: federal, state, and institutional. Missing any of these can significantly impact the amount and type of aid you receive, potentially leading to a denial of specific funds.

The consequences of missing these deadlines can be severe. Federal grants, for instance, are often awarded on a first-come, first-served basis until funds are exhausted. Similarly, state and institutional aid programs have strict application windows, and a late submission often means automatic disqualification from those specific funds, regardless of eligibility.

If you find that you’ve missed a state or institutional deadline, immediately contact your school’s financial aid office. While options may be limited, they can advise if any late applications are accepted or if there are alternative forms of aid still available. For federal aid, submitting as soon as possible after the federal deadline, if you missed it, might still allow for some loan eligibility, but grants will be a long shot.

To prevent this, proactively research all applicable FAFSA deadlines for the upcoming academic year. Mark them on your calendar and aim to submit your application well in advance. Early submission not only secures your place in line for limited funds but also provides ample time to correct any errors.

11. **Failure to Submit Verification Documents**

Being selected for verification means the Department of Education or your school needs to confirm the accuracy of the information you reported on your FAFSA. This isn’t a denial yet, but failing to submit the requested documents—such as tax returns, W-2s, or proof of untaxed income—will quickly lead to one.

If you are selected for verification, your financial aid processing will be paused. Your school cannot disburse any federal aid until all required documentation is received and reviewed. This delay or ultimate denial can put your enrollment at risk if you’re relying on that funding.

The solution here is straightforward: “Submit your paperwork promptly and follow up with your financial aid office.” Respond immediately to any requests for documentation, ensuring all forms are filled out correctly and completely. Maintain open communication with your financial aid counselor to clarify any uncertainties.

To prepare for potential verification, keep organized copies of all financial documents used to complete your FAFSA. This includes income tax returns, W-2 forms, and any records of untaxed income. Prompt action upon notification of verification can prevent unnecessary delays in your aid package.

Read more about: Beyond the Bump: 15 Critical Legal Steps to Take After a Minor Car Accident

12. **Adverse Credit History: Delinquent or Charged-Off Accounts (Parent PLUS Loan Specific)**

Shifting gears to Parent PLUS loans, these federal loans differ significantly from other federal student loans because they require a credit check. A key reason for denial is an adverse credit history, specifically including “one or more accounts that are 90+ days delinquent” or “accounts that have been charged off or sent to collections.”

These entries on a credit report signal to the Department of Education a pattern of financial difficulty or a failure to meet prior credit obligations. Such delinquencies or unresolved debts indicate a higher risk profile, directly resulting in the denial of a Parent PLUS loan application.

However, a denial due to adverse credit history doesn’t have to be the final word. Parents have two main avenues: “Get an endorser or document extenuating circumstances.” An endorser is essentially a co-signer who agrees to repay the loan if the parent borrower defaults. Documenting extenuating circumstances involves providing evidence of specific events that led to the adverse credit, along with proof that these issues have been resolved or are no longer applicable.

Proactively checking your credit report before applying for a Parent PLUS loan is a wise step. If adverse items are present, consider working to resolve delinquencies or establishing a more consistent payment history, though this takes time. Exploring other funding options for your student, such as federal loans in their name, scholarships, or private loans, might also be necessary.

13. **Adverse Credit History: Loan Defaults (Parent PLUS Loan Specific)**

Another critical red flag for Parent PLUS loan eligibility is “defaults on previous loans.” While we discussed defaults generally for federal student loans in Section 1, its presence on a parent’s credit history specifically for a PLUS loan application signals a significant issue of past financial irresponsibility.

Being in default on any prior loan, especially a federal loan, demonstrates a failure to adhere to repayment terms. This indicates a high level of risk for the Department of Education, making the parent ineligible for additional federal PLUS loan funds. It’s a clear signal that prior obligations were not met.

If a Parent PLUS loan is denied due to a default, the most effective course of action to regain federal aid eligibility for any loan type is to “Apply for student loan consolidation or rehabilitation.” These programs are specifically designed to help borrowers resolve their defaulted loans, improve their credit standing, and restore their access to federal financial aid.

To prevent such a situation, it’s crucial for parents to manage all their loan obligations diligently. If facing financial hardship, contacting loan servicers immediately to explore options like deferment, forbearance, or income-driven repayment plans can help avoid default and protect future financial aid eligibility.

14. **Adverse Credit History: Bankruptcy, Repossession, or Foreclosure (Parent PLUS Loan Specific)**

Major negative credit events like “A bankruptcy, repossession, or foreclosure in the last five years” are significant indicators of adverse credit history, leading to an automatic denial for a Parent PLUS loan. These events represent substantial financial distress and are viewed as high-risk by the Department of Education.

The presence of any of these items on a parent’s credit report within the past five years disqualifies them from receiving a Parent PLUS loan. The five-year window is a critical factor, as it indicates recent severe financial setbacks that impact creditworthiness for new federal borrowing.

Similar to other adverse credit denials, parents can “Get an endorser or document extenuating circumstances.” If a parent has filed for bankruptcy, for instance, they might be able to document that they have resolved the bankruptcy and that it no longer indicates an inability to repay the loan.

Rebuilding credit after such major events takes time and consistent effort. In the interim, parents should explore all other funding avenues for their student, including federal student loans in the student’s name, scholarships, and potentially private student loans with a different, creditworthy cosigner.

15. **Adverse Credit History: Wage Garnishments or Tax Liens (Parent PLUS Loan Specific)**

Rounding out the adverse credit history issues for Parent PLUS loan denials are “wage garnishments or tax liens.” These are legal actions initiated due to unpaid debts, signifying active and unresolved serious financial obligations. Their appearance on a credit report is a strong indicator of financial difficulty.

The presence of wage garnishments or tax liens means a denial for a Parent PLUS loan. These are not merely indications of past issues but ongoing financial entanglements where creditors or government entities are actively seeking repayment through legal means, making new lending highly risky.

Should a Parent PLUS loan be denied due to these issues, the options remain to “Get an endorser or document extenuating circumstances.” Providing evidence that the garnishment or lien has been satisfied, or a formal repayment plan is actively being followed, would be crucial for the extenuating circumstances appeal.

Preventing wage garnishments or tax liens involves proactive financial management and addressing debts before they escalate to legal action. For those currently facing these issues, focusing on resolving them is paramount. Simultaneously, exploring alternative funding strategies and ensuring the student maximizes their own federal aid opportunities becomes an important focus.

Getting denied a student loan can certainly feel like a significant hurdle, but as we’ve explored, it’s rarely a dead end for your educational aspirations. Whether the issue lies in meticulous paperwork errors, missed deadlines, or more complex credit challenges with Parent PLUS loans, there is almost always a viable path forward. The key is understanding precisely why your application was denied and then taking swift, informed action. Don’t let a denial discourage you; instead, let it empower you to investigate, correct, and pursue the funding you need. By being thorough, proactive, and willing to seek guidance from financial aid professionals, you can navigate these challenges and secure the financial support to achieve your college dreams.