The automotive industry is in the midst of an unprecedented transformation, with global passenger car sales exceeding 69 million units in 2023, representing an almost 8% increase compared to the previous year. This growth trajectory is only set to continue, especially in key markets like the U.S., driven significantly by the rapid transition towards vehicle electrification. As automakers accelerate towards a future dominated by electric and zero-emission vehicles, the demand for a specific set of raw materials has surged, creating both incredible opportunities and significant, often overlooked, challenges.

This increased reliance on critical raw materials has brought into sharp focus a new dimension of risk for companies within the industry. Beyond traditional operational concerns, issues like geographical concentration of production, price volatility, and environmental impacts associated with extraction and processing are now paramount. Morningstar Sustainalytics has even incorporated “Raw Materials Use” as a new material ESG issue (MEI) in its ESG Risk Ratings, underscoring the gravity of these considerations for engineers and decision-makers.

For engineers charting the course for future vehicle design and production, understanding these material-specific risks is no longer optional; it’s essential. The choices made today will not only dictate manufacturing costs and supply chain resilience but also the long-term sustainability and environmental footprint of the next generation of automobiles. This article shines a spotlight on 11 types of materials that, despite their critical importance, warrant a serious second thought due to the intricate web of risks they present.

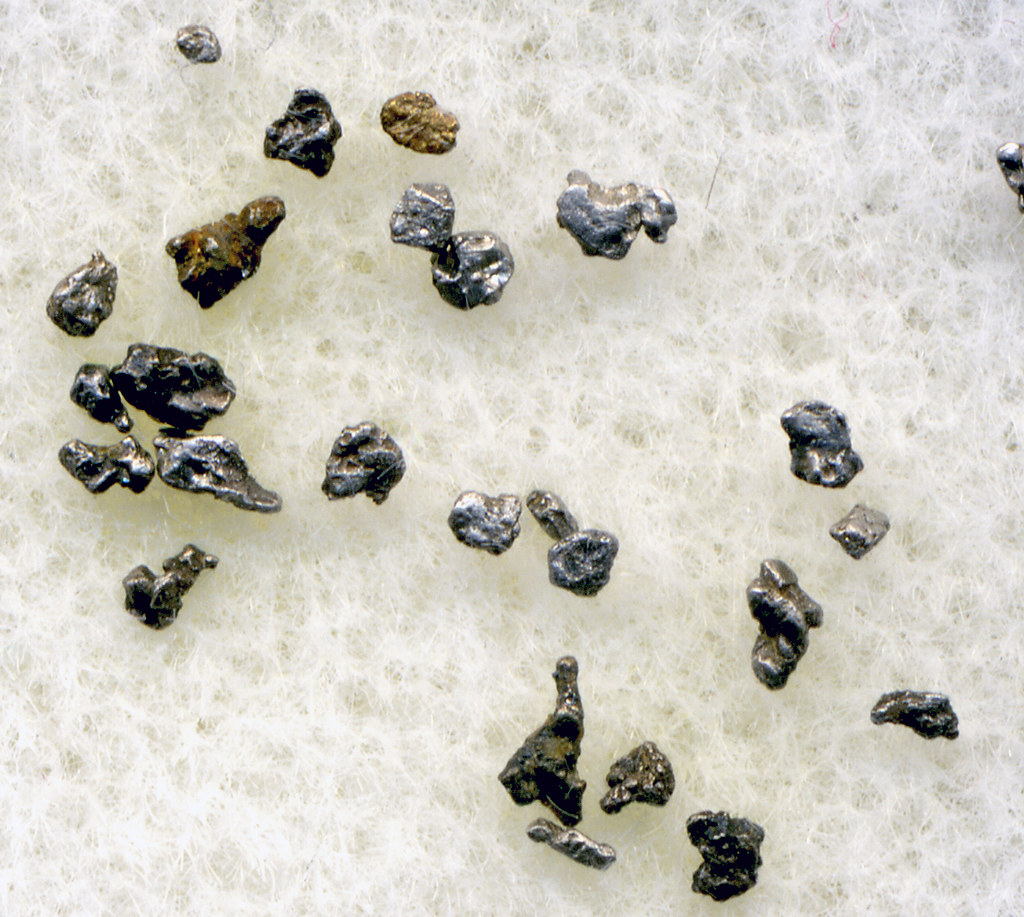

1. **Rare Earth Elements (REEs)**Rare Earth Elements, or REEs, are an umbrella term for a group of 17 metallic elements crucial to many high-tech applications, and particularly indispensable for the burgeoning electric vehicle (EV) market. Their primary role in EVs is in the permanent magnets used in electric motors, where they significantly improve energy efficiency and, consequently, extend driving ranges. Without REEs, achieving the performance metrics consumers expect from modern EVs would be a far greater engineering challenge.

However, the widespread adoption of REEs comes with substantial risks, primarily due to their highly concentrated geographical production. In 2022, China alone accounted for approximately 70% of total REE mine production worldwide. This extreme concentration creates significant ESG (Environmental, Social, and Governance) risks for automobile companies, making them highly vulnerable to supply disruptions stemming from geopolitical tensions, trade disputes, or even localized environmental incidents.

Furthermore, REEs have experienced considerable price volatility in recent years, reaching a peak in 2022. This fluctuation was a direct result of the escalating demand from the EV and renewable energy sectors, compounded by supply chain disruptions during pandemic lockdowns and reduced imports from China after its border closure with Myanmar. Although prices have somewhat decreased since 2023, concerns about potential supply issues from China continue to fuel price instability, forcing automakers to actively seek alternatives and innovative solutions to mitigate production costs.

The International Energy Agency (IEA) forecasts that by 2040, a staggering 40% of the total demand for REEs will originate from clean energy technologies, including the automotive sector’s production of EVs. This projection underscores the escalating dependence of the industry on these materials and the urgent need for robust management strategies. Companies are now exploring methods to reduce the amount of REEs in electric motors; for example, Tesla has reported a 25% decrease in REE usage per vehicle, and BMW has moved away from rare earth permanent magnets altogether, highlighting a significant industry shift towards sustainable material practices.

2. **Neodymium**Among the specific Rare Earth Elements that demand close scrutiny, Neodymium stands out as a critical component. It is explicitly identified as essential for the permanent magnets found in electric motors, directly contributing to the improved energy efficiency and extended driving range that define the performance of contemporary electric vehicles. Its integral role means that any vulnerability affecting the broader REE supply chain directly impacts Neodymium’s availability and cost.

As with other REEs, Neodymium’s production is heavily concentrated geographically, making its supply inherently susceptible to the same global risks discussed for the general category. Automakers’ increasing reliance on Neodymium for their EV powertrains means they are exposed to significant risks from potential supply shortages and price volatility. These factors can translate into substantial operational and financial burdens, affecting everything from production schedules to vehicle affordability.

The drive to innovate and adapt within the industry extends to specific REEs like Neodymium. The efforts by companies such as Tesla to reduce REE usage per vehicle demonstrate a proactive approach to lessen dependence on these critical, yet volatile, materials. Engineers are actively engaged in exploring new motor designs and alternative magnet technologies that can either reduce the amount of Neodymium required or eliminate its need entirely, showcasing the industry’s commitment to resilience and sustainability.

Read more about: Expert Test: 12 Headphones That Deliver Unrivaled Sound Quality Beyond Their Price Tag

3. **Praseodymium**Another vital Rare Earth Element, Praseodymium, plays a similarly critical role alongside Neodymium and Dysprosium in the permanent magnets essential for electric vehicle motors. Its inclusion in these high-performance components directly supports the efficiency and range capabilities that are key selling points for modern EVs. As the automotive industry accelerates its transition towards electrification, the demand for Praseodymium is experiencing a corresponding surge.

This heightened demand places Praseodymium squarely within the sphere of raw materials posing significant risks. Its supply chain shares the same characteristics of geographical concentration and vulnerability to geopolitical factors as other REEs. Engineers must therefore consider the inherent instability in sourcing this material, understanding that global events far removed from the factory floor can directly impact production timelines and costs.

The challenge with Praseodymium, like its rare earth counterparts, lies not just in securing its supply but also in the broader environmental considerations tied to its extraction and processing. While the context highlights the general environmental impacts related to raw material use, the intensive nature of rare earth mining adds another layer of complexity. Therefore, finding ways to optimize its use, explore substitutes, or enhance recycling efforts becomes a critical engineering imperative to mitigate both supply and environmental risks.

Read more about: Unearthing the Secrets: A Deep Dive into the World of Rare-Earth Elements and Their Unseen Impact

4. **Dysprosium**Dysprosium completes the trio of specific Rare Earth Elements explicitly named as critical components in the permanent magnets of electric motors. Its importance in enhancing energy efficiency and extending the driving range of EVs cannot be overstated. As the industry’s focus shifts towards cleaner transportation, the demand for Dysprosium, along with other REEs, is projected to rise dramatically, with clean energy technologies becoming the dominant consumer.

The risks associated with Dysprosium are identical to those of Neodymium and Praseodymium: a highly concentrated global supply, primarily from China, which renders automakers susceptible to supply disruptions and significant price fluctuations. These factors create an unstable foundation for long-term production planning and can lead to unexpected cost increases, directly impacting the profitability and competitiveness of vehicle manufacturers.

Automakers are increasingly aware of these vulnerabilities and are actively pursuing strategies to reduce their dependence on such critical materials. This includes investing in research and development to design motors that require less Dysprosium or exploring completely new powertrain technologies that circumvent the need for rare earth permanent magnets. For engineers, this translates into a mandate to innovate and to critically evaluate material choices not just for performance, but for resilience and strategic independence.

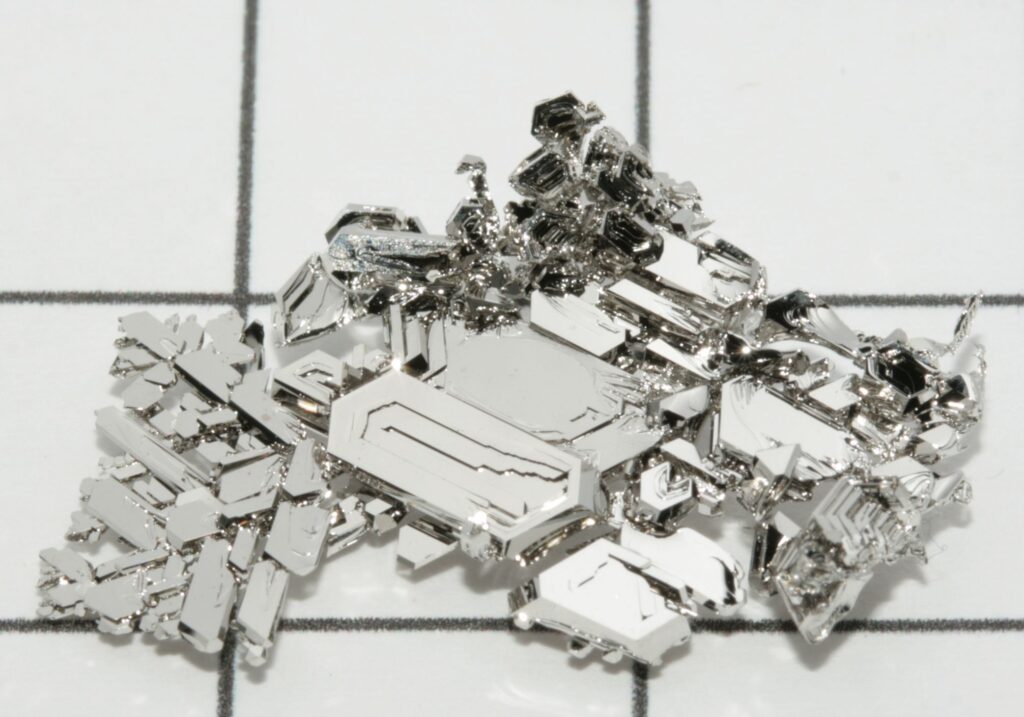

5. **Platinum Group Metals (PGMs)**The Platinum Group Metals (PGMs) represent another category of materials that engineers must approach with caution due to their critical roles and inherent risks. This group, which includes platinum and palladium, remains vitally important across different vehicle technologies. For conventional internal combustion engine (ICE) vehicles, PGMs are indispensable components in catalytic converters, where they play a crucial role in transforming pollutants into less harmful emissions and water vapor, aligning with stringent environmental regulations.

Beyond ICE vehicles, PGMs are also essential in the rapidly developing field of fuel cell electric vehicles (FCEVs). Platinum, for instance, acts as a critical catalyst in FCEVs, facilitating the chemical reactions that generate electricity. This dual application means that PGMs are fundamental to both the legacy and future automotive landscapes, increasing their strategic importance and demand across the industry’s evolving portfolio.

However, the supply chain for PGMs exhibits a geographical concentration similar to that of REEs, amplifying the associated risks. In 2022, South Africa and Russia collectively accounted for approximately 83% of the total PGM mine production worldwide. This heavy reliance on a limited number of countries significantly heightens the risk of potential supply shortages. Geopolitical tensions, trade policies, or even labor disputes in these key producing nations can severely impact the global availability of PGMs, leading to disruptions in automotive production lines globally.

The value of imports for PGMs and other related materials nearly doubled between 2017 and 2022, according to the World Trade Organization, reflecting their growing demand and strategic importance. As the industry transitions towards zero-emission vehicles, the reliance on these materials, particularly for FCEVs, is expected to intensify. Engineers must navigate this complex landscape, balancing the performance benefits of PGMs with the inherent vulnerabilities of their concentrated supply.

6. **Platinum**Within the Platinum Group Metals, Platinum holds a particularly significant position, necessitating specific attention from engineers. Its role in catalytic converters for internal combustion engine vehicles is well-established, contributing directly to environmental compliance by mitigating harmful emissions. This application alone underscores its continued importance in the substantial segment of the automotive market that still relies on gasoline and diesel powerplants.

However, Platinum’s criticality extends significantly into the future of automotive technology, particularly with the advent of fuel cell electric vehicles (FCEVs). In FCEVs, platinum acts as an essential catalyst, enabling the electrochemical reactions that convert hydrogen and oxygen into electricity and water, powering the vehicle. Notably, an FCEV can utilize as much as double the amount of platinum compared to a conventional ICE vehicle, indicating a substantial increase in demand as FCEV technology gains traction.

This heightened demand, coupled with the concentrated global production of PGMs (with South Africa and Russia dominating the market), places Platinum in a precarious position for automakers. The risks of supply chain disruptions, whether from geopolitical events or logistical challenges in the primary producing regions, are ever-present. These potential disruptions can lead to considerable cost increases and production delays, making strategic material sourcing and potentially exploring alternative catalyst materials crucial for long-term stability. The future of clean mobility, while promising, remains deeply intertwined with the careful management of materials like Platinum.

Navigating the Challenges of High-Demand Automotive Materials: A Closer Look at Supply Chain Vulnerabilities, Environmental Impacts, and Strategic Alternatives for Palladium, Hexavalent Chromium, Lithium, Cobalt, and Nickel.

Our journey through critical automotive materials continues, as we now shift our focus to several other high-demand substances that present their own unique sets of challenges. Engineers must carefully consider these materials, not just for their functional benefits, but also for their broader implications on supply chain resilience, environmental footprint, and the strategic direction of the automotive industry. The insights from Morningstar Sustainalytics underscore the increasing importance of managing these raw material risks, urging a proactive and innovative approach.

Read more about: Buyer’s Regret: 12 Compact and Small Cars That Leave Owners Wishing for a Do-Over

7. **Palladium**Palladium, another distinguished member of the Platinum Group Metals (PGMs), plays an indispensable role in the ongoing operation of internal combustion engine (ICE) vehicles. Its primary application lies within catalytic converters, where it is a cornerstone in the critical process of transforming harmful pollutants into less noxious emissions and water vapor, thereby helping vehicles meet increasingly stringent environmental regulations. Despite the industry’s shift towards electrification, the sheer volume of ICE vehicles still on the roads ensures Palladium’s continued strategic importance.

However, the supply chain for Palladium mirrors the vulnerabilities seen with other PGMs, particularly Platinum. Global production of PGMs is heavily concentrated, with South Africa and Russia collectively accounting for approximately 83% of the total mine production in 2022. This extreme reliance on a limited number of countries means that any geopolitical tensions, trade disputes, or localized disruptions in these regions can ripple through the global automotive supply chain, causing significant price volatility and potential shortages.

The strategic value of Palladium, alongside other PGMs, has been clearly demonstrated by the nearly doubled value of imports for these materials between 2017 and 2022. This upward trend reflects not only their growing demand but also their non-negotiable role in modern vehicle manufacturing. For engineers, the challenge is clear: balance the proven performance benefits of Palladium in emission control with the inherent risks stemming from its concentrated and sensitive supply chain, pushing for innovative solutions that secure future availability and stability.

Read more about: Mechanic-Recommended Strategies: 5 Simple, Proven Ways to Safeguard Your Catalytic Converter from Theft

8. **Hexavalent Chromium**Chromium is a ubiquitous material in the automotive industry, highly valued for its ability to enhance durability and corrosion resistance in a variety of metal components, primarily when used in its alloy form. This broad application has fueled a significant market, with forecasts suggesting it will reach a staggering USD 2.3 billion by 2028. Its properties are undeniably beneficial for vehicle longevity and structural integrity, making it a go-to choice for many engineering applications within the sector.

However, the specific form of Hexavalent Chromium, often employed in the plating process for vehicle components, has raised serious environmental red flags. This particular variant has been definitively linked to risks of soil and groundwater contamination, drawing the attention of environmental regulators worldwide. The ecological footprint associated with its use presents a significant challenge for automakers striving for greater sustainability.

In response to these environmental concerns, regulatory bodies have begun to act decisively. The European Union, for instance, has implemented a ban on the use of hexavalent chromium in the production of car parts, including chrome plating, which is set to take full effect by the end of 2024. California, a key market and a leader in environmental legislation, has followed suit with a similar ban, though its enforcement will be phased in gradually between 2027 and 2039. These legislative shifts create an urgent imperative for innovation.

For engineers, these restrictions translate into considerable research and development costs. Automakers must now invest in designing vehicles with fewer or entirely without chrome-plated components, actively seeking alternative materials that can offer comparable durability, corrosion resistance, and aesthetic appeal without the environmental liabilities. This forces a re-evaluation of established practices and pushes the boundaries of material science to find sustainable substitutes.

Read more about: Top Walking Shoes for Men: Expert-Tested for Comfort and Support

9. **Lithium**The global push towards electric vehicles has undeniably placed Lithium at the forefront of critical raw materials. As passenger car sales soar and the industry accelerates its transition towards electrification, the demand for Lithium, a cornerstone component of EV batteries, has surged dramatically. This exponential growth in demand has even led many automakers to take unprecedented steps, directly investing in the mining sector to secure their future supply.

While Lithium is crucial for the energy storage systems that power modern EVs, its increased demand comes with a complex web of risks. The geographic concentration of its extraction and processing, though not as starkly presented in this context as with REEs or PGMs, nonetheless contributes to potential supply disruptions and price volatility. Such instabilities can create significant operational and financial pressures for manufacturers, impacting production timelines and the ultimate affordability of electric vehicles.

The importance of managing these risks is clearly highlighted by Morningstar Sustainalytics’ decision to add “Raw Materials Use” as a new material ESG issue. This framework specifically helps evaluate the environmental impacts related to Lithium’s extraction and use, as well as the management strategies automakers are adopting to mitigate them. Engineers are tasked with not only optimizing battery performance but also with ensuring the responsible and sustainable sourcing of this vital element.

Strategic alternatives and innovative approaches are already being explored across the industry. This includes advancements in battery chemistries that might reduce Lithium content, efforts to improve recycling rates for end-of-life EV batteries, and robust lifecycle assessments (LCAs) to understand and minimize the environmental footprint from mining to disposal. The quest for higher power and energy density in batteries, alongside sustainable sourcing, remains a pivotal engineering challenge.

Read more about: Rhythms of a Rock Legend: Dave Grohl’s 12 Classic Drum Kits and Signature Styles That Forged His Legacy

10. **Cobalt**Cobalt is another essential raw material inextricably linked to the rapid expansion of the electric vehicle market. Much like Lithium and Nickel, the unprecedented growth in EV sales directly translates into a heightened demand for Cobalt, which plays a critical role in the cathodes of many high-performance lithium-ion batteries. Without this versatile element, achieving the desired energy density and lifespan for EV power packs would be significantly more challenging.

The reliance on Cobalt, however, introduces a distinct set of supply chain vulnerabilities and ethical considerations that engineers must navigate. Although specific geographical concentration figures are not detailed in this context, the grouping of Cobalt with Lithium and Nickel under “raw materials used in EVs” points to similar concerns regarding demand-driven risks and potential supply disruptions. These factors contribute to the overall complexity of securing a stable and ethical material pipeline for EV production.

Moreover, the inclusion of “Raw Materials Use” as a new material ESG issue by Morningstar Sustainalytics specifically broadens the scope to evaluate risks associated with materials like Cobalt. This framework assesses both the exposure of companies to these risks and their management strategies, including environmental impacts related to extraction and processing. For automakers, a clear understanding and proactive mitigation of these risks are paramount to maintaining brand reputation and ensuring long-term operational viability.

Engineers are therefore challenged to innovate in ways that reduce dependence on Cobalt while maintaining, or even improving, battery performance. This could involve exploring alternative battery chemistries that use less Cobalt, enhancing recycling technologies to recover more of the material from spent batteries, or implementing stricter due diligence in sourcing to address social and governance concerns often associated with its mining. The responsible stewardship of Cobalt is a critical aspect of sustainable EV manufacturing.

Read more about: Behind the Recall Refusals: 14 Critical Reasons Your Vehicle’s Safety Fix Might Be Denied, and Your Rights as a Consumer

11. **Nickel**Nickel, much like Lithium and Cobalt, is a foundational material propelling the electric vehicle revolution. Its indispensable role in the advanced battery chemistries of EVs contributes significantly to their performance metrics, including energy density and overall range. As the global automotive industry continues its aggressive pivot towards electrification, the demand for Nickel in battery production has seen a corresponding and dramatic increase, underscoring its strategic importance.

The surging demand for Nickel exposes automakers to the same suite of risks that affect other high-value raw materials. This includes the potential for supply chain disruptions, which can stem from factors such as concentrated mining regions, geopolitical instabilities, or logistical challenges. Such vulnerabilities can lead to significant price volatility and impact production schedules, making the strategic management of Nickel supply a critical imperative for vehicle manufacturers.

The “Raw Materials Use” MEI, integrated into Morningstar Sustainalytics’ ESG Risk Ratings, provides a crucial lens through which companies’ exposure and management of risks related to Nickel can be assessed. This encourages automakers to adopt robust management programs, focusing on reducing overall raw material usage, increasing the incorporation of recycled materials into new production, and fostering innovation in material science and processing. These practices are vital for building a resilient and sustainable supply chain.

For engineers, this means an ongoing commitment to eco-design strategies, including lifecycle assessments (LCAs), to evaluate Nickel’s environmental impacts across the vehicle’s lifespan. It also drives innovation in battery design to optimize Nickel content, alongside efforts to establish efficient end-of-life programs for EV batteries to maximize recycling rates. By strategically addressing Nickel’s challenges, the industry can build a more sustainable future for electric mobility.

Read more about: 12 Crucial Money Lessons Former Child Stars Learned the Hard Way (And How You Can Too!)

The journey through the raw materials essential for the automotive industry’s future is as complex as it is critical. From the rare earth elements powering electric motors to the precious metals scrubbing emissions, and the battery components driving the EV revolution, each material presents a unique blend of opportunity and risk. Engineers stand at the vanguard, tasked with navigating supply chain vulnerabilities, mitigating environmental impacts, and championing innovation. The shift towards electrification and sustainable mobility demands a re-evaluation of conventional practices, urging a proactive embrace of eco-design, circular economy principles, and multi-material solutions. By understanding these inherent challenges and committing to strategic, responsible material management, the automotive sector can not only drive technological advancement but also pave the way for a truly sustainable transportation future for generations to come.