Extended car warranties, often called auto protection plans, promise a safeguard against unexpected breakdowns and surprise repair bills. This prospect of peace of mind is incredibly appealing. Especially as today’s vehicles evolve with complex electronics and advanced mechanical systems, repairs can become very costly.

However, this valuable coverage is frequently shrouded in confusion and pervasive misconceptions. The array of plan names, combined with automotive complexities and diverse offerings from warranty companies, makes understanding them challenging. These misunderstandings aren’t just frustrating; they can lead directly to unexpected expenses and deep dissatisfaction when you need your coverage most.

That’s why addressing common myths about extended car warranties is essential. Every contract holder should understand precisely what their plan covers (and doesn’t) and its duration. Lacking these vital details makes informed decisions difficult, fostering false beliefs. Let’s equip you with clear facts for smart, empowering choices regarding your vehicle’s long-term protection.

1. **Myth #1: Extended Warranties Are Always Worth the Cost (or are a scam / waste of money)**The promise of an extended warranty offering peace of mind is attractive, but it’s not universally beneficial. A common misconception paints these warranties as either a panacea or an outright scam. The reality demands a nuanced assessment of your situation, vehicle’s condition, and financial preparedness. This distinction is the first step toward an informed decision.

Consider, for example, if your car is already showing significant signs of age. If you’re intimately familiar with your tow truck driver, an extended warranty might be a poor investment. Funds allocated to a protection plan could be better used as savings towards a new, more reliable vehicle. They could also cover immediate repairs outside a warranty’s scope.

Conversely, if you have a robust emergency fund, a sudden repair bill might not pose a significant financial threat. For those with ample reserves, self-insuring by setting aside money for potential repairs could be more cost-effective. This strategy avoids consistently paying premiums for a warranty you might never fully utilize. This perspective is valuable if it aligns with your financial capacity.

It’s also crucial to distinguish reputable providers from less integrated operators. Many trustworthy companies offer legitimate extended warranties that can genuinely save you from financial distress. These plans protect against unexpected repairs after your original manufacturer’s warranty expires. Companies like Cuvrd emphasize working “only with A-rated providers, trusted partners,” offering “transparent coverage contracts” backed by underwriters with “a track record of fast, fair claims processing.” This transparency underscores that not all plans are scams and can offer substantial value.

Ultimately, the value of an extended warranty isn’t a simple yes or no. It requires weighing potential major repair costs against the warranty price. Consider your car’s age, mileage, reliability, and your financial safety net. By evaluating these factors, you determine if an extended warranty provides beneficial value, preventing it from becoming an unnecessary expense.

2. **Myth #2: Auto Warranties Cover All Repairs and Maintenance**One pervasive and potentially expensive misconception is that an extended warranty acts as an all-encompassing shield. It’s believed to cover every single repair and all routine maintenance your vehicle could ever require. This is simply not the case. While extended warranties protect against specific mechanical failures, they are rarely comprehensive “bumper-to-bumper” coverage, and almost never include routine maintenance.

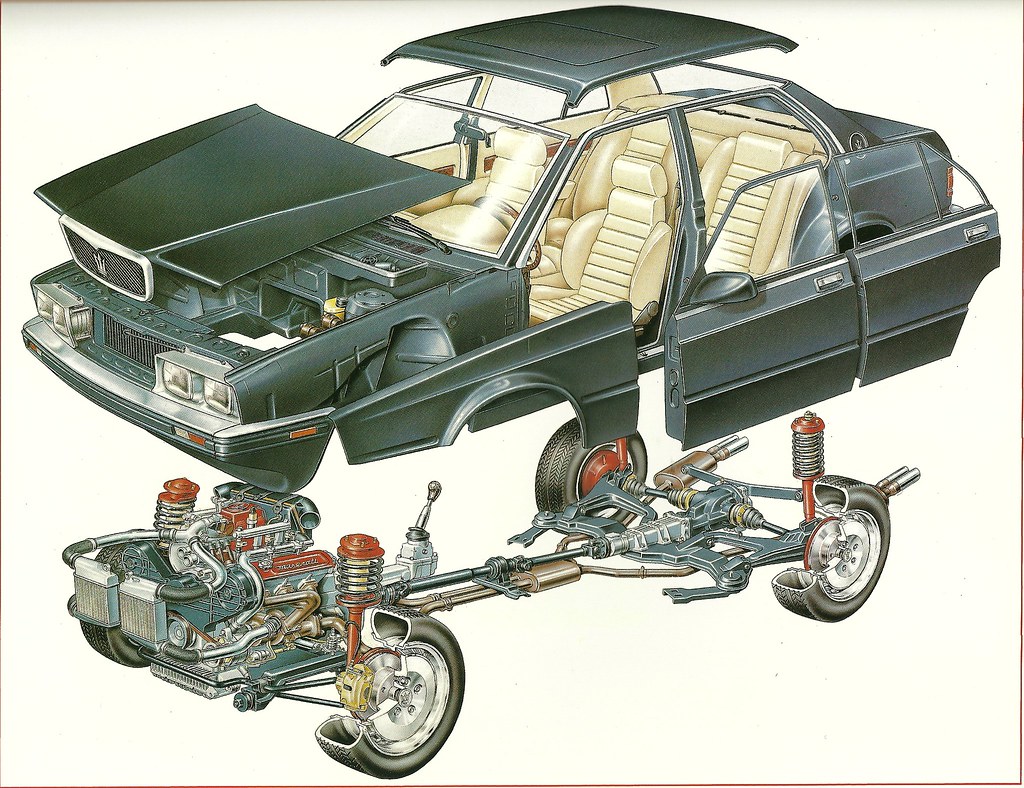

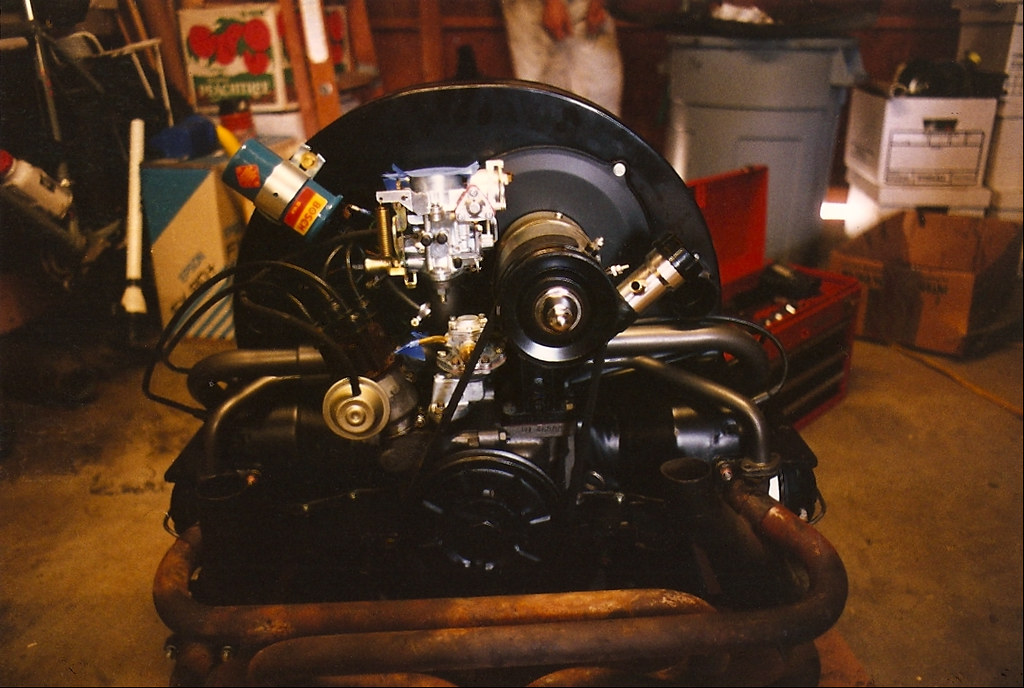

The precise scope of what’s covered varies dramatically across plans and providers. For instance, Endurance offers an “essential program” focused solely on key systems like the engine and transmission—their most affordable option. Choosing this basic coverage means you won’t be protected against issues with other components, such as your air conditioning. This stark difference underscores the necessity of meticulously reviewing “coverage details.”

At the more comprehensive end, plans like Endurance’s “Supreme plan” feature “exclusionary coverage.” This type comes “close to a new car ‘bumper-to-bumper’ warranty,” covering virtually everything *except* a short list of excluded parts. Unsurprisingly, this extensive protection comes at a higher price. The core message remains: always grasp the specific list of covered components and all exclusions before committing.

A vital distinction, frequently overlooked, is that extended warranties address “defects in manufacturing or workmanship,” not “issues relating to wear and tear.” This means common consumables and parts that naturally degrade, such as tires, brake pads, and rotors, are almost universally excluded. These items require replacement due to normal usage, not manufacturing flaws, and remain the owner’s financial responsibility. The context clarifies this, stating, “Most car warranties exclude tires, brake pads, and rotors from coverage.”

Furthermore, routine vehicle maintenance—including oil changes, tire rotations, and diagnostic exams—is generally not covered unless it’s a specific, additional feature of the plan. Endurance’s “Advantage coverage” is an example, offering “up to $3,500 in maintenance services.” However, the source clearly labels this as “the exception, not the rule.” Relying on a standard extended warranty for regular service needs will likely lead to frustration and unexpected bills.

3. **Myth #3: It’s Necessary to Get Car Serviced at the Dealership to Maintain the Warranty**This myth is a pervasive and often financially motivated misconception propagated by some automotive retailers. They foster the false belief that customers must exclusively use dealership service departments to maintain their vehicle’s warranty validity. This is unequivocally false, and it’s critical information every car owner should know to protect their consumer rights.

The federal Magnuson-Moss Warranty Act stands as your protection. This significant law provides “a layer of protection for consumers experiencing problems with their vehicles beyond what is offered by state ‘lemon laws.'” It ensures a manufacturer cannot legally void your warranty simply because you chose an independent shop for routine maintenance or repairs. As long as the service is performed correctly, utilizes approved parts, and adheres to the manufacturer’s recommended schedule, your warranty remains fully intact.

To effectively safeguard your warranty, two steps are paramount: consistent adherence to the manufacturer’s maintenance schedule and the use of quality, approved parts. It is always wise to utilize “an ASE Certified mechanic or shop,” as these professionals meet rigorous industry standards. Beyond this, diligently maintaining comprehensive records of all service performed, including detailed receipts and work orders, is crucial. These records serve as undeniable proof that required maintenance has been completed.

The flexibility to choose your repair facility is often a significant benefit highlighted by reputable extended warranty providers. For instance, Endurance contract holders “can also choose from any ASE Certified mechanic or repair facility for covered repairs.” This freedom not only thoroughly debunks the myth but also empowers consumers to seek competitive pricing and trusted local mechanics, rather than being restricted to potentially more expensive dealership services. It’s about maintaining control over your vehicle’s service needs and ensuring cost-effectiveness.

4. **Myth #4: All Extended Warranties are the Same**Just as there’s a vast landscape of insurance contracts, the realm of extended car warranties is far from uniform. The widespread notion that “all extended warranties are the same” is a significant misconception. It can lead consumers to purchase plans inadequate for their needs or excessively costly for the coverage received. Recognizing this diversity is fundamental to selecting a plan that genuinely offers value and peace of mind.

The variety in coverage options is truly extensive. Car owners are presented with plans offering dramatically different costs and protection levels. Some might concentrate solely on critical powertrain components. Others extend to complex electrical systems, hybrid components, or nearly all mechanical parts (exclusionary coverage). Specific terms, conditions, and, importantly, exclusions vary significantly between providers and even between different tiers of plans from the same company.

Furthermore, the financial structure of extended warranties also varies considerably. Most plans incorporate different deductible options, profoundly impacting your out-of-pocket expenses at the time of repair. This consequently influences your monthly or upfront premium. A higher deductible typically results in lower premiums, offering a practical way to tailor the plan to fit your budget. This flexibility demonstrates that a “one-size-fits-all” approach is rarely suitable.

The context explicitly cautions against “companies that only offer a one-size-fits-all extended warranty without any options for adapting coverage.” Such offerings can be a warning sign, suggesting a lack of consumer-centric design. With limited options, you might inadvertently “either pay too much or find less comprehensive protections” than you truly need. Instead, seek providers offering customizable plans to tailor coverage to your vehicle, driving patterns, and financial parameters.

By diligently comparing different providers, evaluating various plan levels, understanding deductible structures, and meticulously reviewing terms—as encouraged by platforms like Cuvrd—you can confidently navigate the complex market. This thorough evaluation ensures you select a plan that aligns with your vehicle’s requirements and financial expectations, definitively debunking the myth of uniformity.

5. **Myth #5: New Cars Don’t Need an Extended Warranty / Warranties Are Only for New Products**A common belief among many car owners is that a brand-new car, still under its factory warranty, has no immediate need for additional protection. This notion also extends broadly to other products, suggesting extended warranties are exclusively for new purchases. While a manufacturer’s warranty provides essential initial coverage, there are distinct strategic advantages to considering an extended warranty even for a new vehicle, and they are exceptionally valuable for used cars.

One compelling argument for securing an extended warranty for a new car revolves around financial prudence: “The earlier you buy an extended warranty, the cheaper it is.” This principle mirrors how life insurance premiums work; they are typically more affordable the younger you are. Purchasing an extended warranty early—potentially before its factory warranty nears expiration—can effectively lock in a lower rate. This offers significant long-term savings compared to waiting until your original coverage is nearly depleted.

Beyond potential cost savings, many extended warranties provide enhanced benefits not included with a standard factory warranty. Endurance’s “Advantage coverage” is a prime example. While new cars come with basic defect coverage, they rarely offer comprehensive maintenance services. The “Advantage program” includes valuable services like “car battery replacement, alignment checks, and other services you’d otherwise have to pay for, no matter how good the new car warranty is.” These additional perks significantly elevate the overall value proposition.

Furthermore, the idea that extended warranties are *only* for new products is thoroughly debunked by their immense utility for used and high-mileage vehicles. As cars age and accumulate miles, the likelihood of expensive repairs inevitably increases. Once the original manufacturer’s warranty expires, the owner becomes fully responsible for all repair costs. Extended warranties for used cars serve as a crucial financial safety net, particularly for major mechanical issues. They are “especially helpful for used cars once the original warranty is up and the chance of expensive repairs increases.”

Therefore, whether you’re behind the wheel of a brand-new vehicle or a cherished older model, evaluating an extended warranty involves looking intelligently beyond the initial factory coverage. It’s about proactively securing potential cost savings, accessing enhanced benefits, and obtaining critical protection against increased repair likelihood as a vehicle matures. The decision is less about the car’s “newness” and more about implementing smart, forward-thinking vehicle protection strategies.

6. **Myth #6: Extended Warranties Are Too Expensive**The perception that extended warranties are inherently costly is a significant hurdle for many consumers. The initial “sticker shock at the dealership can make extended warranties look cost-prohibitive,” leading many to prematurely dismiss their value. This immediate apprehension often stems from a lack of transparency in pricing and a misunderstanding of how plan costs are determined, painting all warranties with the same broad, expensive brush.

However, the reality of pricing for extended warranties is far more nuanced and flexible than often presented. Unlike a fixed price tag, the cost of an extended warranty is influenced by several factors, including the vehicle’s make, model, age, mileage, and the specific level of coverage chosen. Many trustworthy companies, in contrast to high-pressure dealership tactics, offer upfront and competitive pricing, especially when you consider options available online. This approach helps consumers avoid unnecessary “dealer markups” and find plans that genuinely fit their financial parameters.

Furthermore, extended warranties are not a one-size-fits-all financial commitment. Most plans offer considerable flexibility through various deductible options, directly impacting your upfront or monthly premiums. A higher deductible, for instance, typically leads to lower recurring costs, allowing you to tailor the plan to your budget while still securing essential protection. This empowers you to manage your cash flow effectively, proving that a costly initial impression doesn’t always reflect the final, adaptable price.

When evaluating the expense, it’s crucial to weigh the warranty’s cost against the potential financial burden of unexpected repairs. Modern vehicles, with their complex electronics and intricate mechanical systems, can incur repair bills ranging from hundreds to thousands of dollars for even a single component failure. In many scenarios, “when your repair bill arrives, you’ll be relieved you locked in a rate that ends up paying for itself after just one major repair.” This critical perspective reveals that an extended warranty can transform a potentially devastating out-of-pocket expense into a predictable, manageable investment in your vehicle’s longevity and your financial peace of mind.

To truly demystify the cost, consumers should actively engage in comparing warranty providers and their offerings. “Look at what each warranty covers and how much it costs to get the most bang for your buck.” This proactive approach, coupled with understanding various pricing models and the ability to customize your deductible, is how you can effectively debunk the myth of universal expensiveness and secure valuable protection within your budget.

7. **Myth #7: You’ll Never Use the Warranty**This widespread misconception often stems from a belief in a vehicle’s inherent reliability or an assumption that one will simply be lucky enough to avoid major breakdowns. Many car owners, especially those with relatively new or well-maintained vehicles, might think, “If my car’s been reliable so far, why bother?” They assume that any minor issue will be manageable, and major repairs are something that happens to ‘other people’s’ cars.

However, this overlooks the increasingly intricate nature of modern automotive engineering. Today’s vehicles are sophisticated machines, “packed with complex electronics, turbochargers, and hybrid systems.” The sheer number of components and advanced technologies means there are more points of potential failure, and diagnosing and repairing these systems can be incredibly expensive. Even a seemingly small issue, such as “a single malfunctioning sensor or a failing fuel pump,” can quickly lead to an out-of-pocket expense of “$1,000–$2,000,” proving that even a single repair can justify the cost of coverage.

Contrary to the belief that you’ll never use it, data suggests otherwise. The reality is that “the majority of customers file at least one claim within three years of coverage.” This powerful statistic debunks the myth, illustrating that engaging your warranty is a common occurrence, not a rare exception. As cars age and accumulate miles, the probability of experiencing a significant mechanical issue inevitably rises, making comprehensive protection a wise, proactive decision.

Beyond the tangible financial savings, an extended warranty provides an invaluable sense of security. It offers “peace of mind that comes with knowing you’re covered for those just-in-case moments,” transforming potential financial crises into manageable inconveniences. This allows you to drive with greater confidence, knowing that unexpected breakdowns won’t derail your budget or leave you stranded without support. It’s an empowering tool designed to safeguard your financial well-being against the unpredictability of vehicle ownership.

Consider the broader value proposition beyond just direct repair costs. Having a warranty in place can elevate your car’s resale value, as “Many of them are [transferable], which can up your car’s value if you’re thinking of selling it.” This long-term benefit, coupled with the immediate peace of mind and protection against unexpected expenses, underscores that warranties are often used and provide multiple layers of value, far beyond the initial ‘if it breaks’ scenario.

8. **Myth #8: You Must Buy an Extended Warranty at Checkout**The notion that purchasing an extended warranty is a time-sensitive decision, exclusively available at the point of sale, is a common misconception that often creates undue pressure on consumers. Many believe that if they don’t add the warranty during the initial transaction for their new car or appliance, they’ve missed their only opportunity. This can lead to hurried choices, potentially resulting in less-than-ideal coverage or higher costs simply due to perceived urgency.

Contrary to this widely held belief, you are not cornered into an immediate decision. The fact is that “extended warranties can typically be purchased within a certain timeframe after the initial product purchase,” providing crucial flexibility. This window allows you to step back, research, and make a decision free from the sales pressure often encountered at the checkout counter. It ensures you have the opportunity to truly consider your options rather than committing prematurely.

This extended purchasing window offers a significant advantage: it allows for strategic “timing your purchase.” You can take the time to evaluate the product’s actual performance and reliability after taking it home. For a vehicle, this means driving it for a few weeks or months, getting a real feel for its operation, and seeing if any initial quirks emerge. This practical assessment allows you to align your warranty decision with your personal experience and the car’s demonstrated behavior, rather than solely relying on theoretical needs.

Furthermore, your options for acquiring an extended warranty extend well beyond the original seller. There are “alternative buying options available outside the point of sale,” including reputable “third-party providers or directly from the original manufacturer later on.” This expands your choices significantly, enabling you to “investigate various suppliers to find the most suitable coverage and pricing.” This empowers you to shop around, compare terms, and secure the best possible value for your long-term vehicle protection, definitively debunking the myth of forced immediate purchase.

To maximize your advantage, use this flexibility to your benefit. “It’s imperative to investigate various suppliers to find the most suitable coverage and pricing.” This means not just comparing costs, but also scrutinizing the reputation of the provider, their customer service track record, and the transparency of their contracts. A well-timed, well-researched purchase ensures you’re getting the right protection, on your terms, not just the first offer presented.

9. **Myth #9: The Claims Process Is a Nightmare**The perception that filing an extended warranty claim is an arduous and frustrating ordeal is a powerful deterrent for many potential buyers. Tales of “nightmare stories of claim denials, mountains of paperwork, and months of waiting” circulate, painting a picture of a bureaucratic headache that makes the coverage seem hardly worth the effort. It’s natural to be wary of any process that adds stress during an already inconvenient vehicle breakdown.

However, with reputable extended warranty providers, the claims process is designed to be far more straightforward and user-friendly than these stories suggest. The primary relief comes from the fact that “Most people drop their car off at the repair facility and they take over the process for you.” This means the service center handles the lion’s share of the administrative work, coordinating directly with the warranty administrator. Your role is minimized, allowing you to focus on getting your vehicle back on the road.

A key aspect of this streamlined process is the financial transaction: “Covered repairs are paid directly from the administrator and you simply pay your deductible when you pick up your vehicle.” This eliminates the significant financial burden of paying for a costly repair upfront and then waiting for reimbursement, which can be a major stressor for many. It ensures that your out-of-pocket expense is limited to the deductible, making the repair process financially manageable and transparent.

To ensure a smooth claims experience, the most critical step is selecting a provider known for its transparency and customer commitment. Look for companies that offer “transparent coverage contracts” and are backed by “an insurance underwriter with a track record of fast, fair claims processing.” Understanding your plan’s specific “coverage details” and knowing “how to file a warranty claim” beforehand are practical steps that empower you to navigate any issue with confidence, turning potential nightmares into manageable resolutions. This informed approach will significantly alleviate concerns about the claims process.

Finally, remember the importance of maintaining proper records. “You’ll need to maintain records, and using an ASE Certified mechanic or shop is always a good idea.” While the repair facility often handles the claims submission, having your own meticulous documentation of services performed, including detailed receipts and work orders, serves as an invaluable backup. This diligence ensures you have undeniable proof that required maintenance has been completed, further smoothing any claim.

### The Road Ahead: Driving with Informed Confidence

We’ve tackled some of the most stubborn myths surrounding extended car warranties, moving past the common misconceptions of excessive cost, guaranteed disuse, rigid purchase timings, and daunting claims processes. The aim here is clear: to empower you with direct, actionable knowledge, helping you navigate these complex decisions with confidence.

Understanding the nuanced realities of extended warranties transforms them from a vague expense into a tangible tool for financial protection and peace of mind. By evaluating your specific needs, comparing providers, and leveraging flexible options, you can select a plan that genuinely safeguards your vehicle and your wallet.

Don’t let outdated fears or misinformation drive your decisions. Instead, equip yourself with the facts, critically assess your options, and take control of your vehicle’s long-term protection. Making an informed choice about an extended warranty is a practical step toward greater financial security on the road. For more expert advice on car care and optimizing your vehicle’s lifespan, keep exploring reliable resources designed to empower your journey.