Embarking on the journey of retirement opens up new possibilities, but it also brings unique financial considerations. Successfully navigating these waters, especially when planning for significant expenditures like car ownership, hinges on a single, powerful tool: a well-structured budget. Budgeting isn’t about restriction; it’s about empowerment, giving you the clarity and control to direct your money toward the life you envision, rather than wondering where it all went.

Taking control of your money through diligent budgeting means you are actively telling your finances where to go every month. This proactive approach helps prevent overspending and ensures that your financial resources are aligned with your goals, whether that’s maintaining an emergency fund, traveling, or securing reliable transportation for your retirement years. It’s a foundational skill that even seasoned investors and millionaires employ to maintain their financial equilibrium.

For many, the thought of creating a budget can seem daunting or overwhelming, but it doesn’t have to be. With a clear, step-by-step approach, you can master this essential skill and unlock greater financial peace of mind. We’ll walk you through the fundamental steps to construct a budget that is not only effective but also flexible enough to adapt to your changing needs in retirement. Let’s dive into how you can make a budget work for you, setting the stage for smart financial decisions, including important long-term goals like car ownership.

1. **Understand Your Income**

The very first step in constructing a solid budget is to gain a clear understanding of all the money you expect to receive during the month. This means meticulously listing your income, which refers to any money you plan to get. It includes your regular paychecks, if you’re still working part-time, as well as any extra money you might earn from side hustles, freelance work, or even a garage sale. Think of every stream of income, no matter how small, and ensure it’s accounted for in your financial plan.

It’s crucial to work with your net income, which is the amount you bring home after taxes and any other deductions have been taken out of your paycheck. For those with a spouse, you can create separate income budget lines for each paycheck you both receive, providing a granular view of your household’s total earnings. This detailed approach ensures that you have an accurate picture of the funds available before you begin allocating them.

For individuals with an irregular income, which is common in retirement or if you rely on variable sources, a pragmatic approach is necessary. Take a look at your income over the last few months and list the lowest amount as your income budget line for the current month. This conservative estimate helps you avoid overspending. If you happen to make more later in the month, that extra money can then be allocated toward your savings goals or other budget lines, providing a welcome boost to your financial progress.

Having a clear and precise understanding of your income forms the bedrock of your budget. Without this foundational knowledge, accurately planning for expenses and savings becomes significantly more challenging. It ensures you’re making decisions based on your actual financial capacity, empowering you to make realistic and achievable plans for your future.

Read more about: Therapists Reveal the 10 Worst Excuses Holding You Back from Better Mental Health

2. **List and Prioritize Your Expenses**

Once you have a firm grasp on the money flowing into your accounts, the next critical step is to identify where that money is going. This involves listing all your monthly expenses, a task that often reveals surprising insights into your spending habits. A helpful tip is to open up your online bank account or gather your recent bank statements, as these will provide the necessary information to accurately fill out the numbers for your expenses.

Knowing your budgeting priorities is paramount. When planning for the month ahead, certain expenses should always take precedence over others. The guidance suggests a specific order for listing these expenses to ensure your most vital needs are covered first. Starting with giving, where putting 10% of your income fosters a spirit of generosity, sets a positive tone for your financial plan right from the outset.

Following generosity, prioritize saving. It’s essential to pay yourself first before you pay everyone else, meaning contributions to an emergency fund or other savings goals should be a high priority. If you have existing debt, particularly high-interest debt, addressing that should take precedence over building extensive savings, typically by using your ‘save’ money towards an emergency fund and a debt snowball. This strategic sequencing helps build a strong financial foundation while aggressively tackling liabilities.

Next, focus on what are known as The Four Walls: food, utilities, shelter, and transportation. These are your absolute essentials, and you should create specific budget categories for each, with detailed lines underneath for your particular expenses within those categories, like groceries, electricity, mortgage, or gasoline. Accounting for these fundamental needs ensures your basic living requirements are met before moving on to discretionary spending.

Finally, list all other monthly expenses. Begin with important fixed costs like insurance and childcare, and then move to more variable or non-essential categories such as personal spending, fun money, and entertainment. It’s also wise to include a miscellaneous line in your budget for unexpected expenses that inevitably arise. Remember, categories are like folders and budget lines are the files within them; customize them to accurately reflect all your financial outflows, acknowledging that fixed expenses like rent remain constant, while variable expenses like groceries or gas will fluctuate and may require a few months to accurately estimate.

Read more about: Hybrid Cars in 2025: A Comprehensive Consumer Guide to Value, Performance, and Whether They’re Still Worth Your Investment

3. **Calculate Your Financial Margin (Income – Expenses)**

With your income clearly itemized and your expenses meticulously listed and prioritized, the pivotal third step is to perform the crucial calculation: subtracting your total expenses from your total income. This simple arithmetic reveals your financial margin—the amount of money you have left over after all your anticipated outgoings are covered. The objective is for this number to be greater than zero, indicating that you are living within your means and potentially have funds available for savings or debt reduction.

If, after this calculation, the number is less than zero, it’s a clear signal that you are currently spending more money than you make. This isn’t a cause for despair but rather an opportunity for adjustment. It means you need to revisit your listed expenses and identify areas where you can make changes. This could involve reducing discretionary spending, finding more cost-effective alternatives for necessities, or exploring ways to increase your income, bringing your budget back into a positive balance.

Discovering a positive margin is empowering, as it means you have financial flexibility. This surplus, often referred to as ‘hidden margin,’ represents the money you can intentionally direct towards achieving your financial goals. It might be increasing your emergency fund, accelerating debt repayment, or saving for that significant retirement purchase you’ve been dreaming of, such as a new car. The clarity this calculation provides is invaluable, transforming abstract financial flows into tangible numbers that guide your decisions.

This step is where the rubber meets the road in budgeting. It’s the point where you see the tangible outcome of your income and expense tracking, allowing you to confirm that you’re in control of your money, not the other way around. By consistently performing this subtraction, you gain a powerful understanding of your financial health and the capacity to make informed decisions about your resources.

4. **Track Your Spending Consistently**

Creating a budget is an excellent start, but its true effectiveness hinges on one critical practice: consistently tracking all your spending throughout the month. This means diligently logging every expenditure, no matter how small, to prevent overspending and ensure that your actual outflows align with your planned budget. It’s the daily discipline that transforms a static plan into a dynamic tool for financial control.

There are numerous tools available to assist with tracking your spending, allowing you to choose a method that best fits your lifestyle. You can opt for traditional paper and pencil, which offers a tactile and reflective experience, or utilize a computer spreadsheet for greater organization and automated calculations. For those who prefer convenience and accessibility, budgeting apps like EveryDollar, MoneyLion, Mint, or Rocket Money provide intuitive platforms to input numbers and access your budget on the go.

The key is not the tool itself, but the consistency of its use. Regularly monitoring your spending habits provides invaluable insights into where your money truly goes. If you notice areas where you’re consistently overspending, such as dining out or online subscriptions, this tracking highlights those hotspots, allowing you to make targeted adjustments. This awareness empowers you to cut those costs and reallocate funds towards more pressing financial priorities, such as savings or debt repayment.

Tracking also helps you differentiate between fixed and variable expenses and refine your estimates over time. For instance, the grocery budget line is a common area where people tend to overspend initially. Consistent tracking for a couple of months will help you get the hang of it, allowing you to adjust your best estimate based on your past spending history. This iterative process of tracking, reviewing, and adjusting makes your budget increasingly accurate and effective, serving as a powerful guiding tool for financial success over time.

Read more about: Wheels of Fortune: Uncovering 15 Legendary Celebrity-Connected Cars That Revved Past a Million Dollars

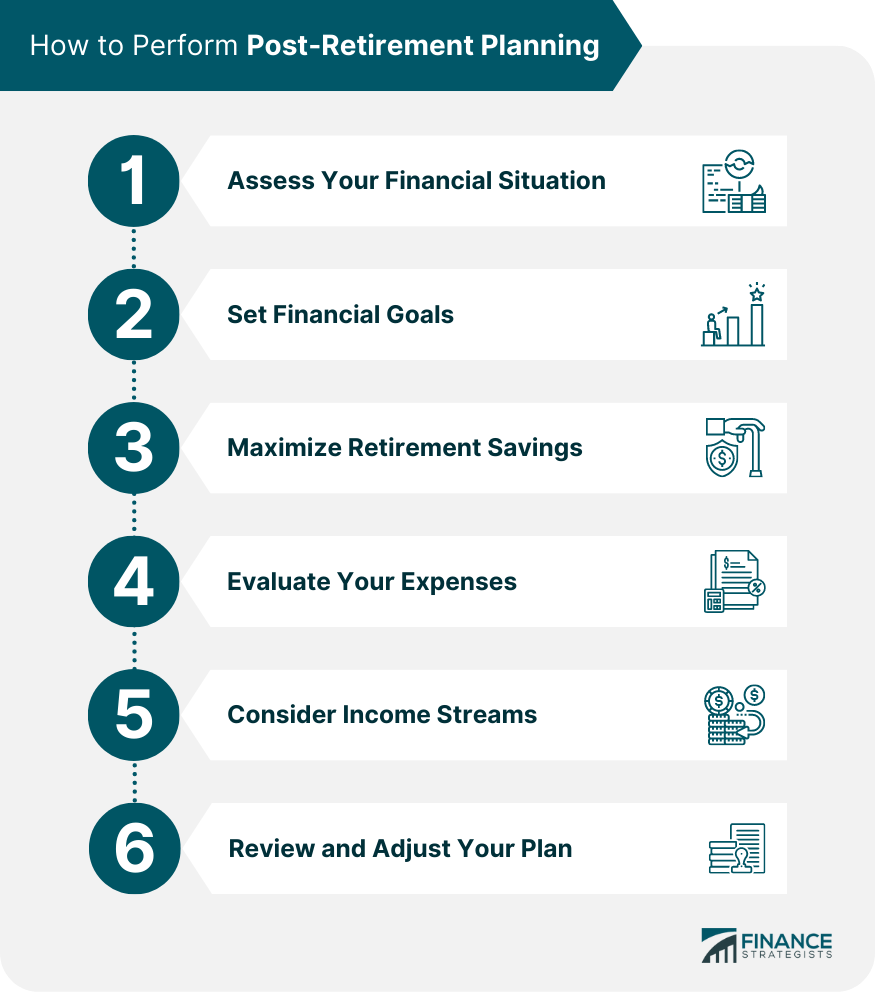

5. **Set Clear Financial Goals**

Budgeting becomes far more meaningful and motivating when it’s tied to specific, clear financial goals. Identifying what you want to achieve with your money is the critical first step in truly making your budget work for you. Whether your aspiration is booking a dream vacation, buying a home, becoming debt-free, or, pertinent to your retirement, securing reliable car ownership, setting these goals helps you stay focused and provides the necessary motivation to stick to your budget plan.

Goals transform abstract numbers into tangible achievements. Without a clear destination, it’s easy to lose momentum or divert funds aimlessly. The process of defining your goals can be supported by various resources, such as the 7 Baby Steps plan, which breaks down important money goals into easy-to-understand, actionable steps. These frameworks help clarify what you should be focusing on at different stages of your financial journey, ensuring your budgeting efforts are strategically aligned.

To amplify your motivation, consider making your goals visible. Placing a photo of your objective near where you perform your budgeting tasks, or creating a vision board, can serve as a constant reminder of what you are working towards. This visual reinforcement helps embed your aspirations into your daily financial decisions, reinforcing the purpose behind every dollar saved or strategically spent.

Even if you don’t have a concrete goal immediately, taking control of your money through budgeting is a worthy goal in itself. It sets you on the right track, ensuring that when a specific aspiration does emerge, you already possess the disciplined habits and financial foundation to pursue it confidently. Your budget essentially becomes the roadmap to realizing these aspirations, connecting your daily spending to your long-term dreams and empowering you to live a more intentional financial life.

Read more about: Therapists Reveal the 10 Worst Excuses Holding You Back from Better Mental Health

6. **Plan for the Unexpected with an Emergency Fund**

An essential and non-negotiable component of any robust budget is planning for the unexpected. Life inevitably throws curveballs, and having an emergency fund is your financial safety net, designed to cushion the impact of unforeseen expenses. These might include sudden medical emergencies, unexpected home repairs, or even the costs associated with car maintenance or replacement in retirement. Without such a fund, these surprises can quickly derail your financial stability and force you into debt.

Financial experts universally recommend building an emergency fund. Many suggest starting small but consistently. For instance, NerdWallet advises aiming for an initial $500, which can be enough to cover many small emergencies. If even that initial amount feels out of reach, the key is to commit to putting at least a little bit toward the fund with every paycheck or income disbursement, gradually building it over time.

The ultimate goal for an emergency fund is typically to accumulate enough to cover three to six months of your basic living expenses. This includes essentials like rent or mortgage payments, groceries, utilities, and other non-negotiable costs. Reaching this target might take a significant amount of time and consistent effort, and that’s perfectly normal. The important thing is to keep adding to it, making it a priority within your budget, much like any other essential expense.

To make building this critical fund easier, consider automating your savings. Setting up automatic deposits from your checking account to a dedicated emergency fund account on your paydays ensures that you are consistently contributing without relying on willpower. This ‘set it and forget it’ approach helps your fund grow steadily. Should an emergency occur, use the fund as intended, and then make replenishing it a top priority, understanding that this financial cushion is vital for your long-term security and peace of mind.”

Sustaining your financial well-being throughout retirement requires more than just an initial budget; it demands ongoing adaptability and the implementation of strategic budgeting methods. As your life circumstances and the economic landscape evolve, so too must your financial plan. This section delves into advanced techniques and management practices that ensure your budget remains a dynamic and effective tool, helping you maintain long-term financial security and realize significant retirement aspirations, such as reliable car ownership.

Read more about: Navigating the Nuances of Money: Lessons from History and Economics for Retirees

7. **Review and Adjust Your Budget Regularly**

Creating a budget is an ongoing process, not a one-time event. The financial world and your personal circumstances are constantly changing, making periodic review and adjustment absolutely essential for your budget to remain effective. Without regular check-ins, your carefully crafted plan can quickly become outdated, failing to accurately reflect your current income, expenses, or financial goals.

This critical step involves comparing your actual spending against your planned budget for the month. It’s an opportunity to identify discrepancies, understand where your money truly went, and pinpoint areas where you might be consistently overspending or underspending. This information is invaluable for making informed adjustments, ensuring your budget aligns with reality and actively supports your financial objectives.

A well-designed budget must possess flexibility to accommodate life’s inevitable shifts. This means being prepared to adjust for seasonal costs, holidays, or unexpected quarterly expenses. If you find a particular budgeting system is no longer serving you, or if your income or spending habits change significantly, don’t hesitate to consider trying a different strategy. Switching your budget isn’t a sign of failure; it simply means your budget is working for your life.

By consistently reviewing your budget, perhaps at the end of each month, you gain clarity on what worked and what didn’t. This iterative process allows you to refine your estimates, especially for variable expenses like groceries, and make necessary changes for the upcoming month. Such diligence transforms your budget into a dynamic guiding tool for sustained financial success in retirement.

Read more about: Why Your Trusted Older Car Might Secretly Be Draining Your Wallet: Unpacking Unexpected Insurance Premium Hikes

8. **Choosing a Budgeting System: The 50/30/20 Rule**

While Section 1 guided you through the foundational steps of creating a budget, the next layer of sophistication involves selecting a specific budgeting system that aligns with your lifestyle and financial personality. Among the myriad of available approaches, the 50/30/20 rule stands out as one of the simplest, most foolproof, and highly strategic methods, particularly suitable for those new to structured budgeting or those seeking a clear, big-picture framework.

This popular rule advocates for a straightforward allocation of your after-tax income. You designate approximately 50% of your income towards “needs,” which encompass essential expenditures like rent or mortgage payments, basic utilities, groceries, transportation costs, and insurance. These are the non-negotiable elements required for living and working, forming the bedrock of your financial stability.

The next 30% of your income is typically allocated to “wants.” These are the expenses that enhance your quality of life but aren’t strictly essential for survival or work. This category might include dining out, streaming services, travel, entertainment, or gifts. It’s crucial to differentiate between wants and needs, though the line can sometimes blur, as decisions like organic groceries or house cleaning services can vary from person to person.

Finally, the remaining 20% of your after-tax income is committed to “savings and debt repayment.” This vital portion is directed toward building your emergency fund, saving for future goals like a new car or a dream vacation, and paying off debt balances beyond the minimum required payments. This balanced approach ensures you’re addressing current needs, enjoying life, and building a secure financial future simultaneously.

It’s important to remember that this rule is a guideline, not a rigid mandate. If your basic needs consistently exceed 50% of your income, it’s perfectly acceptable to temporarily draw from your “wants” category. However, if this imbalance persists, it may be a signal to explore other budgeting models, such as a 60/20/20 breakdown, or to identify opportunities to reduce fixed expenses, like finding a better cell phone plan or refinancing a mortgage.

Read more about: Precision Spending: 12 Budgeting Underdogs That Dominate Financial Debt

9. **Zero-Based Budgeting: Every Dollar Has a Job**

For those who crave granular control and want to ensure every single dollar is purposefully allocated, zero-based budgeting offers a powerful methodology. This approach mandates that every dollar you earn during a given month is assigned a specific job, leaving no funds unaccounted for. It’s a proactive strategy that transforms your money from an ambiguous flow into a directed resource.

In a zero-based budget, you subtract all your planned expenses and savings contributions from your total income, aiming for a net result of zero. This doesn’t mean your bank account balance ends at zero; rather, it signifies that every cent has been given an assignment – whether it’s for rent, savings, gas, or even a discretionary expense like that casual dinner out. By forcing this allocation, the method makes it nearly impossible for “mystery money” to slip through the cracks.

This method thrives on detailed planning and accountability. By meticulously assigning a purpose to each dollar, you gain unparalleled clarity on where your money is going, preventing overspending and ensuring that your financial resources are directly aligned with your priorities. It empowers you to be the master of your money, rather than wondering where it vanished to by month’s end.

Zero-based budgeting is particularly well-suited for individuals who are actively working to pay down debt, as it demands a close examination of every expenditure and fosters a disciplined approach to financial management. It’s an excellent choice for “control freaks and detail lovers” who benefit from knowing precisely how every cent contributes to their financial progress, offering a clear roadmap for achieving ambitious monetary goals in retirement.

Read more about: Unlock Financial Freedom: 10 Budgeting Strategies Financial Gurus Really Wish You’d Stop Ignoring

10. **The Cash Stuffing (or Envelope) Method**

In an increasingly digital financial world, a classic, tactile budgeting method has seen a resurgence for its sheer effectiveness in controlling spending: the cash stuffing, or envelope, method. This technique harkens back to a simpler time, providing a tangible way to manage your money that can be incredibly impactful for those who struggle with overspending, especially with the ease of credit and debit cards.

The premise is straightforward: at the beginning of each budgeting period, you withdraw physical cash for various variable expense categories, such as groceries, gas, or entertainment. You then place these amounts into separate, labeled envelopes. Once the cash in an envelope is depleted, spending for that category stops until the next budgeting cycle. This physical limitation acts as an immediate and undeniable boundary, preventing you from exceeding your allocated funds.

This method’s power lies in its ability to foster immediate accountability. Unlike swiping a card, handing over cash creates a more conscious connection to your spending, making you acutely aware of how much is left. It discourages impulse purchases and encourages mindfulness, forcing you to ask, “Do I really need this?” before parting with your hard-earned money.

For individuals who find themselves consistently overspending or needing a clear, undeniable limit, the cash stuffing method provides the discipline necessary to adhere to a budget. It’s an excellent tool for “overspenders who need discipline and clear limits,” providing a visible, concrete system that makes managing variable expenses simpler and more effective, ensuring funds are available for critical retirement needs like car maintenance.

11. **Automated Budgeting: Let Technology Do the Work**

In the modern era, leveraging technology can transform budgeting from a tedious chore into an almost effortless process. Automated budgeting is a sophisticated approach that capitalizes on digital tools and platforms to track expenses, automate savings, and manage financial flows in the background. It’s ideal for those who prefer a “set it and forget it” strategy, minimizing decision fatigue and boosting consistency.

Apps like MoneyLion, Mint, or Rocket Money are at the forefront of this revolution, offering intuitive platforms that allow you to input numbers, monitor spending, and access your budget on the go. While Section 1 touched upon using apps for tracking, automated budgeting goes a step further by orchestrating various financial tasks automatically. This can include categorizing transactions, sending alerts for overspending, and, most critically, facilitating automatic transfers.

A core benefit of automated budgeting is the simplification of savings. You can set up automatic deposits to dedicated accounts, such as an emergency fund, investment, or retirement account, timed with your paydays. This ensures that a portion of your income is consistently allocated towards your financial goals without relying on willpower or remembering to make manual transfers. For those with irregular incomes, setting reminders for when to move money can further enhance this system.

This hands-off approach makes consistency almost effortless, a crucial element for long-term financial stability in retirement. It empowers “tech-savvy folks” to maintain a disciplined financial regimen, freeing up mental energy while ensuring their money is working efficiently towards critical objectives like funding reliable transportation or other significant retirement expenditures.

Read more about: Unlock Financial Freedom: 10 Budgeting Strategies Financial Gurus Really Wish You’d Stop Ignoring

12. **The “Pay Yourself First” Principle**

At the heart of building substantial wealth and achieving long-term financial security lies a powerful principle: “Pay Yourself First.” This strategic budgeting philosophy flips the traditional spending script by prioritizing savings and investments before any other expenses are considered. It’s a deliberate shift that ensures your financial future is not an afterthought but a primary focus.

Under this principle, as soon as you receive your income, a predetermined amount is immediately directed into your savings, emergency fund, or retirement accounts, such as a Roth IRA. The genius of this system is that it builds wealth in the background, consistently growing your financial cushion without requiring constant willpower or decision-making. You then learn to live comfortably off the remaining funds, effectively adapting your spending to what’s left.

This method inherently addresses the challenge of making saving a consistent habit. By automating contributions, whether it’s for your emergency fund or long-term retirement savings, you’re consistently putting your financial health at the top of your priority list. Financial experts often suggest aiming to save 10-15% of your pre-tax income for retirement, and the “Pay Yourself First” approach makes hitting such targets more attainable.

For “people focused on building wealth or saving consistently,” this principle is a game-changer. It ensures that your most important financial goals, like a robust retirement nest egg or funds for essential large purchases like a reliable car, are systematically funded. By making saving an automatic and non-negotiable part of your budget, you proactively secure your financial freedom and peace of mind for years to come.

Read more about: Unlock Financial Freedom: 10 Budgeting Strategies Financial Gurus Really Wish You’d Stop Ignoring

Embarking on retirement with a clear financial roadmap, especially concerning significant assets like a car, is a testament to thoughtful planning. Whether you adopt a structured system like the 50/30/20 rule, embrace the detailed discipline of zero-based budgeting, or leverage the efficiency of automated tools, the core message remains: consistent, intentional budgeting is your most powerful ally. It’s about empowering yourself to direct your money towards the life you desire, ensuring every mile of your retirement journey is driven with confidence and security.