Your credit score is more than just a number; it’s a vital indicator that follows you through nearly every major financial decision you make. Whether you’re dreaming of a new home, planning to open new lines of credit, or considering an investment, your ability to obtain credit plays an incredibly important role. Understanding this score and the intricate factors that influence it is paramount to securing your financial well-being.

Many people are aware that big financial events like bankruptcy can drastically impact their credit. However, what often goes unnoticed are the seemingly minor, everyday decisions that can also inflict significant damage. Even small missteps, which might appear arbitrary at first glance, have the potential to drag your score down by 50 points or more, creating ripples that can affect your financial opportunities for years to come. The good news is that with the right knowledge, these pitfalls are entirely avoidable.

In this comprehensive guide, we’ll break down some of the most common, yet easily overlooked, mistakes that can instantly ruin your credit score. We’ll explain why they matter, how they interact with the complex algorithms of credit scoring models like FICO, and most importantly, provide you with actionable advice to protect yourself. By understanding these threats and adopting smarter financial habits, you can safeguard your credit and build a robust financial future.

1. **Paying Credit or Loan Payments Late**

This mistake might seem obvious, yet it’s one that almost everyone makes at least once. Your payment history is the single most influential factor in your FICO® Score, making up a significant 35% of its calculation. This means that a consistent record of on-time payments is absolutely crucial for maintaining a healthy credit profile, and conversely, even a single late payment can have a profound and lasting negative impact.

Creditors typically report delinquencies in stages: 30, 60, 90 days late, and beyond. While a payment that is just 30 days late can lower a strong credit score by a significant 60 to 80 points, a 90-day late payment can cause even more severe damage. The repercussions of these late marks are not fleeting; they typically remain on your credit reports for up to seven years, acting as a red flag to potential lenders.

If you find yourself in a situation where a payment might be late, the worst thing you can do is ignore the debt. Instead, communicate proactively with your lenders. While there’s no guarantee, some lenders may be willing to grant a grace period, work out a payment plan to spread out your payments, or even negotiate a reduced amount owed if you contact them before the due date or shortly thereafter. Taking these steps, even if they result in a slight dip, is far better than allowing the delinquency to escalate.

To prevent late payments from ever happening, several simple strategies can be incredibly effective. Setting up autopay for at least the minimum due ensures you never miss a deadline. Utilizing calendar alerts or app notifications can serve as helpful reminders. Many people also find success by making an extra payment before the statement closes, especially if their balance is typically high, to ensure the reported utilization is low and the payment is definitely on time.

Read more about: Dealership Dirt Uncovered: 15 Sneaky Car Sales Tactics Every Buyer Needs to Master

2. **Maxing Out a Credit Card**

Beyond just making payments on time, how much of your available credit you use is another critical factor in your credit score. Your credit utilization ratio, which is simply the amount of available credit you are using compared to your total available credit, accounts for 30% of your FICO® Score. If you frequently spend to your credit limit, this ratio spikes, sending a strong negative signal to lenders.

Running up credit card debt above 50% of your limit will begin to noticeably affect your credit score, with some sources indicating a drop of 50 to 100 points if you max out a card. This high utilization suggests that you are overextended financially, even if you manage to make your payments on time. Lenders interpret high utilization as a higher risk, as it indicates a greater reliance on borrowed funds.

To maintain a healthy credit score, it is widely advised to keep your credit card balances between 10-30% of your limit. Keeping balances below 10% is even better and can help you achieve the highest possible scores. This doesn’t mean you can’t use your cards; it simply means managing your spending wisely to ensure your reported balances are always low relative to your limits.

There are practical steps you can take to improve your utilization. Firstly, make it a priority to keep your balances under that 30% threshold. Secondly, if you have multiple credit cards, spreading your purchases across them can prevent any single card from appearing maxed out. Another effective strategy is to request higher credit limits from your issuers; if your balances remain the same while your limits increase, your utilization ratio will automatically decrease, boosting your score.

Read more about: Your 30s: The Definitive Guide to 14 Essential Financial Moves for Building Lasting Wealth

3. **Racking Up Credit Card Debt Early in Life**

For many, the first taste of credit comes during college, often with a student credit card. While getting an early start on building a credit history is inherently valuable, the habits formed during these initial years can have a profound and long-lasting impact. Past credit history can count for as much as 35% of your credit score, meaning the foundation you lay in your late teens and early twenties is incredibly significant.

Unfortunately, many young adults fall victim to poor spending habits, leading to maxed-out credit cards and a struggle with debt. Little do they know that missed and late payments incurred during these formative years will stay on their record for as long as six or seven years. This period often coincides with crucial life stages when individuals are applying for loans for graduate school, a first car, or even a down payment on a house.

Falling into a debt trap at 19 years old can make it exponentially harder to obtain favorable lines of credit later in life, affecting interest rates, loan approvals, and overall financial flexibility. Lenders will see this history of overextension and late payments, perceiving a higher risk, even if current habits have improved. This early history serves as a predictor of future financial behavior.

The simplest solution is to only apply for credit when you truly need it and to approach credit card use with discipline from the outset. Focus on using your first credit card sparingly, paying off the full balance every month, and developing a strong sense of financial responsibility. This proactive approach will prevent unnecessary interest charges and protect you from stretching yourself too thin financially, setting a positive trajectory for your credit journey.

Read more about: Achieving Financial Synergy: The 15 Best Budgeting Apps for Couples to Track Expenses and Build Wealth

4. **Closing Credit Card Accounts**

It might seem counterintuitive, but closing a credit card account, especially one you’ve held for a while, can often hurt your credit score rather than help it. When you close a credit card account, you immediately reduce the total amount of credit you have available across all your accounts. Since your debt utilization ratio is a significant factor in your credit score, reducing your overall available credit can cause this ratio to go up, even if your balances remain unchanged.

For example, if you have a $500 balance on a card with a $1,000 limit (50% utilization) and you close another card with a $4,000 limit, your total available credit might drop from $5,000 to $1,000. Your $500 balance now represents 50% of your *new total* available credit, and suddenly, your utilization looks much higher across the board, potentially leading to a score drop. The less of your available credit you use, the better, and closing accounts works against this principle.

Furthermore, closing an account can also shorten your average account age. The length of your credit history determines 15% of your credit score, and older accounts generally contribute positively to this factor. If you close an older account, it removes that long history from your active credit profile, which can negatively impact your score over time. While the history of a closed account in good standing may remain on your credit reports for up to 10 years, its immediate impact on your available credit and average age can be detrimental.

If you find yourself needing to close accounts, it’s generally advised to try and close your newer accounts first, as older accounts have longer credit histories that are valuable to your score. If an annual fee is the concern, consider calling the issuer to see if they can waive the fee or offer a no-fee alternative. Sometimes, keeping an older card open, even for small, infrequent purchases paid off immediately, can be a smarter move than canceling it outright.

Read more about: Credit Card Debt at Record Highs: 11 Expert Strategies to Take Control of Your Finances and Pay Down Balances

5. **Applying for New Cards Often**

The allure of rewards programs, introductory APR offers, or simply having more financial flexibility can make applying for new credit cards tempting. However, doing so too frequently can send negative signals to credit bureaus and lenders, potentially leading to a dip in your credit score. This is primarily due to what are known as ‘hard inquiries.’

Every time you apply for a new line of credit, whether it’s a credit card, a loan, or a mortgage, an official inquiry is made on your credit report. This ‘hard inquiry’ allows the lender to assess your creditworthiness. Each hard inquiry typically lowers your credit score by a few points, usually fewer than 5. While a single inquiry might not be a major concern, multiple inquiries in a short period can have a compounding effect, indicating a potential increase in financial risk.

It’s important to differentiate between types of credit applications. For specific types of loans, such as mortgages or auto loans, multiple inquiries made within a short window (typically 14 to 45 days) are often counted as a single inquiry when calculating your score, as lenders understand consumers shop for the best rates. However, this is not the case for credit cards; each application for a credit card typically counts as a separate hard inquiry against you.

Lenders may view multiple applications for new credit cards as a sign that you are relying too heavily on borrowed money, or that you are potentially facing financial difficulties. To minimize this impact, it’s wise to space out your applications by at least six months and only apply for credit when you genuinely need it. Before applying, research credit cards and understand your likelihood of approval to avoid unnecessary inquiries.

Read more about: Lunchbox Legends: The 9 ’90s Snacks That Absolutely Dominated Our Childhoods and Still Spark Joy

6. **Ignoring or Missing Errors on Your Credit Report**

Your credit report is a detailed history of your financial activities, and its accuracy is paramount to your credit score. Unfortunately, credit report errors are far more common than most people realize. These inaccuracies can range from duplicate accounts and incorrect balances to accounts that don’t even belong to you, and even small mistakes have the potential to significantly affect your credit score and your ability to qualify for loans.

Medical payments, in particular, are notorious for generating errors and inaccuracies, often due to their long and complex billing processes. These can linger on your report undetected, silently dragging down your score. Other common errors include outdated information, accounts incorrectly reported as delinquent, or incorrect personal details that could lead to identity confusion.

To safeguard your financial health, it’s crucial to check your credit report periodically. Consumers are entitled to a free annual credit report from all three major credit bureaus—Experian, TransUnion, and Equifax—through AnnualCreditReport.com. Regularly reviewing these reports allows you to spot any inaccuracies or signs of fraud early, before they can cause significant damage to your score.

If you discover an error on your report, it’s imperative to take action immediately. Contact both the credit bureau and the creditor that reported the incorrect information to dispute it. Provide clear documentation supporting your claim and follow up consistently to ensure the mistake is corrected. Ameliorating these errors is a key step in protecting your reputation of reliability and trust with creditors.

Read more about: Retirement Planning Perils: 14 Common (and Costly) Mistakes Every Pre-Retiree Needs to Avoid

7. **Only Making Minimum Payments**

While making minimum payments on your credit card debt might seem like a manageable way to keep your accounts in good standing, it’s a financial habit that can have several hidden negative consequences for your credit score and overall financial health. The primary issue is how interest charges can quickly accumulate, leading to a much larger total debt than initially anticipated.

As your balance grows due to accumulating interest, it directly impacts your credit utilization rate – the percentage of your available credit you’re currently using. As discussed, this ratio accounts for 30% of your FICO® Score. When your card balances rise above 30% of your credit limits, the negative impact on your credit scores increases greatly. Only making minimum payments makes it incredibly difficult to bring this ratio down, often keeping it at an unhealthy level.

Lenders view high utilization as a sign of financial strain, even if you’re consistently making those minimum payments. It signals that you might be stretched thin, increasing the perceived risk associated with lending you more money. This can make it harder to qualify for new loans or lines of credit, or result in less favorable terms and higher interest rates when you do.

Making it a priority to pay down your credit card debt beyond the minimum is a powerful step towards improving your credit score. Consider tackling your debt using structured approaches like the avalanche method (paying off the highest interest rate debt first) or the snowball approach (paying off the smallest balance first). Reducing your overall debt and subsequently your credit utilization rate will have a noticeable and positive effect on your score.” , “_words_section1”: “1997

While the foundational mistakes laid out in the first section are crucial to understand, many other subtle, yet equally damaging, pitfalls exist. These less obvious actions can quietly chip away at your credit health, sometimes with long-lasting consequences, catching even financially savvy individuals by surprise. Recognizing these hidden threats is just as important as mastering the basics, empowering you to navigate the complexities of personal finance with greater confidence and foresight. Let’s delve into seven more areas where seemingly small missteps can lead to significant credit score challenges, offering clear, actionable strategies to keep your financial reputation robust.

Read more about: Achieving Financial Synergy: The 15 Best Budgeting Apps for Couples to Track Expenses and Build Wealth

8. **Paying Your Rent Late**

Most people understand the importance of paying credit card bills and loan installments on time, but what about rent? Many landlords set rent due dates for the first of the month, and while it might seem like a minor delay to send it a few days later, this can lead to serious credit issues. If you consistently fail to pay your rent on time, landlords have the ability to report these late payments, directly impacting your credit record.

Critically, if you don’t pay your rent for 30 days, even if you believe you have a legitimate reason for withholding payment, your credit score can take a noticeable hit. This often overlooked detail is significant because anything that pushes you closer to an eviction notice creates a red flag on your financial file. Such delinquencies can appear on your credit report, signaling to potential lenders that you may be a higher risk borrower, regardless of your other financial habits.

Moreover, it’s not just rent that can cause problems. Unpaid utility bills, cell phone bills, or other minor household expenses can also be sent to collection agencies if ignored. Once in collections, these accounts will appear on your credit report for up to seven years, significantly dragging down your score. To prevent such damage, it’s vital to treat all your recurring bills with the same seriousness as loan payments, setting up automatic payments or reminders to ensure timely remittance.

If you find yourself struggling to pay rent or utility bills, proactive communication with your landlord or service provider is essential. Many prefer to work out a partial payment plan or temporary arrangement rather than escalating to collections or eviction. Addressing these issues early can help you avoid the lasting negative impact on your credit score and protect your financial standing.

Read more about: How to Uncover a Used Car’s Past: A Consumer’s Guide to Identifying Former Rentals, Taxis, and Police Vehicles

9. **Cosigning Gone Wrong**

Cosigning a loan for a family member or friend might seem like a kind and helpful gesture, a way to assist someone who might not qualify for credit on their own. However, it’s a decision with significant hidden risks that can easily derail your own credit health if things go awry. When you cosign a loan, you aren’t just a guarantor; you are taking on full legal responsibility for that debt.

This means that if the primary borrower misses payments or defaults on the loan, those negative marks will directly appear on your credit report as well. Lenders view you as equally liable for the debt, and any misstep by the other party is considered a misstep on your part. A single late payment on a cosigned loan can cause your credit score to drop significantly, just as if it were your own debt that went unpaid.

Before you ever agree to cosign, it’s crucial to understand the full implications and be prepared for the worst-case scenario. If you have already cosigned, proactive steps are necessary to protect your credit. Monitor the account closely; many lenders offer cosigners access to online statements. Have a clear backup plan in place, being prepared to step in and make payments if the borrower is unable to. Additionally, explore whether the loan offers a cosigner release option after a certain number of on-time payments, which could allow you to eventually remove your name from the obligation.

Read more about: Heads Up, Car Buyers! 15 Sneaky Dealership Tricks You Can’t Afford to Miss

10. **Not Alerting Creditors of Name Changes**

In our increasingly interconnected financial world, consistency across your personal information is paramount. While it might seem like a trivial detail, not notifying your creditors of a name change—perhaps due to marriage, divorce, or a legal name change—can lead to unexpected and damaging inaccuracies on your credit report. This oversight can create a disconnect between your official records and your financial accounts.

Bank accounts, credit applications, and various other documents that form your credit history are integrated into your report through numerous channels, some of which may not strictly require identification like your Social Security number to be considered valid. If your name doesn’t match across all these records, it can lead to confusion, duplicate accounts, or even misattribution of financial activities, creating errors that are hard to trace and rectify.

These inconsistencies can make it difficult for credit bureaus to accurately merge your credit files, potentially leading to a “thin file” under your new name or inaccurate reporting. You’ve worked diligently to build a reputation of reliability and trust with your creditors, and allowing errors to creep in due to a simple name discrepancy can tarnish that hard-earned history. It’s essential to proactively update all your financial institutions, including credit card companies, banks, and loan providers, as soon as your name legally changes. Provide clear documentation to ensure your records are consistent across the board, safeguarding your credit from preventable inaccuracies.

Read more about: Car Gone? Your 15-Step Action Plan to Maximize Recovery and Navigate the Aftermath

11. **Closing Your Oldest Account**

Logic might suggest that closing an unused credit card, especially one you opened years ago, is a smart move to simplify your finances or remove temptation. However, this seemingly benign action can actually deal a surprising blow to your credit score. The length of your credit history is a significant component, making up 15% of your FICO® Score, and your oldest accounts are typically the most valuable contributors to this factor.

When you close your oldest credit card account, you instantly shorten your overall credit history and reduce your average account age. This is because that long, positive payment history associated with the closed account is no longer actively contributing to the ‘length of credit history’ factor in your score calculation. Even if the history of the closed account remains on your credit report for up to 10 years, its immediate impact on your active credit profile and average age can be detrimental.

Maintaining older accounts, even if you rarely use them, often proves to be the smarter strategy for your credit score. If an annual fee is your concern, before canceling, contact the issuer to inquire if they can waive the fee for a year or transition you to a no-fee alternative. Sometimes, simply making a small, infrequent purchase on the card and paying it off immediately can keep it active and beneficial to your credit score without incurring significant costs or debt. Think twice before retiring a seasoned financial companion that’s been boosting your credit for years.

Read more about: Unraveling Space Communication: NASA’s Groundbreaking Endeavors and Enduring Challenges

12. **Not Having a Credit Card or Enough Credit Accounts**

It might seem counterintuitive, especially in a discussion about avoiding debt, but not having any credit cards or maintaining a very limited credit history can be just as detrimental to your credit score as having too much debt. For financial institutions considering lending you money, the primary goal is to assess your creditworthiness—your ability and reliability in handling borrowed funds. If you don’t have any credit cards or loans, lenders have very little data to evaluate.

This situation is often referred to as having a “thin credit file.” Without a history of managing revolving credit, lenders can’t see how you use credit, how consistently you make payments, or your overall financial responsibility. They might automatically rule you out for certain loans or flag you as a higher risk simply because there isn’t enough information to demonstrate your reliability. This lack of data can significantly limit your borrowing options and make it harder to get approved for loans or favorable interest rates when you eventually need them.

Furthermore, your credit mix—the variety of credit accounts you manage, such as both revolving credit (like credit cards) and installment loans (like mortgages or auto loans)—makes up about 10% of your FICO® Score. A diversified credit mix indicates a broader ability to handle different types of financial obligations, contributing to a stronger credit profile. If your file is too thin, consider taking proactive steps to build it. A secured credit card, which requires a deposit equal to your credit limit, is an excellent way to establish positive payment history. Alternatively, a small personal loan can add an installment account to your mix, providing lenders with the data they need to assess your credit health.

Read more about: Credit Card Rewards Are Changing: Your 14-Point Master Guide to Maximizing Returns Now

13. **Bouncing Checks**

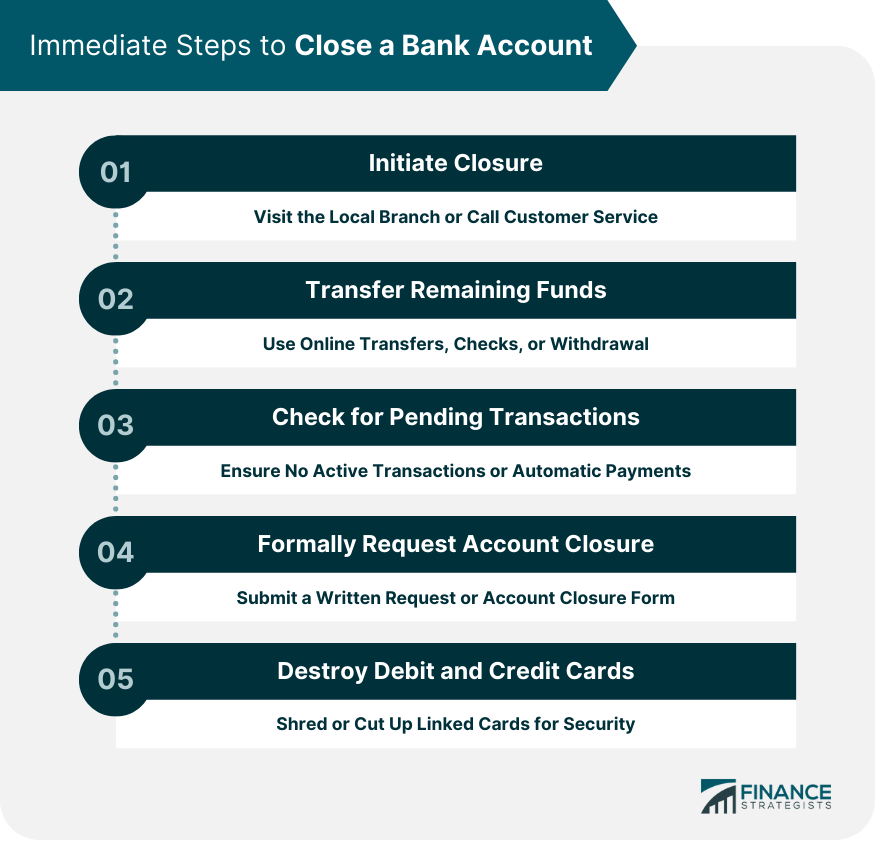

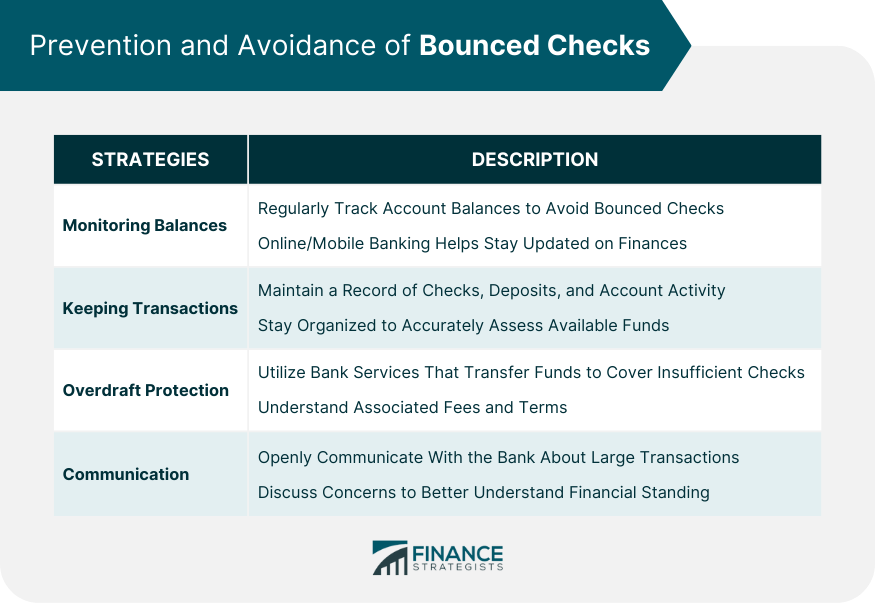

In an age of digital payments, the physical act of writing a check might seem less common, but the consequences of a bounced check can still create significant ripples in your financial standing. While bouncing a check doesn’t directly appear on your credit report, a consistent inability to make payments through your checking or debit account can lead to indirect, yet severe, damage to your credit score. This behavior signals financial mismanagement to your bank and can eventually impact your creditworthiness.

The primary danger lies in what happens next: if a bounced check leads to an unpaid bill, that bill might then be sent to a collection agency. Once a debt is in collections, it absolutely will appear on your credit report, severely impacting your ability to obtain future lines of credit. Collections accounts are a major red flag for lenders, signaling a high-risk borrower. Even if the original amount was small, the collection status can cause substantial and lasting damage.

To prevent this, it’s crucial to diligently manage your bank account balances and be acutely aware of your spending. Set up low-balance alerts through your banking app, reconcile your accounts regularly, and always ensure you have sufficient funds before making payments. Even for small amounts, avoiding bounced checks is a key step in preventing unpaid bills from spiraling into collection issues that could severely damage your hard-earned credit score. Your checking account discipline can have a direct bearing on your credit reputation.

Read more about: Buyer Beware: Unpacking the Suspension Weaknesses of Best-Selling Pickups Under Load and Critical Failure Points

14. **Falling for Credit Score Booster Schemes**

In the quest for a better credit score, it’s easy to be tempted by quick fixes and enticing promises. However, one significant pitfall is falling for various credit schemes that aggressively market themselves as rapid credit score boosters. While they might promise an instant improvement, the reality is that these schemes often come with hidden costs, complex terms, or even deceptive practices that can ultimately harm your credit more than help it.

Newsflash: you don’t have to carry a monthly balance on your credit cards to prove you are creditworthy! This is a common misconception perpetuated by some schemes. Healthy credit is built through responsible, consistent financial behavior, not by paying unnecessary interest or engaging in risky financial maneuvers. Genuine credit improvement is a marathon, not a sprint, and there are no legitimate shortcuts to a strong score.

Any quick credit scheme that promises an overnight miracle will inevitably cost you, one way or another, whether through exorbitant fees, compromised personal information, or practices that actually flag you as a higher risk. The best path forward is always to avoid them at all costs. Instead, focus on proven strategies: keep your debt utilization ratio below the recommended 30%, make all your payments on time, and diligently monitor your credit reports. By adhering to these fundamental, responsible habits, your credit score will improve organically and sustainably, opening doors to better financial opportunities without unnecessary risk.

Your credit score reflects how you manage debt, and every action—big or small—contributes to the picture lenders see. While the most damaging mistakes can set you back for years, even minor habits like keeping balances low or paying before the statement closes make a noticeable difference over time. The key is consistency. If you focus on paying on time, keeping balances under control, and monitoring your credit reports, you’ll not only avoid costly mistakes but also build a credit score that opens the door to better rates and financial opportunities.