Artificial intelligence is no longer a futuristic concept reserved for sci-fi movies; it’s a practical, powerful tool actively reshaping the financial landscape and offering unprecedented opportunities for personalizing your investment strategy. Gone are the days of generic financial advice that barely scratches the surface of your unique circumstances. AI acts as a sophisticated co-pilot, not a replacement for human expertise, capable of sifting through vast oceans of data with remarkable speed and precision to uncover insights previously unattainable. This isn’t merely about enhancing efficiency; it’s about democratizing access to a level of investment customization that was once the exclusive privilege of the wealthiest individuals, now made accessible to you.

For too long, individual investors have navigated a complex world fraught with generalized recommendations and standardized portfolio models, often feeling disconnected from their true financial aspirations. However, AI-powered tools are fundamentally altering this dynamic, enabling strategies to be meticulously tailored to your specific financial goals, individual risk tolerance, and even predictable behavioral patterns. Whether your ambition is to save diligently for a comfortable retirement, fund a child’s education, or accumulate capital for a significant purchase, these innovative technologies are purpose-built to make your investment journey significantly simpler, undeniably smarter, and profoundly more aligned with your unique vision of success.

This comprehensive, actionable guide will meticulously unpack 13 simple yet incredibly powerful ways you can harness this cutting-edge technology to personalize, optimize, and fortify your investment strategy. We’ll begin our deep dive by exploring how AI dramatically enhances the foundational pillars of investment management—from automating cumbersome, repetitive data tasks to sharpening the acuity of risk analysis and facilitating more responsive decision-making. Prepare to unlock a new era of informed and agile financial management, as we introduce the first set of these transformative applications designed to put you firmly in control.

1. **Automating Information Collection & Summarization**One of AI’s immediate and most impactful benefits for investors and financial professionals alike is its unparalleled ability to tackle the “tedious prep work” that often consumes valuable time. Imagine eliminating hours spent manually compiling reports, cleaning disparate datasets, or sifting through thousands of documents to flag anomalies. AI takes on these mundane yet crucial tasks, freeing up human capital for more strategic endeavors, allowing your expertise to truly shine.

This powerful automation directly translates into significant efficiency gains across various financial operations. Consultants like Oliver Wyman have highlighted how generative AI can empower portfolio managers by “automating information collection, summarization, and data cleaning.” This means that the initial, laborious stages of preparing data for analysis are handled swiftly and accurately by machines, laying a pristine, error-free foundation for subsequent decision-making.

The real value here is in the redeployment of human intellect and specialized skills. With AI managing the heavy lifting of raw data processing, investment research and risk analysis teams can “shift focus to higher-value tasks like validation and idea generation.” This strategic reorientation allows human experts to apply their nuanced understanding, critical thinking, and creative problem-solving where it truly matters, rather than being bogged down in rudimentary data preparation.

This capability is not limited to high-end financial institutions. Even basic, no-cost AI tools are being utilized by businesses of all types for tasks such as “minute-taking.” For more advanced needs, modest subscription fees grant access to AI tools that can edit “verbal tics out of a video recording and producing a polished transcript,” showcasing the breadth of its internal applications.

Ultimately, this boost in efficiency is quantifiable and substantial. Oliver Wyman’s findings indicate that this automation can improve productivity by “up to 30%.” This means financial professionals can achieve more in less time, generating insights faster and allowing for a more agile, data-driven response to market dynamics, all while ensuring the foundational data is robust and reliable.

Read more about: 9 AI Tools That Can Write Your Emails for You: Boost Productivity and Perfect Your Professional Communications

2. **Enhancing Investment Research**Beyond merely automating data collection, AI significantly deepens and accelerates the investment research process itself, moving from raw data points to actionable intelligence with remarkable speed and precision. Traditional research often involves labor-intensive analysis of various sources, but AI fundamentally transforms this by processing vast volumes of information to uncover hidden patterns and trends that humans might miss.

AI’s capability to analyze “huge sets of data, such as current market trends” and “historical market trends, economic indicators,” provides a comprehensive backdrop for investment decisions. Crucially, it can also parse “unstructured data like social media sentiment,” offering a qualitative edge by gauging public perception and market psychology, which are often overlooked by conventional, quantitative methods. This enriches the research immensely.

This analytical prowess significantly enhances decision-making in investment management by “reducing the time required for analysis and improving predictive accuracy.” By identifying complex correlations and potential trends that might be invisible or too time-consuming for the human eye to detect, AI provides a richer, more nuanced understanding of market forces, enabling more informed and timely choices about where and when to invest.

For financial firms and individual investors alike, this means that investment research can become a dynamic, insight-driven engine rather than a time-consuming scavenger hunt. Professionals can “shift focus to higher-value tasks like validation and idea generation,” dedicating their expertise to interpreting AI-generated insights and formulating sophisticated strategies, rather than spending countless hours on initial data synthesis and compilation.

Essentially, AI facilitates a paradigm shift in how research is conducted. It provides a deeper, more accurate basis for understanding market dynamics and identifying opportunities. This allows for proactive, strategic positioning within portfolios, ensuring that investment decisions are grounded in the most comprehensive and up-to-date information available.

Read more about: Understanding Car Modifications: A Consumer’s Guide to Insurance, Resale Value, and Hidden Costs

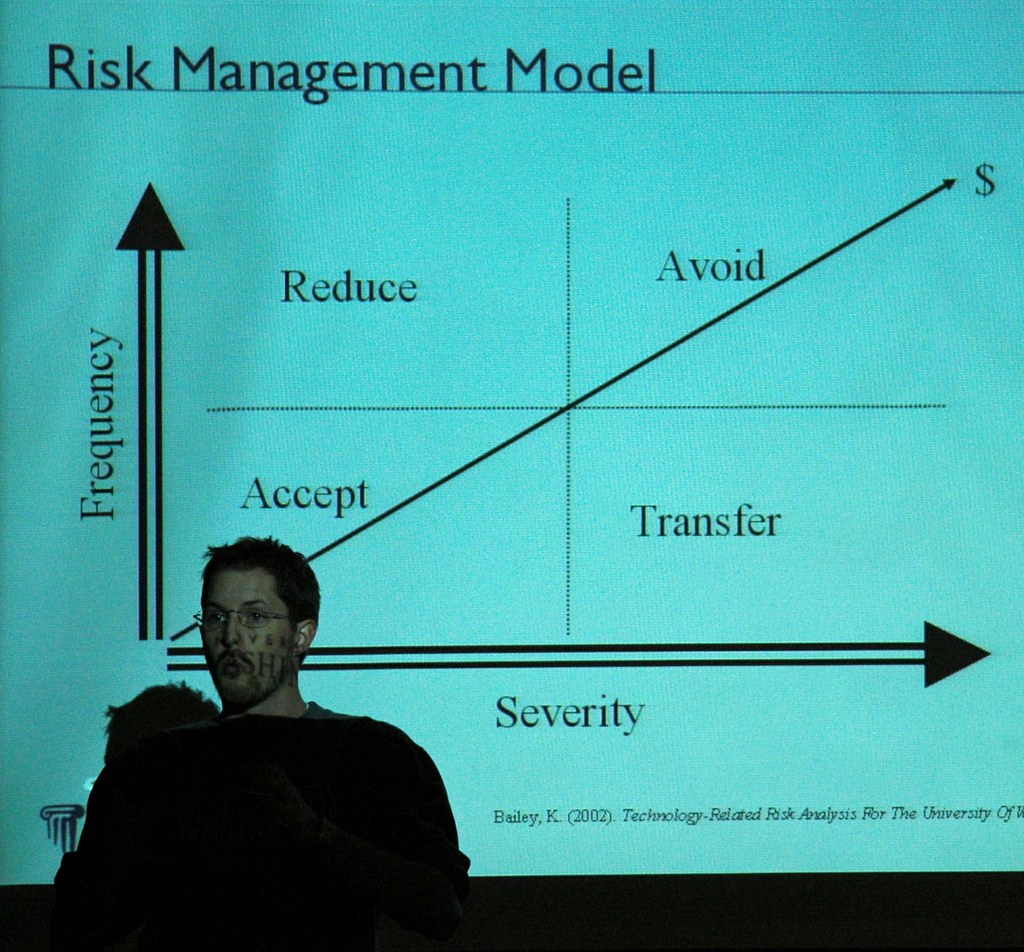

3. **Improving Risk Management Calculations**Risk management is paramount in investment, and AI introduces an unprecedented level of precision and foresight into its calculations, moving far beyond traditional static models. One critical application is its ability to significantly improve the accuracy of “value at risk (VaR),” a key metric that estimates the maximum potential loss a portfolio could incur within a specified time frame and confidence level. This offers a clear numerical boundary for potential downsides.

Furthermore, AI enhances the computation of “expected shortfall,” which provides a more comprehensive view of risk by measuring the average loss an investor could expect to experience beyond the VaR threshold. This dual approach gives a much clearer, more granular picture of a portfolio’s vulnerability to adverse market movements, helping investors quantify and understand their exposure better and plan accordingly.

The secret behind this enhanced accuracy lies in advanced AI techniques, specifically mentioning “a type of AI called a generative adversarial network (GAN).” This innovative network can play sophisticated games against itself, essentially running countless simulations and learning from each iteration. This process is crucial for predictive modeling in complex financial systems.

In doing so, GANs can “determine the likelihood of outcomes in a vast array of forward-looking financial time series,” simulating countless potential market scenarios with remarkable realism and statistical robustness. This predictive capability goes far beyond what traditional models, often based on historical averages, can achieve, making risk assessment significantly more dynamic.

These advanced simulations are then fed directly into VaR and expected shortfall models, which dramatically improves “how firms quantify risk within their specific portfolio and strategy tolerances.” By leveraging AI, investment strategies can be built with a deeper, more adaptive understanding of potential downsides, leading to more resilient portfolios aligned precisely with an investor’s comfort level and long-term objectives.

Read more about: Debunking the Three-Year Myth: 12 Crucial Insights into Enduring EV Battery Life and Performance

4. **Running Scenario Simulations & Stress Tests**Beyond mere numerical calculation, AI empowers investors with the ability to dynamically model and rigorously test their portfolios against a multitude of hypothetical yet realistically plausible market conditions. Bridgewater’s AI Lab offers a prime example of this advanced capability, where its AI “simulates how entire market systems behave,” moving beyond simple historical analysis to sophisticated predictive modeling.

This sophisticated machine learning approach enables risk modeling that “responds to a portfolio’s specific structure.” Unlike generic, off-the-shelf stress tests that apply broad market shocks, AI tailors its scenarios directly to your unique portfolio composition and underlying exposures. This provides an assessment that is deeply personal and highly relevant to your assets.

Crucially, AI doesn’t just scan for obvious red flags or past patterns; instead, it actively “runs scenario simulations and stress tests based on each strategy’s exposures, from commodities to macro trends.” This means it can anticipate how your specific investments will react to a sudden commodity price drop, a shift in global macro trends, or other significant economic events.

The profound benefit here is the ability to adapt risk oversight in “real time,” rather than relying on outdated or static models that quickly become irrelevant in today’s fast-evolving and interconnected markets. By understanding how a portfolio might react under various stress scenarios, investors can proactively adjust their holdings, bolstering resilience and protecting capital before a crisis hits.

Generative AI further refines this capability by “uncovering nuggets in unstructured data sets,” then gleaning insights specific to users’ particular strategies for mitigating industry or geographic risk. This granular understanding allows funds to “acquire or divest assets to properly balance risk and reward,” ensuring the portfolio remains optimized for both protection and growth under any conceivable future.

Read more about: The Raw Truth: 10 Cars That Aced & Failed Crash Tests — Where Engineering Triumph Meets Genuine Disappointment

5. **Tailoring Trade Execution Logic**While seemingly a step removed from core investment strategy, AI-powered trade execution is crucial for personalization, ensuring that every transaction aligns precisely with a portfolio’s overarching intent. Tools such as Tradeweb’s AiEX (Automated Intelligent Execution) or JPMorgan’s Execution Optimizer exemplify this, using “rules-based automation and predictive models to route trades based on strategic preferences.”

The personalization comes from allowing “each strategy to execute trades according to its own logic.” This means an investor can define their specific priorities: some strategies might emphasize “speed to capture short-term market moves,” while others might meticulously optimize for the best possible “price” or aim to “minimize market impact” to protect larger positions. AI ensures these distinct preferences are consistently applied.

Tradeweb’s AiEX, for instance, provides traders with remarkable flexibility to “set specific rules for how they want orders handled—pricing thresholds, timing preferences, or even which counterparties to prioritize.” Once these rules are established, AiEX takes over the automatic routing, eliminating the need for constant manual intervention and potential human error, making execution both efficient and aligned.

This kind of “configurable automation helps funds implement distinct investment strategies at scale, tailoring execution to specific goals, risk profiles, and portfolio mandates.” It frees investment teams from the tactical burden of manual trade execution, allowing them to dedicate their valuable time and expertise to higher-level strategic decisions and the nuanced construction of personalized portfolios.

6. **Analyzing Goals and Prioritizing Timelines**At the heart of any truly personalized investment strategy is a deep and granular understanding of an individual’s financial goals, and AI is uniquely positioned to dissect and prioritize these aspirations with unmatched clarity. Mezzi’s AI system, for example, shines brightly by “analyzing goals to prioritize timelines and requirements,” transforming vague ambitions into clear, actionable financial targets with defined parameters.

The inherent reality is that “different financial goals come with unique timelines, risk levels, and required investments.” A short-term objective like accumulating a down payment for a house in just two years demands a fundamentally different investment approach and risk profile compared to a long-term goal such as building a robust retirement fund over three decades. AI can precisely discern these critical differences, preventing a one-size-fits-all fallacy.

By meticulously examining “your financial goals, timeline, income, savings, risk tolerance, and current market conditions,” AI platforms generate highly specific and pertinent recommendations. This detailed, integrated analysis “lays the groundwork for an ever-evolving investment strategy,” ensuring that every subsequent decision and portfolio adjustment is intentionally aligned with what you genuinely want to achieve and within the specified timeframes.

Mezzi’s AI specifically helps by “analyzing goals to prioritize timelines and requirements,” and then allocating investments based on these varying factors. This eliminates guesswork and ensures that the investment engine is constantly calibrated to your personal race towards your objectives. It’s about designing a specific roadmap for each financial journey you undertake, adapting as your life unfolds.

This tailored approach ensures that your portfolio isn’t just a generic collection of assets, but a dynamically managed engine explicitly designed to propel you towards your individual financial milestones. AI continuously cross-references your investment trajectory against your specified timelines, providing a proactive roadmap for success and allowing for timely adjustments to keep you on track.

Read more about: Behind the Impasse: 12 Core Budget and Contract Challenges That Strain Film Production Partnerships

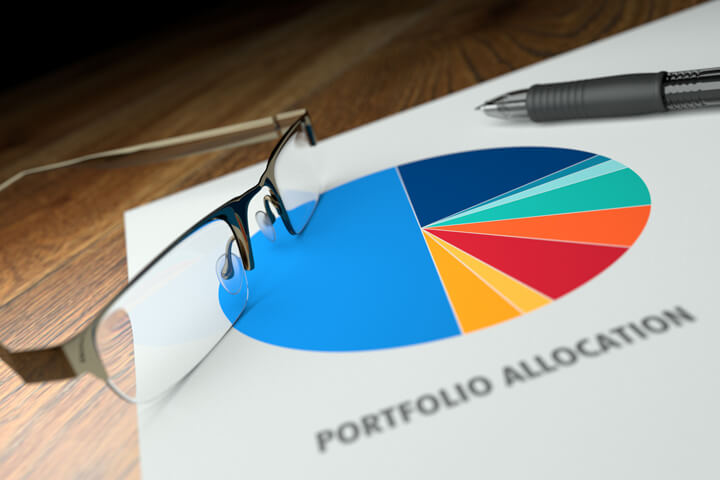

7. **Dynamically Adjusting Asset Allocation**Once your financial goals are clearly defined, AI excels at the crucial and ongoing task of ensuring your asset allocation remains perfectly aligned and responsively calibrated to both your evolving personal journey and prevailing market fluctuations. It fundamentally “adjusts how your assets are distributed based on your goals and risk level,” offering a dynamic and flexible approach far superior to rigid, static allocations that quickly become outdated.

Consider the inherent nuance required for different time horizons and their corresponding risk appetites. “For short-term goals,” AI intelligently “leans toward safer options like fixed-income investments and cash” to meticulously preserve capital and reduce volatility. Conversely, “mid-term goals get a balanced mix” of growth and stability, while “long-term goals focus more on equities for potential growth,” strategically maximizing opportunities over extended periods.

This flexible and adaptive methodology ensures your investments remain on their optimal track as your needs evolve and as market conditions inevitably shift. Mezzi’s AI, for instance, “allocates investments based on varying timelines and risk preferences” and crucially “adjusts dynamically as life circumstances evolve,” guaranteeing continuous alignment with your life’s changing panorama and financial priorities.

A key advantage is AI’s ability to monitor markets “24/7 and rebalance portfolios instantly.” This real-time responsiveness means your portfolio is always optimized, even when you’re not actively watching the news or economic indicators. It quickly adapts to significant market signals, adjusting risk exposure during volatile periods and keeping investments aligned with long-term goals without delay.

Furthermore, this dynamic adjustment capability extends to “balancing risk across the entire portfolio,” ensuring that no single goal inadvertently undermines another. It’s a holistic approach that maintains equilibrium, protecting your wealth while consistently positioning you for the best possible returns within your established comfort zone and without human emotional interference.

Continuing our exploration into AI’s transformative power, we now unveil six more strategic applications that can further personalize and streamline your financial planning, ensuring your investments are not just managed, but truly optimized for your unique life.

Read more about: Unraveling Life’s Grand Tapestry: A Smithsonian Exploration of Biological Evolution’s Core Mechanisms

8. **Streamlining Account Consolidation**For many investors, attempting to manage multiple investment accounts spread across various financial institutions and platforms can quickly become a significant source of complexity, administrative burden, and sheer frustration. Accurately tracking overall performance, gaining a clear understanding of your complete asset allocation, and making truly informed strategic decisions becomes exponentially harder when your financial picture is scattered and fragmented. This is precisely where AI-powered platforms offer a clear, practical, and incredibly efficient solution.

One of the most fundamental and universally appealing features of integrated AI platforms, such as Mezzi, is its robust “Account Consolidation” functionality. This powerful capability allows you to effortlessly “manage all your investment accounts in one place,” instantly bringing an unprecedented level of clarity, organization, and direct control to your entire financial life. Instead of the cumbersome process of logging into several different portals and aggregating data manually, you gain access to a unified, intuitive dashboard where all your assets are grouped, providing a truly holistic and immediate view of your total wealth.

The benefits of this capability extend far beyond mere convenience and time-saving. By consolidating all your accounts, the underlying AI system gains a comprehensive and complete overview of your entire financial profile. This complete and unified data set empowers the algorithms to perform far more accurate, integrated, and insightful analyses, ensuring that every investment recommendation and strategic adjustment considers your total wealth, rather than just isolated pockets of assets. This streamlined approach simplifies portfolio oversight, freeing you to focus on higher-level strategic decisions.

Read more about: Powering the Future: A Deep Dive into the Evolving Landscape of Gas Stations and Mobility Hubs

9. **Optimizing Your Tax Strategy**While achieving robust investment returns is undeniably important, what you are ultimately able to keep after taxes is often the more accurate and impactful measure of true financial success. Many investors, unfortunately, frequently overlook the profound and cumulative impact that a meticulously planned tax strategy can have on their long-term wealth accumulation and overall financial growth. AI-powered investment tools are now democratizing access to sophisticated tax optimization techniques, capabilities previously reserved exclusively for high-net-worth individuals, bringing them directly to the fingertips of everyday investors.

One prime and exceptionally valuable example of this advanced capability is “Tax Strategy,” which crucially includes the intelligent and automated application of “tax-loss harvesting.” This highly effective technique involves strategically selling investments that have incurred a loss to intelligently offset capital gains from profitable investments or, in some cases, even a portion of your ordinary income, thereby significantly lowering your overall tax liability. AI algorithms possess the unparalleled ability to identify these complex opportunities with extreme precision and execute them at the optimal time for maximum benefit.

The inherent beauty and formidable advantage of leveraging AI in this context is its extraordinary ability to perform these intricate calculations and execute transactions with a continuous focus on “keeping your portfolio balanced.” This means the objective is not just about minimizing taxes at any cost, but rather achieving this crucial tax efficiency without compromising your overarching long-term investment strategy or drastically altering your predefined risk profile. By intelligently leveraging AI for comprehensive tax optimization, you can ensure more of your hard-earned money remains invested and continues to compound for your future.

Read more about: Don’t Get Stuck with a Lemon: Your Ultimate 2025 Guide to Spotting Used Car Red Flags Before You Buy

10. **Facilitating Family Goal Collaboration**Financial aspirations often extend far beyond individual ambitions, encompassing shared dreams and collective goals for a family’s future—whether it’s diligently saving for a child’s higher education, meticulously planning for a comfortable joint retirement, or working cohesively towards a significant collective purchase like a family home. Coordinating these diverse and often interconnected goals among multiple family members can introduce significant complexity, potential misunderstandings, and logistical challenges, but AI offers remarkably intelligent and practical solutions to foster seamless collaboration.

Mezzi’s AI platform specifically and elegantly addresses this crucial need through its innovative “Family Collaboration” feature. This powerful and user-friendly tool explicitly “allows shared access so family members can work together on financial goals.” It brilliantly transforms what might otherwise be a disparate collection of individual financial efforts and isolated savings into a unified, transparent, and highly collaborative journey toward common objectives, ensuring everyone is literally on the same page and working towards a shared vision.

The inherent brilliance and thoughtful design of this particular feature lie in its sophisticated ability to facilitate teamwork and shared progress “while keeping individual privacy intact.” This crucial balance ensures that while all designated family members can contribute to and track the collective progress on shared goals, sensitive and personal financial details pertaining to individual accounts or assets remain private and confidential. This comprehensive, AI-driven approach ensures your collective portfolio is robustly set up for both immediate needs and long-term success.

The comprehensive journey through these 13 innovative and actionable applications of AI clearly illuminates that we are witnessing nothing less than a profound revolution in personal finance and investment management. AI is not just a technological enhancement; it is actively democratizing access to sophisticated investment strategies, offering a level of personalization, efficiency, and insight that was previously unimaginable and largely exclusive. It’s about harnessing the immense power of artificial intelligence to not merely grow your wealth, but to truly align it meticulously with your life’s deepest aspirations, making your financial future significantly more predictable, resilient, and inherently empowering.

The era of generic, one-size-fits-all investment advice is rapidly fading into obsolescence, being decisively replaced by a dynamic, intelligent co-pilot that works tirelessly and objectively on your behalf. As we’ve explored throughout this guide, AI consistently delivers “Tailored Strategies” by meticulously evaluating your unique goals and individual risk tolerance, ensures “Better Efficiency” through the automation of countless complex processes, and fortifies “Stronger Risk Management” with its capacity for real-time analysis and adaptive adjustments. These are not merely incremental improvements; they represent foundational shifts that fundamentally redefine what’s truly possible in the realm of personalized investing.

Read more about: Achieving Financial Synergy: The 15 Best Budgeting Apps for Couples to Track Expenses and Build Wealth

To truly seize these formidable advantages and put AI to work effectively for your financial future, the path forward is refreshingly clear, practical, and immediately actionable. Begin by consolidating all your investment accounts onto a unified platform specifically designed for this intelligent integration. Next, take the crucial step of clearly outlining your specific financial objectives, allowing AI’s powerful analytical prowess to transform these aspirations into tangible, measurable targets. Enable AI alerts and automatic monitoring to keep a vigilant, constant eye on your portfolio’s performance, ensuring no emerging opportunity or potential risk goes unnoticed or unaddressed. By embracing these simple yet incredibly powerful steps, you’re not just investing smarter; you’re actively building a resilient, hyper-personalized financial ecosystem meticulously designed to propel you toward every one of your unique dreams and long-term aspirations. The future of personalized investing is not just arriving; it’s here, it’s accessible, and it’s waiting for you to plug in and take charge.