Setting up a trust fund is often considered a prudent step toward safeguarding your family’s financial future, offering a secure foundation for loved ones and ensuring your assets are managed exactly as you intend. It’s a powerful tool for transferring wealth, minimizing estate taxes, and protecting assets from creditors, providing peace of mind that your legacy will endure. However, the path to establishing an effective trust is fraught with potential missteps, much like building a complex structure where one wrong calculation can compromise the entire design.

Even with the best intentions, common oversights in the trust setup process can lead to significant financial setbacks, legal disputes, and undue stress for your beneficiaries. These aren’t minor inconveniences; they can result in thousands of dollars in unnecessary costs, prolonged legal battles, and the complete derailment of your carefully laid plans. Understanding these critical pitfalls is not just a recommendation—it’s the essential first step toward securing your legacy and ensuring your family’s financial security.

This in-depth guide will walk you through some of the most critical trust mistakes people make, exploring why each error is so costly and, most importantly, providing clear, actionable advice to help you avoid them. By illuminating these common pitfalls, we aim to empower you with the knowledge needed to confidently navigate the complexities of trust planning and ensure your family’s financial future is as secure and seamless as you envision.

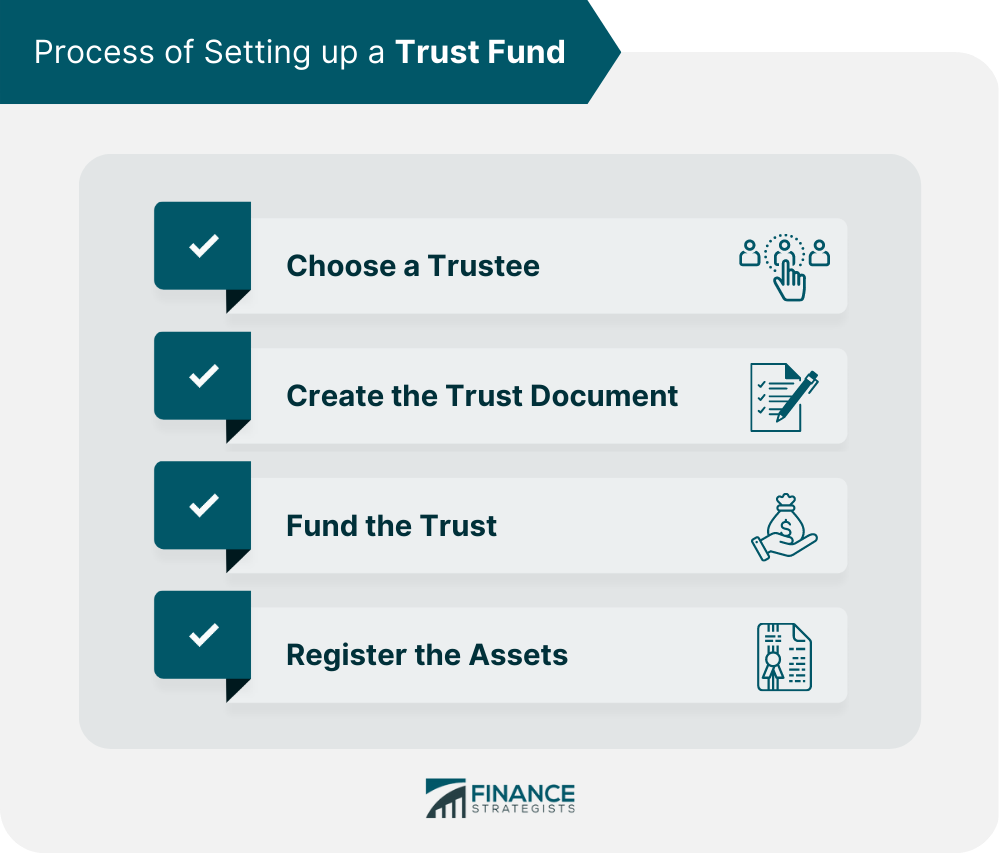

1. **Failing to Properly Fund the Trust**One of the most pervasive and damaging mistakes in trust planning is the failure to properly fund the trust, often referred to as the “empty shell dilemma.” You might painstakingly draft a comprehensive trust document outlining all your wishes, but if you neglect the crucial step of transferring legal ownership of your assets into that trust, the document itself becomes like an empty treasure chest. It cannot hold or manage the assets you intended to protect or distribute, rendering all your meticulous planning ineffective.

This funding process involves formally retitling assets such as your home, bank accounts, investment portfolios, and business interests in the name of the trust. Many individuals mistakenly believe that simply signing the trust document automatically extends protection to their assets. However, as estate planning and probate lawyer Craig R. Fiederlein explains, “Many clients believe that simply signing a trust document provides automatic protection for their assets.” This misconception often leads to assets remaining outside the trust’s legal ownership.

The financial repercussions of an unfunded trust can be substantial. If assets are not officially placed within the trust before your passing, they will likely be subjected to probate. Probate is a court-supervised process that can be lengthy, public, and expensive, often costing between 3% and 7% of an estate’s total value, as a 2024 study by Trust & Will highlighted. This is precisely the scenario most people establish trusts to avoid, underscoring the significant financial burden and emotional toll probate can impose on heirs. Moreover, the intended creditor protection and various tax planning benefits you sought to achieve through the trust may also be lost, meaning beneficiaries could receive a smaller inheritance than planned due to avoidable costs and taxes.

To effectively sidestep this costly error, proactive steps are essential. Begin by collaborating closely with an experienced estate planning attorney to compile a comprehensive inventory of all assets you intend to include in the trust. Subsequently, meticulously retitle each asset, which may involve recording new deeds for real estate, updating account registrations for bank and investment accounts, and formally assigning business interests. Crucially, maintain organized records of all these transfers and obtain written confirmation from financial institutions that the trust is indeed the new legal owner. This diligent approach ensures your trust is fully functional and capable of fulfilling its intended purpose.

Read more about: Beyond the Hype: Unpacking 15 Infamous Rides That Earned a ‘Jerk Car’ Reputation Among Enthusiasts

2. **Choosing the Wrong Trustee**Selecting the right trustee is arguably one of the most critical decisions in establishing a trust, as this individual or entity will be responsible for managing your trust’s assets according to your precise instructions. A significant mistake is choosing an unsuitable person for this pivotal role—someone who may lack financial acumen, integrity, sufficient time, or the ability to remain impartial. Such a choice can lead to severe mismanagement of assets, breaches of fiduciary duty, escalating family disagreements, and ultimately, substantial financial losses for your beneficiaries.

An unqualified trustee can make a myriad of errors, from poor investment decisions that erode the trust’s value to failing to distribute assets as stipulated in the trust document. They might misunderstand complex tax rules, leading to unintended liabilities, or in extreme cases, even misuse funds. As Kiplinger emphasizes, an inappropriate trustee choice can easily instigate interpersonal conflicts and legal disputes among beneficiaries, which can quickly escalate into costly litigation. If a well-meaning but overwhelmed or biased family member is appointed, the strain on family relationships can be immense, potentially sparking expensive legal challenges that deplete trust assets.

Preventing this mistake requires a thoughtful and objective selection process. Seek out a trustee who embodies organization, financial responsibility, unwavering ethics, meticulous attention to detail, and the capacity to make objective decisions. They must also have sufficient time and commitment to dedicate to this significant role. Before finalizing your decision, engage in thorough discussions with your chosen trustee(s) to ensure they fully comprehend the responsibilities and commitment involved. It’s often prudent to consider appointing a co-trustee or a successor trustee, which can provide a valuable layer of continuity and establish essential checks and balances to prevent singular mismanagement.

Furthermore, the trust document itself should meticulously outline the trustee’s powers, responsibilities, and any limitations, providing a clear roadmap for their duties. For parents setting up a trust fund, it’s vital to prioritize professional expertise and impartiality, especially if a suitable family member cannot be identified. Considering a professional trustee or trust company, while incurring fees, can be an invaluable investment due to their specialized knowledge, experience in managing trusts, and commitment to fulfilling fiduciary duties without personal bias, thereby safeguarding your child’s interests effectively.

Read more about: The Ultimate Guide: 12 Simple Rules Affecting How Stars’ Multi-Million Dollar Car Collections Are Inherited

3. **Neglecting to Update the Trust**Many view a trust as a “set it and forget it” instrument, but this is a dangerous misconception that can render your meticulously crafted plan obsolete and ineffective over time. Life is dynamic, and your personal circumstances, family situation, financial status, and even trust laws are constantly evolving. Without periodic reviews and necessary updates, a trust can quickly become misaligned with your current wishes, fail to account for new realities, or become significantly less effective than intended.

An outdated trust carries numerous costly risks. It might inadvertently exclude new family members who have joined your fold since the trust’s inception, such as grandchildren, or, conversely, it could continue to benefit an ex-spouse following a divorce, contrary to your current intentions. Assets might be distributed in ways that no longer suit a beneficiary’s changed needs or circumstances, potentially creating hardship or unfairness. The importance of regular review is underscored by the 2025 Caring.com Wills & Estate Planning Study, which revealed that only 24% of Americans maintain updated estate plans, a statistic that tragically contributes to family disputes and expensive legal battles that could otherwise be avoided.

To ensure your trust remains a living, relevant document, proactive and regular reviews are paramount. It is strongly advised to review your trust with your estate planning attorney every three to five years as a standard practice. More importantly, schedule an immediate review after any significant life event. This includes marriage, divorce, the birth or adoption of a child, the death of a beneficiary or trustee, substantial changes in your financial status, or even a relocation to a different state, as laws can vary. Staying informed about major tax and trust legislation changes is also crucial, as these can directly impact the effectiveness and tax efficiency of your plan, necessitating swift adjustments to preserve its integrity and alignment with your goals.

Read more about: Diesel Durability Unveiled: 10 Engines That Redefine Longevity — And Those That Don’t

4. **Overlooking Tax Implications**While avoiding probate is a primary motivation for establishing a trust, many individuals make the costly mistake of overlooking the complex tax implications inherent in different types of trusts and wealth transfer strategies. Failing to consider various taxes—including estate taxes, gift taxes, income taxes for both the trust and its beneficiaries, and capital gains taxes—can lead to unexpected and substantial tax bills that significantly erode the value of your legacy.

Estate planning attorney Craig R. Fiederlein aptly notes, “Tax planning should be a key part of your trust strategy.” He emphasizes the importance of structuring trusts not just to protect assets and avoid probate, but also to minimize tax exposure. Specific provisions are often necessary, especially for retirement assets directed to a trust, to avoid triggering premature taxation or losing valuable deferral opportunities. A comprehensive approach that integrates tax planning from the outset can save families considerable amounts in unnecessary taxes over the long term, preserving more wealth for the intended beneficiaries.

The absence of careful tax planning can result in the trust or its beneficiaries facing significantly higher tax burdens. You might miss out on crucial tax-saving opportunities, such as the step-up in basis that can reduce capital gains taxes for heirs, or inadvertently accelerate tax payments sooner than necessary. For instance, irrevocable trusts, while offering potential estate tax benefits, come with specific income tax rules that can be surprisingly impactful. In 2024, a non-grantor trust reaches the top federal tax bracket of 37% at a mere $15,200 of taxable income, a stark contrast to the much higher thresholds for individuals. This illustrates how quickly trust income can be subjected to high tax rates without proper foresight and structuring.

To navigate these intricate tax landscapes effectively, several actionable steps are vital. Begin by thoroughly discussing the tax consequences of your chosen trust structure with your estate planning attorney. Ideally, your attorney should coordinate with your CPA or financial advisor to ensure a holistic view of your financial and tax situation. It’s imperative to understand how income generated by trust assets will be taxed and who—the trust or the beneficiaries—will be responsible for these payments. If reducing estate tax is a primary goal, explore advanced strategies such as bypass trusts, Qualified Terminable Interest Property (QTIP) trusts, or Irrevocable Life Insurance Trusts (ILITs), but only after gaining a complete understanding of their complex implications and suitability for your specific circumstances.

Read more about: Behind the Impasse: 12 Core Budget and Contract Challenges That Strain Film Production Partnerships

5. **Mismanaging Beneficiary Designations**A critical, yet frequently overlooked, mistake in estate planning involves the mismanagement of beneficiary designations for specific assets. Many financial instruments, such as life insurance policies, retirement accounts (including IRAs and 401(k)s), and annuities, are designed to pass directly to named beneficiaries. This process bypasses your will or even your carefully drafted trust, meaning that your intentions as expressed in your trust document can be overridden by an outdated or improperly coordinated beneficiary form.

The error isn’t just about neglecting to name beneficiaries; it’s also about miscoordinating them with your overall estate plan. This could involve designating accounts directly into a trust when it might not be the most tax-efficient strategy, or, conversely, failing to name the trust as a beneficiary when it is indeed the best option to ensure proper management for vulnerable beneficiaries or to preserve tax advantages. Without careful alignment, these direct designations can lead to unintended consequences that undermine your overarching estate planning goals.

The costs of mismanaging beneficiary designations can be severe. Incorrect designations can completely override the intentions set forth in your trust, leading to assets being distributed to the wrong individuals. For example, an ex-spouse might inherit a substantial retirement account if the beneficiary information was not updated after a divorce, regardless of what your will or trust states. The Supreme Court case, Kennedy v. Plan Administrator for DuPont (2009), unequivocally confirmed that plan administrators must follow the beneficiary form on file. Furthermore, transferring an IRA directly into a standard trust can trigger immediate income taxation, and naming a trust without proper “see-through” provisions can prevent beneficiaries from stretching distributions over their lifetimes, thereby accelerating tax payments and significantly reducing the long-term value of the inheritance.

To avoid these pitfalls, a meticulous review of all your beneficiary designations is essential. This includes your life insurance policies, retirement accounts, bank accounts with Payable on Death (POD) designations, and investment accounts with Transfer on Death (TOD) registrations. Ensure that these designations are fully aligned with your overall estate plan and the specific provisions within your trust. It is crucial to consult with your attorney to carefully weigh the cost-benefits of naming individuals versus the trust as beneficiaries, particularly for retirement accounts, where preserving tax advantages and ensuring appropriate management for beneficiaries with specific needs are paramount considerations.

Continuing our exploration of common trust pitfalls, we delve into additional critical errors that can undermine the effectiveness of your family trust and jeopardize your carefully laid plans. Just as we’ve seen how improper funding or trustee selection can derail a trust, these next mistakes highlight the necessity of comprehensive planning, professional execution, and ongoing vigilance to ensure your legacy is truly protected.

6. **Lack of Clear Goals and Terms**Failing to establish clear and specific goals and terms for your trust fund is a significant oversight that can lead to widespread confusion, escalating family conflicts, and the unfortunate misuse of assets. Without a precise roadmap, the trustee, no matter how well-intentioned, may struggle to make decisions that truly align with your original intentions, potentially distributing assets in ways you never envisioned.

This lack of clarity can be particularly damaging when it comes to outlining the precise purpose of the trust. Are you establishing it primarily for education, healthcare, general support, or specific milestone achievements? If these objectives are not explicitly stated, the flexibility afforded to the trustee can become a source of ambiguity rather than a benefit. This can also lead to disputes among beneficiaries, who may have differing interpretations of your wishes, sparking costly legal challenges.

To circumvent this common pitfall, it is paramount to meticulously define the trust’s purpose when setting it up. This includes specifying the conditions for distributions, such as age milestones or educational achievements, which provide clear triggers for asset release. Furthermore, incorporating explicit restrictions on asset use—for example, prohibiting extravagant or wasteful purchases—can safeguard the trust’s principal and ensure it serves its intended, often long-term, goals. Provisions for unexpected circumstances, such as disability or financial hardship, should also be thoughtfully included to ensure the trust remains adaptable and supportive in unforeseen situations.

By carefully aligning the trust’s purpose with your child’s needs and your family’s core values, you empower the trustee with a clear set of guidelines. This detailed roadmap not only ensures the trust fulfills its intended purpose but also proactively helps in avoiding potential disputes among beneficiaries, fostering harmony, and securing the financial future you envision without unnecessary complications. Taking this time upfront provides invaluable guidance for all involved parties down the road.

Read more about: The Essential 12: Ironclad Contract Clauses Every Influencer and Brand Needs to Know

7. **Underestimating Ongoing Trust Administration Costs**Many individuals, particularly parents establishing trusts for their children, frequently underestimate or completely overlook the ongoing costs associated with maintaining a trust fund. This is a critical mistake, as these expenses can significantly impact the trust’s overall value over time if they are not properly accounted for and planned into the financial strategy. What might seem like minor fees can accumulate, potentially draining the trust’s principal and making it a less attractive option for some families.

These ongoing trust fund costs are multifaceted and can include various charges. For instance, trustee fees are a significant consideration, especially if a professional trustee or trust company is appointed; these fees are typically a percentage of the trust’s assets, often ranging from 0.5% to 1%. Additionally, there are investment management fees if the trust’s assets are actively managed by a financial advisor. Tax preparation and filing costs are also inevitable, as trusts often have their own tax reporting requirements, distinct from individual income taxes. Furthermore, legal fees for ongoing administration or for resolving potential disputes can arise unexpectedly, adding to the overall expense.

The impact of overlooking these costs can be substantial. As the context highlights, “the initial setup fees and ongoing administrative costs can add up over time, making it a less attractive option for some families.” This cumulative drain can erode the very wealth you intended to preserve, meaning beneficiaries might receive less than anticipated. The complexity of establishing and maintaining a trust requires legal expertise to draft and ongoing management by a trustee, both of which incur fees, adding to the overall financial commitment.

To effectively mitigate this mistake, it is crucial to factor in all potential ongoing expenses when initially setting up your trust fund. Work with your estate planning attorney and financial advisor to develop a realistic budget for these administrative costs. Consider including specific provisions within the trust document to clearly outline how these expenses will be covered. This might involve allocating additional assets specifically to offset these administrative overheads, ensuring the trust’s intended principal remains intact and continues to grow for the benefit of your loved ones, rather than being depleted by unforeseen charges.

Read more about: Your Retirement Blueprint: A State-by-State Guide to How Much Savings You Really Need in the US

8. **Attempting to Draft Trust Documents Without Professional Help (DIYing)**One of the biggest and most perilous trust fund mistakes parents can make is attempting to set up and manage a trust fund without the indispensable guidance of experienced professionals. The complexities of trust law, coupled with intricate tax regulations and nuanced financial management, require specialized knowledge that is rarely possessed by laypersons. Relying on online templates or generic forms in an attempt to save money often proves to be a false economy, leading to far greater costs and complications down the line.

Errors in the legal setup of a trust fund can have severe, far-reaching consequences, potentially rendering the trust invalid, ineffective, or unable to achieve its core objectives. Common pitfalls stemming from a DIY approach include the failure to properly transfer assets into the trust, which effectively creates an “empty shell.” Incomplete or improperly executed trust documents are another frequent error, which can leave critical legal gaps or fail to meet state-specific legal requirements, undermining the trust’s enforceability. Additionally, overlooking crucial details such as updating beneficiary designations on accounts and policies can lead to assets being distributed contrary to your intentions.

As experts emphasize, DIY trust setup is prone to leading to costly errors, such as improperly drafted documents that fail to achieve your goals, significant overlooked tax-saving opportunities, and the implementation of ineffective asset protection strategies. These documents often lack key provisions pertaining to complex tax implications, specific termination clauses, or robust contingency plans for unforeseen events. Should mistakes be discovered later, trying to rectify a poorly constructed DIY trust can be far more intricate and expensive than having it done correctly from the very beginning.

To avoid these critical mistakes, working closely with an experienced estate planning attorney who specializes in trust creation is not merely advisable but essential. Such a professional can meticulously guide you through the entire process, ensuring that all necessary legal steps are completed accurately and that the trust documents are comprehensive and legally sound. They will draft customized trust documents specifically tailored to your family’s unique situation, incorporating the intricate legal components required to preempt issues and provide true peace of mind. Their expertise ensures your trust is properly structured, legally sound, and optimized to meet your family’s specific needs and long-term financial goals.

9. **Overlooking State-Specific Nuances and the Need for Comprehensive Coordination**A common and often underestimated error in trust planning is failing to recognize that a trust, while powerful, is only one component of a broader estate plan, and its effectiveness is deeply intertwined with other legal instruments and state-specific laws. Many individuals inadvertently view their trust in isolation, neglecting to coordinate it with their will, powers of attorney, healthcare directives, and critical beneficiary designations. This oversight, combined with a lack of awareness regarding differing state laws and taxes, can significantly compromise the trust’s efficacy and incur unforeseen costs.

The nuances of state law are not minor details; they can fundamentally impact a trust’s effectiveness, administration, and tax implications. What is permissible or advantageous in one state might be different or even problematic in another. For instance, state-specific tax regulations or probate laws can alter how a trust’s assets are treated upon the grantor’s passing or how income generated by the trust is taxed. Overlooking these geographical distinctions can lead to unintended legal hurdles, increased administrative burdens, or unexpected tax liabilities, effectively draining the trust’s value or complicating its management for beneficiaries.

The overarching necessity of comprehensive coordination cannot be overstated. It involves ensuring that your will clearly aligns with your trust, that your powers of attorney grant the necessary authority to manage assets both inside and outside the trust during incapacity, and that healthcare directives reflect your wishes consistently. Crucially, all beneficiary designations—for retirement accounts, life insurance policies, and other financial instruments—must be meticulously reviewed and aligned with your trust’s provisions. A misaligned designation can legally override your trust’s instructions, diverting assets to unintended recipients or triggering premature taxation, as unequivocally demonstrated by cases like *Kennedy v. Plan Administrator for DuPont (2009)*.

Protecting your family from these expensive and stressful trust errors ultimately comes down to a blend of diligence and expert guidance. Engaging a qualified estate planning attorney who understands not only trust law but also state-specific regulations is paramount. They can provide advice tailored to your unique circumstances and ensure that your entire estate plan functions as a cohesive unit. Implementing regular trust reviews, especially after significant life changes or updates to tax and estate laws, ensures ongoing alignment. By committing to a thorough funding process, selecting your trustee wisely, and ensuring comprehensive coordination across all your estate documents, you build a robust and resilient plan.

By proactively addressing these common pitfalls, you can confidently navigate the complexities of trust planning. This diligent approach ensures your trust will genuinely safeguard your assets, provide for your loved ones exactly as intended, and preserve your legacy without incurring unnecessary costs, taxes, or family disputes. It is more than just legal paperwork; it is a lasting gift of security, thoughtful planning, and peace of mind for generations to come.