The automotive industry, a cornerstone of modern life, is currently navigating a landscape fraught with unprecedented challenges. From escalating tariffs to intricate global supply chain disruptions, the steady flow of vehicle parts—essential for both new car production and ongoing maintenance—is facing significant pressure. For consumers, this translates into a tangible concern: the potential for increased repair costs, extended waiting times, and, in some cases, a genuine scarcity of the components needed to keep their vehicles safely on the road.

At Consumer Reports, our objective is always to provide clear, data-driven insights that empower you to make informed decisions. We’ve delved into the complex interplay of factors contributing to these parts shortages, mirroring the logic behind the Consumer Price Index to track inflationary trends and market behavior across various part types. Our analysis reveals that certain imported components are particularly vulnerable, with their availability and cost directly influenced by these macro-economic shifts. Understanding these risks is paramount for every vehicle owner, especially as these challenges are projected to intensify in the coming years.

This in-depth report identifies 14 crucial categories of imported auto parts and materials that warrant your attention. We will systematically explore why these items are becoming increasingly susceptible to scarcity and price hikes, offering a comprehensive overview of the underlying causes. By presenting this information in an accessible, authoritative manner, we aim to equip you with the knowledge needed to anticipate potential issues and navigate the evolving automotive landscape with greater confidence.

1. **Original Equipment Manufacturer (OEM) Parts**Original Equipment Manufacturer (OEM) parts are those designed and produced by the vehicle’s original maker. These components are often considered the gold standard for repairs, ensuring compatibility and maintaining the vehicle’s original specifications. However, a significant portion of these crucial parts originates outside the United States, making them highly susceptible to international trade policies and geopolitical shifts.

Roughly 44% of OEM parts utilized in collision repair are produced beyond U.S. borders. Many of these non–United States-Mexico-Canada Agreement (USMCA)-compliant parts are now subject to tariffs, specifically the 25% tariff levied on imported auto and auto parts based on Section 232 of the 1962 Trade Act. This direct imposition of tariffs has immediate and measurable financial consequences, which are already making their way through the supply chain to the consumer.

The impact on retail pricing for OEM parts has been notable. Our tracking indicates that retail prices for OEM parts rose 2.1% from Q1 to Q2 2025. This is a significant acceleration compared to the 1% increase observed during the same period in 2024. While aftermarket and recycled parts have not yet experienced a similar surge, the rising cost of OEM components can notably increase auto repair claims costs, potentially leading to higher personal auto insurance premiums for consumers.

This reliance on foreign manufacturing for nearly half of OEM collision repair parts, coupled with the ongoing tariff regime, creates a persistent vulnerability. As the industry continues to grapple with these increased costs, dealerships and repair shops face challenges in sourcing these parts efficiently, potentially leading to longer repair times and higher expenses for the end-user. The long-term implications underscore the importance of understanding the origin and pricing dynamics of OEM components.

Read more about: Beyond the Sticker Shock: The 12 Hidden Costs That Make Luxury Sedan Repairs So Expensive for Owners

2. **Steel and Aluminum**At the very foundation of automotive manufacturing are essential raw materials like steel and aluminum. These metals form the backbone of a vehicle’s structure, chassis, and numerous components. While seemingly basic, their global sourcing and the imposition of tariffs have profound ripple effects throughout the entire automotive supply chain, affecting both vehicle production and the availability of replacement parts.

Steel and aluminum tariffs, specifically a 50% tariff, are in place, justified by both an economic emergency declaration and Section 232 of the Trade Act. This significant tariff percentage directly increases the cost of these foundational materials. Considering that approximately 80% of automotive-grade aluminum is mined in Canada, a key USMCA partner, the broad application of these tariffs highlights the extensive reach of trade barriers.

The U.S. automotive industry supply chain begins with the sourcing of these materials, which are then transformed into specific parts like engines and electronic systems by specialized manufacturers. Disruptions or cost increases at this initial phase propagate through every subsequent tier of the supply chain. Higher costs for raw steel and aluminum translate into increased manufacturing expenses for all components that utilize them, ultimately contributing to higher retail prices for parts.

Furthermore, geopolitical factors and ongoing wars exacerbate global instability, impacting the supply chain of critical raw materials like steel and affecting transportation routes and labor availability. This complex web of challenges underscores why steel and aluminum, though basic, are critical categories to monitor for potential scarcity and price volatility in the automotive sector.

Read more about: Gone But Not Forgotten: 16 Legendary Station Wagons That Defined Family Hauling (and Our Childhoods)

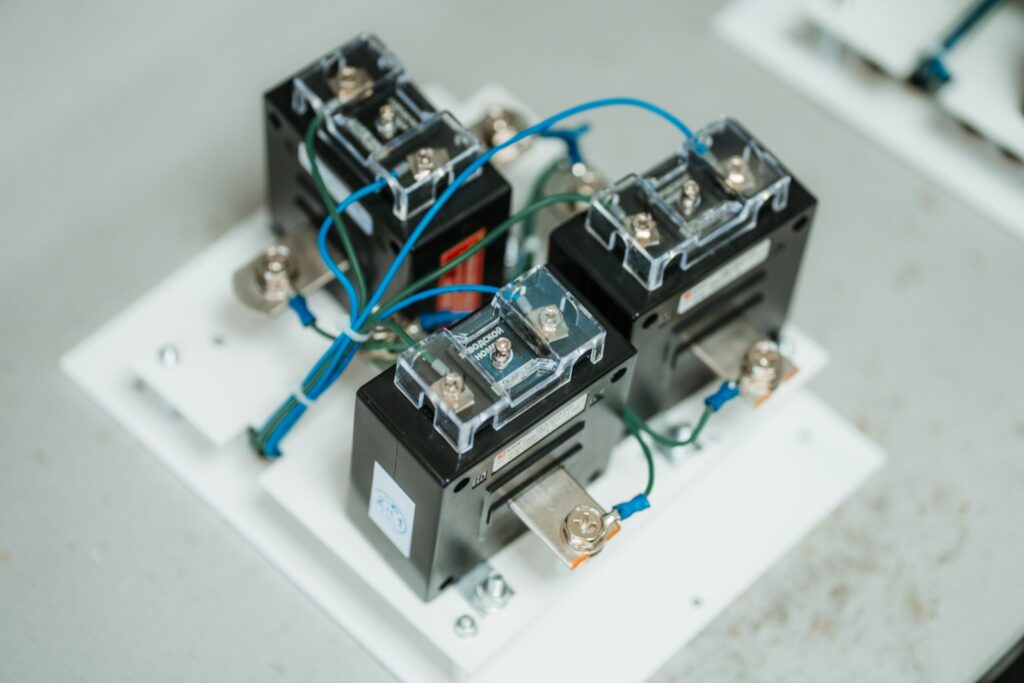

3. **Microchips (Semiconductors)**Modern vehicles are increasingly sophisticated, with advanced safety features, infotainment systems, and engine management all relying heavily on microchips, also known as semiconductors. These tiny, yet powerful, components are the brains behind much of a car’s functionality. The global shortage of microchips has become a critical bottleneck for the automotive industry, causing widespread production delays and impacting the availability of vehicles and parts.

The COVID-19 pandemic significantly disrupted manufacturing operations worldwide, and the semiconductor industry was particularly affected. Factory closures, labor shortages, and an unexpected surge in demand from other sectors (like consumer electronics) caught the automotive industry off guard. With the increasing demand for smart vehicles, the production of microchips has struggled to keep pace, leading to delays in the manufacturing of vehicles and a subsequent shortage of critical components.

Our analysis, referencing reports like The Wall Street Journal, indicates that the price of key components like microchips, tires, and electronic systems has increased by as much as 20% due to these tariffs. This isn’t just about new vehicle production; existing cars needing repairs for electronic modules, engine control units, or sensor systems are directly affected. Repair shops and dealerships have reported difficulties in sourcing these genuine parts, leading to longer repair times.

The intricate, globally interconnected nature of microchip production means that even minor disruptions can have a domino effect throughout the automotive supply chain. The scarcity of these vital components not only drives up costs but also raises significant questions about the long-term reliability and maintenance of new cars, as replacement parts become harder to obtain and more expensive.

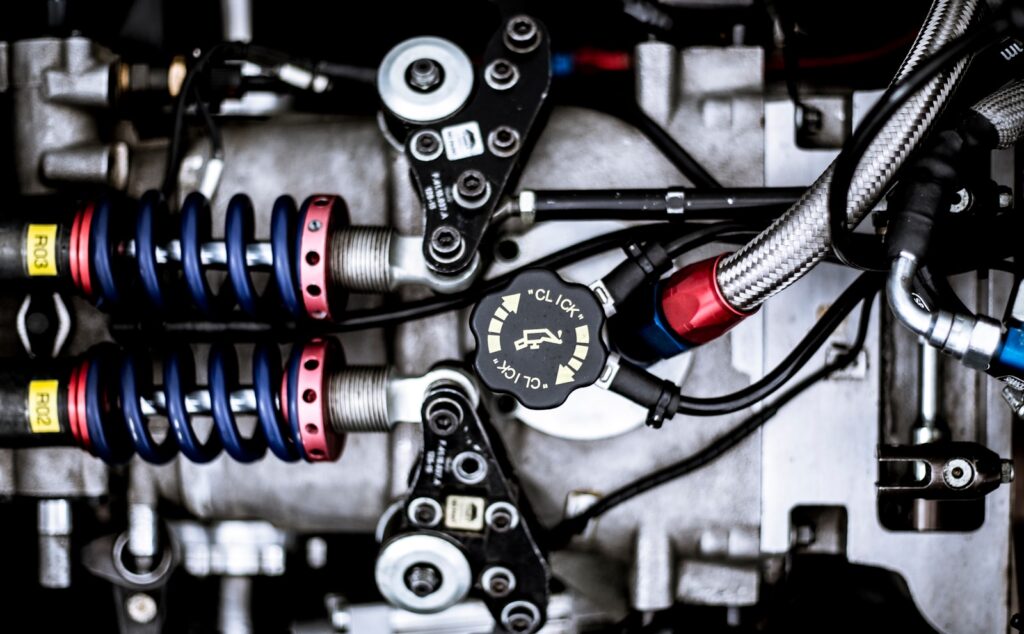

4. **Electronic Systems**Beyond individual microchips, the broader category of electronic systems encompasses a vast array of components crucial for a vehicle’s operation, safety, and comfort. These include complex wiring harnesses, control modules for everything from braking to airbags, navigation systems, and advanced driver-assistance features. Like microchips, these systems often rely on imported components and are therefore sensitive to tariffs and supply chain vulnerabilities.

The interconnectedness of the automotive supply chain means that a shortage in one component, such as microchips, can halt entire production lines for electronic systems. Many auto manufacturers depend heavily on imported components from countries like China, Mexico, and Canada for these sophisticated assemblies. The imposition of tariffs, such as the 25% tariff on car parts imports, directly increases the costs for manufacturers and suppliers of these systems.

According to a recent report, the price of key electronic systems has increased by as much as 20% due to these tariffs, alongside microchips and tires. This increase in cost is often passed down to consumers, leading to higher prices for both new vehicles and crucial repairs. Dealerships and repair shops report difficulties in sourcing genuine parts, especially for popular models, leading to extended waiting times for vehicle repairs.

The complexity of these systems and their reliance on a globally distributed manufacturing base make them particularly susceptible to disruptions. As vehicles become more technologically advanced, the reliability and availability of these imported electronic systems become paramount for maintaining vehicle performance and safety, directly impacting consumer confidence and satisfaction.

Read more about: Navigating the Surge: 12 Key Reasons Your Car Insurance Rates Are Skyrocketing in Today’s Market

5. **Engines**The engine is undeniably the heart of any vehicle, and its intricate assembly relies on a global network of suppliers for various components. While some engines are fully manufactured domestically, a significant portion, or at least many of their critical sub-components, are sourced from international partners. This global dependency makes engines a key category vulnerable to trade policies and supply chain disruptions.

Under the United States-Mexico-Canada Agreement (USMCA), Mexico and Canada supply a wide range of parts, including engines, to U.S. auto manufacturers. Beyond North America, countries like Japan and South Korea also export high-quality engine components. Specifically, all American manufacturers source 22% of their cars’ engines from Japan and 13% from South Korea. This illustrates a substantial reliance on these regions for core powertrain elements.

Furthermore, the text indicates that a lot of final assembly of American cars happens in these countries. For example, General Motors assembles 19% of its models in Mexico and 13% in South Korea. Similarly, Ford assembles 13% of its models in Mexico. This distribution of manufacturing and assembly means that tariffs or disruptions in these key regions can directly impede the availability and increase the cost of complete engines or critical engine parts.

The increasing costs for vehicle parts due to tariffs, coupled with potential delays from global supply chain issues, mean that engines or their sub-components could become more expensive and harder to acquire. This directly impacts repair costs and vehicle downtime, forcing dealerships to adapt their parts sourcing strategies and potentially pass on higher expenses to consumers.

Read more about: The 12 Costly Mistakes Classic Muscle Car Restorers Make: Safeguard Your Dream Project and Your Wallet

6. **Transmission Systems**Transmission systems are another foundational component of a vehicle’s powertrain, responsible for transferring power from the engine to the wheels. Like engines, the manufacturing and sourcing of transmission systems involve a complex global network, making them susceptible to the same vulnerabilities affecting other major imported parts. Their intricate design often requires specialized components from various international suppliers.

Similar to engines, transmission systems are sourced from key international partners. The U.S. manufacturers source 27% of their transmission systems from Japan and 14% from South Korea. Additionally, Mexico and Canada are significant suppliers of transmission systems under the USMCA agreement. This substantial reliance on these regions means that tariffs on imported auto parts, particularly the 25% tariff, directly influence the cost and availability of these crucial components.

It’s important to note the bidirectional nature of this trade: U.S. manufacturers are also leading exporters of transmission systems to non-U.S. car brands, with 87% of Acura and 58% of Honda cars incorporating U.S.-made transmission systems. Toyota, Kia, and Hyundai also source transmission systems from U.S.-based suppliers. However, for domestic vehicles relying on imported transmissions or their parts, the challenges of tariffs and supply chain disruptions remain.

Any disruption in the flow of these imported transmission systems, whether due to increased tariffs or broader supply chain issues like factory closures and transportation bottlenecks, can lead to significant delays in vehicle production and repair. For consumers, this could translate to longer repair times and higher costs when a transmission system or its integral parts need replacement, contributing to the overall challenge of maintaining vehicle reliability.

Read more about: The 12 Costly Mistakes Classic Muscle Car Restorers Make: Safeguard Your Dream Project and Your Wallet

7. **Lithium-ion Batteries**With the automotive industry rapidly shifting towards electric vehicles (EVs), lithium-ion batteries have emerged as an undeniably critical component, powering the next generation of transportation. The demand for these vital energy sources is soaring, and their supply chain is highly concentrated in specific regions, making them a significant point of vulnerability for the future of vehicle parts.

Electric vehicles largely depend on these lithium-ion batteries. The global market for battery production is currently dominated by China, which controls approximately 70% of the world’s battery market. This dominance is not only due to its manufacturing capacity but also its extensive access to crucial raw materials such as lithium reserves and a dominant position in the supply of cobalt and graphite—all essential for battery production.

Chinese companies like CATL (Contemporary Amperex Technology Co. Ltd.) are at the forefront of producing high-quality batteries for electric cars, cementing China’s leadership in global EV manufacturing. This heavy reliance on a single nation for such a critical component creates a substantial supply chain risk. While the context mentions tariffs on imported auto parts generally, any specific tariffs targeting EV components or raw materials for batteries from dominant suppliers could severely impact availability and cost.

As EV adoption continues to grow, the importance of a robust and diversified battery supply chain becomes paramount. Current challenges include high costs, limited recycling facilities, and a lack of standardized processes for battery recycling. Consumers investing in EVs must be aware of the long-term implications of this concentrated supply, including potential repair costs and availability of replacement batteries, which are central to the vehicle’s functionality and lifespan.

As we continue our in-depth analysis, shifting from broad component categories to specific, high-volume parts, we aim to provide you with actionable insights. The challenges facing the automotive supply chain are multifaceted, extending beyond raw materials and high-tech systems to encompass everyday collision repair parts. Understanding the vulnerabilities of these particular imports is crucial for consumers navigating an increasingly complex landscape of vehicle maintenance and ownership.

We’ll now delve into specific parts like fenders, hoods, and bumper components, along with other critical elements, examining how tariffs, global events, and manufacturing practices are creating scarcity. Our objective, as always, is to empower you with the knowledge to anticipate potential issues and make informed decisions about your vehicle’s longevity and repair needs. This systematic exploration will highlight why these seemingly common parts are becoming significant points of concern in the coming decade.

Read more about: Buyer’s Remorse on Wheels: The 15 Vehicles That Left Owners Longing for a Do-Over

8. **Fenders**Fenders are among the most frequently replaced components in collision repair, playing a vital role in protecting a vehicle’s wheels and chassis from road debris. As a high-volume part, fenders are included in our “parts market basket report,” which rigorously tracks inflationary trends across a consistent set of components. This focused tracking allows us to pinpoint how macro-economic shifts, particularly tariffs, are directly affecting their availability and cost.

A significant portion of Original Equipment Manufacturer (OEM) parts, including fenders, are produced outside the United States. Our analysis indicates that roughly 44% of OEM collision repair parts originate beyond U.S. borders. Many of these non–United States-Mexico-Canada Agreement (USMCA)-compliant parts are now subject to a 25% tariff, levied based on Section 232 of the 1962 Trade Act. This tariff directly inflates the cost of imported OEM fenders, a burden that ultimately filters down to the consumer.

The impact of these tariffs on retail pricing is already evident. We’ve observed that retail prices for OEM parts rose by 2.1% from Q1 to Q2 2025, a noticeable acceleration from the 1% increase seen during the same period in 2024. This rising cost for essential components like fenders can significantly increase auto repair claims, potentially leading to higher personal auto insurance premiums for vehicle owners.

Furthermore, the industry’s widespread adoption of just-in-time manufacturing practices, while efficient, leaves little room for flexibility when disruptions occur. Any delay in the complex global supply chain for raw materials like steel and aluminum, or transportation bottlenecks, can quickly escalate into a scarcity of replacement fenders. This vulnerability highlights why these common parts are increasingly difficult and expensive to source, particularly after a decade of compounding pressures.

Read more about: Gone But Not Forgotten: 16 Legendary Station Wagons That Defined Family Hauling (and Our Childhoods)

9. **Hoods**The hood is another indispensable body component, crucial for protecting the engine bay and contributing to a vehicle’s structural integrity. Like fenders, hoods are consistently tracked within our “parts market basket report,” providing a clear picture of how market forces and trade policies are influencing their price and supply. This meticulous monitoring ensures that we can identify inflationary pressures on these high-volume parts early on.

As a major OEM component, imported hoods are equally susceptible to the same tariff regime affecting other non-USMCA-compliant parts. The 25% tariff on imported auto parts, justified under Section 232 of the 1962 Trade Act, directly escalates their landed cost. This increased expense for manufacturers and suppliers inevitably translates into higher retail prices for consumers seeking genuine replacement hoods.

The raw materials themselves, primarily steel and aluminum, are also subject to their own set of tariffs, specifically a 50% tariff. Considering that approximately 80% of automotive-grade aluminum is mined in Canada, a key USMCA partner, the broad application of these tariffs creates ripple effects throughout the manufacturing process. Higher costs for foundational materials directly impact the production cost of steel and aluminum-intensive components like hoods, further fueling price inflation.

Geopolitical factors, including ongoing wars and trade challenges, exacerbate global instability and can significantly disrupt the supply chain for critical raw materials and finished parts. These external pressures, combined with the stringent demands of just-in-time manufacturing, mean that securing OEM hoods can become a protracted and costly endeavor. Consumers face longer waiting times for repairs and higher expenses, making an older vehicle with a damaged hood a considerable financial burden.

Read more about: Seriously What Happened? 14 Once-Ubiquitous Snack Brands We Just Don’t See on Shelves Anymore.

10. **Bumper Parts**Bumper parts are vital for both vehicle aesthetics and, more critically, for passenger safety during low-speed collisions. They are a staple in collision repair estimates and are therefore integral to our “parts market basket report,” allowing us to observe how their market behavior is affected by various economic factors. Their consistent demand makes them a prime indicator of broader supply chain health.

A significant portion of bumper components are imported, rendering them vulnerable to the existing tariff structure. The 25% tariff on car parts imports directly contributes to increased costs for manufacturers and suppliers of these essential safety components. This increase is often passed on to consumers, leading to higher repair bills and a direct impact on the affordability of maintaining a damaged vehicle.

Our analysis of repair claim data provides a sobering outlook: a 25% tariff on imported repair parts, assuming other factors remain static, could increase auto repair claims costs by an estimated 2.7%. This translates to a potential impact of between $80–$100 per repairable claim, based on an average of 13.5 parts replaced per estimate. For bumper repairs, where multiple sub-components might be needed, this adds up quickly.

Geopolitical factors, such as trade challenges with Mexico and Canada, could further complicate the sourcing of bumper parts, which are often produced in these regions under the USMCA. Natural disasters can also cripple manufacturing facilities or transportation routes, leading to unforeseen delays and increased scarcity. These cumulative challenges mean that consumers with older vehicles may struggle to find timely and affordable replacement bumper parts, impacting both safety and resale value.

Read more about: Elevate Your Ride: Simple Secrets to Painting Your Brake Calipers Like a Professional

11. **Lamps**Vehicle lamps, encompassing headlights, taillights, and signal lights, are not merely aesthetic features but critical safety components that ensure visibility and communication on the road. As such, they are included in the key components tracked by our price inflation indices. The increasing sophistication of modern lighting systems, incorporating advanced electronics, further entwines their supply with the vulnerabilities of the high-tech sector.

Imported lamps, especially OEM units, are subject to the same 25% tariff levied on car parts imports. This direct cost increase immediately impacts manufacturers and, subsequently, consumers. Beyond the basic tariff, the electronic complexity of modern lamps—many featuring intricate LED arrays and adaptive lighting modules—means they also rely on microchips and other electronic systems, which have faced severe global shortages and price hikes.

According to reports referenced in our broader analysis, the price of key electronic systems, which are integral to advanced lamps, has increased by as much as 20% due to tariffs and supply chain bottlenecks. This dual impact of tariffs on the physical lamp unit and its internal electronic components creates a significant challenge for sourcing and affordability. Dealerships and repair shops have reported difficulties in obtaining genuine replacement lamps, especially for popular models, leading to extended waiting times for repairs.

The interconnectedness of the automotive supply chain means that disruptions stemming from microchip shortages or factory closures in countries like China, a major producer of electronic components, can directly affect the availability of lamps. This situation forces consumers to potentially compromise on safety or face prolonged vehicle downtime and escalated repair expenses, underscoring the long-term reliability concerns for vehicles after a decade of operation.

Read more about: Gone But Not Forgotten: 14 Legendary Naturally Aspirated Engines That Redefine Automotive Purity

Ultimately, staying informed, prioritizing authorized service centers for quality maintenance, and understanding the warranty implications of imported parts will be crucial for every vehicle owner. This era of supply chain complexity, though challenging, also serves as a powerful catalyst for a more sustainable, adaptable, and ultimately, more robust automotive future.