Banks collected a staggering $5.8 billion in overdrafts and NSF fees in 2023 alone, and these charges are only escalating. For many consumers, this represents money extracted from accounts without their full awareness, often discovered only after reviewing statements to find hundreds of dollars gone in just a few months. These charges frequently hit hardest when individuals are already facing financial strain, turning an unexpected payment into a cascade of costly penalties.

Traditional banks, in particular, have long profited from the complexity and confusion surrounding their fee structures. With a recent report from the Consumer Financial Protection Bureau (CFPB) revealing that Americans paid over $40 billion in hidden banking fees in 2024, the stakes are higher than ever. The landscape of financial charges is constantly evolving, with institutions rebranding old “junk fees” with new names to confuse consumers, as noted by David Uejio, Senior Advisor at the CFPB.

This in-depth guide is designed to pull back the curtain on these stealthy charges. We’ll break down 14 of the most prevalent hidden bank fees, explain how they operate, highlight their real-world impact on your finances, and, most importantly, provide actionable strategies to avoid them altogether. By arming yourself with knowledge, you can reclaim control of your hard-earned money and ensure your banking relationship builds wealth rather than silently draining it.

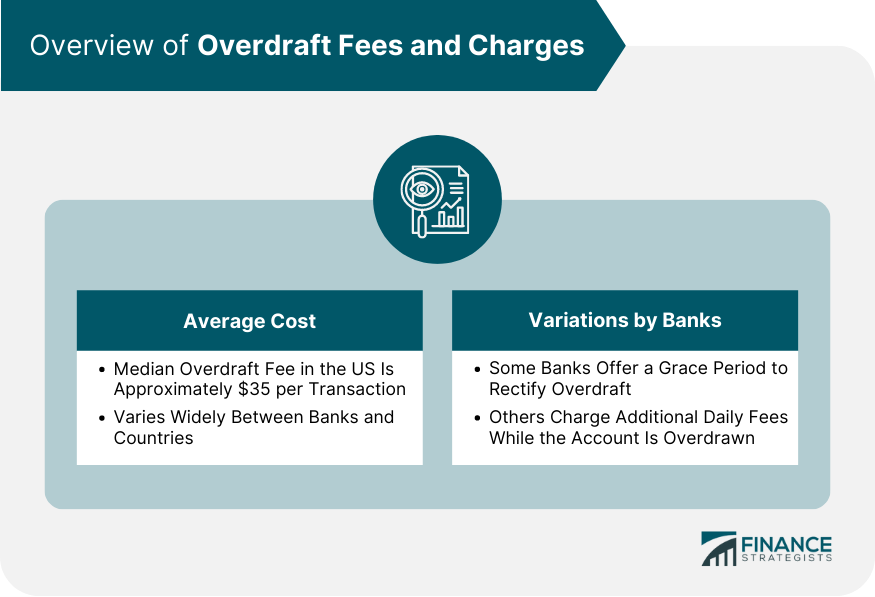

1. **Overdraft and Non-Sufficient Funds (NSF) Fees**Overdraft fees are arguably one of banking’s most profitable revenue streams, generating substantial income from customers’ financial missteps. These charges kick in when you spend more money than you have in your account, essentially by allowing the bank to “cover” the payment for you. The problem is, this “help” comes at a steep price, often catching account holders off guard with its rapid accumulation.

Banks typically charge an average of $35 every time your account goes negative, even if only by a few cents. What’s more concerning is that some institutions permit multiple overdraft fees per day, meaning a single day of poor timing—where automatic payments or small purchases hit an already low balance—can easily result in a customer incurring $175 or more in fees. Compounding this issue, many banks deliberately process your largest transactions first, followed by smaller ones, a practice that maximizes the number of overdrafts they can charge, further amplifying the financial burden on consumers.

The real-world impact of overdraft fees is often felt most acutely during already stressful financial periods. When an account balance is low, the sequencing of transactions by banks can lead to a scenario where multiple overdraft charges quickly add up to amounts greater than the actual transactions themselves. For instance, a college student might unknowingly overdraw their account with a small purchase, only to find several larger pending bills process afterward, each triggering an additional $35 fee. This can quickly deplete an already strained budget, making it harder for individuals to recover financially.

Avoiding these pervasive bank fees is simpler than many realize. The most straightforward protection is to opt out of overdraft coverage entirely; this means your card will simply be declined if funds aren’t available, preventing any fees. Another effective strategy is to set up account alerts that notify you when your balance drops below a certain threshold, such as $100, giving you time to add funds. Linking your savings account for automatic transfers when your checking account runs low also provides a vital safety net. Additionally, explore banks that offer overdraft forgiveness for first-time incidents, credit unions with generally lower fees, or online banks like Chime or Varo, which often boast no overdraft charges at all.

Read more about: Unmasking the Money Traps: 14 Hidden Bank Fees Major Banks Charge and How to Shield Your Wallet

2. **ATM Fees**ATM fees, while seemingly small on an individual basis, possess a stealthy ability to accumulate into substantial annual costs, particularly for individuals who frequently withdraw cash. These charges arise when you use an ATM outside of your bank’s designated network, effectively penalizing you for accessing your own money through another institution’s machine. The structure of these fees can be particularly insidious, often involving a dual charge that quickly inflates the total cost per transaction.

The core of the problem lies in the double-dipping nature of these fees. Out-of-network ATM fees typically range from $2 to $5 per transaction, with your own bank charging you for using a non-affiliated machine, and the ATM owner simultaneously adding their own fee. This means a single withdrawal can cost anywhere from $4 to $10. International travel multiplies these costs dramatically; foreign ATMs usually impose both a withdrawal fee and a conversion fee, and some even offer dynamic currency conversion at unfavorable exchange rates, leading to further hidden expenses that erode your travel budget without clear disclosure.

The real-world impact of these accumulating charges can be significant, yet often goes unnoticed. Business travelers, especially those frequently accessing cash overseas, can easily spend hundreds annually on ATM fees alone. Similarly, individuals who grab cash during daily errands from convenience store ATMs often don’t realize how quickly these seemingly small charges add up over months. A consumer might withdraw cash four times a month, incurring $3 per transaction ($2 from their bank, $1 from the ATM owner), leading to $144 annually. These amounts, while individually minor, collectively represent significant leakage from personal finances that people may not even detect unless they diligently review their annual banking costs.

Smart planning and a proactive approach can prevent most ATM fees. Credit unions frequently offer access to massive ATM networks, such as CO-OP and Allpoint, which often come with no fees for their members. Many online banks, like Charles Schwab or Ally, take it a step further by reimbursing all ATM charges monthly, providing true fee-free access to cash. For everyday needs, grocery stores frequently offer cash back with purchases, entirely eliminating the need for ATM visits. Additionally, strategies like withdrawing larger amounts less frequently, utilizing bank branches during business hours, downloading ATM locator apps to find fee-free machines, and choosing banks with extensive ATM networks can drastically reduce or eliminate these charges.

Read more about: Gone But Not Forgotten: Reliving the Magic of 10 Iconic Video Stores We Miss

3. **Monthly Maintenance Fees**Many banks enthusiastically advertise “free checking accounts,” yet they often subtly impose monthly maintenance fees that can quietly cost customers hundreds of dollars annually. These fees are essentially a charge for simply holding your money in an account, a basic service that many consumers expect to be truly complimentary. However, the reality for many traditional banking customers is a recurring deduction that adds up considerably over time, often contingent on specific, and sometimes hard-to-meet, conditions.

The problem stems from these monthly maintenance fees, which can range from $12 to $25. This makes even a seemingly “free” account an expensive proposition if the waiver requirements are not met. To avoid these fees, many banks demand minimum balances, sometimes exceeding $1,500, or require consistent direct deposits of a certain amount. Other waivers might depend on the size of your transactions or necessitate a sufficient combined balance across all of the bank’s products. For consumers with fluctuating incomes or those who manage multiple accounts, these conditions can be difficult to maintain consistently, leading to unexpected charges.

The real-world impact of these fees often emerges during significant life changes or account transitions, catching customers off guard. Imagine a student who opens a checking account at 19 with no monthly fees, only for her bank to automatically convert it to a standard checking account with a $15 monthly charge after graduation, when her student status ends. She could easily pay hundreds of dollars that year before ever noticing the change. In another scenario, a retiree’s pension might switch from direct deposit to mailed checks, inadvertently triggering $25 monthly maintenance fees on his senior account. Sara’s real-life example from the context revealed she paid $120 annually in monthly maintenance fees before realizing it.

To effectively avoid monthly maintenance fees, consider embracing online banks. They frequently offer genuinely free checking with no balance requirements or complex conditions that are only revealed in the fine print. Credit unions also typically feature lower minimum balance thresholds and more reasonable fee structures, making them an excellent alternative. If you prefer sticking with a traditional bank, it is crucial to ensure you consistently meet the required direct deposit amount or maintain sufficient combined balances across your accounts. Other viable options include community banks that often have lower minimums and exploring employer banking partnerships that may offer fee waivers as part of employee benefits, allowing you to bypass these charges entirely.

Read more about: Navigating the Rental Maze: 14 Hidden Financial Traps in Lease Agreements for Young Professionals, Students, and Families

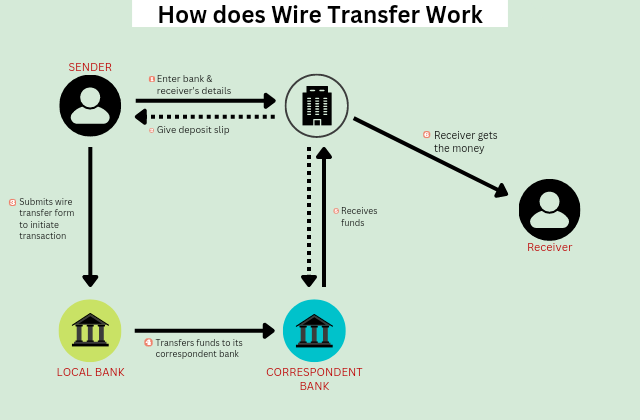

4. **Wire Transfer and Money Movement Fees**Moving your own money, whether between your accounts at different institutions or sending funds to others, presents another significant source of fees that most banks are reluctant to advertise upfront. These charges can be particularly frustrating because they involve accessing or transferring money that is already yours, yet the financial institutions often treat these movements as premium services worthy of a significant charge. The cost associated with these transfers can vary widely depending on the type of transaction and its destination.

Banks’ fees for moving money can quickly accumulate. Domestic wire transfers typically range from $15 to $30, while international wire transfers can be even more exorbitant, costing anywhere from $65 to $100 or more per transaction. Beyond these headline figures, banks may also impose fees for seemingly simple transfers between your own accounts if they are held at different institutions. Even expedited ACH transfers or same-day processing for electronic payments can incur additional fees. The context provides a specific example where PNC started charging $3 for teller-assisted transfers made over the phone or in person, illustrating how even basic services can become costly.

Real-world costs of wire transfers often surface during emergencies, highlighting their financial burden. For instance, if a woman’s father faces a medical emergency abroad, she might need to send money immediately. Beyond the $45 wire transfer fee from her bank, the receiving bank could charge an additional $25, making a necessary act of support surprisingly expensive. In another scenario, a homebuyer might learn about substantial wire fees during the closing process, where a delayed transfer could nearly derail the purchase. He might then be forced to pay extra fees to expedite the process, adding unexpected costs to an already significant investment. For freelancers or remote workers, these fees, particularly for international transactions, can seriously cut into their bottom line.

Fortunately, modern payment apps have largely eliminated most transfer fees for personal transactions. Services like Zelle, Venmo, and PayPal enable instant money movement between friends and family at no direct cost for standard transfers, though they do generate revenue from other fees. For international transfers, specialized services such as Wise (formerly TransferWise) or Revolut offer better exchange rates and significantly lower fees compared to traditional banks. Other free alternatives include using standard ACH transfers for non-urgent domestic payments, leveraging credit union wire services which often have reduced fees, and utilizing robust bill pay systems for recurring payments, all of which provide cost-effective ways to manage your money movement without incurring steep bank charges.

Read more about: 12 Crucial Car Realities Salespeople Wish You’d Understand to Enhance Your Purchase Journey

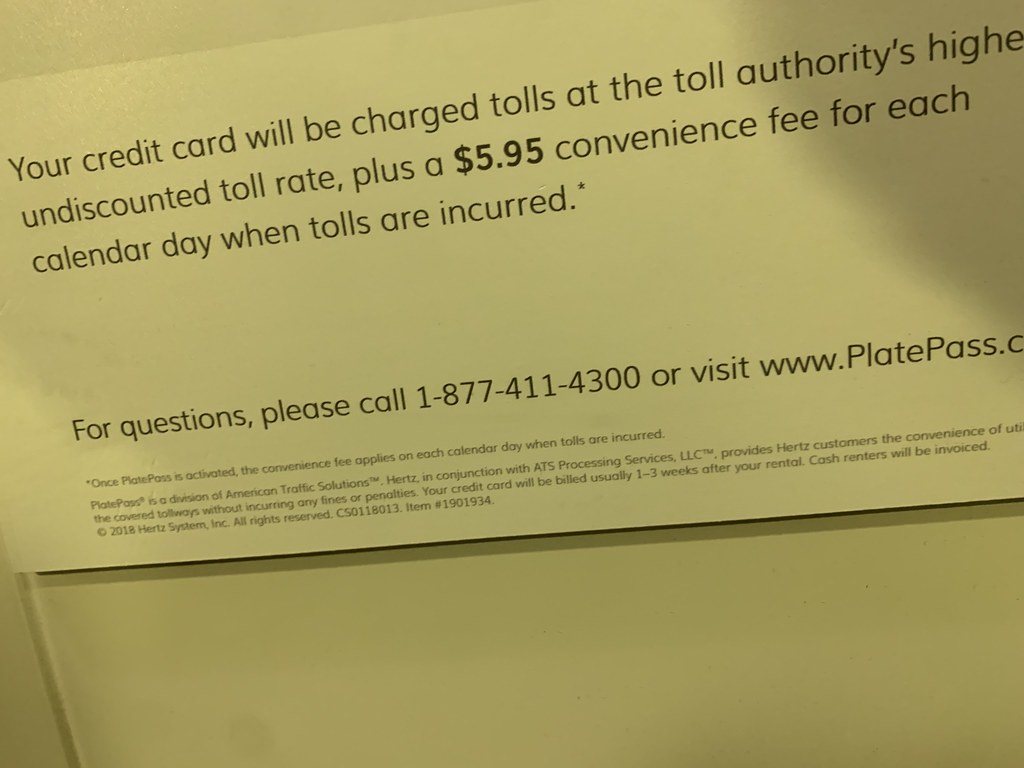

5. **Paper Statement and “Convenience” Fees**In an increasingly digital age, some banks have begun to charge fees for services that were once considered standard inclusions, effectively rebranding basic customer service as premium conveniences. This shift places a financial burden on customers who either prefer traditional methods or, due to various circumstances, cannot fully embrace digital banking solutions. These seemingly small charges, when added up, contribute significantly to the erosion of one’s financial resources over time.

The hidden cost of traditional banking in this regard is multifold. Paper statement fees, for example, can range from $2 to $5 per month at certain banks, accumulating to $60 annually for customers who prefer physical records for budgeting or tax preparation. Beyond mailed statements, telephone banking assistance, once a cornerstone of customer support, may now incur a cost of $5 or more per call at some banks, even for simple balance inquiries. Bill payment by phone is another area where convenience becomes expensive, potentially incurring fees of $10 to $15, despite bank representatives taking only a few minutes to process the payment.

These “convenience” fees create unexpected costs for real people in their daily lives. Consider an elderly customer who, perhaps due to a lack of comfort with technology, refuses to use online banking. She might willingly pay $5 monthly for paper statements because she prefers physical records for tax preparation and peace of mind, unknowingly incurring $60 a year in easily avoidable charges. In another scenario, a business traveler’s automatic payment might fail during a trip, prompting him to call his bank for an emergency payment by phone. Only after the transaction is complete does he discover a $15 convenience fee has been tacked on, adding insult to injury during a stressful situation. Sara’s personal audit in the context highlighted she paid $36 annually in paper statement fees.

To eliminate these unnecessary bank fees, several cost-cutting strategies are available. Electronic statements provide the exact same information as paper copies, often with better organization through search functions and without any monthly charges; simply download PDF statements instead of receiving physical ones. Mobile banking apps have evolved to handle most transactions and inquiries that previously required phone calls, offering a free and immediate alternative. Furthermore, setting up automatic bill pay not only prevents late fees but also eliminates the need for emergency phone payments, thus bypassing associated convenience charges. Other effective methods include ordering checks from discount third-party companies rather than through your bank and setting up account alerts to avoid situations that might necessitate urgent, fee-incurring phone calls.

6. **Early Account Closure Fees**Banks have a knack for penalizing customers at various stages of their account lifecycle, extracting profit not only from active usage but also from the decision to terminate a relationship. Early account closure fees are a prime example of this, designed to discourage quick exits and ensure that the bank has recouped any initial setup or promotional costs associated with opening an account. This penalty often goes unnoticed by consumers, who might assume they are free to close an account at their convenience without financial repercussions.

These timing penalties typically involve a fee of $25 to $50 that can be incurred if you close an account within a specified period, which commonly ranges from 90 to 180 days of its opening. The rationale behind these fees, from the bank’s perspective, is often to offset administrative costs or to prevent customers from taking advantage of new account bonuses without a sustained commitment. However, for the customer, it represents an unexpected barrier to financial flexibility, turning a simple administrative task into a costly one. This charge is distinct from dormant account fees, though both relate to account activity or inactivity over time.

The impact of early closure fees often surfaces when life triggers unexpected changes. For example, someone might switch jobs and, as part of their transition, decide to open a new bank account with their new employer’s preferred financial institution. If they then close their old account after only two months, they could inadvertently trigger an early closure penalty, losing $25 or $50 that could have been saved or used for other expenses. It’s a classic trap where attempting to streamline finances leads to an unforeseen penalty, highlighting the importance of understanding the fine print before making such decisions.

Protecting your accounts from these penalties requires a bit of foresight. The simplest method is to maintain accounts past the minimum required periods—typically 90 to 180 days—before initiating a closure. If you’ve just opened a new account, mark your calendar for the date when the early closure window expires. Should you lose or damage your card and need a replacement, some banks will charge a fee, but this is distinct from closing the account itself. In such cases, if you find yourself needing to close an account, verify the minimum duration with your bank’s customer service to ensure you avoid any unnecessary charges and manage your financial transitions smoothly.

Read more about: Steering Clear of Financial Pitfalls: 14 Critical Mistakes First-Time EV Buyers Must Avoid

7. **Dormant Account / Inactivity Fees**Just as banks penalize customers for leaving too quickly, they also profit from those who stay too long without sufficient activity, introducing what are known as dormant account or inactivity fees. These charges are levied on accounts that have not seen any transactions—deposits, withdrawals, or transfers—for an extended period. This practice creates another revenue stream for banks, capitalizing on customer oversight or life circumstances that lead to periods of account idleness. The concept is that if you’re not actively engaging with your money, the bank will quietly take a portion of it.

The problem with inactivity charges is their stealthy nature. After a period typically ranging from 12 to 24 months with no transactions, many banks will begin to charge a dormant account fee, which can be $5 to $15 monthly. These charges continue until the account is empty, at which point the funds may even be escheated, or sent, to the state as unclaimed property. Most customers remain unaware that their accounts have such inactivity restrictions, making these fees particularly deceptive. The criteria for what constitutes “activity” can vary, but generally, it means any transaction initiated by the account holder, not just interest accruals.

The real-world impact of these fees can be substantial and often affects individuals during long absences or significant life changes. For instance, a service member might deploy overseas for 18 months, understandably focusing on their mission rather than banking. Upon their return, they could discover their account has racked up hundreds of dollars in dormant fees, severely depleting a balance that was intended to be secure. In another case, someone might use a secondary savings account for a specific long-term goal and forget about it for a year, only to find a significant chunk of their savings eroded by monthly inactivity charges. This highlights how these fees can hit people when they can least afford it, often due to circumstances beyond their immediate control.

Protecting your accounts from inactivity fees is quite manageable with a few simple prevention methods. One effective strategy is to set up a small recurring automatic transaction, such as a $5 monthly transfer between your checking and savings accounts. This keeps both accounts active and avoids triggering any inactivity clauses during extended absences. Consolidating multiple unused accounts into one primary account can also simplify management and reduce the risk of overlooking a dormant account. For service members, contacting banks directly about military service exemptions for account fees is a crucial step. Additionally, setting calendar reminders for minimum account duration periods or regular account reviews can help ensure no account falls into dormancy unnoticed, safeguarding your funds from these quiet drains.

Read more about: Unmasking the Money Traps: 14 Hidden Bank Fees Major Banks Charge and How to Shield Your Wallet

8. **Foreign Transaction and Currency Exchange Fees**When your financial journey takes you beyond national borders, either physically or through online shopping with international retailers, banks introduce a complex web of foreign transaction and currency exchange fees. These charges are often obscured, rarely explained clearly upfront, and can quietly inflate the cost of your purchases or withdrawals. For many, these fees are an unwelcome surprise that significantly impacts travel budgets or the true cost of online goods.

The core problem lies in the multiple layers of these international charges. Foreign transaction fees commonly add 2.5% to 3% to every international purchase made with your card, whether you’re physically abroad or simply buying from a foreign website. Compounding this, dynamic currency conversion, often presented as a “convenience” at merchant terminals overseas, typically offers unfavorable exchange rates and additional hidden fees. Some banks even tack on separate fees for international debit card usage, on top of all other conversion costs, making every foreign transaction a potentially costly endeavor.

The real cost of travel or international online shopping becomes strikingly clear when these fees accumulate. Imagine a traveler spending thousands during a week abroad; the cumulative foreign transaction fees could amount to a hefty sum. If they also accept dynamic currency conversion at multiple merchants, they might unknowingly pay significantly more due to disadvantageous exchange rates. Even without leaving home, an international streaming subscription can add unexpected charges, demonstrating how these fees erode purchasing power without immediate, clear disclosure.

Fortunately, navigating the international financial landscape without falling prey to these fees is entirely possible with smart planning. Travel-focused credit cards often eliminate foreign transaction fees and provide better fraud protection. Many online banks also waive international fees as standard features. Always decline dynamic currency conversion at the point of sale, opting instead to pay in the local currency, as your bank or credit card company will generally offer a more favorable exchange rate. Notifying your bank of travel dates prevents card blocks, and researching which cards work best in your destination ensures transparent, low, or no foreign transaction fees.

Read more about: 14 Simple Steps to Start Investing with Just $100 and Build Long-Term Wealth

9. **Excessive Bank Fees on Savings Accounts**It might seem counterintuitive, but your savings account, designed to help you grow your money, can also be a source of unexpected fees. Banks often impose transaction limits on these accounts, and if you treat them like a checking account for frequent withdrawals or transfers, you could be incurring surprising charges. This specific type of fee traps customers trying to manage their finances responsibly, yet unknowingly triggering penalties meant to deter high transaction volumes from savings.

The problem stems from historical federal regulations that limited savings account withdrawals to six per month. While these federal rules were relaxed, many banks still maintain their own internal policies, charging anywhere from $1 to $5 for each transaction exceeding this self-imposed limit. Most customers remain unaware of these restrictions until charges appear. Banks count various types of money movement toward these limits, including transfers to checking, ATM withdrawals, and online bill payments initiated directly from savings.

The real-world impact of these limits often catches individuals off guard. A college student, aiming for a higher interest rate, might use her savings account for daily expenses, believing it smarter than a checking account, only to pay substantial excess fees. Someone facing a medical emergency might make multiple urgent transfers from savings, finding themselves penalized across several transactions, adding financial stress to an already difficult time. This highlights how a lack of awareness can turn a beneficial savings tool into an unexpected drain.

Strategic account management is key to avoiding these fees. Keep frequently accessed emergency funds in a checking account, not savings, to bypass transaction limits. For planned money movements, consolidate needs into larger, less frequent transfers. Many online banks have proactively eliminated these excess transaction fees entirely. Exploring high-yield checking accounts can also offer competitive interest rates without restrictive transaction limits, ensuring your money works for you without hidden drags.

Read more about: Navigating the Economic Maze: 13 Perilous Financial Pitfalls Facing Recent College Graduates

10. **Returned Deposit Fees**Among the less common, yet equally frustrating, hidden bank fees are those levied when a deposit made into your account is returned or bounces. This charge is particularly irksome because you are penalized for someone else’s financial misstep, not your own. It represents an unexpected hit to your balance, often at a time when you were expecting an increase in funds, turning an anticipated positive into a surprising negative.

The problem arises when you deposit a check, either physical or mobile, and the issuer of that check has insufficient funds to cover it. When the check is returned unpaid, your bank, having initially credited your account, will then deduct the amount and often add a “returned deposit fee.” These fees, typically around $10 to $15 per incident, mean that not only is the expected money unavailable, but your account balance is further reduced by a penalty, effectively doubling the negative impact.

The real-world impact can extend beyond the immediate financial deduction, causing significant cash flow issues for individuals or small businesses. Imagine a freelancer depositing a client’s check only to find it bounced days later. They don’t receive payment and their bank charges a fee, complicating financial planning and potentially leading to their own overdrafts. This fee, therefore, creates a ripple effect, penalizing the recipient for a problem originating elsewhere.

To minimize exposure to returned deposit fees, avoid accepting checks from untrusted individuals, opting instead for secure payment methods like direct transfers, digital payment apps, or certified checks. If you must accept a check, wait for funds to fully clear before spending them. Maintaining a sufficient buffer in your checking account can also absorb the impact if a check bounces, preventing subsequent overdrafts. For recurring payments, encourage electronic transfers to bypass check-bouncing risk entirely.

Read more about: Debunking the Top 10 Car Leasing Misconceptions: Your Comprehensive Guide to Smart Leasing Decisions

11. **Mortgage Service Fees**For homeowners, hidden fees can lurk within the complexities of mortgage servicing, quietly adding to the cost of homeownership. These fees are often related to the ongoing management of your loan and can surface in various forms, from routine payment processing to specific requests, making it challenging to save money on your mortgage if you’re not vigilant.

The problem with mortgage service fees is their subtle integration into the loan’s lifecycle, distinct from initial closing costs. They emerge during active repayment, including charges for non-standard payment methods or specific administrative tasks. A common example is a “payoff statement fee,” where your servicer charges you simply for providing documentation when selling or refinancing. These charges, while seemingly minor, collectively contribute to hidden expenses, eroding efforts to minimize housing costs.

The real-world impact can be particularly frustrating. A borrower diligently making payments might incur a $15 fee for paying by phone instead of online. A homeowner selling might find a $75 fee just for an official payoff statement. The March 2025 Bankrate survey found 38% of borrowers paid unexpected fees at closing, demonstrating how “service” fees chip away at financial peace of mind.

To combat these fees, thoroughly review your mortgage agreement and annual statements. Opt for electronic payment methods and set up automatic payments to avoid processing fees. When refinancing or selling, request a detailed breakdown of all fees, including payoff statement charges, and don’t hesitate to question or negotiate them. Many lenders will waive or reduce administrative fees, especially for good payment history. Using financial tools to track mortgage expenses can also flag unusual charges from your servicer, ensuring your efforts to save are not undermined.

Read more about: Don’t Let These Simple Mistakes Sabotage Your Financial Future: How Common Errors Can Instantly Drop Your Credit Score by 50 Points

12. **Mortgage Rate Lock Extension Fees**When buying or refinancing a home, a “rate lock” protects you from interest rate increases. However, delays in closing can trigger an insidious hidden charge: the mortgage rate lock extension fee. These fees quickly accumulate to hundreds of dollars, turning a seemingly secure rate into an unexpected financial burden, particularly if unforeseen complications extend your closing timeline.

The problem is these fees penalize you for circumstances often beyond your control. Lenders typically offer rate locks for a specific period (30, 45, or 60 days). If closing extends past this, due to appraisal, title, or underwriting issues, the lender may charge a fee to extend the lock. These fees are significant, ranging from hundreds to a percentage of the loan, and are usually non-negotiable once triggered, unless addressed upfront.

The real-world impact can be jarring for hopeful homebuyers. Jasmine and Marcus, a newlywed couple, faced a surprising $600 extension fee just days before closing due to unexpected delays. This money, planned for home repair, was siphoned off, leaving them “blinded.” Such fees derail budgets and add immense stress to an already complex, high-stakes transaction.

To safeguard against these fees, careful planning and assertive communication are paramount. Always request a “Loan Estimate” form detailing all potential fees, and meticulously review rate lock terms, including extension costs. Proactively communicate with your lender and all parties to address potential delays. Consider requesting a longer initial rate lock period, even with a slightly higher upfront cost, to build a buffer. Don’t hesitate to negotiate; many lenders will waive or reduce fees if you ask, as Erin Lowry advises. Inquire about “float-down” options, too, to take advantage of lower rates without extending your lock.

Read more about: Don’t Let These Simple Mistakes Sabotage Your Financial Future: How Common Errors Can Instantly Drop Your Credit Score by 50 Points

13. **Card Replacement Fees**A lost or damaged debit card is more than an inconvenience; it can trigger another often-overlooked hidden bank fee. While you might assume replacing your essential banking tool would be free, many financial institutions view it as a chargeable event, turning frustration into an unexpected expense that only surfaces when you need a replacement.

The problem with these fees lies in their punitive nature. If you lose or damage your debit card, some banks charge $5 to $25 for a new one. This baseline cost escalates with urgency; expedited shipping can add another $15 to $30. A simple necessity can thus cost a significant sum, especially if urgency is involved, adding insult to the injury of losing your primary payment method.

The real-world impact often emerges during stressful or financially vulnerable situations. A student on a tight budget losing their card could find a $25 replacement fee plus $20 for expedited delivery represents a substantial portion of their limited funds. A business traveler with a compromised card abroad might face unexpected replacement and international shipping fees, adding to travel stress. These small charges, while seemingly minor, create significant hurdles when least expected.

To minimize card replacement fees, proactive measures are key. Cultivate habits to avoid losing your card, such as consistent storage. When choosing a bank, inquire about their replacement policy; many online banks and credit unions provide free replacements. For online purchases, utilize virtual cards, which are distinct from your physical card and add security. If your physical card is lost, many banks offer a “freeze” option via mobile app, preventing fraudulent activity and allowing you to unfreeze it if found, avoiding an immediate, fee-incurring replacement.

Read more about: Beyond the Sticker Shock: The 12 Hidden Costs That Make Luxury Sedan Repairs So Expensive for Owners

14. **Check Order Fees**In an era dominated by digital payments, physical checks still hold a place for certain transactions, like rent or legal forms. What many consumers don’t realize is that even this basic service can be a source of another hidden bank fee: the charge for ordering new checks. This often-overlooked expense can quietly add up, particularly if you still rely on checks for specific aspects of your financial life.

The problem is straightforward: banks view providing checkbooks as a service for which they can charge. Many banks impose a fee ranging from $15 to $30 for a new checkbook. This means even if you use checks occasionally, replenishing your supply comes with a direct financial cost. For those who rarely write checks, this fee can feel disproportionately high, turning a sporadic necessity into a noticeable expense.

The real-world impact can be surprising. Someone who writes only a few checks a year, perhaps for their landlord, might be astonished to find their bank charging $20 for a new book of 50 checks, many of which may go unused. This is paying a premium for a service obtainable far more affordably elsewhere. For small businesses or individuals who process more payments by check, these costs accumulate, adding unnecessary overhead.

To avoid check order fees, embrace numerous free digital alternatives. Utilize free digital bill pay services for recurring payments, and leverage money transfer apps like Zelle or Venmo for personal transactions. For situations where a physical check is absolutely necessary, consider ordering checks through a third-party provider. These online services typically offer significantly lower costs than ordering directly from your bank, providing the same functionality without the premium markup. Minimize reliance on physical checks, and explore cost-effective alternatives to contribute to a more efficient, fee-free financial strategy.

**An Ending Paragraph for the Article**

Read more about: Hit the Road, Not Your Wallet: America’s Top Affordable Car Camping Adventures for Under $25 a Night

As we’ve journeyed through the intricate labyrinth of hidden bank fees, from the daily drains to the less frequent but potentially high-cost mortgage traps, a clear message emerges: financial vigilance is your most powerful tool. Banks are constantly evolving their fee structures, sometimes rebranding old charges or introducing new ones to capitalize on consumer confusion. But armed with knowledge about these 14 insidious fees—from overdrafts to mortgage extensions and everything in between—you are no longer a passive participant. Take action now: scrutinize your statements, ask direct questions, and embrace the wealth of fee-free banking alternatives. Your hard-earned money deserves to grow, not to be silently siphoned away by charges you never knew existed. Reclaim control, empower your finances, and build the wealth you truly deserve.