Nobody looks forward to an audit notice from the IRS. The very thought can be unsettling, even for those meticulous with their taxes. Yet, understanding what might draw the agency’s attention isn’t about fostering fear; it’s about empowering you to file with greater confidence and accuracy.

With significant new funding, the IRS has committed to increasing audit rates, particularly for high-net-worth individuals. However, audit triggers aren’t exclusive to the super-rich. While overall individual audit rates remain historically low, certain details on your tax return can signal a need for closer inspection from IRS examiners.

The simplest strategy to avoid an audit is to practice accuracy, honesty, and modesty in your filings. As Eric Scaringe, principal at certified public accounting firm UHY, advises, take your time. The IRS uses advanced data analysis, third-party information, and whistleblower tips to identify returns with the “highest potential noncompliance.” Let’s dive into 15 common audit triggers the IRS scrutinizes and how you can safeguard your tax return.

1. **Underreporting Taxable Income**This is a primary concern and a frequent audit trigger for the IRS. The agency has a robust system for comparing the income you report on your return with information received from other sources. Employers and financial institutions, for instance, send W-2s and 1099s to both you and the IRS.

Any discrepancy between these third-party reports and your declared income on Form 1040 will likely raise an immediate red flag. IRS computers are “pretty good at cross-checking” this data, and a mismatch can automatically generate a bill, indicating a problem before a formal audit even begins. These “information returns” are central to the IRS’s detection efforts.

It’s critical to report all taxable income, even if you don’t receive a formal document like a 1099. Income from gig economy work, like driving for Uber or Lyft, tutoring, dog walking, or selling crafts on Etsy, is all taxable. As Elizabeth Young, director of tax practice and ethics for the AICPA, explains, your return can be “flagged for audit” when these mismatches occur.

If you receive an incorrect 1099 or one that reports income not truly yours, contact the issuer immediately to request a corrected form for the IRS. Always verify your W-2s and 1099s against your personal records. Using a final pay stub without cross-referencing against official documents, as National Taxpayer Advocate Erin Collins notes, can lead to discrepancies and IRS inquiries.

2. **High Income Levels**While the IRS has promised not to escalate audit rates for individuals and small businesses earning under $400,000, higher income significantly increases your audit probability. The agency is dedicating a substantial portion of its increased funding to enforcement, particularly targeting high-net-worth individuals.

This promise applies to “total positive incomes of less than $400,000,” meaning income before deductions and losses. The IRS has also confirmed it’s “not considering hiking the $400,000 figure for couples filing a joint tax return.” The 2018 audit rate will serve as the baseline for comparison for 2023 returns and beyond.

The IRS’s specialized “high-wealth exam squad” is aggressively auditing “the super-rich.” These agents employ a “kitchen-sink approach,” scrutinizing not only individual 1040 returns but also the returns of foreign and domestic entities controlled by these individuals. This comprehensive review highlights the intensive focus on complex wealth structures.

Government data reveals that taxpayers with incomes both below $25,000 and above $500,000 have faced higher audit rates. The IRS plans to “increase audits by more than 50% on wealthy individual taxpayers with total income above $10 million,” projecting rates to rise to 16.5% by 2026. This data underscores that while success is desirable, it comes with increased tax scrutiny.

Read more about: Unpacking the True Costs of Owning a Land Rover Discovery Sport: A Comprehensive Guide for Consumers

3. **Being a Non-Filer**Historically, the IRS has faced criticism for a “years-long lack of enforcement activity” against individuals who failed to file required tax returns. That era is over. High-income non-filers are now a top “strategic enforcement priority” for the agency.

The primary target demographic for this initiative includes individuals who earned more than $100,000 but did not file a return. IRS collections officers are actively reaching out to these taxpayers, aiming to resolve issues and bring them into compliance voluntarily.

However, refusal to comply can lead to severe repercussions. Non-filers who ignore IRS attempts to resolve their status may face levies, liens, or even criminal charges. This demonstrates the agency’s firm commitment to ensuring everyone fulfills their filing obligations.

Recently, the IRS sent letters to “over 125,000 people with incomes of more than $400,000 who hadn’t filed a federal income tax return since 2017.” This campaign has been effective, resulting in nearly 21,000 filings and “$172 million in additional taxes paid” as of September 2024, proving the IRS’s renewed focus.

4. **Disproportionately High Deductions, Losses, or Credits**When the deductions, losses, or credits on your tax return appear excessively large relative to your reported income, it’s a significant red flag for the IRS. The agency uses sophisticated algorithms to compare your return against “norms” for similar tax situations, identifying outliers.

As Mark Jaeger of TaxAct illustrates, a freelancer earning $100,000 with typical travel costs of $5,000 would be an “outlier” if they claimed $50,000. Such a deviation is “way outside the mean” and would almost certainly trigger a flag, prompting an IRS inquiry into the validity of those claims.

Claiming substantial losses from the sale of rental property or other investments can also attract IRS attention. Similarly, significant bad debt deductions or losses from worthless stock are areas of interest. These complex claims often require extensive documentation to justify their legitimacy.

Crucially, if you have proper documentation for your deductions, losses, or credits, you should confidently claim them. “Don’t ever feel like you have to pay the IRS more tax than you actually owe.” The key is “substantiation”—having the proof readily available to support every claim if audited.

Read more about: Unveiling Critical Financial Risks for Retirees Over 65: A Consumer Reports Perspective

5. **Large Charitable Deductions**While making charitable contributions is an excellent way to reduce your taxable income and support causes, claims that are “disproportionately large compared with your income” will definitely attract IRS attention. The agency has data on “average charitable donation[s]… for folks at your income level.”

Mark Baran, managing director at CBIZ’s national tax office, notes that a charitable deduction amounting to “30% to 50% of your adjusted gross income” could lead to “another set of eyes” on your return. This indicates that while generosity is valued, its scale relative to your income must appear reasonable.

Specific procedural missteps with noncash donations also increase audit risk. Failing to secure an appraisal for valuable property donations or neglecting to file IRS Form 8283 for noncash donations over $500 makes you “an even bigger audit target.” These forms are essential for verifying the value and legitimacy of such contributions.

The IRS has a particular focus on “abusive syndicated conservation easement deals.” If you’ve donated a conservation or façade easement, or invested in a partnership, LLC, or trust that did, your audit chances “rise exponentially.” Congress has even acted to disallow deductions in “the most egregious conservation easement cases,” underscoring this area as a high-priority enforcement target.

Read more about: Navigating the New Tax Landscape: 14 Key Changes Freelancers Must Know for 2025

6. **Running a Business (Schedule C)**Schedule C, used by self-employed individuals, offers numerous deductions but is simultaneously a “gold mine for IRS agents.” From experience, the IRS knows that sole proprietors sometimes claim excessive deductions or fail to report all income, making this a high-risk area for audits. Scrutiny applies to both high-grossing and smaller businesses.

Certain types of Schedule C businesses are inherently riskier. Those reporting “at least $100,000 of gross receipts” and “cash-intensive businesses” like taxis, car washes, bars, and restaurants face higher audit probabilities. The nature of these operations makes accurate income reporting more challenging to verify.

Reporting “substantial losses on Schedule C,” especially if they offset other income like wages or investments, is another significant red flag. The IRS often questions the legitimacy of these losses, seeking to determine if the activity is genuinely a business intended to generate profit.

A prime audit trigger is claiming “100% business use of a vehicle.” IRS agents are highly skeptical, knowing it’s “rare for someone to actually use a vehicle 100% of the time for business,” particularly if no personal vehicle is available. They also target “heavy SUVs and large trucks used for business” bought late in the year, due to favorable depreciation rules. Meticulous records, including “detailed mileage logs and precise calendar entries,” are crucial to substantiate such claims.

7. **Claiming Hobby Losses**If you consistently report losses on Schedule C from an activity that “sounds like a hobby,” especially when you have “lots of income from other sources,” you’re a prime audit target. The IRS actively seeks taxpayers who use “hobby-sounding activities” to offset significant wage, business, or investment earnings.

“The hobby loss rules are often litigated in the Tax Court,” with the IRS frequently prevailing. While taxpayers have won cases, the burden of proof rests on you. The core challenge is proving your activity is a legitimate business, not just a costly pastime.

To deduct a loss, you must conduct the activity “in a business-like manner” and have a “reasonable expectation of making a profit.” A “safe harbor” exists: if your activity profits in “three out of every five years” (or two out of seven for horse breeding), the law presumes a profit motive, unless the IRS proves otherwise.

Without meeting these safe harbors, determining whether an activity is a hobby or business relies on “each taxpayer’s facts and circumstances.” In an audit, “the IRS is going to make you prove you have a legitimate business and not a hobby,” demanding robust records, a clear business plan, and demonstrable efforts to generate profit.

Navigating the complexities of tax season can feel like traversing a minefield, especially when considering the various factors that might pique the IRS’s interest. While the first seven audit triggers shed light on foundational compliance and common pitfalls, there are several more specialized areas where taxpayers often inadvertently raise red flags. Understanding these additional hot spots is crucial for maintaining a clean record and avoiding the unwelcome scrutiny of an IRS audit.

The agency’s sophisticated data analytics are constantly evolving, and specific industries and types of financial transactions are under a magnifying glass. From intricate business structures to personal financial planning choices, the IRS has developed targeted campaigns and focuses on areas historically prone to non-compliance. Let’s delve into the next eight critical audit triggers that demand meticulous attention and robust documentation.

Read more about: Retirement Planning Perils: 14 Common (and Costly) Mistakes Every Pre-Retiree Needs to Avoid

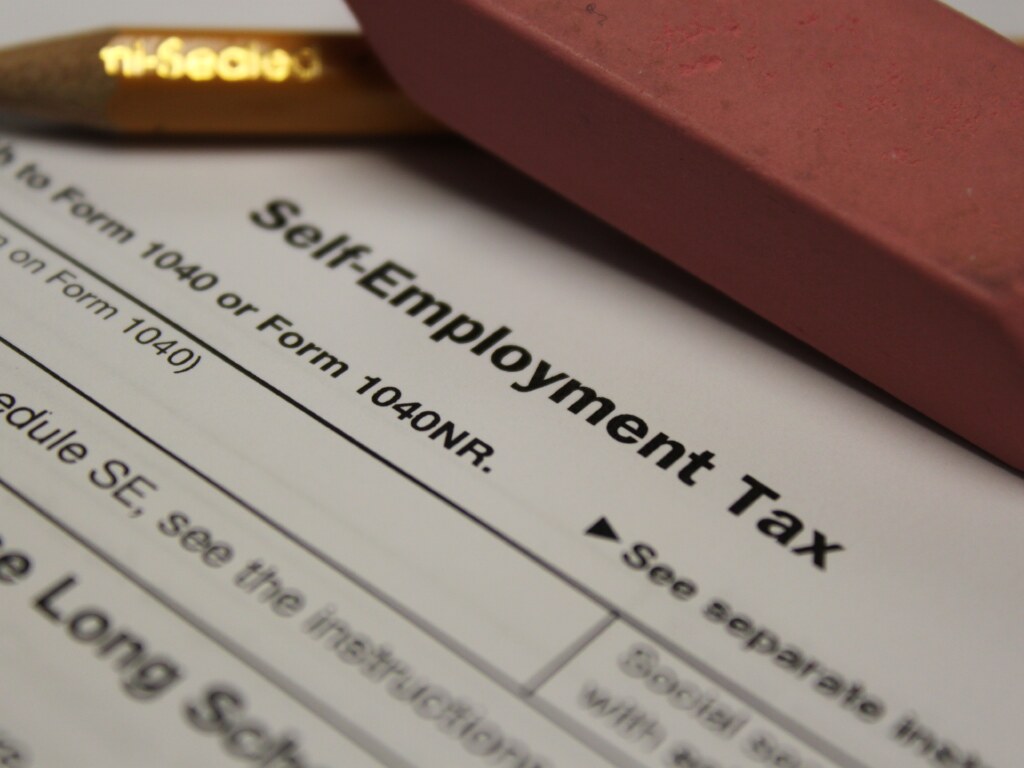

8. **Failing to Report Certain Professional Earnings as Self-Employment Income**The IRS has sharpened its focus on how certain professional earnings are reported, especially concerning self-employment income. Specifically, limited partners and members of Limited Liability Companies (LLCs) in professional service industries are on the agency’s radar if they fail to file Schedule SE and pay self-employment tax on their distributive share of the firm’s income. This isn’t a new issue but an ongoing audit campaign demonstrating the IRS’s persistent interest.

Recent Tax Court rulings have reinforced the IRS’s stance. In 2017, the Tax Court determined that members of a law firm organized as an LLC, who actively participated in the LLC’s operations and management, were not mere investors. Consequently, they were liable for self-employment taxes. This decision set a precedent for similar cases in professional service sectors.

Just last year, another Tax Court decision extended this principle, finding that limited partners who actively participated in a limited partnership could also owe self-employment tax. This particular case involved a hedge fund, illustrating the broad applicability of these rules across various professional financial structures.

IRS examiners have been actively conducting audits over the past few years, keeping a close eye on LLC and LP owners in fields such as law, medicine, consulting, accounting, and architecture. If you’re an owner in such a professional service business, ensuring proper reporting of self-employment income and tax payments is absolutely essential to avoid triggering an audit.

Read more about: Beyond the Hype: 13 Unexpected Realities of the Gig Economy That Demand Your Attention

9. **Claiming Rental Losses**Rental real estate can be a valuable asset, but claiming losses from it often attracts IRS scrutiny. Generally, passive loss rules prevent taxpayers from deducting rental real estate losses against other income. However, the tax law provides two significant exceptions that, while legitimate, are closely watched by the agency.

The first exception allows taxpayers who actively participate in the renting of their property to deduct up to $25,000 of losses against other income. This allowance, however, is not unlimited. It begins to phase out once your adjusted gross income (AGI) exceeds $100,000 and disappears entirely when your AGI reaches $150,000. It’s crucial to understand these income thresholds and to accurately document your active participation.

A second, broader exception applies to “real estate professionals.” To qualify, you must spend more than 50% of your total working hours and over 750 hours each year materially participating in real estate activities as a developer, broker, landlord, or similar role. If you meet these stringent criteria, you can write off rental losses without the AGI limitations.

The IRS actively scrutinizes large rental real estate losses, particularly those claimed by taxpayers asserting professional status. Agents often pull returns of individuals who claim to be real estate professionals but whose W-2 forms or other non-real-estate Schedule C businesses show substantial income. They meticulously check whether these filers truly worked the necessary hours, especially for landlords whose primary day jobs are outside the real estate business.

Read more about: 16-Year-Old Driver Charged After Fatal Marin County Crash Kills Four Teens

10. **Claiming Refundable Tax Credits**Refundable tax credits are designed to provide financial relief, even potentially resulting in a refund greater than the tax owed. However, they are also a consistent source of improper payments, making them a significant audit trigger for the IRS. The agency estimates it wrongly refunded $21.9 billion in earned income tax credits in fiscal year 2023 alone, indicating a staggering 33.5% improper payment rate. This high error rate stems from the complexity of tax rules, unscrupulous preparers, high taxpayer turnover for eligibility, and outright refund fraud.

One such credit is the **Premium Tax Credit**, which assists individuals in affording health insurance purchased through the marketplace. While it has been available for over a decade, its eligibility rules, particularly concerning household income (ranging from 100% to 400% of the federal poverty level, with some exceptions for 2021-2025), are complex. Crucially, individuals eligible for Medicare, Medicaid, or employer-provided affordable health coverage do not qualify. The IRS flags returns showing incomes above the credit limit or those who received advance subsidies but failed to file Form 8962 to reconcile these payments, leading to an audit.

The **Earned Income Tax Credit (EITC)**, a cornerstone refundable credit for lower-income workers with children, is another frequent target. Its eligibility rules are notoriously intricate, often leading to common mistakes, particularly regarding the qualifying child requirements. These include specific relationship, residency, and age tests (e.g., child must be a son, daughter, stepchild, foster child, sibling, niece, nephew, or grandchild who lived with you for more than half the year and is under 19, with exceptions for students and disabled children), as well as needing a Social Security Number. Despite higher earners facing more audits overall, EITC claimants actually experience a 5.5 times higher audit rate due to these complexities and improper payments.

The **Refundable Child Credit** also warrants careful attention. The full child tax credit is valued at $2,000 per child under 17, claimed as a dependent, with specific relationship, residency, citizenship, and SSN requirements. Up to $1,700 of this credit is refundable for some lower-income individuals who have at least $2,500 of earned income. The credit begins to phase out at modified adjusted gross incomes above $400,000 for joint filers or $200,000 for single/head-of-household filers. Ensuring all these conditions are met and accurately reported is paramount to avoid audit flags.

Finally, the **American Opportunity Tax Credit (AOTC)**, designed to offset college costs, offers up to $2,500 per student for the first four years of post-secondary education, with 40% of the credit being refundable. This credit phases out for joint filers with modified AGI above $160,000 ($80,000 for single filers). The IRS has ramped up enforcement, scrutinizing claims for more than four years for the same student, omissions of the school’s taxpayer ID number on Form 8863, claims without a Form 1098-T from the school, and multiple tax breaks for the same college expenses. Each of these credits, while beneficial, demands precision and full adherence to eligibility rules to steer clear of IRS inquiries.

Read more about: Navigating the New Wave of IRS Refund Fraud Scams: A Consumer’s Guide to Protection

11. **Taking an Early Payout from an IRA or 401(k)**Retirement savings accounts like traditional IRAs and 401(k)s are excellent tools for future financial security, but early withdrawals come with strict tax implications that the IRS carefully monitors. The agency is particularly vigilant about ensuring that distributions, especially those taken before age 59½, are properly reported and taxed.

Unless a specific exception applies, distributions taken before age 59½ are subject to a 10% penalty on top of regular income tax. The IRS knows that a substantial number of filers make errors in reporting these retirement payouts, with many mistakenly believing they qualify for an exception when they do not. This widespread non-compliance makes early distributions a prime audit trigger.

A report highlighted the scale of this issue, revealing that 2.8 million taxpayers who received early distributions totaling $12.9 billion in 2021 failed to pay the corresponding 10% additional tax. This demonstrates a significant gap in compliance that the IRS is actively working to close.

While there are legitimate exceptions to the 10% penalty, it’s vital to know precisely which ones apply to your situation. The IRS provides a chart listing withdrawals that escape the penalty, but these can be nuanced. Some exceptions apply only to IRAs, some exclusively to workplace retirement plans, and others apply to both. Consult with a tax professional and ensure every early distribution is accurately accounted for and any applicable penalties or exceptions are correctly applied.

Read more about: Beyond the Showroom Shine: Identifying the Worst Financial Mistakes When Customizing a New Car

12. **Taking an Alimony Deduction**For divorce or separation agreements executed before 2019, alimony payments can be a deductible expense for the payer and taxable income for the recipient. However, these deductions are heavily scrutinized by the IRS due to their complexity and potential for error. Several strict requirements must be met for payments to qualify as alimony.

For instance, the payments must be made under a divorce or separate maintenance decree or a written separation agreement, and the document cannot explicitly state that the payment isn’t alimony. Crucially, the payer’s liability for these payments must cease upon the death of the former spouse – a rule many divorce decrees inadvertently fail to address. Child support payments and noncash property settlements are specifically excluded from the definition of alimony.

The IRS is well aware that many filers claiming this write-off do not fully satisfy these intricate requirements. Beyond the payer’s eligibility, the agency also seeks to ensure consistency in reporting: that both the payer and the recipient have accurately reported the alimony on their respective tax returns. A mismatch in reporting between ex-spouses is a near-certain trigger for an audit.

It’s important to note that for divorce or separation agreements made after 2018, alimony payments are no longer deductible for the payer and are not taxable for the recipient. Older agreements can be modified to conform to these new tax rules if both parties mutually agree and formally amend the agreement. The IRS is vigilant in policing compliance with these changes, making meticulous record-keeping and clear understanding of your agreement’s terms indispensable. Schedule 1 of Form 1040 specifically requires taxpayers deducting alimony to provide the recipient’s Social Security number and the date of the divorce or separation agreement, further emphasizing the need for precise documentation.

Read more about: The 12 Worst Financial Mistakes Professional Athletes Make After Retirement

13. **Failing to Report Gambling Winnings or Claiming Big Gambling Losses**Whether you’re a casual lottery player or a seasoned casino visitor, the IRS expects its share of your winnings. Failing to report gambling winnings is a significant red flag, especially if a casino or other gaming venue has already reported your earnings on a Form W-2G to the IRS. Recreational gamblers must report their winnings as “other income” on their Form 1040, while professional gamblers account for theirs on Schedule C.ngs as “other income” on their Form 1040, while professional gamblers account for theirs on Schedule C.

Equally risky is claiming large gambling losses. While these losses can be deducted, they are only permissible to the extent that you report gambling winnings. Furthermore, recreational gamblers must itemize their deductions to claim these losses. The IRS often scrutinizes returns where large losses appear on Schedule A from recreational gambling without corresponding winnings being included in income. This discrepancy strongly suggests an attempt to reduce taxable income improperly.

Professional gamblers who report substantial losses from their gambling-related activity on Schedule C also face heightened scrutiny from IRS examiners. The agency wants to ensure that these individuals are genuinely engaged in gambling for a living, rather than attempting to write off personal losses from what is effectively a hobby. Robust records of both winnings and losses, demonstrating a clear profit motive, are crucial for any gambler hoping to avoid an audit.

14. **Claiming the Foreign Earned Income Exclusion**For U.S. citizens working abroad, the foreign earned income exclusion can be a substantial tax benefit, allowing them to exclude a significant portion of their income earned outside the United States. For 2024, this amount is up to $126,500, increasing to $130,000 for 2025 returns. However, this exclusion comes with strict eligibility requirements that the IRS actively enforces.

To qualify, taxpayers must meet either the bona fide residence test (meaning they were bona fide residents of another country for an entire tax year) or the physical presence test (requiring them to be outside the U.S. for at least 330 complete days in a 12-month period). Additionally, the taxpayer must have a “tax home” in the foreign country. It’s also critical to remember that this tax break does not apply to amounts paid by the U.S. government or its agencies to their employees working abroad.

IRS agents are particularly adept at identifying individuals who erroneously claim this exclusion, and disputes frequently arise in Tax Court. Areas of particular focus for the IRS include filers who maintain minimal ties to the foreign country where they work but retain an abode in the U.S. (though this U.S. abode restriction doesn’t apply to individuals working in combat zones like Iraq and Afghanistan). Flight attendants, pilots, and employees of U.S. government agencies who mistakenly claim the exclusion while working overseas are also common targets for audit. Precise documentation of residency, physical presence, and the location of one’s tax home is paramount.

Read more about: Unlock Your Retirement Potential: Essential Social Security Changes & Strategies for 2025 and 2026

15. **Operating a Marijuana Business**Despite the growing number of states where marijuana is legal for sale, cultivation, and use, businesses operating in this industry face a unique and burdensome income tax problem at the federal level. A federal statute explicitly prohibits tax deductions for sellers of controlled substances illegal under federal law, which still includes marijuana. This means that, unlike other businesses, marijuana firms are largely barred from claiming standard business write-offs, other than for the cost of the weed itself.

The IRS is keenly aware of this federal prohibition and actively scrutinizes legal marijuana firms that attempt to take improper write-offs on their tax returns. During audits, agents consistently disallow these deductions, and courts have consistently sided with the IRS on this issue. This consistent enforcement underscores the federal government’s position, regardless of state-level legality.

Furthermore, if taxpayers involved in marijuana businesses refuse to comply with document requests from revenue agents during an audit, the IRS is prepared to use more aggressive tactics. This includes issuing third-party summons to state agencies and other entities to seek the necessary information. This demonstrates the agency’s firm commitment to enforcing federal tax law in this contentious area.

However, there might be a glimmer of hope on the horizon for legal marijuana firms. In May, the Department of Justice proposed rules to reclassify marijuana from a Schedule I drug to a Schedule III drug under the Controlled Substances Act. If these final rules are adopted, published, and put into effect, marijuana businesses in states where the drug is legal could potentially begin deducting expenses on their federal income tax returns, and also engage more freely in banking and interstate commerce. The political landscape, however, remains uncertain, with past and present administrations taking differing approaches to cannabis regulation, leaving the future of these businesses’ tax treatment in flux.

Read more about: Navigating the Crossroads: Key Legal and Policy Shifts Redefining the Trucking Industry in 2025

Avoiding an IRS audit isn’t about hiding information; it’s about impeccable preparation and a thorough understanding of the nuances within tax law. As we’ve explored, from professional earnings to the specific challenges faced by emerging industries, the IRS has a keen eye on discrepancies and areas prone to error. The key takeaway remains unwavering: meticulous record-keeping, accurate reporting, and a willingness to seek expert advice are your strongest defenses. By embracing these principles, you can navigate the tax landscape with confidence, ensuring compliance and peace of mind, leaving no room for Uncle Sam’s unwelcome knock on your door.