Navigating the complexities of state and local taxation can often feel like deciphering an intricate financial puzzle. For many Americans, the annual ritual of tax season brings with it a keen awareness of how much of their hard-earned income is directed towards supporting state programs and critical infrastructure. Yet, the true impact of taxes extends far beyond a simple income tax rate; it encompasses a broader measure known as the total tax burden, a critical metric for anyone considering their financial landscape.

WalletHub, a leading financial insights platform, has diligently compiled comprehensive data comparing all 50 states based on this very concept. Unlike tax rates, which can fluctuate wildly depending on an individual’s personal circumstances, the tax burden provides a clear, standardized proportion of total personal income that residents contribute to state and local taxes. This burden is not uniform across the United States, creating significant disparities and, for some fortunate states, surprisingly low financial demands on their citizens.

This in-depth article will delve into a selection of states where your tax burden is remarkably low, providing practical insights and data-driven analysis to help you understand why these locations stand out. Utilizing the latest findings from WalletHub’s April 1, 2025, study, we will meticulously examine the key components of taxation—property taxes, individual income taxes, and sales and excise taxes—to reveal how residents in these states manage to keep more of their paychecks. Join us as we explore the fiscal landscapes of these surprisingly tax-friendly states, starting with those offering the absolute lowest overall tax burdens.

1. **Alaska**Topping the list as the state with the lowest overall tax burden, Alaska presents a compelling case for financial relief, according to WalletHub’s April 1, 2025, study. Its residents experience a total tax burden of just 4.93% of their personal income, a figure significantly lower than any other state. This exceptional position is largely attributable to the state’s distinct tax policies, which diverge sharply from the national norm and provide substantial advantages to its permanent residents.

A cornerstone of Alaska’s low tax burden is its complete absence of an individual income tax. This policy means that residents do not pay state income tax on their annual earnings, a major factor in reducing their overall financial outlay. Furthermore, Alaska is unique in that it also imposes no state sales tax, although some local sales taxes may apply, contributing to a comparatively low sales and excise tax burden of only 1.47% of income. These two zero-tax policies instantly set Alaska apart.

Beyond the absence of income and state sales taxes, Alaska also maintains a manageable property tax burden, which stands at 3.46% of residents’ income. While property taxes are a component of taxation in all states, Alaska’s rate is strategically balanced within its overall fiscal framework. The combination of these factors results in a remarkably light tax load, making Alaska an attractive, albeit remote, option for those prioritizing financial savings.

It is also worth noting that Alaska provides a unique financial benefit through annual oil dividend checks distributed to permanent residents, further enhancing the state’s appeal from a financial perspective. This dividend program represents a distinct approach to revenue sharing that directly benefits its citizens, solidifying Alaska’s position as a truly unique financial environment within the United States, despite considerations such as its challenging weather and fewer job opportunities compared to more populous states.

Read more about: Beyond the Blur: 10 Essential Diabetes Eye Indicators You Can’t Afford to Ignore for Lifelong Vision

2. **Wyoming**Following closely behind Alaska, Wyoming distinguishes itself as the state with the second-lowest overall tax burden, registering at 5.79% of personal income, according to the WalletHub analysis. This western state is another strong contender for individuals and businesses seeking to minimize their tax obligations, employing a strategy that prioritizes the absence of several key tax categories, thereby creating a highly tax-friendly environment.

A primary driver of Wyoming’s low tax burden is its comprehensive lack of personal income tax. This means that residents do not contend with state levies on their wages, salaries, capital gains, or even dividend income. The state’s fiscal approach also extends to corporate income, which is similarly untaxed. These policies significantly reduce the tax complexity and financial pressure on both individuals and enterprises operating within its borders.

While Wyoming does not impose a personal income tax, it sustains its public services through other revenue streams. The state relies notably on severance and excise taxes, particularly on its rich natural resources, such as oil and gas drilling, to generate revenue. This strategic allocation of the tax base allows the state to forgo more direct taxes on individual earnings, distributing the financial responsibility in a manner that favors residents’ take-home pay.

In terms of property taxes, Wyoming maintains relatively low rates, contributing to its overall low burden at 2.81% of personal income. The state also features a moderate sales and excise tax burden of 2.98%. The holistic combination of no state income tax, low property taxes, and a reliance on natural resource taxation solidifies Wyoming’s reputation as one of the most tax-friendly states in the U.S., making it an appealing destination for those looking to keep more of their earnings.

Read more about: Hit the Road, Not Your Wallet: America’s Top Affordable Car Camping Adventures for Under $25 a Night

3. **New Hampshire**New Hampshire secures its place as the state with the third-lowest overall tax burden, standing at 5.94% of personal income, according to WalletHub’s recent study. This New England state adopts a distinctive approach to taxation, particularly known for its policies that significantly ease the burden on wage earners, despite having one notable exception in its tax structure that is currently being phased out.

A key characteristic contributing to New Hampshire’s low overall tax burden is the complete absence of a tax on earned income. This means that residents do not pay state income taxes on their wages or salaries, making it highly attractive for individuals dependent on employment income. This policy is a significant relief for single taxpayers and married couples alike, allowing them to retain a larger portion of their paychecks without state-level deductions.

Historically, New Hampshire did tax interest and dividend income, which could impact certain investors and retirees. However, the state has been progressively phasing out this tax, with its complete elimination slated for the 2025 tax year. This legislative change further enhances the state’s appeal as a low-tax environment, broadening the scope of financial freedom for its residents and making it even more competitive in the coming years.

While New Hampshire does not levy a state sales tax, it does have a relatively high property tax burden, which is reported at 4.87% of residents’ income. In fact, WalletHub notes that New Hampshire has one of the highest property tax burdens in the nation. This high property tax rate is a primary mechanism through which the state generates revenue, balancing the absence of sales and earned income taxes. Despite this, the overall balance of its tax structure, especially with the impending removal of interest and dividend taxes, positions New Hampshire favorably for those seeking a low total tax burden.

Read more about: Navigating the Nation’s Toughest Roads: The 15 U.S. States with the Strictest Vehicle Inspection and Emissions Laws

4. **Tennessee**Tennessee stands out as another state offering a surprisingly low tax burden, ranking fourth nationally with an overall burden of 6.38% of personal income. This southern state has undergone significant tax reform, notably eliminating certain income taxes, which has positioned it as an attractive destination for a broad spectrum of taxpayers, from single individuals to married couples filing jointly.

One of the most impactful changes in Tennessee’s tax landscape was the complete phasing out of taxes on dividend and interest income in 2021. This move officially brought Tennessee into the ranks of states with no state income tax on individual earnings, ensuring that residents retain all of their wage, salary, dividend, and interest income at the state level. This policy provides a substantial financial benefit, alleviating a significant portion of the tax burden that exists in many other states.

To compensate for the absence of income tax, Tennessee does have relatively high sales tax rates, which contribute 4.74% to the overall tax burden, according to WalletHub. These general sales taxes apply to most purchased goods and services, and selective sales taxes are imposed on specific items such as alcohol, tobacco, and public utilities. This structure means that while residents avoid income tax, their spending habits play a more significant role in their total tax contributions.

Despite the higher sales taxes, Tennessee maintains a remarkably low property tax burden, registering at only 1.64% of personal income. This rate is among the lowest in the nation and serves as a major draw for homeowners and those looking to invest in real estate. The combination of no individual income tax and very low property taxes, even with relatively higher sales taxes, solidifies Tennessee’s position as a state where the overall tax burden is kept notably light, particularly benefiting those with high incomes or fixed property assets.

Read more about: Where Did the Open Road Go? Revisiting 8 Beloved American Road Trips Families No Longer Explore

5. **South Dakota**South Dakota emerges as the fifth state with an exceptionally low overall tax burden, recorded at 6.46% of personal income in WalletHub’s recent study. This northern Plains state, rich in history and agricultural heritage, has cultivated a tax environment that is highly advantageous for both individuals and businesses, primarily by eliminating one of the most common forms of state taxation.

A cornerstone of South Dakota’s appealing tax structure is the complete absence of personal income tax. This policy ensures that residents do not face state-level taxation on their wages, salaries, or other forms of individual income. Furthermore, the state also foregoes corporate income tax, making it equally attractive for businesses looking to establish or expand operations without the burden of state corporate levies. This dual absence of income taxes simplifies tax filings and significantly boosts disposable income for its citizens.

To generate necessary public revenue, South Dakota implements sales taxes. The state’s combined state and local sales tax is approximately 6.1 percent, which contributes 4.05% to the overall tax burden, a rate considered relatively low compared to many other parts of the U.S. While residents do contribute through consumption, the simplicity and transparency of this sales tax model, coupled with no income tax filings, streamline the financial responsibilities for taxpayers.

In terms of property taxes, South Dakota maintains a moderate burden, with residents paying 2.41% of their income towards this category. The state’s historical background, including the exploration by Meriwether Lewis and William Clark and the establishment of the Dakota Territory, underscores a long-standing emphasis on self-reliance and resource management, which is reflected in its contemporary fiscal policies. The balanced approach of no income tax, moderate property taxes, and a reasonable sales tax makes South Dakota a strong contender for those seeking a low overall tax burden and a straightforward financial landscape.

Read more about: Where Did the Open Road Go? Revisiting 8 Beloved American Road Trips Families No Longer Explore

6. **Florida**Rounding out our initial exploration of states with the lowest tax burdens is Florida, which registers an overall tax burden of 6.49% of personal income, according to WalletHub’s April 1, 2025, findings. Known for its sunshine, vibrant tourism, and retiree-friendly policies, Florida has crafted a tax system that significantly reduces the financial demands on its residents, particularly by eliminating a major tax category.

The primary appeal of Florida’s tax system is its complete lack of individual income tax. This policy means that residents are not subject to state income taxes on their annual earnings, nor are they taxed on capital gains income or local income. This is a significant draw for a diverse range of taxpayers, including retirees, business owners, and single individuals, allowing them to keep a substantially larger portion of their income compared to those in states with income taxes.

Without an income tax, Florida primarily funds its state government through sales tax and property taxes. The state’s sales and excise tax burden accounts for 3.90% of residents’ income, encompassing general sales taxes on most goods and services. This approach means that consumption plays a larger role in an individual’s total tax contribution, with tourists also significantly contributing to sales tax revenue, thereby exporting some of the tax burden to visitors.

Florida’s property tax burden stands at 2.59% of personal income, which is a moderate rate compared to many states. While residents may still feel the financial impact in these areas, the absence of a state income tax remains a powerful incentive. The state effectively balances its revenue needs through these alternative channels, ensuring that while taxpayers contribute to public services, they do so without the direct imposition of an income tax on their earnings, reinforcing Florida’s reputation as a financially appealing state for many.” , “_words_section1”: “1945

Continuing our exploration of states that offer residents a surprisingly low tax burden, we now delve into the next tier of locations that stand out in WalletHub’s comprehensive April 1, 2025, study. These states each employ distinct fiscal strategies to keep the overall financial demands on their citizens to a minimum, presenting valuable insights for those considering their financial futures and potential relocation. Understanding these varying approaches further illuminates the intricate landscape of state and local taxation across the United States.

Our analysis continues to leverage WalletHub’s robust methodology, which calculates the total tax burden as a proportion of total personal income dedicated to state and local taxes. This standardized metric provides a clear and objective measure, allowing for direct comparison across the 50 states. As we examine these subsequent states, it becomes evident that a low tax burden can be achieved through a multitude of policy choices, from eliminating income taxes to optimizing property and sales tax structures.

Read more about: Navigating Holiday Travel: A Deep Dive into the 12 U.S. Airports Prone to Flight Delays This Season

7. **Delaware**Delaware, often recognized for its business-friendly environment, emerges as the seventh state on our list with a surprisingly low overall tax burden. According to WalletHub’s April 1, 2025, study, residents here face a total tax burden of 6.52% of their personal income. This places Delaware just outside the top six, yet still firmly within the ranks of states that offer significant financial advantages, particularly given its nuanced approach to income taxation.

Unlike many states on this low-tax list, Delaware does impose an individual income tax, accounting for 3.69% of the personal income burden. However, this is strategically balanced by other remarkably low tax components. The state’s property tax burden, for instance, is a mere 1.81% of personal income, which is notably low when compared to national averages. This low property tax rate helps to offset the impact of its income tax, contributing to the state’s favorable overall standing.

A standout feature of Delaware’s tax structure is its exceptionally low sales and excise tax burden, which registers at only 1.02% of personal income. This figure is among the lowest in the nation, providing substantial savings on consumption for residents. The state generates revenue through various means, including a strong focus on corporate and business license taxes, often used disproportionately by out-of-state entities, allowing it to maintain lower direct taxes on its individual citizens.

The combination of a moderate income tax, very low property taxes, and an almost negligible sales tax creates a distinctive and attractive financial landscape. Delaware’s fiscal strategy positions it as a state where, despite having an income tax, the overall burden remains highly competitive, making it appealing for those prioritizing low property and sales tax expenditures.

Read more about: Navigating the Nightmare: The 12 Worst States for Modified Car Enthusiasts

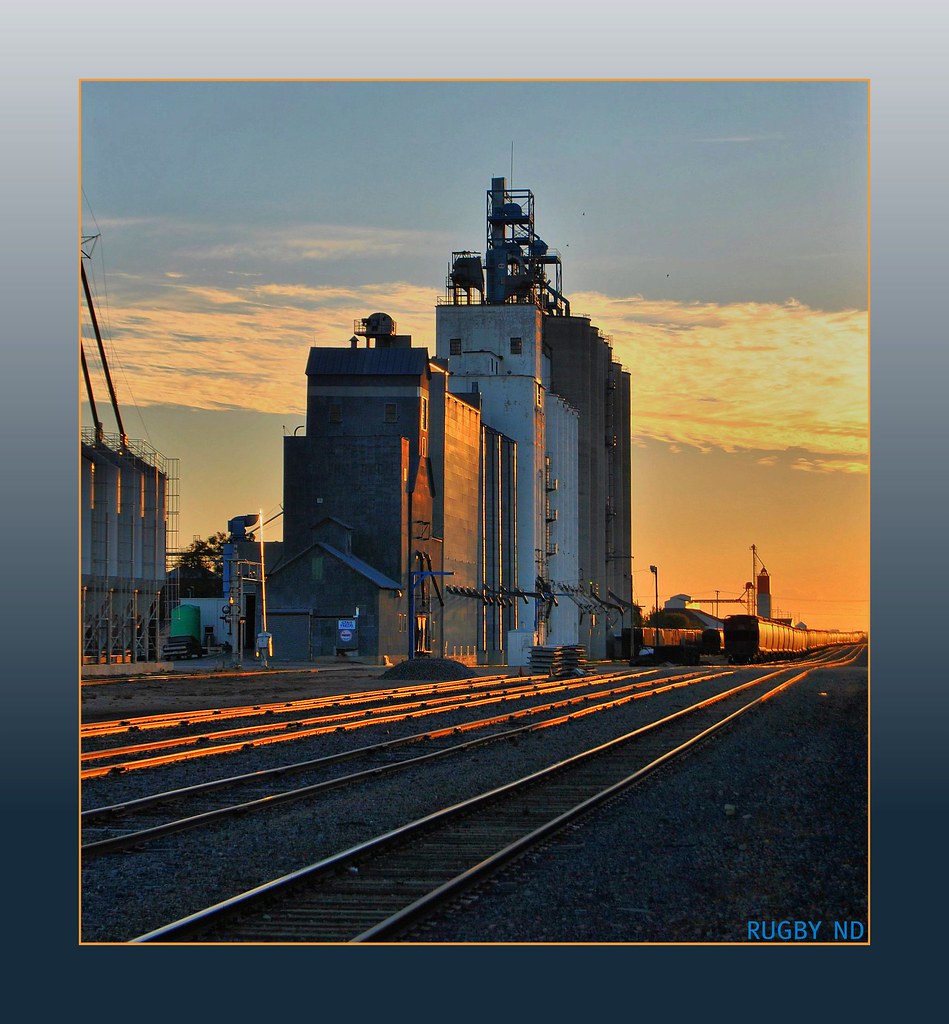

8. **North Dakota**North Dakota secures its position as the eighth state on our list, presenting an overall tax burden of 6.61% of personal income, according to WalletHub’s April 1, 2025, findings. This northern plains state manages to keep individual tax obligations low through a balanced approach that includes relatively modest income taxes and a reliance on other economic sectors for revenue generation.

The individual income tax burden in North Dakota is exceptionally low, standing at just 0.85% of personal income. This places it among the states with the lightest income tax load, utilizing a progressive structure with low marginal rates that benefit a wide range of filers. For many residents, this means a significantly larger portion of their earned income remains in their pockets compared to higher-taxed states.

North Dakota also maintains a reasonable property tax burden, calculated at 2.28% of personal income. This rate is relatively low and contributes positively to the state’s overall tax friendliness. The state’s financial stability is further bolstered by its significant natural resource extraction activities, particularly oil and gas, which generate substantial severance taxes. These revenues enable the state to maintain lower direct taxes on individuals.

In terms of sales and excise taxes, North Dakota’s burden is 3.48% of personal income. While residents contribute through consumption, the state’s comprehensive tax profile, anchored by a very low individual income tax and moderate property taxes, solidifies its standing as a state with a surprisingly manageable financial footprint for its citizens. This thoughtful distribution of the tax base ensures that residents experience a relatively light overall burden.

Read more about: Where Did the Open Road Go? Revisiting 8 Beloved American Road Trips Families No Longer Explore

9. **Oklahoma**Oklahoma earns its place as the ninth state with a notably low tax burden, registering at 7.01% of personal income in WalletHub’s recent study. This Southern Plains state offers a compelling tax environment, particularly distinguished by its remarkably low property tax rates, which significantly contribute to its overall affordability for residents.

A key driver of Oklahoma’s low tax burden is its exceptionally low property tax, which accounts for only 1.62% of personal income. This rate is among the lowest in the nation, providing a substantial financial advantage to homeowners and those considering real estate investments within the state. The minimal impact of property taxes makes Oklahoma an attractive option for individuals and families seeking to reduce their housing-related tax expenses.

Oklahoma does levy an individual income tax, which contributes 1.78% to the overall tax burden. This rate is quite competitive compared to many other states, striking a balance that allows the state to fund public services without imposing excessively high demands on personal earnings. The state’s income tax structure is designed to be relatively straightforward and accessible for taxpayers.

The sales and excise tax burden in Oklahoma stands at 3.61% of personal income. This component covers general sales taxes on goods and services, as well as selective excise taxes on specific items. While sales taxes are a consistent revenue stream, the overall balance of very low property taxes, moderate income taxes, and reasonable sales taxes positions Oklahoma as a financially appealing state for a diverse range of residents.

Read more about: Navigating Holiday Travel: A Deep Dive into the 12 U.S. Airports Prone to Flight Delays This Season

10. **Idaho**Idaho presents itself as the tenth state on our list where residents enjoy a surprisingly low overall tax burden, recorded at 7.54% of personal income by WalletHub’s April 1, 2025, analysis. This Mountain West state offers a balanced tax structure that is appealing to individuals and families seeking a fiscally responsible place to live, contributing to its frequent appearance on lists of low-tax states.

Residents in Idaho benefit from a relatively low property tax burden, which accounts for 1.88% of personal income. This favorable rate ensures that homeownership remains more affordable compared to many other regions of the country. Coupled with a manageable individual income tax burden of 2.34% of personal income, Idaho provides a tax environment where both earnings and assets are taxed at competitive rates.

The state’s sales and excise tax burden is 3.32% of personal income, reflecting contributions through consumption. This rate is moderate and typical of states that balance their revenue streams across various tax categories rather than relying heavily on a single type of taxation. The combined effect of these three tax components creates an accessible and predictable financial framework for residents.

Idaho’s approach to taxation demonstrates a strategy of spreading the tax responsibility across property, income, and consumption, without placing an undue burden on any single category. This thoughtful fiscal policy results in an overall tax burden that is significantly lower than the national average, making Idaho an attractive destination for those prioritizing financial efficiency and a straightforward tax landscape.

Read more about: Navigating Holiday Travel: A Deep Dive into the 12 U.S. Airports Prone to Flight Delays This Season

11. **Texas**Texas, a state renowned for its economic dynamism and robust job market, also stands out for its surprisingly low overall tax burden, ranking eleventh on our list with a total burden of 7.77% of personal income, according to WalletHub’s April 1, 2025, study. A cornerstone of its financial appeal is the complete absence of one of the most significant state taxes.

The primary reason for Texas’s favorable tax environment is its 0.00% individual income tax burden. This means that residents are not subject to state income taxes on their annual earnings, capital gains, or local income taxes. This policy provides a substantial advantage for a wide range of taxpayers, including business owners, single individuals, and retirees, allowing them to retain a considerably larger portion of their income.

To compensate for the absence of an income tax, Texas relies heavily on other forms of taxation, primarily property taxes and sales taxes, to fund its state and local governments. The property tax burden in Texas is 3.55% of personal income, which is higher than some other states on this list but serves as a crucial revenue generator for local services. This reliance on property taxes means that homeowners shoulder a larger share of the tax load.

Furthermore, the state’s sales and excise tax burden accounts for 4.22% of residents’ income. These general sales taxes apply to most purchased goods and services, meaning consumption plays a significant role in an individual’s total tax contribution. Despite the higher property and sales taxes, the powerful incentive of having no state income tax makes Texas an economically attractive state for many seeking to minimize their overall tax obligations.

Read more about: End of an Era: 15 Once-Mighty American Retailers That Vanished Post-2004

12. **Missouri**Rounding out our comprehensive list of states with surprisingly low tax burdens is Missouri, which registers an overall burden of 7.83% of personal income, based on WalletHub’s April 1, 2025, findings. This Midwestern state offers a balanced and comparatively low tax profile, making it an appealing option for residents seeking a predictable and manageable financial environment.

Missouri’s tax structure includes a property tax burden of 2.31% of personal income, which is a moderate rate, contributing to reasonable costs for homeowners across the state. In addition, the individual income tax burden stands at 2.59% of personal income. This rate reflects a system that generates necessary state revenue without imposing overly burdensome levies on personal earnings, aligning with the state’s overall fiscally conservative approach.

Further contributing to the state’s tax landscape is its sales and excise tax burden, which accounts for 2.93% of personal income. This rate is relatively moderate, ensuring that while residents contribute through their consumption, it does not disproportionately impact their overall financial outflow. The combination of these three tax components results in a well-distributed and comparatively light tax load.

By balancing moderate rates across property, income, and sales taxes, Missouri provides a stable and less demanding tax environment for its citizens. This strategic distribution helps maintain an overall tax burden that is lower than many other states, solidifying Missouri’s reputation as a practical and financially considerate place to reside, particularly for those who value predictable tax contributions across different categories.

The landscape of state taxation in the U.S. is incredibly diverse, offering distinct financial advantages depending on a state’s specific fiscal priorities and economic structure. As demonstrated by WalletHub’s comprehensive analysis, from the absolute lowest burdens in states like Alaska and Wyoming to the strategically balanced approaches found in Delaware or Missouri, residents have numerous options for minimizing their financial contributions to state and local governments. Whether through the complete elimination of income taxes, exceptionally low property rates, or manageable sales taxes, these states highlight how thoughtful policy can translate into tangible savings for individuals.

Read more about: New Road Ahead: Unpacking 14 Crucial Driving Law Changes in Key US States for the Coming Year

However, it is crucial for individuals and policymakers alike to recognize that a low tax burden often comes with a unique set of trade-offs, which can include reliance on other revenue sources, or specific economic conditions. Understanding these nuances, alongside the ongoing shifts in federal funding and state legislative responses, is essential for truly appreciating the dynamic nature of state tax policy and its profound impact on residents’ financial well-being.