WASHINGTON — As a federal rescue program channeled hundreds of billions of dollars to businesses across the country during the coronavirus pandemic, companies tied to members of Congress and their families received at least $13.7 million in funds.

The aid flowed through the Paycheck Protection Program, or PPP, designed to provide low-interest, forgivable loans to small businesses struggling under the economic strain of shutdowns and uncertainty. Data released by the U.S. Treasury Department and Small Business Administration, disclosures reviewed by news organizations, including The Associated Press and CQ Roll Call, shed light on the beneficiaries, including businesses connected to prominent lawmakers.

The Paycheck Protection Program stood as a centerpiece of the government’s plan to buoy an economy significantly impacted by the pandemic. The program facilitated $659 billion in loans written by banks but backed by taxpayer money, intended primarily to cover payroll, rent, and similar operational costs for businesses with fewer than 500 employees.

Demand for the initial funding was substantial, with the first $349 billion allocated running out within just two weeks. Many smaller entities reportedly found it difficult to navigate the application process quickly enough to secure funds before they were depleted, even as hundreds of companies traded on stock exchanges, far exceeding the typical image of a small business, received loans peaking at $10 million each, a situation that prompted public criticism and led some recipients to return the funds.

The lack of comprehensive public disclosure about the program’s beneficiaries has also been a point of contention. The administration opted not to release detailed information on loans under $150,000, a decision that obscured the identity of over 80% of the nearly 5 million recipients at the time, according to available data. This lack of transparency spurred an open-records lawsuit initiated by a consortium of news organizations.

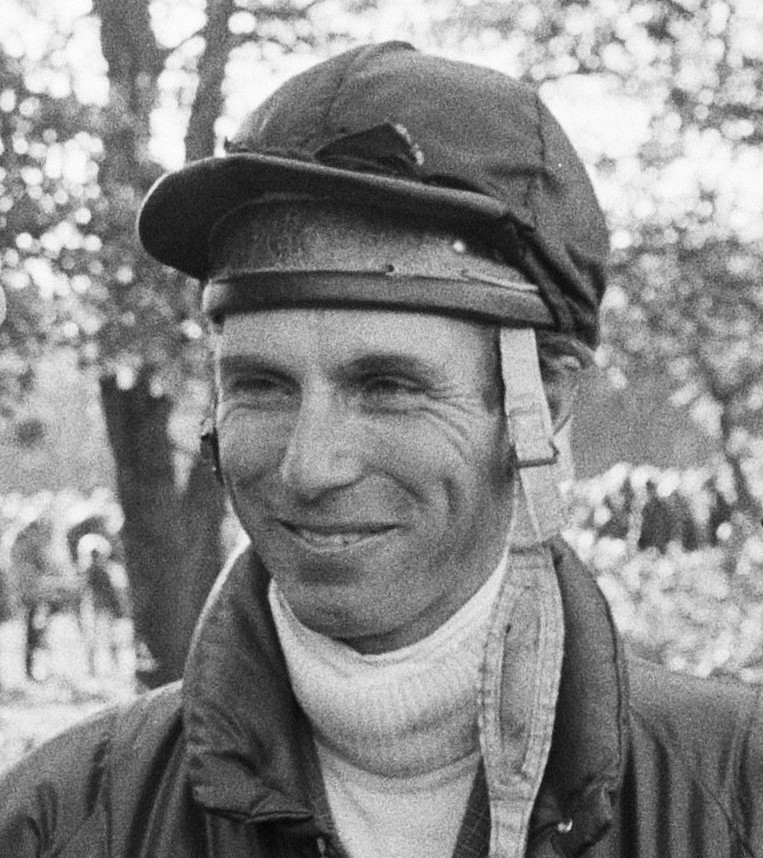

Among the members of Congress connected to businesses that received PPP funds is Republican U.S. Senator Markwayne Mullin of Oklahoma. His family businesses, including entities involved in plumbing and environmental services, were listed as receiving a significant sum from the program.

According to data released by the Treasury Department, four businesses owned by Senator Mullin received a total ranging between $800,000 and $1.9 million through the Paycheck Protection Program. These businesses were identified as Broken Arrow-based Mullin Plumbing, Inc., Mullin Environmental, Inc., Mullin Services, Inc., and Moore-based Mullin Plumbing West Division.

The data further indicated that these companies collectively reported retaining 140 jobs, attributing this outcome in part to the federal loans received. The loans were sought during a period when businesses faced unprecedented challenges.

Senator Mullin’s spokeswoman, Meredith Blanford, stated that the congressman is not involved in the day-to-day operations of the companies. She directed questions regarding the businesses’ operations and the PPP loans to the companies’ chief financial officer.

Mullin’s connection to the businesses extends beyond ownership. According to information reviewed by CQ Roll Call, the Senator’s wife took a salary of over $100,000 from Mullin Plumbing, which itself received a minimum of $350,000 in PPP funds.

This is not the first time Senator Mullin’s business dealings have drawn scrutiny. In 2018, the House Ethics Committee cited Mullin and recommended that he pay back $40,000 to his family business. A review by the committee concluded that the money he had received was out of compliance with House rules and previous recommendations from the panel.

Mullin’s financial profile, detailed in disclosure reports, reveals a substantial net worth, placing him among the wealthiest members of the Senate. His 2023 financial disclosure report estimated his net worth to be between $23,738,148 and $100,151,999. This marks a significant increase from his estimated net worth range of $3,264,031 to $14,386,999 based on his 2018 filing when he was a U.S. Representative.

His financial disclosures also detail his reported income, which was between $2,490,922 and $13,309,700 in 2017 alone. These figures underscore the scale of his business operations prior to and during his time in Congress.

The primary driver of Senator Mullin’s wealth is his business ventures, particularly Mullin Plumbing, the family business he took over at the age of 20 after his father became ill. Under his leadership, the company expanded, becoming a significant source of income.

Beyond the plumbing enterprise, his financial disclosures list a wide array of assets. According to his 2023 report, he holds 107 assets valued between $28,738,148 and $101,152,000. Among his most valuable assets, each reported to be valued between $1,000,001 and $5 million, are specific mutual funds, life insurance policies, and a residential property in Englewood, Florida.

His reported liabilities in the 2023 report range from $1,000,001 to $5 million. In 2018, his reported liability was for the purchase of the Mullin Plumbing company, ranging from $500,001 to $1,000,000.

In addition to his business holdings and real estate, Senator Mullin’s financial activities include active stock trading. He has recently disclosed purchasing stock in companies such as Badger Meters and Raytheon. While he has faced allegations regarding insider trading in the past, the context provided states that no concrete evidence has resulted in formal charges or convictions.

Senator Mullin has also publicly discussed his business background and views on labor relations, particularly in a recent exchange with Teamsters General President Sean O’Brien during a Senate hearing. Mullin recounted efforts by union pipefitters to organize his plumbing employees in 2019.

During the exchange, Mullin stated, “They’d be leaning up against my trucks.” He added, “I’m not afraid of a physical confrontation; in fact, sometimes, I look forward to it.” He questioned the union’s tactics, asking “‘Shame on Mullin?’ For what? Because we were paying higher wages … and we (weren’t) requiring them to pay your guys’ exorbitant salaries?”

Mullin’s description of paying “higher wages” and not requiring employees to fund union salaries highlights his perspective as a business owner and his experience with labor organizing efforts.

Another Oklahoma Republican, U.S. Representative Kevin Hern, who operates multiple McDonald’s restaurant locations in the Tulsa area through KTAK Corp., a management company jointly owned with his wife, Tammy, also saw businesses receive PPP loans. KTAK Corp. received loans ranging from $1 million to $2 million.

Additionally, a firm owned by Representative Hern’s wife, Custom Seating, which focuses on providing and designing furniture for restaurants, received $350,000 from the program. Representative Hern’s Chief of Staff, Cameron Foster, stated that while Hern is not involved in daily operations, the family business was able to maintain employees’ employment levels thanks to the PPP loan.

Financial disclosures show Representative Hern is the wealthiest candidate among those running for congressional seats in Oklahoma. His most recent filing placed his net worth between $36 million and $92 million. His KTAK Corp. operations constitute a significant portion of his reported assets, valued between $25 million and $50 million, and accounted for $1 million to $5 million of his reported income in a previous year.

Beyond Oklahoma, companies linked to prominent figures involved in shaping pandemic relief legislation also received PPP funds. Speaker Nancy Pelosi’s husband, Paul Pelosi, described as a “minor, passive investor” with an 8.1 percent stake in a partnership with EDI Associates and Piatti Restaurant Company, saw those firms receive at least $2.4 million combined.

A spokesman for Paul Pelosi told CQ Roll Call that he was “not involved in or even aware of this PPP loan.” These firms support the hospitality industry, including an investment in the El Dorado Hotel in Sonoma, California, aligning with the types of businesses the PPP program was designed to assist.

Other members with family ties to firms receiving funds include House Labor-HHS Appropriations Chairwoman Rosa DeLauro of Connecticut. The polling and research firm Greenberg Quinlan Rosner Research, which bears the name of her husband and one of its founders, Stanley Greenberg, received at least $350,000.

While the firm’s website does not list Greenberg as current staff, DeLauro’s financial disclosure indicated the firm paid him a salary. A spokesperson for DeLauro stated that neither she nor Greenberg were aware of the firm’s decision to apply for a PPP loan.

Pennsylvania Democrat Matt Cartwright, also an appropriator, has a connection to Scranton law firm Munley Law PC, which received a minimum of $350,000. Cartwright’s wife, Marion Munley, is a partner there; Cartwright himself was a partner before his House bid in 2012.

A spokesperson for Representative Cartwright said he “had no involvement with this loan in any way.” While Cartwright remains in the firm’s retirement plan per his financial disclosure, he no longer holds ownership or stock in the firm.

Ethical concerns surrounding members of Congress benefiting, directly or indirectly, from legislation they vote on have been highlighted by government oversight groups. Aaron Scherb, a spokesman for Common Cause, a nonpartisan government watchdog, noted that while not always illegal, members voting on bills from which they can personally benefit “certainly looks bad and smells bad.” Scherb added, “We think it certainly should be illegal.”

Scott Amey, general counsel of the Project on Government Oversight, echoed these concerns. He stated that taxpayers should be worried if Members used their official position to advance their financial interests. Amey suggested that “Shaping the COVID-19 legislative response knowing that an outside interest will benefit could be inconsistent with the conscientious performance of their congressional duties and a violation of ethics rules.”

Amey further advised that members who benefited from PPP funds through their businesses should be transparent about their involvement in the loan process and how the money impacted their financial situation.

Several other members of Congress also have business ties to entities that received PPP funding. California Democratic Representative Scott Peters’ wife, Lynn E. Gorguze, heads Cameron Holdings, which includes Sinclair & Rush Inc., a company that shifted production to face shields during the pandemic and received a minimum of $2 million. Gorguze’s stake in the company is valued at a quarter of a million dollars.

Republican Representative Vern Buchanan of Florida saw his Ford and Nissan dealerships receive a minimum total of $2.4 million, reportedly the most among dealerships affiliated with a member of Congress. Texas Republican Representative Roger Williams’ JRW Corporation received a minimum of $1 million, with his stake exceeding $50 million.

Pennsylvania Republican Representative Mike Kelly’s four dealerships each received a minimum $150,000 loans. While a spokesperson stated he is not involved in day-to-day operations per ethics policies, his disclosure listed that both he and his wife earned salaries from one of the dealerships.

Two California House members with agricultural interests were also listed: Republican Devin Nunes, whose invested wineries received a minimum of $1 million each, and Democrat TJ Cox, whose almond processor company received $350,000.

Georgia Republican Representative Rick W. Allen’s construction firm, where his wife is chairwoman, received at least $350,000. These cases, spanning various industries and party lines, illustrate the broad reach of the PPP program into entities connected to those who crafted and voted on the relief legislation.

Even a political campaign received a PPP loan. Democrat Christine Mann, a candidate in a Texas primary runoff, disclosed a $28,600 loan used for payroll, which was later repaid. Her spokeswoman explained the campaign was “hit financially during the pandemic” and sought to ensure staff received a livable wage, noting Mann’s work as a physician testing for COVID-19.

The data on PPP loans to businesses tied to members of Congress and their families underscores the complex intersection of personal finance, business interests, and public service. The program, while aimed at widespread economic relief, also highlighted the financial portfolios and potential conflicts of interest among those in positions of power, prompting calls for greater transparency and stricter ethical guidelines regarding how lawmakers’ personal and family business interests intersect with their legislative duties and access to federal aid programs.

Scrutiny of these financial ties, facilitated by the public release of data from the PPP program and required personal financial disclosures, provides a detailed look into the economic standing and business involvements of congressional members. It reinforces the ongoing public and watchdog group interest in understanding how policy decisions may align with the financial realities of the nation’s elected representatives.