The global financial landscape is currently experiencing a period of profound reassessment, with a concerning report issued by the United Nations highlighting that over 50 countries are confronting the imminent threat of bankruptcy. Predominantly poor or developing nations, these countries are confronted with a stark reality that underscores pervasive vulnerability within the international economic system. This situation serves as a critical indicator of broader market stresses and potential contagion effects, necessitating rigorous analysis from financial experts globally.

It is a widespread misconception that only the most fragile economies are prone to such severe financial distress. However, even nations traditionally regarded as economically robust can encounter significant challenges, as demonstrated by various global events and historical precedents. The intricate interplay of global trade dynamics, unpredictable geopolitical shifts, dramatic fluctuations in commodity prices, and crucial domestic policy decisions all contribute to a volatile environment. Financial stability can rapidly deteriorate under these multifaceted pressures, providing a vital lesson for global economic governance and proactive policy – making.

In this in – depth analysis, we shift our focus to examine ten countries that, according to available data and expert evaluations, are on the verge of complete financial collapse. Our objective is to offer a clear, factual, and data – driven overview of the unique circumstances afflicting each nation, drawing directly from the most relevant economic indicators and historical precedents. This detailed examination aims to clarify the specific challenges and underlying factors contributing to their precarious financial situations, providing comprehensive insights into contemporary sovereign debt crises.

1. **Ukraine** Ukraine’s financial predicaments are profoundly intertwined with its protracted conflict with Russia, a geopolitical reality that has imposed immense pressure on its economic stability. The sustained hostilities have severely disrupted economic activities, strained public finances, and deterred foreign investment, creating an exceptionally challenging environment for debt servicing. This ongoing conflict constitutes a substantial drain on national resources, complicating any trajectory toward fiscal recovery.

Acknowledging the gravity of the situation, the International Monetary Fund (IMF) sanctioned Ukraine’s debt restructuring plan in March 2015. This was a pivotal step designed to alleviate immediate fiscal burdens and provide some financial leeway for the beleaguered nation. Despite such international interventions and restructuring endeavors, Ukraine’s credit rating has plummeted to unprecedented depths, reaching Ca, as evaluated by Moody’s, an independent credit risk assessment entity. This classification designates it as the second – lowest possible level, unequivocally indicating diminished market confidence.

Such a low rating significantly affects creditors, who are now confronted with a recovery rate estimated to range between a mere 35% and 65% on their loans. This substantial range implies considerable potential losses for those holding Ukrainian debt, underscoring the high risk involved. The severity of Ukraine’s fiscal situation is further accentuated by the almost certain probability of a default on government debt. This scenario clearly demonstrates the profound economic cost of protracted geopolitical instability and the formidable challenges inherent in national financial recovery under such circumstances.

Read more about: An-124: Resilient Soviet-Era Cargo Giant Still Rules Global Logistics

2. **Argentina** Argentina has a long and complex history of sovereign debt crises, with its most significant bankruptcy occurring in 2001 when its national debt soared above an alarming $130 billion. This monumental financial collapse stemmed from a confluence of interconnected factors, including the contentious policy of pegging the peso to the US Dollar, an unsustainable escalation of public debt, and endemic rampant corruption that permeated government structures. These systemic issues left Argentina acutely ill-prepared to absorb severe economic shocks, ultimately leading to it becoming the record-holder for the largest debt default in history, having missed payments exceeding $100 billion.

The origins of Argentina’s chronic financial troubles can be traced back even further, notably to the turbulent late 1980s. During this period, The New York Times vividly reported an astonishing annual inflation rate that peaked at a staggering 12,000% in the South American country. In a desperate, albeit controversial, attempt to curb this rampant hyperinflation, the government made the crucial decision to peg its peso currency directly to the US dollar. While this strategic move initially succeeded in attracting much – needed foreign capital into the economy, it simultaneously imposed significant constraints on the government’s operational flexibility, a critical detail that would later prove problematic.

This strict currency peg severely limited the government’s ability to counteract currency appreciation, a crucial mechanism for maintaining export competitiveness in a globalized market. As the peso effectively became more expensive relative to other international currencies, Argentine exports became prohibitively costly, thereby undermining a vital engine of economic growth and external revenue generation. This historical context reveals a recurring pattern of policy choices that, while offering apparent short – term relief, frequently laid the groundwork for future, more profound economic disruptions, perpetually challenging Argentina’s pursuit of enduring financial stability.

Read more about: From Pop Star to Courtroom: The Tax Evasion Charges Facing Former ‘The Voice’ Coach Shakira

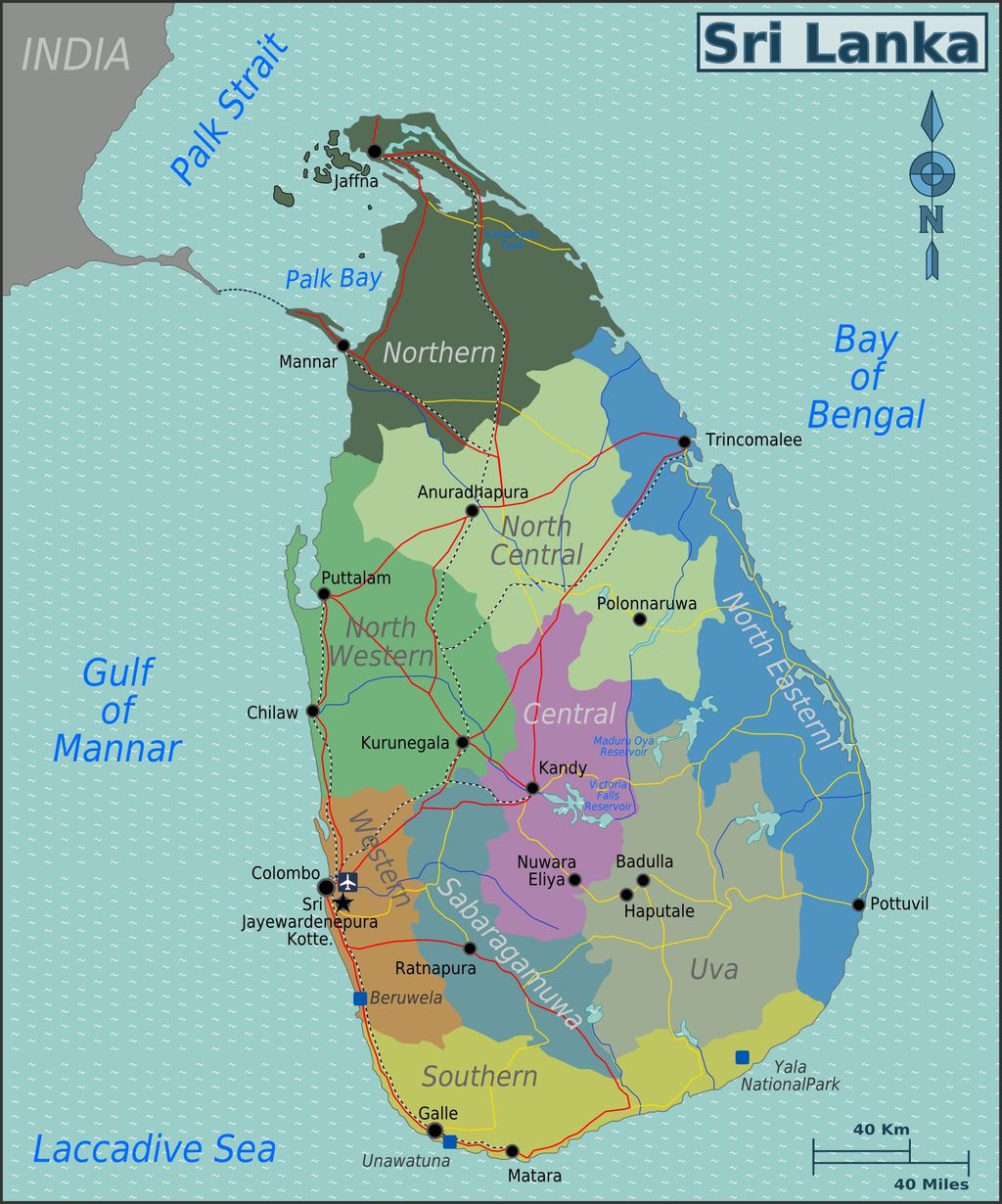

3. **Sri Lanka** Sri Lanka serves as the most recent and striking example of a sovereign state succumbing to the immense pressures of bankruptcy, having officially declared its inability to service its foreign loans. The gravity of its predicament was openly acknowledged by President Ranil Wickremesinghe, who forthrightly warned the nation that the economic crisis was anticipated to persist until at least the end of the subsequent year. This unequivocal admission signaled a protracted period of hardship for its citizens and posed a significant challenge for the government to navigate.

With a considerable foreign debt totaling $51 billion, the government formally announced a default in April 2022, marking a pivotal juncture in its financial trajectory and international standing. This announcement immediately precipitated intense negotiations with the International Monetary Fund (IMF) for a potential bailout package, a common yet often arduous recourse for nations in such dire fiscal straits. Such international assistance typically entails stringent reform commitments, adding another layer of complexity to the recovery process.

The global pandemic significantly intensified Sri Lanka’s already faltering economy, leading to widespread job losses and a sharp decline in tourism, a sector of vital importance for the nation’s revenue generation. Once a highly coveted tourist destination, numerous hotels and businesses were tragically compelled to shut down due to the ongoing crisis, further crippling economic activity and livelihoods. Compounding these severe external pressures were deeply ingrained internal factors such as rampant government corruption and persistent political instability, which collectively contributed to the comprehensive economic collapse, necessitating urgent and fundamental reforms.

Read more about: What Your Mechanic Won’t Tell You: 18 Secrets Every Car Owner Should Know

4. **Tunisia** Tunisia stands out as one of Africa’s most financially fragile nations, often resorting to seeking assistance from the International Monetary Fund amid a challenging and intricate economic landscape. The North African country is presently struggling with a substantial budget deficit that amounts to nearly 10% of its GDP, a significant fiscal imbalance that unequivocally reveals its structural economic vulnerabilities. This persistent deficit imposes considerable and unsustainable pressure on its national finances, hampering its capacity to invest in growth.

Furthermore, Tunisia has the dubious distinction of having one of the world’s highest public sector wage bills, a particularly onerous financial burden that severely restricts fiscal flexibility and diverts resources from other crucial sectors. The political dynamics within Tunisia further exacerbate its economic recovery endeavors, as President Kais Saied’s consolidation of power has aroused considerable concern within the international community. This concern relates to the nation’s democratic trajectory and, crucially, its adherence to the necessary economic reforms frequently mandated by international lenders.

Market indicators vividly mirror this escalating tension and uncertainty, with Tunisian bond spreads surging to over 2,800 basis points. This dramatic rise serves as a clear indication of heightened investor anxiety regarding the country’s creditworthiness and ability to fulfill its obligations. The precariousness of its financial situation is further highlighted by its inclusion in Morgan Stanley’s top three list of potential defaulters, a bleak assessment shared with Ukraine and El Salvador. This comprehensive perspective underscores that Tunisia’s economic difficulties arise from a complex interplay of fiscal imbalances, governance challenges, and political shifts, collectively necessitating urgent and effective policy interventions to avert a more severe crisis.

5. **Venezuela** Venezuela has witnessed a severe and rapid deterioration in its financial standing, culminating in a series of dramatic downgrades by all major credit rating agencies between September 2014 and January 2015. This precipitous decline is directly attributable to the nation’s overwhelming and exclusive reliance on oil exports, which historically accounted for a staggering 94% of its national income. Such an undiversified economic structure made Venezuela exceptionally susceptible to unpredictable fluctuations in global energy markets, a susceptibility that ultimately proved catastrophic when crude oil prices experienced a dramatic plunge.

The sharp collapse of crude oil prices from an average of 88.42perbarreltoapaltry54.03 in December 2014 directly led to a rapid and alarming increase in Venezuela’s default risk. With its primary, almost sole, source of revenue significantly reduced, the government found itself in increasingly dire financial straits, struggling immensely to keep its head above water and meet its national and international obligations. This profound dependence on a single commodity exposed the inherent fragility of its economic model, as global market shifts had an immediate and devastating impact on its fiscal well-being.

The severity of Venezuela’s sovereign debt crisis is further highlighted by its historical defaults, including a particularly significant one in November 2017 when the nation defaulted on a colossal US$65 billion in external debt. This default followed years of unsustainable borrowing practices, which had accumulated an enormous debt burden over time. Compounded by the sustained decline in global oil prices, these intertwined factors have left Venezuela in a protracted state of financial chaos, characterized by severe hyperinflation, widespread shortages, and a profound struggle to regain any semblance of economic stability, casting a grim shadow over its immediate future.

Having conducted a meticulous examination of the initial five nations teetering on the financial brink, our analysis now expands to an additional group of countries grappling with distinct yet equally profound economic vulnerabilities. This second segment continues our data-driven exploration, meticulously detailing the unique debt crises, underlying economic stressors, and the pervasive impacts of global events that have propelled Russia, Egypt, Jamaica, Mexico, and Greece to the verge of financial instability, along with their ongoing endeavors to navigate these treacherous fiscal waters. Each case serves as a crucial case study in the complexities of modern sovereign finance, revealing the diverse routes to economic precarity and the challenges inherent in achieving lasting stability.

Read more about: 20 Dangerous Countries for Drivers

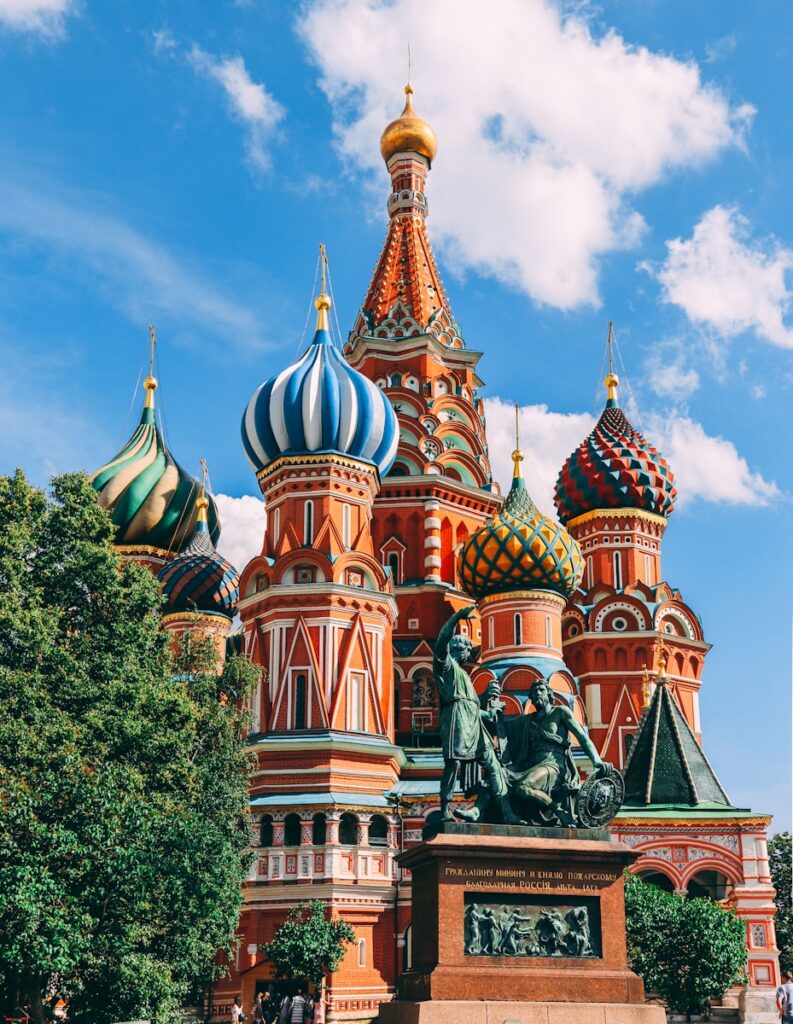

6. **Russia** Russia, a nation with a tumultuous financial history, has a well – documented record of sovereign defaults, having declared bankruptcy an extraordinary nine times throughout its history. The most recent significant episode occurred in 1998, when the country faced a substantial debt amounting to $17 billion. This crisis was largely precipitated by a confluence of external pressures, including the repercussions of the Asian financial crisis and a significant decline in global oil demand, which severely impaired Russia’s economic stability and led to an escalating international debt burden.

The culmination of these factors was manifested in the Ruble Crisis of 1998, a period of intense financial turmoil. During this crisis, the Russian stock market witnessed a dramatic downturn, losing an astonishing 75% of its value, while the nation was grappling with hyperinflation that reached a staggering 80%. Amidst these severe economic disruptions, Russia faced considerable difficulties in repaying its obligations to the International Monetary Fund (IMF), ultimately managing to refund just under 10 billion out of the initial 17 billion. The profound economic downturn that followed also resulted in a significant rise in unemployment rates, climbing by 13%.

Furthermore, the challenges to Russia’s financial stability have persisted into more recent times. Notably, the country encountered another debt default in 2022. This recurring pattern highlights the persistent vulnerabilities within Russia’s economic framework, often influenced by global commodity price fluctuations and geopolitical dynamics, which repeatedly test the resilience of its financial systems.

Read more about: Ever Wonder Which Dark Side Your Zodiac Sign Might Be Hiding? We’ve Got the Twisted Truth!

7. **Egypt** Egypt’s financial well – being has garnered considerable attention from economists and investors, primarily owing to its high debt – to – GDP ratio, which currently stands at approximately 95%. This elevated ratio signifies a substantial level of national indebtedness relative to its economic output, a situation that has already prompted a noteworthy outflow of funds as market participants re – evaluate their positions. The country is confronted with substantial financial obligations in the short to medium term, including a staggering $100 billion in hard – currency debt that must be repaid over the next five years.

Adding to these immediate pressures, a sizable $3.3 billion bond is due to mature in 2024, presenting another critical challenge for Cairo’s fiscal management. In an attempt to stabilize its precarious financial situation, the Egyptian government implemented a crucial measure in March 2022, devaluing the pound by 15% and simultaneously seeking assistance from the International Monetary Fund. However, despite these proactive actions, the market remains skeptical about the immediate prospects for stability, as evidenced by bond spreads climbing to over 1,200 basis points.

Further indicators of persistent market apprehension are manifested in credit default swaps (CDS), which are “signaling a 55% probability of a payment failure,” highlighting significant investor concern regarding Egypt’s ability to meet its financial commitments. Beyond these fiscal metrics, Egypt’s economy is grappling with broader structural issues, including high unemployment rates, persistent inflation, and the pervasive impact of political instability. The nation’s reliance on tourism, a sector severely affected by global events such as the pandemic, along with complexities in its relationships with neighboring countries, collectively contribute to its challenging economic outlook, reminiscent of the crisis that led to the ‘Urabi revolt and the subsequent British invasion of Egypt in 1876.

Read more about: Exploring Biblical Events Through Science: Surprising Confirmations

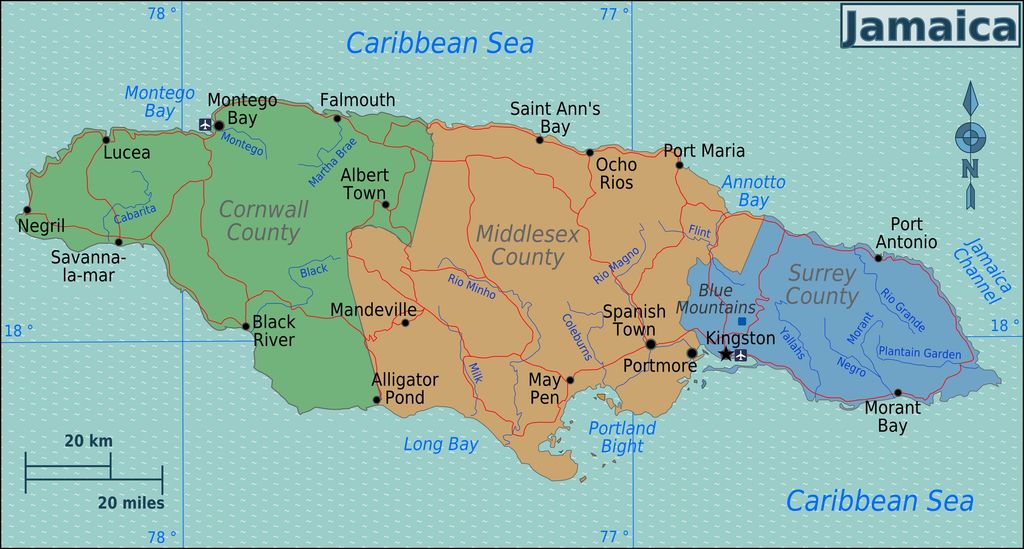

8. **Jamaica** Jamaica’s trajectory in the credit – rating arena offers a particularly compelling case study in sovereign debt assessment. Moody’s, a leading independent credit – risk assessment firm, has assigned Jamaica a Caa2 rating, which, while still indicative of high risk, signifies a noteworthy upgrade from its previous Caa3 classification. What renders Jamaica’s financial outlook truly distinctive, especially for a country with such a low credit rating, is its accompanying positive outlook.

This positive outlook from Moody’s constitutes an uncommon indication of potential improvement in a nation’s capacity to meet its financial obligations, particularly when its current rating remains firmly entrenched in speculative – grade territory. It implies that despite existing vulnerabilities, there are perceived factors or policy trajectories that could result in an enhancement of its creditworthiness in the future. This rare combination can be interpreted by investors as a cautiously optimistic signal, suggesting a belief that the country is progressing in the right direction, albeit slowly.

Such an assessment by a major rating agency is of critical importance because it can influence foreign investment inflows and borrowing costs, potentially paving the way for economic recovery and stability. The nuanced nature of Jamaica’s rating — a low, high – risk classification coupled with a positive outlook — highlights the complexities involved in evaluating sovereign risk, often reflecting a careful equilibrium between historical challenges and recent endeavors or anticipated policy improvements that could modify its fiscal trajectory.

Read more about: Boxing Legend George Foreman, Two-Time Heavyweight Champion and Cultural Icon, Dies at 76

9. **Mexico** Mexico’s financial history encompasses a significant crisis in 1982 when the nation defaulted on a colossal $80 billion state loan. This fiscal catastrophe was largely brought about by an excessively ambitious expansion of public debt, which originated from the economic policies implemented by the Luis Echeverria administration. These programs, while designed to stimulate growth, ultimately resulted in an unsustainable accumulation of national liabilities that proved impossible to manage.

The situation was further aggravated when the Mexican peso underwent a dramatic devaluation, plunging by 50% following an oil shock and a general deterioration of economic conditions. Despite this drastic decline in currency value, the devalued peso was still inadequate to enable Mexico to service its swelling debts. Consequently, the government was compelled to default on loans from both the United States and the International Monetary Fund, an event that set off a chain of adverse economic repercussions across the region and beyond.

This 1982 default was not an isolated occurrence in Mexico’s financial chronicle; historical records reveal an earlier default in 1850. The recurring pattern of debt crises underscores persistent structural vulnerabilities within the Mexican economy, often associated with external commodity price shocks, domestic policy decisions regarding public spending, and the challenges of maintaining currency stability. These historical precedents highlight the continuing necessity for prudent fiscal management and economic diversification to mitigate future risks.

Read more about: Trump’s Top 16 Vehicle Picks for the Ultimate Route 66 Road Trip

10. **Greece** Greece was thrust into a severe financial crisis following the global financial downturn of 2008, an event that laid bare deep – seated structural weaknesses within its economy. The nation was struck exceptionally hard, necessitating several massive international bailouts that collectively amounted to a staggering 240 billion euros, highlighting the immense scale of its fiscal distress. A pivotal moment in this crisis unfolded in 2012 when Greece officially defaulted on a jaw – dropping 138 billion dollars of its debt, setting a new, somber record for the largest sovereign default ever documented.

In the wake of this monumental default, Greece embarked on a period of rigorous debt restructuring, a painstaking process aimed at making its financial obligations more manageable. The country eventually made a partial return to the international bond market, a cautious stride toward restoring investor confidence. However, this arduous recovery journey was inextricably linked to the implementation of stringent austerity measures, which imposed substantial burdens on the Greek populace.

These rigorous fiscal policies, while intended to rectify national finances, led to widespread and severe financial hardships for many Greek residents. The social cost was particularly conspicuous in the labor market, with the average unemployment rate in Greece reaching a staggering 20.16% between 2012 and 2022, according to Statista. Furthermore, Greece also encountered a payment default to the IMF in 2015, although this payment was ultimately made after a 20 – day delay, further demonstrating the precariousness of its financial position during this period.

Read more about: Inside the US Army’s 250th Anniversary Parade: Tanks, Logistics, and Spectacle on the National Mall

The comprehensive analysis of these ten nations—Ukraine, Argentina, Sri Lanka, Tunisia, Venezuela, Russia, Egypt, Jamaica, Mexico, and Greece—offers invaluable insights into the multifaceted nature of sovereign debt crises in the contemporary global economy. Each country’s distinct path toward potential bankruptcy constitutes a complex tapestry, interwoven with geopolitical conflicts, historical economic mismanagement, inherent structural vulnerabilities, and the profound impacts of global market fluctuations. From Venezuela’s resource dependence to Ukraine’s conflict – induced struggles and Argentina’s historical defaults, the lessons are evident: financial stability represents a delicate equilibrium, constantly challenged by both internal governance issues and unpredictable external shocks. For investors, policymakers, and global citizens alike, comprehending these critical cases is not merely an academic endeavor but a crucial necessity for navigating an increasingly interconnected and volatile financial landscape, underscoring the urgent requirement for robust reforms and international cooperation to prevent widespread contagion and promote sustainable economic resilience.