Alright, let’s talk about something a little bit spicy, but also super fascinating: what makes someone seem ‘lower class’ in the eyes of others? Now, before anyone gets their feathers ruffled, let’s be super clear. We’re not talking about judgment here, or economic status in a shaming way. Not at all! We’re diving into how perceptions are formed, and it’s less about your bank account and more about the subtle behaviors and everyday realities that psychology—and real-life observations—highlight.

It’s like this: ‘classiness’ isn’t just about fancy clothes or a loaded wallet. It’s often about those deeper traits, behaviors, and even personal beliefs that make people feel grounded, positive, and genuinely empathetic. As the experts tell us, truly classy people are empathetic, first and foremost. They’re not necessarily flaunting their status or wealth. Instead, they’re the ones who genuinely look out for their neighbors and themselves, radiating a kindness that actually helps others live better, more meaningful lives. Pretty cool, right?

But here’s the flip side: there are also a bunch of things that, almost instantly, can make someone appear ‘low class,’ according to psychology. These aren’t always obvious or in-your-face. Sometimes, they’re quite unsuspecting and subtle, a stark contrast to those empathetic vibes we just talked about. We’re going to peel back the layers on some of these fascinating insights, exploring seven key traits that are less about what you *have* and more about how you *are* in the world.

1. **Lacking Perspective**: Ever met someone who just seems totally focused on the now, with no real vision for tomorrow? Psychology points to this ‘lacking perspective’ as one of those things that can instantly make someone look low class. It’s not just about money; it’s about a mindset that hyper-focuses on present gratification, perhaps showing no ambition or even failing to set those long-term goals that give life direction.

This kind of limited thinking can actually push people into behaviors and habits that don’t truly reflect who they are, deep down. It ends up sabotaging their authenticity. And guess what? Authenticity is a huge deal! A study in *Personality and Individual Differences* shows that being genuine isn’t just tied to your psychological health and general well-being, it also shapes how people see and interact with you. Everyone loves authenticity, but if you’re constantly seeking attention and can’t see the big picture, being real becomes a much tougher gig.

2. **Having No Empathy**: This one might sting a bit, but it’s crucial. Despite empathy being a declining trait (especially with the rise of narcissism, according to social psychologist Sara Konrath), having no empathy is still one of those red flags that screams ‘low class’ in the psychological playbook. Think about it: in arguments, this can pop up as gaslighting, blame-shifting, guilt-tripping, or even dodging necessary conversations.

It can also be way simpler, like constantly taking over a conversation or interrupting someone mid-sentence. People who lack empathy might not say it directly, but their actions speak volumes. These behaviors tend to push others away, making people want to avoid spending too much time with them. Nobody wants to feel like they’re talking to a brick wall, right?

3. **Lacking Self-Worth**: We all know that low self-esteem can sometimes stem from things completely out of our control—think perfectionist standards from others, societal pressures, or even a toxic relationship. But, surprisingly, it’s also identified as something that can make a person look low class. It’s not about being a victim; it’s about the behaviors that follow.

People struggling with self-worth might settle for less, constantly seek validation and attention from others, and sometimes, even sabotage others for their own emotional coping. While it feels super personal, your self-esteem actually impacts how others perceive you. A study from the *Journal of Personality and Social Psychology* suggests it even affects your judgment of relationships and connections. It’s a powerful internal compass that guides how you interact with the world, and how the world interacts with you.

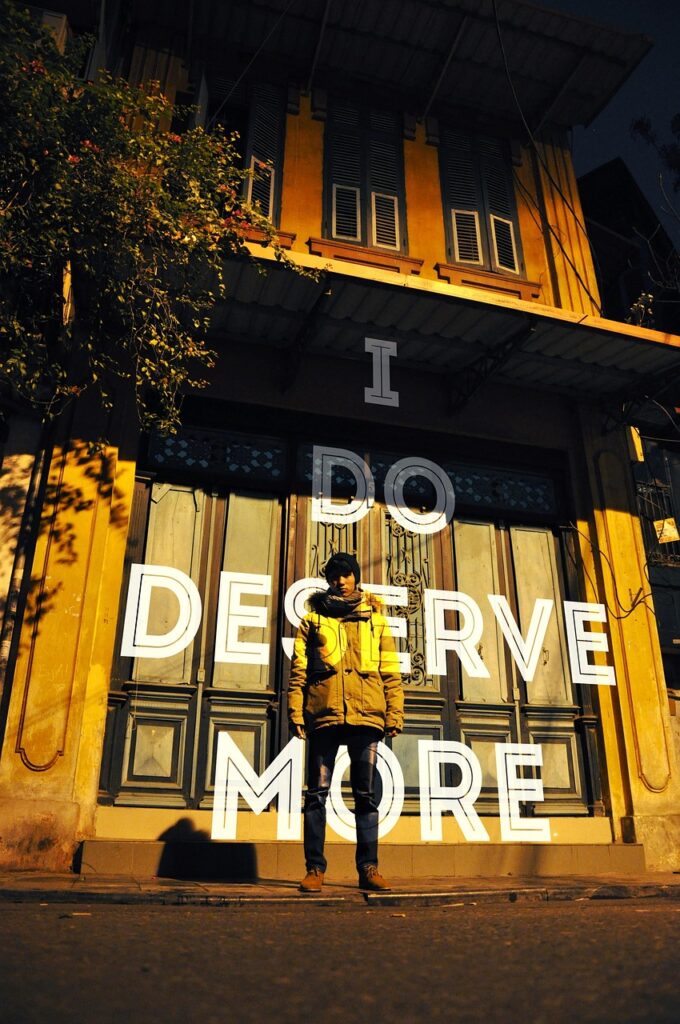

4. **Endlessly Following Trends**: Who doesn’t want to feel like they belong? It’s totally human, especially in a society that piles on unrealistic expectations for success, as a 2023 study pointed out. But here’s the catch: constantly being pushed to ‘fit in’ by endlessly following trend cycles can actually strip away your sense of individuality and unique self. That individualism, ironically, is what often fosters real feelings of closeness and community with others.

Seeking attention by chasing every new trend can, according to psychology, instantly make someone look low class and even isolate them. The blame often falls on the cycle of comparison and idolism that fuels these trends. Yet, people are often perceived as ‘low class’ for falling into this trap, losing the personal identity, self-expression, and authenticity that others generally find ‘classy’ and truly charming. It’s a tricky tightrope to walk.

5. **Valuing Material Things Over Experiences**: Picture this: someone who always talks about their new car, their designer bag, or the latest gadget, rather than an amazing trip they took or a new skill they learned. According to a study in the *Journal of Psychology & Clinical Psychiatry*, people who consistently overemphasize material goods and possessions over life experiences tend to have lower general well-being and health. They’re caught up in status symbols and showing off wealth, latching onto material things that aren’t stable or healthy. Instead of investing in relationships and stepping outside their comfort zone, they’re accumulating stuff.

Here’s a little secret to being ‘classy,’ both for yourself and in how others see you: seek out experiences! These are the things that truly encourage you to change, grow, bond, and ultimately live a more meaningful life. It’s not about what you own, but the richness of your journey and connections.

6. **Struggling to Afford Emergency Expenses**: We’re living in a wild era where financial insecurity often shows up in our inability to cope with those totally unexpected bills. Think about it: a sudden car repair that pops up out of nowhere, or an urgent doctor’s bill that lands on your lap. For many, not having a financial safety net means facing ‘lower-class’ struggles they really don’t need to, and sometimes, they don’t even realize how much this impacts their perceived stability. It’s like being caught without an umbrella when the rain starts pouring!

This isn’t a small problem, either. According to Federal Reserve research, a whopping 37% of Americans admitted they’d have a tough time coming up with just $400 to cover an emergency expense without having to resort to a loan or, gasp, selling some of their precious possessions. That kind of limitation isn’t just a number; it totally messes with everyday life, piles on the stress, and makes planning for anything beyond tomorrow a real uphill battle. It’s a constant tightrope walk, and that pressure can definitely be felt by those around you.

This isn’t about judging anyone’s situation; it’s about recognizing the deep impact of this financial tightrope walk. The constant worry about unexpected costs isn’t just a personal burden; it can subtly influence daily decisions and interactions, leading to a perception of living on the edge. It’s a stark contrast to the carefree spontaneity that often comes with a robust financial buffer, and this difference, unfortunately, can scream ‘lower class’ to observers, even when it’s purely circumstantial.

7. **Reliance on High-Interest Loans or Payday Lenders**: This one is a bit of a tough pill to swallow, but it’s a biggie. Needing to rely on those predatory financial services, like payday loans or rent-to-own schemes, is a glaring sign of some really tough economic times. Bankrate reports that these are almost always just short-term fixes, but the real kicker is that they trap people in a brutal cycle of debt. We’re talking about borrowing that comes with unbelievably high interest rates, sometimes even upwards of a mind-boggling 400% APR! It’s enough to make your jaw drop, right?

Without access to traditional credit options or any real savings to fall back on, achieving genuine financial freedom becomes nearly impossible. It’s like being stuck in quicksand; every step you take to get out just pulls you deeper. And while these services might offer a moment of convenience (because, let’s be real, sometimes you just *need* that cash), their long-term side effect almost always leads to even greater economic instability. It’s a vicious cycle that’s incredibly hard to break free from.

This reliance isn’t just a personal struggle; it’s a visible marker of financial distress that can unconsciously shape perceptions. The very act of needing to resort to such extreme measures suggests a lack of stable financial foundations, which can contribute to the ‘lower class’ label in the eyes of others. It’s a powerful signal of desperation and limited options, making it clear that a person is constantly battling against overwhelming financial odds, rather than building towards a more secure future.

8. **Living Paycheck to Paycheck**: This one is, sadly, painfully common for so many people. Imagine this: your paycheck finally lands in your account, but before you can even properly celebrate, every single penny is already spoken for. Rent, groceries, gas, insurance—poof! Gone in a blink. There’s absolutely no wiggle room for any surprises, big or small. A blown tire or a surprise doctor’s visit doesn’t just cause a little stress; it sends you scrambling, trying to figure out how to make ends meet all over again.

A recently released CNBC survey showed that an estimated 20% of Americans are living paycheck to paycheck. And get this: that includes people who are actually making more on average than the official poverty line. This isn’t just a minor inconvenience; it’s catastrophic for even the tiniest disruptions, like reduced work hours or an unexpected new bill. Your emergency savings might exist in theory, but it’s often more a wish than a solid plan. And once you dip into it, rebuilding that fund can take months, if not longer.

This isn’t about being poor in the traditional sense; it’s about being constantly pressured, living with the exhausting mental load of knowing everything is fine… until it’s suddenly not. When you live under that kind of constant financial strain for an extended period, it absolutely wears you down. This continuous struggle, the visible lack of financial breathing room, can subtly communicate a sense of instability and lack of abundance, inadvertently leading others to categorize such individuals as ‘lower class’ despite their diligent efforts.

There you have it. From the subtle psychological signals to the raw, everyday realities of financial struggles and lifestyle choices, ‘class’ is way more nuanced than just the numbers in your bank account. It’s about the silent battles, the resourceful adaptations, and the constant grind that defines so many lives. It’s a reminder that everyone’s journey is different, and what might ‘scream lower class’ to some is actually a testament to incredible resilience, grit, and the sheer effort it takes to navigate a world that doesn’t always play fair. It’s about understanding, not judging, and maybe, just maybe, recognizing a little bit of yourself or someone you know in these real-life scenarios.